Question: Great Ape Glassworks manufacturers glass used for

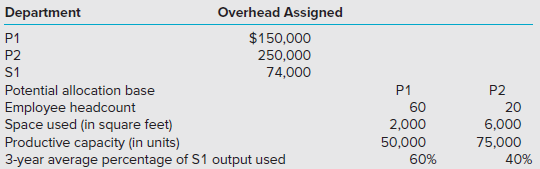

Great Ape Glassworks manufacturers glass used for the screens on smart phones. They have two producing departments, P1 and P2, and only one service department, S1. The company is able to track overhead to the various departments but wants to allocate the service department costs to the producing departments. However, they are not sure which of the multiple allocation bases should be selected. The data they collected appears in the tables below.

Required:

1. Determine the total estimated overhead cost for each of the producing departments after allocating the cost of the service department:

a. Using employee headcount as the allocation base.

b. Using occupied space as the allocation base.

c. Using productive capacity as the allocation base.

d. Using the 3-year average use as the allocation base.

2. Which of the four proposed allocation bases would you recommend and why?

> You are a relatively recent hire to the Hartz & Co., a local manufacturer of plumbing supply products. You have been asked to prepare for a presentation to the company’s management a condensed statement of cash flows for the months of November and Decemb

> Bond Company budgets the following purchases of direct materials for the first quarter of the year: All purchases of direct materials are made on credit. On average, the company pays for 80 percent of its purchases in the month of acquisition and the r

> Timpco, a retailer, makes both cash and credit sales (i.e., sales on open account). Information regarding budgeted sales for the last quarter of the year is as follows: Past experience shows that 5 percent of credit sales are uncollectible. Of the cred

> White Corporation’s budget calls for the following sales for next year: Each unit of the product requires 3 pounds of direct materials. The company’s policy is to begin each quarter with an inventory of product equal

> It is typically beneficial for companies to take advantage of early- payment discounts allowed on purchases made on credit. To see why this is the case, determine the effective rate of interest associated with not taking advantage of the early-payment di

> Smith Company can produce two types of carpet cleaners, Brighter and Cleaner. Data on these two products are as follows: The number of machine hours to produce one unit of Brighter is 1, while the number of machine hours for each unit of Cleaner is 2.

> Lawn Master Company, a manufacturer of riding lawn mowers, has a projected income for the coming year as follows: Required: 1. Determine the breakeven point in sales dollars. 2. Determine the required sales in dollars to earn a before-tax profit of $8,

> Required 1. Using the data from 2022 in Exhibit 9.1, create an Excel spreadsheet to provide a sensitivity analysis of the effect on operating profit of potential changes in demand for HFI Inc., ranging from a 20 percent decrease to a 20 percent increase.

> Today’s retailers are finding that online sales and service are a necessary ingredient of their overall marketing and selling strategy because of increased competition. In certain retail sectors, consumers are moving to the internet in large numbers for

> TastyKreme and Krispy Kake are both producers of baked goods, but each has followed a different production strategy. The differences in their strategies resulted in differences in their cost structure, as shown in the following table: Required: 1. Comp

> Weighted-average costs per equivalent unit are $2 for direct materials and $3 for conversion. There are no transferred-in costs and no spoilage. What is the cost of goods completed and transferred out if 10,000 units are completed and 1,000 units are in

> Units sold ………………………………………………………. 1,000 Price ……………………………………………………………….. $ 10 Sales ………………………………………………………… $10,000 Variable manufacturing costs ………………………… 4,000 Fixed manufacturing costs ……………………………… 2,000 Variable selling costs …………………………………….. 1,000 Fi

> The following sales and cost data (in thousands) are for two companies in the transportation industry: Required: 1. Calculate the degree of operating leverage (DOL) for each company. If sales increase from the present level, which company benefits more

> Harold McWilliams owns and manages a general merchandise store in a rural area of Virginia. Harold sells appliances, clothing, auto parts, and farming equipment, among a wide variety of other types of merchandise. Because of normal seasonal and cyclical

> Companies that have a high demand for making copies, both color and black and white, often choose to lease a high-end copier that provides fast and reliable service at a reasonable cost. The lease is usually for 3 to 5 years, and the cost to the user is

> Cohen Company produces and sells socks. Variable cost is $6 per pair, and fixed costs for the year total $75,000. The selling price is $10 per pair. Required: Calculate the following: 1. The breakeven point in units. 2. The breakeven point in sales doll

> For the most recent year, Triad Company had fixed costs of $240,000 and variable costs of 75% of total sales revenue, earned $70,000 of net income after taxes, and had an income tax rate of 35%. Required: Calculate the following: 1. Before-tax income. 2

> The Jurassic Classics has four employees on its sales team and uses a compensation that provides each person with a base salary of $40,000 per year and the opportunity to earn commission on sales. The current commission is 5% of gross sales, and sales fo

> The motivation for getting the MBA degree has many aspects—the prestige, greater opportunity for promotion, change of occupation, and increase in pay. To focus just on this last motivation, suppose that you are interested in getting an MBA and are studyi

> Questar Electronics, a producer of a wide range of consumer products, is facing increasing competitive pressures from foreign producers. In response, Questar is reexamining its overall management control system, including the way the company compensates

> Vista Company manufactures electronic equipment. It currently purchases the special switches used in each of its products from an outside supplier. The supplier charges Vista $2 per switch. Vista’s CEO is considering purchasing either m

> Beginning WIP is 2,000 units; 44,000 units completed, and ending WIP is 3,000 units, which are 100% complete for direct materials and 50% complete for conversion costs. The beginning WIP inventory is 100% complete for direct materials and 50% complete fo

> Connelly Inc., a manufacturer of quality electric ice cream makers, has experienced a steady growth in sales over the past few years. Since her business has grown, Jan Delany, the president, believes she needs an aggressive advertising campaign next year

> Albedo Inc. manufactures high-end replacement telescope lenses for amateur and professional astronomers that are seeking to upgrade the performance of their telescopes. You have just become employed as a staff accountant at Albedo and Jordan Coleman, the

> The Following table shows additional regression results presented by the researchers in the study described in Exercise 8-39. There are two regressions. The right hand column shows the results for all 57 patients. The left hand column shows the results f

> Interpreting Regression Results Recent research into the cost of various medical procedures has shown the impact of certain complications encountered in surgery on the total cost of patient’s stay in the hospital. The researchers used r

> For several years many utilities have been able to use regression analysis to forecast monthly utility usage by residential customers using weather forecasts, the number of holidays, the number of days in the month and other factors. For example, the Con

> The concept of learning curves has broad application in business, medicine, and many other fields. For example, the Gompertz Equation is a mathematical model that can be used to predict the number of deaths at a certain age. The Gompertz Equation is very

> Ethan Manufacturing Inc. produces floor mats for automobiles. The owner, Joseph Ethan, has asked you to assist in estimating maintenance costs. Together, you and Joseph determine that the single best cost driver for maintenance costs is machine hours. Th

> Horton Manufacturing Inc. produces blinds and other window treatments for residential homes and offices. The owner is concerned about the maintenance costs for the production machinery, as maintenance costs for the previous fiscal year were higher than h

> Wang Manufacturing uses regression analysis to predict manufacturing overhead costs based on direct labor hours and/or machine hours and has developed the three following regression equations: Required: Which regression would you choose and why?

> Lawson Advertising Agency is trying to persuade Kansas City Sailboards Company to spend more on advertising. The agency’s argument is that a constant and strong positive relationship exists between advertising and sales in the sailboard industry. Sue Law

> For problems 6-18 to 6-21, fill in the missing amount. Work-in-Process Inventory, November 1 45,000 units Work-in-Process Inventory, November 30 23,000 units Units started during November 57,000 units Units completed and transferred during Novembe

> Chloe’s Cafe bakes croissants that it sells to local restaurants and grocery stores. The average costs to bake the croissants are $0.55 for 2,500 and $0.50 for 5,000. Required: If the total cost function for croissants is linear, what will be the averag

> The following costs are for Optical View Inc., a contact lens manufacturer: Required: 1. Calculate and graph total costs, total variable cost, and total fixed cost. 2. For each level of output, calculate the per-unit total cost, per-unit variable cost,

> ChimneySweep provides cleaning services for residential chimneys and fireplaces. The cleaning service requires $35 in variable costs for cleaning materials. The fixed costs of labor, the company’s truck, and administrative support are $165,000 per year.

> Match each cost to the appropriate cost behavior pattern shown in graphs (a) through (l). Any graph can fit two or more patterns. 1. The cost of lumber used to manufacture wooden kitchen tables. 2. The cost of order fillers in a warehouse. When demand in

> Data mining, or the use of large amounts of consumer data to predict buying patterns, is widely used in certain industries to help companies in selecting the most profitable products and services, setting prices, and increasing consumer demand for their

> Many companies face increasingly unpredictable costs and revenues, as the recession affects demand for products and the costs of materials and labor for these products. Revenues and costs have fluctuated significantly in recent years for such cost elemen

> Webster Company produces 25,000 units of product A, 20,000 units of product B, and 10,000 units of product C from the same manufacturing process at a cost of $340,000. A and B are joint products, and C is regarded as a by-product. The unit selling prices

> Arkansas Corporation manufactures liquid chemicals A and B from a joint process. It allocates joint costs on the basis of sales value at split-off. Processing 5,000 gallons of product A and 1,000 gallons of product B to the split-off point costs $5,600.

> Tango Company produces joint products M, N, and T from a joint process. This information concerns a batch produced in April at a joint cost of $120,000: Required: How much of the joint cost should be allocated to each joint product using the net realiz

> Donation of blood through the American Red Cross and other organizations is an important way to maintain the blood supplies which are critical to patient treatment in hospitals. Three blood products are produced from blood received from donors: 1. Red

> For problems 6-18 to 6-21, fill in the missing amount. Work-in-Process Inventory, September 1 5,500 tons Work-in-Process Inventory, September 30 3,400 tons Units started during September ? Units completed and transferred during September 7,300 ton

> Identify the different types of business firms and other organizations that use cost management information, and explain how the information is used.

> Robinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department’s efforts (in percentages) to the other departments is: The direct operating cos

> HomeLife Life Insurance Company has two service departments (actuarial and premium rating) and two production departments (advertising and sales). The distribution of each service department’s efforts (in percentages) to the other depar

> In the last several years, airlines have succeeded in boosting profits by adding fees for previously free services such as in-flight snacks and meals, checked baggage, priority boarding, and other services. These fees have caused some shifts in customer

> Cost allocation is often the centerpiece of conflict that is resolved in court cases. The litigation usually involves the dispute over how costs are allocated to a product or product line that is of interest to the plaintiff. This is particularly an is

> Nonprofit organizations are exempt from federal income tax except for income from any activities that are unrelated to the nonprofit’s charitable purpose. An example is the use of a laboratory for both tax-exempt basic medical research and for testing a

> Taxes R Us (TRU), an income tax preparation firm, uses the FIFO method of process costing for its monthly reports. TRU has no materials cost in the preparation of the returns. The following shows its March information: Returns in process, March 1 (30% c

> Pablo Company calculates the cost for an equivalent unit of production using process costing. Required: 1. Compute the costs per equivalent unit for both the weighted-average and FIFO methods. 2. Explain the difference between the FIFO and weighted-aver

> Perrette Motor Company rebuilds automobile engines that have been damaged or are in need of extensive repair. The rebuilt engine has a 100,000-mile warranty and is purchased by auto shops, large motor pools in companies and governmental units, and some i

> Holly Company has the following information for December 1 to December 31. All direct materials are 100% complete. Required: 1. Calculate equivalent units using the weighted-average and FIFO methods. 2. Use the given information to determine whether Ho

> For problems 6-18 to 6-21, fill in the missing amount. Work-in-Process Inventory, June 1 ? Work-in-Process Inventory, June 30 55,000 gallons Units started during June 75,000 gallons Units completed and transferred during June 83,000 gallons

> Murray Chemical Company refines a variety of petrochemical products. These data are from the firm’s Houston plant: Work-in-Process Inventory, September 1 …………………… 4,000,000 gallons Direct materials ………………………………………………………….. 50% completed Conversion ……………

> Northern Washington Lumber Company grows, harvests, and processes timber for use as building lumber. The following data pertain to the company’s sawmill: Work-in-Process Inventory, January 1 (direct …………………………………………. materials: 60%, conversion: 40%) ………

> The food-processing industry, like most process industries, is a common user of process costing. Consider, for example, the sugar manufacturing industry. The processes in sugar manufacturing can differ depending on the agricultural product used to produc

> Washington State Fisheries, Inc. processes salmon for various distributors. Two departments, processing and packaging, are involved. Data relating to tons of salmon sent to the processing department during May follow: Required: 1. Calculate the number

> Process costing is a good fit for companies in process industries in which costs are more easily traced to production departments than to individual products. The products are generally produced on a continuous, mass production basis. Process industries

> Second Republic Bank is a lending company that operates in the Southeastern United States. Current economic conditions have kept lending rates low which limits the revenue potential for Second Republic. The bank manager, Vivian Caldwell is concerned ab

> Garner Industries manufactures precision tools. The firm uses an activity-based costing system. CEO Deb Garner is very proud of the accuracy of the system in determining product costs. She noticed that since the installment of the ABC system 10 years ear

> Colleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Colleen Company sells its products at $200 per unit. The firm’s gross margin ratio is 25%. Both Jerry and Kate pay t

> The luxury hotel chain, Ritz-Carlton recently introduced a system called “Mystique” that collects information about its customers from employees and staff at the hotel. The information is used to personalize the services provided to each guest. For examp

> Studemeir Paint & Floors (SPF) is a retail store specializing in home improvement. The store has experienced net operating losses in its Other Flooring Products line during the last few periods. SPF’s management team thinks that the

> For problems 6-18 to 6-21, fill in the missing amount. Work-in-Process Inventory, February 1 80,000 units Work-in-Process Inventory, February 28 ? Units started during February 60,000 Units completed and transferred during February 75,000

> Supermart Food Stores (SFS) has experienced net operating losses in its frozen food products line in the last few periods. Management believes that the store can improve its profitability if SFS discontinues frozen foods. The operating results from the m

> Activity-based costing is used widely within the U.S. government. One example is the Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS). APHIS helps to protect U.S. agriculture from exotic pests and diseases, to minimize wildl

> The Lindex General Hospital has determined the activities of a nurse including the following: a. Report for duty and review patient charts b. Visit each patient and take her/his temperature c. Update patients’ records d. Coordinate lab and radiology e

> North Company designs and manufactures machines that facilitate DNA sequencing. Depending on the intended purpose of each machine and its functions, each machine is likely to be unique. The job costing system in its Norfolk plant has five activity cost p

> Lexan Textile Company’s Job X12 had one of its 20 units spoiled. The cost incurred on the unit was $600. It was specific normal spoilage with an estimated disposal price of $300 for the spoiled unit. Job Y34 had common normal spoilage with the estimated

> Progressive Painting Company (PPC) is a successful company in commercial and residential painting. PPC has a variety of jobs: new construction, repair and repainting of existing structures, and restoration of very old buildings and homes. The company is

> Norton Associates is an advertising agency in Austin, Texas. The company’s controller estimated that it would incur $325,000 in overhead costs for the current year. Because the overhead costs of each project change in direct proportion to the amount of d

> Tomek Company uses a job costing system that applies factory overhead on the basis of direct labor hours. The company’s factory overhead budget for the current year included the following estimates: Budgeted total factory overhead ………………………………. $568,000

> Whitley Construction Company is in the home remodeling business. Whitley has three teams of highly skilled employees, each of whom has multiple skills involving carpentry, painting, and other home remodeling activities. Each team is led by an experienced

> Johnson Inc. is a job-order manufacturing company that uses a predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours are 95,000 and estimated factory overhead is $6

> The materials handling charge for ABC Corp. is $0.50 per pound of finished product. What is the materials handling charge for a job that produced 10,000 units at a weight of 6 pounds per unit?

> Alles Company uses a job costing system that applies factory overhead on the basis of direct labor dollars. No job was in process on February 1. During the month of February, the company worked on these three jobs: During the month, the company complet

> Erkens Company uses a job costing system with normal costing and applies factory overhead on the basis of machine-hours. At the beginning of the year, management estimated that the company would incur $1,980,000 of factory overhead costs and use 66,000 m

> Papa’s Pizza Heaven serves take-out pizza from three locations in Columbus, Maryland. Papa’s considers each pizza delivered (even if the order is for two or more pizzas) as the cost object for the company. The company incurs the following costs: 1. Food

> Pet Partner is a small company that provides per boarding, grooming and minor medical services for dogs and cats. The company has been successful for its first three years because of its careful attention to customer expectations. The staff knows the

> Company A has 50% of its total variable manufacturing cost in labor and the other 50% in fuel cost. Company B has 80% of its total variable manufacturing cost in labor and the remainder in fuel cost. Suppose in a given year labor costs rise 5% and fuel c

> The American Institute of CPAs (AICPA) and the Hackett Group, a consulting firm, partnered to study the trends in the nature and amount spent on the accounting function in corporations. A key finding was that the world’s best accounting

> Billy Bob's Manufacturing had the following data for the fiscal year ended December 31. Direct Materials Inventory, January 1 ……………………………….. $ 30,000 Direct materials purchases ………………………………………………… 350,000 Direct materials used ……………………………………………………….. 34

> Zipcar (www.zipcar.com) is a car sharing club founded in Cambridge, MA in 1999. The club members pay an annual fee and then have the opportunity to rent from a pool of available cars for a fixed hourly or daily rate. Zipcar is located largely in select m

> Habib Manufacturing has five manufacuring departments and operating and cost information for the two most recent months of activity. Required: Identify whether the cost in each department is fixed, variable, or mixed.

> Adams Manufacturing’s five manufacturing departments had the following operating and cost information for the two most recent months of activity: Required: Identify whether the cost in each department is fixed, variable, or mixed.

> Locke Data Processing reported expenses of $5 million for labor, of which $3 million was for data analysis and $2 million was for data entry. Locke recorded 30,000 hours of data analysis and 100,000 hours of data entry. What are the activity-based rates

> PhotoGraphicImages, Inc (PGI) is an international supplier of graphic and digital photo images that are used in the publishing business and by a variety of firms that need graphic images for their annual reports, sales brochures and other documents. PGI

> Jan Holliday Dance Studios is a chain of 45 wholly owned dance studios that offer private lessons in ballroom dancing. The studios are located in various cities throughout the southern and southeastern states. Holliday offers a set of 12 private lessons;

> The Accounting Club wants to have a party for its members. The cost of renting a space is $1,500, and the cost of refreshments will be $15 per person. Required 1. What is the total cost if 100 people attend? What is the average cost? 2. What is the tota

> To retain skilled employees instead of letting them go when demand falls, Lincoln Electric trains employees for other tasks in the company. The Cleveland-based manufacturer of welding and cutting parts has integrated the approach in all its operations, s

> Jane Wilson is the production manager for a company that produces high-fashion designer clothing for women. The product is made in small batches, which are pre-sold to high-end retailers, based on specific orders. Jane manages the flow of small batches o

> Zeller Manufacturing Company produces four lines of high-quality lighting fixtures in a single manufacturing plant. Products are built to specific customer specifications. All products are made-to-order. Management of the plant lists the following as the

> The following is a list of costs from the accounting records of Sunshine Pool Management, Inc. Each of Sunshine’s 77 customers is a swin club. Sunshine maintains each customer’s pool by providing supplies, cleaning, and repairs. 1. Lifesaving supplies

> Speedy Auto Service provides oil changes, tire repair/replacement, and minor repairs from 12 different locations in Wadesborough, Pennsylvania. The technicians who replace the oil and parts (mostly windshield wipers, air filters, and the like) are paid f

> Seventh Generation, Inc. (SGI) manufactures environmentally-friendly cleaning products, including laundry detergent, soap, and all-purpose cleaners. Prior to 2008, SGI would not do business with Wal-Mart, because of the perception of a poor environmental

> One way the value chain can be helpful is to provide a basis for a company to determine the full cost of its product or service, over the entire value chain. Often companies tend to focus only on manufacturing costs and ignore the upstream (design and te

> Haywood Printing is processing a job with the following activity rates: If this job requires 5 hours for 1,000 copies, what is the activity-based cost of the job?

> A recent report of the consulting firm McKinsey & Company indicates that about one-half of all corporate alliance fail. These alliances are partnerships in which the two corporations participate in one or more of the activities in the industry value chai