Question: Heurion Company is a job-order costing

Heurion Company is a job-order costing firm that uses a plant wide overhead rate based on direct labor hours. Estimated information for the year is as follows:

Overhead ………………………………… $789,000

Direct labor hours ………………………. 100,000

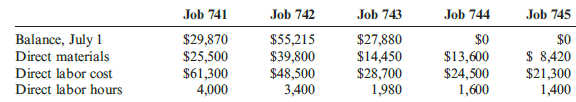

Heurion worked on five jobs in July. Data are as follows:

By July 31, Jobs 741 and 743 were completed and sold. The remaining jobs were in process.

Required:

1. Calculate the plant wide overhead rate for Heurion Company. (Note: Round to the nearest cent.)

2. Prepare job-order cost sheets for each job showing all costs through July 31. (Note: Round all amounts to the nearest dollar.)

3. Calculate the balance in Work in Process on July 31.

4. Calculate Cost of Goods Sold for July.

Transcribed Image Text:

Job 741 Job 742 Job 743 Job 744 Job 745 Balance, July 1 $29,870 $25,500 $61,300 4,000 $55,215 $39,800 $27,880 $14,450 $28,700 1,980 $0 $0 Direct materials $13,600 $ 8,420 $48,500 3,400 Direct labor cost $24,500 1,600 $21,300 Direct labor hours 1,400

> Carly Davis, production manager, was upset and puzzled by the latest performance report, which indicated that she was $100,000 over budget. She and her staff had worked hard to beat the budget. Now she saw that three items—direct labor, power, and setups

> Explain how overhead is assigned to production when a predetermined overhead rate is used.

> Fernando’s is a tiny sandwich shop just off the State University campus. Customers enter and place their orders at a small counter area. All orders are take-out because there is no space for dining in. The owner of Fernandoâ€

> Quarterly budgeted overhead costs for two different levels of activity follow. The 2,000 level was the expected level from the master budget. The actual activity level was 1,700 hours. Required: 1. Prepare a flexible budget for an activity level of 1,7

> Stillwater Designs is considering a new Kicker speaker model: Solo X18, which is a large and expensive subwoofer (projected price is $760 to distributors). The company controls the design specifications of the model and contracts with manufacturers in ma

> Spelzig Company manufactures radio-controlled toy cars. Spelzig has developed the following flexible budget for overhead for the coming year. Activity level is measured in direct labor hours. The factory produces two different toy cars. The production

> Ladan Suriman, controller for Healthy Pet Company, has been instructed to develop a flexible budget for overhead costs. The company produces two types of dog food. Basic Diet is a standard mixture for healthy dogs. Special Diet is a reduced protein formu

> Ladan Suriman, controller for Healthy Pet Company, has been instructed to develop a flexible budget for overhead costs. The company produces two types of dog food. Basic Diet is a standard mixture for healthy dogs. Special Diet is a reduced protein formu

> The Lubbock plant of Morril’s Small Motor Division produces a major subassembly for a 6.0 horsepower motor for lawn mowers. The plant uses a standard costing system for production costing and control. The standard cost sheet for the subassembly follows:

> Tom Belford and Tony Sorrentino own a small business devoted to kitchen and bath granite installations. Recently, building contractors have insisted on up-front bid prices for a house rather than the cost-plus system that Tom and Tony were used to. They

> Basuras Waste Disposal Company has a long-term contract with several large cities to collect garbage and trash from residential customers. To facilitate the collection, Basuras places a large plastic container with each household. Because of wear and tea

> Jordana Krull owns The Eatery in Miami, Florida. The Eatery is an affordable restaurant located near tourist attractions. Jordana accepts cash and checks. Checks are deposited immediately. The bank charges $0.50 per check; the amount per check averages $

> Explain how both small and large organizations can benefit from budgeting.

> Optima Company is a high-technology organization that produces a mass-storage system. The design of Optima’s system is unique and represents a breakthrough in the industry. The units Optima produces combine positive features of both compact and hard disk

> Dwight D. Eisenhower was the 34th president of the United States and the Supreme Commander of the Allied Forces during World War II. Much of his army career was spent in planning. He once said that ‘‘planning is everything; the plan is nothing.’’ Requir

> Ryan Richards, controller for Grange Retailers, has assembled the following data to assist in the preparation of a cash budget for the third quarter of 2014: a. Sales: May (actual) ………â&#

> Aragon and Associates has found from past experience that 25% of its services are for cash. The remaining 75% are on credit. An aging schedule for accounts receivable reveals the following pattern: a. Ten percent of fees on credit are paid in the month

> Consider the following independent environmental activities: a. A company takes actions to reduce the amount of material in its packages. b. After its useful life, a soft-drink producer returns the activated carbon used for purifying water for its bevera

> Goldman Company has a JIT system in place. Each manufacturing cell is dedicated to the production of a single product or major subassembly. One cell, dedicated to the production of telescopes, has four operations: machining, finishing, assembly, and qual

> John Thomas, vice president of Mallett Company (a producer of a variety of plastic products), has been supervising the implementation of an ABC management system. John wants to improve process efficiency by improving the activities that define the proces

> Danna Martin, president of Mays Electronics, was concerned about the end-of-the year marketing report that she had just received. According to Larry Savage, marketing manager, a price decrease for the coming year was again needed to maintain the company’

> Levy Inc. manufactures tractors for agricultural usage. Levy purchases the engines needed for its tractors from two sources: Johnson Engines and Watson Company. The Johnson engine has a price of $1,000. The Watson engine is $900 per unit. Levy produces a

> Grundvig Manufacturing produces several types of bolts used in aircrafts. The bolts are produced in batches and grouped into three product families. Because the product families are used in different kinds of aircraft, customers also can be grouped into

> Describe the differences between process costing and job-order costing.

> Morrisom National Bank has requested an analysis of checking account profitability by customer type. Customers are categorized according to the size of their account: low balances, medium balances, and high balances. The activities associated with the th

> Elmo Clinic has identified three activities for daily maternity care: occupancy and feeding, nursing, and nursing supervision. The nursing supervisor oversees 150 nurses, 25 of whom are maternity nurses (the other nurses are located in other care areas s

> For years, Tamarindo Company produced only one product: backpacks. Recently, Tamarindo added a line of duffel bags. With this addition, the company began assigning overhead costs by using departmental rates. (Prior to this, the company used a predetermin

> Benson Pharmaceuticals uses a process-costing system to compute the unit costs of the over the counter cold remedies that it produces. It has three departments: Mixing, Encapsulating, and Bottling. In Mixing, the ingredients for the cold capsules are mea

> Sea crest Company uses a process costing system. The company manufactures a product that is processed in two departments: A and B. As work is completed, it is transferred out. All inputs are added uniformly in Department A. The following summarizes the p

> Janbo Company produces a variety of stationery products. One product, sealing wax sticks, passes through two processes: blending and molding. The weighted average method is used to account for the costs of production. After blending, the resulting produc

> Millie Company produces a product that passes through an assembly process and a finishing process. All manufacturing costs are added uniformly for both processes. The following information was obtained for the assembly department for June: a. WIP, June 1

> Mimasca Inc. manufactures various holiday masks. Each mask is shaped from a piece of rubber in the molding department. The masks are then transferred to the finishing department, where they are painted and have elastic bands attached. Mimasca uses the we

> Alfombra Inc. manufactures throw rugs. The throw-rug department weaves cloth and yarn into throw rugs of various sizes. Alfombra uses the weighted average method. Materials are added uniformly throughout the weaving process. In August, Alfombra switched

> Recently, Stillwater Designs expanded its market by becoming an original equipment supplier to Jeep Wrangler. Stillwater Designs produces factory upgraded speakers specifically for Jeep Wrangler. The Kicker components and speaker cabinets are outsourced

> Give some examples of service firms that might use job-order costing, and explain why it is used in those firms.

> Recently, Stillwater Designs expanded its market by becoming an original equipment supplier to Jeep Wrangler. Stillwater Designs produces factory upgraded speakers specifically for Jeep Wrangler. The Kicker components and speaker cabinets are outsourced

> Benson Pharmaceuticals uses a process-costing system to compute the unit costs of the over the counter cold remedies that it produces. It has three departments: Mixing, Encapsulating, and Bottling. In Mixing, the ingredients for the cold capsules are mea

> Med Services Inc. is divided into two operating departments: Laboratory and Tissue Pathology. The company allocates delivery and accounting costs to each operating department. Delivery costs include the costs of a fleet of vans and drivers that drive thr

> Lowder Inc. builds custom conveyor systems for warehouses and distribution centers. During the month of July, the following occurred: a. Purchased materials on account for $42,630. b. Requisitioned materials totaling $27,000 for use in production: $12,5

> Sea crest Company uses a process costing system. The company manufactures a product that is processed in two departments: A and B. As work is completed, it is transferred out. All inputs are added uniformly in Department A. The following summarizes the p

> Barrymore Costume Company, located in New York City, sews costumes for plays and musicals. Barrymore considers itself primarily a service firm, as it never produces costumes without a preexisting order and only purchases materials to the specifications o

> The following transactions occurred during the month of April for Nelson Company: a. Purchased materials costing $4,610 on account. b. Requisitioned materials totaling $4,800 for use in production, $3,170 for Job 518 and the remainder for Job 519. c. Rec

> During August, Leming Inc. worked on two jobs. Data relating to these two jobs follow: Overhead is assigned on the basis of direct labor hours at a rate of $11. During August, Job 64 was completed and transferred to Finished Goods. Job 65 was the only

> Suppose that back in the 1970s, Steve was asked to build speakers for two friends. The first friend, Jan, needed a speaker for her band. The second friend, Ed, needed a speaker built into the back of his hatchback automobile. Steve figured the following

> Thayn Company produces an arthritis medication that passes through two departments: Mixing and Tableting. Thayn uses the weighted average method. Data for February for Mixing is as follows: BWIP was zero; EWIP had 36,000 units, 50% complete; and 420,000

> What are job-order costing and process costing? What types of firms use job-order costing? Process costing?

> Xania Inc. uses a normal job-order costing system. Currently, a plant wide overhead rate based on machine hours is used. Xania’s plant manager has heard that departmental overhead rates can offer significantly better cost assignments th

> Pavlovich Prosthetics Company produces artificial limbs for individuals. Each prosthetic is unique. On January 1, three jobs, identified by the name of the person being fitted with the prosthetic, were in process with the following costs: During the mo

> Spade Millhone Detective Agency performs investigative work for a variety of clients. Recently, Alban Insurance Company asked Spade Millhone to investigate a series of suspicious claims for whiplash. In each case, the claimant was driving on a freeway an

> The management of Golding Company has determined that the cost to investigate a variance produced by its standard cost system ranges from $2,000 to $3,000. If a problem is discovered, the average benefit from taking corrective action usually outweighs th

> Buenolorl Company produces a well-known cologne. The standard manufacturing cost of the cologne is described by the following standard cost sheet: Direct materials: Liquids (4.5 oz. @ $0.40) …………………………………. $1.80 Bottles (1 @ $0.05) …………………………………

> Cabanarama Inc. designs and manufactures easy-to-set-up beach cabanas that families can set up for picnicking, protection from the sun, and so on. The cabanas come in a kit that includes canvas, lacing, and aluminum support poles. Cabanarama has expanded

> Mantenga Company provides routine maintenance services for heavy moving and transportation vehicles. Although the vehicles vary, the maintenance services provided follow a fairly standard pattern. Recently, a potential customer has approached the company

> Italia Pizzeria is a popular pizza restaurant near a college campus. Brandon Thayn, an accounting student, works for Italia Pizzeria. After several months at the restaurant, Brandon began to analyze the efficiency of the business, particularly inventory

> A-Tech Company uses 36,000 circuit boards each year in its production of stereo units. The cost of placing an order is $15. The cost of holding one unit of inventory for one year is $3. Currently, A-Tech orders 3,000 circuit boards in each order. Requir

> Fun Time Company produces three lines of greeting cards: scented, musical, and regular. Segmented income statements for the past year are as follows: Kathy Bunker, president of Fun Time, is concerned about the financial performance of her firm and is s

> Zeitgeist Company manufactures silicon sleeves for MP3 players. In August 2013, Zeitgeist began producing the colorful sleeves. During the month of August, 16,000 were produced, and 14,750 were sold at $6.95 each. The following costs were incurred: Dire

> During its first year of operations, Sugar smooth Inc. produced 55,000 jars of hand cream based on a formula containing 10% glycolic acid. Unit sales were 52,300 jars. Fixed overhead totaled $27,500 and was applied at the rate of $0.50 per unit produced.

> Assume that Stillwater Designs produces two automotive subwoofers: S12L7 and S12L5. The S12L7 sells for $475, and the S12L5 sells for $300. Projected sales (number of speakers) for the coming five quarters are as follows: The vice president of sales be

> Assume that Stillwater Designs produces two automotive subwoofers: S12L7 and S12L5. The S12L7 sells for $475, and the S12L5 sells for $300. Projected sales (number of speakers) for the coming five quarters are as follows: The vice president of sales be

> Party-Hearty Company makes a variety of holiday party packs. One party pack is for a bachelorette party. It includes a tiara, a pink feathered boa, and a t-shirt emblazoned with ‘‘I’m the Bride.’’ Pink feathered boas are purchased from an outside supplie

> Pohling Company makes a variety of household appliances, including automatic can openers. Small motors used in making can openers are purchased from an outside supplier. Each year, 20,000 small motors are used, at the rate of 80 small motors per day. How

> Ranger Company purchases 17,280 units of Product Beta each year in lots of 864 units per order. The cost of placing one order is $10, and the cost of carrying one unit of product in inventory for a year is $6. Required: 1. What is the EOQ for Beta? 2. H

> Knit line Inc. produces high-end sweaters and jackets in a single factory. The following information was provided for the coming year. A sales commission of 5% of sales is paid for each of the two product lines. Direct fixed selling and administrative

> Plata Company produces two products: a mostly handcrafted soft leather briefcase sold under the label Maletin Elegant and a leather briefcase produced largely through automation and sold under the label Maletin Fina. The two products use two overhead act

> In the first quarter of operations, a manufacturing cell produced 80,000 stereo speakers, using 20,000 production hours. In the second quarter, the cycle time was 10 minutes per unit with the same number of production hours as were used in the first quar

> The following six situations at Diviney Manufacturing Inc. are independent. a. A manual insertion process takes 30 minutes and 8 pounds of material to produce a product. Automating the insertion process requires 15 minutes of machine time and 7.5 pounds

> The Receiving Department has three activities: unloading, counting goods, and inspecting. Unloading uses a forklift that is leased for $15,000 per year. The forklift is used only for unloading. The fuel for the forklift is $3,600 per year. Other operatin

> The Sabroso Chocolate Company uses activity-based costing (ABC). The controller identified two activities and their budgeted costs: Setting up equipment …………â€&br

> Patten Company uses activity-based costing (ABC). Patten manufactures toy cars using two activities: plastic injection molding and decal application. Patten’s 2013 total budgeted overhead costs for these two activities are $675,000 (80% for injection mol

> Bienestar Company produces two types of get-well cards: scented and regular. Drivers for the four activities are as follows: The following activity data have been collected: Inspecting products ……â€&b

> Water fun Technology produces engines for recreational boats. Because of competitive pressures, the company was making an effort to reduce costs. As part of this effort, management implemented an activity-based management system and began focusing its at

> Hammer Company produces a variety of electronic equipment. One of its plants produces two laser printers: the deluxe and the regular. At the beginning of the year, the following data were prepared for this plant: In addition, the following information

> A hospital is in the process of implementing an ABC system. A pilot study is being done to assess the effects of the costing changes on specific products. Of particular interest is the cost of caring for patients who receive in-patient recovery treatment

> Loren Inc. manufactures products that pass through two or more processes. During April, equivalent units were computed using the FIFO method: Units started and completed ………………………………………… 4,600 Units in BWIP 3 Fraction to Complete (60%) …………………… 840 Unit

> Drysdale Dairy produces a variety of dairy products. In Department 12, cream (transferred in from Department 6) and other materials (sugar and flavorings) are mixed at the beginning of the process and churned to make ice cream. The following data are for

> Loran Inc. had the following equivalent units schedule and cost for its fabrication department during September: Required: 1. Calculate the unit cost for materials, for conversion, and in total for the fabrication department for September. 2. Calculate

> Byford Inc. produces a product that passes through two processes. During November, equivalent units were calculated using the weighted average method: Units completed ………………………………………………………………………………. 196,000 Add: Units in EWIP 3 Fraction complete (60,000

> Stevenson Company is divided into two operating divisions: Battery and Small Motors. The company allocates power and general factory costs to each operating division using the direct method. Power costs are allocated on the basis of the number of machine

> Stevenson Company is divided into two operating divisions: Battery and Small Motors. The company allocates power and general factory costs to each operating division using the direct method. Power costs are allocated on the basis of the number of machine

> Yurman Inc. uses a job-order costing system. During the month of May, the following transactions occurred: a. Purchased materials on account for $29,670. b. Requisitioned materials totaling $24,500 for use in production. Of the total, $9,200 was for Job

> Ensign Landscape Design designs landscape plans and plants the material for clients. On April 1, there were three jobs in process, Jobs 39, 40, and 41. During April, two more jobs were started, Jobs 42 and 43. By April 30, Jobs 40, 41, and 43 were comple

> Roseler Company uses a normal job-order costing system. The company has two departments through which most jobs pass. Overhead is applied using a plant wide overhead rate of $10 per direct labor hour. During the year, several jobs were completed. Data pe

> Consider the following independent jobs. Overhead is applied in Department 1 at the rate of $6 per direct labor hour. Overhead is applied in Department 2 at the rate of $8 per machine hour. Direct labor wages average $10 per hour in each department. Re

> In December, Davis Company had the following cost flows: Required: 1. Prepare the journal entries to transfer costs from (a) Molding to Grinding, (b) Grinding to Finishing, and (c) Finishing to Finished Goods. 2. CONCEPTUAL CONNECTION Explain how the j

> Derry Company uses job-order costing. At the end of the month, the following information was gathered: The beginning balance of Finished Goods was $300, consisting of Job 300 which was not sold by the end of the month. Required: 1. Calculate the balan

> Gorman Company builds internal conveyor equipment to client specifications. On October 1, Job 877 was in process with a cost of $18,640 to date. During October, Jobs 878, 879, and 880 were started. Data on costs added during October for all jobs are as

> Jagjit Company designs and builds retaining walls for individual customers. On August 1, there were two jobs in process: Job 93 with a beginning balance of $8,750, and Job 94 with a beginning balance of $7,300. Jagjit applies overhead at the rate of $8 p

> Cassien Inc. manufactures products that pass through two or more processes. During June, equivalent units were computed using the weighted average method: Units completed ……………………………………………………………………. 53,400 Units in EWIP 3 Fraction complete (36,000 3 60%

> On July 1, Job 46 had a beginning balance of $1,235. During July, prime costs added to the job totaled $560. Of that amount, direct materials were three times as much as direct labor. The ending balance of the job was $1,921. Required: 1. What was overh

> At the beginning of the year, Glaser Company estimated the following: Glaser uses departmental overhead rates. In the assembly department, overhead is applied on the basis of direct labor hours. In the testing department, overhead is applied on the bas

> At the beginning of the year, Horvath Company estimated the following: Overhead …………………………………… $486,400 Direct labor hours …………………………… 95,000 Horvath uses normal costing and applies overhead on the basis of direct labor hours. For the month of January,

> Ranger Company purchases 17,280 units of Product Beta each year in lots of 864 units per order. The cost of placing one order is $10, and the cost of carrying one unit of product in inventory for a year is $6. Required: 1. How many orders for Beta does

> a. Auto manufacturing b. Dental services c. Auto repair d. Costume making Required: CONCEPTUAL CONNECTION For each of the given types of industries, give an example of a firm that would use job-order costing. Then, give an example of a firm that would u

> a. Hospital services b. Custom cabinet making c. Toy manufacturing d. Soft-drink bottling e. Airplane manufacturing (e.g., 767s) f. Personal computer assembly g. Furniture making (e.g., computer desks sold at discount stores) h. Custom furniture making i

> Each of the following situations is independent. Required: 1. Kester Company had ending inventory cost of $5,000 under absorption costing. Ending inventory cost $3,400 under variable costing. Kester produced 16,000 units and sold 15,200. What was fixed

> Sommers Company uses the following rule to determine whether materials usage variances should be investigated: A materials usage variance will be investigated anytime the amount exceeds the lesser of $12,000 or 10% of the standard cost. Reports for the p

> Stillwater Designs rebuilds defective units of its S12L7 Kicker speaker model. During the year, Stillwater rebuilt 7,500 units. Materials and labor standards for performing the repairs are as follows: Direct materials (1 recon kit @ $150) ……………….. $150.

> In the coming year, Kalling Company expects to sell 28,700 units at $32 each. Kalling’s controller provided the following information for the coming year. Units production ………………………………………………… 30,000 Unit direct materials ……………………………………………. $9.95 Unit di

> Overton Company produced 80,000 units last year. The company sold 79,000 units and there was no beginning inventory. The company chose practical activity—at 80,000 units—to compute its predetermined overhead rate. Manufacturing costs are as follows: Dir