Question: Hart Golf Co. uses titanium in the

Hart Golf Co. uses titanium in the production of its specialty drivers. Hart anticipates that it will need to purchase 200 ounces of titanium in November 2017, for clubs that will be sold in advance of the spring and summer of 2018. However, if the price of titanium increases, this will increase the cost to produce the clubs, which will result in lower profit margins.

To hedge the risk of increased titanium prices, on May 1, 2017, Hart enters into a titanium futures contract and designates this futures contract as a cash flow hedge of the anticipated titanium purchase. The notional amount of the contract is 200 ounces, and the terms of the contract give Hart the option to purchase titanium at a price of $500 per ounce. The price will be good until the contract expires on November 30, 2017.

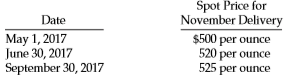

Assume the following data with respect to the price of the call options and the titanium inventory purchase.

Instructions

Present the journal entries for the following dates/transactions.

a. May 1, 2017—Inception of futures contract, no premium paid.

b. June 30, 2017—Hart prepares financial statements.

c. September 30, 2017—Hart prepares financial statements.

d. October 5, 2017—Hart purchases 200 ounces of titanium at $525 per ounce and settles the futures contract.

e. December 15, 2017—Hart sells clubs containing titanium purchased in October 2017 for $250,000. The cost of the finished goods inventory is $140,000.

f. Indicate the amount(s) reported in the income statement related to the futures contract and the inventory transactions on December 31, 2017.

Transcribed Image Text:

Spot Price for November Delivery Date May 1, 2017 June 30, 2017 September 30, 2017 $500 per ounce 520 per ounce 525 per ounce

> Leno Computers manufactures tablet computers for sale to retailers such as Fallon Electronics. Recently, Leno sold and delivered 200 tablet computers to Fallon for $20,000 on January 5, 2017. Fallon has agreed to pay for the 200 tablet computers within 3

> The information below pertains to Barkley Company for 2018. Net income for the year…………………………………$1,200,000 7% convertible bonds issued at par ($1,000 per bond); each bond is convertible into 30 shares of common stock…………………………………………..2,000,000 6% convert

> Charles Austin of the controller’s office of Thompson Corporation was given the assignment of determining the basic and diluted earnings per share values for the year ending December 31, 2018. Austin has compiled the information listed below. 1. The com

> Melton Corporation is preparing the comparative financial statements for the annual report to its shareholders for fiscal years ended May 31, 2017, and May 31, 2018. The income from operations for the fiscal year ended May 31, 2017, was $1,800,000 and in

> Amy Dyken, controller at Fitzgerald Pharmaceutical Industries, a public company, is currently preparing the calculation for basic and diluted earnings per share and the related disclosure for Fitzgerald’s financial statements. Below is

> Assume that Amazon.com has a stock-option plan for top management. Each stock option represents the right to purchase a share of Amazon $1 par value common stock in the future at a price equal to the fair value of the stock at the date of the grant. Amaz

> Angela Corporation issues 2,000 convertible bonds at January 1, 2016. The bonds have a 3-year life, and are issued at par with a face value of $1,000 per bond, giving total proceeds of $2,000,000. Interest is payable annually at 6%. Each bond is converti

> Linda Berstler Company sponsors a defined benefit pension plan. The corporation’s actuary provides the following information about the plan. Instructions a. Compute the actual return on the plan assets in 2017. b. Compute the amount

> The financial statements of M&S are presented in Appendix E. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to M&S’s financial statements and the accompanying notes to ans

> Jack Kelly Company has grown rapidly since its founding in 2007. To instill loyalty in its employees, Kelly is contemplating establishment of a defined benefit plan. Kelly knows that lenders and potential investors will pay close attention to the impact

> The financial statements of M&S are presented in Appendix E. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to M&S’s financial statements and the accompanying notes to ans

> At January 1, 2017, Hennein Company had plan assets of $280,000 and a projected benefit obligation of the same amount. During 2017, service cost was $27,500, the settlement rate was 10%, actual and expected return on plan assets were $25,000, contributio

> Kleckner Company started operations in 2013. Although it has grown steadily, the company reported accumulated operating losses of $450,000 in its first four years in business. In the most recent year (2017), Kleckner appears to have turned the corner and

> Callaway Corp. has a deferred tax asset account with a balance of $150,000 at the end of 2017 due to a single cumulative temporary difference of $375,000. At the end of 2018, this same temporary difference has increased to a cumulative amount of $500,000

> Komissarov Company has a debt investment in the bonds issued by Keune Inc. The bonds were purchased at par for $400,000 and, at the end of 2017, have a remaining life of 3 years with annual interest payments at 10%, paid at the end of each year. This deb

> Assume the same information as in IFRS17-12 except that Roosevelt has an active trading strategy for these bonds. The fair value of the bonds at December 31 of each year-end is as follows. Instructions a. Prepare the journal entry at the date of the b

> On January 1, 2017, Roosevelt Company purchased 12% bonds, having a maturity value of $500,000, for $537,907.40. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2017, and mature January 1, 2022, with interest received Januar

> The financial statements of M&S are presented in Appendix E. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to M&S’s financial statements and the accompanying notes to answ

> Your client, Cascade Company, is planning to invest some of its excess cash in 5-year revenue bonds issued by the county and in the shares of one of its suppliers, Teton Co. Teton’s shares trade on the over-the-counter market. Cascade plans to classify t

> The financial statements of M&S are presented in Appendix E. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to M&S’s financial statements and the accompanying notes to ans

> On December 21, 2017, Zurich Company provided you with the following information regarding its trading investments. During 2018, Carolina Co. shares were sold for $9,500. The fair value of the shares on December 31, 2018, was Stargate Corp. shares&acir

> Assume that Sarazan Company has a share-option plan for top management. Each share option represents the right to purchase a $1 par value ordinary share in the future at a price equal to the fair value of the shares at the date of the grant. Sarazan has

> On June 1, 2017, Mills Company sells $200,000 of shelving units to a local retailer, ShopBarb, which is planning to expand its stores in the area. Under the agreement, ShopBarb asks Mills to retain the shelving units at its factory until the new stores a

> Assume the same information in IFRS16-11, except that Angela Corporation converts its convertible bonds on January 1, 2017. Instructions a. Compute the carrying value of the bond payable on January 1, 2017. b. Prepare the journal entry to record the c

> On January 1, 2017, Gottlieb Corporation issued $4,000,000 of 10-year, 8% convertible debentures at 102. Interest is to be paid semiannually on June 30 and December 31. Each $1,000 debenture can be converted into eight shares of Gottlieb Corporation $100

> The December 31, 2017, balance sheet of Kepler Corp. is as follows. On March 5, 2018, Kepler Corp. called all of the bonds as of April 30 for the principal plus interest through April 30. By April 30, all bondholders had exercised their conversion to c

> On January 1, 2016, when its $30 par value common stock was selling for $80 per share, Plato Corp. issued $10,000,000 of 8% convertible debentures due in 20 years. The conversion option allowed the holder of each $1,000 bond to convert the bond into five

> On January 1, 2017, Hi and Lois Company purchased 12% bonds having a maturity value of $300,000 for $322,744.44. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2017, and mature January 1, 2022, with interest received on Jan

> Aubrey Inc. issued $4,000,000 of 10%, 10-year convertible bonds on June 1, 2017, at 98 plus accrued interest. The bonds were dated April 1, 2017, with interest payable April 1 and October 1. Bond discount is amortized semiannually on a straight-line basi

> Presented below are five different situations. Provide an answer to each of these questions. 1. The Kawaski Jeep dealership sells both new and used Jeeps. Some of the Jeeps are used for demonstration purposes; after 6 months, these Jeeps are then sold a

> Respond to the questions related to the following statements. 1. A wholly unperformed contract is one in which the company has neither transferred the promised goods or services to the customer nor received, or become entitled to receive, any considerat

> Refer to the revenue arrangement in E18-13. Instructions Repeat requirements (a) and (b) assuming Crankshaft does not have market data with which to determine the standalone selling price of the installation services. As a result, an expected cost plus

> Crankshaft Company manufactures equipment. Crankshaft’s products range from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $200,000 to $1,500,000 and are quoted inclusive of installation. The

> Kristin Company sells 300 units of its products for $20 each to Logan Inc. for cash. Kristin allows Logan to return any unused product within 30 days and receive a full refund. The cost of each product is $12. To determine the transaction price, Kristin

> Shaw Company sells goods that cost $300,000 to Ricard Company for $410,000 on January 2, 2017. The sales price includes an installation fee, which has a standalone selling price of $40,000. The standalone selling price of the goods is $370,000. The insta

> Refer to the revenue arrangement in E18-10. Repeat the requirements, assuming a. Geraths estimates the standalone selling price of the installation based on an estimated cost of $400 plus a margin of 20% on cost, and b. given uncertainty of finding ski

> Geraths Windows manufactures and sells custom storm windows for threeseason porches. Geraths also provides installation service for the windows. The installation process does not involve changes in the windows, so this service can be performed by other v

> At December 31, 2017, the available-for-sale debt portfolio for Steffi Graf, Inc. is as follows. On January 20, 2018, Steffi Graf, Inc. sold security A for $15,100. The sale proceeds are net of brokerage fees. Instructions a. Prepare the adjusting e

> The following information is available for Barkley Company at December 31, 2017, regarding its investments. Instructions a. Prepare the adjusting entry (if any) for 2017, assuming no balance in the Fair Value Adjustment account at January 1, 2017. Nei

> Assume the same information as in E17-3 except that the securities are classified as available-for-sale. The fair value of the bonds at December 31 of each year-end is as follows. Instructions a. Prepare the journal entry at the date of the bond purch

> On January 2, 2017, Parton Company issues a 5-year, $10,000,000 note at LIBOR, with interest paid annually. The variable rate is reset at the end of each year. The LIBOR rate for the first year is 5.8%. Parton Company decides it prefers fixed-rate financ

> On January 2, 2017, MacCloud Co. issued a 4-year, $100,000 note at 6% fixed interest, interest payable semiannually. MacCloud now wants to change the note to a variable-rate note. As a result, on January 2, 2017, MacCloud Co. enters into an interest rat

> Elaina Company has the following investments as of December 31, 2017: Investments in common stock of Laser Company……………………$1,500,000 Investment in debt securities of FourSquare Company…………..$3,300,000 In both investments, the carrying value and the fair

> Assume the same information as in E17-19 for Lilly Company. In addition, assume that the investment in the Woods Inc. stock was sold during 2018 for $195,000. At December 31, 2018, the following information relates to its two remaining investments of com

> On July 10, 2017, Amodt Music sold CDs to retailers on account and recorded sales revenue of $700,000 (cost $560,000). Amodt grants the right to return CDs that do not sell in 3 months following delivery. Past experience indicates that the normal return

> Jaycie Phelps Inc. acquired 20% of the outstanding common stock of Theresa Kulikowski Inc. on December 31, 2017. The purchase price was $1,200,000 for 50,000 shares. Kulikowski Inc. declared and paid an $0.85 per share cash dividend on June 30 and on Dec

> The following are two independent situations. Situation 1: Conchita Cosmetics acquired 10% of the 200,000 shares of common stock of Martinez Fashion at a total cost of $13 per share on March 18, 2017. On June 30, Martinez declared and paid $75,000 cash

> Aranda Corporation made the following cash purchases of securities during 2017, which is the first year in which Arantxa invested in securities. 1. On January 15, purchased 10,000 shares of Sanchez Company’s common stock at $33.50 per share plus commiss

> Assume the same information as E17-9 and that Steffi Graf, Inc. reports net income in 2017 of $120,000 and in 2018 of $140,000. Total holding gains (including any realized holding gain or loss) equal $40,000 in 2018. Instructions a. Prepare a statemen

> On August 15, 2016, Outkast Co. invested idle cash by purchasing a call option on Counting Crows Inc. common shares for $360. The notional value of the call option is 400 shares, and the option price is $40. The option expires on January 31, 2017. The fo

> Venzuela Company’s net income for 2017 is $50,000. The only potentially dilutive securities outstanding were 1,000 options issued during 2016, each exercisable for one share at $6. None has been exercised, and 10,000 shares of common were outstanding dur

> On January 1, 2017, Crocker Company issued 10-year, $2,000,000 face value, 6% bonds, at par. Each $1,000 bond is convertible into 15 shares of Crocker common stock. Crocker’s net income in 2017 was $300,000, and its tax rate was 40%. The company had 100,

> The Simon Corporation issued 10-year, $5,000,000 par, 7% callable convertible subordinated debentures on January 2, 2017. The bonds have a par value of $1,000, with interest payable annually. The current conversion ratio is 14:1, and in 2 years it will i

> On June 1, 2015, Andre Company and Agassi Company merged to form Lancaster Inc. A total of 800,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis. On April 1, 2017, the company issued an additional 400,00

> Michek Company loans Sarasota Company $2,000,000 at 6% for 3 years on January 1, 2017. Michek intends to hold this loan to maturity. The fair value of the loan at the end of each reporting period is as follows. December 31, 2017…………..$2,050,000 December

> In 2016, Chirac Enterprises issued, at par, 60 $1,000, 8% bonds, each convertible into 100 shares of common stock. Chirac had revenues of $17,500 and expenses other than interest and taxes of $8,400 for 2017. (Assume that the tax rate is 40%.) Throughout

> At January 1, 2017, Langley Company’s outstanding shares included the following. 280,000 shares of $50 par value, 7% cumulative preferred stock 900,000 shares of $1 par value common stock Net income for 2017 was $2,530,000. No cash dividends were declare

> On January 1, 2017, Lennon Industries had stock outstanding as follows. 6% Cumulative preferred stock, $100 par value, issued and outstanding 10,000 shares…………………………………………………………$1,000,000 Common stock, $10 par value, issued and outstanding 200,000 Share

> Presented below is information related to the purchases of common stock by Lilly Company during 2017. Instructions (Assume a zero balance for any Fair Value Adjustment account.) a. What entry would Lilly make at December 31, 2017, to record the inves

> Hagar Corporation has municipal bonds classified as a held-to-maturity at December 31, 2017. These bonds have a par value of $800,000, an amortized cost of $800,000, and a fair value of $720,000. The company believes that impairment accounting is now app

> Ace Company had 200,000 shares of common stock outstanding on December 31, 2018. During the year 2019, the company issued 8,000 shares on May 1 and retired 14,000 shares on October 31. For the year 2019, Ace Company reported net income of $249,690 after

> On January 1, 2018, Wilke Corp. had 480,000 shares of common stock outstanding. During 2018, it had the following transactions that affected the common stock account. February 1…………………………..Issued 120,000 shares March 1………………………Issued a 10% stock dividend

> Kenseth Company has the following securities in its portfolio on December 31, 2017. None of these investments are accounted for under the equity method. All of the securities were purchased in 2017. In 2018, Kenseth completed the following securities

> Tweedie Company issues 10,000 shares of restricted stock to its CFO, Mary Tokar, on January 1, 2017. The stock has a fair value of $500,000 on this date. The service period related to this restricted stock is 5 years. Vesting occurs if Tokar stays with t

> Derrick Company issues 4,000 shares of restricted stock to its CFO, Dane Yaping, on January 1, 2017. The stock has a fair value of $120,000 on this date. The service period related to this restricted stock is 4 years. Vesting occurs if Yaping stays with

> Stave Company invests $10,000,000 in 5% fixed rate corporate bonds on January 1, 2017. All the bonds are classified as available-for-sale and are purchased at par. At year-end, market interest rates have declined, and the fair value of the bonds is now $

> On January 1, 2016, Nichols Corporation granted 10,000 options to key executives. Each option allows the executive to purchase one share of Nichols’ $5 par value common stock at a price of $20 per share. The options were exercisable within a 2-year perio

> On January 1, 2018, Titania Inc. granted stock options to officers and key employees for the purchase of 20,000 shares of the company’s $10 par common stock at $25 per share. The options were exercisable within a 5-year period beginning January 1, 2020,

> On November 1, 2017, Columbo Company adopted a stock-option plan that granted options to key executives to purchase 30,000 shares of the company’s $10 par value common stock. The options were granted on January 2, 2018, and were exercisable 2 years after

> On May 1, 2017, Friendly Company issued 2,000 $1,000 bonds at 102. Each bond was issued with one detachable stock warrant. Shortly after issuance, the bonds were selling at 98, but the fair value of the warrants cannot be determined. Instructions a. Pr

> On September 1, 2017, Sands Company sold at 104 (plus accrued interest) 4,000 of its 9%, 10-year, $1,000 face value, nonconvertible bonds with detachable stock warrants. Each bond carried two detachable warrants. Each warrant was for one share of common

> On December 21, 2017, Bucky Katt Company provided you with the following information regarding its equity investments. During 2018, Colorado Co. stock was sold for $9,400. The fair value of the stock on December 31, 2018, was Clemson Corp. stockâ

> Taveras Enterprises provides the following information relative to its defined benefit pension plan. Balances or Values at December 31, 2017 Projected benefit obligation………………………………………………$2,737,000 Accumulated benefit obligation…………………………………………..1,980,0

> Kenseth Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets. The average remaining service life per employee in 2016 and 2017 is 10 years and in 2018 an

> Gingrich Importers provides the following pension plan information. Fair value of pension plan assets, January 1, 2017……………..$2,400,000 Fair value of pension plan assets, December 31, 2017…………..2,725,000 Contributions to the plan in 2017…………………………………………

> Andrews Company has five employees participating in its defined benefit pension plan. Expected years of future service for these employees at the beginning of 2017 are as follows. Future Employee………………..Years of Se

> On March 1, 2017, Parnevik Company sold goods to Goosen Inc. for $660,000 in exchange for a 5-year, zerointerest-bearing note in the face amount of $1,062,937 (an inputed rate of 10%). The goods have an inventory cost on Parnevik’s books of $400,000. Pre

> Access the glossary (“Master Glossary”) to answer the following. a. What is the definition of a customer? b. What is a performance obligation? c. How is standalone selling price defined? d. What is a transaction price?

> A metal tank with volume 3.10 L will burst if the absolute pressure of the gas it contains exceeds 100 atm. (a). If 11.0 mol of an ideal gas is put into the tank at 23.0°C, to what temperature can the gas be warmed before the tank ruptures? Ignore the th

> A diver observes a bubble of air rising from the bottom of a lake (where the absolute pressure is 3.50 atm) to the surface (where the pressure is 1.00 atm). The temperature at the bottom is 4.0°C, and the temperature at the surface is 23.0° C. (a). What

> If a certain amount of ideal gas occupies a volume V at STP on earth, what would be its volume (in terms of V) on Venus, where the temperature is 1003°C and the pressure is 92 atm?

> An ideal gas has a density of 1.33 × 10-6 g/cm3 at 1.00 × 10-3 atm and 20.00 C. Identify the gas.

> The gas inside a balloon will always have a pressure nearly equal to atmospheric pressure, since that is the pressure applied to the outside of the balloon. You fill a balloon with helium (a nearly ideal gas) to a volume of 0.600 L at 19.00 C. What is th

> An empty cylindrical canister 1.50 m long and 90.0 cm in diameter is to be filled with pure oxygen at 22.0 0C to store in a space station. To hold as much gas as possible, the absolute pressure of the oxygen will be 21.0 atm. The molar mass of oxygen is

> A Jaguar XK8 convertible has an eight-cylinder engine. At the beginning of its compression stroke, one of the cylinders contains 499 cm3 of air at atmospheric pressure (1.01 × 105 Pa) and a temperature of 27.0 0C. At the end of the stroke, the air has be

> You have several identical balloons. You experimentally determine that a balloon will break if its volume exceeds 0.900 L. The pressure of the gas inside the balloon equals air pressure (1.00 atm). (a). If the air inside the balloon is at a constant 22.

> A 3.00-L tank contains air at 3.00 atm and 20.00 C. The tank is sealed and cooled until the pressure is 1.00 atm. (a). What is the temperature then in degrees Celsius? Assume that the volume of the tank is constant. (b). If the temperature is kept at t

> Helium gas with a volume of 3.20 L, under a pressure of 0.180 atm and at 41.00 C, is warmed until both pressure and volume are doubled. (a). What is the final temperature? (b). How many grams of helium are there? The molar mass of helium is 4.00 g/mol.

> An oscillator vibrating at 1250 Hz produces a sound wave that travels through an ideal gas at 325 m/s when the gas temperature is 22.0 0C. For a certain experiment, you need to have the same oscillator produce sound of wavelength 28.5 cm in this gas. Wha

> A 20.0-L tank contains 4.86 × 10-4 kg of helium at 18.0 °C. The molar mass of helium is 4.00 g/mol. (a). How many moles of helium are in the tank? (b). What is the pressure in the tank, in pascals and in atmospheres?

> A vessel whose walls are thermally insulated contains 2.40 kg of water and 0.450 kg of ice, all at 0.0 °C. The outlet of a tube leading from a boiler in which water is boiling at atmospheric pressure is inserted into the water. How many grams of steam mu

> A 4.00-kg silver ingot is taken from a furnace, where its temperature is 750.0 °C, and placed on a large block of ice at 0.0° C. Assuming that all the heat given up by the silver is used to melt the ice, how much ice is melted?

> An insulated beaker with negligible mass contains 0.250 kg of water at 75.0° C. How many kilograms of ice at -20.0° C must be dropped into the water to make the final temperature of the system 40.0 °C?

> A laboratory technician drops a 0.0850-kg sample of unknown solid material, at 100.0 °C, into a calorimeter. The calorimeter can, initially at 19.0° C, is made of 0.150 kg of copper and contains 0.200 kg of water. The final temperature of the calorimeter

> An asteroid with a diameter of 10 km and a mass of 2.60 × 1015 kg impacts the earth at a speed of 32.0 km/s, landing in the Pacific Ocean. If 1.00% of the asteroid’s kinetic energy goes to boiling the ocean water (assume an initial water temperature of 1

> Evaporation of sweat is an important mechanism for temperature control in some warm-blooded animals. (a). What mass of water must evaporate from the skin of a 70.0-kg man to cool his body 1.00C ? The heat of vaporization of water at body temperature (3

> Camels require very little water because they are able to tolerate relatively large changes in their body temperature. While humans keep their body temperatures constant to within one or two Celsius degrees, a dehydrated camel permits its body temperatur

> What is the amount of heat input to your skin when it receives the heat released (a). by 25.0 g of steam initially at 100.0 °C, when it is cooled to skin temperature 134.0° C2? (b). By 25.0 g of water initially at 100.0 °C, when it is cooled to 34.0° C

> What must the initial speed of a lead bullet be at 25.0 °C so that the heat developed when it is brought to rest will be just sufficient to melt it? Assume that all the initial mechanical energy of the bullet is converted to heat and that no heat flows f

> A welder using a tank of volume 0.0750 m3 fills it with oxygen (molar mass 32.0 g/mol) at a gauge pressure of 3.00 × 105 Pa and temperature of 37.00 C. The tank has a small leak, and in time some of the oxygen leaks out. On a day when the temperature is