Question: French Taylor is a new staff accountant

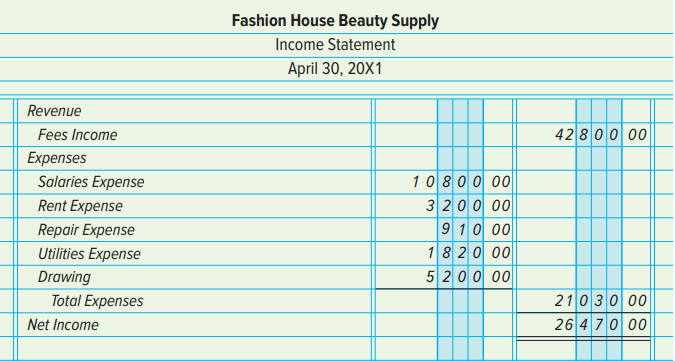

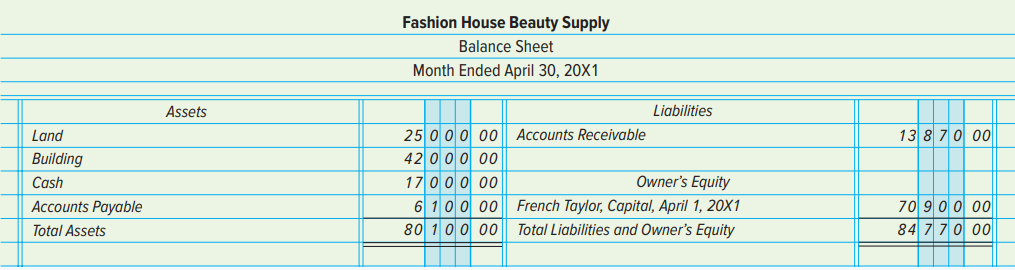

French Taylor is a new staff accountant for Fashion House Beauty Supply. He has asked you to review the financial statements prepared for April to find and correct any errors. Review the income statement and balance sheet that follow and identify the errors Taylor made (he did not prepare a statement of owner’s equity). Prepare a corrected income statement and balance sheet, as well as a statement of owner’s equity, for Fashion House Beauty Supply.

> Keller Company issued the following notes during 20X1. Find the interest due on each of the notes, using the interest formula method. Show all calculations. 1. A $30,000 note at 9 percent for 180 days, issued February 15. 2. A $28,000 note at 12 percent

> Pittman Company records uncollectible accounts expense as they occur. Selected transactions for 20X1 and 20X2 are described below. The accounts involved in these transactions are Notes Receivable, Accounts Receivable, and Uncollectible Accounts Expense.

> The balances of selected accounts of the Davidson Company on December 31, 20X1, are given below: Accounts Receivable $ 850,000 Allowance for Doubtful Accounts (credit) 4,000 Total Sales 10,050,000 Sales Returns and Allowances (total) 250,000 INSTRUCTIONS

> The schedule of accounts receivable by age, shown below, was prepared for the Lucero Company at the end of the firm’s fiscal year on December 31, 20X1: INSTRUCTIONS 1. Compute the estimated uncollectible accounts at the end of the year

> What kind of account is Sales Returns and Allowances?

> 1. The new accountant for Asheville Hardware Center, a large retail store, found the following weaknesses in the firm’s cash-handling procedures. How would you explain to management why each of these procedures should be changed? a. No

> Euro Leather Products sells leather clothing at both wholesale and retail. The company has found that there is a higher rate of uncollectible accounts from retail credit sales than from wholesale credit sales. Euro computes its estimated loss from uncoll

> For each of the unrelated situations below, identify the accounting principle or concept violated (if a violation exists) and explain the nature of the violation. If you believe that the treatment is in accordance with GAAP, state the major principle or

> Sadie Hawkins owns The Education Supply Center, a small store that sells educational supplies. Hawkins recently approached the local bank for a loan to finance a planned expansion of her store. Hawkins prepared the balance sheet shown below and submitted

> Samuel Cox, owner of Cox Video Center, sent the income statement shown below to several of his creditors who had asked for financial statements. The business is a sole proprietorship that sells audio and other electronic equipment. One of the creditors l

> The accounting treatment or statement presentation of various items is discussed below. The items pertain to unrelated businesses. INSTRUCTIONS Indicate in each case whether the item has been handled in accordance with generally accepted accounting princ

> Read each of the following statements carefully and indicate whether each is true or false. 1. Accounting principles and standards are based on the assumption that statements will be read by individuals who have little understanding of accounting and rep

> The data below concerns adjustments to be made at Tea Leaf Importers. INSTRUCTIONS 1. Record the adjusting entries in the general journal as of December 31, 20X1. Use 25 as the first journal page number. Include descriptions. 2. Record reversing entries

> Obtain all data that is necessary from the worksheet prepared for Healthy Eating Foods Company. Then follow the instructions to complete this problem. INSTRUCTIONS 1. Record adjusting entries in the general journal as of December 31, 20X1. Use 25 as the

> Obtain all data necessary from the worksheet prepared for Enoteca Fine Wines in Problem 12.6A at the end of Chapter 12. Then follow the instructions to complete this problem. INSTRUCTIONS 1. Prepare a classified income statement for the year ended Decemb

> Good to Go Auto Products distributes automobile parts to service stations and repair shops. The adjusted trial balance data that follows is from the firm’s worksheet for the year ended December 31, 20X1. INSTRUCTIONS 1. Prepare a cla

> How is a multicolumn special journal proved at the end of each month?

> Superior Hardwood Company distributes hardwood products to small furniture manufacturers. The adjusted trial balance data given below is from the firm’s worksheet for the year ended December 31, 20X1. INSTRUCTIONS 1. Prepare a classifie

> Enoteca Fine Wines is a retail store selling vintage wines. On December 31, 20X1, the firm’s general ledger contained the accounts and balances below. All account balances are normal. Cash $ 29,886 Accounts Receivable 1,500 Prepaid Advertising 480 Suppli

> Healthy Eating Foods Company is a distributor of nutritious snack foods such as granola bars. On December 31, 20X1, the firm’s general ledger contained the accounts and balances that follow. INSTRUCTIONS 1. Prepare the Trial Balance section of a 10-colum

> The Green Thumb Gardener is a retail store that sells plants, soil, and decorative pots. On December 31, 20X1, the firm’s general ledger contained the accounts and balances that appear below. INSTRUCTIONS 1. Prepare the Trial Balance section of a 10-colu

> On July 31, 20X1, after one month of operation, the general ledger of Michael Mendoza, CPA, contained the accounts and balances given below. INSTRUCTIONS 1. Prepare a partial worksheet with the following sections: Trial Balance, Adjustments, and Adjusted

> On July 1, 20X1, Cherie Wang established Cherie Wang Financial Services. Selected transactions for the first few days of July follow. INSTRUCTIONS 1. Record the transactions on page 1 of the general journal. Omit descriptions. Assume that the firm initia

> Based on the information below, record the adjusting journal entries that must be made for Kisling Distributors on June 30, 20X1. The company has a June 30 fiscal year-end. Use 18 as the page number for the general journal. a.–b. Merchandise Inventory, b

> The following information relates to Ponte Manufacturing Company’s workers’ compensation insurance premiums for 20X1. On January 15, 20X1, the company estimated its premium for workers’ compensation i

> 1. Complete Form 940, the Employer’s Annual Federal Unemployment Tax Return. Assume that all wages have been paid and that all quarterly payments have been submitted to the state as required. The payroll information for 20X1 appears bel

> Certain transactions and procedures relating to federal and state unemployment taxes follow for Robin’s Nest LLC, a retail store owned by Robin Roberts. The firm’s address is 2007 Lovely Lane, Dallas, TX 75268-0967. Th

> Assume you are the accountant for Catalina Industries. John Catalina, the owner of the company, is in a hurry to receive the financial statements for the year ended December 31, 20X1, and asks you how soon they will be ready. You tell him you have just c

> 1. On July 15, the firm issued a check to deposit the federal income tax withheld and the FICA tax (both employee and employer shares for the third month [June]). Based on your computations in Problem 11.2A, record the issuance of the check in general jo

> A payroll summary for Mark Consulting Company, owned by Mark Fronke, for the quarter ending June 30, 20X1, appears below. The firm made the required tax deposits as follows: a. For April taxes, paid on May 15. b. For May taxes, paid on June 17. INSTRUCTI

> The payroll register of Exterior Cleaning Company showed total employee earnings of $5,000 for the payroll period ended July 14. INSTRUCTIONS 1. Compute the employer’s payroll taxes for the period. Use rates of 6.2 percent for the employer’s share of the

> Metro Media Company pays its employees monthly. Payments made by the company on October 31 follow. Cumulative amounts for the year paid to the persons prior to the October 31 payroll are also given. 1. Tori Parker, president, gross monthly salary of $20,

> Alex Wilson operates On-Time Courier Service. The company has four employees who are paid on an hourly basis. During the workweek beginning December 15 and ending December 21, 20X1, employees worked the number of hours shown below. Information about thei

> Country Covers has four employees and pays them on an hourly basis. During the week beginning June 24 and ending June 30, these employees worked the hours shown below. Information about hourly rates, marital status, withholding allowances, and cumulative

> Robin Market works for Cycle Industries. Her pay rate is $14.50 per hour and she receives overtime pay at one and one-half times her regular hourly rate for any hours worked beyond 40 in a week. During the pay period that ended December 31, 20X1, Robin w

> The following transactions took place at Fabulous Fashions Outlet during July 20X1. Fabulous Fashions Outlet uses a perpetual inventory system. The firm operates in a state with no sales tax. Record the transactions in a general journal. Use 8 as the pag

> On August 1, 20X1, the accountant for Western Exports downloaded the company’s July 31, 20X1, bank statement from the bank’s website. The balance shown on the bank statement was $28,810. The July 31, 20X1, balance in the Cash account in the general ledge

> During the bank reconciliation process at Fontes & Barone Consultancy on May 2, 20X1, the following two errors were discovered in the firm’s records. 1. The checkbook and the cash payments journal indicated that Check 2206 dated April 17 was issued for $

> On June 1, 20X1, Jenna Davis opened the Leadership Coaching Agency. She plans to use the chart of accounts given below. INSTRUCTIONS 1. Journalize the transactions. Be sure to number the journal pages and write the year at the top of the Date column. Inc

> On August 31, 20X1, the balance in the checkbook and the Cash account of the Sonoma Creek Bed and Breakfast was $13,031. The balance shown on the bank statement on the same date was $13,997. NOTES a. The firm’s records indicate that a $1,600 deposit date

> On May 2, 20X1, PHF Vacations received its April bank statement from First City Bank and Trust. Enclosed with the bank statement, which appears below, was a debit memorandum for $210 that covered an NSF check issued by Doris Fisher, a credit customer. Th

> The Hike and Bike Outlet is a retail store. Transactions involving purchases and cash payments for the firm during June 20X1 are listed below, as are the general ledger accounts used to record these transactions. INSTRUCTIONS 1. Open the general ledger a

> Awesome Sounds is a wholesale business that sells musical instruments. Transactions involving sales and cash receipts for the firm during April 20X1 follow, along with the general ledger accounts used to record these transactions. INSTRUCTIONS 1. Open th

> The cash payments of The Aristocrats Jewels, a retail business, for June and the general ledger accounts used to record these transactions appear below. INSTRUCTIONS 1. Open the general ledger accounts and enter the balances as of June 1. 2. Record all p

> Car Geek is a retail store that sells car care products over the Internet. The firm’s cash receipts for February and the general ledger accounts used to record these transactions are shown below. INSTRUCTIONS 1. Open the general ledger

> Office Plus is a retail business that sells office equipment, furniture, and supplies. Its credit purchases and purchases returns and allowances for September are shown below. The general ledger accounts and the creditors’ accounts in t

> The Old English Garden Shop is a retail store that sells garden equipment, furniture, and supplies. Its credit purchases and purchases returns and allowances for July are listed below. The general ledger accounts used to record these transactions are als

> This problem is a continuation of Problem 8.1A. INSTRUCTIONS 1. Set up an accounts payable subsidiary ledger for Lens Queen. Open an account for each of the creditors listed below and enter the balances as of June 1, 20X1. Arrange the accounts payable le

> Lens Queen is a retail store that sells cameras and photography supplies. The firm’s credit purchases and purchases returns and allowances transactions for June 20X1 appear below, along with the general ledger accounts used to record th

> Bella Floral Designs is a wholesale shop that sells flowers, plants, and plant supplies. The transactions shown below took place during January. All customers have credit terms of n/30. INSTRUCTIONS 1. Record the transactions in the proper journal. Use 7

> Elegant Dining sells china, glassware, and other gift items that are subject to an 8 percent sales tax. The shop uses a general journal and a sales journal similar to those illustrated in this chapter. All customers have payment terms of n/30. INSTRUCTIO

> Towncenter Furniture specializes in modern living room and dining room furniture. Merchandise sales are subject to an 8 percent sales tax. The firm’s credit sales and sales returns and allowances for February 20X1 are reflected below, a

> Great Lakes Appliances is a retail store that sells household appliances. Merchandise sales are subject to an 8 percent sales tax. The firm’s credit sales for July are listed below, along with the general ledger accounts used to record

> A partially completed worksheet for At Home Pet Care Service, a firm that grooms pets at the owner’s home, follows. INSTRUCTIONS 1. Record balances as of December 31 in the ledger accounts. 2. Prepare the worksheet. 3. Journalize (use 3

> On December 31, after adjustments, Ponthieu Company’s ledger contains the following account balances: INSTRUCTIONS 1. Record the balances in the ledger accounts as of December 31. 2. Journalize the closing entries in the general journal

> A completed worksheet for The Best Group is shown below. INSTRUCTIONS 1. Record balances as of December 31, 20X1, in the ledger accounts. 2. Journalize (use 3 as the page number) and post the adjusting entries. Use account number 131 for Prepaid Advertis

> Research Associates, owned by Alex Raman, is retained by large companies to test consumer reaction to new products. On January 31, 20X1, the firm’s worksheet showed the following adjustments data: (a) supplies used, $2,340; (b) expired

> Shayla Green owns Creative Designs. The trial balance of the firm for January 31, 20X1, the first month of operations, is shown below. INSTRUCTIONS 1. Complete the worksheet for the month. 2. Prepare an income statement, statement of ownerâ€&#

> The completed worksheet for Chavarria Corporation as of December 31, 20X1, after the company had completed the first month of operation, appears below. INSTRUCTIONS 1. Prepare an income statement. 2. Prepare a statement of owner’s equity. The owner made

> Brenda Jo Smith is an architect who operates her own business. The accounts and transactions for the business follow. INSTRUCTIONS (1) Analyze the transactions for January 20X1. Record each in the appropriate T accounts. Identify each entry in the T acco

> The adjusted trial balance of Campus Book Store and Supply Company as of November 30, 20X1, after the firm’s first month of operations, appears below. Appropriate adjustments have been made for the following items: a. Supplies used duri

> The trial balance of Ortiz Company as of January 31, 20X1, after the company completed the first month of operations, is shown in the partial worksheet below. INSTRUCTIONS Complete the worksheet by making the following adjustments: supplies on hand at th

> Four transactions for Airline Maintenance and Repair Shop that took place in November 20X1 appear below, along with the general ledger accounts used by the company. INSTRUCTIONS Record the transactions in the general journal and post them to the appropri

> The following journal entries were prepared by an employee of International Marketing Company who does not have an adequate knowledge of accounting. INSTRUCTIONS Examine the journal entries carefully to locate the errors. Prepare journal entries to corre

> On October 1, 20X1, Helen Kennedy opened an advertising agency. She plans to use the chart of accounts listed below. INSTRUCTIONS 1. Journalize the transactions. Number the journal page 1, write the year at the top of the Date column, and include a descr

> The transactions that follow took place at the Cedar Hill Recreation and Sports Arena during September 20X1. This firm has indoor courts where customers can play tennis for a fee. It also rents equipment and offers tennis lessons. INSTRUCTIONS Record eac

> The following accounts and transactions are for Vincent Sutton, Landscape Consultant. INSTRUCTIONS Analyze the transactions. Record each in the appropriate T accounts. Identify each entry in the T accounts by writing the letter of the transaction next to

> The following occurred during June at Brown Financial Planning. INSTRUCTIONS Analyze each transaction. Use T accounts to record these transactions and be sure to put the name of the account on the top of each account. Record the effects of the transactio

> Since graduating from college five years ago, you have worked for a national chain of men’s clothing stores. You have held several positions within the company and are currently manager of a local branch store. Over the past three years

> Home Suppliers, Inc. sells a variety of consumer products. Its comparative income statement and balance sheet for the years 2022 and 2021 are presented on the following pages. The Retained Earnings balance on January 1, 2021, was $188,442. Also, Preferre

> At the beginning of the summer, Humphrey Nelson was looking for a way to earn money to pay for his college tuition in the fall. He decided to start a lawn service business in his neighborhood. To get the business started, Humphrey used $6,000 from his sa

> The chart of accounts and account balances of The Purple Company on January 1, 2022, are shown below. The company does not use reversing entries. Round all computations to the nearest whole dollar. 1. Open the general ledger accounts and enter the balanc

> The Fashion Rack is a retail merchandising business that sells brand-name clothing at discount prices. The firm is owned and managed by Teresa Lojay, who started the business on April 1, 20X1. This project will give you an opportunity to put your knowled

> This project will give you an opportunity to apply your knowledge of accounting principles and procedures by handling all the accounting work of Eli’s Consulting Services for the month of January 2020. Assume that you are the chief acco

> On December 1, Karl Zant opened a speech and hearing clinic. During December, his firm had the following transactions involving revenue and expenses. Did the firm earn a net income or incur a net loss for the period? What was the amount? Paid $6,200 for

> At the beginning of September, Helen Rojas started Rojas Wealth Management Consulting, a firm that offers financial planning and advice about investing and managing money. On September 30, the accounting records of the business showed the following infor

> The following equation shows the effects of a number of transactions that took place at Cantu Auto Repair Company during the month of July. Describe each transaction.

> Technology World had the following revenue and expenses during the month ended July 31. Did the firm earn a net income or incur a net loss for the period? What was the amount? Fees for computer repairs $93,600 Advertising expense 16,200 Salaries expense

> The Business Center had the transactions listed below during the month of June. Show how each transaction would be recorded in the accounting equation. Compute the totals at the end of the month. The headings to be used in the equation follow. TRANSACTIO

> The following financial data are for the dental practice of Dr. Jose Ortiz when he began operations in July. Determine the amounts that would appear in Dr. Ortiz’s balance sheet. 1. Owes $42,000 to the Sanderson Equipment Company. 2. Has cash balance of

> Indicate the impact of each of the transactions below on the fundamental accounting equation (Assets = Liabilities + Owner’s Equity) by placing an “I” to indicate an increase and a “

> Santiago Madrid opened a gym and fitness studio called Perfect Body Fitness and Spa Center at the beginning of November of the current year. It is now the end of December, and Madrid is trying to determine whether he made a profit during his first two mo

> The fundamental accounting equations for several businesses follow. Supply the missing amounts.

> Just before Henderson Laboratories opened for business, Eugene Henderson, the owner, had the following assets and liabilities. Determine the totals that would appear in the firm’s fundamental accounting equation (Assets = Liabilities + Owner’s Equity). C

> Harbor Corporation is manufacturing a part that is used in its finished product. The costs for each unit of the part follow: Direct materials $ 34 Direct labor 35 Manufacturing overhead: Variable costs $25 Fixed costs 8 33 Total cost $102 The fixed overh

> Harbor Corporation is manufacturing a part that is used in its finished product. The costs for each unit of the part follow: Direct materials $ 34 Direct labor 35 Manufacturing overhead: Variable costs $25 Fixed costs 8 33 Total cost $102 The fixed overh

> Santa Clara Microelectronics is considering the purchase of a new factory machine at a cost of $195,000. The machine would perform a function that is now being performed by hand. The new machine would have a life of 10 years, would produce 16,500 units a

> The standard cost sheet for the leading product made by Queen Corporation shows the following data: Direct materials $ 52 Direct labor (3 hours at $23/hour) 69 Manufacturing overhead: Variable costs (3 hours at $23/hour) 69 Fixed costs (3 hours at $20/ho

> Wisconsin Manufacturing has an opportunity to export 2,500 units of its product to a foreign country. The current selling price is $176, but the special order will be sold at a unit price of $110. This special order will not affect its current sales, all

> Memphis Company is considering replacing its existing wrapping system with new equipment. The existing system has a book value of $125,000 and a remaining useful life of two years. The new wrapping system would cost $300,000 and have a useful life of fiv

> Starmont Manufacturing Co. divided all of its costs and expenses into fixed and variable components. Data for the company’s first year of operations follows. Ignore income taxes. Beginning inventory of finished goods –0– Units produced (no work in proces

> Starmont Manufacturing Co. divided all of its costs and expenses into fixed and variable components. Data for the company’s first year of operations follows. Ignore income taxes. Beginning inventory of finished goods –0– Units produced (no work in proces

> The following account balances are for Ping Chung, Certified Public Accountant, as of April 30, 20X1. Cash $120,000 Accounts Receivable 48,000 Maintenance Expense 18,400 Advertising Expense 15,560 Fees Earned 107,200 Ping Chung, Capital, April 1 ? Salari

> The standard cost card for a unit of Product AX at the Cleaning Chemicals Corp. shows the following standard cost information: Materials: 2 gallons at $12 per gallon $ 24 Labor: 5 hours at $20 per hour 100 Overhead: 80% of direct labor 80 Total $204 Duri

> The standard cost card for a unit of Product AX at the Cleaning Chemicals Corp. shows the following standard cost information: Materials: 2 gallons at $12 per gallon $ 24 Labor: 5 hours at $20 per hour 100 Overhead: 80% of direct labor 80 Total $204 Duri

> The standard cost card for a unit of Product AX at the Cleaning Chemicals Corp. shows the following standard cost information: Materials: 2 gallons at $12 per gallon $ 24 Labor: 5 hours at $20 per hour 100 Overhead: 80% of direct labor 80 Total $204 Duri

> The standard cost card for a unit of Product AX at the Cleaning Chemicals Corp. shows the following standard cost information: Materials: 2 gallons at $12 per gallon $ 24 Labor: 5 hours at $20 per hour 100 Overhead: 80% of direct labor 80 Total $204 Duri

> The standard cost card for a unit of Product AX at the Cleaning Chemicals Corp. shows the following standard cost information: Materials: 2 gallons at $12 per gallon $ 24 Labor: 5 hours at $20 per hour 100 Overhead: 80% of direct labor 80 Total $204 Duri

> The standard cost card for a unit of Product AX at the Cleaning Chemicals Corp. shows the following standard cost information: Materials: 2 gallons at $12 per gallon $ 24 Labor: 5 hours at $20 per hour 100 Overhead: 80% of direct labor 80 Total $204 Duri

> In preparing the standard cost for each unit of QS500, the company’s only product, the accountant for Total Earth Solvents Corporation has developed the following data for the year 20X1: Total budgeted production, 23,000 units Raw material: Two units of