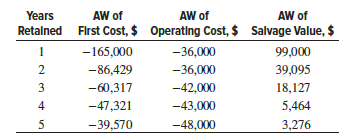

Question: From the data shown below, the economic

From the data shown below, the economic service life of the asset is:

(a) 2 years

(b) 3 years

(c) 4 years

(d) 5 years

> Buckeye Creek Amusement Park is open from the beginning of May to the end of October. Buckeye Creek relies heavily on the sale of season passes. The sale of season passes brings in significant revenue prior to the park opening each season, and season pas

> When trying to decide what car to buy, real value is not necessarily determined by how much you spend on the initial purchase. Instead, cars that are reliable and don’t cost much to own often represent the best values. But, no matter ho

> Consumer Reports tested 166 different point-and-shoot digital cameras. Based upon factors such as the number of megapixels, weight (oz.), image quality, and ease of use, they developed an overall score for each camera tested. The overall score ranges fro

> As part of a study on transportation safety, the U.S. Department of Transportation collected data on the number of fatal accidents per 1000 licenses and the percentage of licensed drivers under the age of 21 in a sample of 42 cities. Data collected over

> One measure of the risk or volatility of an individual stock is the standard deviation of the total return (capital appreciation plus dividends) over several periods of time. Although the standard deviation is easy to compute, it does not take into accou

> TourisTopia Travel (Triple T) is an online travel agency that specializes in trips to exotic locations around the world for groups of ten or more travelers. Triple T’s marketing manager has been working on a major revision of the homepage of Triple T’s w

> Suppose that a local chapter of sales professionals in the greater San Francisco area conducted a survey of its membership to study the relationship, if any, between the years of experience and salary for individuals employed in inside and outside sales

> As part of a long-term study of individuals 65 years of age or older, sociologists and physicians at the Wentworth Medical Center in upstate New York investigated the relationship between geographic location and depression. A sample of 60 individuals, al

> Fresno Board Games manufactures and sells several different board games online and through department stores nationwide. Fresno’s most popular game, ¡Cabestrillo Cinco!, is played with 5 six-sided dice. Fresno has purchased dice for this game from Box C

> Six months ago, Fuentes Salty Snacks, Inc., added a new flavor to its line of potato chips. The new flavor, candied bacon, was introduced through a nationwide rollout supported by an extensive promotional campaign. Fuentes’ management is convinced that q

> Young Professional magazine was developed for a target audience of recent college graduates who are in their first 10 years in a business/professional career. In its two years of publication, the magazine has been fairly successful. Now the publisher is

> For a 60–40 D-E mix of investment capital, the maximum cost for debt capital that would yield a WACC of 10% when the cost of equity capital is 4% is closest to: (a) 8% (b) 12% (c) 14% (d) 16%

> All of the following are examples of debt capital, except: (a) Mortgage on equipment (b) Long-term bonds (c) Short-term loan from a bank (d) Preferred stock

> If benefits are $10,000 per year forever starting in year 1, and costs are $50,000 at time zero and $50,000 at the end of year 2, the B/C ratio at i = 10% per year is closest to: (a) 0.93 (b) 1.10 (c) 1.24 (d) 1.73

> All of the following cash flows should be classified as disbenefits, except: (a) Cost of fish from hatchery to stock lake at state park (b) Decrease in property values due to closure of a government research lab (c) School overcrowding because of militar

> If two mutually exclusive alternatives have B/C ratios of 1.5 and 1.4 for the lower first-cost and higher first-cost alternatives, respectively: (a) The B/C ratio on the increment between them is greater than 1.4 (b) The B/C ratio on the increment betwee

> From the PW, AW, and FW values shown, the conventional B/C ratio is closest to: (a) 1.27 (b) 1.33 (c) 1.54 (d) 2.76

> If two mutually exclusive alternatives have B/C ratios of 1.4 and 1.5 for the lower and higher cost alternatives, respectively: (a) The B/C ratio on the increment between them is equal to 1.5 (b) The B/C ratio on the increment between them is between 1.4

> All of the following are examples of unethical behavior, except: (a) Deception (b) Withholding information (c) Lying (d) Offering engineering services at a lower cost than a competitor

> In evaluating three mutually exclusive alternatives by the B/C method, the alternatives were ranked A, B, and C, respectively, in terms of increasing cost, and the following results were obtained for overall B/C ratios: 1.1, 0.9, and 1.3. On the basis of

> An alternative has the following cash flows: benefits = $50,000 per year; disbenefits = $27,000per year; costs = $25,000 per year. The B/C ratio is closest to: (a) 0.92 (b) 0.96 (c) 1.04 (d) 2.00

> The division manager would like to know how much the WACC varies for different D-E mixes, especially about 15% to 20% on either side of the 50% debt financing option in plan A. Plot the WACC curve and compare its shape with that of Figure 10–2.

> All of the following cash flows can be identified as benefits, except: (a) Longer tire life because of smooth pavement (b) $200,000 annual income to local businesses because of tourism created by water reservoir (c) Expenditure of $20 million for constru

> All of the following are primarily associated with public sector projects, except: (a) Low interest rates (b) Stocks (c) Benefits (d) Infinite life

> In a conventional B/C ratio: (a) Disbenefits and M&O costs are subtracted from benefits (b) Disbenefits are subtracted from benefits, and M&O costs are subtracted from costs (c) Disbenefits are subtracted from benefits, and M&O costs are added to costs (

> Ten noneconomic attributes are identified as A, B, C, ..., J. If they are rank-ordered in terms of decreasing importance with a value of 10 assigned to A, 9 to B, etc., the weighting of attribute B is closest to: (a) 0.24 (b) 0.17 (c) 0.08 (d) 0.04

> Alternative locations for an advanced wastewater recycling plant are being evaluated using four attributes identified as attributes 1, 2, 3, and 4 with weights of 0.4, 0.3, 0.2, and 0.1, respectively. If the value rating scale is from 1 to 10, and the ra

> Three attributes are first cost, safety, and environmental concerns. Assigned importance scores are 100, 75, and 50, respectively. The weight for environmental concerns is closest to: (a) 0.44 (b) 0.33 (c) 0.22 (d) 0.11

> All of the following are acceptable attribute identification approaches, except: (a) Employing small group discussions (b) Using the same attributes that competing entities use (c) Getting input from experts with relevant experience (d) Surveying the sta

> The importance values (0 to 100) for five attributes are shown below. The weight to assign to attribute 1 is: (a) 0.16 (b) 0.20 (c) 0.22 (d) 0.55 Attribute………………. Importance Score 1……………………………………… 55 2…………………………………….. 45 3…………………………………….. 85 4………………………

> Medzyme Pharmaceuticals has maintained a 50–50 D-E mix for capital investments. Equity capital has cost 11%; however, debt capital that has historically cost 9% is now 20% higher than that. If Medzyme does not want to exceed its historical weighted avera

> If the after-tax rate of return for a cash flow series is 11.2% and the corporate effective tax rate is 39%, the approximated before-tax rate of return is closest to: (a) 6.8% (b) 5.4% (c) 18.4% (d) 28.7%

> The engineer must make a recommendation on the financing plan by the end of the day. He does not know how to consider all the tax angles for the debt financing in plan A. However, he does have a handbook that gives these relations for equity and debt cap

> Gonzales, Inc. financed a new product as follows: $5 million in stock sales at 13.7% per year, $2 million in retained earnings at 8.9% per year, and $3 million through convertible bonds at 7.8% per year. The company’s WACC is closest to: (a) 9% per year

> All of the following are factors that affect the effective MARR of a project, except: (a) Project risk (b) Product selling price (c) Availability of capital (d) Attractiveness of other investment opportunities

> Of the following words, the one not related to ethics is: (a) Virtuous (b) Honest (c) Lucrative (d) Proper

> The statements contained in a code of ethics are variously known as all of the following, except: (a) Canons (b) Norms (c) Standards (d) Laws

> Cost-effectiveness analysis (CEA) differs from benefit/cost analysis (B/C) in that: (a) CEA cannot handle multiple alternatives (b) CEA compares alternatives on the basis of a specific outcome rather than solely on monetary units (c) CEA cannot handle in

> The estimated first cost of a permanent national monument is $2 million with annual benefits and disbenefits estimated at $360,000 and $42,000, respectively. The B/C ratio at 6% per year is closest to: (a) 0.16 (b) 0.88 (c) 1.73 (d) 2.65

> For the two independent projects shown, determine which, if any, should be funded at i = 10% per year using the B/C ratio method: (a) Fund neither (b) Fund X (c) Fund Y (d) Fund both X and Y

> A permanent flood-control dam is expected to have an initial cost of $2.8 million and an annual M&O cost of $20,000. In addition, minor reconstruction will be required every 5 years at a cost of $200,000. As a result of the dam, flood damage will be redu

> The first cost of grading and spreading gravel on a short rural road is expected to be $700,000. The road will have to be maintained at a cost of $25,000 per year. Even though the new road is not very smooth, it allows access to an area that previously c

> A milling machine with enhanced CNC controls that allow for high-speed machining of free-form parts was purchased 2 years ago for $195,000. The company wants to purchase a recently available faster model with control up to 8 axes for $240,000. The presen

> What values of MARR should the engineer use to determine the better financing plan?

> In a replacement study, the correct value to use when determining the purchase price of the challenger is: (a) Its first cost when it was purchased (b) Its first cost minus the trade-in value of the defender (c) Its first cost plus the trade-in value of

> The annual worth values for a defender, which can be replaced with a similar used asset, and a challenger are estimated. The defender should be replaced: (a) Now (b) 1 year from now (c) 2 years from now (d) 3 years from now

> The cost characteristics of a CO testing machine that was purchased 5 years ago for $100,000 are shown below. The equation to determine the AW of retaining the tester one more year and then replacing it is: (a) AW = −15,000(A/P,i,1) &ac

> A presently owned machine has the projected market value and M&O costs shown below. At an interest rate of 10% per year, the AW for keeping the machine 2 more years is closest to: (a) $29,650 (b) $32,840 (c) $35,770 (d) $39,720

> Assume the MARR is 10% per year for this analysis. A presently owned machine that was purchased 8 years ago for $450,000 is under consideration for replacement. It has an annual operating cost of $120,000 per year and a salvage value of $40,000 whenever

> The annual worth values for a defender, which can be replaced with a similar used asset, and a challenger are estimated below. The economic service life of the challenger is (a) 2 years (b) 3 years (c) 4 years (d) 5 years

> The equivalent annual worth of an existing machine at American Semiconductor is estimated to be $ −70,000 per year over its remaining useful life of 3 years. It can be replaced now or later with a machine that will have an AW of $ −90,000 per year if it

> To work this problem via spreadsheet, please refer to the data in Problem 10.50. (a) Determine which proposal, A or B, to select using the weighted attribute method and the importance scores for the manager and the supervisor. (b) You have given proposal

> For the nonconventional net cash flow series experienced over the first 3 years of operation by Viking, Inc., an Internet-based sports boat and ski equipment sales company, perform a thorough ROR analysis for the owners, Julie Merkel and Carl Upton, to i

> Use a cost-effectiveness analysis to compare the four alternatives.

> Ten years ago, JD and his colleagues resigned from a major aerospace corporation, after many years of salaried employment, to form JRG Solar, Inc. with the intent to make a significant impact on the international renewable energy market based on years of

> Charles Enterprises got into the drone manufacturing business at the inception of the technology. Net cash flows (in $ million units) for years 0 through 5 had its ups and downs as shown below. However, a few years ago, Charles started selling 3-D printa

> Determine the following for the quarterly cash flow estimates. (a) i* value or values; (b) if an MARR of 5% per quarter is achievable; and (c) the minimum revenue in quarter 8 that will generate an i* that meets the MARR.

> An Australian steel company, ASM International, claims that a savings of 40% of the cost of stainless steel threaded bar can be achieved by replacing machined threads with precision weld depositions. A U.S. manufacturer of rock bolts and grout-in-fitting

> You need to determine i* per year for the cash flows shown below. Since you have a new boss, you decided to perform a thorough analysis. Do the following: (a) Use a spreadsheet to find i*. (b) Develop two charts on the spreadsheet: a column chart that pl

> Cloey has just purchased new bedroom furniture from Haverty’s for a total of $10,000. She paid 20% down and, through a special promotional, she can pay off the $8000 in ten $800, no-interest payments over the next 10 months. The smaller print at the bott

> TrvlSafe, a manufacturer of air-freightable pet crates with imbedded chips to monitor the health of the pet, has identified two projects that have relatively high risk; however, they are expected to move the company into new revenue markets. Utilize a sp

> In Problem 10.38, Mosaic Software could invest $10,000,000 over a 6-year period with a net cash flow estimate of $1,115,000 per year. The equity portion of the investment will cost 9.25% per year; however, the debt portion can vary from 20% to 80% of the

> Financing plans for a project are summarized below for Encore Productions. (a) Plot the WACC and indicate the D-E mix with the lowest WACC. (b) Yesterday, the president of Angkor Bank, the bank that usually makes loans to Encore, informed the CFO that in

> In a one-year-later replacement analysis, if all estimates are still current and the year is nD, the action that should be taken is: (a) Keep the defender 1 more year (b) Replace the defender with the challenger (c) Look for a new challenger and calculat

> Determine if a definitive decision on lighting can be determined by doing the following: Use a benefit/cost analysis to compare the four alternatives to determine if any are economically justified.

> The economic service life of an asset is: (a) The length of time required to recover the first cost of the asset (b) The time when the operating cost is at a minimum (c) The time when the salvage value goes below 25% of the first cost (d) The time when t

> A replacement analysis is most objectively conducted from the viewpoint of: (a) An outsider (b) A consultant (c) A nonowner (d) Any of the above

> Halcrow, Inc. expects to replace a downtime tracking system currently installed on CNC machines. The challenger system has a first cost of $70,000, an estimated AOC of $20,000 the first year increasing by 20% per year thereafter, a maximum useful life of

> An existing process involving polymers that reduce friction loss in engines is described in Problem 11.37. Assume it is possible to do an augmentation and upgrade to the existing process machinery that will provide a 2-year extension to its useful life.

> First, develop the spreadsheet to confirm the replacement study decision conducted for Randall- Rico Consultants in Problem 11.31. Then answer the questions below posed by Mr. Randall in a meeting when he was informed of the results of the replacement st

> Perform the required analysis of truck-bed sizes in Problem 8.33 using a spreadsheet. Data from problem 8.33 A recent graduate who wants to start an excavation/ earth-moving business is trying to determine which size of used dump truck to buy. He knows t

> A mechanical engineer at Anode Metals is considering five equivalent projects, some of which have different life expectations. Salvage value is nil for all alternatives. Assuming that the company’s MARR is 13% per year, determine which

> Ryan has received cost and salvage value estimates for two competing fire sprinkler systems to be installed in his office building. System A has a first cost of $100,000, annual M&O costs of $10,000, and a $20,000 salvage value after 5 years. System B ha

> In Problem 8.20, two methods of cooling water treatment are analyzed. These are revenue alternatives which generate annual savings against their costs. (a) Perform the complete procedure for incremental ROR analysis for revenue alternatives to determine

> Kleen Corp., a privately owned and operated single-stream recycling facility, has annual contracts with several cities in the Tri-County Metropolitan Area. Kleen Corp. wants to add a new set of sensors to its existing machinery that will separate plasti

> What would the lighted, night-to-day accident ratio have to be to make alternative Z economically justified by the B/C ratio?

> For the net cash flow series shown, (a) apply the two rules of sign change, (b) find the external rate of return using the ROIC method at an investment rate of 15% per year, and (c) determine an i* using the IRR function with and without the ROIC determi

> For the cash flows shown, determine: (a) the number of possible i* values (b) the i* value displayed by the IRR function (c) the external rate of return using the MIRR method if ii = 18% per year and ib = 10% per year.

> For the net cash flow series, (a) determine the number of possible i* values using the two sign tests, (b) find the EROR using the MIRR method with an investment rate of 20% per year and a borrowing rate of 10% per year, and (c) use the MIRR function to

> Profit and loss (in $1000 units) associated with the sale of a vision-guided machine tool loading system and the resulting NCF amounts are recorded. (a) Use sign-change rules to determine the possible number of i* values. (b) Find all i* values between 0

> There are two potential locations to construct an urgent care walk-in clinic to serve rural residents. The DN alternative is an option since the clinic is not a requirement; it would be a convenience for future patients. When incremental B/C analysis was

> For the FOUNDATION Fieldbus H1 installation analyzed in Problem 9.27, do the following: (Data is repeated below.) (a) Find the PI for the first 6 years of operation. (b) Find the required ΔNCF for next year if Dickinson plans to invest an add

> Consider the four independent projects outlined below. At 5% per year and a 15-year study period, (a) determine which projects are acceptable, and (b) the value of the annual M&O cost to make any nonacceptable project acceptable with a B/C ratio of a

> Use the estimates from Problem 9.39 (repeated below) to answer the questions asked concerning the extraction of rare metals in a National Wildlife Preserve. Utilize the B/C method, a 5-year study period, and a discount rate of 10% per year. The monetary

> What do you think of these suggestions from the plant superintendent and the line manager?

> Assume you are an investor with a large amount of ready cash, looking for an innovative solar energy product. What amount would you be willing to offer for the business at this point (end of year 12) if you require a 12% per year return on all your inves

> Consider the cash flow series over the 12 years. Is there any indication that multiple rates of return may be present? If so, use the spreadsheet already developed to search for ROR values in the range ±100% other than the one determined in exercise 3 ab

> Arc-bot Technologies, manufacturers of six-axis, electric servo-driven robots, has experienced the cash flows shown in a shipping department. (a) Determine the number of possible rate of return values. (b) Find all i* values between 0 and 100%.

> How many property-damage accidents could be prevented on the unlighted portion if it were lighted?

> Discuss the possibility of multiple rate of return values for all the actual and incremental cash flow series. Find any multiple rates in the range of 0% to 100%.

> If the MARR = 12%, which server should be selected? Use the PW or AW method to make the selection.

> The production of polyamide from raw materials of plant origin, such as castor oil, requires 20% less fossil fuel than conventional production methods. Darvon Chemicals borrowed $6 million to implement the process. If the interest rate on the loan is 10%

> A small industrial contractor purchased a warehouse building for storing equipment and materials that are not immediately needed at construction job sites. The cost of the building was $100,000 and the contractor has just made an agreement with the selle

> Assume alternatives A and B are being evaluated by the rate of return method against a MARR of 15% per year. Alternative B requires a higher initial investment than A and the i* values are i * A = 20% and i * B = 16% per year. Under what circumstance is

> A to Z Mortgages made a home equity loan to your friend. For a 4-year loan of $10,000 at 10% per year, what annual payment must he make to pay off the entire loan in 4 years if interest is charged on (a) the original principal amount of $10,000, and (b)

> A $10,000 loan amortized over 5 years at an interest rate of 10% per year requires payments of $2638 to completely remove the loan when interest is charged on the unrecovered balance of the principal. If interest is charged on the original principal inst

> What is (a) the highest, and (b) lowest rate of return (in percent) possible?

> Equipment that was purchased by Newport Corporation for making pneumatic vibration isolators cost $90,000 two years ago. It has a market value that can be described by the relation $90,000 − 8000k, where k is the years from time of purchase. The operatin

> A third-year college friend of yours opened Mike’s Bike Repair Shop when he was a freshmen working on a sociology degree. He shared his NCF figures for the 3 years, including the $17,000 amount that it took to get started in business. (a) Determine the n

> A machine tool purchased 2 years ago for $40,000 has a market value best described by the relation $40,000 − 3000k, where k is the number of years from time of purchase. Experience with this type of asset has shown that its annual operating cost is descr