Question: Hardy Photography’s checkbook lists the

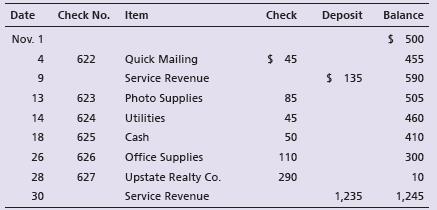

Hardy Photography’s checkbook lists the following:

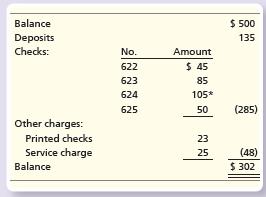

Hardy’s November bank statement shows the following:

Requirements:

1. Prepare Hardy Photography’s bank reconciliation at November 30, 2018.

2. How much cash does Hardy actually have on November 30, 2018?

3. Journalize any transactions required from the bank reconciliation.

Transcribed Image Text:

Date Check No. Item Check Deposit Balance Nov. 1 $ 500 4 622 Quick Mailing $ 45 455 9. Service Revenue $ 135 590 13 623 Photo Supplies 85 505 14 624 Utilities 45 460 18 625 Cash 50 410 26 626 Office Supplies 110 300 28 627 Upstate Realty Co. 290 10 30 Service Revenue 1,235 1,245 Balance $ 500 Deposits 135 Checks: No. Amount 622 $ 45 623 85 624 105* 625 50 (285) Other charges: Printed checks 23 Service charge Balance 25 (48) $ 302

> The records of Vintage Color Engraving reveal the following: Compute cash flows from operating activities by the indirect method for year ended December 31, 2018. $ 36,000 Depreciation expense $ 5,000 Net income Sales revenue 53,000 Decrease in cur

> The statement of cash flows categorizes like transactions for optimal reporting. Identify each item as a (n): • Operating activity—addition to net income (O+) or subtraction from net income (O-) • Investing activity—cash inflow (I+) or cash outflow (I-)

> Consider the following transactions: Identify the category of the statement of cash flows, indirect method, in which each transaction would be reported. Date Accounts and Explanation Debit Credit a. Cash 72,000 Common Stock 72,000 b. Treasury Stock

> Consider the following transactions: a. Purchased equipment for $130,000 cash. b. Issued $14 par preferred stock for cash. c. Cash received from sales to customers of $35,000. d. Cash paid to vendors, $17,000. e. Sold building for $19,000 gain for cash.

> How does the direct method differ from the indirect method when preparing the operating activities section of the statement of cash flows?

> What is free cash flow, and how is it calculated?

> What should the net change in cash section of the statement of cash flows always reconcile with?

> What accounts on the balance sheet must be evaluated when completing the financing activities section of the statement of cash flows?

> Old Mills’s income statement appears as follows (amounts in thousands): Use the following ratio data to complete Old Mills’s income statement: 1. Inventory turnover is 3.70 (beginning Merchandise Inventory was $810;

> Accel’s Companies, a home improvement store chain, reported the following summarized figures: Accel’s has 10,000 common shares outstanding during 2018. Requirements: 1. Compute earnings per share (EPS) for 2018 for

> Accel’s Companies, a home improvement store chain, reported the following summarized figures: Accel’s has 10,000 common shares outstanding during 2018. Requirements: 1. Compute the profit margin ratio for Accel&acir

> Accel’s Companies, a home improvement store chain, reported the following summarized figures: Accel’s has 10,000 common shares outstanding during 2018. Requirements: 1. Compute the debt ratio and the debt to equity

> Accel’s Companies, a home improvement store chain, reported the following summarized figures: Accel’s has 10,000 common shares outstanding during 2018. Requirements: 1. Compute the inventory turnover, daysâ

> Caleb King is interested in investing in Orange Corporation. What types of tools should Caleb use to evaluate the company?

> Traditional Mills’s balance sheet appears as follows (amounts in thousands): Use the following ratio data to complete Traditional Mills’s balance sheet. 1. Current ratio is 0.72. 2. Acid-test ratio is 0.36. TRADI

> Accel’s Companies, a home improvement store chain, reported the following summarized figures: Accel’s has 10,000 common shares outstanding during 2018. Requirements: 1. Compute Accel’s Companies&ac

> Data for Connor, Inc. and Alto Corp. follow: Requirements: 1. Prepare common-size income statements. 2. Which company earns more net income? 3. Which company’s net income is a higher percentage of its net sales revenue? Connor Alt

> Great Value Optical Company reported the following amounts on its balance sheet at December 31, 2018 and 2017: Prepare a vertical analysis of Great Value’s assets for 2018 and 2017. 2018 2017 Cash and Receivables $ 80,640 $ 80,575

> What accounts on the balance sheet must be evaluated when completing the investing activities section of the statement of cash flows?

> Muscateer Corp. reported the following revenues and net income amounts: Requirements: 1. Calculate Muscateer’s trend analysis for revenues and net income. Use 2016 as the base year, and round to the nearest percent. 2. Which measure i

> Verifine Corp. reported the following on its comparative income statement: Prepare a horizontal analysis of revenues and gross profit—both in dollar amounts and in percentages—for 2019 and 2018. (In millions) 201

> Briefly describe the ratios that can be used to evaluate a company’s stock as an investment.

> Briefly describe the ratios that can be used to evaluate a company’s profitability.

> Briefly describe the ratios that can be used to evaluate a company’s ability to pay longterm debt.

> Briefly describe the ratios that can be used to evaluate a company’s ability to sell merchandise inventory and collect receivables.

> Briefly describe the ratios that can be used to evaluate a company’s ability to pay current liabilities.

> What is vertical analysis? What item is used as the base for the income statement? What item is used as the base for the balance sheet?

> What is an annual report? Briefly describe the key parts of the annual report.

> What are some common red flags in financial statement analysis?

> If current liabilities increase, what is the effect on cash? What about a decrease in current liabilities?

> Theater by Design and Show Cinemas are asking you to recommend their stock to your clients. Because Theater by Design and Show Cinemas earn about the same net income and have similar financial positions, your decision depends on their statement of cash f

> What is separation of duties?

> What is internal control?

> The October 31 bank statement of Wyndham’s Healthcare has just arrived from State Bank. To prepare the bank reconciliation, you gather the following data: a. The October 31 bank balance is $6,290. b. The bank statement includes two cha

> The May cash records of Donald Insurance follow: Donald’s Cash account shows a balance of $17,750 at May 31. On May 31, Donald Insurance received the following bank statement: Additional data for the bank reconciliation follow: a. The

> Suppose that on September 1, Cool Gyrations, a disc jockey service, creates a petty cash fund with an imprest balance of $350. During September, Ruth Mangan, fund custodian, signs the following petty cash tickets: On September 30, prior to replenishmen

> On September 1, Party Salad Dressings creates a petty cash fund with an imprest balance of $600. During September, Michael Martell, the fund custodian, signs the following petty cash tickets: On September 30, prior to replenishment, the fund contains t

> Each of the following situations has an internal control weakness. a. Jade Applications has decided that one way to cut costs in the upcoming year is to fire the external auditor. The business believes that the internal auditor should be able to efficie

> Pendley Productions makes all sales on credit. Cash receipts arrive by mail. Larry Chipello, the mailroom clerk, opens envelopes and separates the checks from the accompanying remittance advices. Chipello forwards the checks to another employee, who make

> The August 31 bank statement of Well Healthcare has just arrived from United Bank. To prepare the bank reconciliation, you gather the following data: a. The August 31 bank balance is $4,540. b. The bank statement includes two charges for NSF checks from

> The December cash records of Davidson Insurance follow: Davidson’s Cash account shows a balance of $17,450 at December 31. On December 31, Davidson Insurance received the following bank statement: Additional data for the bank reconc

> How does preferred stock differ from common stock?

> During periods of rising costs, which inventory costing method produces the highest gross profit?

> Suppose that on June 1, Rockin’ Gyrations, a disc jockey service, creates a petty cash fund with an imprest balance of $300. During June, Michael Martell, fund custodian, signs the following petty cash tickets: On June 30, prior to rep

> On June 1, Fab Salad Dressings creates a petty cash fund with an imprest balance of $300. During June, Al Franklin, the fund custodian, signs the following petty cash tickets: On June 30, prior to replenishment, the fund contains these tickets plus cas

> Each of the following situations has an internal control weakness. a. Upside-Down Applications develops custom programs to customer’s specifications. Recently, development of a new program stopped while the programmers redesigned Upside-Down’s accounting

> Seawind Productions makes all sales on credit. Cash receipts arrive by mail. Justin Broadway, the mailroom clerk, opens envelopes and separates the checks from the accompanying remittance advices. Broadway forwards the checks to another employee, who mak

> Levon Helm was a kind of one-man mortgage broker. He would drive around Tennessee looking for homes that had second mortgages, and if the criteria were favorable, he would offer to buy the second mortgage for “cash on the barrelhead.” Helm bought low and

> Visit http://www.pearsonhighered.com/Horngren to view a link to Target Corporation’s 2015 Fiscal Year Annual Report. Study the audit opinion (labeled Report of Independent Registered Public Accounting Firm) of Target Corporation and the Target Corporatio

> The following items could appear on a bank reconciliation: a. Outstanding checks, $670. b. Deposits in transit, $1,500. c. NSF check from customer, no. 548, for $175. d. Bank collection of note receivable of $800, and interest of $80. e. Interest earned

> Marathon Running Shoes reports the following: Journalize all entries required for Marathon Running Shoes. 2018 Recorded National Express credit card sales for of $96,000, processor fee of 1%. Ignore Cost of Goods Sold. Sep. 1 net of 15 Recorded Val

> How does authorized stock differ from outstanding stock?

> Just Hangin’ Night Club maintains an imprest petty cash fund of $150, which is under the control of Sandra Morgan. At March 31, the fund holds $14 cash and petty cash tickets for office supplies, $128, and delivery expense, $15. Requirements: 1. Explain

> When using a perpetual inventory system and the weighted-average inventory costing method, when does the business compute a new weighted-average cost per unit?

> Jackie’s Dance Studio created a $220 imprest petty cash fund. During the month, the fund custodian authorized and signed petty cash tickets as follows: Requirements: 1. Make the general journal entry to create the petty cash fund. Inc

> Gary’s Great Cars purchases high-performance auto parts from a Nebraska vendor. Dave Simon, the accountant for Gary’s, verifies receipt of merchandise and then prepares, signs, and mails the check to the vendor. Requirements: 1. Identify the internal co

> Dogtopia sells pet supplies and food and handles all sales with a cash register. The cash register displays the amount of the sale. It also shows the cash received and any change returned to the customer. The register also produces a customer receipt but

> The following situations suggest a strength or a weakness in internal control. a. Top managers delegate all internal control procedures to the accounting department. b. Accounting department staff (or the bookkeeper) orders merchandise and approves invo

> Jim Root Corporation operates four bowling alleys. The business just received the October 31, 2018, bank statement from City National Bank, and the statement shows an ending balance of $910. Listed on the statement are an EFT rent collection of $440, a s

> Match the following terms with their definitions. 1. Internal control a. Two or more people working together to overcome internal controls. 2. Control procedures b. Part of internal control that ensures resources are not 3. Firewalls wasted. 4. Encr

> Consider each situation separately. Identify the missing internal control procedure from these characteristics: • Assignment of responsibilities • Separation of duties • Audits • Electronic devices • Other controls (specify) a. While reviewing the recor

> This case is based on an actual situation. Centennial Construction Company, headquartered in Dallas, Texas, built a Rodeway Motel 35 miles north of Dallas. The construction foreman, whose name was Slim Chance, hired the 40 workers needed to complete the

> What is a corporation?

> Canyon Canoe Company has decided to open a new checking account at River Nations Bank during March 2019. Canyon Canoe Company’s March Cash T-account for the new cash account from its general ledger is as follows: Canyon Canoe Company&

> In 100 words or fewer, explain why there may be a difference between the bank statement ending cash balance and the ending balance in the Cash account. Give at least two examples each of adjustments to the bank balance and to the book balance.

> Under a perpetual inventory system, what are the four inventory costing methods and how does each method determine ending merchandise inventory and cost of goods sold?

> Dick’s Sporting Goods, Inc. is headquartered in Pennsylvania and is a leading sporting goods retailer. Dick’s offers a variety of high-quality sports equipment, apparel, footwear and accessories. The company sells inventory in their stores (Dick’s Sporti

> The periodic inventory records of Flexon Prosthetics indicate the following for the month of July: At July 31, Flexon counts four units of merchandise inventory on hand. Compute ending merchandise inventory and cost of goods sold for Flexon using the

> The periodic inventory records of Flexon Prosthetics indicate the following for the month of July: At July 31, Flexon counts four units of merchandise inventory on hand. Compute ending merchandise inventory and cost of goods sold for Flexon using the

> Broadway Communications reported the following figures in its annual financial statements: Cost of Goods Sold ………………………………………………………………………………… $ 18,400 Beginning Merchandise Inventory …………………………………………………………560 Ending Merchandise Inventory ………………………………………

> New York Pool Supplies’s merchandise inventory data for the year ended December 31, 2019, follow: Requirements: 1. Assume that the ending merchandise inventory was accidentally overstated by $1,800. What are the correct amounts for co

> Refer to Short Exercises S6-4 through S6-6. After completing those exercises, answer the following questions: Short Exercise (6-4 to 6-6): Boston Cycles started October with 12 bicycles that cost $42 each. On October 16, Boston bought 40 bicycles at $6

> Boston Cycles started October with 12 bicycles that cost $42 each. On October 16, Boston bought 40 bicycles at $68 each. On October 31, Boston sold 34 bicycles for $100 each. Requirements: 1. Prepare Boston Cycle’s perpetual inventory record assuming th

> Gullo Company reported these figures for 2018 and 2017: Requirements: 1. Compute Gullo Company’s earnings per share for 2018. Assume the company paid the minimum preferred dividend during 2018. Round to the nearest cent. 2. Compute Gu

> Boston Cycles started October with 12 bicycles that cost $42 each. On October 16, Boston bought 40 bicycles at $68 each. On October 31, Boston sold 34 bicycles for $100 each. Requirements: 1. Prepare Boston Cycle’s perpetual inventory record assuming th

> Canyon Canoe Company is considering raising additional capital for further expansion. The company wants to finance a new business venture into guided trips down the Amazon River in South America. Additionally, the company wants to add another building on

> In March 2019, Crystal Clear Cleaning opened a new checking account at First Regional Bank. The bank statement dated March 31, 2019, for Crystal Clear Cleaning follows: Crystal Clear Cleaning’s Cash account in the general ledger shows

> Boston Cycles started October with 12 bicycles that cost $42 each. On October 16, Boston bought 40 bicycles at $68 each. On October 31, Boston sold 34 bicycles for $100 each. Requirements: 1. Prepare Boston Cycle’s perpetual inventory record assuming th

> Facebook, Inc. is a mobile application and Web site that enables people to connect, share, discover, and communicate with each other. The company also owns Instagram, messenger, WhatsApp, and Oculus. Requirements: 1. Review Item 5 (Dividend Policy) of t

> ABC Corporation’s accounting records include the following items, listed in no particular order, at December 31, 2018: The income tax rate for ABC Corporation is 39%. Prepare ABC’s income statement for the year ended

> Decor and More Imports recently reported the following stockholders’ equity: Suppose Decor and More split its common stock 2-for-1 in order to decrease the market price per share of its stock. The company’s stock was

> Nelly, Inc. had 320,000 shares of $2 par value common stock issued and outstanding as of December 15, 2018. The company is authorized to issue 1,300,000 common shares. On December 15, 2018, Nelly declared a 40% stock dividend when the market value for Ne

> Element Water Sports has 13,000 shares of $1 par value common stock outstanding. Element distributes a 5% stock dividend when the market value of its stock is $15 per share. Requirements: 1. Journalize Element’s declaration of the stock dividend on Augu

> Copperhead Trust has the following classes of stock: Requirements: 1. Copperhead declares cash dividends of $44,000 for 2018. How much of the dividends goes to preferred stockholders? How much goes to common stockholders? 2. Assume the preferred stock

> The balance sheet of Cullins Management Consulting, Inc. at December 31, 2017, reported the following stockholders’ equity: During 2018, Cullins completed the following selected transactions: Requirements: 1. Record the transactions

> Java Company earned net income of $85,000 during the year ended December 31, 2018. On December 15, Java declared the annual cash dividend on its 4% preferred stock (par value, $120,000) and a $0.25 per share cash dividend on its common stock (50,000 shar

> Discount Furniture, Inc. completed the following treasury stock transactions in 2018: Requirements: 1. Journalize these transactions. Explanations are not required. 2. How will Discount Furniture, Inc. report treasury stock on its balance sheet as of D

> Colorado Corporation has two classes of stock: common, $3 par value; and preferred, $30 par value. Requirements: 1. Journalize Colorado’s issuance of 4,500 shares of common stock for $6 per share. 2. Journalize Colorado’s issuance of 4,500 shares of pre

> Due to recent beef recalls, Southwest Steakhouse is considering incorporating. Bob, the owner, wants to protect his personal assets in the event the restaurant is sued. Requirements: 1. Which advantage of incorporating is most applicable? What are other

> Boston Cycles started October with 12 bicycles that cost $42 each. On October 16, Boston bought 40 bicycles at $68 each. On October 31, Boston sold 34 bicycles for $100 each. Requirements: 1. Prepare Boston Cycle’s perpetual inventory record assuming th

> What does the disclosure principle require?

> Taylor Corporation discovered in 2019 that it had incorrectly recorded in 2018 a cash payment of $70,000 for utilities expense. The correct amount of the utilities expense was $35,000. Requirements: 1. Determine the effect of the error on the accounting

> Wyler, Inc.’s 2018 balance sheet reported the following items—with 2017 figures given for comparison: Net income for 2018 was $3,690. Compute Wyler’s rate of return on common stockholdersâ

> Refer to the HEB data in Short Exercise S13-16. Assume the market price of HEB’s common stock is $19.50 per share. Compute HEB’s price/earnings ratio. Short Exercise S13-16: HEB Corporation had net income for 2018 of $60,450. HEB had 15,500 shares of c

> HEB Corporation had net income for 2018 of $60,450. HEB had 15,500 shares of common stock outstanding at the beginning of the year and 20,100 shares of common stock outstanding as of December 31, 2018. During the year, HEB declared and paid preferred div

> The following information was taken from the records of Arizona Motorsports, Inc. at November 30, 2018: Prepare a multi-step income statement for Arizona Motorsports for the fiscal year ended November 30, 2018. Include earnings per share. $ 95,000

> Kingston, Inc. had beginning retained earnings of $135,000 on January 1, 2018. During the year, Kingston declared and paid $85,000 of cash dividends and earned $75,000 of net income. Prepare a statement of retained earnings for Kingston, Inc. for the yea

> Return to the ABC data in Short Exercise S13-12. ABC had 8,000 shares of common stock outstanding during 2018. ABC declared and paid preferred dividends of $4,000 during 2018. Show how ABC reports EPS data on its 2018 income statement. Short Exercise S1

> Cedar Corporation issued 36,000 shares of $1 par value common stock in exchange for a building with a market value of $160,000. Record the stock issuance.

> Nelson Corporation issued 9,000 shares of $3 stated value common stock for $11 per share on July 7. Record the stock issuance.