Question: Illinois Exchange Company completed the following

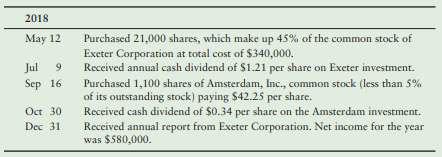

Illinois Exchange Company completed the following long-term investment transactions during 2018:

At year-end, the fair value of the Amsterdam stock is $30,900. The fair value of the Exeter stock is $652,000.

Requirements:

1. For which investment is fair value used in the accounting? Why is fair value used for one investment and not the other?

2. Show what Illinois Exchange would report on its year-end balance sheet and income statement for these investment transactions. It is helpful to use a T-account for the Equity method Investment account. Ignore income tax.

> On January 3, 2018, Pawnee Company paid $230,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $1,000, sales tax of $6,000, and $28,000 for a special platform on which to place the computer. Pawnee’s mana

> Without making journal entries, record the transactions of E-E-27B directly in the McCloud T-account, Equity-method Investment. Assume that after all the noted transactions took place, McCloud sold its entire investment in Brown for cash of $1,400,000. H

> Blair, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except Land. Blair completed the following transactions: Requirement: 1. Record the transactions in B

> Forest Lake Resort reported the following on its balance sheet at December 31, 2018: On July 1, 2019, the resort expanded operations and purchased additional equipment for cash at a cost of $109,000. The company depreciates buildings using the straight

> Becker Supply, Inc., opened an office in White Bear Lake, Minnesota. Becker incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building The company depreciates buildings over 30 years,

> Walker Corporation reported the following related to property and equipment (all in millions) Requirements: 1. Draw T-accounts for Property and Equipment and Accumulated Depreciation. Enter the information as presented and solve for the unknown in each

> Bargain Basement Corporation operates general merchandise and food discount stores in the United States. The company reported the following information for the three years ending December 31, 2017: Requirements: 1. Compute the net profit margin ratio fo

> At the end of 2017, Solar Power had total assets of $17.8 billion and total liabilities of $9.1 billion. Included among the assets were property, plant, and equipment with a cost of $4.5 billion and accumulated depreciation of $3.4 billion. Solar Power c

> Atlantic Energy Company’s balance sheet includes the asset Iron Ore Rights. Atlantic Energy paid $2.9 million cash for the right to work a mine that contained an estimated 225,000 tons of ore. The company paid $68,000 to remove unwanted buildings from th

> Caribbean Sales, Inc., sells electronics and appliances. The excerpts that follow are adapted from Caribbean’s financial statements for 2018 and 2017 Requirements: 1. How much was Caribbean’s cost of plant assets at A

> On January 2, 2018, Jupiter Company paid $270,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $1,800, sales tax of $6,900, and $31,300 for a special platform on which to place the computer. Jupiter’s ma

> Mayfield, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except Land. Mayfield completed the following transaction. Requirement: 1. Record the transactions

> McCloud Corporation owns equity-method investments in several companies. McCloud paid $1,800,000 to acquire a 30% investment in Brown Software Company. Brown reported net income of $660,000 for the first year and declared and paid cash dividends of $460,

> The accounting records of Boston Home Store show these data (in millions): The shareholders are very happy with Boston’s steady increase in net income. However, auditors discovered that the ending inventory for 2016 was understated by

> Eddie’s Convenience Stores’ income statement for A1 the year ended December 31, 2017, and its balance sheet as of December 31, 2017, are as follows: The business is organized as a proprietorship, so it pays no corporat

> Ross Company, a camera store, lost some inventory in a fire on December 15. To file an insurance claim, the company must estimate its December 15 inventory using the gross profit method. For the past two years, Ross Company’s gross pr

> Sprinkle Top, Inc., and Coffee Shop Corporation are both specialty food chains. The two companies reported these figures, in million Requirements: 1. Compute the gross margin percentage and the rate of inventory turnover for Sprinkle Top and Coffee Sho

> Freshwater Trade Mart has recently had lackluster sales. The rate of inventory turnover has dropped, and the merchandise is gathering dust. At the same time, competition has forced Freshwater’s suppliers to lower the prices that Freshwater will pay when

> The records of Eaton Aviation include the following accounts for inventory of aviation parts at July 31 of the current year: Requirements: 1. Prepare a partial income statement through gross profit under the average-cost, FIFO, and LIFO methods. Round

> SWAT Surplus began March 2018 with 100 tents that cost $10 each. During the month, the company made the following purchases at cost:18 26 The company sold 318 tents, and at March 31, the ending inventory consisted of 52 tents. The sales price of each te

> A Swoosh Sports outlet store began December 2018 with 47 pairs of running shoes that cost the store $34 each. The sales price of these shoes was $63. During December, the store completed these inventory transactions: Requirements: 1. The preceding data

> Western Trading Company purchases inventory in crates of merchandise; each crate of inventory is a unit. The fiscal year of Western Trading ends each January 31. Assume you are dealing with a single Western Trading store in Nashville, Tennessee. The Nash

> The accounting records of Timberlake Home Store show these data (in millions) The shareholders are very happy with Timberlake’s steady increase in net income. However, auditors discovered that the ending inventory for 2016 was underst

> During the most recent year, Smither Travelers Co. bought 3,400 shares of German Corporation common stock at $37, 630 shares of British Corporation stock at $47.00, and 1,400 shares of Milan Corporation stock at $76. At December 31, Hoover’s Online repor

> Ricky’s Convenience Stores’ income statement for the year ended December 31, 2017, and its balance sheet as of December 31, 2017, are as follows: The business is organized as a proprietorship, so it pays no corporate

> Cleveland Company, a camera store, lost some inventory in a fire on October 15. To file an insurance claim, the company must estimate its October 15 inventory using the gross profit method. For the past two years, Cleveland Company’s gr

> Crispy Donut, Inc., and Calhoun Coffee Corporation are both specialty food chains. The two companies reported these figures, in millions: Requirements: 1. Compute the gross margin percentage and the rate of inventory turnover for Crispy Donut and Calh

> Anderson Trade Mart has recently had lackluster sales. The rate of inventory turnover has dropped, and the merchandise is gathering dust. At the same time, competition has forced Anderson’s suppliers to lower the prices that Anderson will pay when it rep

> The records of Atlanta Aviation include the following accounts for inventory of aviation parts at July 31 of the current year: Requirements: 1. Prepare a partial income statement through gross profit under the average-cost, FIFO, and LIFO methods. Roun

> Navy Surplus began July 2018 with 80 stoves that cost $10 each. During the month, the company made the following purchases at cost: The company sold 250 stoves, and at July 31, the ending inventory consisted of 50 stoves. The sales price of each stove w

> A Gold Medal Sports outlet store began August 2018 with 42 pairs of running shoes that cost the store $31 each. The sales price of these shoes was $63. During August, the store completed these inventory transactions: Requirements: 1. The preceding dat

> Eastern Trading Company purchases inventory in crates of merchandise; each crate of inventory is a unit. The fiscal year of Eastern Trading ends each January 31. Assume you are dealing with a single Eastern Trading store in San Diego, California. The

> The notes to the Alliance Ltd. financial statements reported the following data on December 31, Year 1 (end of the fiscal year): Alliance amortizes bond discounts using the effective-interest method and pays all interest amounts at December 31. Require

> 1. Journalize the following transactions of Lyons Communications, Inc.: 2. At December 31, 2018, after all year-end adjustments have been made, determine the carrying amount of Lyons’ bonds payable, net. 3. For the six months ended Ju

> Journalize the following long-term, equity investment transactions of Johnson Department Stores: a. Purchased 420 shares of Gates Fine Foods common stock at $35 per share (less than 10% of Gates’ outstanding stock), with the intent of holding the stock

> On February 28, 2018, Shark Corp. issued 10%, 10-year bonds payable with a face value of $1,500,000. The bonds pay interest on February 28 and August 31. The company amortizes bond discount using the straight-line method. Requirements: 1. If the market

> The board of directors of Mailroom Plus authorized the issue of $8,000,000 of 6%, 10-year bonds payable. The semiannual interest dates are May 31 and November 30. The bonds are issued on May 31, 2018, at par. Requirements: 1. Journalize the following tr

> The accounting records of Burgess Foods, Inc., include the following items at December 31, 2018: Requirements: 1. Show how each relevant item would be reported on the Burgess Foods classified balance sheet. Include headings and totals for current liabil

> On December 31, 2018, Mainland Corporation issues 6%, 10-year convertible bonds payable with a face value of $4,000,000. The semiannual interest dates are June 30 and December 31. The market interest rate is 8%. Mainland amortizes bond discounts using th

> At December 31, 2018, Filbert Corporation’s adjusted trial balance shows the following balances: Filbert Corporation provides multi-year warranties with its products. Half of the Accrued Warranty Liability relates to warranty liabiliti

> The following transactions of Smooth Sounds Music Company occurred during 2018 and 2019: Requirement: 1. Record the transactions in Smooth Sounds’ journal. Explanations are not required.

> Bennett Go-Karts sells motorized go-karts. Bennett Go-Karts are motorized and are typically purchased by amusement parks and other recreation facilities, but are also occasionally purchased by individuals for their own personal use. The company uses a pe

> December 31, 2018, Jackson Corporation’s adjusted trial balance shows the following balances: Jackson Corporation provides multi-year warranties with its products. Half of the Accrued Warranty Liability relates to warranty liabilities

> The following transactions of Melody Music Company occurred during 2018 and 2019: Requirement: 1. Record the transactions in Melody Music Company’s journal. Explanations are not required.

> Marine experienced these events during the current year. a. December revenue totaled $110,000; and, in addition, Big Wave collected sales tax of 7%. The tax amount will be sent to the state of Delaware early in January. b. On August 31, Big Wave signed a

> Amherst Corporation, an investment banking company, often has extra cash to invest. Suppose Amherst buys 900 shares of Hurricane Corporation stock at $57 per share, representing less than 5% of Hurricane’s outstanding stock. Amherst expects to hold the H

> Randall Go-Karts sells motorized go-karts. Randall Go-Karts are motorized and are typically purchased by amusement parks and other recreation facilities, but are also occasionally purchased by individuals for their own personal use. The company uses a pe

> Insurance companies and pension plans hold large quantities of bond investments. Rainy Day Corp. purchased $1,500,000 of 8% bonds of Quantrill, Inc., for 95 on January 1, 2018. These bonds pay interest on January 1 and July 1 each year. They mature on Ja

> The beginning balance sheet of Lansing Corporation included the following long-term asset: Lansing completed the following investment transactions during the year: At year-end, the fair values of Lansing’s investments were as follows:

> During the fourth quarter of 2018, Harvestology, Inc. generated excess cash, which the company invested in equity securities as follows: Requirements: 1. Open T-accounts for Cash (including its beginning balance of $21,000), Investment in Equity Securit

> Insurance companies and pension plans hold large quantities of bond investments. Sea Insurance Corp. purchased $2,000,000 of 9% bonds of Sheehan, Inc., for 96 on January 1, 2018. These bonds pay interest on January 1 and July 1 each year. They mature on

> EnviroFriend Structures, Inc., builds environmentally sensitive structures. The company’s 2018 revenues totaled $2,780 million. At December 31, 2018, and 2017, the company had, respectively, $656 million and $591 million in current asse

> Western Electronics completed these selected transactions during March 2018: a. Sales of $2,400,000 are subject to an accrued warranty cost of 9%. The accrued warranty payable at the beginning of the year was $37,000, and warranty payments for the year

> Buckeye has an annual payroll of $170,000. In addition, the company incurs payroll tax expense of 9% of the annual payroll. At December 31, Buckeye owes salaries of $7,800 and FICA and other payroll tax of $850. The company will pay these amounts early n

> Centennial Publishing completed the following transactions for one subscriber during 2018: Requirement: 1. Journalize these transactions (explanations not required). Then report any liability on the company’s balance sheet at December

> On September 30, 2018, Baytex, Inc., purchased 6.8% bonds of Whitmore Corporation at 98 as a long-term, held-to-maturity investment. The maturity value of the bonds will be $35,000 on September 30, 2023. The bonds pay interest on March 31 and September 3

> The LO 4accounting records of Carmen Appliances included the following balances at the end of the period: In the past, Carmen’s warranty expense has been 8% of sales. During the current period, the business paid $7,500 to satisfy the w

> Sherlock Sports Authority purchased inventory costing $30,000 by signing a 4%, short-term, one-year note payable. The purchase occurred on July 31, 2018. Sherlock pays annual interest each year on July 31. Journalize the company’s (a) purchase of invento

> Cape Cod Sales Company completed the following note payable transactions: Requirements: 1. How much interest expense must be accrued at December 31, 2018? (Round your answer to the nearest whole dollar.) 2. Determine the amount of Cape Cod Salesâ&

> On September 1, 2019, The Shoppes at Forest Lake, Inc., purchased inventory costing $63,000 by signing an 8%, six-month, short-term note payable. The company will pay the entire note (principal and interest) on the note’s maturity date. Requirements: 1.

> Barnacle Sales, Inc.’s, comparative income statements and balance sheets show the following selected information for 2017 and 2018: Requirements: 1. Calculate the company’s accounts payable turnover and daysâ

> Green Earth Homes, Inc., builds environmentally sensitive structures. The company’s 2018 revenues totaled $2,770 million. At December 31, 2018, and 2017, the company had, respectively, $663 million and $613 million in current assets. Th

> Pine Systems’ revenues for LO 52018 totaled $27.1 million. As with most companies, Pine is a defendant in lawsuits related to its products. Note 14 of the Pine annual report for 2018 reported the following: Requirements: 1. Suppose Pin

> Electronics completed these selected transactions during March 2018: a. Sales of $2,050,000 are subject to an accrued warranty cost of 9%. The accrued warranty payable at the beginning of the year was $32,000, and warranty payments for the year totaled $

> Key West has an annual payroll of $150,000. In addition, the company incurs payroll tax expense of 10% of the annual payroll. At December 31, Key West owes salaries of $8,000 and FICA and other payroll tax of $1,000. The company will pay these amounts ea

> Travis Publishing completed the following transactions for one subscriber during 2018: Requirement: 1. Journalize these transactions (explanations not required). Then report any liability on the company’s balance sheet at December 31,

> Kingman Financial paid $590,000 for a 30% investment in the common stock of Cavalier, Inc. For the first year, Cavalier reported net income of $240,000, and at year-end declared and paid cash dividends of $110,000. On the balance-sheet date, the fair val

> Accounting records of Artie’s Appliances included the following balances at the end of the period: In the past, Artie’s warranty expense has been 8% of sales. During the current period, the business paid $7,500 to sati

> Assume Howard Manufacturing Corporation completed the following transactions: a. Sold a store building for $690,000. The building had cost Howard Manufacturing $1,200,000, and at the time of the sale, its accumulated depreciation totaled $510,000. b. Los

> Hometown Supply Company reported the following information in its comparative financial statements for the fiscal year ended January 31, 2018: Requirements: 1. Compute the net profit margin ratio for the years ended January 31, 2018, and 2017. Did it i

> Assume Voltron Company paid $22 million to acquire Brighton Industries. Assume further that Brighton had the following summarized data at the time of the Voltron acquisition (amounts in millions): Brighton’s current assets had a curr

> 1. Milton Printers incurred external costs of $700,000 for a patent for a new laser printer. Although the patent gives legal protection for 20 years, it was expected to provide Milton with a competitive advantage for only eight years due to expected tech

> Bearcreek Mines paid $433,000 for the right to extract ore from a 450,000-ton mineral deposit. In addition to the purchase price, Bearcreek Mines paid a $155 filing fee to the county recorder, a $2,800 license fee to the state of Utah, and $95,045 for a

> Canyon Truck Company is a large trucking company. The company uses the units-of-production (UOP) method to depreciate its trucks.To follow are facts about one Mack truck in the company’s fleet. When this truck was acquired in 2018, the tractor-trailer ha

> On January 2, 2018, Drake Furnishings purchased display shelving for $8,100 cash, expecting the shelving to remain in service for five years. Drake depreciated the shelving on a double-declining-balance basis, with $1,300 estimated residual value. On Sep

> On January 1, 2017, Lincoln Manufacturing purchased a machine for $930,000. The company expected the machine to remain useful for eight years and to have a residual value of $110,000. Lincoln Manufacturing uses the straight-line method to depreciate its

> Chester Consultants purchased a building for $430,000 and depreciated it on a straight-line basis over 40 years. The estimated residual value was $70,000. After using the building for 20 years, Chester realized that the building would remain useful only

> Without making journal entries, record the transactions of E-E-20A directly in the Shay T-account, Equity-method Investment. Assume that after all the noted transactions took place, Shay sold its entire investment in Faulk for cash of $1,600,000. How muc

> On January 1, 2018, Black Iron Bar & Grill purchased a building, paying $56,000 cash and signing a $101,000 note payable. The company paid another $60,000 to remodel the building. Furniture and fixtures cost $51,000, and dishes and supplies—a current ass

> Lima Pizza bought a used Toyota delivery van on January 2, 2018, for $18,600. The van was expected to remain in service for four years (57,000 miles). At the end of its useful life, Lima management estimated that the van’s residual value would be $1,500.

> During 2018, Ming’s Book Store paid $486,000 for land and built a store in Naperville, Illinois. Prior to construction, the city of Naperville charged Ming’s $1,000 for a building permit, which Ming’s paid. Ming’s also paid $15,000 for architect’s fees

> Belvidere Self Storage purchased land, paying $170,000 cash as a down payment and signing a $180,000 note payable for the balance. Belvidere also had to pay delinquent property tax of $2,000, title insurance costing $2,500, and $3,000 to level the land a

> Assume Alfonso Corporation completed the following transactions: a. Sold a store building for $670,000. The building had cost Alfonso $1,600,000, and at the time of the sale, its accumulated depreciation totaled $930,000. b. Lost a store building in a fi

> Handley Grocery Corporation reported the following information in its comparative financial statements for the fiscal year ended January 31, 2018: Requirements: 1. Compute the net profit margin ratio for the years ended January 31, 2018, and 2017. Did i

> Assume Kaledan Company paid $15 million to acquire Roeder Industries. Assume further that Roeder had the following summarized data at the time of the Kaledan acquisition (amounts in millions): Roeder’s current assets had a current mark

> Sweitzer Printers incurred external costs of $400,000 for a patent for a new laser printer. Although the patent gives legal protection for 20 years, it was expected to provide Sweitzer with a competitive advantage for only ten years due to expected tech

> On January 1, 2017, Stockton Manufacturing purchased a machine for $910,000. The company expected the machine to remain useful for eight years and to have a residual value of $80,000. Stockton Manufacturing uses the straight-line method to depreciate i

> Fresno Consultants purchased a building for $440,000 and depreciated it on a straight-line basis over 40 years. The estimated residual value was $82,000. After using the building for 20 years, Fresno realized that the building would remain useful only 14

> Shay Corporation owns equity-method investments in several companies. Shay paid $1,600,000 to acquire a 25% investment in Faulk Software Company. Faulk reported net income of $620,000 for the first year and declared and paid cash dividends of $480,000.

> Ardmore Investments purchased Columbia Corporation shares on December 16 for $110,000. Ardmore plans on holding the securities a few months. Ardmore owns less than 2% of the outstanding shares of Columbia. 1. Suppose the Columbia shares decreased in val

> On January 1, 2018, Little City Bar & Grill purchased a building, paying $58,000 cash and signing a $110,000 note payable. The company paid another $62,000 to remodel the building. Furniture and fixtures cost $55,000, and dishes and supplies—a current

> Accounting records for Allegheny Corporation yield the following data for the year ended June 30, 2018: Requirements: 1. Journalize Allegheny’s inventory transactions for the year under the perpetual system. 2. Report ending inventory,

> Banta Tile & Marble Corporation reported the following comparative income statements for the years ended November 30, 2018, and 2017: Banta’s president and shareholders are thrilled by the company’s boost in sales

> Valentine Antiques, Inc., began May with inventory of $49,300. The business made net purchases of $50,200 and had net sales of $81,300 before a fire destroyed the company’s inventory.For the past several years, Valentine’s gross profit percentage has bee

> McGuire Industries prepares budgets to help manage the company. McGuire is budgeting for the fiscal year ended January 31, 2018. During the preceding year ended January 31, 2017, sales totaled $9,200 million and cost of goods sold was $6,300 million. A

> The Hooper Book Company’s accounting records include the following for 2018 (in thousands): Requirements: 1. Prepare Hooper Book Company’s single-step income statement for the year ended December 31, 2018, including e

> Evaluate the common stock of Tristan Distributing Company as an investment. Specifically, use the two common stock ratios to determine whether the common stock became more or less attractive during the past year. (The number of common stock shares was th

> Altar Loan Company’s balance sheet at December 31, 2018, reports the following: During 2018, Altar Loan earned net income of $6,200,000. Calculate Altar Loan’s earnings per common share (EPS) for 2018; round EPS to t

> For 2018 and 2017, calculate return on sales, asset turnover, return on assets (ROA), leverage, return on common stockholders’ equity (ROE), gross profit percentage, operating income percentage, and earnings per share to measure the abi

> Evansville Furniture Company has asked you to determine whether the company’s ability to pay its current liabilities and long-term debts improved or deteriorated during 2018. To answer this question, calculate the following ratios for 2