Question: In the assembly department of Osaka Company,

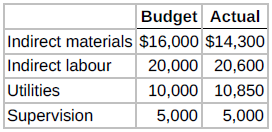

In the assembly department of Osaka Company, budgeted and actual manufacturing overhead costs for the month of April 2020 were as follows:

The department manager can control all costs. Prepare a responsibility report for April for the cost centre.

Prepare a responsibility report for a cost centre.

Transcribed Image Text:

Budget Actual Indirect materials $16,000 $14,300 Indirect labour 20,000 20,600 Utilities 10,000 10,850 Supervision 5,000 5,000

> Lapides Ltd. is a small company that is currently analyzing capital expenditure proposals for the purchase of equipment. The capital budget is limited to $250,000, which Lapides believes is the maximum capital it can raise. The financial adviser is prepa

> The owners of Les Tigres de Trois-Rivières hockey club are considering a deal with an older, established club whereby they can acquire the services of Pierre Luc, a very high scorer and great gate attraction, in exchange for Robert McCain (currently paid

> The City of Craston has recently turned its attention to the apparent problem of a shortage of public transportation. In the past few years, more and more complaints have surfaced regarding inadequate bus services or difficulties in obtaining taxi servic

> Migami Company is considering the purchase of a new machine. The invoice price of the machine is $122,000, freight charges are estimated to be $3,000, and installation costs are expected to be $5,000. The salvage value of the new equipment is expected to

> Morgan Company is considering a capital investment of $210,000 in additional productive facilities. The new machinery is expected to have a useful life of five years with no salvage value. Depreciation is by the straight-line method. During the life of t

> Dryden Service Centre just purchased an automobile hoist for $18,600. The hoist has a five-year life and an estimated salvage value of $1,400. Installation costs and freight charges were $3,900 and $900, respectively. Dryden uses straight-line depreciati

> Mane Event is considering opening a new hair salon in Lethbridge, Alberta. The cost of building a new salon is $300,000. A new salon will normally generate annual revenues of $70,000, with annual expenses (including depreciation) of $41,500. At the end o

> Summer Company is considering three capital expenditure projects. Relevant data for the projects are as follows: Determine the internal rate of return. Annual income is constant over the life of the project. Each project is expected to have zero salvag

> Kendra Corporation is involved in the business of injection moulding of plastics. It is considering the purchase of a new computer-aided design and manufacturing machine for $430,000. The company believes that with this new machine it will improve produc

> Roche and Young, CPAs, are preparing their service revenue (sales) budget for 2020. Their practice is divided into three departments: auditing, tax, and consulting. Billable hours for each department, by quarter, are as follows: Prepare a sales budget fo

> TLC Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently is not equipped to do. Estimates for each machine are as follows: // Instructions Calculate t

> Jack’s Custom Manufacturing Company is considering three new projects. Each one requires an equipment investment of $25,000, will last for three years, and will produce the following net annual cash flows: The equipmentâ€&#

> Dobbs Corporation is considering purchasing a new delivery truck. The truck has many advantages over the company’s current truck (not the least of which is that it runs). The new truck would cost $56,000. Because of the increased capacity, reduced mainte

> Riuto Company accumulated the following standard cost data concerning product I-Tal. Materials per unit: 2 kg at $5 per kilogram Labour per unit: 0.2 hours at $14 per hour Manufacturing overhead: Predetermined rate is 125% of direct labour cost Instruct

> The standard cost of product 999 includes two units of direct materials at $6.00 per unit. During August, the company bought 29,000 units of materials at $6.20 and used those materials to produce 15,000 units. Calculate standard cost. Instructions Calcu

> The service division of Retro Industries reported the following results for 2020. Calculate ROI and expected return on investments. Sales ……………………………….. $500,000 Variable costs ……………………. 300,000 Controllable fixed costs …….. $ 75,000 Average operating a

> The Atlantic division operates as a profit centre. It reports the following for the year. Prepare a responsibility report. Instructions Prepare a responsibility report for the Atlantic division at December 31, 2020. Budgeted Actual Sales $2,000,000

> Chickasaw Company expects to produce 50,000 units of product XLA during the current year. Budgeted variable manufacturing costs per unit are direct materials $7, direct labour $12, and overhead $18. Annual budgeted fixed manufacturing overhead costs are

> In Moore Company's flexible budget graph, the fixed cost line and the total budgeted cost line intersect the vertical axis at $90,000. The total budgeted cost line is $330,000 at an activity level of 60,000 direct labour hours. Calculate total budgeted c

> Wade Company expects to produce 5,500 units of product IOA during the current year. Budgeted variable manufacturing costs per unit are direct materials $7, direct labour $13, and overhead $18. Monthly budgeted fixed manufacturing overhead costs are $8,00

> Point Claire Company had the following results during the most recent year: sales $500,000; residual income $5,000; investment turnover 2.5; and a required rate of return of 15%. Calculate amounts related to ROI. Instructions a. Calculate the total asse

> Zeller Company estimates that 2020 sales will be $40,000 in quarter 1, $48,000 in quarter 2, and $58,000 in quarter 3. Cost of goods sold is 50% of sales. Management desires to have ending finished goods inventory equal to 10% of the next quarter's expec

> Venetian Company management wants to maintain a minimum monthly cash balance of $20,000. At the beginning of April, the cash balance is $22,000, expected cash receipts for March are $245,000, and cash disbursements are expected to be $256,000. Determine

> Oak Creek Company is preparing its budgeted income statement for 2020. Relevant data pertaining to its sales, production, and direct materials budgets are found in D10.12. Calculate budgeted total unit cost and prepare budgeted income statement. In addit

> Oak Creek Company is preparing its master budget for 2020. Relevant data pertaining to its sales, production, and direct materials budgets are as follows. Prepare sales, production, and direct materials budgets. Sales: Sales for the year are expected to

> T&Y Company purchased 12,000 units of raw material on account for $23,400, when the standard cost was $24,000. Later in the month, T&Y Company issued 11,200 units of raw materials for production, when the standard units allowed were 11,600. T&Y Company i

> The following are objectives for Whitefeather Corporation: 1. Ethics violations 2. Credit rating 3. Customer retention 4. Stockouts 5. Reportable accidents 6. Brand recognition Match balanced scorecard perspectives and their objectives. Instructions Ind

> The standard cost of product 2525 includes 1.9 hours of direct labour at $14.00 per hour. The predetermined overhead rate is $22.00 per direct labour hour. During July, the company incurred 4,100 hours of direct labour at an average rate of $14.30 per ho

> Information for Sierra Company is given in D13.10. Assume that annual revenues would increase by $80,000, and annual expenses (excluding depreciation) would increase by $41,000. Sierra uses the straight line method to calculate depreciation expense. The

> Ranger Corporation has decided to invest in renewable energy sources to meet part of its energy needs for production. It is considering solar power versus wind power. After considering cost savings as well as incremental revenues from selling excess elec

> Information for Sierra Company is given in D13.10. In addition, the company’s required rate of return is 12%. Instructions Calculate net present value of an investment and its internal rate of return. a. Calculate the net present value on this project a

> Good-Buy Electronics Inc. produces and sells two models of pocket calculators, Deluxe and Standard. The calculators sell for $8 and $5, respectively. Because of the intense competition Good-Buy faces, management budgets sales annually. Its projections fo

> Sierra Company is considering a long-term investment project called ZIP. ZIP will require an investment of $120,000. It will have a useful life of four years and no salvage value. Annual cash inflows would increase by $80,000, and annual cash outflows wo

> The four perspectives in the balanced scorecard are (1) financial, (2) customer, (3) internal process, and (4) learning and growth. Match each of the following objectives with the perspective it is most likely associated with: a. Plant capacity utilizat

> Using the data in BE12.6, calculate the fixed overhead production volume variance. Calculate overhead volume variance. Data from BE12.6: H&X Co. uses a standard job cost system with a normal capacity of 25,000 direct labour hours. H&X Co. produces 12,00

> Using the data in BE12.6, calculate the fixed overhead spending (budget) variance. Calculate overhead budget variance. Data from BE12.6: H&X Co. uses a standard job cost system with a normal capacity of 25,000 direct labour hours. H&X Co. produces 12,00

> H&X Co. uses a standard job cost system with a normal capacity of 25,000 direct labour hours. H&X Co. produces 12,000 units, which cost $185,700 for direct labour (23,000 hours), $27,525 for variable overhead, and $136,400 for fixed overhead. The standar

> Talbot Company’s standard labour cost per unit of output is $22 (2 hours × $11.00 per hour). During August, the company incurs 2,100 hours of direct labour at an hourly cost of $10.80 per hour in making 1,000 units of finished product. Calculate the tota

> Sprague Company’s standard materials cost per unit of output is $10 (2 kg × $5.00). During July, the company purchases and uses 3,200 kg of materials costing $16,160 in making 1,500 units of finished product. Calculate the total, price, and quantity mate

> Labour data for making one unit of finished product in Hideo Company are as follows: (1) Price—hourly wage rate $15.00, payroll taxes $0.95, and fringe benefits $1.50. (2) Quantity—actual production time 1.5 hours, rest periods and cleanup 0.3 hours, a

> Hideo Company accumulates the following data concerning raw materials in making one unit of finished product: (1) Price—net purchase price $2.50, freight in $0.40, and receiving and handling $0.25. (2) Quantity— required materials 3 kg, allowance for was

> Valdez Company uses standards and budgets. For the year, estimated production of product X is 500,000 units. The total estimated costs for materials and labour are $1.3 million and $1.7 million, respectively. Calculate the estimates for (a) a standard co

> Diane Buswell is preparing the 2020 budget for one of Current Designs' rotomoulded kayaks. Extensive meetings with members of the sales department and executive team have resulted in the following unit sales projections for 2020. Quarter 1 …………. 1,000 k

> For its three investment centres, Stahl Company accumulates the following data: Calculate the return on investment (ROI) for each centre. Calculate return on investment using ROI formula. Centre I Centre II Centre III Sales $2,000,000 $4,000,000 $

> For the year ending December 31, 2020, Sanjay Company accumulates the following data for the plastics division, which it operates as an investment centre: contribution margin—$700,000 budgeted, $715,000 actual; controllable fixed costs—$300,000 budgeted,

> Advent Manufacturing Company accumulates the following summary data for the year ending December 31, 2020, for its water division. The division operates as a profit centre: sales—$2 million budgeted, $2,080,000 actual; variable costs—$1 million budgeted,

> A company that manufactures recreational pedal boats has approached Mike Cichanowski to ask if he would be interested in using Current Designs' rotomould expertise and equipment to produce some of the pedal boat components. Mike is intrigued by the idea

> The executive team at Current Designs has gathered to evaluate the company’s operations for the last month. One of the topics on the agenda is a special order to produce a batch of 20 kayaks for a client. Mike Cichanowski asked the others if the special

> The Current Designs staff has prepared the annual manufacturing budget for the rotomoulded line based on an estimated annual production of 4,000 kayaks during 2020. Each kayak will require 54 kilograms of polyethylene powder and a finishing kit (rope, se

> Data for Dukane Company are given in BE11.4. In March 2020, the company incurs the following costs in producing 100,000 units: direct materials $425,000, direct labour $590,000, and variable overhead $805,000. Actual fixed overhead equalled budgeted fixe

> Dukane Company expects to produce 1.2 million units of product XX in 2020. Monthly production is expected to range from 80,000 to 120,000 units. Budgeted variable manufacturing costs per unit are as follows: direct materials $4, direct labour $6, and ov

> In Hinsdale Company, direct labour is $20 per hour. The company expects to operate at 10,000 direct labour hours each month. In January 2020, the company incurs direct labour totalling $204,000 in working 10,400 hours. Prepare (a) a static budget report

> On July 2, 2020, the accounting staff of Waterway's B.C. plant was shocked to discover that their accounting system had been compromised by a brand new computer virus called “badget.” While their software supplier was able to provide a fix within hours o

> Data for Westphal Company are given in BE11.1. In the second quarter, budgeted sales were $400,000, and actual sales were $405,000. Prepare a static budget report for the second quarter and for the year to date. Prepare static budget reports. Data from

> Russo Manufacturing Company uses the following budgets: balance sheet, capital expenditures, cash, direct labour, direct materials, income statement, manufacturing overhead, production, sales, and selling and administrative expenses. Prepare a diagram th

> Data for the investment centres for Stahl Company are given in BE11.9. The centres expect the following changes in the next year: Centre I a 15% increase in sales; Centre II a $200,000 decrease in costs; and Centre III a $400,000 decrease in average oper

> For the quarter ended March 31, 2020, Westphal Company accumulates the following sales data for its product, Garden-Tools: $350,000 budgeted; $335,000 actual. Prepare a static budget report for the quarter. Prepare static budget reports.

> Rajiv Company has completed all of its operating budgets. The sales budget for the year shows 50,000 units and total sales of $2,250,000. The total cost of making one unit of sales is $25. It estimates selling and administrative expenses to be $300,000 a

> Rado Company classifies its selling and administrative expenses budget into variable and fixed components. It expects variable expenses to be $25,000 in the first quarter, and expects $5,000 increments in the remaining quarters of 2020. It expects fixed

> Savage Ltd. expects variable manufacturing overhead costs to be $20,000 in the first quarter of 2020, with $4,000 increments in each of the remaining three quarters. It estimates fixed overhead costs to be $35,000 in each quarter. Prepare the manufacturi

> For Tracey Company, units to be produced are 5,000 in quarter 1 and 6,000 in quarter 2. It takes 1.6 hours to make a finished unit, and the expected hourly wage rate is $15. Prepare a direct labour budget by quarters for the six months ending June 30, 20

> Gomez Company has 2,000 kg of raw materials in its December 31, 2020, ending inventory. Required production for January and February is 5,000 and 6,000 units, respectively. Two kilograms of raw materials are needed for each unit, and the estimated cost p

> Sales budget data for Maltz Company are given in BE10.2. Management wants to have an ending finished goods inventory equal to 20% of the next quarter's expected unit sales. Prepare a production budget by quarters for the first six months of 2020. Prepare

> Waterways Corporation has recently acquired a small manufacturing operation in British Columbia that produces one of its more popular items. This plant will provide these units for resale in retail hardware stores in British Columbia and Alberta. Because

> Maltz Company estimates that unit sales will be 10,000 in quarter 1; 12,000 in quarter 2; 14,000 in quarter 3; and 18,000 in quarter 4. Using a sales price of $80 per unit, prepare the sales budget by quarters for the year ending December 31, 2020. Prepa

> Journalize the following transactions for Rogler Manufacturing. a. Incurred direct labour costs of $24,000 for 3,000 hours. The standard labour cost was $25,500. b. Assigned 3,000 direct labour hours costing $24,000 to production. Standard hours were 3,1

> Journalize the following transactions for Orkin Manufacturing. a. Purchased 6,000 units of raw materials on account for $11,500. The standard cost was $12,000. b. Issued 5,600 units of raw materials for production. The standard units were 5,800. Journali

> Engles Oil Company is considering investing in a new oil well. It is expected that the oil well will increase annual revenues by $130,000 and will increase annual expenses by $70,000, including depreciation. The oil well will cost $470,000 and will have

> The Transcanadian Transportation Company uses a responsibility reporting system to measure the performance of its three investment centres: planes, taxis, and limos. It measures segment performance using a system of responsibility reports and return on i

> The Medina and Haley Dental Clinic provides both preventive and orthodontic dental services. The two owners, Martin Medina and Cybil Haley, operate the clinic as two separate investment centres: preventive services and orthodontic services. Each owner is

> The green division of Campana Company reported the following data for the current year: Calculate ROI for current year and for possible future changes. Sales …………………………………………………. $3,000,000 Variable costs ………………………………………. 1,980,000 Controllable fixed co

> The sports equipment division of Brandon McCarthy Company is operated as a profit centre. Sales for the division were budgeted for 2020 at $900,000. The only variable costs budgeted for the division were cost of goods sold ($440,000) and selling and admi

> Longhead Manufacturing Limited has three divisions that are operated as profit centres. Actual operating data for the divisions are as follows: Calculate missing amounts in responsibility reports for three profit centres, and prepare a responsibility re

> The mixing department manager of Crede Company is able to control all overhead costs except rent, property taxes, and salaries. Budgeted monthly overhead costs for the mixing department, in alphabetical order, are as follows: Prepare a responsibility rep

> Marcum Company's organization chart includes the president; the vice-president of production; three assembly plants—Vancouver, Hamilton, and Saint John; and two departments within each plant—machining and finishing. Budgeted and actual manufacturing cost

> Sherrer Company has two production departments: fabricating and assembling. At a department managers' meeting, the controller uses flexible budget graphs to explain the total budgeted costs. Separate graphs based on direct labour hours are used for each

> Viera Corporation is considering investing in a new facility. The estimated cost of the facility is $2,045,000. It will be used for 12 years, then sold for $716,000. The facility will generate annual cash inflows of $400,000 and will need new annual cash

> Tilger Farm Supply Company manufactures and sells a fertilizer called Snare. The following data are available for preparing budgets for Snare for the first two quarters of 2020. Prepare a budgeted income statement and supporting budgets. 1. Sales: Quarte

> Lorch Company prepares monthly cash budgets. Relevant data from operating budgets for 2021 are as follows: Prepare a cash budget for two months. All sales are on account. Lorch expects collections to be 50% in the month of sale, 40% in the first month

> Lyon Factory Ltd. manufactures two products: chairs and stools. Each chair requires 3 m of upholstery and 4 kg of steel. Each stool requires 2 m of upholstery and 5 kg of steel. Upholstery costs $2 per metre and steel costs $5 per kilogram. Calculate cas

> Colt Industries had sales in 2019 of $5.6 million and gross profit of $1.1 million. Management is considering two alternative budget plans to increase its gross profit in 2020. Prepare sales and production budgets and calculate the cost per unit under tw

> Colt Division had the following results for the year just ended: Compare ROI and residual income with supporting calculations. Colt is considering a new product line that would involve the following: Colt's parent company, North Inc., has a company-w

> National Motors is a major car manufacturer with a wide variety of models, including its most recent one, the Mountaineer. The new model uses parts and components from external suppliers, as well as some from the following divisions of National Motors: C

> Lawton Homes, founded by a former vice-president of Haniwall Industries in P11.45A, has been manufacturing prefabricated houses for the past five years. To compete with Haniwall, Lawton also expanded into the precut housing market by acquiring one of its

> Haniwall Industries has manufactured prefabricated houses for over 20 years. Calculate ROI and residual income and discuss impact on manager performance. The houses are constructed in sections that are assembled on customers' lots. Haniwall expanded into

> Kanjak Company uses a responsibility reporting system. It has divisions in Calgary, Winnipeg, and Sudbury. Each division has three production departments: cutting, shaping, and finishing. Responsibility for each department belongs to a manager who report

> Iqaluit Corporation recently announced a bonus plan to be awarded to the vice-president of the most profitable division. The three managers are to choose whether the ROI or residual income (RI) will be used to measure profitability. In addition, they mus

> Frost Company is evaluating the purchase of a rebuilt spotwelding machine to be used in the manufacture of a new product. The machine will cost $176,000, has an estimated useful life of seven years and a salvage value of zero, and will increase net annua

> Chudzik Manufacturing Company makes garden and lawn equipment. The company operates through three divisions. Each division is an investment centre. Operating data for the lawn mower division for the year ended December 31, 2020, and relevant budget data

> Korene Manufacturing Inc. operates the home appliance division as a profit centre. Operating data for this division for the year ended December 31, 2020, are shown in the following table: Prepare a responsibility report for a profit centre. In addition

> Laesecke Company uses budgets to control costs. The May 2020 budget report for the company's packaging department is as follows: State the total budgeted cost formula, and prepare flexible budget reports for two time periods. The monthly budget amounts

> Rotech Co. began operations in January 2019. The information below is for Rotech Co.'s operations for the three months from January to March (the first quarter) of 2020: Prepare a cash budget. Expenses for Quarter 1 …………………………………………… Depreciation ………………

> The Big Sister Company is in a seasonal business and prepares quarterly budgets. Its fiscal year runs from January 1 through December 31. Production occurs only in the first quarter (January to March), but sales take place throughout the year. The sales

> Kurian Industries' balance sheet at December 31, 2019, follows. Prepare budgeted income statement and balance sheet. / / Budgeted data for the year 2020 include the following: To meet sales requirements and to have 3,000 units of finished goods on ha

> Kirkland Ltd. estimates sales for the second quarter of 2020 will be as follows: Prepare a raw materials purchase budget in dollars. April …………… 2,550 units May ……………. 2,475 units June ………….. 2,390 units The target ending inventory of finished products

> The budget committee of Ridder Company collects the following data for its Westwood Store in preparing budgeted income statements for July and August 2020: Prepare purchases and income statement budgets for a merchandiser. 1. The store expects sales for

> The controller of Harrington Company estimates sales and production for the first four months of 2020 as follows: Prepare a cash budget for a quarter. Sales are 40% cash and 60% on account, and 60% of credit sales are collected in the month of the sale

> Montreal Inc. manufactures garden hoses for large stores. The standard costs for a dozen garden hoses are as follows: Calculate variances. Direct materials …………â€

> Martelle Company is performing a post-audit of a project completed one year ago. The initial estimates were that the project would cost $250,000, would have a useful life of nine years and zero salvage value, and would result in net annual cash flows of

> Toronto Manufacturing Company uses a standard cost system. John Robert, a financial analyst for Toronto Manufacturing Company, has been given information with respect to standard cost variances for one of the plants. These variances are given below. Calc