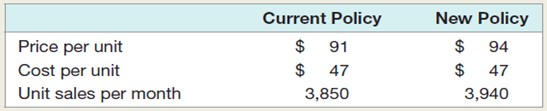

Question: In Problem 14, what is the break-

In Problem 14, what is the break-even quantity for the new credit policy?

Problem 14:

The Harrington Corporation is considering a change in its cash-only policy. The new terms would be net one period. Based on the following information, determine if Harrington should proceed or not. The required return is 2.5 percent per period.

,,,

> Tool Manufacturing has an expected EBIT of $64,000 in perpetuity and a tax rate of 35 percent. The firm has $95,000 in outstanding debt at an interest rate of 8.5 percent, and its unlevered cost of capital is 15 percent. What is the value of the firm acc

> Knight Inventory Systems, Inc., has announced a rights offer. The company has announced that it will take four rights to buy a new share in the offering at a subscription price of $35. At the close of business the day before the ex-rights day, the compan

> Roth Corp. wants to raise $5.6 million via a rights offering. The company currently has 650,000 shares of common stock outstanding that sell for $50 per share. Its underwriter has set a subscription price of $23 per share and will charge the company a 6

> Show that the value of a right just prior to expiration can be written as:Value of a right = PRO – PX = (PRO – PS)/(N + 1) Where P RO , P S , and P X stand for the rights-on price, the subscription price, and the ex-rights price, respectively, and N is t

> Floyd Industries stock has a beta of 1.50. The company just paid a dividend of $.80, and the dividends are expected to grow at 5 percent. The expected return of the market is 12 percent, and Treasury bills are yielding 5.5 percent. The most recent stock

> Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the following table. If the corporate tax rate is 34 percent, what is the after tax cost of Ying’s debt?,,,

> Goodbye, Inc., recently issued new securities to finance a new TV show. The project cost $15 million, and the company paid $850,000 in flotation costs. In addition, the equity issued had a flotation cost of 7 percent of the amount raised, whereas the deb

> Scanlin, Inc., is considering a project that will result in initial after tax cash savings of $2.7 million at the end of the first year, and these savings will grow at a rate of 4 percent per year indefinitely. The firm has a target debt–equity ratio of

> Stock Y has a beta of 1.3 and an expected return of 18.5 percent. Stock Z has a beta of .70 and an expected return of 12.1 percent. If the risk-free rate is 8 percent and the market risk premium is 7.5 percent, are these stocks correctly priced?

> Assume that the historical return on large-company stocks is a predictor of the future returns. What return would you estimate for large company stocks over the next year? The next 5 years? 20 years? 30 years?

> Over a 40-year period an asset had an arithmetic return of 15.3 percent and a geometric return of 11.9 percent. Using Blume’s formula, what is your best estimate of the future annual returns over 5 years? 10 years? 20 years?

> In Problem 18, what is the probability that the return is less than -100 percent (think)? What are the implications for the distribution of returns?Problem 18:Assuming that the returns from holding small-company stocks are normally distributed, what is t

> Suppose the returns on long-term corporate bonds are normally distributed. Based on the historical record, what is the approximate probability that your return on these bonds will be less than - 2.2 percent in a given year? What range of returns would yo

> In an effort to capture the large jet market, Airbus invested $13 billion developing its A380, which is capable of carrying 800 passengers. The plane has a list price of $280 million. In discussing the plane, Airbus stated that the company would break ev

> Hybrid cars are touted as a “green” alternative; however, the fi nancial aspects of hybrid ownership are not as clear. Consider the 2006 Honda Accord Hybrid, which had a list price of $5,450 (including tax consequences) more than a Honda Accord EX sedan.

> In the previous problem, you feel that the values are accurate to within only ±10 percent. What are the best-case and worst-case NPVs? (Hint: The price and variable costs for the two existing sets of clubs are known with certainty; only the sales gained

> McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $750 per set and have a variable cost of $330 per set. The company has spent $150,000 for a marketing study that determined the company will sell 51,000 sets per year for

> You are considering a new product launch. The project will cost $1,700,000, have a four-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 190 units per year; price per unit will be $18,000, variable cost

> Asset W has an expected return of 15.2 percent and a beta of 1.25. If the risk-free rate is 5.3 percent, complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the relationship between portfolio expected return and portf

> In the previous problem, what is the degree of operating leverage at the given level of output? What is the degree of operating leverage at the accounting break-even level of output?Previous problem:Consider a four-year project with the following informa

> Consider a four-year project with the following information: initial fixed asset investment = $490,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $32; variable costs = $19; fixed costs = $210,000; quantity so

> A stock has had the following yearend prices and dividends:What are the arithmetic and geometric returns for the stock?

> A stock has had returns of 3 percent, 38 percent, 21 percent, -15 percent, 29 percent, and - 13 percent over the last six years. What are the arithmetic and geometric returns for the stock?

> You find a certain stock that had returns of 7 percent, - 12 percent, 18 percent, and 19 percent for four of the last five years. If the average return of the stock over this period was 10.5 percent, what was the stock’s return for the missing year? What

> You bought one of Great White Shark Repellant Co.’s 8 percent coupon bonds one year ago for $1,030. These bonds make annual payments and mature six years from now. Suppose you decide to sell your bonds today, when the required return on the bonds is 7 pe

> Keira Mfg. is considering a rights offer. The company has determined that the ex-rights price would be $71. The current price is $76 per share, and there are 19 million shares outstanding. The rights offer would raise a total of $60 million. What is the

> In the previous problem, what would the ROE on the investment have to be if we wanted the price after the offering to be $98 per share? (Assume the PE ratio remains constant.) What is the NPV of this investment? Does any dilution take place?Previous prob

> The Metallica Heavy Metal Mining (MHMM) Corporation wants to diversify its operations. Some recent fi nancial information for the company is shown here:MHMM is considering an investment that has the same PE ratio as the fi rm. The cost of the investment

> Teardrop, Inc., wishes to expand its facilities. The company currently has 8 million shares outstanding and no debt. The stock sells for $50 per share, but the book value per share is $18. Net income is currently $17 million. The new facility will cost $

> A stock has a beta of 1.35 and an expected return of 16 percent. A risk-free asset currently earns 4.8 percent.a. What is the expected return on a portfolio that is equally invested in the two assets?b. If a portfolio of the two assets has a beta of .95,

> In Problem 27, suppose you’re confident about your own projections, but you’re a little unsure about Detroit’s actual machine screw requirement. What is the sensitivity of the project OCF to changes in the quantity supplied? What about the sensitivity of

> Consider a project to supply Detroit with 35,000 tons of machine screws annually for automobile production. You will need an initial $3,200,000 investment in threading equipment to get the project started; the project will last for five years. The accoun

> Show that if we consider the effect of taxes, the degree of operating leverage can be written as: DOL = 1 + [FC × (1 - T ) - T × D ] / OCF Notice that this reduces to our previous result if T = 0. Can you interpret this in words?

> This problem concerns the effect of taxes on the various break-even measures.a. Show that, when we consider taxes, the general relationship between operating cash flow, OCF, and sales volume, Q , can be written as:b. Use the expression in part (a) to fin

> From our discussion of the Fisher effect in Chapter 7, we know that the actual relationship between a nominal rate, R, a real rate, r, and an inflation rate, h, can be written as:1 + r = (1 + R)/ (1 + h)This is the domestic Fisher effect.a. What is the n

> In the previous problem, assume the equity increases by 1,250 solaris due to retained earnings. If the exchange rate at the end of the year is 1.24 solaris per dollar, what does the balance sheet look like?Previous problem:Atreides International has oper

> In Problem 15, what is the break-even price per unit under the new credit policy? Assume all other values remain the same.Problem 15:Happy Times currently has an all-cash credit policy. It is considering making a change in the credit policy by going to t

> This is a comprehensive project evaluation problem bringing together much of what you have learned in this and previous chapters. Suppose you have been hired as a fi nancial consultant to Defense Electronics, Inc. (DEI), a large, publicly traded firm tha

> Trower Corp. has a debtequity ratio of 1.20. The company is considering a new plant that will cost $145 million to build. When the company issues new equity, it incurs a flotation cost of 8 percent. The flotation cost on new debt is 3.5 percent. What is

> Use the results of Problem 26 to find the degree of operating leverage for the company in Problem 27 at the base-case output level of 35,000 units. How does this number compare to the sensitivity figure you found in Problem 28? Verify that either approac

> A stock has an expected return of 14 percent, its beta is 1.45, and the expected return on the market is 11.5 percent. What must the risk-free rate be?

> Use the results of Problem 25 to find the accounting, cash, and financial break-even quantities for the company in Problem 27

> Suppose you observe the following situation:a. Calculate the expected return on each stock.b. Assuming the capital asset pricing model holds and stock A’s beta is greater than stock B’s beta by .25, what is the expecte

> Suppose you observe the following situation:Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-free rate?

> Consider the following information about Stocks I and II:The market risk premium is 8 percent, and the risk-free rate is 4 percent. Which stock has the most systematic risk? Which one has the most unsystematic risk? Which stock is “risk

> You have $100,000 to invest in a portfolio containing Stock X and Stock Y. Your goal is to create a portfolio that has an expected return of 18.5 percent. If Stock X has an expected return of 17.2 percent and a beta of 1.4, and Stock Y has an expected re

> Photo chronograph Corporation (PC) manufactures time series photographic equipment. It is currently at its target debt equity ratio of .70. It’s considering building a new $45 million manufacturing facility. This new plant is expected to generate after

> In Problem 14, what is the break-even price per unit that should be charged under the new credit policy? Assume that the sales figure under the new policy is 4,100 units and all other values remain the same.Problem 14:The Harrington Corporation is consid

> Assume a firm’s debt is risk-free, so that the cost of debt equals the risk-free rate, R f . Define

> Saché, Inc., expects to sell 700 of its designer suits every week. The store is open seven days a week and expects to sell the same number of suits every day. The company has an EOQ of 500 suits and a safety stock of 100 suits. Once an order is placed, i

> A stock has an expected return of 13.5 percent, its beta is 1.17, and the risk-free rate is 5.5 percent. What must the expected return on the market be?

> In a world of corporate taxes only, show that the WACC can be written as WACC = R U × [1 - T C ( D / V )]

> Come and Go Bank offers your firm a 10 percent discount interest loan for up to $25 million, and in addition requires you to maintain a 5 percent compensating balance against the amount borrowed. What is the effective annual interest rate on this lending

> In exchange for a $400 million fixed commitment line of credit, your firm has agreed to do the following:1. Pay 1.9 percent per quarter on any funds actually borrowed.2. Maintain a 4 percent compensating balance on any funds actually borrowed.3. Pay an u

> After completing its capital spending for the year, Carlson Manufacturing has $1,000 extra cash. Carlson’s managers must choose between investing the cash in Treasury bonds that yield 6 percent or paying the cash out to investors who would invest in the

> National Business Machine Co. (NBM) has $2 million of extra cash after taxes have been paid. NBM has two choices to make use of this cash. One alternative is to invest the cash in fi nancial assets. The resulting investment income will be paid out as a s

> As discussed in the text, in the absence of market imperfections and tax effects, we would expect the share price to decline by the amount of the dividend payment when the stock goes ex dividend. Once we consider the role of taxes, however, this is not n

> The Gecko Company and the Gordon Company are two firms whose business risk is the same but that have different dividend policies. Gecko pays no dividend, whereas Gordon has an expected dividend yield of 5 percent. Suppose the capital gains tax rate is ze

> A project has the following estimated data: price = $57 per unit; variable costs = $32 per unit; fixed costs = $9,000; required return = 12 percent; initial investment = $18,000; life = four years. Ignoring the effect of taxes, what is the accounting bre

> In each of the following cases, find the unknown variable:,,,

> In each of the following cases, calculate the accounting break-even and the cash break-even points. Ignore any tax effects in calculating the cash break-even.,,,

> A stock has an expected return of 10.2 percent, the risk-free rate is 4.5 percent, and the market risk premium is 8.5 percent. What must the beta of this stock be?

> In the previous problem, suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ± 10 percent. Calculate the best-case and worst-case NPV fi gures.Previous problem:We are evaluating a project that cos

> We are evaluating a project that costs $724,000, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 90,000 units per year. Price per unit is $43, variab

> For the company in the previous problem, suppose management is most concerned about the impact of its price estimate on the project’s profitability. How could you address this concern? Describe how you would calculate your answer. What values would you u

> Olin Transmissions, Inc. has the following estimates for its new gear assembly project: price = $1,900 per unit; variable costs = $240 per unit; fixed costs = $4.8 million; quantity = 95,000 units. Suppose the company believes all of its estimates are ac

> K-Too Ever wear Corporation can manufacture mountain climbing shoes for $24.86 per pair in variable raw material costs and $14.08 per pair in variable labor expense. The shoes sell for $135 per pair. Last year, production was 120,000 pairs. Fixed costs w

> Southern Alliance Company needs to raise $45 million to start a new project and will raise the money by selling new bonds. The company will generate no internal equity for the foreseeable future. The company has a target capital structure of 65 percent c

> Suppose your company needs $20 million to build a new assembly line. Your target debtequity ratio is .75. The flotation cost for new equity is 8 percent, but the flotation cost for debt is only 5 percent. Your boss has decided to fund the project by borr

> An all-equity firm is considering the following projects:The T-bill rate is 5 percent, and the expected return on the market is 11 percent.a. Which projects have a higher expected return than the firm’s 11 percent cost of capital?b. Whi

> Titan Mining Corporation has 9 million shares of common stock outstanding, 250,000 shares of 6 percent preferred stock outstanding, and 105,000 7.5 percent semiannual bonds outstanding, par value $1,000 each. The common stock currently sells for $34 per

> In the previous problem, what will be the new degree of operating leverage in each case?Previous problem:At an output level of 10,000 units, you have calculated that the degree of operating leverage is 2.35. The operating cash flow is $43,000 in this cas

> A stock has a beta of 1.05, the expected return on the market is 11 percent, and the risk-free rate is 5.2 percent. What must the expected return on this stock be?

> At an output level of 10,000 units, you have calculated that the degree of operating leverage is 2.35. The operating cash flow is $43,000 in this case. Ignoring the effect of taxes, what are fixed costs? What will the operating cash flow be if output ris

> A proposed project has fixed costs of $73,000 per year. The operating cash flow at 8,000 units is $87,500. Ignoring the effect of taxes, what is the degree of operating leverage? If units sold rise from 8,000 to 8,500, what will be the increase in operat

> In the previous problem, suppose fixed costs are $130,000. What is the operating cash flow at 58,000 units? The degree of operating leverage?Previous problem:At an output level of 65,000 units, you calculate that the degree of operating leverage is 3.40.

> At an output level of 65,000 units, you calculate that the degree of operating leverage is 3.40. If output rises to 70,000 units, what will the percentage change in operating cash flow be? Will the new level of operating leverage be higher or lower? Expl

> Consider a project with the following data: accounting break-even quantity = 15,500 units; cash break-even quantity = 13,200 units; life = five years; fixed costs = $140,000; variable costs = $24 per unit; required return = 16 percent. Ignoring the effec

> Night Shades Inc. (NSI) manufactures biotech sunglasses. The variable materials cost is $5.43 per unit, and the variable labor cost is $3.13 per unit.a. What is the variable cost per unit?b. Suppose NSI incurs fixed costs of $720,000 during a year in whi

> Suppose a corporation currently sells Q units per month for a cash-only price of P . Under a new credit policy that allows one month’s credit, the quantity sold will be Q and the price per unit will be P. Defaults will be percent of credit sales. The v

> Consider the following information about two alternative credit strategies:The higher cost per unit reflects the expense associated with credit orders, and the higher price per unit reflects the existence of a cash discount. The credit period will be 90

> Silicon Wafers, Inc. (SWI), is debating whether or not to extend credit to a particular customer. SWI’s products, primarily used in the manufacture of semiconductors, currently sell for $1,140 per unit. The variable cost is $760 per unit. The order under

> The Johnson Company sells 3,300 pairs of running shoes per month at a cash price of $90 per pair. The firm is considering a new policy that involves 30 days’ credit and an increase in price to $91.84 per pair on credit sales. The cash price will remain a

> You own a portfolio equally invested in a risk free asset and two stocks. If one of the stocks has a beta of 1.38 and the total portfolio is equally as risky as the market, what must the beta be for the other stock in your portfolio?

> Bismark Co. is in the process of considering a change in its terms of sale. The current policy is cash only; the new policy will involve one period’s credit. Sales are 40,000 units per period at a price of $510 per unit. If credit is offered, the new pri

> The variance of the daily cash flows for the Pele Bicycle Shop is $890,000. The opportunity cost to the firm of holding cash is 7 percent per year. What should the target cash level and the upper limit be if the tolerable lower limit has been established

> Based on the Miller–Orr model, describe what will happen to the lower limit, the upper limit, and the spread (the distance between the two) if the variation in net cash flow grows. Give an intuitive explanation for why this happens. What happens if the v

> Slap Shot Corporation has a fixed cost associated with buying and selling marketable securities of $40. The interest rate is currently .021 percent per day, and the firm has estimated that the standard deviation of its daily net cash flows is $70. Manage

> Econoline Crush, Inc., uses a Miller–Orr cash management approach with a lower limit of $43,000, an upper limit of $125,000, and a target balance of $80,000. Explain what each of these points represents; then explain how the system will work.

> The All Day Company is currently holding $690,000 in cash. It projects that over the next year its cash outflows will exceed cash inflows by $140,000 per month. How much of the current cash holdings should be retained, and how much should be used to incr

> Debit and Credit Bookkeepers needs a total of $16,000 in cash during the year for transactions and other purposes. Whenever cash runs low, it sells $1,500 in securities and transfers the cash in. The interest rate is 5 percent per year, and selling secur

> White Whale Corporation has an average daily cash balance of $1,300. Total cash needed for the year is $43,000. The interest rate is 5 percent, and replenishing the cash costs $8 each time. What are the opportunity cost of holding cash, the trading cost,

> Given the following information, calculate the target cash balance using the BAT model:Annual interest rate ……………………………….…………. 6%Fixed order cost ………………………………………..……… $25Total cash needed …………………………………..…… $8,500How do you interpret your answer?

> All Night Corporation has determined that its target cash balance if it uses the BAT model is $2,700. The total cash needed for the year is $28,000, and the order cost is $10. What interest rate must All Night be using?

> You own a stock portfolio invested 25 percent in Stock Q, 20 percent in Stock R, 15 percent in Stock S, and 40 percent in Stock T. The betas for these four stocks are .84, 1.17, 1.11, and 1.36, respectively. What is the portfolio beta?

> Indicate the likely impact of each of the following on a company’s target cash balance. Use the letter I to denote an increase and D to denote a decrease. Briefly explain your reasoning in each case:a. Commissions charged by brokers decrease.b. Interest

> Suppose your company imports computer motherboards from Singapore. The exchange rate is given in Figure 21.1 . You have just placed an order for 30,000 motherboards at a cost to you of 204.7 Singapore dollars each. You will pay for the shipment when it a

> Suppose the current exchange rate for the Polish zloty is Z 2.17. The expected exchange rate in three years is Z 2.26. What is the difference in the annual inflation rates for the United States and Poland over this period? Assume that the anticipated rat

> The treasurer of a major U.S. firm has $30 million to invest for three months. The interest rate in the United States is .37 percent per month. The interest rate in Great Britain is .51 percent per month. The spot exchange rate is £.55, and the three-mon

> Use Figure 21.1 to answer the following questions: Suppose interest rate parity holds, and the current six-month risk-free rate in the United States is 2.2 percent. What must the six-month risk-free rate be in Great Britain? In Japan? In Switzerland?Figu