Question: From the information shown for possible location

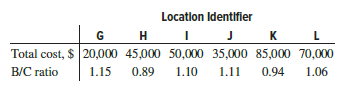

From the information shown for possible location of campgrounds and lodging at a national park, determine which project, if any, should be selected from the six mutually exclusive projects. Selected incremental B/C ratios are included. If the proper comparisons have not been made, state which one(s) are needed.

Comparison………………….. ΔB/C

G vs. H………………………………….. 0.68

G vs. I…………………………………….. 0.73

H vs. J…………………………………….. 0.10

I vs. J………………………………………. 1.07

J vs. G……………………………………… 1.07

H vs. K…………………………………….. 1.00

H vs. L……………………………………… 1.36

J vs. K……………………………………… 0.82

J vs. L………………………………………. 1.00

K vs. L……………………………………… 0.40

G vs. L………………………………………. 1.02

> In conducting a B/C analysis, (a) why is it usually necessary to take a specific viewpoint in categorizing cost, benefit, disbenefit estimates; and (b) what are two specific viewpoints that you can identify if the situation is a financial transaction bet

> In conducting a replacement study of assets with different lives, can the annual worth values over the asset’s own life cycle be used in the comparison, if the study period is (a) unlimited, (b) limited, and the study period is not an even multiple of as

> Machine A was purchased 5 years ago for $90,000. Its operating cost is higher than expected, so it will be used for only 4 more years. Its operating cost this year will be $40,000, increasing by $2000 per year through the end of its useful life. The chal

> With the estimates shown below, Sarah needs to determine the trade-in (replacement) value of machine X that will render its AW equal to that of machine Y at an interest rate of 8% per year. Determine the RV (a) by hand solution, and (b) using a spreadshe

> A company that makes micro motion compact coriolis meters purchased a new packaging system for $600,000. The estimated salvage value was $28,000 after 10 years. Currently the expected remaining life is 7 years with an AOC of $27,000 per year and an estim

> In Example 11.8, the in-place kiln and replacement kiln (GH) were evaluated using a fixed study period of 6 years. This is a significantly shortened period compared to the expected 12-year life of the challenger. Use the best estimates available througho

> In order to replace an old process for producing a polymer that reduces friction loss in engines, two current-technology machines have been identified. Process K will have a first cost of $160,000, an operating cost of $7000 per month, and a salvage valu

> A machine purchased 3 years ago for $140,000 is now too slow to satisfy the demand of customers. It can be upgraded now for $79,000 or sold to a smaller company internationally for $40,000. The upgraded machine will have an annual operating cost of $85,0

> In the process of performing a replacement study, an engineer at a fiber optics manufacturing company has two options to reduce costs on a production line. The currently owned Robot X can be sold now for $82,000. If kept, it will have an annual M&O cost

> When determining the economic service life of a new piece of equipment, an engineer made the calculations below; however, the annual worth of the salvage value for 2 years of retention was omitted. Complete the analysis by determining the following to ma

> The rate of return at the end of year 8 for two situations: (a) the business is sold for the net cash amount of $100,000 and (b) no sale.

> Searching for ways to cut costs and increase profit, one of the industrial engineers at Home Comfort Furniture Manufacturers, Inc. determined that the equivalent annual worth of an existing machine over its remaining useful life of 2 years is $70,000 per

> Randall-Rico Consultants, 5 years ago, purchased for $45,000 a microwave signal graphical plotter for corrosion detection in concrete structures. It is expected to have the market values and annual operating costs shown for its remaining useful life of u

> A presently owned machine has the projected market value and M&O costs shown below. An outside vendor of services has offered to provide the service of the existing machine at a fixed price per year. If the presently owned machine is replaced now, th

> The plant manager has asked you to do a cost analysis to determine when currently owned equipment should be replaced. The manager stated that under no circumstances will the existing equipment be retained longer than two more years and that once it is re

> State-of-the-art digital imaging equipment purchased 2 years ago for $50,000 had an expected useful life of 5 years and a $5000 salvage value. After its installation the performance was poor, and it was upgraded for $20,000 one year ago. Increased demand

> A presently owned machine can last 3 more years, if properly maintained at a cost of $15,000 per year. Its AOC is $31,000 per year. After 3 years, it can be sold for an estimated $9000. A replacement costs $80,000 with a $10,000 salvage value after 3 yea

> State what is meant by the cash flow approach and list two of its limitations in a replacement study.

> In Example 11.3, the market value (salvage value) series of the proposed $38 million replacement kiln (GH) dropped to $25 million in only 1 year and then retained 75% of the previous year’s market value through the remainder of its 12-year expected life.

> A piece of equipment has a first cost of $150,000, a maximum useful life of 7 years, and a market (salvage) value described by the relation S = 120,000 – 20,000k, where k is the number of years since it was purchased. The salvage value cannot go below ze

> A large, standby electricity generator in a hospital operating room has a first cost of $70,000 and may be used for a maximum of 6 years. Its salvage value, which decreases by 15% per year, is described by the equation S = 70,000(1 − 0.15)n, where n is t

> The following estimates (in $1000 units) have been developed for a security system upgrade at Chicago’s O’Hare Airport. (a) Calculate the conventional B/C ratio at a discount rate of 10% per year. Is the project justified? (b) Determine the minimum first

> An injection molding system has a first cost of $180,000, and an annual operating cost of $84,000 in years 1 and 2, increasing by $5000 per year thereafter. The salvage value of the system is 25% of the first cost regardless of when the system is retired

> A piece of onboard equipment has a first cost of $600,000, an annual cost of $92,000, and a salvage value that decreases to zero by $150,000 each year of the equipment’s maximum useful life of 5 years. Assume the company’s MARR is 10% per year. (a) Deter

> An airport Baggage Handing Department has evaluated two proposals for baggage delivery conveyor systems. A present worth analysis at i = 15% per year of estimated revenues and costs resulted in PWA = $460,000 and PWB = $395,000. In addition to this econo

> John, who works for Dumas Jewelers, has decided to use the weighted attribute method to compare three systems of cutting diamonds for setting into rings, earrings, necklaces, and bracelets. Once the final inspector and cutting manager scored each of thre

> Different types and capacities of crawler hoes are being considered for use in a significant excavation project to bury fiber-optic cable in Argentina. Several supervisors who have experience with similar projects have identified key attributes and their

> Two friends each invested $20,000 of their own (equity) funds. Stan, being more conservative, purchased utility and manufacturing corporation stocks. Theresa, being a risk taker, leveraged the $20,000 and purchased a $100,000 condo for rental property. C

> Deavyanne Johnston, the engineering manager at TZO Chemicals, is conducting an evaluation of alternatives based on ROR. She was given the following data and told that due to the unusually large number of investment opportunities the company now has, all

> A new annular die process is to be installed for extruding pipes, tubes, and tubular films. The phase I installed price for the dies and machinery is $2,000,000. The manufacturer has not decided how to finance the system. The WACC over the last 5 years h

> Mrs. McKay’s Nutrition Products has different methods by which a $600,000 project can be funded using debt and equity capital. A net cash flow of $90,000 per year is estimated for 7 years. Determine the rate of return for each plan, and

> Halifax Technologies primarily relies on 100% equity financing to fund projects. A good opportunity is available that will require $250,000 in capital. The Halifax owner can supply the money from personal investments that currently earn an average of 8.5

> What is the minimum amount that must be received in each of years 5 through 8 for option 3 (the one Elmer wants) to be best economically? Given this amount, what does the sale price have to be, assuming the same payment arrangement as presented above?

> Mosaic Software has an opportunity to invest $10,000,000 in a new engineering remote-control system for offshore drilling platforms in partnership with two other companies. Financing for Mosaic will be split between common stock sales ($5,000,000) and a

> Why is it financially unhealthy for an individual to maintain a large percentage of debt financing over a long period of time, that is, to be highly leveraged?

> Last year a Japanese engineering materials corporation, Yamachi Inc., purchased U.S. Treasury bonds that returned an average of 4% per year. Now, Euro bonds are being purchased with a realized average return of 3.9% per year. The volatility factor of Ya

> Common stock issued by Meggitt Sensing Systems paid stockholders an initial dividend of $0.93 per share on an average price of $18.80 last year. The company expects to grow the dividend rate at a maximum of 1.5% per year. The stock volatility is 1.19, an

> An international pharmaceutical company is initiating a new project that requires $2.5 million in debt capital. The current plan is to sell 20-year bonds that pay 4.2% per year, payable quarterly, at a 3% discount on the face value. The company has an ef

> Tri-States Gas Producers expects to borrow $800,000 for field engineering improvements. Two methods of debt financing are possible—borrow it all from a bank or issue debenture bonds. The company will pay an effective 8% per year to the bank for 8 years.

> A company that makes several different types of skateboards, Jennings Outdoors, incurred interest expenses of $1,200,000 per year from various types of debt financing. The company received $19,000,000 in year 0 through the sale of discounted bonds with a

> The cash flow plan associated with a debt financing transaction allowed a company to receive $2,800,000 now in lieu of future interest payments of $196,000 per year for 10 years plus a lump sum of $2,800,000 in year 10. If the company’s effective tax rat

> An engineering student has only 45 minutes before the final exam in her Engineering Economy class. She needs help in understanding cost-effectiveness analysis because she knows from the instructor’s review session that a CEA problem wil

> The annual cost and an effectiveness measure of items salvaged per year for four mutually exclusive, service sector alternatives have been collected. Calculate (a) the cost effectiveness ratio for each alternative, and (b) use the CER to identify the bes

> Prepare plots of the PW versus i for each of the five options. Estimate the breakeven rate of return between options.

> There are a number of techniques to help people stop smoking, but their cost and effectiveness vary widely. One accepted measure of effectiveness of a program is “percentage of enrollees quitting.” The table in this pr

> Productivity improvement is a primary goal for the new owners of a plastic pipe extrusion plant. The CEO decided to undertake, on a trial basis, a series of actions directed toward improving employee morale as a first step toward productivity increasing

> Various techniques have been proposed to curb cross-border drug smuggling into a country. The costs of implementing each strategy along a particularly rugged section of the border are indicated below. The table also includes a score that is compiled base

> Several alternatives are under consideration to enhance security at a county jail. Since the alternatives serve different areas of the facility, all that are economically attractive will be implemented. Determine which one(s) should be selected, based on

> In order to safeguard the public health, environment, public beaches, water quality, and economy of south San Diego County, California, and Tijuana, Mexico, federal agencies in the United States and Mexico developed four alternatives for treating wastewa

> The city of Valley View, California, is considering various proposals regarding the disposal of used tires. All proposals involve shredding, but the benefits differ in each plan. An incremental B/C analysis was initiated, but the engineer conducting the

> The Department of Defense is considering three sites in the National Wildlife Preserve for extraction of rare metals. The cash flows associated with each site are summarized. The extraction period is limited to 5 years and the interest rate is 10% per ye

> A public-private partnership has been formed between a city, county, and construction/management company to attract a professional athletic team to the area. Assume you are the engineer with the company and are assisting with the benefit/cost analysis. T

> A public utility in a medium-size city is considering two cash rebate programs to achieve water conservation. Program 1, which is expected to cost an average of $60 per household, provides a rebate of 75% of the purchase and installation costs of an ultr

> If John’s father insists that he make 25% per year or more on the selected option over the next 10 years, what should he do? Use all the methods of economic analysis you have learned so far (PW, AW, ROR) so John’s father can understand the recommendation

> There are two potential locations to construct an urgent care walk-in clinic to serve rural residents. Use B/C analysis to determine which location, if any, is better at an interest rate of 8% per year.

> Two relatively inexpensive alternatives are available for reducing potential earthquake damage at a top secret government research site. The cash flow estimates for each alternative are given below. At an interest rate of 8% per year, use the B/C ratio m

> One of two alternatives will be selected to reduce flood damage in a rural community in central Arizona. The estimates associated with each alternative are available. Use B/C analysis at a discount rate of 8% per year over a 20-year study period to deter

> Dickinson, a large oil and gas drilling and operating corporation, has invested over the past 6 years in the installation and operation of a FOUNDATION Fieldbus H1 (FF H1) system developed by Pepperl+Fuchs of Germany. A project engineer has collected inf

> With an installed capacity in excess of 11,000 MW, the Belo Monte dam complex on the Xingu River in Brazil will be the world’s third largest hydroelectric dam. The project is expected to cost $16 billion and will begin producing electricity upon completi

> From the following data for a PPP project, calculate the (a) conventional, and (b) modified benefit/ cost ratios using an interest rate of 6% per year and an infinite project period.

> In most developed countries, laws that prohibit texting-while-driving (TWD) have been enacted. Hambara and Associates, a systems engineering consulting company, has won the contract to assist the Callaghan Police Department in implementing projects that

> A rate of return analysis was initiated for the infinite- life alternatives shown below. (a) Fill in the 10 blanks in the incremental rate of return (Δi*) columns. (b) How much revenue is associated with each alternative? (c) Which alternati

> Four different machines were under consideration for materials flow improvement on a drug bottling line. An engineer performed the economic analysis to select the best machine, but some of his calculations were removed from the report by a disgruntled em

> The four alternatives described below are being evaluated by the rate of return method. (a) If the proposals are independent, which should be selected at a MARR of 16% per year? (b) If the proposals are mutually exclusive, which one should be selected at

> Develop the actual cash flow series and incremental cash flow series (in $1000 units) for all five options in preparation for an incremental ROR analysis.

> A small manufacturing company could expand its operation by adding new products. Any or all of the products shown below can be added. If the company uses a MARR of 15% per year and a 5-year project period, which products, if any, should the company intro

> You are considering five projects, all of which can be considered to last indefinitely. If the company’s MARR is 15% per year, determine which should be selected if they are (a) independent projects, and (b) mutually exclusive alternati

> For the four revenue alternatives below, use the ROR method results to determine: (a) Which one(s) to select, if MARR = 17% per year and the proposals are independent. (b) Which one to select, if MARR = 14.5% per year and the alternatives are mutually ex

> Old Southwest Canning Co. has determined that any one of four machines can be used in its chili canning operation. The cost of the machines are estimated below, and all machines have a 5-year life. If the minimum attractive rate of return is 25% per year

> A company that makes clutch disks for race cars has the annual net cash flows shown for one department. Year…………………… NCF, $1000 0……………………………………. −65 1………………………………………. 30 2……………………………………… 84 3….…………………………………. −10 4…………………………………….. −12 (a) Determine the n

> A metal plating company is considering four different methods for recovering by-product heavy metals from a manufacturing site’s liquid waste. The investment costs and annual net incomes associated with each method have been estimated.

> For the nonconventional net cash flow shown, determine the external rate of return using the MIRR method at a borrowing rate of 10% per year and an investment rate of (a) 15% per year, and (b) 30% per year.

> A new advertising campaign by a company that manufactures products that apply biometric, surveillance, and satellite technologies resulted in the cash flows shown. Calculate unique external rate of return values using (a) the ROIC method with an investme

> Steel cable barriers in highway medians are a lowcost way to improve traffic safety without overstressing department of transportation budgets. Cable barriers cost $44,000 per mile, compared with $72,000 per mile for guardrail and $419,000 per mile for c

> Business and engineering seniors are comparing methods of financing their college education during their senior year. The business student has $30,000 in student loans that comes due at graduation. Interest is an effective 4% per year. The engineering se

> Use any method of economic analysis to display on the spreadsheet the value of the incremental ROR between server 2 with a life estimate of 5 years and a life estimate of 8 years.

> Tom, the owner of Burger Palace, determined that his weighted average cost of capital is 8%. He expects a return of 4% per year on all of his investments. A proposal presented by the owner of the Dairy Choice next door seems quite risky to Tom, but it is

> Five independent projects were ranked in decreasing order by two measures—rate of return (ROR) and present worth (PW)—to determine which should be funded with the total initial investment not to exceed $30 million. (a)

> A new cross-country, trans-mountain water pipeline needs to be built at an estimated first cost of $200,000,000. The consortium of cooperating companies has not fully decided the financial arrangements of this adventurous project. The WACC for similar pr

> For each of the following scenarios, state whether an incremental ROR analysis is required to select an alternative and state why or why not. Assume that alternative Y requires a larger initial investment than alternative X and that the MARR is 20% per y

> Jamison Specialties manufactures programmable incremental encoders that resist shock and vibration for use in harsh environments. Five years ago, the company invested $650,000 in an automated quality control system and recorded savings of$105,000 per yea

> Explain how the viewpoint established before a public sector analysis is started can turn an estimate from being categorized as a disbenefit to a cost, or vice versa.

> Identify the following funding sources as primarily public or private. (a) Municipal bonds (b) Retained earnings (c) Sales taxes (d) Automobile license fees (e) Bank loans ( f ) Savings accounts (g) An engineer’s IRA (Individual Retirement Account) (h) S

> Determine i* per year for the cash flows shown using factors and the IRR function.

> Use factors and a spreadsheet to determine the interest rate per period from the following equation: 0 = −40,000 + 8000(P∕A,i*,5) + 8000(P∕F,i*,8)

> If a manufacturer of electronic devices invests $650,000 in equipment for making compact piezoelectric accelerometers for general purpose vibration measurement, estimate the rate of return from revenue of $225,000 per year for 10 years and $70,000 in sal

> Use incremental ROR analysis to decide between the servers at MARR = 12%.

> A chemical engineer working for a large chemical products company was asked to make a recommendation about which of three mutually exclusive revenue alternatives should be selected for improving the marketability of personal care products used for condit

> When conducting an ROR analysis of mutually exclusive cost alternatives: (a) All of the projects must be compared against the do-nothing alternative (b) More than one project may be selected (c) An incremental investment analysis is necessary to identify

> A company that manufactures high-strength epoxys is considering investing $100,000 in two new adhesives identified as X and Z. The investment in X is $20,000 and is expected to yield a rate of return of 40% per year. Your supervisor asked you to determin

> The rate of return for alternative X is 18% per year and for alternative Y is 17%, with Y requiring a larger initial investment. If a company has a minimum attractive rate of return of 16%: (a) The company should select alternative X (b) The company shou

> Alternative A has a rate of return of 14% and alternative B has a rate of return of 17%. If the investment required in B is larger than that required for A, the rate of return on the increment of investment between A and B is: (a) Larger than 14% (b) Lar

> For the nonconventional net cash flow series shown, the external rate of return per year using the MIRR method, with an investment rate of 20% per year and a borrowing rate of 8% per year, is closest to: (a) 10.8% (b) 12.0% (c) 14.8% (d) 16.7%

> When applying the MIRR approach to determine the external rate of return of a project, which of the following statements is true? (a) The borrowing rate, ib, is usually equal to the MARR. (b) The borrowing rate, ib, is usually greater than the investment

> Five years ago, an alumnus of a university donated $50,000 to establish a permanent endowment for scholarships. The first scholarships were awarded 1 year after the contribution. If the amount awarded each year, that is, the interest on the endowment, is

> A bulk materials hauler purchased a used dump truck for $50,000 two years ago. The operating costs have been $5000 per month and revenues have averaged $7500 per month. The truck was just sold for $11,000. The rate of return is closest to: (a) 2.6% per m

> An investment of $60,000 ten years ago resulted in uniform income of $10,000 per year for the 10-yearperiod. The rate of return on the investment was closest to: (a) 10.6% per year (b) 14.2% per year (c) 16.4% per year (d) 18.6% per year

> In a separate conversation, the line manager told you to not plan for a rebuild after 6000 hours because the pump will be replaced after a total of 10,000 hours of operation. The line manager wants to know what the base AOC in year 1 can be to make the E

> Basset, a furniture manufacturing company, borrowed $1 million and repaid the loan through monthly payments of $20,000 for 2 years plus a single lump-sum payment of $1 million at the end of 2 years. The interest rate on the loan was closest to: (a) 0.5%

> For the net cash flow and cumulative cash flows shown, the value of x is nearest: (a) $−8,000 (b) $−16,000 (c) $16,000 (d) $41,000