Question: GoGo Ltd. manufactures three models of children'

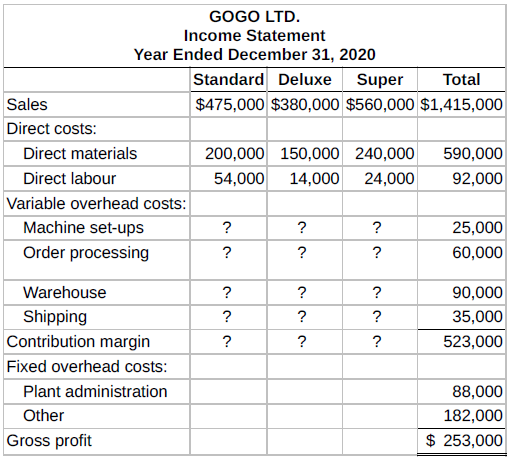

GoGo Ltd. manufactures three models of children's swing sets: Standard, Deluxe, and Super. The Standard set is made of steel, the Deluxe set is made of aluminum, and the Super set is made of a titanium aluminum alloy. Because of the different materials used, production requirements differ significantly across models in terms of machine types and time requirements. However, once the parts are produced, assembly time per set is similar for the three models. For this reason, GoGo has adopted the practice of allocating overhead costs on the basis of machine hours. Last year, the company produced 5,000 Standard sets, 500 Deluxe sets, and 2,000 Super sets. The company had the following revenues and expenses for the year:

Assign overhead costs using traditional costing and ABC; compare results.

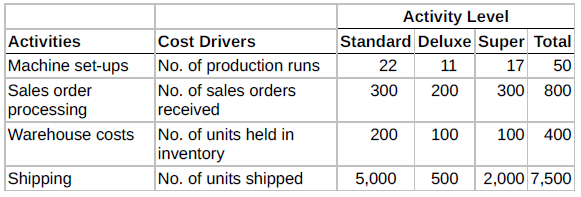

The chief financial officer of GoGo has hired a consultant to recommend cost allocation bases. The consultant has recommended the following:

The consultant found no basis for allocating the plant administration and other fixed overhead costs, and recommended that they not be applied to products.

Instructions

a. Complete the income statement using the bases recommended by the consultant. Do not allocate any fixed overhead costs.

CM for Super $233,167

b. Explain how activity-based costing might result in better decisions by

GoGo's management.

Transcribed Image Text:

GOGO LTD. Income Statement Year Ended December 31, 2020 Standard Deluxe Super Total Sales $475,000 $380,000 $560,000 $1,415,000 Direct costs: Direct materials 200,000 150,000 240,000 590,000 Direct labour 54,000 14,000 24,000 92,000 Variable overhead costs: Machine set-ups ? ? 25,000 Order processing ? ? ? 60,000 Warehouse ? ? ? 90,000 Shipping ? ? ? 35,000 Contribution margin ? ? ? 523,000 Fixed overhead costs: Plant administration 88,000 Other 182,000 Gross profit $ 253,000 . Activity Level Activities Cost Drivers Standard Deluxe Super Total Machine set-ups No. of production runs 22 50 11 17 Sales order No. of sales orders 300 200 300 800 processing received Warehouse costs No. of units held in 200 100 100 400 |inventory Shipping No. of units shipped 5,000 500 2,000 7,500

> With reference to foreign exchange turnover in 2013: a. Rank by volume the relative size of spot, forwards, and swaps. b. List the five most important geographic locations for foreign exchange turnover in descending order. c. List the three most importan

> What is a nondeliverable forward and why does it exist?

> Define and differentiate the different type of swap transactions in the foreign exchange markets.

> Define each of the following types of foreign exchange transactions: a. Spot b. Outright forward c. Forward-forward swaps

> For each of the foreign exchange market participants, identify their motive for buying or selling foreign exchange.

> How is the global foreign exchange market structured? Is digital telecommunications replacing people?

> What is the J-Curve adjustment path?

> What are the three major functions of the foreign exchange market?

> A foreign subsidiary does not have an independent cost of capital. However, in order to estimate the discount rate for a comparable host-country firm, the analyst should try to calculate a hypothetical cost of capital. How is this done?

> Capital budgeting for a foreign project uses the same theoretical framework as domestic capital budgeting. What are the basic steps in domestic capital budgeting?

> Culver Cheese Company has developed a new cheese slicer called the Slim Slicer. The company plans to sell this slicer through its monthly catalogue. Given market research, Culver management believes the company can charge $20 for the Slim Slicer. Prototy

> The fastener division of Northern Textile Industries manufactures zippers and then sells them to customers for $8 per unit. Its variable cost is $3 per unit, and its fixed cost per unit is $1.50. Management would like the fastener division to transfer 12

> Presented below are data for ProTech Appliance Repair Shop: Use time-and-material pricing to determine bill. Repair technicians' wages ……. $120,000 Fringe benefits ………………………. 40,000 Overhead ………………………………. 50,000 The desired profit margin per hour is $1

> Floor Show Corporation produces area rugs. The following perunit cost information is available: direct materials $18, direct labour $9, variable manufacturing overhead $5, fixed manufacturing overhead $6, variable selling and administrative expenses $3,

> Clear Water is considering introducing a water filtration device for its one-litre water bottles. Market research indicates that 1 million units can be sold if the price is no more than $3. If Clear Water decides to produce the filters, it will need to i

> Using the data in BE9.4, calculate the markup percentage using variable-cost pricing. Calculate markup percentage using variable-cost approach. Data from BE9.4: Schuman Corporation produces microwave units. The following per-unit cost information is ava

> Using the data in BE9.4, calculate the markup percentage using the absorption-cost approach. Calculate markup percentage using absorption-cost approach. Data from BE9.4: Schuman Corporation produces microwave units. The following per-unit cost informati

> Podrive Company manufactures computer hard drives. The market for hard drives is very competitive. The current market price for a computer hard drive is $45. Podrive would like a profit of $15 per drive. How can Podrive Company accomplish this objective?

> Quick Pix is a large digital processing centre that serves 130 outlets in grocery stores, service stations, camera and photo shops, and drugstores in 16 nearby towns. Quick Pix operates 24 hours a day, six days a week. Classify each of the following acti

> Wu and Martin is an architectural firm that is contemplating the installation of activity-based costing. The following activities are performed daily by staff architects. Classify these activities as valueadded or non–value-added: (a) designing and draft

> For Biswell Company, variable costs are 70% of sales and fixed costs are $195,000. Calculate the required sales in dollars that are needed to achieve management's target operating income of $75,000. (Use the contribution margin approach.) Calculate sales

> Milner Manufacturing uses a job-order costing system. On May 1, the company has a balance in Work in Process Inventory of $3,500 and two jobs in process: Job No. 429 $2,000, and Job No. 430 $1,500. During May, a summary of source documents reveals the fo

> Hirani Novelty Company identified the following activities in its production and support operations. Classify each of these activities as either value-added or non–value-added. Classify activities as value-added or non–value-added. a. Purchasing b. Recei

> Computer Parts Inc., a manufacturer of computer chips, employs activity-based costing. The following budgeted data for each of the activity cost pools are provided for the year 2020. Calculate activity-based overhead rates. // For 2020, the company had

> Look on the Internet for time management resources that are designed specifically for students. If you cannot find one, look at the University of Guelph library web page. Instructions Use the resources to answer the following questions. a. Why is it imp

> Marcus Lim, the cost accountant for Hi-Power Mower Company, recently installed activity-based costing at the company's western lawn tractor (riding mower) plant, where three models are manufactured: the 8-horsepower Bladerunner, the 12-horsepower Quickcu

> Java Inc. is a distributor and processor of a variety of different blends of coffee. The company buys coffee beans from around the world and roasts, blends, and packages them for resale. Java Inc. currently offers 10 different coffees in 500-gram bags to

> Canadian Motorcycle Company (CMC) produces two models of motorcycles: Faster and Slower. The company has five categories of overhead costs: purchasing, receiving, machine operating, handling, and shipping. Each category represents the following percentag

> The CEO of Walker Ltd. is currently investigating ways to modernize the company's manufacturing process. At the first staff meeting, the chief engineer presented a proposal for automating the assembly department, and recommended that the company purchase

> Coats Galore Inc. uses activity-based costing as the basis for information to set prices for its six lines of seasonal coats. Calculate the activity-based overhead rates using the following budgeted data for each of the activity cost pools. Calculate act

> The Peace Barber Shop employs four barbers. One barber, who also serves as the manager, is paid a salary of $3,900 per month. The other barbers are paid $1,900 per month. In addition, each barber is paid a commission of $2 per haircut. Other monthly cost

> Wet Ride Inc. manufactures and distributes three types of water skis: beginner, intermediate, and advanced. Production is highly automated for the beginner model, whereas the intermediate and advanced models require increasing degrees of labour, dependin

> For Dene Company, the predetermined overhead rate is 150% of direct labour cost. During the month, Dene incurred $100,000 of factory labour costs, of which $85,000 is direct labour and $15,000 is indirect labour. Actual overhead incurred was $120,000. Ap

> B & B Electronics Company manufactures two large-screen television models: the Deluxe, which has been produced for many years and sells for $900, and the Flat, a new model, which sells for $1,260. Based on the following income statement for 2020, the

> Aerotech International Inc. of Montreal has supported a research and development (R&D) department that for many years has been the sole contributor to the company's new products. The R&D activity is an overhead cost centre that provides services

> For the past five years, Collins Ltd. has been running a consulting practice in which it provides two major services: general management consulting and executive training seminars. The CFO is not quite sure that he is charging accurate fees for the diffe

> ProDriver Inc. (PDI) recently started operations to obtain a share of the growing market for golf equipment. PDI manufactures two models of specialty drivers: the Thunderbolt model and the Earthquake model. Two professional engineers and a professional g

> McDonald and O'Toole is a law firm that serves both individuals and corporations. A controversy has developed between the partners of the two service lines as to who is contributing the greater amount to the bottom line. The area of contention is the ass

> Scalar Manufacturing produces automobile parts in batches in one continuous manufacturing process. The company uses direct labour hours to assign overhead to each part. Magda Malakova, the financial controller, is wondering what the reasons are for the l

> National Steel Company has budgeted manufacturing overhead costs of $2.5 million. It has allocated overhead on a plant-wide basis to its two products (Standard Steel and Deluxe Steel) using machine hours, which are estimated to be 100,000 for the current

> Quality Paints Inc. uses a traditional cost accounting system to apply quality-control costs uniformly to all its products at a rate of 30% of the direct labour cost. The monthly direct labour cost for the varnish paint line is $100,000. The company is c

> Ronald Enterprises Ltd. has estimated the following costs for producing and selling 15,000 units of its product: Calculate the break-even point in units and target income after tax. Direct materials ………………………………………….………. $75,000 Direct labour …………………………

> Prime Furniture designs and builds premium factory-made wood armoires for homes. All are made of white oak. Its budgeted manufacturing overhead costs for the year 2020 are as follows. Assign overhead costs using traditional costing and ABC; compare resul

> Ayala Company manufactures four products in a single production facility. The company uses activity-based costing. The company has identified the following activities through its activity analysis: (a) inventory control, (b) machine set-ups, (c) employee

> During the current month, Seeza Corporation completed Job 310 and Job 312. Job 310 cost $60,000 and Job 312 cost $40,000. Job 312 was sold on account for $90,000. Journalize the entries for the completion of the two jobs and the sale of Job 312. Prepare

> Mars Company has four categories of overhead: purchasing and receiving materials, machine operating costs, material handling, and shipping. The costs estimated for these categories for the coming year are as follows: Assign overhead costs using tradition

> Tough Thermos Inc. manufactures two plastic thermos containers at its plastic moulding facility in Lethbridge, Alberta. Its large container, called the Ice House, has a volume of five litres, side carrying handles, a snap-down lid, and a side drain and p

> VidPlayers Inc. manufactures two types of DVD players: a deluxe model and a superior model. The deluxe model is a multi-format progressive-scan DVD player with networking capability, Dolby digital, and DTS decoder. The superior model's primary feature is

> Hy and van Lamsweerde is a public accounting firm that offers two primary services: auditing and tax return preparation. A controversy has developed between the partners of the two service lines regarding who is contributing the greater amount to the bot

> International Steel Company has budgeted manufacturing overhead costs of $1,930,000. It has allocated overhead on a plant-wide basis to its two products (soft steel and hard steel) using machine hours, which are estimated to be 90,000 for the current yea

> Stellar Stairs Co. designs and builds factory-made premium wooden stairways for homes. The manufactured stairway components (spindles, risers, hangers, hand rails) permit installation of stairways of varying lengths and widths. All are made of white oak

> Imagen Arquitectónica of Tijuana, Mexico, is contemplating a major change in its cost structure. Currently, all of its drafting work is performed by skilled draftspersons. Alfredo Ayala, Imagen's owner, is considering replacing the draftspersons with a c

> Kiddy Company manufactures bicycles. It recently received a request to manufacture 10 units of a mountain bike at a price lower than it normally accepts. Bruce, the sales manager, indicated that, if the order were accepted at that price, the company coul

> Jacobson Electronics manufactures two HD television models: the Royale, which sells for $1,400, and a new model, the Majestic, which sells for $1,100. The production costs calculated per unit under traditional costing for each model in 2020 were as follo

> Allen Inc. is a manufacturer of quality shoes. The company has always used a plant-wide allocation rate for allocating manufacturing overhead to its products. The plant manager believes it is time to change to a better method of cost allocation. The acco

> Fishel Company is working on two job orders. The job cost sheets show the following: Assign costs to work in process. Prepare the three summary entries to record the assignment of costs to Work in Process from the data on the job cost sheets. Job 2

> Altex Co. identifies the following activities that pertain to manufacturing overhead: material handling, machine set-ups, factory machine maintenance, factory supervision, and quality control. For each activity, identify an appropriate cost driver. Ident

> FireOut Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-litre cylinder that holds 2.5 kilograms

> Otto Dieffenbach & Sons Inc. is a small manufacturing company that uses activity-based costing. Dieffenbach & Sons accumulates overhead in the following activity cost pools. Classify activities by level. 1. Hiring personnel 2. Managing parts inventory 3.

> Having itemized its costs for the first quarter of next year's budget, Galavic Corporation wants to install an activity-based costing system. First, it identified the activity cost pools in which to accumulate factory overhead; second, it identified the

> Duplessis and Najarali is a law firm that is initiating an activity-based costing system. Réjean Duplessis, the senior partner and a strong supporter of ABC, has prepared the following list of activities performed by a typical lawyer in a day at the firm

> Anna Bellatorre Inc. is interested in using its activity-based costing system to improve its operating efficiency and its profit margins by applying activity-based management techniques. As part of this undertaking, you have been asked to classify its pl

> The CVP income statements shown below are available for Billings Company and Bozeman Company. Calculate the degree of operating leverage and evaluate the impact of alternative cost structures on operating income. Instructions a. Calculate the degree of

> In an effort to expand the usefulness of its activity-based costing system, Peter Catalano's Verde Vineyards decides to adopt activity-based management techniques (ABM). One of these ABM techniques is classifying its activities as either value-added or n

> Lim Clothing Company manufactures its own designed and labelled sports attire and sells its products through catalogue sales and retail outlets. While Lim has used activity-based costing in its manufacturing activities for years, it has always used tradi

> H&Y Company uses four activity pools to apply overhead to its products. Each activity has a cost driver used to allocate the overhead costs to the product. The activities and related overhead costs are as follows: Calculate overhead rates and assign

> Fontillas Instrument, Inc. manufactures two products: missile range instruments and space pressure gauges. During April, it produced 50 range instruments and 300 pressure gauges and incurred estimated overhead costs of $94,500. An analysis of estimated o

> During the current month, Dalmar Company incurs the following manufacturing costs: Prepare journal entries for manufacturing costs. 1. Purchased raw materials of $16,000 on account. 2. Incurred factory labour of $40,000. Of that amount, $31,000 relates t

> Peter Catalano's Verde Vineyards, in the Niagara Peninsula, produces three varieties of wine: merlot, viognier, and pinot noir. His winemaster, Kyle Pohle, has identified the following activities as cost pools for accumulating overhead and assigning it t

> Sassafras Inc. has conducted an analysis of overhead costs related to one of its product lines using a traditional costing system (volume based) and an activity-based costing system. Following are its results: Identify differences between costing systems

> Galavic Corporation manufactures snowmobiles in its Blue Mountain plant. It has budgeted the following costs for the first quarter's operations. Identify activity cost pools and cost drivers. Instructions Classify the above costs of Galavic Corporation

> Shady Lady sells window coverings to both commercial and residential customers. The following information relates to its budgeted operations for the current year: Assign overhead using traditional costing and ABC. The controller, Susan Chan, is concern

> Alonzo Inc. manufactures two products: car wheels and truck wheels. To determine the amount of overhead to assign to each product line, the controller, YuYu Ortega, has developed the following information: Assign overhead using traditional costing and AB

> Mega Electronix sells television sets and Blu-ray DVD players. The business is divided into two divisions along product lines. A variable cost income statement for a recent quarter's activity is presented below: Determine the break-even point in dollars

> International Fabrics has budgeted overhead costs of $955,000. It has allocated overhead on a plant-wide basis to its two products (wool and cotton) using direct labour hours, which are estimated to be 477,500 for the current year. The company has decide

> Khan Inc. has conducted the following analysis related to its product lines using a traditional costing system (volume-based) and an activity-based costing system. Both the traditional and activity-based costing systems include direct materials and direc

> Elle Inc. makes two types of handbags: standard and custom. The controller has decided to use a plant-wide overhead rate based on direct labour costs. The president has heard of activity-based costing and wants to see how the results would differ if this

> Ready Ride is a trucking company. It provides local, short-haul, and long-haul services. It has developed the following three cost pools. Apply ABC to a service company. Instructions a. Calculate the activity-based overhead rates for each pool. b. Dete

> Good Harvest Company manufactures four lines of garden tools. As a result of an activity analysis, the accounting department has identified eight activity cost pools. Each of the product lines is produced in large batches, with the whole plant devoted to

> At December 31, balances in Manufacturing Overhead are Diaz Company—debit $1,200, Garcia Company—credit $900. Prepare the adjusting entry for each company at December 31, assuming the adjustment is made to cost of goods sold. Prepare adjusting entries fo

> Weber Industries has three activity cost pools and two products. It estimates production of 3,000 units of Product BC113 and 1,400 of Product AD908. Having identified its activity cost pools and the cost drivers for each pool, Weber accumulated the follo

> Tool Time Inc. operates 20 injection moulding machines in the production of tool boxes of four different sizes, named the Apprentice, the Handyman, the Journeyman, and the Professional. Classify each of the following costs as unit-level, batch-level, pro

> Infotrac Inc. sells a high-speed retrieval system for information. It provides the following information for the year. Identify differences between costing systems. Overhead is applied on the basis of machine hours. a. Calculate the predetermined overh

> Presented below are the CVP income statements for Finch Company and Sparrow Company. They are in the same industry, with the same operating incomes, but different cost structures. Calculate break-even point with change in operating leverage. Calculate

> Veejay Golf Accessories sells golf shoes, gloves, and a laser guided range-finder that measures distance. Shown below are unit cost and sales data: Calculate the break-even point in units for a company with multiple products. Fixed costs are $660,000.

> Sanjay's Shingle Corporation is considering the purchase of a new automated shingle-cutting machine. The new machine will reduce variable labour costs but will increase depreciation expense. The contribution margin is expected to increase from $160,000 t

> The degrees of operating leverage for Delta Corp. and Epsilon Co. are 1.4 and 5.6, respectively. Both have operating incomes of $50,000. Determine their respective contribution margins. Determine contribution margin.

> NYX Inc. sells its product for $24 per unit and variable costs are $14 per unit. Its fixed costs are $130,000. Calculate the required sales in units to achieve its target operating income of 10% of total costs. Calculate required sales for target operati

> Part 1 The vice-president of sales and marketing, Madison Tremblay, is trying to plan for the coming year in terms of production needs to meet the forecasted sales. The board of directors is very supportive of any initiatives that will lead to increased

> Rapid Auto has 200 auto-maintenance service outlets nationwide. It provides two main lines of service: oil changes and brake repair. Oil changes and related services represent 70% of its sales and provide a contribution margin ratio of 20%. Brake repair

> Grass King manufactures lawn mowers, weed trimmers, and chainsaws. Grass King has fixed costs of $4.2 million. Its sales mix and contribution margin per unit are as follows: Calculate the break-even point in units for a company with more than one product

> An investment banker is analyzing two companies that specialize in the production and sale of candied apples. Old-Fashioned Apples uses a labour-intensive approach, and Mech-Apple uses a mechanized system. Variable costing income statements for the two c

> A firm sells its product for $30 per unit. Its direct material costs are $6 per unit and direct labour costs are $4. Fixed manufacturing overhead costs are $40,000 and variable overhead costs are $8 per unit. Calculate the required sales in dollars to br

> Volmar Company had sales in 2020 of $1,250,000 on 50,000 units. Variable costs totalled $600,000, and fixed costs totalled $500,000. Prepare a CVP income statement before and after changes in the business environment. A new raw material is available tha

> Determine the missing amounts: Determine missing amounts for contribution margin. Unit Selling Unit Variable Contribution Margin Contribution Price Margin Ratio (b) Costs per Unit 1. $640 $352 (a) 2. $300 (c) $ 93 (d) 3. (e) (f) $325 25%

> Current Designs manufactures two different types of kayaks: rotomoulded kayaks and composite kayaks. The following information is available for each product line. The company's fixed costs are $820,000. An analysis of the sales mix identifies that roto

> Friendly Airways Inc., a small two-plane passenger airline, has asked for your assistance in some basic analysis of its operations. The planes seat 10 passengers each, and they fly commuters from Friendly's base airport to the major city in the province,

> Moran Company reports the following operating results for the month of August: sales $310,000 (units 5,000); variable costs $217,000; and fixed costs $70,000. Management is considering the following independent courses of action to increase operating inc

> Johansen Company had $210,000 of operating income in 2020, when the selling price per unit was $150, the variable costs per unit were $90, and the fixed costs were $570,000. Management expects per-unit data and total fixed costs to remain the same in 202

> In the month of June, New Day Spa served 560 clients at an average price of $120. During the month, fixed costs were $21,024 and variable costs were 60% of sales. Calculate the contribution margin and break-even point. Instructions a. Determine the cont