Question: Holly Company incurred research and development

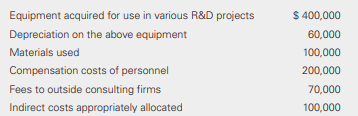

Holly Company incurred research and development costs in Year 1 as follows:

The total research and development expense in Holly ’s Year 1 income statement under U.S. GAAP should be:

a. $930,000

b. $870,000

c. $530,000

d. $470,000

> On January 1, 2018, Union Power and Light commenced construction of a new generating plant to serve the northeast corridor of the state. The total cost of the project is $4,100,000, and it will be completed on June 1, 2019. Scheduled payments to contract

> IFRS. Repeat the requirements in P11-10 assuming that Hein Technologies reports under IFRS. Assume that all the conditions to capitalize development costs have been met. What is the difference between the research and development expense under U.S. GAAP

> Hein Technologies conducted the following cash transactions on January 1. 1. Paid $712,000 to fund internal research designed to develop a new digital scanner. The company expects the useful life to be 3 years. 2. Patented a product based on internal res

> Hoppie Products signed a contract with Coleman Manufacturing to design, develop, and produce a specialized plastic molding machine for its factory operations. The machine is not currently sold to the public. Hoppie issued a 3%, 8-year, $690,000 note paya

> O’Sullivan Corporation provided the following information regarding its ending inventory for the current year. O’Sullivan manufactures three types of athletic shoes. Selling costs are 10% of the selling price. The comp

> Framingdale Factories, Inc. manufactures low-cost furniture. The company produces three sizes of wardrobes 4 foot (S), 6 foot (M), and 8 foot (L). Framingdale provided the following data: Required: a. Determine the inventory carrying value with the lowe

> Silvio’s Taverns, Inc. adopted the dollar-value LIFO Method in 2015. Information related to Silvio’s inventory follows: Required: a. Compute Silvio’s ending inventory under the dollar-value LIFO meth

> The following information was provided by Capri Company: Capri adopted the dollar-value LIFO method using 2014 as the base year. Required: a. Compute Capri’s ending inventory under the dollar-value LIFO method for the years 2014 throu

> Nat’s Toy Stores Limited adopted the dollar-value LIFO inventory method using 2017 as the base year. The cumulative price index for 2018 through 2021 was 1.01, 1.03, 1.04 and 1.06, respectively. Ending inventory according to Natâ&

> The Happenings Company adopted the dollar-value LIFO inventory method on December 31, 2017, when the price index was 1.00. Ending inventory on the date that it adopted dollar-value LIFO follows. The cumulative price index for 2018 is 1.3385, and the cum

> Arc Company sells stone garden statues and offers a 6% discount to its high-volume customers. Sunny Garden Center purchased statues on account with a list price of $54,000 and received a volume discount of 6% of the purchase price. Give the journal entry

> The Outsider Company, Inc. provided the following information regarding its inventory for the year ended December 31, 2019. It made all of the purchases before it had any sales transactions for the year. Required: a. Compute the LIFO reserve at the begi

> Use the information provided in P10-1 for Morocco Imports. For each of the three cost-flow assumptions (moving-average, FIFO, and LIFO methods): Required: a. Prepare a partial income statement up to the cost of goods sold section. b. Compute the gross p

> The Wallace Weed Corporation provided the following data related to its inventory at the end of the current year: Required: a. What is Wallace Weed’s ending inventory and cost of goods sold under the conventional retail method? Round p

> The Tally Billiard Supply Corporation provided the following data related to its inventory at the end of the current year: What are Tally Corporation’s ending inventory and cost of goods sold under the conventional retail method? Round

> The Johnny Fruit Company provided the following data related to its inventory at the end of the current year. Round percentages to two decimal places. Required: a. What are Johnny Fruit’s ending inventory and cost of goods sold under t

> The Monte Sales Company provided the following data related to its inventory at the end of the current year. Round percentages to two decimal places. Required: a. What are Monte’s ending inventory and cost of goods sold under the conve

> In 2018, Sawyer Company experienced a major casualty loss. The roof of its ware house collapsed in an ice storm and destroyed its entire inventory. The company began the year with inventory of $598. It made purchases of $2,400 but returned $24 worth of m

> On January 1, 2017, Goodbye Electronics Outlets adopted the conventional retail method of accounting for its merchandise inventory. Determine the company’s ending inventory under the conventional retail method. (Round percentages to tw

> John Stevens Corporation uses the conventional retail method for financial reporting. The company’s inventory records are summarized here. Estimate John Stevens’ ending inventory using the conventional retail inventor

> Morocco Imports provided the following information regarding its inventory for the current year, its second year of operations. Compute Morocco’s ending inventory and cost of goods sold under each of the following cost-flow assumptions

> Round-up Garden Center established a $200 imprest petty cash fund at the beginning of the year. The fund custodian held the cash to be used to pay minor expenditures. During the year, the following expenditures were paid from the imprest petty cash fund

> Astro Carpets Incorporated provided the following accounts related to beginning balances in its accounts receivable and allowance accounts for the current year: Prepare the journal entries to record the following transactions that occurred during the cu

> Softa Company borrows $850,000 from Deer Financing Associates by securing a revolving line of credit at a 6% interest rate on April 15. Interest is due and payable at the end of each month based on the outstanding balance at the beginning of the month. S

> Council Company develops an aged schedule of accounts receivable at the end of each year. The company estimated an allowance for uncollectible accounts based on the following estimates: Council reported net credit sales of $20,000,000 for the current y

> Anche Company has organized its accounts receivable by customer and how long each receivable has been outstanding. Anche records bad debt expense based on an analysis of an aged schedule. The following information is as of the end of the year (December 3

> Cho Sportswear, Ltd. develops an aged schedule of accounts receivable at the end of each year. The company estimated an allowance for uncollectible accounts based on the following estimates: *The percentages are applied after a specific review of all

> Paulson Corporation provided the following account analyses for the current year: Required: Prepare the journal entry to record the bad debt provision at year-end assuming that Paulson estimates its uncollectible accounts at 5% of its ending accounts re

> The partial balance sheets of Williams Iron Works, Inc. follow: Additional Information: • Net credit sales for 2019 amounted to $9,350,000. • Cash collections for 2019 were $930,000. Required: a. Determine the amo

> Seramin Importers, Inc. sells coffee pots for $80 each. On November 12, the company sold 35 to a customer on account with terms of 1/15, n/30. The customer paid for 25 of the coffee pots on November 27 and paid for the remaining 10 on December 11. Requi

> Accounts receivable disclosures from Exhibit 9.8 in the text and the following information, answer the questions. Required: a. How is the carrying value of accounts receivable determined? b. What factors influence management’s judgmen

> Using the transactions listed in P9-9, prepare a partial balance sheet at December 31 and a partial income statement for the current year Data from P9-9:

> Gem Consulting established a $500 imprest petty cash fund at the beginning of the year. The fund custodian held the cash to be used to pay minor expenditures. During the year, the custodian paid the following expenditures from the petty cash fund: Meal

> Prepare the journal entries required to record the following transactions on the books of Sullivan Stamping Company (assume that the company uses the allowance method). Required: a. Writes off an account from Stewart Foods in the amount of $489,000. b.

> Pablo Products, Ltd. sells stuffed animals to local convenience stores and small pharmacy chains. All of Pablo’s sales are on consignment. The consignee receives a 15% commission for each product sold. Pablo completed the following cons

> Bernard Brothers Building (BBB) signed a contract for a fixed fee of $60,000 and used the completed-contract method to account for the contract. BBB provided the following information related to the contract. Required: a. Prepare the journal entries req

> Repeat the requirements of P8-9 assuming Wayne Computer Consultants uses the completed-contract method to report its long-term contracts. Data From P8-9:

> Wayne Computer Consultants, Incorporated develops and installs integrated computer systems and networks for large utilities. On January 2, 2018, the company signed a contract to deliver an electricity deployment system for a grid covering three New Engla

> Repeat the requirements of P8-7 assuming Bigelow Contractors uses the completed-contract method to report its long-term contracts. Additionally, compare the reported gross profit and net asset (liability) position reported under the percentage-of-complet

> Bigelow Contractors signed a contract to construct a storage facility for RGN Manufacturing, Inc. The fixed-fee contract specifies that the facility is to be completed in three years. Bigelow uses the percentage-of-completion method (cost-to-cost approac

> Nance Network Consultants, Incorporated uses the percentage-of completion method to account for its long-term contracts. It uses the cost-to-cost approach to measure progress. During the current year, Nance signed a contract to develop a computer network

> The transaction price must reflect the time value of money if: a. The vendor expects the period between customer payment and delivery of goods or services will be less than two years. b. The contract has a financing component that is significant to the c

> Telecom Co. enters into a two-year contract with a customer to provide wireless service (voice and data) for $40 per month. To induce customers, Telecom Co. provides a free phone. Telecom Co. normally sells the phone on a standalone basis for $200. Telec

> The following information pertains to Pewter Cup Company at August 30. Prepare the bank reconciliation for Pewter Cup by determining the correct balances for both book and bank. Prepare any required journal entries. 1. Cash balance per bank, $769 2. Au

> A performance obligation is: a. An enforceable promise in a contract with a customer to transfer a good or service to the customer. b. An offer to transfer a good or service to the customer. c. An expectation of a customer for the receipt of a good or se

> All of the following are elements of a contract except: a. The contract has commercial substance. b. The vendor can identify payment terms for the goods or services. c. It is not approved by both parties to the agreement. d. The vendor can identify each

> Pate paid $50,000 and gave a plot of undeveloped land with a carrying amount of $320,000 and a fair value of $450,000 to Bizzell Co. in exchange for a plot of undeveloped land with a fair value of $500,000. The land was carried on Bizzell’s books at $350

> Hi-Tech Corp. spent $300,000 on research and development to generate new product lines. Only one of the five product lines resulted in a patented item; the remaining four were considered unsuccessful. The cost of the product that was successfully patente

> Hi-Tech Corp. spent $300,000 on research and development to generate new product lines. Only one of the five product lines resulted in a patented item, and the remaining four were considered unsuccessful. Under U.S. GAAP, how much of the $300,000 should

> Visual Graphics Company sold a printing press for $74,000 on the last day of the reporting period. The printing press had a gross and net amount of $100,000 and $65,000, respectively, reflected on the balance sheet at that date. Which of the following is

> Lavery Company purchased a machine that was installed and placed in service on July 1, Year 1, at a cost of $240,000. Salvage value was estimated at $40,000. The machine is being depreciated over 10 years by the double-declining balance method. For the y

> On January 1, Year 1, Bluebird Inc. borrowed $10 million at a rate of 9% for 5 years and began construction of its new regional office building. Bluebird has no other debt. During Year 1, Bluebird’s weighted-average accumulated construction expenditures

> On June 30, Year 1, Bluebird Inc. purchased a $750,000 tract of land for a new regional office. Costs related to purchasing the property and preparing the land for construction included: In its December 30, Year 1, balance sheet, Boyd should report a ba

> The following information pertains to Silver Key Company. Prepare the bank reconciliation at July 31 by determining the correct balances for both book and bank using the following template. Prepare any required journal entries.

> On March 1, Year 1, LuxWear Inc. had beginning inventory and purchases at cost of $50,000 and $20,000, respectively. The beginning inventory and purchases had a retail value of $75,000 and $30,000, respectively. The company had sales of $60,000, as well

> . The Loyd Company had 150 units of product Omega on hand at December 1, Year 1, costing $400 each. Purchases of product Omega during December were as follows: Sales during December were 500 units on December 30. Assume that a perpetual inventory system

> The Loyd Company had 150 units of product Omega on hand at December 1, Year 1, costing $400 each. Purchases of product Omega during December were as follows: Sales during December were 500 units on December 30. Assume that a perpetual inventory system i

> Simmons, Inc. uses the lower-of-cost-or-market method to value its inventory that is accounted for using the FIFO method. Data regarding an item in its inventory is as follows: What is the lower-of-cost-or-market method for this item? a. $18 b. $26 c.

> Simmons, Inc. uses the lower-of-cost-or-market method to value its inventory that is accounted for using the LIFO method. Data regarding an item in its inventory is as follows: What is the lower of cost or market for this item? a. $21 b. $20 c. $28

> The Loyd Company had 150 units of product Omega on hand at December 1, Year 1, costing $400 each. Purchases of product Omega during December were as follows: Sales during December were 500 units on December 30. Assume that a perpetual inventory system i

> Giddens Company adopted the dollar-value LIFO inventory method on December 31, Year 1. On December 31, Year 1, Giddens’ inventory was in a single inventory pool and was valued at $400,000 under the dollar value LIFO method. Inventory da

> Which of the following disclosures about accounts receivable are required? I. Accounts receivable serving as collateral II. The percentage used to calculate allowance for doubtful accounts III. Total allowance for doubtful accounts. a. I only b. I and I

> On November 30, Year 1, Derin Corporation agreed with its customers to change accounts receivable to notes receivable in order to allow a longer payment period. The terms of the note’s receivable are that the principal is due on Novembe

> Stanberry Company sold $500,000 of net accounts receivable to Cork Company for $450,000. The receivables were sold outright on a without recourse basis, and Stanberry Company retained no control over the receivables. The journal entries to record the sal

> Hanna Lighting recently transferred $60,000 of electrical supplies to Goshen Super markets on consignment. The retail price of the supplies is $81,000. Hanna offers its consignees a 25% fee on the retail price of the inventory sold. Hanna shipped the sup

> On its December 31, Year 2, balance sheet, Red Rock Candle Company reported accounts receivable of $855,000 net of an allowance for doubtful accounts of $45,000. On December 31, Year 3, Red Rock’s balance sheet showed gross accounts receivable of $922,00

> Fernandez Company had an accounts receivable balance of $150,000 on December 31, Year 2, and $175,000 on December 31, Year 3. The company wrote off $40,000 of accounts receivable during Year 3. Sales for Year 3 totaled $600,000, and all sales were on acc

> The following are held by YRT Corporation at December 31, Year 1: Cash in checking account $15,000 Petty cash 250 Check from customer dated 01/31/Year 2 350 3-month certificate of deposit, due 01/15/Year 2 40,000 12-month certificate of deposit, due 02/2

> Disclosures for annual periods of public companies must include all but which of the following with respect to contracts with customers? a. Identification of the top five largest customers. b. Disaggregation of reported revenues. c. Explanations of chan

> Assume a retailer sells 10 widgets for $2,000 each. The widgets cost $100 and the sale includes a return right for 90 days. The retailer determines that the probability of returns associated with sales of the widgets is 10% based on prior customer behavi

> All of the following are indicators that the vendor is acting as an agent instead of as a principal except: a. The other party is primarily responsible for fulfilling the contract. b. The vendor has latitude in establishing prices for the other party’s g

> During Year 1, Meriwether Construction Company started a construction job with a contract price of $3,000,000. The job was completed in Year 2, and the company uses the percentage of completion method. The following information is available for Year 1 an

> Which of the following indicators is not considered when determining whether performance obligations are satisfied at a point in time? a. The vendor has a present right to payment for the asset. b. The customer is likely to reject delivery of the asset.

> When allocating the transaction price to separate performance obligations, one must determine the standalone selling price of the goods or services. Which of the following is not an estimation method for determining the standalone selling price? a. Adjus

> Items that may cause variable consideration include: a. Discounts. b. An hourly rate for services. c. A fixed fee. d. A retainer.

> Historically, about 5% of the merchandise that Thompson Tools, Inc. sells is returned. In the month of March, Thompson Tools sold merchandise costing $546,000 to customers for $712,000. The company uses a perpetual inventory system and all sales are on a

> Shifty Beaver Transmission Company enters into a contract with a major U.S. auto manufacturer to design and produce four-speed transmissions for small SUVs. Under the terms of the contract, Shifty Beaver will deliver the transmission immediately, but the

> Skivoso Incorporated owns and operates high-priced ski resorts in Europe. Skivoso recently entered into a contract to provide lodging for several corporate events and conferences sponsored by JeffCo for a total fee of $10,000,000. JeffCo agreed to additi

> King Rat Pest Control, Incorporated was recently hired to exterminate pests in an office complex for $300,000. King Rat will receive an additional $10,000 based on the success of the extermination. The additional $10,000 will be paid in full if the exter

> Show now Film Company grants a customer the rights to broadcast three films under a single licensing agreement. The arrangement includes a fixed fee of $90,000. The arrangement provides for an even reduction in the film license fee if the third film is n

> Pagit Inc, a software development company, enters into a contract with Plato Company to provide computer and hosting services. Pagit will provide a hosted accounting software system that requires Plato to purchase hardware from Pagit. Plato also purchase

> Assume that the project in E11-8 was not completed in Year 1. Yawyag was required to make two additional payments to the contractor in Year 2: $900,000 on April 1 and $1,800,000 on August 1 of Year 2. On January 2 of Year 2, Yawyag was required to take o

> Yawyag Corporation engaged Sir Peter, Inc. to design and construct a manufacturing facility. Construction began on January 2 and was completed on December 31 of the current year. The following payments were made to the contractor during the year: To spec

> How would the solution to E11-6 change if Rolling Blackout Power Company was an IFRS reporter and earned $11,000 interest income on investing the excess funds from the construction loan during the year? Prepare the journal entry to record the cash intere

> Rolling Blackout Power Company constructed a new power plant to supply energy to the Northeast Electrical Grid. The construction began on January 2 and ended on December 31 of the current year. On the date of completion, the plant had a total cost of $8,

> Quartech Enterprises manufactures and distributes thermostats for major kitchen appliances. At the beginning of the current year, Quartech decided to expand its operations by acquiring a metal soldering machine. The machine is to be produced by the manuf

> Using the information provided in BE8-21, prepare the journal entry to record $5,000 of actual sales returns within one year after revenue was recognized by Botti Data From BE8-21: Botti Incorporated manufactures and sells professional ski equipment. Bo

> Spill Oil Corporation drilled 10 oil wells at the beginning of the current year. The total exploration costs associated with this oil and gas activity amounted to $8,500,000. Only six of the wells were producing; the remaining wells are dry or nonproduct

> Repeat the requirements in E11-40 assuming that FFC uses the successful-efforts method. Data from E11-40: a. Determine the total cost of the natural resource under the full-cost method. b. Prepare the journal entries to record the acquisition of the na

> Ferro Fuel Company (FFC) acquired a tract of land to be used for oil and gas exploration at the beginning of the current year. FFC paid $500,000 to acquire the land, paid $325,000 in development costs, and incurred $130,000 in exploration and evaluation

> On December 31, 2018, the Clearwater Corporation acquired a custom-made plant asset by issuing a promissory note with a face value of $750,000, a due date of December 31, 2023, and a stated (coupon) rate of interest of 2%. Interest is compounded annually

> Assume that Sebastian Company from E11-38 reports under IFRS. Prepare the journal entry to record the exchange on the books of Sebastian Company. Data from E11-38: Brown Company contracts with Sebastian Company to exchange refrigerated trucks. Brown Com

> Brown Company contracts with Sebastian Company to exchange refrigerated trucks. Brown Company will trade three SMC trucks for four DROF trucks owned by Sebastian Company. The DROF refrigerated trucks have a cost of $100,000 and accumulated depreciation u

> Brown Company contracts with Sebastian Company to exchange refrigerated trucks. Brown Company will trade three SMC trucks for four DROF trucks owned by Sebastian Company. The trucks are approximately the same age and have the same remaining useful lives.

> Clarke Company traded a used mixing machine for a new model. The used machine has a book value of $11,000 (cost $32,000 less $21,000 accumulated depreciation) and a fair market value of $8,000. The new mixing machine has a list price or fair value of $31

> Clayton Company exchanged a used machine with a book value of $26,000 (cost $54,000 less $28,000 accumulated depreciation) and cash of $8,000 for a delivery truck. The machine is estimated to have a fair market value of $36,000. The cash flows related to

> Doris Company traded a tract of land to Rick’s Real Estate for a similar tract of land with no significant effect on future cash flows. The old land had a carrying value of $6,500,000. The land was appraised for $9,000,000. As part of the exchange, Doris

> Botti Incorporated manufactures and sells professional ski equipment. Botti offers a money-back guarantee for one year after the date of purchase. Cash sales for the current year amounted to $620,000. Botti estimates that 5% of all sales are returned wit

> Mercurial Company traded its cutting equipment for the newer air-cooled equipment manufactured by Broad Street Corporation. The air-cooled equipment will increase Mercurial’s productivity. The old equipment had a book value of $140,000 (cost of $700,000

> Assume that the Ecara Video Game Company reports under IFRS. Repeat the requirement of E11-31, part (c). Data from E11-31: Prepare the journal entry for Ecara to record the exchange as if the exchange had lacked commercial substance.