Question: Hawkeye Company’s balance sheet reported, under

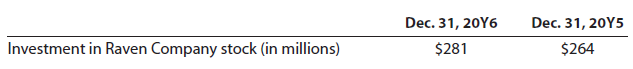

Hawkeye Company’s balance sheet reported, under the equity method, its long-term investment in Raven Company for comparative years as follows:

In addition, the 20Y6 Hawkeye Company income statement disclosed equity earnings in the Raven Company investment as $25 million. Hawkeye Company neither purchased nor sold Raven Company stock during 20Y6. The fair value of the Raven Company stock investment on December 31, 20Y6, was $310 million.

Explain the change in Investment in Raven Company Stock from December 31, 20Y5, to December 31, 20Y6.

> Black and Shannon have decided to form a partnership. They have agreed that Black is to invest $360,000 and that Shannon is to invest $120,000. Black is to devote one-half time to the business, and Shannon is to devote full time. The following plans for

> At the end of the current year, Accounts Receivable has a balance of $4,770,000, Allowance for Doubtful Accounts has a debit balance of $17,230, and sales for the year total $63,800,000. Bad debt expense is estimated at 3⁄4 of 1% of sales. Determine (a)

> Best Buy is a specialty retailer of consumer electronics, including personal computers, entertainment software, and appliances. Best Buy operates retail stores in addition to the Best Buy, Media Play, On Cue, and Magnolia Hi-Fi websites. For two recent y

> The cash account for Norwegian Medical Co. at April 30 indicated a balance of $403,784. The bank statement indicated a balance of $468,460 on April 30. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed

> The following items were selected from among the transactions completed by Shin Co. during the current year: Jan. 10. Purchased merchandise on account from Beckham Co., $420,000, terms n/30. Feb. 9. Issued a 30-day, 6% note for $420,000 to Beckham Co., o

> The following transactions were completed by Emmanuel Company during the current fiscal year ended December 31: Jan. 29. Received 40% of the $17,000 balance owed by Jankovich Co., a bankrupt business, and wrote off the remainder as uncollectible. Apr. 18

> The comparative balance sheet of Iglesias Inc. for December 31, 20Y3 and 20Y2, is as follows: The income statement for the year ended December 31, 20Y3, is as follows: Additional data obtained from an examination of the accounts in the ledger for 20Y3

> The comparative balance sheet of Orange Angel Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. Net income,

> The comparative balance sheet of Iglesias Inc. for December 31, 20Y3 and 20Y2, is shown as follows: Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: a. The investments were sold for $210,000 cash. b. Eq

> O’Brien Industries Inc. is a book publisher. The partial balance sheets for December 31, 20Y4 and 20Y5 are as follows: The available-for-sale investments at cost and fair value on December 31, 20Y4, are as follows: The investment in J

> Soto Industries Inc. is an athletic footware company that began operations on January 1, 20Y3. The following are bond (held-to-maturity) transactions by Soto Industries Inc., which has a fiscal year ending on December 31: 20Y3 Apr. 1. Purchased $100,000

> Forte Inc. produces and sells theater set designs and costumes. The company began operations on January 1, 20Y6. The following transactions relate to securities acquired by Forte Inc., which has a fiscal year ending on December 31, 20Y6: Jan. 10. Purchas

> Rios Co. is a regional insurance company that began operations on January 1, 20Y2. The following selected transactions relate to investments acquired by Rios Co., which has a fiscal year ending on December 31: 20Y2 Feb. 1. Purchased 7,500 shares of Caldw

> At the end of the current year, Accounts Receivable has a balance of $2,450,000, Allowance for Doubtful Accounts has a credit balance of $14,860, and sales for the year total $31,600,000. Bad debt expense is estimated at 1⁄2 of 1% of sales. Determine (a)

> O’Halloran, Inc., produces and sells outdoor equipment. On July 1, Year 1, O’Halloran, Inc., issued $32,000,000 of 6-year, 8% bonds at a market (effective) interest rate of 7%, receiving cash of $33,546,022. Interest on the bonds is payable semiannually

> On July 1, Year 1, Khatri Industries Inc. issued $18,000,000 of 10-year, 5% bonds at a market (effective) interest rate of 6%, receiving cash of $16,661,102. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the

> O’Halloran Inc. produces and sells outdoor equipment. On July 1, Year 1, O’Halloran Inc. issued $32,000,000 of six-year, 8% bonds at a market (effective) interest rate of 7%, receiving cash of $33,546,022. Interest on the bonds is payable semiannually on

> On July 1, Year 1, Khatri Industries Inc. issued $18,000,000 of 10-year, 5% bonds at a market (effective) interest rate of 6%, receiving cash of $16,661,102. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the

> The following selected accounts appear in the ledger of Upscale Construction Inc. at the beginning of the current year: Preferred 2% Stock, $80 par (200,000 shares authorized, 65,000 shares issued) … $ 5,200,000 Paid-In Capital in Excess of Par—Preferred

> The partners have capital balances of $69,000, $85,000, and $12,000, respectively. The cash balance is $38,000, the book values of noncash assets total $152,000, and liabilities total $24,000. The partners share income and losses in the ratio of 2:2:1.

> On December 1 of the current year, the following accounts and their balances appear in the ledger of Latte Corp., a coffee processor: Preferred 2% Stock, $50 par (250,000 shares authorized, 80,000 shares issued) ……………………………………. $ 4,000,000 Paid-In Capita

> Journalize the following transactions in the accounts of Arrow Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 19. Sold merchandise on account to Dr. Sinclair Welby, $77,000

> MGM Resorts International owns and operates hotels and casinos including the MGM Grand and the Bellagio in Las Vegas, Nevada. As of a recent year, MGM reported accounts receivable of $747,981,000 and allowance for doubtful accounts of $90,775,000. Johnso

> Boeing is one of the world’s major aerospace firms with operations involving commercial aircraft, military aircraft, missiles, satellite systems, and information and battle management systems. As of a recent year, Boeing had $1,877 million of receivables

> Journalize the following transactions, using the allowance method of accounting for Uncollectible receivables: Oct. 2. Received $1,140 from Elita Ramirez and wrote off the remainder owed of $2,570 as uncollectible. Dec. 20. Reinstated the account of Elit

> The following data are taken from the financial statements of Basinger Inc. Terms of all sales are 2/10, n/45. a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days’ sales in receivables. Round

> PepsiCo, Inc., the parent company of Frito-Lay snack foods and Pepsi beverages, had the following current assets and current liabilities at the end of two recent years: a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one

> The following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years: a. Determine for each year (1) The working capital, (2) The current ratio, and (3) The quick ratio. Round ratios to one decimal place. b. Wh

> The table that follows shows the stock price, earnings per share, and dividends per share for three companies for a recent year: a. Determine the price-earnings ratio and dividend yield for the three companies. Round ratios and percentages to one decima

> The following information was taken from the financial statements of Zeil Inc. for December 31 of the current fiscal year: Common stock, $20 par (no change during the year) …………….. $8,000,000 Preferred $3 stock, $50 par (no change during the year) …………..

> The balance sheet for Quigg Inc. at the end of the current fiscal year indicated the following: Bonds payable, 8% ……………………. $7,500,000 Preferred $4 stock, $50 par …………. 3,750,000 Common stock, $10 par ………………. 7,500,000 Income before income tax expense wa

> The following comparative income statement (in thousands of dollars) for two recent fiscal years was adapted from the annual report of Speedway Motorsports, Inc., owner and operator of several major motor speedways, such as the Atlanta, Texas, and Las Ve

> The following data were taken from the financial statements of Loveseth Inc. for the current Fiscal year. Assuming that total assets were $6,000,000 at the beginning of the current fiscal year, determine the following: (a) Ratio of fixed assets to long-

> Ralph Lauren Corporation sells apparel through company-owned retail stores. Recent financial information for Ralph Lauren follows (in thousands): Assume that the apparel industry average return on total assets is 11.4% and the average return on stockhol

> Three major segments of the transportation industry are motor carriers such as YRC Worldwide, railroads such as Union Pacific, and transportation logistics services such as C.H. Robinson Worldwide, Inc. Recent financial statement information for these th

> Maggiano Supply Company received a 120-day, 6% note for $420,000, dated June 12, from a customer on account. a. Determine the due date of the note. b. Determine the maturity value of the note. c. Journalize the entry to record the receipt of the payment

> Recent balance sheet information for two companies in the food industry, Mondelez International, Inc., and The Hershey Company, is as follows (in thousands): a. Determine the ratio of liabilities to stockholders’ equity for both compan

> Hasbro, Inc., and Mattel, Inc., are the two largest toy companies in North America. Condensed liabilities and stockholders’ equity from a recent balance sheet are shown for each company as follows (in thousands): The income from operat

> The following data were extracted from the income statement of Shriver Inc.: a. Determine for each year (1) the inventory turnover and (2) the number of days’ sales in inventory. Round to the nearest dollar and one decimal place. b. Wh

> Selected data derived from the income statement and balance sheet of National Beverage Co. for a recent year are as follows: Income statement data (in thousands): Net income …………………………………………………..………………. $149,774 Loss on disposal of property …………………………………

> The income statement disclosed the following items for the year: Depreciation expense …………………. $ 57,000 Gain on di

> The net income reported on the income statement for the current year was $290,000. Depreciation recorded on equipment and a building amounted to $150,500 for the year. Balances of the current asset and current liability accounts at the beginning and end

> The net income reported on the income statement for the current year was $73,600. Depreciation recorded on store equipment for the year amounted to $27,400. Balances of the current asset and current liability accounts at the beginning and end of the year

> The income statement for Stallion Company for the current year ended June 30 and balances of selected accounts at the beginning and end of the year are as follows: Prepare the Cash Flows from (used for) Operating Activities section of the statement of c

> State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $300,000 of bonds, on which there was $4,000 of unamortized discount, for $303,000. b. Sold 40,000 shares of $

> The comparative balance sheet of Hirayama Industries Inc. for December 31, 20Y2 and 20Y1, is as follows: The following additional information is taken from the records: 1. Land was sold for $153. 2. Equipment was acquired for cash. 3. There were no disp

> Financial statement data for years ending December 31 for Cinderella Company follow: a. Determine the accounts receivable turnover for 20Y9 and 20Y8. Round accounts receivable turnover to one decimal place. b. Determine the days’ sales

> On its income statement for a recent year, Tesla, Inc., reported a net loss of $1,063 million from operations. On its statement of cash flows, it reported $2,098 million of net cash flows from operating activities. Explain this apparent contradiction bet

> Demopoulos Company acquired $150,000 of Marimar Co., 6% bonds on May 1 at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, Demopoulos Company sold $55,000 of the bonds for 98. Journalize the entries to record the f

> On January 6, 20Y8, Bulldog Co. purchased 34% of the outstanding common stock of Gator Co. for $212,000. Gator Co. paid total dividends of $24,000 to all shareholders on June 30, 20Y8. Gator had a net loss of $56,000 for 20Y8. a. Journalize Bulldog’s pur

> On January 4, 20Y4, Ferguson Company purchased 480,000 shares of Silva Company’s common stock directly from one of the founders for a price of $30 per share. Silva has 1,200,000 shares outstanding, including the Daniels shares. On July 2, 20Y4, Silva pai

> Seamus Industries Inc. buys and sells investments as part of its ongoing cash management. The following investment transactions were completed during the year: Feb. 24. Acquired 1,000 shares of Tett Co.’s common stock for $85 per share plus a $150 broker

> Quan Corp. manufactures construction equipment. Journalize the entries to record the following selected equity investment transactions completed by Quan during a recent year using the fair value method. Feb. 2. Purchased for cash 3,100 shares of Celeste

> On December 31, 20Y7, Valur Co. had the following available-for-sale investment disclosure within the Current Assets section of the balance sheet: There were no purchases or sales of available-for-sale investments during 20Y8. On December 31, 20Y8, the

> Booking Holdings Inc. is a leading provider of online travel and related services, provided to consumers and local partners through six primary brands: Booking.com, KAYAK, priceline.com, agoda.com, Rentalcars.com, and OpenTable. In a recent annual report

> The following equity investment transactions were completed by Vintage Company during a recent year: Apr. 10. Purchased 11,000 shares of Delew Company’s common stock for a price of $60 per share plus a brokerage commission of $220. Delew Company has 250,

> Financial statement data for years ending December 31 for Schultze-Solutions Company follow: a. Determine the accounts receivable turnover for 20Y2 and 20Y1. Round accounts receivable turnover to one decimal place. b. Determine the daysâ€

> The market price for Microsoft Corporation closed at $101.57 and $85.95 on December 31, current year, and previous year, respectively. The dividends per share were $1.68 for current year and $1.56 for previous year. a. Determine the dividend yield for Mi

> At the market close of a recent year, McDonald’s Corporation had a closing stock price of $198.01. In addition, McDonald’s Corporation had a dividend per share of $4.19 during the previous year. Determine McDonald’s Corporation’s dividend yield. Round to

> M. Jones Inc. purchased the following available-for-sale securities during 20Y5, its first year of operations: The fair value of the various available-for-sale securities on December 31, 20Y5, was as follows: a. Journalize the adjusting entry for the f

> Gruden Bancorp Inc. purchased a portfolio of trading securities during 20Y3, its first year of operations. The cost and fair value of this portfolio on December 31, 20Y3, are as follows: On May 10, 20Y4, Gruden Bancorp Inc. purchased trading securities

> The investments of Charger Inc. include an investment of trading securities of Raiders Inc. purchased on February 24, 20Y7, for $551,000. The fair value of the securities on December 31, 20Y7, is $609,000. a. Journalize the entries for the February 24 pu

> The following bond investment transactions were completed by Starks Company: Jan. 31. Purchased 75, $1,000 government bonds at 100 plus accrued interest of $375 (1 month). The bonds pay 6% annual interest on July 1 and January 1. July 1. Received semiann

> Gillooly Co. purchased $360,000 of 6%, 20-year Lumpkin County bonds on May 11, Year 1, directly from the county, at their face amount plus accrued interest. The bonds pay semiannual interest on April 1 and October 1. On October 31, Year 1, Gillooly Co. s

> Bula Investments acquired $240,000 of Effenstein Corp., 8% bonds at their face amount on October 1, 20Y1. The bonds pay interest on October 1 and April 1. On April 1, 20Y2, Bula sold $90,000 of Effenstein Corp. bonds at 102. Journalize the entries to rec

> On February 22, Triangle Corporation acquired 34,000 shares of the 500,000 outstanding common stock of Jupiter Co. at $25 plus commission charges of $680. On June 1, a cash dividend of $1.70 per share was received. On November 12, 7,000 shares were sold

> Rushton Corp., a wholesaler of music equipment, issued $11,000,000 of 20-year, 9% callable bonds on March 1, 20Y1, at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year. Journalize the

> Financial data for McMasters Company follow: For Year Ended December 31 Cash on December 31 …………………… $ 138,780 Cash flow from operations …………… (308,400) a. Compute the ratio of cash to monthly cash expenses. b. Interpret the results computed in (a).

> Favreau Corporation wholesales repair products to equipment manufacturers. On April 1, Year 1, Favreau Corporation issued $35,000,000 of five-year, 7% bonds at a market (effective) interest rate of 6%, receiving cash of $36,492,785. Interest is payable s

> On the first day of its fiscal year, Jacinto Company issued $6,500,000 of six-year, 7% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. The bonds were issued at a market (effective) int

> Abioye Co. produces and distributes semiconductors for use by computer manufacturers. Abioye Co. issued $700,000 of 10-year, 9% bonds on May 1 of the current year at face value, with interest payable on May 1 and November 1. The fiscal year of the compan

> Stone Energy Corporation’s 7.5% bonds due in 2022 were reported as selling for 77.00. Were the bonds selling at a premium or at a discount? Why is Stone Energy Corporation able to sell its bonds at this price?

> The financial statements for Nike, Inc., are presented in Appendix C at the end of the text. What is the major source of financing for Nike? Financial Statements of Nike, Inc. in Appendix C:

> Based on the data in Exercise 14-1, what factors other than earnings per share should be considered in evaluating these alternative financing plans? Data in Exercise 14-1: Bonds payable, 5% (issued at face amount) ………… $6,000,000 Preferred $2.00 stock,

> The following data were taken from recent annual reports of Southwest Airlines, which operates a low-fare airline service to more than 50 cities in the United States: a. Determine the times interest earned ratio for the current and preceding years. Roun

> On January 1, Year 1, Wedekind Company issued a $170,000, five-year, 8% installment note to Shannon Bank. The note requires annual payments of $42,578, beginning on December 31, Year 1. Journalize the entries to record the following: Year 1 Jan. 1. Issue

> Henriksen Co., which produces and sells biking equipment, is financed as follows: Bonds payable, 5% (issued at face amount) ………… $6,000,000 Preferred $2.00 stock, $100 par …………………………. 3,000,000 Common stock, $25 par ……………………………………… 5,000,000 Income tax i

> Ergonomics Supply Inc., a wholesaler of office products, was organized on July 1 of the current year, with an authorization of 80,000 shares of preferred 2% stock, $70 par, and 900,000 shares of $11 par common stock. The following selected transactions w

> The dividend yield of Suburban Propane was 10.2% in a recent year, and the dividend yield of Alphabet was 0% in the same year. What might explain the difference between these ratios?

> On October 31, Pidgeon Stones Inc., a marble contractor, issued for cash 320,000 shares of $5 par common stock at $12, and on November 19, it issued for cash 45,000 shares of preferred stock, $60 par at $72. a. Journalize the entries for October 31 and N

> Caterpillar Inc. and Deere & Company are two large companies that manufacture and sell equipment used in the construction, mining, agricultural, and forestry industries. The companies reported the following data (in millions) for two recent years: a

> Pacific Gas and Electric Company is a large gas and electric utility operating in northern and central California. Three recent years of financial data for Pacific Gas and Electric Company are as follows: a. Determine the earnings per share for fiscal Y

> PickApart Arts, Inc., had earnings of $565,300 for the year. The company had 55,000 shares of common stock outstanding during the year and issued 23,000 shares of $50 par value preferred stock. The preferred stock has a dividend of $2.10 per share. There

> The following Stockholders’ Equity section of the balance sheet prepared as of the end of the current year: a. List the errors in the preceding statement of stockholders’ equity. b. Prepare a corrected statement of st

> Pressure Pumps Corporation, a manufacturer of industrial pumps, reports the following results for the year ended January 31, 20Y2: Retained earnings, February 1, 20Y1 ……………….. $29,842,000 Net income ……………………………………………………….. 4,082,000 Cash dividends declar

> The following accounts and their balances were selected from the adjusted trial balance of Block Ayala Group Inc., a freight forwarder, at October 31, the end of the current fiscal year: Common Stock, no par, $22 stated value ……………………….. $ 5,500,000 Paid

> Yard Spray Inc. develops and produces spraying equipment for lawn maintenance and industrial uses. On January 31 of the current year, Yard Spray Inc. reacquired 42,000 shares of its common stock at $36 per share. On June 14, 19,000 of the reacquired shar

> Yeoman Grill Restaurant Corporation wholesales ovens and ranges to restaurants throughout the Southwest. Yeoman Grill Restaurant Corporation, which had 35,000 shares of common stock outstanding, declared a 3-for-1 stock split. a. What will be the number

> Advanced Life Co. is an HMO for businesses in the Albuquerque area. The following account balances appear on the balance sheet of Advanced Life Co.: Common stock (600,000 shares authorized; 400,000 shares issued), $8 par, $3,200,000; Paid-in capital in e

> Kroger, a grocery store chain, recently had a price-earnings ratio of 7.6, while the average price-earnings ratio in the grocery store industry was 18.6. What might explain this difference?

> Internal Insights Inc., a developer of radiology equipment, has stock outstanding as follows: 70,000 shares of cumulative preferred 2% stock, $60 par, and 100,000 shares of $10 par common. During its first four years of operations, the following amounts

> Exploit Media, LLC, has three members: WACS Partners, Elyse O’Reilly, and Encounter Newspaper, LLC. On January 1, 20Y2, the three members had equity of $275,000, $55,000, and $220,000, respectively. WACS Partners contributed an additional $69,000 to Expl

> Lynn Carpenter and Matthew Fredrick formed a partnership in which the partnership agreement provided for salary allowances of $58,000 and $41,000, respectively. Determine the division of a $33,000 net loss for the current year, assuming that remaining in

> Using each of the five assumptions as to income division listed in Exercise 12-3, determine the income participation of Dawson and McDonald if the year’s net income is $136,000. Assumptions listed in Exercise 12-3: (a) No agreement concerning division o

> Beau Dawson and Willow McDonald formed a partnership, investing $276,000 and $92,000, respectively. Determine their participation in the year’s net income of $380,000 under each of the following independent assumptions: (a) No agreement concerning divisi

> Squeeky Cleaning Services, LLC, provides cleaning services for office buildings. The firm has 10 members in the LLC, which did not change between 20Y8 and 20Y9. During 20Y9, the business terminated two commercial contracts. The following revenue and empl

> The accounting firm of Deloitte & Touche is the largest international accounting firm in the world as ranked by total revenues. For two recent years, Deloitte & Touche reported the following for its U.S. operations: a. For the current and previo

> The capital accounts of Lorraine Grecco and Carrie Rosenfeld have balances of $64,000 and $99,000, respectively, on January 1, 20Y4, the beginning of the fiscal year. On March 10, Grecco invested an additional $11,000. During the year, Grecco and Rosenfe

> After closing the accounts on July 1, prior to liquidating the partnership, the capital account balances of Silver, Carillo, and Tingley are $77,700, $51,800, and $25,900, respectively. Cash, noncash assets, and liabilities total $72,500, $124,200, and $

> After the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $64,900 and $86,500, respectively. Lewan Gorman is to be admitted to the partnership, contributing $43,300 cas