Question: Horizontal analysis (trend analysis) percentages

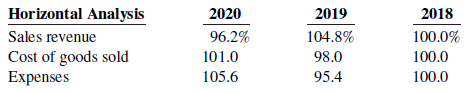

Horizontal analysis (trend analysis) percentages for Phoenix Company’s sales revenue, cost of goods sold, and expenses are listed here.

Explain whether Phoenix’s net income increased, decreased, or remained unchanged over the 3-year period.

Transcribed Image Text:

Horizontal Analysis 2020 2019 2018 Sales revenue 96.2% 104.8% 100.0% Cost of goods sold Expenses 101.0 98.0 100.0 105.6 95.4 100.0

> Torres Company accumulates the following summary data for the year ending December 31, 2020, for its Water Division, which it operates as a profit center: sales $2,000,000 budget, $2,080,000 actual; variable costs—$1,000,000 budget, $1,050,000 actual; an

> In the Assembly Department of Hannon Company, budgeted and actual manufacturing overhead costs for the month of April 2020 were as follows. All costs are controllable by the department manager. Prepare a responsibility report for April for the cost cen

> Data for Gundy Company are given in BE25.4. In March 2020, the company incurs the following costs in producing 100,000 units: direct materials $520,000, direct labor $596,000, and variable overhead $805,000. Actual fixed costs were equal to budgeted fixe

> Sterling, Inc. reports the following financial information for its sports clothing segment. Average operating assets ………………………………. $3,000,000 Controllable margin ………………………………………… $ 630,000 Minimum rate of return ………………………………………….. 10% Compute the retur

> Data for the investment centers for Gerrard Company are given in BE25.9. The centers expect the following changes in the next year: (I) increase sales 15%, (II) decrease costs $400,000, and (III) decrease average operating assets $500,000. Compute the

> For the quarter ended March 31, 2020, Croix Company accumulates the following sales data for its newest guitar, The Edge: $315,000 budget; $305,000 actual. Prepare a static budget report for the quarter.

> Kaspar Industries expects credit sales for January, February, and March to be $220,000, $260,000, and $300,000, respectively. It is expected that 75% of the sales will be collected in the month of sale, and 25% will be collected in the following month. C

> Using the information in P26.2A, compute the overhead controllable variance and the overhead volume variance. Data from P26.2: Ayala Corporation accumulates the following data relative to jobs started and finished during the month of June 2020. Overhe

> North Company has completed all of its operating budgets. The sales budget for the year shows 50,000 units and total sales of $2,250,000. The total unit cost of making one unit of sales is $25. Selling and administrative expenses are expected to be $300,

> Elbert Company classifies its selling and administrative expense budget into variable and fixed components. Variable expenses are expected to be $24,000 in the first quarter, and $4,000 increments are expected in the remaining quarters of 2020. Fixed exp

> For Roche Inc., variable manufacturing overhead costs are expected to be $20,000 in the first quarter of 2020, with $5,000 increments in each of the remaining three quarters. Fixed overhead costs are estimated to be $40,000 in each quarter. Prepare the m

> For Gundy Company, units to be produced are 5,000 in quarter 1 and 7,000 in quarter 2. It takes 1.6 hours to make a finished unit, and the expected hourly wage rate is $15 per hour. Prepare a direct labor budget by quarters for the 6 months ending June 3

> Perine Company has 2,000 pounds of raw materials in its December 31, 2019, ending inventory. Required production for January and February of 2020 are 4,000 and 5,000 units, respectively. Two pounds of raw materials are needed for each unit, and the estim

> Sales budget data for Paige Company are given in BE24.2. Management desires to have an ending finished goods inventory equal to 25% of the next quarter’s expected unit sales. Prepare a production budget by quarters for the first 6 months of 2020. Data f

> Paige Company estimates that unit sales will be 10,000 in quarter 1, 14,000 in quarter 2, 15,000 in quarter 3, and 18,000 in quarter 4. Using a sales price of $70 per unit, prepare the sales budget by quarters for the year ending December 31, 2020.

> For Astoria Company, actual sales are $1,000,000, and break-even sales are $800,000. Compute (a) the margin of safety in dollars and (b) the margin of safety ratio.

> For Flynn Company, variable costs are 70% of sales, and fixed costs are $195,000. Management’s net income goal is $75,000. Compute the required sales in dollars needed to achieve management’s target net income of $75,000. (Use the contribution margin app

> Maris Company uses the following budgets: balance sheet, capital expenditure, cash, direct labor, direct materials, income statement, manufacturing overhead, production, sales, and selling and administrative expense. Prepare a diagram of the interrelatio

> Using the information in P26.1A, compute the overhead controllable variance and the overhead volume variance. Data from P26.1: Rogen Corporation manufactures a single product. The standard cost per unit of product is shown below. Direct materials—1 pou

> Presto Corp. had total variable costs of $180,000, total fixed costs of $110,000, and total revenues of $300,000. Compute the required sales in dollars to break even.

> Production costs chargeable to the Finishing Department in June in Hollins Company are materials $12,000, labor $29,500, and overhead $18,000. Equivalent units of production are materials 20,000 and conversion costs 19,000. Compute the unit costs for mat

> Russell Inc. had sales of $2,200,000 for the first quarter of 2020. In making the sales, the company incurred the following costs and expenses. Prepare a CVP income statement for the quarter ended March 31, 2020. Variable Fixed $440,000 Cost of goo

> In Mordica Company, total materials costs are $33,000, and total conversion costs are $54,000. Equivalent units of production are materials 10,000 and conversion costs 12,000. Compute the unit costs for materials, conversion costs, and total manufacturin

> Markowis Corp. has collected the following data concerning its maintenance costs for the past 6 months. Compute the variable- and fixed-cost elements using the high-low method. Units Produced Total Cost 18,000 32,000 $36,000 July August September 4

> Factory labor data for Dieker Company is given in BE20.2. During January, time tickets show that the factory labor of $6,000 was used as follows: Job 1 $2,200, Job 2 $1,600, Job 3 $1,400, and general factory use $800. Prepare a summary journal entry to r

> For Wesland Company, a mixed cost is $15,000 plus $18 per direct labor hour. Diagram the behavior of the cost using increments of 500 hours up to 2,500 hours on the horizontal axis and increments of $15,000 up to $60,000 on the vertical axis.

> Data for Warner Company are given in BE21.1. Supporting records show that (a) the Assembly Department used $24,000 of the raw materials and $35,000 of the factory labor, and (b) the Finishing Department used the remainder. Journalize the assignment of th

> Monthly production costs in Dilts Company for two levels of production are as follows. Indicate which costs are variable, fixed, and mixed, and give the reason for each answer. Cost 2,000 Units 4,000 Units Indirect labor $10,000 $20,000 Supervisory

> Data for Hollins Company are given in BE21.8. Production records indicate that 18,000 units were transferred out, and 2,000 units in ending work in process were 50% complete as to conversion costs and 100% complete as to materials. Prepare a cost reconci

> Jorgensen Corporation uses standard costs with its job order cost accounting system. In January, an order (Job No. 12) for 1,900 units of Product B was received. The standard cost of one unit of Product B is as follows. Normal capacity for the month wa

> The executive team at Current Designs has gathered to evaluate the company’s operations for the last month. One of the topics on the agenda is the special order from Huegel Hollow, which was presented in CD2. Recall that Current Designs had a special ord

> During the first quarter, Francum Company incurs the following direct labor costs: January $40,000, February $30,000, and March $50,000. For each month, prepare the entry to assign overhead to production using a predetermined rate of 70% of direct labor

> The Smelting Department of Kiner Company has the following production data for November. Beginning work in process 2,000 units that are 100% complete as to materials and 20% complete as to conversion costs; units transferred out 9,000 units; and ending w

> Factory labor data for Warner Company are given in BE21.2. Manufacturing overhead is assigned to departments on the basis of 160% of labor costs. Journalize the assignment of overhead to the Assembly and Finishing Departments.

> Staples, Inc. is one of the largest suppliers of office products in the United States. Suppose it had net income of $738.7 million and sales of $24,275.5 million in 2020. Its total assets were $13,073.1 million at the beginning of the year and $13,717.3

> The following data were taken from the income statements of Mydorf Company. a. Compute for each year (1) the inventory turnover and (2) days in inventory. b. What conclusions concerning the management of the inventory can be drawn from these data?

> Using the data in BE21.10, prepare the cost section of the production cost report for Pix Company using the FIFO approach. Data from BE21.10: Pix Company has the following production data for March: no beginning work in process, units started and comple

> Pix Company has the following production data for March: no beginning work in process, units started and completed 30,000, and ending work in process 5,000 units that are 100% complete for materials and 40% complete for conversion costs. Pix uses the FIF

> Warner Company purchases $50,000 of raw materials on account, and it incurs $60,000 of factory labor costs. Journalize the two transactions on March 31, assuming the labor costs are not paid until April.

> Ruiz Engineering Contractors incurred service salaries and wages of $36,000 ($28,000 direct and $8,000 indirect) on an engineering project. The company applies overhead at a rate of 25% of direct labor. Record the entries to assign service salaries and

> In alphabetical order below are current asset items for Roland Company’s balance sheet at December 31, 2020. Prepare the current assets section (including a complete heading). Accounts receivable ………………………………………………… $200,000 Cash ……………………………………………………………

> Coolplay Corp. is thinking about opening a soccer camp in southern California. To start the camp, Coolplay would need to purchase land and build four soccer fields and a sleeping and dining facility to house 150 soccer players. Each year, the camp would

> Presented below are Rook Company’s monthly manufacturing cost data related to its tablet computer product. a. Utilities for manufacturing equipment $116,000 b. Raw materials (CPU, chips, etc.) $ 85,000 c. Depreciation on manufacturing b

> Data pertaining to job cost sheets for Dieker Company are given in BE20.3 and BE20.4. Prepare the job cost sheets for each of the three jobs using the format shown in Illustration 20.8. Data from BE20.3: In January, Dieker Company requisitions raw mate

> In January, Dieker Company requisitions raw materials for production as follows: Job 1 $900, Job 2 $1,200, Job 3 $700, and general factory use $600. Prepare a summary journal entry to record raw materials used.

> During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: raw materials purchased $4,000 on account, factory labor incurred $6,000 of which $5,200 relates to factory wages payable and $800 relates to pay

> The following data are taken from the financial statements of Colby Company. a. Compute for each year (1) the accounts receivable turnover and (2) the average collection period. At the end of 2018, accounts receivable was $520,000. b. What conclusions

> Use the same data from BE19.9 above and the data below. Determine the missing amounts. Data from BE19.9: Presented below are incomplete manufacturing cost data. Determine the missing amounts for three different situations. Total Work Work Cost of

> Dieker Company begins operations on January 1. Because all work is done to customer specifications, the company decides to use a job order cost system. Prepare a flowchart of a typical job order system with arrows showing the flow of costs. Identify the

> Francum Company has the following data: direct labor $209,000, direct materials used $180,000, total manufacturing overhead $208,000, and beginning work in process $25,000. Compute (a) total manufacturing costs and (b) total cost of work in process.

> Identify whether each of the following costs should be classified as product costs or period costs. a. Manufacturing overhead. b. Selling expenses. c. Administrative expenses. d. Advertising expenses. e. Direct labor. f. Direct materials.

> Using these data from the comparative balance sheet of Rollaird Company, perform horizontal analysis. December 31, 2020 December 31, 2019 $ 400,000 Accounts receivable Inventory Total assets $ 460,000 780,000 650,000 3,164,000 2,800,000

> On January 1, 2020, Bryce Inc. changed from the LIFO method of inventory pricing to the FIFO method. Explain how this change in accounting principle should be treated in the company’s financial statements.

> On August 1, Shaw Company buys 1,000 shares of Estrada common stock for $37,000 cash. On December 1, Shaw sells the stock investments for $40,000 in cash. Journalize the purchase and sale of the common stock.

> Each of the items below must be considered in preparing a statement of cash flows for Baskerville Co. for the year ended December 31, 2020. For each item, state how it should be shown in the statement of cash flows for 2020 if the indirect method is used

> Vertical analysis (common-size) percentages for Palau Company’s sales revenue, cost of goods sold, and expenses are as follows. Did Palau’s net income as a percent of sales increase, decrease, or remain unchanged ove

> If Coho Company had net income of $382,800 in 2020 and it experienced a 16% increase in net income over 2019, what was its 2019 net income?

> Net income was $500,000 in 2018, $485,000 in 2019, and $518,400 in 2020. What is the percentage of change from (a) 2018 to 2019, and (b) from 2019 to 2020? Is the change an increase or a decrease?

> Using the data presented in BE18.4 for Rollaird Company, perform vertical analysis. Data from BE18.4: December 31, 2020 December 31, 2019 $ 400,000 Accounts receivable Inventory Total assets $ 460,000 780,000 650,000 3,164,000 2,800,000

> Suppose these selected condensed data are taken from recent balance sheets of Bob Evans Farms (in thousands). Compute the current ratio for each year and comment on your results. 2020 2019 Cash $ 13,606 $ 7,669 Accounts receivable 23,045 31,087 19,

> Hinck Corporation reported net cash provided by operating activities of $360,000, net cash used by investing activities of $250,000 (including cash spent for capital assets of $200,000), and net cash provided by financing activities of $70,000. Dividends

> Assume that during 2020, Cypress Semiconductor Corporation reported net cash provided by operating activities of $155,793,000, net cash used in investing activities of $207,826,000 (including cash spent for plant assets of $132,280,000), and net cash use

> The T-accounts for Equipment and the related Accumulated Depreciation—Equipment for Luo Company at the end of 2020 are shown here. In addition, Luo’s income statement reported a loss on the disposal of plant assets o

> The comparative balance sheets for Montalvo Company show these changes in noncash current asset accounts: accounts receivable decrease $80,000, prepaid expenses increase $28,000, and inventories increase $30,000. Compute net cash provided by operating ac

> The net income for Metz Co. for 2020 was $280,000. For 2020, depreciation on plant assets was $70,000, and the company incurred a loss on disposal of plant assets of $12,000. Compute net cash provided by operating activities under the indirect method, as

> Telfer, Inc. reported net income of $2.8 million in 2020. Depreciation for the year was $160,000, accounts receivable decreased $350,000, and accounts payable decreased $280,000. Compute net cash provided by operating activities using the indirect method

> The following T-account is a summary of the Cash account of Cuellar Company. What amount of net cash provided (used) by financing activities should be reported in the statement of cash flows? Cash (Summary Form) Balance, Jan. 1 8,000 Receipts from

> During the year, prepaid expenses decreased $5,600, and accrued expenses increased $2,400. Indicate how the changes in prepaid expenses and accrued expenses payable should be entered in the reconciling columns of a worksheet. Assume that beginning balanc

> Howell Corporation reported income tax expense of $340,000,000 on its 2020 income statement and income taxes payable of $297,000,000 at December 31, 2019, and $522,000,000 at December 31, 2020. What amount of cash payments were made for income taxes duri

> Suppose Columbia Sportswear Company had accounts receivable of $206,024,000 at the beginning of a recent year, and $267,653,000 at year-end. Sales revenue was $1,095,307,000 for the year. What is the amount of cash receipts from customers?

> The management of Morrow Inc. is trying to decide whether it can increase its dividend. During the current year, it reported net income of $875,000. It had net cash provided by operating activities of $734,000, paid cash dividends of $70,000, and had cap

> Suppose in a recent quarter, Alliance Atlantis Communications Inc. reported net cash provided by operating activities of $45,600,000 and revenues of $264,800,000. Cash spent on plant asset additions during the quarter was $1,600,000. No dividends were pa

> Christina Corporation purchased 400 shares of Nolan Inc. common stock for $13,200 (Christina does not have significant influence). During the year, Nolan paid a cash dividend of $3.25 per share. At year-end, Nolan stock was selling for $34.50 per share.

> Financial Statement Kruger Corporation has the following long-term investments. (1) Common stock of Eidman Co. (10% ownership), cost $108,000, fair value $115,000. (2) Common stock of Pickerill Inc. (30% ownership), cost $210,000, equity $260,000. (3) De

> Financial Statement For the data presented in BE16.6, show the financial statement presentation of the securities and related accounts. Assume the securities are noncurrent. Data from BE16.6: In its first year of operations, Godfrey Corporation purchase

> In its first year of operations, Godfrey Corporation purchased, as a long-term investment, available-for-sale debt securities costing $72,000. At December 31, 2020, the fair value of the securities is $68,000. Prepare the adjusting entry to record the se

> Financial Statement For the data presented in BE16.4, show the financial statement presentation of the trading securities and related accounts. Data from BE16.4: The cost of the trading debt securities of Munoz Company at December 31, 2020, is $64,000.

> The cost of the trading debt securities of Munoz Company at December 31, 2020, is $64,000. At December 31, 2020, the fair value of the securities is $59,000. Prepare the adjusting entry to record the securities at fair value.

> Noler Company owns 25% of Lauer Company. For the current year, Lauer reports net income of $180,000 and declares and pays a $50,000 cash dividend. Record Noler’s equity in Lauer’s net income and the receipt of dividends from Lauer.

> Randle Inc. issues $300,000, 10-year, 8% bonds at 98. Prepare the journal entry to record the sale of these bonds on March 1, 2020.

> Writing Presented below is the partial bond discount amortization schedule for Gomez Corp. Gomez uses the effective-interest method of amortization. a. Prepare the journal entry to record the payment of interest and the discount amortization at the end

> Golden Inc. issues $4 million, 5-year, 10% bonds at 102, with interest payable annually on January 1. The straight-line method is used to amortize bond premium. a. Prepare the journal entry to record the sale of these bonds on January 1, 2020. b. Prepare

> Sweetwood Company issues $5 million, 10-year, 9% bonds at 96, with interest payable annually on January 1. The straight-line method is used to amortize bond discount. a. Prepare the journal entry to record the sale of these bonds on January 1, 2020. b. P

> Imhoff Company leases a new building from Noble Construction, Inc. The present value of the lease payments is $700,000. The lease is a finance lease. Prepare the journal entry that the lessee should make to record this transaction.

> Detroit Company has a stock portfolio valued at $6,000. Its cost was $4,000. If the Fair Value Adjustment account has a debit balance of $300, prepare the journal entry at year-end.

> Ownbey Corporation purchased debt investments for $52,000 on January 1, 2020. On July 1, 2020, Ownbey received cash interest of $2,340. Journalize the purchase and the receipt of interest. Assume that no interest has been accrued.

> State whether each of the following statements is true or false. If false, indicate how to correct the statement. _____ 1. Mortgage bonds and sinking fund bonds are both examples of debenture bonds. _____ 2. Convertible bonds are also known as callable b

> Tropic Zone Corporation experienced the following variances: materials price $350 U, materials quantity $1,700 F, labor price $800 F, labor quantity $500 F, and total overhead $1,200 U. Sales revenue was $92,100, and cost of goods sold (at standard) was

> The Rockies Division operates as a profit center. It reports the following for the year ending December 31, 2020. Prepare a responsibility report for the Rockies Division at December 31, 2020. Budget Actual Sales $2,000,000 $1,890,000 760,000 550,0

> In Pargo Company’s flexible budget graph, the fixed cost line and the total budgeted cost line intersect the vertical axis at $90,000. The total budgeted cost line is $350,000 at an activity level of 50,000 direct labor hours. Compute total budgeted cost

> Larkin Company accumulated the following standard cost data concerning product I-Tal. Direct materials per unit: 2 pounds at $5 per pound Direct labor per unit: 0.2 hours at $16 per hour Manufacturing overhead: Allocated based on direct labor hours at a

> The service division of Raney Industries reported the following results for 2020. Sales ………………………………. $500,000 Variable costs …………………… 300,000 Controllable fixed costs ……… 75,000 Average operating assets …. 625,000 Management is considering the followi

> Wade Company estimates that it will produce 6,000 units of product IOA during the current month. Budgeted variable manufacturing costs per unit are direct materials $7, direct labor $13, and overhead $18. Monthly budgeted fixed manufacturing overhead cos

> Snow Cap Company has a unit selling price of $250, variable costs per unit of $170, and fixed costs of $160,000. Compute the break-even point in units using (a) the mathematical equation and (b) unit contribution margin.

> Cedar Grove Industries produces and sells a cell phone-operated home security control. Information regarding the costs and sales of security controls during May 2020 are provided below. Unit selling price of security control ………………………………………….. $45 Unit v

> Summary financial information for Gandaulf Company is as follows. Compute the amount and percentage changes in 2020 using horizontal analysis, assuming 2019 is the base year. Dec. 31, 2020 Dec. 31, 2019 Current assets $ 200,000 $ 220,000 Plant asse

> Amanda Company reports the following total costs at two levels of production. Classify each cost as variable, fixed, or mixed. 5,000 Units 10,000 Units Indirect labor $ 3,000 $ 6,000 Property taxes 7,000 7,000 56,000 Direct labor 28,000 Direct mate

> Huebner Corporation leases new equipment for 10 years on December 31, 2020. The present value of the lease payments is $192,000. After recording this lease, Huebner has assets of $1,800,000, liabilities of $1,100,000, and stockholders’ equity of $700,000

> The condensed financial statements of Murawski Company for the years 2019 and 2020 are presented as follows. (Amounts in thousands.) Compute the following ratios for 2020 and 2019. a. Current ratio. b. Inventory turnover. (Inventory on 12/31/18 was $3

> During the current month, Wacholz Company incurs the following manufacturing costs. a. Purchased raw materials of $18,000 on account. b. Incurred factory labor of $40,000. Of that amount, $31,000 relates to wages payable and $9,000 relates to payroll tax