Question: If Roundtree from Problem 7 decides to

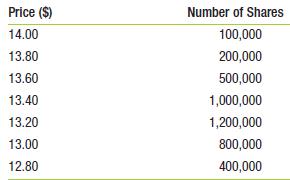

If Roundtree from Problem 7 decides to issue an extra 500,000 shares (for a total of 2.3 million shares), how much total money will it raise?

In Problem 7:

Roundtree Software is going public using an auction IPO. The firm has received the following bids:

Transcribed Image Text:

Price ($) Number of Shares 14.00 100,000 13.80 200,000 13.60 500,000 13.40 1,000,000 13.20 1,200,000 13.00 800,000 12.80 400,000

> Kartman Corporation is evaluating four real estate investments. Management plans to buy the properties today and sell them three years from today. The annual discount rate for these investments is 15%. The following table summarizes the initial cost and

> Fabulous Fabricators needs to decide how to allocate space in its production facility this year. It is considering the following contracts: a. What are the profitability indexes of the projects? b. What should Fabulous Fabricators do? NPV Use of Faci

> Your storage firm has been offered $100,000 in one year to store some goods for one year. Assume your costs are $95,000, payable immediately, and the cost of capital is 8%. Should you take the contract?

> Hassle-Free Web is bidding to provide Web-page hosting services for Hotel Lisbon. Hotel Lisbon pays its current provider $10,000 per year for hosting its Web page and handling transactions on it, etc. Hassle-Free figures that it will need to purchase equ

> Gateway Tours is choosing between two bus models. One is more expensive to purchase and maintain, but lasts much longer than the other. Its discount rate is 11%. It plans to continue with one of the two models for the foreseeable future; which one should

> You need a particular piece of equipment for your production process. An equipment-leasing company has offered to lease you the equipment for $10,000 per year if you sign a guaranteed five-year lease. The company would also maintain the equipment for you

> You are considering the following two projects and can only take one. Your cost of capital is 11%. a. What is the NPV of each project at your cost of capital? b. What is the IRR of each project? c. At what cost of capital are you indifferent between the

> You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $10 million. Investment A will generate $2 million per year (starting at the end of the first year) in perpetuity. Investment B will gen

> You are choosing between two projects, but can only take one. The cash flows for the projects are given in the following table: a. What are the IRRs of the two projects? b. If your discount rate is 5%, what are the NPVs of the two projects? c. Why do IRR

> You are considering making a movie. The movie is expected to cost $10 million upfront and take a year to make. After that, it is expected to make $5 million in the year it is released and $2 million for the following four years. What is the payback perio

> You are considering investing in a new gold mine in South Africa. Gold in South Africa is buried very deep, so the mine will require an initial investment of $250 million. Once this investment is made, the mine is expected to produce revenues of $30 mill

> You are getting ready to start a new project that will incur some cleanup and shutdown costs when it is completed. The project costs $5.4 million upfront and is expected to generate $1.1 million per year for ten years and then have some shutdown costs in

> You have just been offered a contract worth $1 million per year for five years. However, to take the contract, you will need to purchase some new equipment. Your discount rate for this project is 12%. You are still negotiating the purchase price of the e

> You have an opportunity to invest $100,000 now in return for $80,000 in one year and $30,000 in two years. If your cost of capital is 9%, what is the NPV of this investment?

> Your firm is considering a project that will cost $4.55 million upfront, generate cash flows of $3.5 million per year for three years, and then have a cleanup and shutdown cost of $6 million in the fourth year. a. How many IRRs does this project have? b

> You own a coal mining company and are considering opening a new mine. The mine itself will cost $120 million to open. If this money is spent immediately, the mine will generate $20 million for the next ten years. After that, the coal will run out and the

> Innovation Company is thinking about marketing a new software product. Upfront costs to market and develop the product are $5 million. The product is expected to generate profits of $1 million per year for ten years. The company will have to provide prod

> Professor Wendy Smith has been offered the following deal: A law firm would like to retain her for an upfront payment of $50,000. In return, for the next year the firm would have access to eight hours of her time every month. Smith’s rate is $550 per hou

> How many IRRs are there in part (b) of Problem 9? Does the IRR rule work in this case? Information from Problem 9: Bill Clinton reportedly was paid $10 million to write his book My Life. The book took three years to write. In the time he spent writing,

> Boeing Corporation has just issued a callable (at par) three-year, 5% coupon bond with semiannual coupon payments. The bond can be called at par in two years or anytime thereafter on a coupon payment date. It has a price of $99. a. What is the bond’s yie

> General Electric has just issued a callable (at par) ten-year, 6% coupon bond with annual coupon payments. The bond can be called at par in one year or anytime thereafter on a coupon payment date. It has a price of $102. a. What is the bond’s yield to ma

> Your firm successfully issued new debt last year, but the debt carries covenants. Specifically, you can only pay dividends out of earnings made after the debt issue and you must maintain a minimum quick (acid-test) ratio of 1:1. Your net income this year

> How many IRRs are there in part (a) of Problem 9? Does the IRR rule give the right answer in this case? Information from Problem 9: Bill Clinton reportedly was paid $10 million to write his book My Life. The book took three years to write. In the time h

> Your firm is issuing $100 million in straight bonds at par with a coupon rate of 6% and paying total fees of 3%. What is the net amount of funds that the debt issue will provide for your firm?

> You are finalizing a bank loan for $200,000 for your small business and the closing fees payable to the bank are 2% of the loan. After paying the fees, what will be the net amount of funds from the loan available to your business?

> You are the CFO of RealNetworks on July 1, 2008. The company’s stock price is $6.74 and its convertible debt (as shown in Table 15.7) is now callable. a. What is the value of the shares the bondholders would receive per $1000 bond if th

> A $1000 face value bond has a conversion ratio of 40. You estimate the transaction costs of conversion to be 3% of the face value of the bond. What price must the stock reach in order for you to convert?

> You own a bond with a face value of $10,000 and a conversion ratio of 450. What is the conversion price?

> Roundtree Software is going public using an auction IPO. The firm has received the following bids: Assuming Roundtree would like to sell 1.8 million shares in its IPO, what will be the winning auction offer price? Price ($) Number of Shares 14.00 100

> Assuming that you own only the Series A preferred stock in Problem 4 (and that each share of all series of preferred stock is convertible into one share of common stock), what percentage of the firm do you own after the last funding round? Data from Pro

> Based on the information in Problem 4 (and that each share of all series of preferred stock is convertible into one share of common stock), what fractions of the firm do the Series B, C, and D investors each own in your firm? In Problem 4 Round Price

> Three years ago, you founded your own company. You invested $100,000 of your own money and received 5 million shares of Series A preferred stock. Your company has since been through three additional rounds of financing. a. What is the pre-money valuation

> Your start-up company needs capital. Right now, you own 100% of the firm with 10 million shares. You have received two offers from venture capitalists. The first offers to invest $3 million for 1 million new shares. The second offers $2 million for 500,0

> Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars) (see MyFinanceLab for

> Starware Software was founded last year to develop software for gaming applications. The founder initially invested $800,000 and received 8 million shares of stock. Starware now needs to raise a second round of capital, and it has identified a venture ca

> You have started a company and are in luck—a venture capitalist has offered to invest. You own 100% of the company with 5 million shares. The VC offers $1 million for 800,000 new shares. a. What is the implied price per share? b. What is the post-money v

> MacKenzie Corporation currently has 10 million shares of stock outstanding at a price of $40 per share. The company would like to raise money and has announced rights issue. Every existing shareholder will be sent one right per share of stock that he or

> Foster Enterprises’ stock is trading for $50 per share and there are currently 10 million shares outstanding. It would like to raise $100 million. If its underwriter charges 5% of gross proceeds, a. How many shares must it sell? b. If it expects the stoc

> On January 20, Metropolitan, Inc., sold 8 million shares of stock in an SEO. The market price of Metropolitan at the time was $42.50 per share. Of the 8 million shares sold, 5 million shares were primary shares being sold by the company, and the remainin

> The firm you founded currently has 12 million shares, of which you own 7 million. You are considering an IPO where you would sell 2 million shares for $20 each. What is the maximum number of secondary shares you could sell and still retain more than 50%

> The firm you founded currently has 12 million shares, of which you own 7 million. You are considering an IPO where you would sell 2 million shares for $20 each. If all of the shares sold are from your holdings, how much will the firm raise? What will you

> The firm you founded currently has 12 million shares, of which you own 7 million. You are considering an IPO where you would sell 2 million shares for $20 each. If all of the shares sold are primary shares, how much will the firm raise? What will your pe

> Your firm is selling 3 million shares in an IPO. You are targeting an offer price of $17.25 per share. Your underwriters have proposed a spread of 7%, but you would like to lower it to 5%. However, you are concerned that if you do so, they will argue for

> Chen Brothers, Inc., sold 4 million shares in its IPO, at a price of $18.50 per share. Management negotiated a fee (the underwriting spread) of 7% on this transaction. What was the dollar cost of this fee?

> In the HomeNet example from the chapter, its receivables are 15% of sales and its payables are 15% of COGS. Forecast the required investment in net working capital for HomeNet assuming that sales and cost of goods sold (COGS) will be (see MyFinanceLab fo

> If Margoles Publishing from Problem 11 paid an underwriting spread of 7% for its IPO and sold 10 million shares, what was the total cost (exclusive of underpricing) to it of going public?

> Margoles Publishing recently completed its IPO. The stock was offered at a price of $14 per share. On the first day of trading, the stock closed at $19 per share. a. What was the initial return on Margoles? b. Who benefited from this underpricing? Who lo

> Your investment bankers price your IPO at $15 per share for 10 million shares. If the price at the end of the first day of trading is $17 per share, a. What was the percentage underpricing? b. How much money did the firm miss out on due to underpricing?

> Three years ago, you founded Outdoor Recreation, Inc., a retailer specializing in the sale of equipment and clothing for recreational activities such as camping, skiing, and hiking. So far, your company has gone through three funding rounds: It is now 20

> Slow ’n Steady, Inc., has a stock price of $30, will pay a dividend next year of $3, and has expected dividend growth of 1% per year. What is your estimate of Slow ’n Steady’s cost of equity capital?

> HighGrowth Company has a stock price of $20. The firm will pay a dividend next year of $1, and its dividend is expected to grow at a rate of 4% per year thereafter. What is your estimate of HighGrowth’s cost of equity capital?

> Steady Company’s stock has a beta of 0.20. If the risk-free rate is 6% and the market risk premium is 7%, what is an estimate of Steady Company’s cost of equity?

> Dewyco has preferred stock trading at $50 per share. The next preferred dividend of $4 is due in one year. What is Dewyco’s cost of capital for preferred stock?

> Laurel, Inc., has debt outstanding with a coupon rate of 6% and a yield to maturity of 7%. Its tax rate is 35%. What is Laurel’s effective (after-tax) cost of debt?

> OpenSeas, Inc., is evaluating the purchase of a new cruise ship. The ship would cost $500 million, but would operate for 20 years. OpenSeas expects annual cash flows from operating the ship to be $70 million and its cost of capital is 12%. a. Prepare an

> Avicorp has a $10 million debt issue outstanding, with a 6% coupon rate. The debt has semi-annual coupons, the next coupon is due in six months, and the debt matures in five years. It is currently priced at 95% of par value. a. What is Avicorp’s pre-tax

> Consider a simple firm that has the following market-value balance sheet: Next year, there are two possible values for its assets, each equally likely: $1200 and $960. Its debt will be due with 5% interest. Because all of the cash flows from the assets m

> Book Co. has 1 million shares of common equity with a par (book) value of $1, retained earnings of $30 million, and its shares have a market value of $50 per share. It also has debt with a par value of $20 million that is trading at 101% of par. a. What

> Andyco, Inc., has the following balance sheet and an equity market-to-book ratio of 1.5. Assuming the market value of debt equals its book value, what weights should it use for its WACC calculation? Assets Liabilities and Equity 1000 Debt 400 Equity

> MV Corporation has debt with market value of $100 million, common equity with a book value of $100 million, and preferred stock worth $20 million outstanding. Its common equity trades at $50 per share, and the firm has 6 million shares outstanding. What

> You are planning to issue debt to finance a new project. The project will require $20 million in financing and you estimate its NPV to be $15 million. The issue costs for the debt will be 3% of face value. Taking into account the costs of external financ

> RiverRocks realizes that it will have to raise the financing for the acquisition of Raft Adventures by issuing new debt and equity. The firm estimates that the direct issuing costs will come to $7 million. How should it account for these costs in evaluat

> Your company has two divisions: One division sells software and the other division sells computers through a direct sales channel, primarily taking orders over the Internet. You have decided that Dell Computer is very similar to your computer division, i

> CoffeeStop primarily sells coffee. It recently introduced a premium coffee-flavored liquor. Suppose the firm faces a tax rate of 35% and collects the following information. If it plans to finance 11% of the new liquor-focused division with debt and the r

> RiverRocks’ purchase of Raft Adventures (from Problem 18) will cost $100 million, but will generate cash flows that start at $15 million in one year and then grow at 4% per year forever. What is the NPV of the acquisition?

> FastTrack Bikes, Inc., is thinking of developing a new composite road bike. Development will take six years and the cost is $200,000 per year. Once in production, the bike is expected to make $300,000 per year for ten years. The cash inflows begin at the

> You have an opportunity to invest $50,000 now in return for $60,000 in one year. If your cost of capital is 8%, what is the NPV of this investment?

> Suppose Capital One is advertising a 60-month, 5.99% APR motorcycle loan. If you need to borrow $8000 to purchase your dream Harley-Davidson, what will your monthly payment be?

> You make monthly payments on your car loan. It has a quoted APR of 5% (monthly compounding). What percentage of the outstanding principal do you pay in interest each month?

> You are thinking of making an investment in a new plant. The plant will generate revenues of $1 million per year for as long as you maintain it. You expect that the maintenance costs will start at $50,000 per year and will increase 5% per year thereafter

> Which do you prefer: a bank account that pays 5% per year (EAR) for three years or a. an account that pays 2.5% every six months for three years? b. an account that pays 7.5% every 18 months for three years? c. an account that pays 0.5% per month for th

> You are considering two ways of financing a spring break vacation. You could put it on your credit card, at 15% APR, compounded monthly, or borrow the money from your parents, who want an 8% interest payment every six months. Which is the lower rate?

> Suppose you are considering renting an apartment. You, the renter, can be viewed as an agent while the company that owns the apartment can be viewed as the principal. What agency conflicts do you anticipate? Suppose, instead, that you work for the apartm

> Your bank is offering you an account that will pay 20% interest in total for a two-year deposit. Determine the equivalent discount rate for a period length of a. six months. b. one year. c. one month.

> Tailor Johnson, a U.S. maker of fine menswear, has a subsidiary in Ethiopia. This year, the subsidiary reported and repatriated earnings before interest and taxes (EBIT) of 100 million Ethiopian birrs. Assume the current exchange rate is 8 birr/$ or The

> Manzetti Foods, a U.S. food processing and distribution company, is considering an investment in Germany. You are in Manzetti’s corporate finance department and are responsible for deciding whether to undertake the project. The expected

> The dollar cost of debt for Healy Consulting, a U.S. research firm, is 7.5%. The firm faces a tax rate of 30% on all income, no matter where it is earned. Managers in the firm need to know its yen cost of debt because they are considering launching a new

> Maryland Light, a U.S. manufacturer of light fixtures, is considering an investment in Japan. The dollar cost of equity for Maryland Light is 11%. You are in the corporate treasury department, and you need to know the comparable cost of equity in Japanes

> Summit Systems will pay a dividend of $1.50 this year. If you expect Summit’s dividend to grow by 6% per year, what is its price per share if the firm’s equity cost of capital is 11%?

> You work for a U.S. firm, and your boss has asked you to estimate the cost of capital for countries using the euro. You know that S = $1.20/€ and F1 = $1.157/€. Suppose the dollar WACC for your company is known to be 8%. If these markets are internationa

> You have been accepted into college. The college guarantees that your tuition will not increase for the four years you attend college. The first $10,000 tuition payment is due in six months. After that, the same payment is due every six months until you

> Etemadi Amalgamated, the U.S. manufacturing company in Problem 7, is still considering a new project in Portugal. All information presented in Problem 7 is still accurate, except the spot rate is now S = $0.85/€ about 26% lower. What is

> Etemadi Amalgamated, a U.S. manufacturing firm, is considering a new project in Portugal. You are in Etemadi’s corporate finance department and are responsible for deciding whether to undertake the project. The expected free cash flows,

> Mia Caruso Enterprises, a U.S. manufacturer of children’s toys, has made a sale in India and is expecting a 400 million rupee cash inflow in one year. (The currency of India is the rupee). The current spot rate is S = $0.022/rupee and the one-year forwar

> You plan to deposit $500 in a bank account now and $300 at the end of one year. If the account earns 3% interest per year, what will the balance be in the account right after you make the second deposit?

> You are thinking about investing $5000 in your friend’s landscaping business. Even though you know the investment is risky and you can’t be sure, you expect your investment to be worth $5750 next year. You notice that the rate for one-year Treasury bills

> You are a U.S. investor who is trying to calculate the present value of a €5 million cash inflow that will occur one year in the future. The spot exchange rate is S = $1.25/€ and the forward rate is F1 = $1.215/€ You estimate that the appropriate dollar

> You are a broker for frozen seafood products for Choyce Products. You just signed a deal with a Belgian distributor. Under the terms of the contract, in one year you will deliver 4000 kilograms of frozen king crab for 100,000 euros. Your cost for obtaini

> Suppose your employer offers you a choice between a $5000 bonus and 100 shares of the company’s stock. Whichever one you choose will be awarded today. The stock is currently trading for $63 per share. a. Suppose that if you receive the stock bonus, you a

> You are an international shrimp trader. A food producer in the Czech Republic offers to pay you 2 million Czech koruna today in exchange for a year’s supply of frozen shrimp. Your Thai supplier will provide you with the same supply for 3 million Thai bah

> What four financial statements can be found in a firm’s 10-K filing? What checks are there on the accuracy of these statements?

> Suppose the interest rate is 8% APR with monthly compounding. What is the present value of an annuity that pays $100 every six months for five years?

> Suppose Acap Corporation will pay a dividend of $2.80 per share at the end of this year and a dividend of $3 per share next year. You expect Acap’s stock price to be $52 in two years. Assume that Acap’s equity cost of capital is 10%. a. What price would

> NoGrowth Corporation currently pays a dividend of $0.50 per quarter, and it will continue to pay this dividend forever. What is the price per share of NoGrowth stock if the firm’s equity cost of capital is 15%?

> Achi Corp. has preferred stock with an annual dividend of $3. If the required return on Achi’s preferred stock is 8%, what is its price?

> Anle Corporation has a current stock price of $20 and is expected to pay a dividend of $1 in one year. Its expected stock price right after paying that dividend is $22. a. What is Anle’s equity cost of capital? b. How much of Anle’s equity cost of capita

> The yield to maturity of a $1000 bond with a 7% coupon rate, semiannual coupons, and two years to maturity is 7.6% APR, compounded semiannually. What must its price be?

> A local bank is running the following advertisement in the newspaper: “For just $1000 we will pay you $100 forever!” The fine print in the ad says that for a $1000 deposit, the bank will pay $100 every year in perpetuity, starting one year after the depo

> You currently have a one-year-old loan outstanding on your car. You make monthly payments of $300. You have just made a payment. The loan has four years to go (i.e., it had an original term of five years). Show the timeline from your perspective. How wou

> For each of the following pairs of Treasury securities (each with $1000 par value), identify which will have the higher price: a. A three-year zero-coupon bond or a five-year zero coupon bond? b. A three-year zero-coupon bond or a three-year 4% coupon bo