Question: Griseta & Dubel Inc. was formed early this

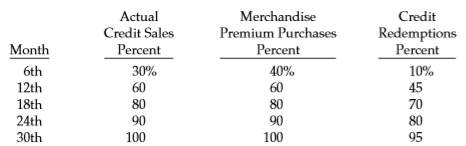

Griseta & Dubel Inc. was formed early this year to sell merchandise credits to merchants, who distribute the credits free to their customers. For example, customers can earn additional credits based on the dollars they spend with a merchant (e.g., airlines and hotels). Accounts for accumulating the credits and catalogs illustrating the merchandise for which the credits may be exchanged are maintained online. Centers with inventories of merchandise premiums have been established for redemption of the credits. Merchants may not return unused credits to Griseta & Dubel. The following schedule expresses Griseta & Dubel’s expectations as to the percentages of a normal month’s activity that will be attained. For this purpose, a “normal month’s activity†is defined as the level of operations expected when expansion of activities ceases or tapers off to a stable rate. The company expects that this level will be attained in the third year and that sales of credits will average $6,000,000 per month throughout the third year.

Griseta & Dubel plans to adopt an annual closing date at the end of each 12 months of operation.

Instructions

a. Discuss the factors to be considered in determining when revenue should be recognized.

b. Apply the revenue recognition factors to the Griseta & Dubel Inc. revenue arrangement.

c. Provide balance sheet accounts that should be used and indicate how each should be classified.

Transcribed Image Text:

Actual Credit Sales Merchandise Credit Redemptions Percent Premium Purchases Month Percent Percent 6th 30% 40% 10% 12th 60 60 45 80 18th 24th 80 70 90 90 80 30th 100 100 95

> During 2017, Kate Holmes Co.’s first year of operations, the company reports pretax financial income at $250,000. Holmes’s enacted tax rate is 45% for 2017 and 40% for all later years. Holmes expects to have taxable in

> Taxable income and pretax financial income would be identical for Huber Co. except for its treatments of gross profit on installment sales and estimated costs of warranties. The following income computations have been prepared. The tax rates in effect

> Novotna Inc.’s only temporary difference at the beginning and end of 2016 is caused by a $3 million deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable (only one-half of which is classified as a current ass

> Assume the same information as E19-12, except that at the end of 2016, Jennifer Capriati Corp. had a valuation account related to its deferred tax asset of $45,000. Instructions a. Record income tax expense, deferred income taxes, and income taxes pay

> Jennifer Capriati Corp. has a deferred tax asset account with a balance of $150,000 at the end of 2016 due to a single cumulative temporary difference of $375,000. At the end of 2017, this same temporary difference has increased to a cumulative amount of

> At the end of 2016, Lucretia McEvil Company has $180,000 of cumulative temporary differences that will result in reporting the following future taxable amounts. 2017………….$ 60,000 2018…………….50,000 2019…………...40,000 2020………..…30,000 $

> The following facts relate to Duncan Corporation. 1. Deferred tax liability, January 1, 2017, $60,000. 2. Deferred tax asset, January 1, 2017, $20,000. 3. Taxable income for 2017, $105,000. 4. Cumulative temporary difference at December 31, 2017, giv

> Employees at your company disagree about the accounting for sales returns. The sales manager believes that granting more generous return provisions can give the company a competitive edge and increase sales revenue. The controller cautions that, dependin

> Taylor Marina has 300 available slips that rent for $800 per season. Payments must be made in full by the start of the boating season, April 1, 2018. The boating season ends October 31, and the marina has a December 31 year-end. Slips for future seasons

> Aaron’s Agency sells an insurance policy offered by Capital Insurance Company for a commission of $100 on January 2, 2017. In addition, Aaron will receive an additional commission of $10 each year for as long as the policyholder does not cancel the polic

> Blair Biotech enters into a licensing agreement with Pang Pharmaceutical for a drug under development. Blair will receive a payment of $10,000,000 if the drug receives regulatory approval. Based on prior experience in the drug-approval process, Blair det

> Bill Amends, owner of Real Estate Inc., buys and sells commercial properties. Recently, he sold land for $3,000,000 to the Blackhawk Group, a developer that plans to build a new shopping mall. In addition to the $3,000,000 sales price, Blackhawk Group ag

> Jeff Heun, president of Concrete Always, agrees to construct a concrete cart path at Dakota Golf Club. Concrete Always enters into a contract with Dakota to construct the path for $200,000. In addition, as part of the contract, a performance bonus of $40

> Jupiter Company sells goods to Danone Inc. by accepting a note receivable on January 2, 2017. The goods have a sales price of $610,000 (cost of $500,000). The terms are net 30. If Danone pays within 5 days, however, it receives a cash discount of $10,000

> On January 1, 2017, Lesley Benjamin signed an agreement, covering 5 years, to operate as a franchisee of Campbell Inc. for an initial franchise fee of $50,000. The amount of $10,000 was paid when the agreement was signed, and the balance is payable in fi

> Pacific Crossburgers Inc. charges an initial franchise fee of $70,000. Upon the signing of the agreement (which covers 3 years), a payment of $28,000 is due. Thereafter, three annual payments of $14,000 are required. The credit rating of the franchisee i

> Yanmei Construction Company began operations on January 1, 2017. During the year, Yanmei Construction entered into a contract with Lundquist Corp. to construct a manufacturing facility. At that time, Yanmei estimated that it would take 5 years to complet

> Hamilton Construction Company uses the percentage-of-completion method of accounting. In 2017, Hamilton began work under contract #E2-D2, which provided for a contract price of $2,200,000. Other details follow: Instructions a. What portion of the tota

> Monat Company has grown rapidly since its founding in 2004. To instill loyalty in its employees, Monat is contemplating establishment of a defined benefit plan. Monat knows that lenders and potential investors will pay close attention to the impact of th

> During 2017, Nilsen Company started a construction job with a contract price of $1,600,000. The job was completed in 2019. The following information is available. Instructions a. Compute the amount of gross profit to be recognized each year, assuming

> Refer to the information in E18-31. Instructions a. Does the accounting for capitalized costs change if the contract is for 1 year rather than 3 years? Explain. b. Dan’s Demolition is a startup company; as a result, there is more than insignificant un

> Rex’s Reclaimers entered into a contract with Dan’s Demolition to manage the processing of recycled materials on Dan’s various demolition projects. Services for the 3-year contract include collecting, sorting, and transporting reclaimed materials to recy

> Tyler Financial Services performs bookkeeping and tax-reporting services to startup companies in the Oconomowoc area. On January 1, 2017, Tyler entered into a 3-year service contract with Walleye Tech. Walleye promises to pay $10,000 at the beginning of

> In September 2017, Gaertner Corp. commits to selling 150 of its iPhone-compatible docking stations to Better Buy Co. for $15,000 ($100 per product). The stations are delivered to Better Buy over the next 6 months. After 90 stations are delivered, the con

> On January 1, 2017, Gordon Co. enters into a contract to sell a customer a wiring base and shelving unit that sits on the base in exchange for $3,000. The contract requires delivery of the base first but states that payment for the base will not be made

> Celic Inc. manufactures and sells computers that include an assurance-type warranty for the first 90 days. Celic offers an optional extended coverage plan under which it will repair or replace any defective part for 3 years from the expiration of the ass

> On January 2, 2017, Grando Company sells production equipment to Fargo Inc. for $50,000. Grando includes a 2-year assurance warranty service with the sale of all its equipment. The customer receives and pays for the equipment on January 2, 2017. During 2

> On May 3, 2017, Eisler Company consigned 80 freezers, costing $500 each, to Remmers Company. The cost of shipping the freezers amounted to $840 and was paid by Eisler Company. On December 30, 2017, a report was received from the consignee, indicating tha

> Wood-Mode Company is involved in the design, manufacture, and installation of various types of wood products for large construction projects. Wood-Mode recently completed a large contract for Stadium Inc., which consisted of building 35 different types o

> Kleckner Company started operations in 2013. Although it has grown steadily, the company reported accumulated operating losses of $450,000 in its first four years in business. In the most recent year (2017), Kleckner appears to have turned the corner and

> Zagat Inc. enters into an agreement on March 1, 2017, to sell Werner Metal Company aluminum ingots. As part of the agreement, Zagat also agrees to repurchase the ingots on May 1, 2017, at the original sales price of $200,000 plus 2%. Instructions a. P

> Cramer Corp. sells idle machinery to Enyart Company on July 1, 2017, for $40,000. Cramer agrees to repurchase this equipment from Enyart on June 30, 2018, for a price of $42,400 (an imputed interest rate of 6%). Instructions a. Prepare the journal ent

> Uddin Publishing Co. publishes college textbooks that are sold to bookstores on the following terms. Each title has a fixed wholesale price, terms f.o.b. shipping point, and payment is due 60 days after shipment. The retailer may return a maximum of 30%

> Organic Growth Company is presently testing a number of new agricultural seeds that it has recently harvested. To stimulate interest, it has decided to grant to five of its largest customers the unconditional right of return to these products if not full

> On July 1, 2017, Selig Company purchased for cash 30% of the outstanding common stock of Spoor Corporation. Both Selig and Spoor have a December 31 year-end. Spoor Corporation, whose common stock is actively traded on the NASDAQ exchange, paid a cash div

> On July 1, 2018, Fontaine Company purchased for cash 40% of the outstanding common stock of Knoblett Company. Both Fontaine Company and Knoblett Company have a December 31 yearend. Knoblett Company, whose common stock is actively traded in the over-the-c

> Revenue is usually recognized at the point of sale (a point in time). Under special circumstances, however, bases other than the point of sale are used for the timing of revenue recognition. Instructions a. Why is the point of sale usually used as the

> Lexington Co. has the following securities outstanding on December 31, 2017 (its first year of operations). During 2018, Summerset Company stock was sold for $9,200, the difference between the $9,200 and the “fair valueâ€&#

> Revenue is recognized based on a five-step process that is applied to a company’s revenue arrangements. Instructions a. Briefly describe the five-step process. b. Explain the importance of contracts when analyzing revenue arrangements. c. How are fa

> Thinken Technology recently merged with College Electronix (CE), a computer graphics company. In performing a comprehensive audit of CE’s accounting system, Gerald Ott, internal audit manager for Thinken Technology, discovered that the new subsidiary did

> What procedures are followed in the allocation of a discount?

> Vickie Plato, accounting clerk in the personnel office of Streisand Corp., has begun to compute pension expense for 2019 but is not sure whether or not she should include the amortization of unrecognized gains/losses. She is currently working with the fo

> Davis Corporation is a medium-sized manufacturer of paperboard containers and boxes. The corporation sponsors a noncontributory, defined benefit pension plan that covers its 250 employees. Sid Cole has recently been hired as president of Davis Corporatio

> Maria Rodriquez and Lynette Kingston are discussing accounting for income taxes. They are currently studying a schedule of taxable and deductible amounts that will arise in the future as a result of existing temporary differences. The schedule is as foll

> At December 31, 2017, Higley Corporation has one temporary difference which will reverse and cause taxable amounts in 2018. In 2017, a new tax act set taxes equal to 45% for 2017, 40% for 2018, and 34% for 2019 and years thereafter. Instructions Explai

> Part A: This year, Gumowski Company has each of the following items in its income statement. 1. Gross profits on installment sales. 2. Revenues on long-term construction contracts. 3. Estimated costs of product warranty contracts. 4. Premiums on offic

> The asset-liability approach for recording deferred income taxes is an integral part of generally accepted accounting principles. Instructions a. Indicate whether each of the following independent situations should be treated as a temporary difference

> Fahey Company sells Stairmasters to a retailer, Physical Fitness, Inc., for $2,000,000. Fahey has a history of providing price concessions on this product if the retailer has difficulty selling the Stairmasters to customers. Fahey has experience with sal

> Revenue is recognized for accounting purposes when a performance obligation is satisfied. In some situations, revenue is recognized over time as the fair values of assets and liabilities change. In other situations, however, accountants have developed gu

> Judy Schaeffer is getting up to speed on the new guidance on revenue recognition. She is trying to understand the revenue recognition principle as it relates to the five-step revenue recognition process. Instructions a. Describe the revenue recognitio

> Describe the accounting for refund liabilities.

> Referring to the revenue arrangement in BE18-6, determine the transaction price for the contract, assuming a. Nair is only able to estimate whether the building can be completed by August 1, 2018, or not (Nair estimates that there is a 70% chance that t

> Nair Corp. enters into a contract with a customer to build an apartment building for $1,000,000. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $150,000 to be paid if the building is ready fo

> Fairbanks Corporation purchased 400 shares of Sherman Inc. common stock for $13,200 (Fairbanks does not have significant influence). During the year, Sherman paid a cash dividend of $3.25 per share. At year-end, Sherman stock was selling for $34.50 per s

> Ragatz, Inc., a drug company, reported the following information. The company prepares its financial statements in accordance with GAAP. 2017 (,000) Current liabilities……………………………….$ 554,11

> The financial statements of P&G are presented in Appendix B. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to P&G’s financial statements and accompanying notes to answer

> The financial statements of P&G are presented in Appendix B. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to P&G’s financial statements and the accompanying notes to answ

> The financial statements of P&G are presented in Appendix B. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to P&G’s financial statements and the accompanying notes to answ

> The financial statements of P&G are presented in Appendix B. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to P&G’s financial statements and the accompanying notes to answ

> The financial statements of P&G are presented in Appendix B. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to P&G’s financial statements and the accompanying notes to ans

> The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies’ complete annual reports, including the notes to the financial statements, are available online. Instructions Use the companies’ financi

> Destin Company signs a contract to manufacture a new 3D printer for $80,000. The contract includes installation which costs $4,000 and a maintenance agreement over the life of the printer at a cost of $10,000. The printer cannot be operated without the i

> The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies’ complete annual reports, including the notes to the financial statements, are available online. Instructions Use the companies’ financi

> The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies’ complete annual reports, including the notes to the financial statements, are available online. Instructions Use the companies’ financi

> The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies’ complete annual reports, including the notes to the financial statements, are available online. Instructions Use the companies’ financia

> The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies’ complete annual reports, including the notes to the financial statements, are available online. Instructions Use the companies’ financi

> DeJohn Company, which began operations at the beginning of 2015, produces various products on a contract basis. Each contract generates a gross profit of $80,000. Some of DeJohn’s contracts provide for the customer to pay on an installment basis. Under t

> On January 1, 2016, Garner issued 10-year, $200,000 face value, 6% bonds at par. Each $1,000 bond is convertible into 30 shares of Garner $2 par value common stock. The company has had 10,000 shares of common stock (and no preferred stock) outstanding th

> PENCOMP’s balance sheet at December 31, 2017, is as follows. Accounting Prepare an income statement for 2018 and a balance sheet as of December 31, 2018. Also, prepare the pension expense journal entry for the year ended December 31,

> Diversified Industries manufactures sump-pumps. Its most popular product is called the Super Soaker, which has a retail price of $1,200 and costs $540 to manufacture. It sells the Super Soaker on a standalone basis directly to businesses. Diversified als

> Instar Company has several investments in the securities of other companies. The following information regarding these investments is available at December 31, 2017. 1. Instar holds bonds issued by Dorsel Corp. The bonds have an amortized cost of $320,0

> Engelhart Implements Inc. sells tractors to area farmers. The price for each tractor includes GPS positioning service for 9 months (which facilitates field settings for planting and harvesting equipment). The GPS service is regularly sold on a standalone

> Frozen Delight, Inc. charges an initial franchise fee of $75,000 for the right to operate as a franchisee of Frozen Delight. Of this amount, $25,000 is collected immediately. The remainder is collected in four equal annual installments of $12,500 each. T

> Identify the five steps in the revenue recognition process.

> What was viewed as a major criticism of GAAP as it relates to revenue recognition?

> Identify and explain the three types of classifications for investments in debt securities.

> Describe the revenue recognition principle.

> Explain the current environment regarding revenue recognition.

> What is service cost, and what is the basis of its measurement?

> Pretax financial income for Lake Inc. is $300,000, and its taxable income is $100,000 for 2018. Its only temporary difference at the end of the period relates to a $70,000 difference due to excess depreciation for tax purposes. If the tax rate is 40% for

> Roth Inc. has a deferred tax liability of $68,000 at the beginning of 2018. At the end of 2018, it reports accounts receivable on the books at $90,000 and the tax basis at zero (its only temporary difference). If the enacted tax rate is 34% for all perio

> What is an uncertain tax position, and what are the general guidelines for accounting for uncertain tax positions?

> On October 10, 2017, Executor Co. entered into a contract with Belisle Inc. to transfer Executor’s specialty products (sales value of $10,000, cost of $6,500) on December 15, 2017. Belisle agrees to make a payment of $5,000 upon delivery and signs a prom

> Hillside Company enters into a contract with Sanchez Inc. to provide a software license and 3 years of customer support. The customer-support services require specialized knowledge that only Hillside Company’s employees can perform. How many performance

> Explain the accounting for contract modifications.

> What are the two types of warranties? Explain the accounting for each type.

> What qualitative and quantitative disclosures are required related to revenue recognition?

> Explain the reporting for a. costs to fulfill a contract and b. collectibility.

> In what situation will the unrealized holding gain or loss on inventory be reported in income?

> Describe the conditions when contract assets and liabilities are recognized and presented in financial statements.

> Campus Cellular provides cell phones and 1 year of cell service to students for an upfront, nonrefundable fee of $300 and a usage fee of $5 per month. Students may renew the service for each year they are on campus (on average, students renew their servi

> What is meant by the term “underlying” as it relates to derivative financial instruments?

> What are the reporting issues in a sale with a repurchase agreement?

> Under what conditions does a company recognize revenue over a period of time?

> Use the information from BE17-1 but assume the bonds are purchased as an available-for-sale security. Prepare Garfield’s journal entries for a. the purchase of the investment, b. the receipt of annual interest and discount amortization, and c. the yea

> In measuring the transaction price, explain the accounting for a. time value of money, and b. noncash consideration.

> Explain how to account for the impairment of a held-to maturity debt security.

> Explain the accounting for sales with right of return.

> How do companies recognize revenue from a performance obligation over time?

> Where on the asset side of the balance sheet are debt investments classified as trading securities, available-for sale securities, and held-to-maturity securities reported? Explain.