Question: Heavey and Lovas Furniture Repair Service, a

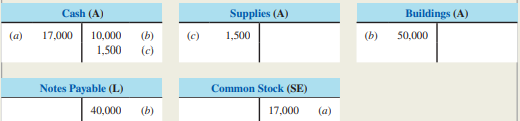

Heavey and Lovas Furniture Repair Service, a company with two stockholders, began operations on June 1. The following T-accounts indicate the activities for the month of June.

Required:

For each of the events (a)–(c), explain what transaction resulted in the indicated increases and/or decreases in the T-accounts.

> Using the adjusted balances in E4-16, give the closing journal entry for the year ended December 31. Data from E4-16: Mint Cleaning Inc. prepared the following unadjusted trial balance at the end of its second year of operations ending December 31.&Aci

> Using the adjusted balances in E4-16, prepare an income statement, statement of retained earnings, and classified balance sheet for the year ended December 31. Data from E4-16: Mint Cleaning Inc. prepared the following unadjusted trial balance at the e

> How do you report revenue from a contract that contains more than one performance obligation but specifies only one (total) transaction price?

> Mint Cleaning Inc. prepared the following unadjusted trial balance at the end of its second year of operations ending December 31. (Assume amounts are reported in thousands of dollars.) Other data not yet recorded at December 31: a. Insuran

> North Star prepared the following unadjusted trial balance at the end of its second year of operations ending December 3 Other data not yet recorded at December 31: a. Rent expired during the year, $1,200. b. Depreciation expense for the year, $1,000.

> Dyer, Inc., completed its first year of operations on December 31, 2018. Because this is the end of the annual accounting period, the company bookkeeper prepared the following preliminary income statement: You are an independent CPA hired by the company

> On December 31, 2018, Alan and Company prepared an income statement and balance sheet but failed to take into account four adjusting journal entries. The income statement, prepared on this incorrect basis, reported income before income tax of $30,000. Th

> The following accounts are used by Mouse Potato, Inc., a computer game maker. Required: For each of the following independent situations, give the journal entry by entering the appropriate code(s) and amount(s). We’ve done the first o

> Indicate the most likely effect of the following changes in credit policy on the receivables turnover ratio and days to collect (+ for increase, − for decrease, and NE for no effect). a. Granted credit with shorter payment deadlines. b. Granted credit

> The adjusted trial balance for Rowdy Profits Corporation reports that its equipment cost $250,000. For the current year, the company has recorded $30,000 of depreciation, which brings the total depreciation to date to $150,000. Required: Using the head

> Partial comparative income statements are presented below for Commonplace Corporation. The company’s manager provides the following additional information: a. The company received a bill for $2,400 of electricity and other utility ser

> Gibson Company’s adjusted balances at December 31, 2018 (listed alphabetically), were: Gibson prepared, but did not yet post, additional adjusting journal entries (AJEs) for $3,000 of depreciation and $26,200 of income taxes incurred b

> Wolverine World Wide, Inc., manufactures military, work, sport, and casual footwear and leather accessories under a variety of brand names, such as Caterpillar, Hush Puppies, Wolverine, and Steve Madden. The following transactions occurred during a recen

> Under accrual basis accounting, expenses are recognized when incurred. The following transactions occurred in January: a. American Express paid its salespersons $3,500 in commissions related to December sales of financial advisory services. Answer from

> What is a performance obligation?

> Under accrual basis accounting, expenses are recognized when incurred. The following transactions occurred in January: a. American Express paid its salespersons $3,500 in commissions related to December sales of financial advisory services. Answer from

> Under accrual basis accounting, expenses are recognized when incurred, which means the activity giving rise to the expense has occurred. Assume the following transactions occurred in January: a. Dell paid its computer service technicians $90,000 in sala

> According to the revenue recognition principle, revenues should be recognized when or as the company performs acts promised to the customer. For many businesses, this condition is met at the point of delivery of goods or services. The following transacti

> According to the revenue recognition principle, revenues should be recognized when or as the company performs acts promised to the customer. For many businesses, this condition is met at the point of delivery of goods or services. The following transacti

> Adobe Systems Incorporated reported the following accounts and amounts (in millions) in its financial statements for the year ended December 2, 2016. Prepare a classified balance sheet. The Allowance for Doubtful Accounts relates entirely to Accounts Rec

> Sirius XM Holdings Inc. sells a dash-top satellite radio receiver and one-year subscription for a total price of $80. By purchasing this deal, the subscriber is entitled to receive hardware (i.e., the radio), a software update that is automatically downl

> EZ Reader was founded in January to provide text reading and recording services. Selected transactions for EZ Reader’s first month of business are as follows: a. Issued common stock to investors for $50,000 cash. b. Billed customers $

> An analysis of transactions made during July by NepCo, an Internet service provider, during its first month of operations is shown below. Increases and decreases affecting revenues and expenses are explained. Required: 1. Describe the business activiti

> Match each definition with its related term by entering the appropriate letter in the space provided.

> Based on the transactions posted to T-accounts in E3-18, create an unadjusted trial balance for Tongo, Inc., for the month ended January 31. Distinguish the balance sheet and income statement accounts as shown in Exhibit 3.10. Data from E3-18: For each

> For each of the transactions in E3-16Â (including the sample), post the effects to the appropriate T-accounts and determine ending account balances. Beginning account balances have been given. The sample transaction has been posted as an examp

> What five steps are to be followed when applying the core revenue recognition principle?

> For each of the transactions in E3-16Â (including the sample), write the journal entry using the format shown in this chapter. Data from E3-16: In January, Tongo, Inc., a branding consultant, had the following transactions. Indicate the accou

> In January, Tongo, Inc., a branding consultant, had the following transactions. Indicate the accounts, amounts, and direction of the effects on the accounting equation under the accrual basis. A sample is provided. a. (Sample) Received $9,500 cash for c

> A company’s accounting records included the following accounts. Required: 1. For each T-account, describe the typical transactions that cause it to increase and decrease. 2. Express each T-account in equation format (Beginning + Incr

> What basic characteristic distinguishes items reported on the income statement from items reported on the balance sheet?

> Over-the-Top Technologies (OTT) operates a computer repair and web consulting business. News Now (NN) publishes a local newspaper. The two companies entered into the following transactions. a. NN billed OTT for $500 of advertising services provided this

> Ricky’s Piano Rebuilding Company has been operating for one year. On January 1, at the start of its second year, its income statement accounts had zero balances and its balance sheet account balances were as follows: Required: 1. Crea

> Rowland & Sons Air Transport Service, Inc., has been in operation for three years. The following transactions occurred in February: Feb. 1 Paid $200 for rent of hangar space in February. Feb. 4 Received customer payment of $800 to ship several items to

> Greek Peak is a ski resort in upstate New York. The company sells lift tickets, ski lessons, and ski equipment. It operates several restaurants and rents townhouses to vacationing skiers. The following hypothetical December transactions are typical of th

> Sysco, formed in 1969, is America’s largest marketer and distributor of food service products, serving nearly 250,000 restaurants, hotels, schools, hospitals, and other institutions. The following transactions are typical of those that occurred in a rece

> Match each definition with its related term by entering the appropriate letter in the space provided.

> Home Comfort Furniture Company completed four transactions, with the dollar effects indicated in the following schedule: Required: 1. Write a brief explanation of transactions (1) through (4). Explain any assumptions you made. 2. Compute the ending bal

> What two questions are answered by the core revenue recognition principle?

> 2-8 Analyzing the Effects of Transactions in T-Accounts Mulkeen Service Company, Inc., was incorporated by Conor Mulkeen and five other managers. The following activities occurred during the year: a. Received $60,000 cash from the managers; each was iss

> 1. For each of the events in E2-6, prepare journal entries, checking that debits equal credits. 2. Explain your response to event (c) Data from E2-6: NIKE, Inc., with headquarters in Beaverton, Oregon, is one of the world’s leading manufacturers of ath

> RecRoom Equipment Company received an $8,000, six-month, 6 percent note to settle an $8,000 unpaid balance owed by a customer. Prepare journal entries to record the following transactions for RecRoom. Rather than use letters to reference each transaction

> NIKE, Inc., with headquarters in Beaverton, Oregon, is one of the world’s leading manufacturers of athletic shoes and sports apparel. Assume the following activities occurred during a recent year. The dollar amounts in (a) and (b) are

> For each of the events in E2-4, prepare journal entries, checking that debits equal credits. Data from E2-4: The following events occurred for Favata Company: a. Received $10,000 cash from owners and issued stock to them. b. Borrowed $7,000 cash from a

> The following events occurred for Favata Company a. Received $10,000 cash from owners and issued stock to them. b. Borrowed $7,000 cash from a bank and signed a note due later this year. c. Bought and received $800 of equipment on account. d. Purchas

> As described in a recent annual report, Digital Diversions, Inc. (DDI), designs, develops, and distributes video games for computers and advanced game systems. DDI has been operating for only one full year. Required: For each of the following accounts

> The following are independent situations. a. A company orders and receives 10 personal computers for office use for which it signs a note promising to pay $25,000 within three months. b. A company purchases for $21,000 cash a new delivery truck that has

> Business Sim Corp. (BSC) issued 1,000 common shares to Kelly in exchange for $12,000. BSC borrowed $30,000 from the bank, promising to repay it in two years. BSC paid $35,000 for computer equipment with check number 101 and signed a note for $5,000 due i

> Columbia Sportswear Company reported the following in recent balance sheets (amounts in millions). Required: 1. Calculate the current ratio (rounded to two decimal places) at September 30, 2016, and December 31, 2015. 2. Did the companyâ€&#

> Why is it appropriate to use cash basis accounting in your personal life but not in the business world?

> Laser Delivery Services, Inc. (LDS), was incorporated January 1. The following transactions occurred during the year: a. Received $40,000 cash from the company’s founders in exchange for common stock. b. Purchased land for $12,000, si

> Nova Corporation hired a new product manager and agreed to provide her a $20,000 relocation loan on a six-month, 7 percent note. Prepare journal entries to record the following transactions for Nova Corporation. Rather than use letters to reference each

> Complete the following table by entering either increase or decrease in each cell:

> Indicate whether the following items should be included in the inventory of XO Group, a company that arranges and supplies wedding services for couples and other wedding consultants. a. Goods being held by XO Group on consignment from Emerald Bridal. b

> Repeat M7-23, except assume the 2018 ending inventory was overstated by $10,000. Data from M7-23: Assume the 2018 ending inventory of Shea’s Shrimp Shack was understated by $10,000. Explain how this error would affect the amounts reported for cost of g

> Assume the 2018 ending inventory of Shea’s Shrimp Shack was understated by $10,000. Explain how this error would affect the amounts reported for cost of goods sold and gross profit for 2018 and 2019

> Repeat M7-13, except assume Literacy for the Illiterate uses a perpetual inventory system and it sold 600 units between January 9 and January 28. Data from M7-13: In its first month of operations, Literacy for the Illiterate opened a new bookstore and

> Repeat M7-11, except assume Literacy for the Illiterate uses a perpetual inventory system and it sold 600 units between January 9 and January 28. Data from M7-12: In its first month of operations, Literacy for the Illiterate opened a new bookstore and

> Repeat M7-11, except assume Literacy for the Illiterate uses a perpetual inventory system and it sold 600 units between January 9 and January 28. Data from M7-11: In its first month of operations, Literacy for the Illiterate opened a new bookstore and

> Abercrombie & Fitch Co. reported the following in its financial statement notes. Has the inventory in transit been sold to Abercrombie & Fitch as FOB shipping point, or FOB destination?

> Refer to M7-10. Calculate the cost of ending inventory and cost of goods sold assuming a perpetual inventory system is used in combination with (a) FIFO and (b) LIFO. Data from M7-10: Aircard Corporation tracks the number of units purchased and sold th

> Solve for the missing information designated by “?” in the following table. Round the Inventory Turnover Ratio and Days to Sell to one decimal.

> Zumiez Inc. is a leading action sports retailer, selling its skateboarding, snowboarding, surfing, and BMX merchandise under the Blue Tomato brand. The company’s financial statement notes reported, “Merchandise inventories may include items that have bee

> Complete the following table by entering either debit or credit in each cell:

> Indicate the most likely effect of the following changes in inventory management on the inventory turnover ratio (+ for increase, − for decrease, and NE for no effect). _____ a. Inventory delivered by suppliers daily (small amounts) instead of weekly (l

> During fiscal 2014, BlackBerry Limited wrote down its BB10 smartphone inventory by approximately $1,700,000,000 because its cost exceeded its net realizable value. Show the effects of this adjustment on the accounting equation and show the journal entry

> The Jewel Fool had the following inventory items on hand at the end of the year. Determine the lower of cost or market/net realizable value per unit and the total amount that should be reported on the balance sheet for each item of inventory.

> Complete the requirements for M7-11 assuming LIFO is used in a periodic inventory system Data from M7-11: In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought merchandise in the following order: (1) 300 units

> Complete the requirements for M7-11 assuming LIFO is used in a periodic inventory system. Data from M7-11: In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought merchandise in the following order: (1) 300 units

> In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought merchandise in the following order: (1) 300 units at $7 on January 1, (2) 450 units at $8 on January 8, and (3) 750 units at $9 on January 29. Assuming 900 un

> Aircard Corporation tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period as if it uses a periodic inventory system. Given the following information, calculate t

> Match the type of inventory with the type of business by placing checkmarks in the applicable columns:

> Merchandise costing $2,000 is sold for $3,000 on terms 2/30, n/60. If the customer pays within the discount period, what amount will be reported on the income statement as net sales and as gross profit?

> During its first year of operations, Drone Zone Corporation (DZC) bought goods from a manufacturer on account at a cost of $50,000. DZC returned $8,000 of this merchandise to the manufacturer for credit on its account. DZC then sold $38,000 of the remain

> Explain why revenues are recorded as credits and expenses as debits.

> During its first year of operations, Drone Zone Corporation (DZC) bought goods from a manufacturer on account at a cost of $50,000. DZC returned $8,000 of this merchandise to the manufacturer for credit on its account. DZC then sold $38,000 of the remain

> Inventory at the beginning of the year cost $13,400. During the year, the company purchased (on account) inventory costing $84,000. Inventory that had cost $80,000 was sold on account for $95,000. At the end of the year, inventory was counted and its cos

> Assume Anderson’s General Store bought, on credit, a truckload of merchandise from American Wholesaling costing $23,000. If Anderson’s paid National Trucking $650 cash for transportation, immediately returned goods to American Wholesaling costing $1,200,

> Dillard’s, Inc., operates department stores located primarily in the Southwest, Southeast, and Midwest. In its 2016 third-quarter report, the company reported Cost of Goods Sold of $880 million, ending inventory for the third quarter of $1,900 million, a

> XO Group sells merchandise to companies (and individuals) for significant milestones in life, such as getting married, moving in together, and having a baby. Indicate (yes/no) whether the following costs should be recorded in the Inventory account in XO

> Inventory that cost $500 is sold for $700, with terms of 2/30, n/60. Give the journal entries to record (a) the sale of merchandise and (b) collection of the accounts receivable. Assume the sales discount is taken and accounted for using the net method,

> Inventory that cost $500 is sold for $700, with terms of 2/30, n/60. Give the journal entries to record (a) the sale of merchandise and (b) collection of the accounts receivable. Assume the sales discount is taken and accounted for using the gross method

> Using the information in M6-9, prepare the journal entries needed at (a) time of sale and (b) collection of payment from the customer, assuming the company uses a perpetual inventory system with the net method of recording sales discounts. Data from M6-

> Using the information in M6-9, prepare the journal entries needed at (a) time of sale and (b) collection of payment from the customer, assuming the company uses a perpetual inventory system with the gross method of recording sales discounts.

> Using the information in M6-19, prepare the journal entries needed on October 5 and 20, assuming the company uses a perpetual system and records purchase discounts using the net method Data from M-19: On October 5, your company buys and receives invent

> Explain why stockholders’ equity is increased by revenues and decreased by expenses.

> Drs. Glenn Feltham and David Ambrose began operations of their physical therapy clinic, called Northland Physical Therapy, on January 1, 2017. The annual reporting period ends December 31. The trial balance on January 1, 2018, was as follows (the amounts

> Corey’s Campus Store has $4,000 of inventory on hand at the beginning of the month. During the month, the company buys $41,000 of merchandise and sells merchandise that had cost $30,000. At the end of the month, $13,000 of inventory is on hand. How much

> On October 5, your company buys and receives inventory costing $5,000, on terms 2/30, n/60. On October 20, your company pays the amount owed relating to the October 5 purchase. Prepare the journal entries needed on October 5 and 20, assuming the company

> If net sales are $300,000, cost of goods available for sale is $280,000, and gross profit percentage is 35%, what is the amount of ending inventory?

> Fortune Brands Home & Security, Inc., sells Master Lock padlocks. It reported an increase in net sales from $4.0 billion in 2014 to $4.6 billion in 2015, and an increase in gross profit from $1.4 billion in 2014 to $1.6 billion in 2015. Based on these nu

> Luxottica Group, the Italian company that sells Ray Ban and Oakley sunglasses, reported net sales of €8.8 billion in 2015 and €7.6 billion in 2014. Gross profit increased from €5.1 billion in 2014 to €6.0 billion in 2015. Was the increase in gross profit

> Ziehart Pharmaceuticals reported Net Sales of $178,000 and Cost of Goods Sold of $58,000. Candy Electronics Corp. reported Net Sales of $36,000 and Cost of Goods Sold of $26,200. Calculate the gross profit percentage for both companies (rounded to one de

> Using the information in M6-13, calculate the gross profit percentage (rounded to one decimal place). How has Sellall performed, relative to the gross profit percentages reported for Walmart in the chapter? Data from M6-13: Sellall Department Stores re

> Sellall Department Stores reported the following amounts in its adjusted trial balance prepared as of its December 31 year-end: Administrative Expenses, $2,400; Cost of Goods Sold, $22,728; Income Tax Expense, $3,000; Interest Expense, $1,600; Interest R

> A company that usually sells satellite TV equipment for $50 and two years of satellite TV service for $450 has a special, time-limited offer in which it sells the equipment for $300 and gives the two years of satellite service for “free.” If the company

> Nord Store’s perpetual accounting system indicated ending inventory of $20,000, cost of goods sold of $100,000, and net sales of $150,000. A year-end inventory count determined goods costing $15,000 were actually on hand. Calculate (a) the cost of shrink

> Show the income statement equation and define each element.

> In its annual report, American Eagle Outfitters states that its “e-commerce operation records revenue upon the estimated customer receipt date of the merchandise.” Is this FOB shipping point or FOB destination? If American Eagle were to change to the oth

> Identify the type of business as service (S), retail merchandiser (RM), or wholesale merchandiser (WM) for each of the following.