Question: Hass Foods Inc. sponsors a post-retirement

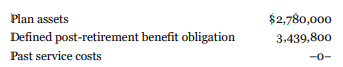

Hass Foods Inc. sponsors a post-retirement medical and dental benefit plan for its employees. The company adopted the provisions of IAS 19 beginning January 1, 2020. The following balances relate to this plan on January 1, 2020:

As a result of the plan's operation during 2020, the following additional data were provided by the actuary. 1. The service cost for 2020 was $273,000.

2. The discount rate was 7%.

3. Funding payments in 2020 were $234,000.

4. The actual return on plan assets was $158,500.

5. The benefits paid on behalf of retirees from the plan were $171,600.

Instructions

a. Calculate the post-retirement benefit expense for 2020.

b. Prepare a continuity schedule for the defined post-retirement benefit obligation and for the plan assets from the beginning of the year to the end of 2020.

c. At December 31, 2020, prepare a schedule reconciling the plan's surplus or deficit with the post-retirement amount reported on the SFP.

d. If Hass Foods had remained with ASPE instead of moving to IFRS, how would your answers to parts (a) to (c) change, if at all?

e. Explain in what ways, if any, the accounting requirements for this plan are different from the requirements for a defined benefit pension plan.

Transcribed Image Text:

Plan assets $2,780,000 Defined post-retirement benefit obligation 3,439,800 Past service costs -0-

> A small company has developed an improved process for making solar panels. The company needs to set its prices and wants those prices to reflect the efficiencies of producing larger batches. The data show the following: A scatterplot of Cost per Unit v

> The home retail industry experienced relatively consistent annual growth until the economic crisis of 2006. Here is a scatterplot of the Net Sales ($B) of The Home Depot from 1995 through 2004, along with a regression and a time series plot of the residu

> In Exercise 29, we created a linear model describing the trend in the number of passengers departing from Oakland (CA) airport each month from 1997 to 2007. Here’s the residual plot, but with lines added to show the order of the values

> Can the amount of money that a country spends on health (as % of GDP) be predicted by other economic indicators? Here’s a regression predicting Expenditures on Public Health (as % of GDP) from Expected Years of Schooling and Internet Us

> Like many fast-food restaurant chains, Burger King (BK) provides data on the nutrition content of its menu items on its website. Here’s a multiple regression predicting calories for Burger King foods from Protein content (g), Total Fat

> The dataset holds various measures of the 50 United States. The Murder rate is per 100,000, HS Graduation rate is in %, Income is per capita income in dollars, Illiteracy rate is per 1000, and Life Expectancy is in years. Find a regression model for Life

> Here’s another model for the MSRP of off-road motorcycles. a) Would this be a good model to use to predict the price of an off-road motorcycle if you knew its bore, clearance, and engine strokes? Explain. b) The Honda CRF450X has an M

> In Exercise 41, we saw data on off-road motorcycles and examined scatterplots. Review those scatterplots. Here’s a regression of MSRP on both Displacement and Bore. Both of the predictors are measures of the size of the engine. The displacement is the to

> More than one million motorcycles are sold annually (www.webbikeworld.com). Off-road motorcycles (often called “dirt bikes”) are a market segment (about 18%) that is highly specialized and offers great variation in fea

> Are there fundamental differences between liberal arts colleges and universities? In this case, we have information on the top 25 liberal arts colleges and the top 25 universities in the United States. We will consider the type of school as our response

> An important challenge in clinical trials is patients who drop out before the trial is completed. This can cost pharmaceutical companies millions of dollars because patients who have received a tested treatment for months must be combined with those who

> A regression model from the collection of houses in Exercise 15 shows the following: a) The slope of Age is negative. Does this indicate that older houses cost less, on average? Explain. b) Why did the model subtract 38.5122 from Age in the quadratic t

> Consider the model you fit in Exercise 37 to predict Walmart’s revenue from the Retail Index, CPI, and Personal Consumption index. a) Plot the residuals against the predicted values and comment on what you see. b) Identify and remove the four cases corre

> Walmart is the second largest retailer in the world. The data file on the disk holds monthly data on Walmart’s revenue, along with several possibly related economic variables. a) Using computer software, find the regression equation predicting Walmart re

> In Exercise 35 you identified several countries that had potentially large inf luence on the model in Chapter 18, Exercise 36, predicting HDI. Set those countries aside and rerun the model. Write up a few sentences on the impact that leaving these countr

> In Chapter 18, Exercise 36 we found a model for HDI (the UN’s Human Development Index) from Life expectancy, schooling, mean years of school, and log(GNI/capita) for 188 countries. Using software that provides regression diagnostics (leverage values, Coo

> In Exercise 33 we saw that there were several potential high inf luence points. After a researcher set aside those four countries, she refit the model in Exercise 33. A plot of residuals vs. predicted values showed: a) What assumption and/or condition

> In Chapter 18, Exercise 33 we found a model for GDP per Capita from three country characteristics: Cell phones/100 people, Internet Users/100 people, and Primary Completion Rate. A look at leverage values and Cook’s Distance identifies

> The model in Exercise 30 is missing one predictor that we might have expected to see. Engine Displacement is highly correlated 1r = 0.7832 with MSRP, but that variable has not entered the model (and, indeed, would have a P-value of 0.54 if it were added

> In Exercise 8 we found a model for the gross revenue from U.S. movie theatres for 106 recent movies that were rated either R or PG-13. A plot of residuals against predicted revenue shows: A histogram of the y-variable, US Gross, shows: a) What assump

> Off-road motorcycles (often called “dirt bikes”) are a segment (about 18%) of the growing motorcycle market. Because dirt bikes offer great variation in features, they are a good market segment to study to learn about

> In Chapter 18, Exercise 46 we found a model for national Health Expenditures from an economic variable, Internet Users/100 people, and Primary Completion Rate. A look at leverage values and Cook’s Distances identifies several countries

> A collection of houses in a neighborhood of Boston shows the following relationship between Price and Age of the house: a) Describe the relationship between Price and Age. Explain what this says in terms of house prices. b) A linear regression of Price

> For the first model considered in Exercise 27, with all four predictors in the model, a plot of Leverage values shows the two largest values are San Francisco, USA (0.094), and Hamilton, Bermuda (0.077). a) By examining the values of their predictor va

> The Brief Case in Chapter 4 introduced the Cost of Living dataset that contains an estimate of the cost of living for 511 cities worldwide in 2017. In addition to the overall Cost of Living Index are: the Rent Index, Groceries Index, Restaurant Index, an

> Breakfast cereal manufacturers publish nutrition information on each box of their product. As we saw in Chapter 17, there is a long history of cereals being associated with nutrition. Here’s a regression to predict the number of Calorie

> Insurance companies base their premiums on many factors, but basically all the factors are variables that predict life expectancy. Life expectancy varies from state to state. Here’s a regression that models Life Expectancy in terms of o

> Here’s a plot of the studentized residuals from the regression model of Exercise 18 plotted against ArterialMPH. The plot is colored according to City Size (Small, Medium, Large, and Very Large), and regression lines are fit for each ci

> In Exercise 19, we raised questions about two gourmet pizzas. After removing them, the resulting regression looks like this. A plot of the residuals against the predicted values for this regression looks like this. It has been colored according to the

> Pedro Martinez, who retired from Major League Baseball in 2012, had a stellar career, helping the Boston Red Sox to their first World Series title in 86 years in 2004. The next year he became a free agent and the New York Mets picked him up for $53 milli

> Each week about 100 million customers—nearly one-third of the U.S. population—visit one of Walmart’s U.S. stores. How does Walmart’s revenue relate to the state of the economy in gen

> Here’s a scatterplot of the residuals from the regression in Exercise 18 plotted against mean Highway mph. a) The point plotted with an x is Los Angeles. Read the graph and explain what it says about traffic delays in Los Angeles and

> Here’s a scatterplot of the residuals against predicted values for the regression model found in Exercise 17. a) The two extraordinary points in the lower right are Reggio’s and Michelina’s, two gou

> An additive model for the Gas prices is: a) What is the value predicted by this model for January 2010 1Time = 20102? b) Do you think the predictions from this model are likely to be accurate? Explain.

> The Texas Transportation Institute (tti.tamu.edu) studies traffic delays. They estimate that in 2014 the average commuter lost 42 hours in traffic congestion, compared to 18 hours in 1982, and wasted 19 gallons of fuel. Total costs of congestion reached

> Manufacturers of frozen foods often reformulate their products to maintain and increase customer satisfaction and sales. So they pay particular attention to evaluations of their products in comparison to their competitors’ products. Fro

> Using the regression table in Exercise 14, answer the following questions. a) How was the t-ratio of 2.83 found for Attendance? (Show what is computed using numbers found in the table.) b) How many seasons are included in this regression? How can you tel

> Using the regression table in Exercise 13, answer the following questions. a) How was the t-ratio of 0.221 found for Police Pay? (Show what is computed using numbers from the table.) b) How many states are used in this model. How do you know? c) The t-ra

> In 1990, the United Nations created a single statistic, the Human Development Index or HDI, to summarize the health, education, and economic status of countries. Here is a multiple regression model trying to predict HDI. a) Write the regression model.

> In Chapter 17, Exercise 54 predicted the price ($/lb) of lobster harvested in the Maine lobster fishing industry. Here’s a multiple regression to predict the Price from the number of Traps (millions), the number of License Holders, and

> In Chapter 17, Exercise 53 predicted the annual value of the Maine lobster industry catch from the number of licensed lobster fishers. The lobster industry is an important one in Maine, with annual landings worth more than $500,000,000 and employment con

> The gross domestic product (GDP) is an important measure of the overall economic strength of a country. GDP per capita makes comparisons between different size countries more meaningful. A researcher looking at GDP, fit the following model based on an ed

> Here’s a regression of monthly revenue of Walmart Corp, during 2004–2006 relating that revenue to the Total U.S. Retail Sales, the Personal Consumption Index, and the Consumer Price Index. a) Write the regression m

> The AFL-CIO has undertaken a study of 30 secretaries’ yearly salaries (in thousands of dollars). The organization wants to predict salaries from several other variables. The variables to be considered potential predictors of salary are:

> An additive regression model for the Apple prices is: a) What is the name for the kind of variable called Jan in this model? b) Why is there no predictor variable for December?

> For the series of Output per unit of capital: a) Make a time series plot. b) Describe the trend component. c) Is there evidence of a seasonal component? d) Is there evidence of a cyclic component?

> Mazza Corp. owes Tsang Corp. a $110,000, 10-year, 10% note issued at par plus $11,000 of accrued interest. The note is due today, December 31, 2020. Because Mazza Corp. is in financial trouble, Tsang Corp. agrees to forgive the accrued interest and $10,0

> At December 31, 2019, Shutdown Manufacturing Limited had outstanding a $300,000, 12% note payable to Thornton National Bank. Dated January 1, 2017, the note was issued at par and due on December 31, 2020, with interest payable each December 31. During 20

> Refer to the example of HTSM Corp. in Appendix 19A and assume it is now 2021, three years after the defined benefit pension plan for Lee Sung was initiated. In December 2021, HTSM's actuary provided the company with an actuarial revaluation of the plan.

> You are the auditor of Beaton and Gunter Inc., the Canadian subsidiary of a public multinational engineering company that offers a defined benefit pension plan to its eligible employees. Employees are permitted to join the plan after two years of employm

> Etienne Inc., a Canadian company traded on the Venture Exchange of the Toronto Stock Exchange, has sponsored a non-contributory defined benefit pension plan for its employees since 1992. Relevant information about the pension plan on January 1, 2020, is

> Instructions Refer to the data in P19.9, except now assume Dela Corporation reports under IFRS. Depending on what your instructor assigns, do either parts (a), (b), (c), and (e) or parts (d) and (e). From P19.9: Dela Corporation initiated a defined ben

> RWL Limited provides a long-term disability program for its employees through an insurance company. For an annual premium of $20,000, the insurance company is responsible for providing long-term salary continuation to disabled employees after a three-mon

> The following are two independent situations related to future taxable and deductible amounts that resulted from temporary differences at December 31, 2020. In both situations, the future taxable amounts relate to property, plant, and equipment depreciat

> Sarah Corp. reported the following differences between SFP carrying amounts and tax bases at December 31, 2019: The differences between the carrying amounts and tax bases were expected to reverse as follows: Tax rates enacted at December 31, 2019, were

> You, the ethical accountant, are the new controller at ProVision Corporation. It is January 2021 and you are currently preparing the December 31, 2020 financial statements. ProVision manufactures household appliances. It is a private company and has been

> Andrew Weiman and Mei Lee are discussing accounting for income taxes. They are currently studying a schedule of taxable and deductible amounts that will arise in the future as a result of existing temporary differences. The schedule applies to a company

> The accounting records of Steven Corp., a real estate developer, indicated income before income tax of $850,000 for its year ended December 31, 2020, and of $525,000 for the year ended December 31, 2021. The following data are also available. 1. Steven

> The following information applies to Edward Corporation, which reports under IFRS. 1. Prior to 2019, taxable income and accounting income were identical. 2. Accounting income was $1.7 million in 2019 and $1.4 million in 2020. 3. On January 1, 2019, eq

> The accounting income of Grace Corporation and its taxable income for the years 2020 to 2023 are as follows: The change in the tax rate from 25% to 30% was not enacted until early in 2021. Accounting income for each year includes an expense of $40,000 t

> At December 31, 2019, Wright Corporation had a temporary difference (related to pensions) and reported a related deferred tax asset of $30,000 on its balance sheet. At December 31, 2020, Wright has five temporary differences. An analysis reveals the foll

> On December 31, 2019, Haley Inc. has taxable temporary differences of $2.2 million and a deferred tax liability of $616,000. These temporary differences are due to Haley having claimed CCA in excess of book depreciation in prior years. Haley's year end i

> Aaron Engines Ltd., a private business following ASPE, operates small engine repair outlets and is a tenant in several of Tran Holdings Inc.'s strip shopping malls. Aaron signed several lease renewals with Tran that each called for a three-month rent-fre

> Chen Corporation reported income before income tax for the year ended December 31, 2020, of $1,645,000. In preparing the 2020 financial statements, the accountant discovered an error that was made in 2019. The error was that a piece of land with a cost o

> Carly Inc. reported the following accounting income (loss) and related tax rates during the years 2015 to 2021: Accounting income (loss) and taxable income (loss) were the same for all years since Carly began business. The tax rates from 2018 to 2021 we

> The following information relates to Shirley Corporation's transactions during 2020, its first year of operations. 1. Income before income tax on the income statement for 2020 was $64,000. 2. Income before income tax ($64,000 above) is net of a loss du

> The 2017 financial statements (for the year ended December 30, 2017) and 10-year financial review (use the 2016 annual report) of Canadian Tire Corporation, Limited can be found at www.sedar.com or on the company's website. Instructions a. What makes

> The following information was disclosed during the audit of Shawna Inc.: 1. On January 1, 2020, equipment was purchased for $400,000. For financial reporting purposes, the company uses straight-line depreciation over a five-year life, with no residual v

> The treasurer of Hing Wa Corp. has read on the Internet that the stock price of Ewing Inc. is about to take off. In order to profit from this potential development, Hing Wa purchased a call option on Ewing common shares on July 7, 2020, for $480. The cal

> An excerpt from the statement of financial position of Twilight Limited follows: Notes and Assumptions December 31, 2020 1. Options were granted/written in 2019 that give the holder the right to purchase 100,000 common shares at $8 per share. The aver

> Isabelle Leclerc is the controller at Camden Pharmaceutical Industries, a public company. She is currently preparing the calculation for basic and diluted earnings per share and the related disclosure for Camden's external financial statements. The follo

> Cornwall Inc., a publicly accountable enterprise that reports in accordance with IFRS, issued convertible bonds for the first time on January 1, 2020. The $1 million of six-year, 10% (payable annually on December 31, starting December 31, 2020), converti

> Bryce Corporation is preparing the comparative financial statements for the annual report to its shareholders for the fiscal years ended May 31, 2020, and May 31, 2021. The income from operations was $1.8 million and $2.5 million, respectively, for each

> Tseng Corporation Ltd. has the following capital structure at the following fiscal years ended December 31: The following additional information is available. 1. On July 31, 2020, Tseng Corporation exchanged common shares for a large piece of equipment

> Use the same information for Audrey Inc. as in P17.3, but also assume the following. 1. On September 30, 200,000 convertible preferred shares were redeemed. If they had been converted, these shares would have resulted in an additional 100,000 common sha

> Audrey Inc. has 1 million common shares outstanding as at January 1, 2020. On June 30, 2020, 4% convertible bonds were converted into 100,000 additional shares. Up to that point, the bonds had paid interest of $250,000 after tax. Net income for the year

> Loretta Corporation, a publicly traded company, is preparing the comparative financial statements to be included in the annual report to shareholders. Loretta's fiscal year ends May 31. The following information is available. 1. Income from operations b

> The IFRS Foundation publishes the “Pocket Guide to IFRS Standards: The Global Financial Reporting Language.” The guide shows continuing progress toward further enhancing the quality of IFRS and increasing adoption around the world. The IFRS Foundation t

> Rocky Mountain Corp. currently has an issued debenture outstanding with Abbra Bank. The note has a principal of $2 million, was issued at face value, and interest is payable at 7%. The term of the debenture was 10 years, and was issued on December 31, 20

> Gateway Corporation has outstanding 200,000 common shares that were issued at $10 per share. The balances at January 1, 2020, were $21 million in its Retained Earnings account; $4.3 million in its Contributed Surplus account; and $1.1 million in its Accu

> The following information is available for Dylan Inc., a company whose shares are traded on the Toronto Stock Exchange: Other information: 1. For all of the fiscal year 2020, $100,000 of 6% cumulative convertible bonds have been outstanding. The bonds

> Jackie Enterprises Ltd. has a tax rate of 30% and reported net income of $8.5 million in 2020. The following details are from Jackie's statement of financial position as at December 31, 2020, the end of its fiscal year: Other information: 1. Quarterly

> The following information is for Polo Limited for 2020: There were no changes during 2020 in the number of common shares, preferred shares, or convertible bonds outstanding. For simplicity, ignore the requirement to book the convertible bonds' equity po

> On December 31, 2020, Master Corp. had a $10-million, 8% fixed-rate note outstanding that was payable in two years. It decided to enter into a two-year swap with First Bank to convert the fixed-rate debt to floating-rate debt. The terms of the swap speci

> Treeton Inc. had net income for the fiscal year ended June 30, 2020, of $5 million. There were 500,000 common shares outstanding throughout 2020. The average market price of the common shares for the entire fiscal year was $50. Treeton's tax rate was 25%

> On September 30, 2020, Gargiola Inc. issued $4 million of 10-year, 8% convertible bonds for $4.6 million. The bonds pay interest on March 31 and September 30 and mature on September 30, 2030. Each $1,000 bond can be converted into 80 no par value common

> On January 1, 2020, Salem Corp. issued $1.1 million of five-year, zero-interest-bearing notes along with warrants to buy 1 million common shares at $22 per share. On January 1, 2020, Salem had 9.3 million common shares outstanding and the market price wa

> Floral Gardens Incorporated is a nationwide chain of garden centres that operates as a private company. In 2020, it issued three new financial instruments. All three of these instruments are new to you (in your role as controller), and you are working on

> Locate the 2018 audited annual financial statements of a company that may be experiencing financial difficulties, such as Sears Holding Corporation, an American company traded on the NASDAQ. Instructions a. Identify the name of the company, the busine

> Oregano Inc. was formed on July 1, 2017. It was authorized to issue an unlimited number of common shares and 100,000 cumulative and non-participating preferred shares carrying a $2 dividend. The company has a July 1 to June 30 fiscal year. The following

> Some of the account balances of Vos Limited at December 31, 2019, are as follows: The price of the company's common shares has been increasing steadily on the market; it was $21 on January 1, 2020, and advanced to $24 by July 1 and to $27 at the end of

> On April 1, 2020, Taylor Corp. sold 12,000 of its $1,000 face value, 15-year, 11% bonds at 97. Interest payment dates are April 1 and October 1. The company follows ASPE and uses the straight-line method of bond discount amortization. On March 1, 2021, T

> In the following two independent cases, the company closes its books on December 31: 1. Armstrong Inc. sells $2 million of 10% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The bonds' due date is September 1, 2023. The bonds

> Lasson Corp. has 5,000 preferred shares outstanding ($2 dividend), which were issued for $150,000, and 30,000 common shares, which were issued for $550,000. Instructions The following schedule shows the amount of dividends paid out over the past four

> Adventureland Incorporated purchased metal to build a new roller coaster on December 31, 2020. Adventureland provided a $500,000 down payment and agreed to pay the balance in equal instalments of $200,000 every December 31 for five years. Adventureland c

> Jeremiah Limited issued 10-year, 7% debentures with a face value of $2 million on January 1, 2013. The proceeds received were $1.7 million. The discount was amortized on the straight-line basis over the 10-year term. The terms of the debentures stated th

> Thompson Limited, a private company with no published credit rating, completed several transactions during 2020. In January, the company bought under contract a machine at a total price of $1.2 million. It is payable over five years with instalments of $

> On December 31, 2020, Faital Limited acquired a machine from Plato Corporation by issuing a $600,000, non–interest-bearing note that is payable in full on December 31, 2024. The company's credit rating permits it to borrow funds from its several lines of

> Selected transactions on the books of Pfaff Corporation follow: Instructions a. Assume that Pfaff follows ASPE. Prepare the journal entries for the transactions above. Round to the nearest dollar. b. How would your answers to the above change if Pfaff

> Healy Corp., a leader in the commercial cleaning industry, acquired and installed, at a total cost of $110,000 plus 15% HST, three underground tanks to store hazardous liquid solutions needed in the cleaning process. The tanks were ready for use on Febru