Question: Hadera Company prepared its annual financial

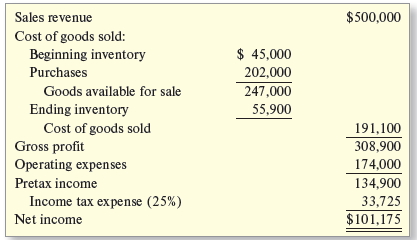

Hadera Company prepared its annual financial statements dated December 31 of the current year. The company applies the FIFO inventory costing method; however, the company neglected to apply lower of cost or net realizable value to the ending inventory. The preliminary current year income statement follows:

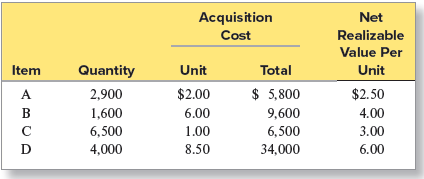

Assume that you have been asked to restate the current year financial statements to incorporate lower of cost or NRV. You have developed the following data relating to the current year ending inventory:

Required:

1. Restate the income statement to reflect lower of cost or net realizable value valuation of the current year ending inventory. Apply lower of cost or NRV on an item-by-item basis and show computations.

2. Compare and explain the lower of cost or net realizable value effect on each amount that was changed on the income statement in requirement (1).

3. What is the conceptual basis for applying lower of cost or net realizable value to merchandise inventories?

4. Thought question: What effect did lower of cost or net realizable value have on the current year cash flow? What will be the long-term effect on cash flow?

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Zoom investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Required: 1.

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Nike investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Required: 1.

> Refer to the financial statements and footnotes of Target given in Appendix B at the end of this book. All dollar amounts are in millions. Required: 1. What is the amount of accrued wages and benefits at the end of the most recent fiscal year? a. $1,931

> Refer to the financial statements of Walmart Inc. in Appendix C at the end of this book. All dollar amounts are in millions. 1. What depreciation method does Walmart use for its property and equipment? 2. What was the balance of accumulated depreciation

> The notes to a recent annual report from Lakshmi Financial Services Corporation indicated that the company acquired another company, Sanjeev Insurance Company. Assume that Lakshmi finalized the purchase of Sanjeev on January 2 of the current year. Lakshm

> Russeck Incorporated is a small manufacturing company that makes model trains to sell to toy stores. It has a small service department that repairs customers’ trains for a fee. The company has been in business for five years. At the end

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Papa Johns investor relations).Select SEC Filings or Annual Report or Financials to obtain the 10-K for the three most recent years available.* R

> Refer to the financial statements of Target Corporation in Appendix B at the end of this book. All dollar amounts are in millions. Use the notes to the financial statements for answering some of the questions. 1. How much did the company spend on propert

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Papa John’s investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Requir

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Papa John’s investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Requir

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Papa Johns investor relations). Select SEC Filings or Annual Report or Financials (whichever the website provides) to obtain the 10-K for the mos

> Finding Financial Information Refer to the financial statements of Target Corporation in Appendix B at the end of this book. All dollar amounts are in millions. (Note: Fiscal year 2019 for Target runs from February 2, 2019 to February 1, 2020.) 1. What i

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Zoom investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available. Required: For

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Papa John’s investor relations).Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Require

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Zoom investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Required: 1.

> Using the financial information presented in Exhibit 13.1, calculate the following ratios for fiscal 2020 for The Home Depot: • Net profit margin ratio • Quality of income ratio • Receivables turnover ratio • Cash ratio • Times interest earned ratio • Pr

> The Gap, Inc., is a global retailer of apparel, accessories, and personal care products for women, men, and children under the Gap, Banana Republic, Old Navy, Athleta, Intermix, Janie and Jack, and Hill City brands. The Company operates approximately 3,9

> You have the opportunity to invest $10,000 in one of two companies from a single industry. The only information you have is below. Which company would you select? Justify your choice.

> The price/earnings ratio provides important information concerning the stock market’s assessment of the growth potential of a business. The following are price/earnings ratios for selected companies. Match the company with its ratio and

> IBM recently redefined its strategy to focus the company on cloud computing and artificial intelligence. IBM employs over 345,000 people across more than 175 countries. Assume a recent statement of cash flows contained the following information (in milli

> Mulkilteo Company obtained a charter from the state in January of this year. The charter authorized 1,000,000 shares of common stock with a $5 par value. During the year, the company earned $429,000. Also during the year, the following selected transacti

> Several years ago, Ben & John Company issued bonds with a face value of $2,000,000 for $2,090,000. As a result of declining interest rates, the company has decided to call the bonds at a call premium of 5 percent over par. The bonds have a current book v

> Several years ago, Max Company issued bonds with a face value of $2,000,000 for $2,090,000. As a result of declining interest rates, the company has decided to call the bonds at a call premium of 5 percent over par. The bonds have a current book value of

> Assume that on January 1 of Year 1, Tesla, Inc., decided to start a fund to build an addition to its plant. Tesla will deposit $320,000 in the fund at each year-end, starting on December 31 of Year 1. The fund will earn 9 percent annual interest, which w

> Kameamea Company was granted a charter on January 1 that authorized the following stock: Common stock: $40 par value; 100,000 shares authorized Preferred stock: 8 percent; $5 par value; 20,000 shares authorized During the year, the following transactions

> On January 1 of this year, Pablo Insurance Corporation issued bonds with a face value of $4,000,000 and a coupon rate of 9 percent. The bonds mature in five years and pay interest annually every December 31. When the bonds were sold, the annual market ra

> Use the data from Alternate Problem AP9-4 to complete this problem. Required: For each transaction (including adjusting entries) listed in Alternate Problem AP9-4, indicate the effects (e.g., Cash + or −) using the format below. You do

> A recent annual report for AMERCO, the holding company for U-Haul International, Inc., included the following note: AMERCO subsidiaries own property, plant, and equipment that are utilized in the manufacture, repair, and rental of U-Haul equipment and th

> Use data from Problem AP9-2 to complete this problem. Required: For each transaction (including adjusting entries) listed in Problem AP9-1, indicate the effects (e.g., Cash + or −) using the format below. You do not need to include amou

> Use the data presented in AP6-1, which were selected from the records of Sharkim Company for the year ended December 31, current year. Required: 1. Give the journal entries for these transactions, including the write-off of the uncollectible account and

> Newell Brands Inc. is a leading global consumer goods company with a strong portfolio of well-known brands, including Sharpie, Paper Mate, Mr. Coffee, Rubbermaid, Yankee Candle, and others. The items reported on its income statement for the year ended De

> What do profitability ratios focus on? What is an example of a profitability ratio and how is it computed?

> What are component percentages? Why are they useful?

> What are the two general methods for making financial comparisons?

> Explain why rapid growth in total sales might not necessarily be a good thing for a company.

> Explain how a company’s accounting policy choices can affect its ratios.

> Explain briefly the application of the lower of cost or net realizable value concept to ending inventory and its effect on the income statement and balance sheet when net realizable value is lower than cost.

> How is treasury stock reported on the balance sheet? If a corporation resells treasury stock at a price above or below the price paid to originally acquire the treasury shares, how does it record this difference?

> Connors LLC has been operating for three years as a lumber producer specializing in pine, aspen, and hardwoods. During this period, it has experienced rapid growth in sales revenue and in inventory. Mr. Connors and his associates have hired you as Connor

> What are the purposes of (a) the income statement, (b) the balance sheet, (c) the statement of cash flows, and (d) the statement of stockholders’ equity?

> Recording Transactions, Preparing Journal Entries, Posting to T-Accounts, Preparing the Balance Sheet, and Evaluating the Current Ratio Apple Inc., headquartered in Cupertino, California, designs, manufactures, and markets smartphones, personal computers

> Refer to the information regarding Zimmerman Company in P4-2. Required: 1. Indicate whether each transaction relates to a deferred revenue, deferred expense, accrued revenue, or accrued expense. 2. Using the following headings, indicate the effect of eac

> Recording Transactions in T-Accounts, Preparing the Balance Sheet from a Trial Balance, and Evaluating the Current Ratio (AP2-3) Jaguar Plastics Company has been operating for three years. At December 31 of last year, the accounting records reflected the

> The following data were selected from the records of Sykes Company for the year ended December 31, current year. In the following order, except for cash sales, the company sold merchandise and made collections on credit terms 2/10, n/30 (assume a unit sa

> Papa John’s International Inc. operates and franchises pizza delivery and carryout restaurants worldwide. The following is an alphabetical list of accounts and amounts reported in a recent year’s set of financial state

> The financial statements for Lainey’s Famous Pizza are below. Lainey’s operates more than 250 locations in 30 states and 11 countries. Required: 1. Compute the following ratios for Year 3 using information from the com

> You have the opportunity to invest $10,000 in one of two companies from a single industry. The only information you have is below. Which company would you select? Justify your choice.

> The following was in the financial press pertaining to GoDaddy Corporation: GoDaddy’s (GDDY) stock was sold for $26 per share during its opening day of trading. GoDaddy sold 23 million shares at its IPO. Required: 1. Record the issuance of stock, assumin

> Just prior to the end of the fiscal year, Biofuel Corporation reported the following information: Required: Complete the table below for each of the three following independent cases: Case 1: The board of directors declared a cash dividend of $0.02 per s

> The following information was extracted from the records of Cascade Company at the end of the fiscal year after all adjusting entries were completed: Required: 1. Prepare the stockholders’ equity section of the balance sheet at the end

> Wapato Corporation purchased a new piece of equipment at the beginning of Year 1 for $1,000,000. The expected life of the asset is 20 years with no residual value. The company uses straight-line depreciation for financial reporting purposes and accelerat

> Springer International Publishing, headquartered in Berlin, Germany, is a leading global publisher of scientific, technical, and medical journals and books for researchers in academia, scientific institutions, and corporate R&D departments. For print pub

> Starn Tool & Manufacturing Company, located in Meadville, PA, provides component machining for robotics, drones, vision systems, and special machines and assemblies for the aerospace, military, commercial, automotive, and medical industries. Assume the c

> Best Buy Co., Inc., headquartered in Richfield, Minnesota, is one of the leading consumer electronics retailers, operating more than 1,100 stores across the globe. The following was reported in a recent annual report: Required: 1. Assuming that Best Buy

> A recent annual report for Delta Air Lines included the following note: Assume that Delta made extensive repairs on an airplane engine, increasing the fuel efficiency and extending the useful life of the airplane. The existing airplane originally cost $4

> On January 2, Summers Company received a machine that the company had ordered with an invoice price of $85,000. Freight costs of $1,000 were paid by the vendor per the sales agreement. The company exchanged the following on January 2 to acquire the machi

> The August, current year, bank statement for Allison Company and the August, current year, ledger account for cash follow: Outstanding checks at the end of July were for $270, $430, and $320. No deposits were in transit at the end of July. Required: 1. C

> The bookkeeper at Jefferson Company has not reconciled the bank statement with the Cash account, saying, “I don’t have time.” You have been asked to prepare a reconciliation and review the procedures

> Cloud Comfort, Inc., researches, designs, manufactures, and distributes interior furnishings for use in various environments including office, health care, educational, and residential settings. The items reported on its income statement for the year end

> The December 31, current year, bank statement for Rivas Company and the December current year ledger account for cash follow. The November, current year, bank reconciliation showed the following: correct cash balance at November 30, $64,100; deposits in

> Mateo Inc. is a retailer of men’s and women’s clothing aimed at college-age customers. Listed below are additional transactions that Mateo was considering at the end of the accounting period. Required: Complete the fol

> Sonos, Inc., designs, develops, manufactures, and sells multi-room audio products. The Sonos sound system provides customers with an immersive listening experience created by the design of its speakers and components, a proprietary software platform, and

> Nordstrom, Inc., is a leading fashion retailer that offers customers an extensive selection of high-quality fashion brands focused on apparel, shoes, cosmetics, and accessories for women, men, young adults, and children. The items reported on its income

> Refer to the information regarding Mellor Towing Company in P4-3. Required: 1. Indicate whether each transaction relates to a deferred revenue, deferred expense, accrued revenue, or accrued expense. 2. Using the following headings, indicate the effect of

> Ramirez Company is completing the information processing cycle at its fiscal year-end on December 31. Following are the correct balances at December 31 for the accounts both before and after the adjusting entries. Required: 1. Compare the amounts in the

> Which of the following will increase a company’s current liabilities? 1. A company purchases a new truck with cash. 2. A company receives cash from taking out a long-term loan. 3. A company collects half of its accounts receivable balance. 4. A company p

> Calculate the current ratio for Matteo’s Taco Company at the end of 2018 and 2019, based on the following data: What does the result suggest about the company over time? What can you say about the ratio for Matteo’s Ta

> Seattle Corporation is considering changing its inventory method from FIFO to LIFO. Assume that inventory prices have been increasing. All else equal, what impact would you expect the change to have on the following ratios: net profit margin, fixed asset

> Catena’s Marketing Company has the following adjusted trial balance at the end of the current year. Cash dividends of $600 were declared at the end of the year, and 500 additional shares of common stock ($0.10 par value per share) were

> Buzz Coffee Shops is famous for its large servings of hot coffee. Last year a customer spilled a cup of hot coffee on himself and decided to file a lawsuit against Buzz for $1,000,000. Buzz’s management thinks the chances of the company having to pay any

> The bookkeeper at Washington Company has not reconciled the bank statement with the Cash account, saying, “I don’t have time.” You have been asked to prepare a reconciliation and review the procedures

> Honda Motor Corporation of Japan is a leading international manufacturer of automobiles, motorcycles, all-terrain vehicles, and personal watercraft. As a Japanese company, it follows Japanese GAAP and reports its financial statements in billions of yen (

> The following is a list of account titles and amounts (dollars in millions) from a recent annual report of Hasbro, Inc., a leading manufacturer of games, toys, and interactive entertainment software for children and families: Required: Prepare the asset

> Identifying Account Titles The following are independent situations. a. A new company is formed and sells 100 shares of $1 par value stock for $12 per share to investors. b. A company purchases for $18,000 cash a new delivery truck that has a list, or st

> Match each definition with its related term by entering the appropriate letter in the space provided. There should be only one definition per term (that is, there are more definitions than terms).

> Dollar General Corporation operates general merchandise stores that feature quality merchandise at low prices. All stores are located in the United States, predominantly in small towns in midwestern and southeastern states. In a recent year, the company

> GolfGear & More, Inc., is a regional and online golf equipment retailer. The company reported the following for the current year: Purchased a long-term investment for cash, $15,000. Paid cash dividend, $12,000. Sold equipment for $6,000 cash (cost, $

> Refer to the information for Peak Heights Company in Exercise 12-7. Required: Present the operating activities section of the statement of cash flows for Peak Heights Company using the direct method.

> Gibraltar Industries is a Buffalo, New York–based manufacturer and distributor of building products for residential, industrial, infrastructure, renewable energy, and conservation markets. In a recent year, it reported the following act

> At the beginning of the year, the stockholders’ equity section of the balance sheet of Solutions Corporation reflected the following: On February 1, the board of directors declared a 60 percent stock dividend to be issued April 30. The

> Denzel Corporation is planning to issue bonds with a face value of $600,000 and a coupon rate of 7.5 percent. The bonds mature in four years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year

> Perry Corporation is a local grocery store organized seven years ago as a corporation. At that time, a total of 10,000 shares of common stock were issued to the three organizers. The store is in an excellent location and sales have increased each year. A

> Denzel Corporation is planning to issue bonds with a face value of $600,000 and a coupon rate of 7.5 percent. The bonds mature in four years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year

> On January 1 of this year, Kona Corporation sold bonds with a face value of $1,400,000 and a coupon rate of 8 percent. The bonds mature in four years and pay interest semiannually every June 30 and December 31. Kona uses the straight-line amortization me

> Apple recently issued a series of bonds with various maturity dates. The information below pertains to one of Apple’s bonds: Explain why investors would care about knowing the coupon rate and yield percentages. Assume that over the next

> Jose Company sells a wide range of goods through two retail stores operated in adjoining cities. Jose purchases most of the goods it sells in its stores on credit, promising to pay suppliers later. Occasionally, a short-term note payable is used to obtai

> At the end of each year, you plan to deposit $2,000 in a savings account. The account will earn 9 percent annual interest, which will be added to the fund balance at year-end. The first deposit will be made at the end of Year 1. Required (show computatio

> Peloton Corporation sells fitness products and associated subscription services. Effective management of its properties is a key to its success. As the following note in a recent annual report indicates, Peloton leases various types of property: The Comp

> Cauce Corporation is preparing its year-end balance sheet. The company records show the following selected amounts at the end of the year: Required: 1. Identify current liabilities and compute working capital. Why is working capital important to manageme

> Trotman Company had three intangible assets at the end of the current year: a. Computer software and website development technology purchased on January 1 of the prior year for $70,000. The technology is expected to have a four-year useful life to the co

> The following data were included in a recent Apple Inc. annual report ($ in millions): Required: 1. Compute Apple’s fixed asset turnover ratio for 2018, 2019, and 2020. Round your answers to two decimal points. 2. How might a financial

> Freeport-McMoRan Copper & Gold Inc., headquartered in Phoenix, Arizona, is a leading international mining company of copper, gold, and molybdenum. Its revenues were over $14 billion in a recent year. Assume that in February of last year, Freeport-McMoRan

> HarveySafe Inc. is a provider of commercial and residential security and monitoring systems. Listed below are additional transactions that Harvey was considering at the end of the accounting period. Required: Complete the following tabulation, indicating

> Delta Air Lines owns hundreds of aircraft, with about 60 percent of its fleet consisting of Boeing aircraft, while Airbus aircraft make up about 40 percent. It sold seven used Boeing 767-300 jets to Amazon.com as Amazon plans to expand its growing Amazon

> Microsoft Corporation is a leading technology company with products ranging from operating systems, productivity applications, server applications, business solution applications, software development tools, to devices including PCs, tablets, and gaming

> In its recent annual report, PepsiCo included the following information in its balance sheets (dollars in millions): Required: Explain the effects of the changes in inventory and accounts payable on cash flow from operating activities for the current yea

> BorgWarner Inc. is a leading global supplier of highly engineered automotive systems and components primarily for powertrain applications. The following note was contained in its recent annual report: Required: 1. What amount of ending inventory would ha

> Dell Inc. is the leading manufacturer of personal computers. In a recent year, it reported the following in millions of dollars: Required: 1. Determine the inventory turnover ratio and average days to sell inventory for the current year. 2. Explain the m

> Griffin Corporation prepared the following two income statements (simplified for illustrative purposes): During the third quarter, it was discovered that the ending inventory for the first quarter should have been $4,280. Required: 1. What effect did thi

> Microsoft develops, produces, and markets a wide range of computer software, including the Windows operating system. On its recent financial statements, Microsoft reported the following information about net sales revenue and accounts receivable (amounts