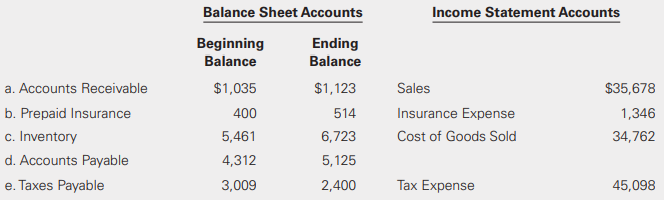

Question: Identify and compute the cash flow related

Identify and compute the cash flow related to each item on the following income statement. Use the direct method.

> Place the performance measures in the order in which they are commonly presented on the statement of net income. • Earnings per Share • Gross profit • Income from Continuing Operations • Net Income • Operating Income

> Bowe Company provided the following list of accounts. Prepare a classified balance sheet using the report format.

> Using the information provided in BE6-6, prepare a classified balance sheet using the account format. Data From BE6-6:

> Martell Manufacturing Incorporated provided the following list of account balances for the current year ended December 31. Prepare a classified balance sheet for the current year using the report format.

> Armstrong Associates provided the following balance sheet for its current year ended December 31. The following account analyses were made during the company’s recent year-end audit. Required: Prepare a corrected classified balance she

> Classify the following accounts as current assets, noncurrent assets, current liabilities, noncurrent liabilities, or stockholders’ equity.

> Classify the following accounts as current assets, noncurrent assets, current liabilities, noncurrent liabilities, contributed capital, or accumulated other comprehensive income.

> The Firefly Company is preparing its annual financial statements and needs to identify all its related parties. Which of the following would be related parties of the Firefly Company?

> The Junebug Corporation is preparing its annual financial statements and needs to determine which of the following events are subsequent events. If the event is a subsequent event, identify whether it should be recognized or disclosed in the financial st

> Complete the following financial statement articulation exercises. a. If net income is $40,000 and comprehensive income is $32,000, what is other comprehensive income (loss)? b. If ending retained earnings is $76,000, beginning retained earnings is $42,0

> List and explain the three primary disadvantages of the statement of financial position.

> Identify each of the earnings items as primarily permanent or transitory in nature.

> Identify whether each of the following items is added or subtracted from net income to compute cash flows from operating activities under the indirect method.

> A list of cash receipts and cash payments for Tucson Telecommunications follows. Compute cash flows from operating activities under the direct reporting format.

> A list of cash receipts and cash payments for Bexis Communications follows. Classify each amount as operating, investing, or financing, assuming that Bexis Communications reports under IFRS. Use the direct method.

> A list of cash receipts and cash payments for Axis Communications follows. Classify each amount as operating, investing, or financing, assuming that Axis Communications reports under IFRS. Use the direct method.

> A list of cash receipts and cash payments for Mexis Communications follows. Classify each amount as operating, investing, or financing, assuming that Mexis Communications reports under IFRS. Use the direct method.

> A list of cash receipts and cash payments for Exis Communications follows. Classify each amount as operating, investing, or financing, assuming that Exis Communications reports under IFRS. Use the direct method.

> A list of cash receipts and cash payments for Bexis Communications follows. Classify each amount as operating, investing, or financing. Use the direct method.

> A list of cash receipts and cash payments for Axis Communications follows. Classify each amount as operating, investing, or financing. Use the direct method.

> A list of cash receipts and cash payments for Mexis Communications follows. Classify each amount as operating, investing, or financing. Use the direct method.

> A list of cash receipts and cash payments for Exis Communications follows. Classify each amount as operating, investing, or financing. Use the direct method.

> Match the item with the advantages and disadvantages of the income statements.

> List and explain the three primary advantages of the statement of financial position.

> Green Grasshopper Incorporated is interested in assessing the following scenarios on its indicators of liquidity, solvency, and profitability. Solve each scenario independently. a. Green Grasshopper’s debt-to-equity ratio is 40%. It is considering issuin

> Identify whether the following measures are indicators of liquidity, solvency, or profitability.

> Can the terms net income and comprehensive income be used interchangeably? Explain.

> Use the information from BE6-25 to compute the net cash flow from operating activities for Tennis Emporium under the direct reporting format. Data From BE6-25:

> In what way is the income statement useful for financial statement users?

> What are the three limitations of the income statement?

> Is it possible to convert a present value of an ordinary annuity table to the present value of an annuity due table? Explain.

> Is the present value of an ordinary annuity more valuable than an annuity due? Explain.

> Is it possible to convert the future value of an ordinary annuity table to the future value of an annuity due table? Explain.

> Can an ordinary annuity table be used to determine the present value of a three-year investment that pays $100 in the first year, $150 in the second, and $200 in the last year of the contract? Explain.

> What is the relation between the present value of an investment and time and interest rate? Explain.

> If interest is compounded more than once a year, will the effective interest rate be higher than the annual stated interest rate? Explain.

> Will an investor earn more if interest is compounded semiannually or if the investment pays only simple interest? Explain.

> What is interest? Explain

> Tennis Emporium provided the following information for the current year. Compute the net cash flow from operating activities for Tennis Emporium under the indirect reporting format.

> How do firms report assets on the balance sheet under IFRS?

> How do firms report assets on the balance sheet?

> Where is accumulated other comprehensive income reported on the financial statements? Why?

> When can a liability be classified as current?

> What items are included in cash and cash equivalents? How would financial statement preparers report these items on the balance sheet?

> What are the four major components of stockholders’ equity? Explain each component.

> What does a firm’s solvency measure?

> Explain the five different types of auditor’s opinions.

> What does it mean when an auditor issues an adverse opinion on the financial statements?

> What do auditors attest to in an audit report?

> What information is provided in the Management’s Discussion and Analysis section of the financial statements?

> How does the role of the FASB differ from that of the Securities and Exchange Commission with regard to the establishment of accounting standards?

> What is a related-party transaction? Why does the FASB require disclosure of related parties?

> Over what period must management assess the entity’s ability to continue as a going concern under IFRS?

> Over what period must management assess the entity’s ability to continue as a going concern under U.S. GAAP?

> How do firms report a material subsequent event on the financial statements?

> What does a firm’s liquidity measure?

> What is a subsequent event under IFRS?

> What is a subsequent event?

> What is included in the summary of significant accounting policies disclosure?

> Match each annual report section with its description. Annual report sections: a. Management’s discussion and analysis b. Auditors’ report c. Management’s responsibility for the financial statement

> Why are the notes to the financial statements an integral part of the financial statements?

> How is net income closed? Is the closing entry the same for other comprehensive income? Explain.

> What is financial statement articulation?

> What are the two formatting options for reporting the operating activities section of the statement of cash flows? Explain both formats.

> What is the purpose of the cash flow statement?

> Why is the cash flow statement useful to the users of the financial statements?

> What are the two main balance sheet formats? Explain both formats.

> What are the limitations of the balance sheet?

> Is it useful to compare working capital among companies in the same industry to determine relative liquidity? Explain.

> What does a high current ratio indicate about a company?

> Green Grasshopper Incorporated is interested in assessing the following scenarios on its indicators of profitability. Solve each scenario independently. a. Green Grasshopper has taken significant steps to decrease expenses and expects its net income to i

> What does the debt-to-equity ratio measure for a company?

> What are the two key measures of liquidity? Explain each measure.

> What is the difference between liquidity and solvency?

> Who is responsible for designing and implementing a company’s system of internal controls? Where is this policy stated?

> What information is included in the annual report letter written by managers of publicly traded companies?

> What is management’s responsibility for the financial statements?

> Where do auditors include their report on the effectiveness of a firm’s internal controls? Explain.

> How is a company’s profit margin calculated?

> Explain the difference between return on equity and return on assets.

> What defines a company’s profitability?

> Complete the following vertical analyses of Dragonfly Corporation’s income statement. What line item is the largest percent of sales in 2019? How has it changed from 2018 to 2019?

> What is the difference between vertical and horizontal analysis?

> What are comparative financial statements and why are they useful?

> Do auditors use financial statement analysis techniques? Explain.

> What is financial statement analysis?

> What accounts are summarized on the statement of stockholders’ equity?

> Are companies reporting under U.S. GAAP required to prepare a statement of stockholders’ equity? Explain.

> Can entities report other comprehensive income in the statement of stockholders’ equity? Explain.

> Is the presentation of comprehensive income identical under IFRS and U.S. GAAP? Explain Answer: U.S. GAAP and IFRS both allow the one statement or two consecutive statement approaches of reporting other comprehensive income. In the one-statement approa

> What two choices must companies make when reporting comprehensive income?

> Are items of other comprehensive income included in the computation of net income? Explain.

> Complete the following horizontal analyses of Dragonfly Corporation’s income statement. What was the largest percentage increase in expenses? What was the largest percentage decrease in expenses? What would explain the changes?

> Match the description with the advantages and disadvantages of the income statements.

> What items are included in net income?

> If Procter & Gamble sells its Fabric Care and Home Care business segment, would it account for the sale as a discontinued operation? Explain.

> Does a business segment qualify as a discontinued operation? Explain.

> Explain why operating income is an important measure of financial performance.

> What are the six key items to be reported on the statement of net income under IFRS? Must a company report operating income under IFRS?

> Is the presentation of the statement of net income under IFRS and U.S. GAAP identical? Explain.