Question: Graph the Social Security tax function for

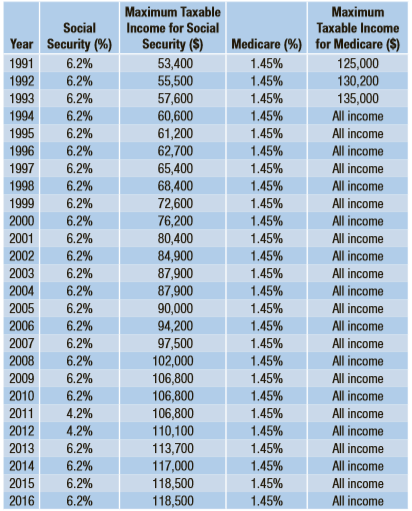

Graph the Social Security tax function for 1992. What are the coordinates of the cusp? On the same axes, graph the Medicare function.

Transcribed Image Text:

Maximum Taxable Maximum Income for Social Security ($) 53,400 55,500 57,600 60,600 61,200 62,700 65,400 68,400 72,600 76,200 80,400 84,900 87,900 87,900 90,000 94,200 97,500 102,000 106,800 106,800 106,800 110,100 113,700 117,000 118,500 118,500 Social Taxable Income Year Security (%) Medicare (%) for Medicare ($) 125,000 130,200 135,000 All income 1991 6.2% 1.45% 1992 6.2% 1.45% 1993 6.2% 1.45% 1994 6.2% 1.45% 1995 6.2% 1.45% All income 1996 6.2% 1.45% All income 1997 6.2% 1.45% All income 1998 6.2% 1.45% All income 1999 6.2% 1.45% All income 2000 6.2% 1.45% All income 2001 6.2% 1.45% All income 2002 6.2% 1.45% All income 2003 6.2% 1.45% All income 2004 6.2% 6.2% 1.45% All income 2005 1.45% All income 2006 6.2% 1.45% All income 2007 2008 6.2% 6.2% 1.45% All income 1.45% All income 2009 6.2% 1.45% All income 2010 6.2% 1.45% All income 2011 4.2% 1.45% All income 2012 4.2% 1.45% All income 2013 6.2% 1.45% All income 2014 6.2% 1.45% All income 2015 6.2% 1.45% All income 2016 6.2% 1.45% All income

> How might the quote apply to what you have learned?

> What is the total value of all of the Sprint Corp shares traded? HD 32.3M@126.26A1.13 S 1.1K@3.33V0.78 VZ 3.32K@51.02A2.27 XOM 0.66K@81.75V1.58

> How many shares of Home Depot are indicated on the ticker? HD 32.3M@126.26A1.13 S 1.1K@3.33V0.78 VZ 3.32K@51.02A2.27 XOM 0.66K@81.75V1.58

> A company produces a security device known as Toejack. Toejack is a computer chip that parents insert between the toes of a child, so parents can track the child’s location at any time using an online system. The company has entered into an agreement wit

> A car leaves four skid marks each 50 feet in length. The drag factor for the road is 0.9. Let x represent the braking efficiency. a. What is the range of values that can be substituted for x? b. Let the speed be represented by the variable y and x repr

> Phil sold his shares of Verizon Communications Inc., as indicated on the above ticker. a. How many shares did he sell? b. How much did each share sell for? c. What was the total value of all the shares Phil sold? HD 32.3M@126.26A1.13 S 1.1K@3.33V

> Jessica put in an order for some shares of Exxon Mobil Corp. a. As shown on the ticker, how many shares did Jessica buy? b. How much did each share cost? c. What was the value of Jessica’s trade? HD 32.3M@126.26A1.13 S 1.1K@3.3

> How might a large trade “move the market”? How might those words apply to what you have learned?

> Marina wants to take out a $500,000 loan to purchase a new home. The bank offers a 25-year loan with an APR of 3.8%. If she purchases 1 point for 1% of the value of the loan, she will reduce her APR by 0.3%. a. What is her monthly savings with the point

> A profit function is determined to be P = -180p2 + 154000p - 28,950,500. Find the roots of the equation. Are they real or complex? If complex, what does this imply about the profit function?

> The credit union offered Zach a $200,000, 10-year loan at a 3.625% APR. Should Zach purchase 1 point or no points? Each point lowers the APR by 0.125% and costs 1% of the loan amount. Justify your reasoning.

> The bank offered Annette a $380,000, 30-year mortgage at 3.54%. She is deciding whether to purchase 2 points to reduce her APR by 0.25% per point. Each point will cost 1% of the loan value. a. Calculate her monthly payments with the points. b. Calculate

> Dylan purchased A points, each of which reduced his APR by B%. The cost per point was 1% of the loan amount. His new APR is C%, and his points cost him D dollars. Write an algebraic expression for: a. the original APR b. the principal

> Toni purchased 3 points, each of which reduced her APR by 0.125%. Each point cost 1% of her loan value. Her new APR is 3.2%, and the points cost her $8,100. a. What was the original APR? b. What is her principal?

> J.P. has been offered a 20-year, $350,000 loan with a 3.9% APR. If he purchases 1 point, his APR will reduce to 3.7%. How much will his monthly payment savings be?

> A company produces a security device known as Toejack. Toejack is a computer chip that parents insert between the toes of a child, so parents can track the child’s location at any time using an online system. The company has entered into an agreement wit

> Rhonda wants to take out a 30-year, $280,000 loan with a 4.4% APR. She is considering purchasing 2 points, which will decrease her APR by 0.125% per point. Each point will cost 1% of her loan. Compare her monthly payments with and without the purchase of

> Examine the graph below. It shows the global iPhone phone sales by year in millions of units sold. a. Write nine ordered pairs with the first coordinate being the year number and the second being the units sold in millions as shown here. 1,400,000 unit

> Investigate the difference between compounding annually and simple interest for parts a–j. Round to the nearest cent. a. Find the simple interest for a 1-year CD for $5,000 at a 2.5% interest rate. b. Find the interest for a 1-year CD for $5,000 at an

> Mike and Julie receive $20,000 in gifts from friends and relatives for their wedding. They deposit the money into an account that pays 2.75% interest, compounded daily. a. Will their money double within 10 years? b. Will their money double within 15 ye

> Determine the cost of the points and the new interest rate for each loan amount and interest rate. Assume each point costs 1% of the loan amount. a. $400,000, original APR 4.1%, 1 point with a 0.2% discount b. $250,000, original APR 3.95%, 2 points wit

> A profit function is determined to be P = -200p2 + 116,000p - 21,191,200. Find the roots of the equation. Are they real or complex? If complex, what does this imply about the profit function?

> Gino has a debit card. The account pays no interest. He keeps track of his purchases and deposits in this debit card register. Find the missing entries a–f. $ BAZ78.19E 92.19 NUVBER OR CODE PAYMENT AVOUNT DEPOSIT AMOUNT DATE TRANBA

> Interpret the quote in the context of what you learned about credit and charge cards in this section.

> Naoko has these daily balances on his credit card for September’s billing period. He paid his balance from the August billing in full. 2 days @ $99.78 15 days @ $315.64 11 days @ $515.64 2 days @ $580.32 a. His APR is 15.4%. How much is the finance

> In a year when the maximum income for Social Security was $118,500, Bart worked at two jobs. In one job he earned $99,112. In his second job, he earned $56,222. Both of his employers took out Social Security tax. As a result, Bart had paid excess Social

> A company produces a security device known as Toejack. Toejack is a computer chip that parents insert between the toes of a child, so parents can track the child’s location at any time using an online system. The company has entered into an agreement wit

> A politician is listening to a proposal for a new Social Security tax plan. The graph is shown. The two parts of the graph are disconnected where 145,000x 5 . Explain why this would be an unfair Social Security tax function. Social Security Таx ($)

> Milo’s car straight line depreciates monthly over time. He knew that after 7 months his car was worth $26,930. According to an online car value calculator, after 30 months, he determined that his car was worth $19,800. How much does his car depreciate ea

> A politician is considering removing the maximum taxable income and having all income subject to Social Security tax. Why might this be unfair to very affluent people?

> Explain why the slope of the Social Security function, before it becomes horizontal, cannot equal 1.

> Kennesaw Credit Union offers a 4.25%, 15-year mortgage. Sadie wants to borrow $300,000 and purchase enough negative points to eliminate her $9,000 closing costs. Each point increases her APR by 0.125% and reduces the bank's closing costs by 1% of the pri

> Lincoln Towers Bank offers borrowers a zero closing cost loan. Each negative point reduces the bank’s closing costs by 1% of the principal and increases the APR by 0.125%. Ibraheem wants to borrow $450,000 from Lincoln Towers at 3.48% for 20 years. The e

> Flip Flops manufactures beach sandals. Their expense and revenue functions are a. Determine the profit function. b. Determine the price, to the nearest cent, that yields the maximum profit. c. Determine the maximum profit, to the nearest cent. E =

> Read the quote at the beginning of this section. Interpret the quote in terms of what you have learned about discount points.

> In 2007, Jessica earned p dollars, where p . 100,000. She was paid monthly. Express the amount her employer contributed to her Social Security tax in February algebraically. Maximum Taxable Maximum Income for Social Security ($) 53,400 55,500 57,60

> In 2011, the Social Security tax rate was lowered to 4.2% to help stimulate the economy. The government figured that if people paid less taxes they would have more money to buy goods and services. How much did a worker who earned $128,900 in 2011 save on

> Draw graphs of expense function Y1 and revenue function Y2 on the same set of axes that meet the following criteria. Maximum revenue: $125,000 Breakeven points: $40 and $160 Price at which no revenue is made: $200 Maximum expenses: $105,000

> Complete the following chart. For each family, complete Form 1040, Schedule A, and Schedule B to find total itemized deductions, interest and ordinary dividends, adjusted gross income, taxable income, tax due, and amount of refund or amount owed. Round

> Mr. and Mrs. Delta are filing a joint tax return. Together they had an income of $100,830 last year. Their total deductions were $16,848. a. What was Mr. and Mrs. Delta’s taxable income? b. What is the tax on the amount in part a? c. The Deltas receiv

> Vito is single. His total income before deductions was $147,760. He was able to reduce his total income by $14,198 when he filled out Schedule A. How much did he save in tax by using Schedule A? Use Schedule X on page 382.

> Jonathan is a single taxpayer. His total income before deductions was $63,110. He was able to reduce his total income by $10,312 when he filled out Schedule A. How much did he save in tax by using Schedule A?

> Maria and Don had $20,800 in medical expenses. Their family medical insurance covered 60% of these expenses. The IRS allows medical and dental expense deductions for the amount that exceeds 10% of a taxpayer’s adjusted gross income. If their adjusted gro

> Round all monetary answers to the nearest dollar. Use the tax tables in the Appendix or the appropriate schedule based on filing status. 2. Chiara had $5,700 in out-of-pocket medical expenses last year. Her medical insurance covered 80% of these expenses

> Keesha earned x dollars per month in 2006, where x , $5,600. a. Did she earn more or less than the maximum taxable income for 2006? b. Express her Social Security tax for the year algebraically. c. Express her Medicare tax for the year algebraically.

> Business Bargains manufactures office supplies. It is considering selling sticky notes in the shape of the state in which they will be sold. The expense and revenue functions are E = -250 + 50,0005 and R = -225p2 + 7,200. a. Determine the profit functio

> In 1995, Eve earned d dollars, where d , 50,000. Express the amount she paid to Social Security and Medicare as a function of d. Maximum Taxable Maximum Income for Social Security ($) 53,400 55,500 57,600 60,600 61,200 62,700 65,400 68,400 72,600 7

> How can the quote be interpreted in light of what you have learned about income taxes in this section?

> Use the following graph to answer the questions below. Let Y1 = expense function and y2 = revenue function a. Explain the significance of point (D, B). b. Explain the significance of point (E, A). c. Explain the significance of point (F, C). d. Expl

> Express the 1993 Social Security tax function as a piecewise function t(x), where x is the annual income. Graph the function. What are the coordinates of the cusps on the graph? Maximum Taxable Maximum Income for Social Security ($) 53,400 55,500 57

> In 1991, Social Security and Medicare taxes were itemized separately on paycheck stubs and tax forms for the first time. The table on the right gives a historical look at Social Security and Medicare taxes. a. Find the maximum a person could contribu

> A car is traveling at 68 km/h. Cargo is strapped to the roof at a height of 1.6 m. The car hits a concrete barrier, and the cargo is horizontally ejected off the roof. Use these two equations to determine how long it takes for the cargo to hit the ground

> Cargo is tied with rope on the roof of a 4.5-foot-tall car. The car is traveling down a road at 42 mph and hits a concrete barrier. The rope snaps, allowing the cargo to propel forward. Use the equations y = -16.1t2 + 4 .75 and y = -0.0042x2 + 4.75 where

> Five years ago, a certain make and model of a car now considered to be a classic had a selling price of $26,000. Examine this geometric sequence representing the yearly appreciation in the price of the car since then: $26,000 $31,200 $37,400 $44,928 $53,

> In 1978, Dawn earned $48,000. a. What was her monthly gross pay? b. In what month did Dawn reach the maximum taxable Social Security income? c. How much Social Security tax did Dawn pay in February of 1978? d. How much Social Security tax did Dawn p

> A car vehicle price history for a certain make and model contains the following list of yearly price values: $30,000 $28,500 $27,075 $25,721.25. The original price of the car was $30,000. It exponentially depreciated to $28,500 after 1 year and continued

> A reconstructionist took measurements from yaw marks left at the scene of an accident. Using a 46-ft chord, the middle ordinate measured approximately 6 ft. The drag factor for the road surface was 0.95. Determine the radius of the yaw mark to the neares

> A car was traveling at 52 mi/h before it enters into a skid. It was determined that the drag factor of the road surface is 1.05, and the braking efficiency is 80%. How long might the average skid mark be to the nearest tenth of a foot for this situation?

> How might those words apply to what has been outlined in this lesson?

> Richie was driving on an asphalt road that had a 40 mi/h speed limit. A bicyclist veered into his lane, causing him to slam on his brakes. His tires left three skid marks of 69 ft, 70 ft, and 74 ft. The road had a drag factor of 0.95. His brakes were ope

> Marlena is driving on an interstate at 65 km/h. She sees a traffic jam about 30 meters ahead and needs to bring her car to a complete stop before she reaches that point. Her reaction time is approximately ¾ of a second. Is she far enough away from the tr

> Tricia is driving 64 miles per hour on an interstate highway. She must make a quick stop because there is an emergency vehicle ahead. a. What is her approximate reaction distance? Round to the nearest foot. b. What is her approximate braking distance?

> Max is driving 42 miles per hour. A dog runs into the street and Max reacts in about three-quarters of a second. What is his approximate reaction distance?

> Ann’s car gets about 12 kilometers per liter of gas. She is planning a 2,100-kilometer trip. To the nearest liter, how many liters of gas should Ann plan to buy? At an average price of $0.71per liter, how much should Ann expect to spend for gas?

> Jonathan’s car gets approximately 25 miles per gallon. He is planning a 980-mile trip. About how many gallons of gas will his car use for the trip? At an average price of $2.50 per gallon, how much should Jonathan expect to spend for gas? Round to the ne

> Using yearly car values, a graphing calculator has calculated the following exponential regression equation: y = abx, a = 28,158.50, b = 0.815. a. What is the rate of depreciation for this car? b. How much is this car worth to the nearest dollar after

> In 1990, Jerry’s gross pay was $78,000. a. What was his monthly gross pay? b. In what month did Jerry hit the maximum taxable Social Security income? c. How much Social Security tax did Jerry pay in January of 1990? d.

> The following two-way table displays information about favorite sports cars that resulted from a survey given to all students at Shore High School. a. Find P(B), P(C), P(B|C) and explain whether or not events B and C are independent. b. What is the pr

> Jerome just purchased a 4-year-old car for $12,000. He was told that this make and model depreciates exponentially at a rate of 5.8% per year. What was the original price to the nearest hundred dollars?

> Gracie deposited $20,000 into an account that compounds interest weekly at a rate of 1.56%. Each week, her bank withdraws $200 from the account and puts that amount into her mortgage account. How long will it take until the account has a balance of $0? R

> The straight line depreciation equation for a car is y = -2400x + 36,000. a. What is the original price of the car? b. How much value does the car lose per year? c. How many years will it take for the car to totally depreciate?

> A local newspaper charges d dollars for a three-line classified ad. Each additional line costs a dollars. Express the cost of a six-line ad algebraically.

> Classic Car Monthly charges $49 for a three-line classified ad. Each additional line costs $9.50. For an extra $30, a seller can include a photo. How much would a five-line ad with a photo cost?

> Paul has a universal life insurance policy with a face value of f dollars. The current cash value of the policy is c dollars. The premium is m dollars per month. He is going to use the cash value to pay for premiums for as long as it lasts. In those mont

> Alex took out a 15-year term life insurance policy with a face value of f dollars. Over the lifetime of the policy, he pays monthly payments of m dollars. He dies after making payments for 1½ years. Express algebraically the difference between the amount

> Reliable Insurance Company offers a term life insurance policy with a renewable annual premium. The first-year premium is $795. Premiums increase by 4.1% each year. What will premiums be in the nth year?

> Charleen is single. She is filling out the Social Security worksheet shown on page 624 so she can determine the amount of her Social Security benefits that she will pay federal income tax on. The following lines were taken from her tax information. • Li

> Juanita started collecting Social Security at age 65. Her Social Security full monthly retirement benefit is $2,128. Her benefit is reduced since she started collecting before age 66. Using the reduction percentages from Example 4 in Section 10-2, find h

> The table on the right gives a historical look at Social Security tax before there was a separate Medicare tax. Find the maximum you could pay into Social Security for each year. Maximum Taxable Maximum You Could Pay Income ($) Social Year Security

> Nick’s annual salary is $90,000. His employer matches his 401(k) contributions at $0.75 for each dollar up to 8% of his annual salary. Nick contributes $350 from each biweekly paycheck to his 401(k) account. What is the combined total of his annual contr

> Kadeem deposited $50,000 into an account that compounds interest semiannually at a rate of 1.8%. At the end of each 6-month period, the bank withdraws $5,000 from the account. How long will it take until the account has a balance of $0? Round your answer

> Anna turned age 62 in 2016, and she is computing Social Security benefits. Using the formula from Example 3 in Section 10-2, compute her Social Security full retirement benefit if her average monthly salary over her 35 highest-paying years was $3,766. Ro

> In 1990, the amount of earnings required to earn one Social Security credit was $520. In the tax year 1990, Maggie earned $187 biweekly. How many Social Security credits did she earn in 1990?

> NuEditions Book Company uses a final average salary formula to calculate an employee’s pension benefits. The amount used in the calculations is the salary average of the final 3 years of employment. The retiree will receive an annual benefit that is equi

> Petra’s employer offers an annual pension benefit calculated by multiplying 2.46% of the career average salary times the number of years employed. Here are Petra’s annual salaries over the last 16 years of employment: Years Employed Multiplier 15–19 $52

> Circuit Technologies offers their employees a flat pension plan in which a predetermined dollar amount (multiplier) is multiplied by the number of years of service to determine the monthly pension benefit using the schedule shown. After working at Circui

> Regina is a 45-yearold supervisor for a communications company. Her tax filing status is married filing separately. She withdrew $50,000 from her tax-deferred retirement account to pay off her loans. Regina’s taxable income for that yea

> Hannah contributed $300 per month into her retirement account in pre-tax dollars during the last tax year. Her taxable income for the year was $72,000. She files taxes as a single taxpayer. a. What would her taxable income have been had she contribute

> Hillary’s employer offers an annual pension benefit for employees that have worked for the company for more than 10 years. The benefit is calculated by multiplying 5.08% of the career average salary by the number of years that exceeds 10 that the employe

> Mitch opened a retirement account that has an annual rate of 2.2% compounded annually. He is planning on retiring in 13 years. How much must he deposit into that account each year so that he can have a total of $1,000,000 by the time he retires? Round to

> How can the quote be interpreted in the context of what you have learned in this section about Social Security?

> Deanna is 62 years old. She plans to retire in 3 years. She has $300,000 in a savings account that yields 2.25% interest compounded daily. She has calculated that her final working year’s salary will be $94,000. She has been told by her financial advisor

> The Lieberman Insurance Company sells a 5-year term insurance policy with face value of $250,000 to a 39-year-old man for an annual premium of $973. The mortality table is given below. a. Assume the policyholder pays the premium annually. What is the i

> Use the mortality table to answer parts a and b. a. If the company insures 10,000 63-year-old males, how many are expected to die before their 64th birthday? Round to the nearest integer. b. Based on the table, what is the probability that a 63-year-o

> In 2016, the maximum taxable income for Social Security was $118,500. The tax rates were 6.2% for Social Security and 1.45% for Medicare. a. What is the maximum anyone could have paid into FICA tax in the year 2016? b. Bill had two jobs in 2016. One em

> A company is interested in producing and selling a new device called an eye POD (eyewear personal optical device). The eye POD is an MP3 and video player built into a pair of sunglasses. The user can listen to music from the small earphones and watch vid

> A company is interested in producing and selling a new device called an eye POD (eyewear personal optical device). The eye POD is an MP3 and video player built into a pair of sunglasses. The user can listen to music from the small earphones and watch vid

> Alexa is starting a small business. She has done a great deal of research in supply, demand, expense, and revenue directly relating to what her business will be selling. Based on the data, she has determined her profit function to be P = - 200p2 – 200p+

> The expense function for a widget is E = -3,000 + 250,000. The revenue function is R = -600p2 + 25,000p. a. Write the profit equation in simplified form. b. Use the axis of symmetry formula to determine the maximum profit price and the maximum profit.

> Express the revenue function in terms of price given the demand function. a. q= -900p + 120000 b. q= - 88000p + 234 000000