Question: Identify the normal balance and type of

Identify the normal balance and type of account for the following. In identifying the normal balance, use “Dr†for debit or “Cr†for credit. The first one is done as an example.

> Susie’s Sweater Factory employs two managers for the factory. These managers work 12 hours per day at $16 per hour. After eight hours, they receive overtime pay. Management is trying to cut costs. They have decided to promote the managers to a salary pos

> Meri Medical Supplies estimates that its office employees will earn $175,000 next year and its factory employees will earn $600,000. The firm pays the following rates for workers’ compensation insurance: $0.60 per $100 of wages for the office employees a

> On January 31, AC Gourmet Shop prepared its Employer’s Annual Federal Unemployment Tax Return, Form 940. During the previous year, the business paid total wages of $462,150 to its 14 employees. Of this amount, $98,000 was subject to FUTA tax. Using a rat

> On April 30, Quality Furniture Company prepared its state unemployment tax return for the first quarter of the year. The firm had taxable wages of $85,000. Because of a favorable experience rating, Quality pays SUTA tax at a rate of 1.4 percent. How much

> At the end of the weekly payroll period on June 30, the payroll register of Known Consultants showed employee earnings of $50,000. Determine the firm’s payroll taxes for the period. Use a social security rate of 6.2 percent, Medicare rate of 1.45 percent

> Given the following scenario, choose the best answer. At the end of the quarter, the business owed $2,000 in total payroll taxes. The amount due must be deposited: a. on the last business day of the quarter. b. on the last day of the quarter. c. on the d

> On July 31, the payroll register for Red Company showed the following totals for the month: gross earnings, $38,950; social security tax, $2,414.90; Medicare tax, $564.78; income tax, $5,842.00; and net amount due, $30,128.32. Of the total earnings, $30,

> Private Investigations has two office employees. A summary of their earnings and the related taxes withheld from their pay for the week ending June 7, 20X1, follows. 1. Prepare the general journal entry to record the company’s payroll f

> 1. Why should managers check the amount spent for overtime? 2. The new controller for CAR Company, a manufacturing firm, has suggested to management that the business change from paying the factory employees in cash to paying them by check. What reasons

> Data about the marital status, withholding allowances, and weekly salaries of the four office workers at Ollie’s Office Supply Company follow. Use the tax tables in Figure 10.2 to find the amount of federal income tax to be deducted fro

> Using the earnings data given in Exercise 10.3, determine the amount of Medicare tax to be withheld from each employee’s gross pay for December. Assume a 1.45 percent Medicare tax rate and that all salaries and wages are subject to the tax.

> During one week, four production employees of Morgan Manufacturing Company worked the hours shown below. All these employees receive overtime pay at one and one-half times their regular hourly rate for any hours worked beyond 40 in a week. Determine the

> The hourly rates of four employees of European Enterprises follow, along with the hours that these employees worked during one week. Determine the gross earnings of each employee.

> After returning from a three-day business trip, the accountant for Southeast Sales, Johanna Estrada, checked bank activity in the company’s checking account online. The activity for the last three days follows. After matching these tran

> Flores Company received a bank statement showing a balance of $13,000 on November 30, 20X1. During the bank reconciliation process, Flores Company’s accountant noted the following bank errors: 1. A check for $153 issued by Flora, Inc., was mistakenly cha

> Venturi Office Supplies received a bank statement showing a balance of $73,047 as of March 31, 20X1. The firm’s records showed a book balance of $72,987 on March 31. The difference between the two balances was caused by the following items. Prepare a ban

> At Pleasonton Delivery and Courier Service, the following items were found to cause a difference between the bank statement and the firm’s records. Indicate whether each item will affect the bank balance or the book balance when the bank reconciliation s

> Johnson Corporation received a bank statement showing a balance of $15,900 as of October 31, 20X1. The firm’s records showed a book balance of $15,572 on October 31. The difference between the two balances was caused by the following items. Prepare the a

> You and four friends have decided to create a new service company called Unpacking for You. Your company unpacks for families once they have moved into a new house. Your business is primarily a cash business. Each family will pay you $100 for each room t

> On January 2, 20X1, The Orange Legal Clinic issued Check 2108 for $400 to establish a petty cash fund. Indicate how this transaction would be recorded in a general journal. Use 1 as the journal page number.

> Southern Gift Shop, a retail business, started business on April 29, 20X1. It keeps a $300 change fund in its cash register. The cash receipts for the period from April 29 to April 30, 20X1, are shown below. Record the cash receipts on April 29 and April

> 1. Use the final balances of the vendor accounts after completing Exercise 8.8 to prepare a schedule of accounts payable for GeekAuto Supplies, Inc., as of January 31, 20X1. 2. Does the total of your accounts payable schedule agree with the balance of th

> Post the entries in the general journal below to the accounts payable account in the general ledger and to the appropriate accounts in the accounts payable ledger. Assume the following account balances at January 1, 20X1, for GeekAuto Supplies, Inc.: Use

> On June 30 the general ledger of Kisling, Inc., had the following balances:

> Bae Company (buyer) and Johnson, Inc. (seller), engaged in the following transactions during February 20X1: Journalize the transactions above in a general journal for both Bae Company and Johnson, Inc. Use 20 as the journal page for both companies.

> Record the following transactions of LeCoz Fashions:

> Record the following transactions of Evelyn’s Designs in a general journal:

> Record the following transactions of Beach Bikes in a general journal:

> The following excerpt was taken from The Home Depot, Inc., 2018 Annual Report (for the fiscal year ended February 3, 2019): Analyze: 1. What percentage of total assets is made up of cash and cash equivalents at February 3, 2019? 2. Cash receipt and cash

> Lantz Corporation engaged in the following transactions during June. Record these transactions in a general journal.

> Bushnell Company (buyer) and Schiff, Inc. (seller), engaged in the following transactions during February 20X1: Both companies use the perpetual inventory system. Journalize the transactions above in a general journal for both Bushnell Company and Schif

> On April 1, Manning Meat Distributors sold merchandise on account to Fichman’s Franks for $3,700 on Invoice 1001, terms 2/10, n/30. The cost of merchandise sold was $2,200. Payment was received in full from Fichman’s Franks, less discount, on April 10. R

> Record the following transactions of Fashion Park in a general journal. Fashion Park must charge 8 percent sales tax on all sales. The company uses the perpetual inventory system.

> Wang Corporation operates in a state with no sales tax. The company uses the perpetual inventory system. Record the following transactions in a general journal:

> Record the following transactions of Evelyn’s Designs in a general journal. The company uses the perpetual inventory system.

> Lantz Corporation engaged in the following transactions during June. The company uses the perpetual inventory system. Record these transactions in a general journal.

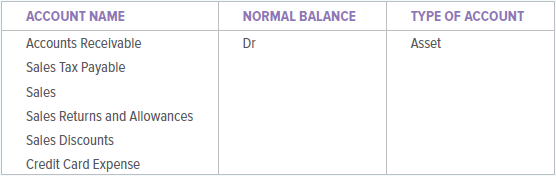

> Identify the normal balance and type of account for the following. In identifying the normal balance, use “Dr” for debit or “Cr” for credit. The first one is done as an example.

> Identify the normal balance and type of account for the following. In identifying the normal balance, use “Dr” for debit or “Cr” for credit. The first one is done as an example.

> Post the entries in the general journal below to the Accounts Receivable account in the general ledger and to the appropriate accounts in the accounts receivable ledger for Valentino Company. Assume the following account balances at January 1, 20X1: Use

> Alec Rubino is the sole owner of Spectra Medical Instruments (Spectra), a small but successful distributor of medical supplies. Alec inherited the business from his father and is not really interested in running it on a day-to-day basis. Alec hired John

> On April 1, Moloney Musical Instruments sold merchandise on account to Fronke’s Flutes for $7,000 on Invoice 1001, terms 2/10, n/30. Payment was received in full from Fronke’s Flutes, less discount, on April 10. Required: Record the transactions on April

> Johnson Distributors, a wholesale firm, made sales using the following list prices and trade dis- counts. What amount should be recorded for each sale? 1. List price of $7,000 and trade discounts of 35 percent and 10 percent. 2. List price of $5,800 and

> Rivera Company made sales using the following list prices and trade discounts. What amount should be recorded for each sale? 1. List price of $900 and trade discount of 25 percent. 2. List price of $2,260 and trade discount of 30 percent. 3. List price o

> Record the following transactions of Urban Star Sporting Goods in a general journal. Urban Star Sporting Goods must charge 8 percent sales tax on all sales.

> Record the following transactions of Divine Divas Fashions in a general journal. Fashion Park must charge 8 percent sales tax on all sales.

> The following transactions took place at Animal World Amusement Park during May. Animal World Amusement Park must charge 8 percent sales tax on all sales.

> W. Tsang Distributors operates in a state with no sales tax. Record the following transactions in a general journal:

> 1. Use the final balances of the customer accounts after completing Exercise 7.9 to prepare a schedule of accounts receivable for Valentino Company at January 31, 20X1. 2. Should the total of your accounts receivable schedule agree with the balance of th

> Complete a chart of the accounting cycle by writing the steps of the cycle in their proper sequence.

> 1. The new accountant for Asheville Hardware Center, a large retail store, found the following weaknesses in the firm’s cash-handling procedures. How would you explain to management why each of these procedures should be changed? a. No cash register proo

> On December 31, the Income Summary account of Ballon Company has a debit balance of $222,000 after revenue of $234,000 and expenses of $456,000 were closed to the account. Kenneth Ballon, Drawing has a debit balance of $24,000 and Kenneth Ballon, Capital

> The ledger accounts of Aveeno Company appear as follows on March 31, 20X1: All accounts have normal balances. Journalize and post the closing entries. Use 4 as the page number for the general journal in journalizing the closing entries. Use account numbe

> The Income Summary and Violante Autro, Capital accounts for Autro Production Company at the end of its accounting period follow Complete the following statements: 1. Total revenue for the period is______. 2. Total expenses for the period are______. 3. Ne

> From the following list, identify the accounts that will appear on the postclosing trial balance. ACCOUNTS 1. Cash 2. Accounts Receivable 3. Supplies 4. Equipment 5. Accumulated Depreciation 6. Accounts Payable 7. Brianna Celina, Capital 8. Brianna Celin

> Following are the steps in the accounting cycle. Arrange the steps in the proper sequence. 1. Prepare a worksheet. 2. Journalize and post adjusting entries. 3. Analyze transactions. 4. Journalize the transactions. 5. Post the journal entries. 6. Journali

> On December 31, 20X1, the ledger of Hunter Company contained the following account balances: All the accounts have normal balances. Journalize the closing entries. Use 4 as the general journal page number.

> Lancaster Company must make three adjusting entries on December 31, 20X1. a. Supplies used, $11,000 (supplies totaling $18,000 were purchased on December 1, 20X1, and debited to the Supplies account). b. Expired insurance, $8,200; on December 1, 20X1, th

> Assume that a firm reports net income of $135,000 prior to making adjusting entries for the following items: expired rent, $10,500; depreciation expense, $12,300; and supplies used, $5,400. Assume that the required adjusting entries have not been made. W

> On January 31, 20X1, the general ledger of Johnson Company showed the following account balances. Prepare the worksheet through the Adjusted Trial Balance section. Assume that every account has the normal debit or credit balance. The worksheet covers the

> A company is developing objectives for paying bills on account. Some possible objectives follow: ■ Stretch cash flow as much as possible. ■ Develop a good reputation as a company that always pays bills on time. ■ Do not pay vendors until payment is recei

> Within a company’s annual report, a section called “Notes to Consolidated Financial Statements” offers general information about the company along with detailed notes related to its financial statements. Analyze Online: On the American Eagle Outfitters,

> For each of the following situations, determine the necessary adjustments. 1. A firm purchased a three-year insurance policy for $27,000 on July 1, 20X1. The $27,000 was debited to the Prepaid Insurance account. What adjustment should be made to record e

> Determine the necessary end-of-June adjustments for Conner Company. 1. On June 1, 20X1, Conner Company, a new firm, paid $16,800 rent in advance for a seven-month period. The $16,800 was debited to the Prepaid Rent account. 2. On June 1, 20X1, the firm b

> The following transactions took place at the Pimental Employment Agency during November 20X1. Record the general journal entries that would be made for these transactions. Use a compound entry for each transaction.

> Post the journal entries that you prepared for Exercise 4.2 to the general ledger. Use the account names shown in Exercise 4.2.

> Selected accounts from the general ledger of Martin Consulting Services follow. Record the general journal entries that would be made to record the following transactions. Be sure to include dates and descriptions in these entries. 101 Cash 111 Accounts

> The accounts that will be used by Metro Moving Company follow. Prepare a chart of accounts for the firm. Classify the accounts by type, arrange them in an appropriate order, and assign suitable account numbers.

> From the trial balance and the net income or net loss determined in Exercise 3.6, prepare a statement of owner’s equity and a balance sheet for Residential Relocators as of December 31, 20X1.

> The following financial statement excerpt is taken from the 2018 Annual Report (for the fiscal year ended February 3, 2019) for The Home Depot, Inc.: 1. The Cost of Sales amount on The Home Depot, Inc., consolidated statements of earnings rep- resents th

> Using the account balances from Exercise 3.5, prepare a trial balance and an income statement for Residential Relocators. The trial balance is for December 31, 20X1, and the income statement is for the month ended December 31, 20X1.

> In each of the following sentences, fill in the blanks with the word debit or credit:

> Indicate whether each of the following accounts normally has a debit balance or a credit balance: 1. Cash 2. Blaine Brownell, Capital 3. Fee Income 4. Accounts Payable 5. Supplies 6. Equipment 7. Accounts Receivable 8. Salaries Expense

> Johnson Cleaning Service has the following account balances on December 31, 20X1. Set up a T account for each account and enter the balance on the proper side of the account.

> Using the information provided in Exercise 2.8, prepare a statement of owner’s equity for the month of September and a balance sheet for Rojas Wealth Management Consulting as of September 30, 20X1.

> On December 1, Karl Zant opened a speech and hearing clinic. During December, his firm had the following transactions involving revenue and expenses. Did the firm earn a net income or incur a net loss for the period? What was the amount? Paid $6,200 for

> At the beginning of September, Helen Rojas started Rojas Wealth Management Consulting, a firm that offers financial planning and advice about investing and managing money. On September 30, the accounting records of the business showed the following infor

> The following equation shows the effects of a number of transactions that took place at Cantu Auto Repair Company during the month of July. Describe each transaction.

> Anna Abraham is the accounts payable clerk for Jiffy Delivery Service. This company runs 10 branches in the San Diego area. The company pays for a variety of expenses. Anna writes the checks for each of the vendors and the controller signs the checks. An

> Technology World had the following revenue and expenses during the month ended July 31. Did the firm earn a net income or incur a net loss for the period? What was the amount?

> The Business Center had the transactions listed below during the month of June. Show how each transaction would be recorded in the accounting equation. Compute the totals at the end of the month. The headings to be used in the equation follow. TRANSACTIO

> The following financial data are for the dental practice of Dr. Jose Ortiz when he began operations in July. Determine the amounts that would appear in Dr. Ortiz’s balance sheet. 1. Owes $42,000 to the Sanderson Equipment Company. 2. Has cash balance of

> Why is it important for business records to be separate from the records of the business’s owner or owners? What is the term accountants use to describe this separation of personal and business records?

> What types of people or organizations are interested in financial information about a firm, and why are they interested in this information?

> Briefly describe the flow of data through a simple accounting system.

> Where does the accountant obtain the data needed for the adjusting entries?

> Why is a postclosing trial balance prepared?

> Where does the accountant obtain the data needed for the closing entries?

> What three procedures are performed at the end of each accounting period before the financial information is interpreted?

> 1. Why should management be concerned about paying its invoices on a timely basis? 2. Why is it important for a firm to maintain a satisfactory credit rating? 3. Suppose you are the new controller of a small but growing company and you find that the firm

> Name the steps of the accounting cycle.

> How does the straight-line method of depreciation work?

> Are the following assets depreciated? Why or why not? a. Prepaid Insurance b. Delivery Truck c. Land d. Manufacturing Equipment e. Prepaid Rent f. Furniture g. Store Equipment h. Prepaid Advertising i. Computers

> Why is an accumulated depreciation account used in making the adjustment for depreciation?

> What is book value?

> What three amounts are reported on the balance sheet for a long-term asset such as equipment?

> Why is it necessary to journalize and post adjusting entries?

> What effect does each item in Question 1 have on owner’s equity?

> A firm purchases machinery, which has an estimated useful life of 10 years and no salvage value, for $60,000 at the beginning of the accounting period. What is the adjusting entry for depreciation at the end of one month if the firm uses the straight-lin

> Divide into groups of four individuals. Your company is named Cole’s Cooking Supplies. Assign one person as Cole’s sales associate; one as the company’s A/R clerk; one as the customer Louisa’s Cooking School; and one as Louisa’s A/P clerk. Record the tra

> What adjustment would be recorded for expired insurance?