Question: Google, Inc. and Microsoft Corporation design and

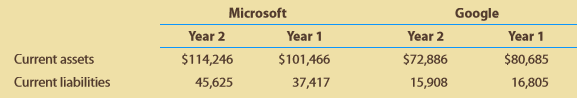

Google, Inc. and Microsoft Corporation design and distribute consumer and enterprise software, including overlaps in search, business productivity, and mobile operating systems. Google’s primary source of revenue is from advertising, while Microsoft’s is from software subscription and support fees. The following year-end data (in millions) were taken from recent balance sheets for both companies:

A. Compute the working capital for each company for both years.

B. Which company has the larger working capital at the end of Year 2?

C. Is working capital a good measure of relative liquidity in comparing the two companies? Explain.

D. Compute the current ratio for both companies. (Round to one decimal place.)

E. Which company has the larger relative liquidity based on the current ratio?

F. Based on your analysis, comment on the short-term debt-paying ability of these two companies.

Transcribed Image Text:

Microsoft Google Year 2 Year 1 Year 2 Year 1 Current assets $114,246 $101,466 $72,886 $80,685 Current liabilities 45,625 37,417 15,908 16,805

> Littlejohn, Inc. manufactures machined parts for the automotive industry. The activity cost associated with Part XX-10 is as follows: Each unit requires 30 minutes of fabrication direct labor. Moreover, Part XX-10 is manufactured in production run size

> Skidmore Electronics manufactures consumer electronic products. The company has three assembly labor classifications, S-1, S-2, and S-3. The three classifications are paid $15, $18, and $22 per hour, respectively. The assembly activity for a new smartpho

> Blue Ribbon Flour Company manufactures flour by a series of three processes, beginning in the Milling Department. From the Milling Department, the materials pass through the Sifting and Packaging departments, emerging as packaged refined flour. The balan

> Gourmet Master, Inc. uses activity-based costing to determine the cost of its stainless steel ovens. Activity-based product cost information is as follows: These activities only include the labor portion of the cost. Fabrication is the cutting and shap

> Eastern Skies Airlines has three flights that depart from New York City and arrive in Chicago every day. The three flights are as follows: Each flight uses a jet with a capacity of 180 seats. The airline measures the utilization of the aircraft by pass

> Midstate Containers Inc. manufactures cans for the canned food industry. The operations manager of a can manufacturing operation wants to conduct a cost study investigating the relationship of tin content in the material (can stock) to the energy cost fo

> Pix Paper Inc. produces photographic paper for printing digital images. One of the processes for this operation is a coating (solvent spreading) operation, where chemicals are coated onto paper stock. There has been some concern about the cost performanc

> Mystic Bottling Company bottles popular beverages in the Bottling Department. The beverages are produced by blending concentrate with water and sugar. The concentrate is purchased from a concentrate producer. The concentrate producer sets higher prices f

> Brady Furniture Company manufactures wooden oak furniture. The company employs a job cost system to trace manufacturing costs to jobs. Each job represents a batch of furniture of the same type. Information regarding direct materials on selected jobs thro

> Raneri Trophies Inc. uses a job order cost system for determining the cost to manufacture award products (plaques and trophies). Among the company’s products is an engraved plaque that is awarded to participants who complete a training

> Alvarez Manufacturing Inc. is a job shop. The management of Alvarez Manufacturing Inc. uses the cost information from the job sheets to assess cost performance. Information on the total cost, product type, and quantity of items produced is as follows:

> The Valley Hospital measures the in-patient occupancy of the hospital by determining the number of patient days divided by the number of available bed days in the hospital for a time period. The following in-patient data are available for the months of A

> Sunrise Suites and Nationwide Inns operate competing hotel chains across the region. Hotel capacity information for both hotels is as follows: Information on the number of guests for each hotel and the average length of visit for June were as follows:

> Pittsburgh Aluminum Company uses a process cost system to record the costs of manufacturing rolled aluminum, which consists of the smelting and rolling processes. Materials are entered from smelting at the beginning of the rolling process. The inventory

> A recent annual report of Hilton Hotels and Marriott International provided the following occupancy data for two recent years: A. Is the occupancy trend favorable or unfavorable for Hilton Hotels? B. Is the occupancy trend favorable or unfavorable for

> Priceline Group , Inc. is a leading provider of online travel reservation services, including brand names Priceline, KAYAK, and Open Table. Selected cash flow information from the statement of cash flows for three recent years is as follows (in millions)

> Marriott International, Inc. , and Hyatt Hotels C or p or at ion are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in mi

> Deere & Company manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere’s credit division loans money to customers to finance the purchase of th

> The condensed income statements through income from operations for Amazon. com, Inc. , Best Buy , Inc. , and Walmart Stores, Inc. for a recent fiscal year follow (in millions): 1. Prepare comparative common-sized income statements for each company. (Ro

> T&T Inc. is a leading global provider of telecommunication services. Facebook , Inc. is a major worldwide social media company. AT&T has a lengthy history and was founded by Alexander Graham Bell. Facebook has a short history and was founded by M

> Radio Shack C or p or at i on is a consumer electronics retailer. Recently, the company declared bankruptcy to provide financial protection while attempting to reorganize its operations. Annual report information for the three most recent years prior to

> Amazon .com, Inc. is one of the largest Internet retailers in the world. Best Buy , Inc. is a leading retailer of consumer electronics and media products in the United States, while Walmart Stores, Inc. is the leading retailer in the United States. Amazo

> BB&T Corporation and Region s Financial Corporation are large regional banking companies. The net income and average common shares outstanding for both companies were reported in recent financial reports as follows (in millions): In addition, BB&am

> Caterpillar Inc. is the world’s leading manufacturer of construction and mining equipment. In addition, Birinyi Associates identified Caterpillar as one of the top five companies to repurchase their own shares in a recent year.12 Three

> Dover Chemical Company manufactures specialty chemicals by a series of three processes, all materials being introduced in the Distilling Department. From the Distilling Department, the materials pass through the Reaction and Filling departments, emerging

> Pacific Gas and Electric Company is a large gas and electric utility operating in northern and central California. Three recent years of financial data for Pacific Gas and Electric are as follows (in millions): A. Determine the earnings per share for Y

> Amazon .com, Inc. is one of the largest Internet retailers in the world. Walmart is the largest retailer in the United States. Amazon and Walmart compete in similar markets; however, Walmart sells through both traditional retail stores and the Internet,

> Hilton Worldwide Holdings, Inc. and Marriott International, Inc. are two of the largest hotel operators in the world. Selected financial information from recent income statements for both companies follows (in millions): A. Compute the times interest e

> Aeropostale, Inc. is a specialty fashion retailer targeting young adults. The income before income tax expense and interest expense for four recent years follow (in millions): A. Compute the time interest earned ratio for each year. (Round to one decim

> Arch Coal, Inc. is a major coal mining company in the United States. Condensed income statement information for three recent years follows (in millions): A. Compute the times interest earned ratio for the three years. (Round to one decimal place.) B. H

> Amazon .com, Inc. is one of the largest Internet retailers in the world. Walmart Stores, Inc. is the largest retailer in the United States. Amazon and Walmart compete in similar markets; however, Walmart sells through both traditional retail stores and t

> Cabela’s Incorporated is a leading specialty retailer of outdoor sports merchandise. Dick ’ s Sporting Goods, Inc. is a leading full-line retailer of sporting equipment and apparel. The current assets and current liabi

> Nan Marcus Group is one of the largest luxury fashion retailers in the world. Kohl’ s Corporation sells moderately priced private and national branded products through more than 1,100 department stores located throughout the United Stat

> The Hershey Company is the largest producer of chocolate in North America under the Hershey’s and Reese’s brand names. The following balance sheet information is provided at the end of three recent years (in thousands)

> Amazon .com, Inc. is one of the largest Internet retailers in the world. Best Buy , Inc. is a leading retailer of consumer electronics and media products in the United States. Amazon and Best Buy compete in similar markets; however, Best Buy sells throug

> Bavarian Chocolate Company processes chocolate into candy bars. The process begins by placing direct materials (raw chocolate, milk, and sugar) into the Blending Department. All materials are placed into production at the beginning of the blending proces

> The following table shows the sales and average book value of fixed assets for three different companies from three different industries for a recent year: A. For each company, determine the fixed asset turnover ratio. (Round to one decimal place.) B.

> FedEx Corporation and United Parcel Service , Inc. compete in the package delivery business. The major fixed assets for each business include aircraft, sorting and handling facilities, delivery vehicles, and information technology. The sales and average

> Verizon Communications Inc. is a major telecommunications company in the United States. Two recent balance sheets for Verizon disclosed the following information regarding fixed assets: Verizon’s revenue for the year was $120,550 mill

> Amazon .com, Inc. is the world’s leading Internet retailer of merchandise and media. Amazon also designs and sells electronic products, such as e-readers. Netflix, Inc. is the world’s leading Internet television networ

> Use the data in ADM-2 and ADM-3 to analyze the accounts receivable turnover ratios of R alp h Lau r en Corporation and L Brands, Inc. A. Compute the accounts receivable turnover ratios for Ralph Lauren and LÂ Brands for the years shown in ADM-

> Brands, Inc. sells women’s clothing and personal health care products through specialty retail stores including Victoria’s Secret and Bath & Body Works stores. L Brands reported the following (in millions) for two

> Ralph Lauren Corporation designs, markets, and distributes a variety of apparel, home décor, accessory, and fragrance products. The company’s products include such brands as Ralph Lauren, Polo by Ralph Lauren, and Chaps. Fo

> Amazon .com, Inc. is one of the largest Internet retailers in the world. Best Buy , Inc. is a leading retailer of consumer electronics and media products in the United States. Amazon and Best Buy compete in similar markets; however, Best Buy sells throug

> Three companies that compete in the athletic and active wear market segment are Nike , Inc. , lululemon at hleticainc. , and Under Armour , Inc. Nike is the largest designer and seller of athletic footwear and apparel in the world. Lululemon designs and

> Krispy Kreme Doughnuts, Inc. is a leading retailer and wholesaler of doughnuts. Krispy Kreme owns or franchises 1,000 stores where the “hot” light tells you if doughnuts are cooking. Dunk in ’Brands G

> Preston & Grover Soap Company manufactures powdered detergent. Phosphate is placed in process in the Making Department, where it is turned into granulars. The output of Making is transferred to the Packing Department, where packaging is added at the

> Apache Corporation is an independent energy company that explores, develops, and produces oil and gas products. Apache operates worldwide, including in the United States, Canada, and the North Sea. The profitability of the oil and gas business is highly

> Amazon .com, Inc. is one of the largest Internet retailers in the world. Netflix , Inc. provides digital streaming and DVD rentals in the United States. Amazon and Netflix compete in streaming and digital services; however, Amazon also sells many other p

> The Kroger Company, a national supermarket chain, reported the following data (in millions) in its financial statements for a recent year: Total sales…………………………………$108,465 Total assets: Beginning of year……………………………29,281 End of year…………………………………….

> The Home Depot reported the following data (in millions) in its recent financial statements: A. Determine the asset turnover ratio for Home Depot for Year 2 and Year 1. (Round to two decimal places). B. What conclusions can be drawn from these ratios c

> Amazon. com, Inc. is one of the largest Internet retailers in the world. Netflix, Inc. provides digital streaming and DVD rentals in the United States. Amazon and Netflix compete in streaming and digital services; however, Amazon also sells many other pr

> Sears Holdings C or p or at ion is one of the largest mall-based retailers in the United States. The following year-end data were taken from a recent Sears balance sheet (in millions): A. Compute the working capital and the current ratio as of December

> The following year-end data were taken from recent balance sheets of U nde r A r mou r , I nc. (in millions): A. Compute the working capital and the current ratio as of December 31, Year 2 and Year 1. (Round to one decimal place.) B. What conclusions c

> Amazon .com, Inc. is the largest Internet retailer in the United States. Best Buy , Inc. is a leading retailer of technology and media products in the United States. Amazon and Best Buy compete in similar markets; however, Best Buy sells through both tra

> The following total liabilities and stockholders’ equity information (in millions) is provided for Papa John’ s International, Inc. and Y u m! Brands, Inc. at the end of a recent year: Yum! Brands is a much larger co

> Technology Accessories Inc. is a designer, manufacturer, and distributor of accessories for consumer electronic products. Early in 20Y3, the company began production of a leather cover for tablet computers, called the iLeather. The cover is made of stitc

> The following data are taken from recent financial statement of Nike, Inc. (in millions): A. Determine the amount of change (in millions) and percent of change in net income from Year 1 to Year 2. B. Determine the percentage relationship

> Chipotle Mexican Grill, Inc. is a quick-service restaurant providing a focused menu of burritos, tacos, and salads. Chipotle’s balance sheets for the end of two recent years are as follows (in thousands): A. Prepare a vertical analys

> Amazon .com, Inc. is one of the largest Internet retailers in the world. We will use Amazon as a continuing company exercise to reinforce the various tools and techniques for analyzing financial statements. We will begin with the ratio of liabilities to

> Low e’ s Companies, Inc. , a major competitor to T h e Ho me Depot in the home improvement retail business, operates over 1,800 stores. Lowe’s recently reported the following end of-year balance sheet data (in millions

> The Home Depot , Inc. , is the world’s largest home improvement retailer and one of the largest retailers in the United States based on sales volume. Home Depot operates over 2,200 stores that sell a wide assortment of building, home im

> Hewlett Packard Company (HP ) and Apple Inc. are both developers and marketers of computer equipment and peripherals. However, the two companies follow different manufacturing strategies. HP maintains a significant portion of its own manufacturing capabi

> Monster Beverage C or p or at ion develops, markets, and sells energy and other alternative beverage brands. Brown-F or man C or p or at ion manufactures and sells a wide variety of spirit and wine beverages, such as Jack Daniel’sÂ

> Chipotle Mexican Grill, Inc. is a quick-service restaurant providing a focused menu of burritos, tacos, and salads. Chipotle’s balance sheets for the end of two recent years are as follows: A. Prepare a horizontal analysis of the two

> Amazon .com, Inc. is one of the largest Internet retailers in the world. Target Corporation is one of the largest value-priced general merchandisers operating in the United States. Target sells through nearly 1,800 brick-and-mortar stores and through the

> The following data (in millions) are taken from the financial statements of Walmart Stores, Inc. : A. For Walmart, determine the amount of change in millions and the percent of change (rounded to one decimal place) from Year 1 to Year 2

> Clapton Company manufactures custom guitars in a wide variety of styles. The following incomplete ledger accounts refer to transactions that are summarized for May: In addition, the following information is available: A. Materials and direct labor were

> Suzi Nomro operates Watercraft Supply Company, an online boat parts distributorship that is in its third year of operation. The following income statement was prepared for the year ended October 31, 2018. Suzi is considering a proposal to increase net

> The following data (in millions) are taken from the financial statements of T ar g e t C or p or at i on, the owner of Target stores: A. For Target, determine the amount of change in millions and the percent of change (rounded to one dec

> Amazon .com, Inc. is the largest Internet retailer in the United States. Amazon’s income statements through income from operations for two recent years follow: A. Prepare a horizontal analysis of the operating income statements. (Roun

> Project 1 requires an original investment of $125,000. The project will yield cash flows of $50,000 per year for 10 years. Project 2 has a calculated net present value of $135,000 over an eight-year life. Project 1 could be sold at the end of eight years

> A project is estimated to cost $463,565 and provide annual net cash flows of $115,000 for nine years. Determine the internal rate of return for this project, using Exhibit 5. Exhibit 5: Present Value of an Annuity of $1 at Compound Interest Year 6%

> A project has estimated annual net cash flows of $70,000 for four years and is estimated to cost $190,000. Assume a minimum acceptable rate of return of 10%. Using Exhibit 5, determine (A) the net present value of the project and (B) the present value in

> A project has estimated annual net cash flows of $36,500. It is estimated to cost $222,650. Determine the cash payback period.

> McFadden Company owns equipment with a cost of $475,000 and accumulated depreciation of $280,000 that can be sold for $175,000, less a 7% sales commission. Alternatively, McFadden Company can lease the equipment for four years for a total of $180,000, at

> Product J19 is produced for $11 per gallon. Product J19 can be sold without additional processing for $18 per gallon, or processed further into Product R33 at an additional cost of $7 per gallon. Product R33 can be sold for $24 per gallon. Prepare a diff

> Pasadena Candle Inc. budgeted production of 785,000 candles for the year. Each candle requires molding. Assume that six minutes are required to mold each candle. If molding labor costs $18 per hour, determine the direct labor cost budget for the year.

> A company manufactures various-sized plastic bottles for its medicinal product. The manufacturing cost for small bottles is $75 per unit (100 bottles), including fixed costs of $28 per unit. A proposal is offered to purchase small bottles from an outside

> Stretch and Trim Carpet Company sells and installs commercial carpeting for office buildings. Stretch and Trim Carpet Company uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted

> Product AG52 has revenue of $748,000, variable cost of goods sold of $640,000, variable selling expenses of $90,000, and fixed costs of $50,000, creating a loss from operations of $32,000. Prepare a differential analysis as of October 7 to determine if P

> The Commercial Division of Galena Company has income from operations of $12,680,000 and assets of $74,500,000. The minimum acceptable return on assets is 12%. What is the residual income for the division?

> Pasadena Candle Inc. budgeted production of 785,000 candles for the year. Wax is required to produce a candle. Assume 10 ounces of wax is required for each candle. The estimated January 1 wax inventory is 16,000 pounds. The desired December 31 wax invent

> Pasadena Candle Inc. projected sales of 800,000 candles for the year. The estimated January 1 inventory is 35,000 units, and the desired December 31 inventory is 20,000 units. What is the budgeted production (in units) for the year?

> Vinton Company’s costs were under budget by $36,000. The company is divided into North and South regions. The North Region’s costs were over budget by $45,000. Determine the amount that the South Region’s costs were over or under budget.

> Prepare a cost of goods sold budget for Pasadena Candle Inc. using the information in Basic Exercises 3 and 4. Assume the estimated inventories on January 1 for finished goods and work in process were $200,000 and $41,250, respectively. Also assume the d

> At the beginning of the period, the Fabricating Department budgeted direct labor of $33,600 and equipment depreciation of $5,000 for 1,200 hours of production. The department actually completed 1,300 hours of production. Determine the budget for the depa

> How does the target cost method differ from cost-plus approaches?

> Explain why rewarding sales personnel on the basis of total sales might not be in the best interests of a business whose goal is to maximize profits.

> Why might management analyze product profitability?

> Hildreth Company uses a job order cost system. The following data summarize the operations related to production for April, the first month of operations: A. Materials purchased on account, $147,000. B. Materials requisitioned and factory labor used: C

> A new assistant controller recently was heard to remark: “All the assembly workers in this plant are covered by union contracts, so there should be no labor variances.” Was the controller’s remark correct? Discuss.

> Since all costs of operating a business are controllable, what is the significance of the term non controllable cost?

> In the variable costing income statement, how are the fixed manufacturing costs reported, and how are the fixed selling and administrative expenses reported?

> Which of the following costs would be included in the cost of a manufactured product according to the variable costing concept: (A) rent on factory building, (B) direct materials, (C) property taxes on factory building, (D) electricity purchased to opera

> Which type of manufacturing cost (direct materials, direct labor, variable factory overhead, fixed factory overhead) is included in the cost of goods manufactured under the absorption costing concept but is excluded from the cost of goods manufactured un

> Briefly discuss the differences between (A) adoption of IFRS by the U.S. Securities and Exchange Commission and (B) convergence of U.S. GAAP with IFRS.

> Do the terms debit and debit and debit credit signify increase or credit signify increase or credit decrease or can they signify either? Explain.

> Explain why service companies use different activity bases than manufacturing companies to classify costs as fixed or variable.

> When using the negotiated price approach to transfer pricing, within what range should the transfer price be established?