Question: In 1979, Steve Blake founded Blake Electronics

In 1979, Steve Blake founded Blake Electronics in Long Beach, California, to manufacture resistors, capacitors, inductors, and other electronic components. During the Vietnam War, Steve was a radio operator, and it was during this time that he became proficient at repairing radios and other communications equipment. Steve viewed his 4-year experience with the army with mixed feelings. He hated army life, but this experience gave him the confidence and the initiative to start his own electronics firm.

Over the years, Steve kept the business relatively unchanged. By 1992, total annual sales were in excess of $2 million. In 1996, Steve’s son, Jim, joined the company after finishing high school and 2 years of courses in electronics at Long Beach Community College. Jim was always aggressive in high school athletics, and he became even more aggressive as general sales manager of Blake Electronics. This aggressiveness bothered Steve, who was more conservative. Jim would make deals to supply companies with electronic components before he bothered to find out if Blake Electronics had the ability or capacity to produce the components. On several occasions, this behavior caused the company some embarrassing moments when Blake Electronics was unable to produce the electronic components for companies with which Jim had made deals.

In 2000, Jim started to go after government contracts for electronic components. By 2002, total annual sales had increased to more than $10 million, and the number of employees exceeded 200. Many of these employees were electronic specialists and graduates of electrical engineering programs from top colleges and universities. But Jim’s tendency to stretch Blake Electronics to take on additional contracts continued as well, and by 2007, Blake Electronics had a reputation with government agencies as a company that could not deliver what it promised. Almost overnight, government contracts stopped, and Blake Electronics was left with an idle workforce and unused manufacturing equipment. This high overhead started to melt away profits, and in 2009, Blake Electronics was faced with the possibility of sustaining a loss for the first time in its history.

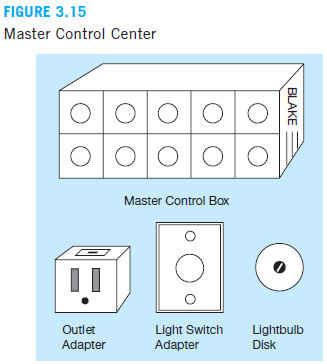

In 2010, Steve decided to look at the possibility of manufacturing electronic components for home use. Although this was a totally new market for Blake Electronics, Steve was convinced that this was the only way to keep Blake Electronics from dipping into the red. The research team at Blake Electronics was given the task of developing new electronic devices for home use. The first idea from the research team was the Master Control Center. The basic components for this system are shown in Figure 3.15.

The heart of the system is the master control box. This unit, which would have a retail price of $250, has two rows of five buttons. Each button controls one light or appliance and can be set as either a switch or a rheostat. When set as a switch, a light finger touch on the button turns a light or appliance on or off. When set as a rheostat, a finger touching the button controls the

intensity of the light. Leaving your finger on the button makes the light go through a complete cycle ranging from off to bright and back to off again.

To allow for maximum flexibility, each master control box is powered by two D-sized batteries that can last up to a year, depending on usage. In addition, the research team has developed three versions of the master control box—versions A, B, and C. If a family wants to control more than 10 lights or appliances, another master control box can be purchased.

The light bulb disk, which would have a retail price of $2.50, is controlled by the master control box and is used to control the intensity of any light. A different disk is available for each button position for all three master control boxes. By inserting the light bulb disk between the light bulb and the socket, the appropriate button on the master control box can completely control the intensity of the light. If a standard light switch is used, it must be on at all times for the master control box to work.

One disadvantage of using a standard light switch is that only the master control box can be used to control the particular light. To avoid this problem, the research team developed a special light switch adapter that would sell for $15. When this device is installed, either the master control box or the light switch adapter can be used to control the light.

When used to control appliances other than lights, the master control box must be used in conjunction with one or more outlet adapters. The adapters are plugged into a standard wall outlet, and the appliance is then plugged into the adapter. Each outlet adapter has a switch on top that allows the appliance to be controlled from the master control box or the outlet adapter. The price of each outlet adapter would be $25.

The research team estimated that it would cost $500,000 to develop the equipment and procedures needed to manufacture the master control box and accessories. If successful, this venture could increase sales by approximately $2 million. But will the master control boxes be a successful venture? With a 60% chance of success estimated by the research team, Steve had serious doubts about trying to market the master control boxes even though he liked the basic idea. Because of his reservations, Steve decided to send requests for proposals (RFPs) for additional marketing research to 30 marketing research companies in southern California.

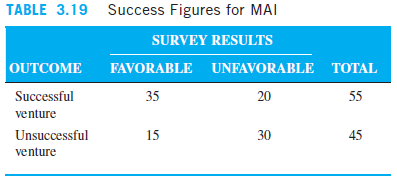

The first RFP to come back was from a small company called Marketing Associates, Inc. (MAI), which would charge $100,000 for the survey. According to its proposal, MAI has been in business for about 3 years and has conducted about 100 marketing research projects. MAI’s major strengths appeared to be individual attention to each account, experienced staff, and fast work. Steve was particularly interested in one part of the proposal, which revealed MAI’s success record with previous accounts. This is shown in Table 3.19.

The only other proposal to be returned was by a branch office of Iverstine and Walker, one of the largest marketing research firms in the country. The cost for a complete survey would be $300,000. While the proposal did not contain the same success record as MAI, the proposal from Iverstine and Walker did contain some interesting information. The chance of getting a favorable survey result, given a successful venture, was 90%. On the other hand, the chance of getting an unfavorable survey result, given an unsuccessful venture, was 80%. Thus, it appeared to Steve that Iverstine and Walker would be able to predict the success or failure of the master control boxes with a great amount of certainty.

Steve pondered the situation. Unfortunately, both marketing research teams gave different types of information in their proposals. Steve concluded that there would be no way that the two proposals could be compared unless he got additional information from Iverstine and Walker. Furthermore, Steve wasn’t sure what he would do with the information and whether it would be worth the expense of hiring one of the marketing research firms.

Discussion Questions

1. Does Steve need additional information from Iverstine and Walker?

2. What would you recommend?

Transcribed Image Text:

FIGURE 3.15 Master Control Center Master Control Box Light Switch Adapter Outlet Lightbulb Adapter Disk BLAKE TABLE 3.19 Success Figures for MAI SURVEY RESULTS OUTCOME FAVORABLE UNFAVORABLE TOTAL Successful 35 20 55 venture Unsuccessful 15 30 45 venture

> The Long Island Life Insurance Company sells a term life insurance policy. If the policy holder dies during the term of the policy, the company pays $100,000. If the person does not die, the company pays out nothing, and there is no further value to the

> Two states of nature exist for a particular situation: a good economy and a poor economy. An economic study may be performed to obtain more information about which of these will actually occur in the coming year. The study may forecast either a good econ

> A financial advisor has recommended two possible mutual funds for investment: Fund A and Fund B. The return that will be achieved by each of these depends on whether the economy is good, fair, or poor. A payoff table has been constructed to illustrate th

> Mark Martinko has been a class A racquetball player for the past 5 years, and one of his biggest goals is to own and operate a racquetball facility. Unfortunately, Mark thinks that the chance of a successful racquetball facility is only 30%. Mark’s lawye

> Peter Martin is going to help his brother who wants to open a food store. Peter initially believes that there is a 50–50 chance that his brother’s food store would be a success. Peter is considering doing a market research study. Based on historical data

> Southwestern University (SWU), a large state college in Stephenville, Texas, 30 miles southwest of the Dallas/Fort Worth metroplex, enrolls close to 20,000 students. In a typical town– gown relationship, the school is a dominant force i

> Bill Holliday is not sure what he should do. He can build a quadplex (i.e., a building with four apartments), build a duplex, gather additional information, or simply do nothing. If he gathers additional information, the results could be either favorable

> Jerry Smith (see Problem 3-38) has done some analysis about the profitability of the bicycle shop. If Jerry builds the large bicycle shop, he will earn $60,000 if the market is favorable, but he will lose $40,000 if the market is unfavorable. The small s

> The physicians in Problem 3-36 have been approached by a market research firm that offers to perform a study of the market at a fee of $5,000. The market researchers claim their experience enables them to use Bayes’ Theorem to make the following statemen

> Refer to the leasing decision facing Beverly Mills in Problem 3-31. Develop the opportunity loss table for this situation. Which option would be chosen based on the minimax regret criterion? Which alternative would result in the lowest expected opportuni

> What is the meaning of mutually exclusive events? What is meant by collectively exhaustive? Give an example of each.

> Describe the use of sensitivity analysis and post optimality analysis in analyzing the results.

> What are the two basic laws of probability?

> List some sources of input data.

> What is Bayes’ Theorem, and when can it be used?

> Briefly trace the history of quantitative analysis. What happened to the development of quantitative analysis during World War II?

> In January 2012, Northern Airlines merged with Southeast Airlines to create the fourth largest U.S. carrier. The new North– South Airline inherited both an aging fleet of Boeing 727-300 aircraft and Stephen Ruth. Stephen was a tough for

> What is the quantitative analysis process? Give several examples of this process.

> What are the three categories of business analytics?

> Define quantitative analysis. What are some of the organizations that support the use of the scientific approach?

> What is the difference between quantitative and qualitative analysis? Give several examples.

> Discuss the role of sensitivity analysis in LP. Under what circumstances is it needed, and under what conditions do you think it is not necessary?

> The mathematical relationships that follow were formulated by an operations research analyst at the Smith–Lawton Chemical Company. Which ones are invalid for use in an LP problem, and why? Maximize profit = 4X1 + 3X1X2 + 8X2 + 5X3 subject to 2X1 + X2 +

> The production manager of a large Cincinnati manufacturing firm once made the statement, “I would like to use LP, but it’s a technique that operates under conditions of certainty. My plant doesn’t have that certainty; it’s a world of uncertainty. So LP c

> You have just formulated a maximization LP problem and are preparing to solve it graphically. What criteria should you consider in deciding whether it would be easier to solve the problem by the corner point method or the isoprofit line approach?

> It has been said that each LP problem that has a feasible region has an infinite number of solutions. Explain.

> It is important to understand the assumptions underlying the use of any quantitative analysis model. What are the assumptions and requirements for an LP model to be formulated and used?

> The Toledo Leather Company has been producing leather goods for more than 30 years. It purchases prepared hides from tanners and produces leather clothing accessories such as wallets, belts, and handbags. The firm has just developed a new leather product

> Explain how a change in a technological coefficient can affect a problem’s optimal solution. How can a change in resource availability affect a solution?

> Develop your own original LP problem with two constraints and two real variables. (a) Explain the meaning of the numbers on the right hand side of each of your constraints. (b) Explain the significance of the technological coefficients. (c) Solve you

> A linear program has a maximum profit of $600. One constraint in this problem is 4X + 2Y ≤ 80. Using a computer, we find the dual price for this constraint is 3, and there is a lower bound of 75 and an upper bound of 100. Explain what this means.

> A linear program has the objective of maximizing profit = 12X + 8Y. The maximum profit is $8,000. Using a computer, we find the upper bound for profit on X is 20 and the lower bound is 9. Discuss the changes to the optimal solution (the values of the var

> Discuss the similarities and differences between minimization and maximization problems using the graphical solution approaches of LP.

> If the ROP is greater than the order quantity, explain how the ROP is implemented. Can the ROP be more than twice the order quantity, and, if so, how is such a situation handled?

> What is the ROP? How is it determined?

> What are some of the assumptions made in using the EOQ?

> Why wouldn’t a company always store large quantities of inventory to eliminate shortages and stockouts?

> Under what circumstances can inventory be used as a hedge against inflation?

> After watching a movie about a young woman who quit a successful corporate career to start her own baby food company, Julia Day decided that she wanted to do the same. In the movie, the baby food company was very successful. Julia knew, however, that it

> Briefly describe what is meant by ABC analysis. What is the purpose of this inventory technique?

> Briefly explain the marginal analysis approach to the single-period inventory problem.

> When using safety stock, how is the standard deviation of demand during the lead time calculated if daily demand is normally distributed but lead time is constant? How is it calculated if daily demand is constant but lead time is normally distributed? Ho

> Briefly describe what is involved in solving a quantity discount model.

> What assumptions are made in the production run model?

> What is the purpose of sensitivity analysis?

> Why is inventory an important consideration for managers?

> Explain how the number of seasons is determined when forecasting with a seasonal component.

> Explain what would happen if the smoothing constant in an exponential smoothing model was equal to zero. Explain what would happen if the smoothing constant was equal to one.

> Describe briefly the steps used to develop a forecasting system.

> Explain what information is provided by the F test.

> Morgan Arthur has spent the past few weeks determining inventory costs for Armstrong, a toy manufacturer located near Cincinnati, Ohio. She knows that annual demand will be 30,000 units per year and that the carrying cost will be $1.50 per unit per year.

> Harrington Health Food stocks 5 loaves of Neutro- Bread. The probability distribution for the sales of Neutro-Bread is listed in the following table. How many loaves will Harrington sell on average? NUMBER OF LOAVES SOLD PROBABILITY 0 ……………………………………………

> Explain how the adjusted r2 value is used in developing a regression model.

> Which of the following are probability distributions? Why? (a) RANDOM VARIABLE X PROBABILITY 2 ………………………………………….………….. 0.1 -1 ……………………………………………….…….. 0.2 0 …………………………………………………….. 0.3 1 ………………………………………………..….. 0.25 2 …………………………………………………….. 0.15 (b)

> Develop your own set of constraint equations and inequalities, and use them to illustrate graphically each of the following conditions: (a) an unbounded problem (b) an infeasible problem (c) a problem containing redundant constraints

> Under what condition is it possible for an LP problem to have more than one optimal solution?

> Let the annual demand for an arbitrary commodity be 1,000 units per year and the associated EOQ be 400 units per order. Under this circumstance, the number of orders per year would be (D>Q) = 2.5 orders per year. How can this be so?

> Discuss the major inventory costs that are used in determining the EOQ.

> What is the purpose of inventory control?

> What is the objective of JIT?

> What is the difference between the gross and the net material requirements plans?

> What is the overall purpose of MRP?

> What happens to the production run model when the daily production rate becomes very large?

> Discuss how the coefficient of determination and the coefficient of correlation are related and how they are used in regression analysis.

> What is MAD, and why is it important in the selection and use of forecasting models?

> Describe briefly the Delphi technique.

> What effect does the value of the smoothing constant have on the weight given to the past forecast and the past observed value?

> What are some of the problems and drawbacks of the moving average forecasting model?

> What is a qualitative forecasting model, and when is it appropriate?

> What is the difference between a causal model and a time-series model?

> Explain when a CMA (rather than an overall average) should be used in computing a seasonal index. Explain why this is necessary.

> In using the decomposition method, the forecast based on trend is found using the trend line. How is the seasonal index used to adjust this forecast based on trend?

> How is the impact of seasonality removed from a time series?

> A seasonal index may be less than one, equal to one, or greater than one. Explain what each of these values would mean.

> Discuss the use of dummy variables in regression analysis.

> Explain how a plot of the residuals can be used in developing a regression model.

> What is the SSE? How is this related to the SST and the SSR?

> What is the difference between prior and posterior probabilities?

> What information should be placed on a decision tree?

> What is the overall purpose of utility theory?

> What is the break-even point? What parameters are necessary to find it?

> C. W. Churchman once said that “mathematics … tends to lull the unsuspecting into believing that he who thinks elaborately thinks well.” Do you think that the best QA models are the ones that are most elaborate and complex mathematically? Why?

> How is the efficiency of sample information computed?

> What is the EVSI? How is this computed?

> Managers are quick to claim that quantitative analysts talk to them in a jargon that does not sound like English. List four terms that might not be understood by a manager. Then explain in nontechnical language what each term means.

> Describe how you would determine the best decision using the EMV criterion with a decision tree.

> What is a random variable? What are the various types of random variables?

> What is implementation, and why is it important?

> Describe the characteristics of a Bernoulli process. How is a Bernoulli process associated with the binomial distribution?

> Give some examples of various types of models. What is a mathematical model? Develop two examples of mathematical models.

> What techniques are used to solve decision-making problems under uncertainty? Which technique results in an optimistic decision? Which technique results in a pessimistic decision?

> Explain how a scatter diagram can be used to identify the type of regression to use.

> Describe the various approaches used in determining probability values.

> What is a time-series forecasting model?

> What is the meaning of least squares in a regression model?

> Beverly Mills has decided to lease a hybrid car to save on gasoline expenses and to do her part to help keep the environment clean. The car she selected is available from only one dealer in the local area, but that dealer has several leasing options to a

> Define opportunity loss. What decision-making criteria are used with an opportunity loss table?

> Even though independent gasoline stations have been having a difficult time, Susan Solomon has been thinking about starting her own independent gasoline station. Susan’s problem is to decide how large her station should be. The annual r

> Mick Karra is the manager of MCZ Drilling Products, which produces a variety of specialty valves for oil field equipment. Recent activity in the oil fields has caused demand to increase drastically, and a decision has been made to open a new manufacturin

> In Problem 3-27, Farm Grown, Inc., has reason to believe the probabilities may not be reliable due to changing conditions. If these probabilities are ignored, what decision would be made using the optimistic criterion? What decision would be made using t