Question: In the last chapter you created some

In the last chapter you created some queries for the Snick’s Board Shop. Now Caitlin would like you to help her create some forms to view information from the database. Make the following changes for Caitlin using the ch11-05_student_name file you created in Chapter 11. (Note: Open your ch11-05_student_name file and then save it as ch12-05_student_name before making the indicated changes.)

a. Note the existing relationships between the Product, Manufacturer, and Category tables. Now delete those relationships, and then change the field size of Product ID to 10, Product Name to 35, Manufacturer ID to 10, Style to 15, Category Name to 25, Manufacturer Name to 25, and Phone Number to 15. Now reestablish the relationships you previously deleted enforcing referential integrity. Use the Forms Wizard to create a new form that includes the Product ID, Product Name, Category Name, Manufacturer Name, Price, Style, Quantity, and Picture fields. View the data by Product in a columnar layout. Name your form Form A and then navigate to Product ID 61-16758 and print that record only.

b. Modify the form you created and saved in (a) by changing the Category Name text box to a list box control that provides a list of all Categories: Complete, Ramp, Longboards, Protective Gear, Rails, and T-Shirts. Move the fields below Category Name down so all are viewable on the form. Change the title of the form to Form B in the form header and then save the modified form as Form B. Print the record containing 61-16758 only.

c. Create a new form containing all of the fields from the product table in columnar layout with a title of Form C.Make the Manufacturer ID a combo box control based on the Manufacturer ID field of the Manufacturer table. Print the documenter page that documents the new combo box.

d. Add a new data type Yes/No field titled Green to the Manufacturer table and then add a new form containing all the fields in the Manufacturer table in columnar format titled Form D. The new Green field designates whether a manufacturer has qualified for the energy-saving status granted by the state. Currently only Zero, Anti-Hero, and Board pusher are designated ‘‘Green’’ by the state. Place checks in the Green fields for those three manufacturers. Print the Board pusher record.

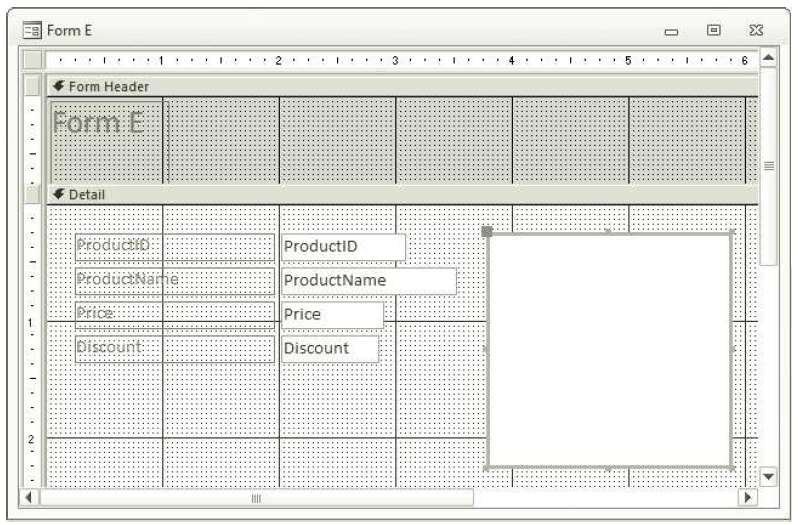

e. Create a new form containing the Product ID, Product Name, Price, Discount, and Picture fields viewed by Product in a Columnar layout titled Form E. Delete the Picture label and move the picture control to the right hand side of the form. Resize the Product Name and Price fields so that your form looks like Figure 12.43: Now add a new calculated control titled Discounted Price and formatted as currency below the Discount field to compute the discounted price (Price less discount, if any). Print the record for Product ID 61-16758.

f. Create a new form with a sub-form containing the fields Category- Name, Product Name, Price, and Style viewing the data by Category is a Datasheet layout and title Form F. Resize the fields displayed in the sub-form and then print the form for the complete category.

g. Make sure you keep a copy of this file for use in the next chapter.

Figure 12.43:

> Salary Plans Bobby recently accepted a sales position in Portland, Oregon. He can select between the two salary plans shown in the table. Determine the dollar amount of weekly sales that would result in Bobby earning more with Plan B than with Plan A.

> Quartz Countertops Larry wishes to have three quartz countertops installed in his new kitchen. The countertops are rectangular and have the following dimensions: 3½t ( 6 ft, 2½ft ( 8 ft, and 3 ft ( 11½ ft. The cost of the countertops is $84 per square fo

> A set of constraints and a profit function are given. (a) Graph the constraints and determine the vertices of the feasible region. (b) Use the vertices obtained in part (a) to determine the maximum and minimum profit. x + 2y ≤ 14 7x + 4y ( 28 x ( 2 x ≤

> Unemployment Rate The following graph shows the unemployment rate in the United States for the years 2005–2013 In which years, from 2005–2013, was the unemployment rate in the United States a) 7 5% b) 6 5.5% c) > 7.

> Solve the system of equations by the addition method. If the system does not have a single ordered pair as a solution, state whether the system is inconsistent or dependent. 6x + 6y = 1 4x + 9y = 4

> The number of phone calls between two cities during a given time period, N, varies directly as the populations p1 and p2 of the two cities and inversely to the distance, d, between them. If 100,000 calls are made between two cities 300 mi apart and the p

> Cost of a Lawn Service Jim and Wendy’s home lot is illustrated here. They wish to hire a lawn service to cut their lawn. M&M Lawn Service charges $0.03 per square yard of lawn. How much will it cost them to have their lawn cut?

> A set of constraints and a profit function are given. (a) Graph the constraints and determine the vertices of the feasible region. (b) Use the vertices obtained in part (a) to determine the maximum and minimum profit. x + y ≤50 x + 3y ≤ 90 x ( 0 y ( 0 P

> Graph the solution set of the inequality, where x is an integer, on the number line.

> 4x + y = 6 -8x - 2y = 13 Solve the system of equations by the addition method. If the system does not have a single ordered pair as a solution, state whether the system is inconsistent or dependent.

> Fill in the blanks with an appropriate word, phrase, or symbol(s) 2. Anything of value pledged by the borrower that the lender may sell or keep if the borrower does not repay the loan is called the _____or collateral. 4. When using the simple interest fo

> Guitar Strings The number of vibrations per second, v, of a guitar string varies directly as the square root of the tension, t, and inversely as the length of the string, l. If the number of vibrations per second is 5 when the tension is 225 kg and the l

> Nancy has just purchased a new house that is in need of new flooring. Use the measurements given on the floor plans of Nancy’s house to obtain the answer. Cost of Saxony Carpeting The cost of Saxony carpeting is $7.49 per square foot. T

> A set of constraints and a profit function are given. (a) Graph the constraints and determine the vertices of the feasible region. (b) Use the vertices obtained in part (a) to determine the maximum and minimum profit. x + 2y ≤ 6 3x + 2y ≤ 12 x ( 0 y ( 0

> -2 ( 2x + 3 ( 6 Graph the solution set of the inequality, where x is an integer, on the number line.

> 2x + 3y = 6 5x - 4y = -8 Solve the system of equations by the addition method. If the system does not have a single ordered pair as a solution, state whether the system is inconsistent or dependent.

> Stopping Distance of a Car The stopping distance, d, of a car after the brakes are applied varies directly as the square of the speed, s, of the car. If a car traveling at a speed of 40 miles per hour can stop in 80 feet, what is the stopping distance of

> Nancy has just purchased a new house that is in need of new flooring. Use the measurements given on the floor plans of Nancy’s house to obtain the answer. Cost of Linoleum The cost of linoleum is $3.49 per square foot. This price inclu

> A feasible region and its vertices are shown. Determine the maximum and minimum values of the given objective function. K = 40x + 50y

> -2 ( x ( 6 Graph the solution set of the inequality, where x is an integer, on the number line.

> 3x - 4y = 11 x + 2y = -3 Solve the system of equations by the addition method. If the system does not have a single ordered pair as a solution, state whether the system is inconsistent or dependent.

> Fill in the blank with an appropriate word, phrase, or symbol(s). 2. A matrix that contains the same number of rows and columns is called a(n) _______matrix. 4. The number of rows in a 4 ( 3 matrix is_______ . 6. When multiplying a matrix by a real numbe

> Pressure and Volume The volume of a gas, V, varies inversely as its pressure, P. If the volume of a gas is 6400 cubic centimeters (cc) when the pressure is 25 millimeters (mm) of mercury, determine the volume when the pressure is 200 mm of mercury.

> Nancy has just purchased a new house that is in need of new flooring. Use the measurements given on the floor plans of Nancy’s house to obtain the answer. Cost of Laminate Flooring The cost of oak laminate flooring is $9.75 per square f

> A feasible region and its vertices are shown. Determine the maximum and minimum values of the given objective function. K = 10x + 8y

> -2(x – 1) ( 3(x – 4)+ 5 Graph the solution set of the inequality, where x is an integer, on the number line.

> x + 2y = 15 3x + y = 5 Solve the system of equations by the addition method. If the system does not have a single ordered pair as a solution, state whether the system is inconsistent or dependent.

> Property Tax The property tax, t, on a home is directly proportional to the assessed value, v, of the home. If the property tax on a home with an assessed value of $140,000 is $2100, what is the property tax on a home with an assessed value of $180,000?

> One square meter equals 10,000 cm2. Use this information to convert the following. 8372 cm2 to square meters

> Graph the system of linear inequalities and indicate the solution set. x ≤ 0 y ≤ 0

> -5x - 1 ( 17 - 2x Graph the solution set of the inequality, where x is an integer, on the number line.

> x + y = 6 -2x + y = -3 Solve the system of equations by the addition method. If the system does not have a single ordered pair as a solution, state whether the system is inconsistent or dependent.

> (2). The fifth axiom of elliptical geometry states that given a line and a point not on the line, __________ line can be drawn through the given point parallel to the given line. (4). A model for Euclidean geometry is a(n) __________. (6). A model for hy

> (2). A polygon whose sides are all the same length and whose interior angles all have the same measure is called a(n) _________ polygon. (4). The sum of the measures of the interior angles of a triangle is _________. (6). The sum of the measures of the

> What are the purposes of forms?

> What questions are asked by the Simple Query Wizard?

> What facts must be identified for each query?

> What are queries?

> You are to create Kelly’s Boutique’s financial analyses as of December 31, 2018, and as of December 31, 2019. Following the Chapter 3 examples, use the student file ch3-04.xls to create a vertical and horizontal analysis of the balance sheet and income s

> Rosey’s Roses is located in Savannah, Georgia, and specializes in the sale of roses. You, as the manager of the business, are curious to see how Excel might help you manage the business and account for its inventory. To that end, you ha

> Snick’s Board Shop is located in La Jolla, California, and specializes in complete and longboard skateboards and equipment. Owner Casey ‘‘Snick’’ Miller is curious

> The Wine Depot, located in Santa Barbara, California, imports and sells high-quality wine from around the world. Owner Barbara Fairfield is curious to see how Excel might help her manage the business and account for its inventory. Her husband, Bud, is th

> Kelly’s Boutique, located in Pewaukee, Wisconsin, sells a unique combination of books and women’s shoes. Customers love to peruse her book inventory while trying on the latest in shoe fashions, often buying both books

> You are to add another depreciation schedule for What SUP. Use the ch4-01_SLN_student_name.xls worksheet you created in this chapter. Add a new depreciation worksheet, labeled Asset 1003, using the Move or Copy Shortcut menu. The asset to be depreciated

> You must have completed Case 3 in the previous chapter in order to continue working on this case. In the previous chapter you modified some forms for Snick’s Board Shop. Now Caitlin would like you to help her create some new reports. Make the following c

> You must have completed Case 4 in the previous chapter in order to continue working on this case. In the last chapter, you created some queries for Rosey’s Roses. Now the company would like you to help it create some forms to illustrate information from

> Note: You must have completed Case 2 in the previous chapter in order to continue working on this case. In the last chapter you modified some queries for the Wine Depot. Now Barbara would like you to help her create some new forms. Make the following cha

> You must have completed Case 1 in the previous chapter in order to continue working on this case. In the last chapter you added and modified some queries for Kelly’s Boutique. She would now like you to create some new forms. Make the fo

> Note: You must have completed Case 4 in the previous chapter in order to continue working on this case. In the last chapter, you modified some tables for Rosey’s Roses. Now the company would like you to help it create some queries to ex

> You must have completed Case 3 in the previous chapter in order to continue working on this case. In the last chapter you modified some tables for the Snick’s Board Shop. Now Caitlin would like you to help her create some queries to extract information f

> In the last chapter you modified some tables for the Wine Depot. Now Barbara would like you to help her create some queries to extract some information from the database. Make the following changes for Barbara using the ch10- 04_student_name file you cre

> What SUP Partial Year Sum of the Year’s Digits Depreciation for Asset 1004 Create a new worksheet to calculate depreciation for a table purchased on August 1, 2017, for $95,000. It has an estimated salvage value of $2,000 and is to be depreciated over 10

> In the last chapter you added and modified some tables for Kelly’s Boutique. She would now like you to create, run, and print some select, parameter, and action queries. Make the following changes for Kelly, using the ch10-03_student_ n

> In Chapter 9, you created a database for Rosey’s Roses consisting of a Product table, a Type table, and a Grower table. You also created an initial query, form, and report. You have now been asked to make some changes to those files. Make the following c

> In Chapter 9 you created a database for the Snick’s Board Shop consisting of a Products table, a Category table, and a Manufacturer table. You also created an initial query, form, and report. Caitlin has now asked you to make some chang

> Note: You must have completed Case 2 in the previous chapter in order to continue working on this case. In Chapter 9 you created a database for the Wine Depot consisting of a Wine Products table, a Winery table, and a Buyer table. You also created an ini

> In Chapter 9 you created a database for Kelly’s Boutique consisting of a Book table, a Department table, and a Publisher table. You also created an initial form, query, and report. Kelly would now like you to make some adjustments to th

> Rosey’s Roses is interested in more effectively managing their inventory. They would like you to put together a database of their current inventory. Create a new database file using the information below. Name the file ch9-06_student_ n

> Snick’s Board Shop is interested in more effectively managing their inventory. Casey and Caitlin would like you to put together a database of their current inventory. Create a new database file using the information below. Name the file

> The Wine Depot is interested in more effectively managing their inventory. Barbara would like you to put together a database of their current wine inventory. Create a new database file using the following information and name the file ch9-04_student_name

> Recall from Chapter 2 that Kelly’s Boutique sells books as well as women’s shoes. Kelly’s son Casey, a college accounting student who is home for the holidays, is eager to help his mom incorporate com

> Rosey’s Roses is contemplating several alternative means of financing their acquisition of $100,000 in new equipment in year 1. One option is to borrow $80,000 from a local bank. The bank has asked them to produce a 3-year cash budget broken down by year

> Create a new worksheet to calculate depreciation for a table purchased on August 1, 2017, for $95,000. It has an estimated salvage value of $2,000 and is to be depreciated over 10 years using the double declining balance method. Follow the same process u

> Snick’s Board Shop is contemplating several alternative means of financing their acquisition of $350,000 in new equipment in year 1. One option is to borrow $300,000 from a local bank. The bank has asked them to produce a 3-year cash budget broken down b

> The Wine Depot is contemplating several alternative means of financing their annual acquisition of $70,000 in equipment. One option is to borrow $300,000 from a local bank for 5 years at 11 percent per annum. The bank has asked them to produce a 4-year c

> Kelly’s Boutique is contemplating several means of financing their acquisition of $200,000 in special equipment. One alternative is to borrow $200,000 from a local bank for 10 years at 12 percent per annum. The bank has asked them to produce a 1-year cas

> Rosey’s Roses is considering several alternative means of financing an expansion. One alternative is to borrow $100,000 from a local bank, but another alternative is to borrow this amount from investors by issuing bonds. Both alternatives involve a 10-ye

> Snick’s Board Shop is considering several alternative means of financing an expansion. One alternative is to borrow $65,000 from a local bank, but another alternative is to borrow this amount from investors by issuing bonds. Both alternatives involve a 2

> Wine Depot is considering several alternative means of financing an expansion. One alternative is to borrow $500,000 from a local bank, but another alternative is to borrow this amount from investors by issuing bonds. Both alternatives involve a 3-year d

> Kelly’s Boutique is contemplating several alternative means of financing an expansion. One alternative is to borrow $425,000 from a local bank; another alternative is to borrow this amount from investors by issuing bonds. Both alternatives involve a 5-ye

> Rosey’s Roses owned the fixed assets shown below as of December 31, 2019: This assignment has no beginning student file. You are to create Rosey’s fixed asset depreciation worksheets using the straight-line depreciatio

> Snick’s Board Shop owned the fixed assets shown below as of December 31, 2018: You are to create Snick’s fixed asset depreciation worksheets using the straight-line depreciation method and based on the information in t

> The Wine Depot owned the following fixed assets as of December 31, 2018: You are to create Wine Depot’s fixed asset depreciation summary and individual depreciation worksheets using the straight-line depreciation method and based on the

> Create a new worksheet to calculate depreciation for a table purchased on August 1, 2017, for $95,000. It has an estimated salvage value of $2,000 and is to be depreciated over 10 years using the straight-line method. Follow the same process used in the

> Kelly’s Boutique owned the following fixed assets as of December 31, 2018: You are to create a fixed asset depreciation summary and individual depreciation worksheets for Kelly’s Boutique using the straight-line deprec

> You are to create a financial analysis for Rosey’s Roses as of December 31, 2022, and December 31, 2023. Following the Chapter 3 examples, use the student file ch3-07.xls to create a vertical analysis of the balance sheet and income statement as of Decem

> You are to create a financial analysis for Snick’s Board Shop as of December 31, 2017, and December 31, 2018. Following the Chapter 3 examples, use the student file ch3-06.xls to create a vertical and horizontal analysis of the balance sheet and income s

> You are to create Wine Depot’s financial analyses as of December 31, 2020, and as of December 31, 2021. Following the Chapter 3 examples, use the student file ch3-05.xls to create a vertical and horizontal analysis of the balance sheet and income stateme

> Use student file ch7-13 to solve 3 of these problems. This file has three worksheets labeled: Present and Future Values, Cost Prediction, and Allowance for Uncollectibles. Complete the file answering the questions below and then save the file as ch7-13_s

> Use student file ch7-13 to solve 3 of these problems. This file has three worksheets labeled: Present and Future Values, Cost Prediction, and Allowance for Uncollectibles. Complete the file answering the questions below and then save the file as ch7-13_s

> Use student file ch7-13 to solve 3 of these problems. This file has three worksheets labeled: Present and Future Values, Cost Prediction, and Allowance for Uncollectibles. Complete the file answering the questions below and then save the file as ch7-13_s

> The company is planning for the future and would like you to prepare a present value analysis. Using the file ch7-10, complete a present value analysis for the following situations. Save the file as ch7-10_student_name (replacing student_name with your n

> During a recent year, Snick’s Board Shop had sales on account of $45,000, collections of $45,500, write-offs of $800, a beginning balance in accounts receivable of $5,000, and a beginning balance in the allowance for uncollectible accounts of $300. At ye

> Snick’s Board Shop is trying to better understand the behavior of their utility expenses. They have accumulated utility expenses over the last 9 months and believe hours open per month are a good predictor of expense behavior. Utility expenses include el

> You are to create a depreciation chart for What SUP for Asset 1003. After completing assignments 1, 2, and 3, and following the steps shown in the chapter, create a new chart comparing straight-line, double declining balance, and sum-of-the-year’s digits

> The Wine Depot is planning for the future and would like you to prepare a present value analysis. Using the file ch7-07, complete a present value analysis for the following situations. Save the file as ch7-07_student_name (replacing student_name with you

> During a recent year, the Wine Depot had sales on account of $1,601,542, collections of $1,523,541, write-offs of $23,487, a beginning balance in accounts receivable of $758,271, and a beginning balance in the allowance for uncollectible accounts of $25,

> The Wine Depot is trying to better understand the behavior of their selling expenses. They have accumulated selling expenses over the last 6 months and believe units sold are a good predictor of expense behavior. Selling expenses include commissions on s

> Kelly is planning for the future and would like you to prepare a present value analysis. Using the file ch7-04 complete a present value analysis for the following situations. Save the file as ch7-04_student_name (replacing student_name with your name). P

> During a recent year Kelly’s Boutique had sales on account of $6,025,000, collections of $5,800,000, write-offs of $50,000, a beginning balance in accounts receivable of $500,000, and a beginning balance in the allowance for uncollectible accounts of $37

> Kelly has a very fluctuating workforce based on seasonal demand. She’s ranged from having 10 employees in one month to 35 employees in another month. Some employees are paid a salary, others are paid hourly. She would like to know more about how these co

> Open the report created in Assignment 2. Change the title of the report to Products by Buyer. Add lines to separate each buyer. Add a line above the grand total amount. Save the new report as Ch 13 Assignment 3. Make sure all values are visible and then

> Create a report using the Buyer Name, Product Name, Quantity, Unit Cost, and Total Cost fields present in the Buyer query. View the data by Buyers Table and group by Buyer Name. Use the summary option feature of Access to the sum Total Cost, showing deta

> Using the Ch13-02 file, create a report using all the fields present in the Buyer Query. View the data by Product Table with no grouping or summarization in a portrait orientation and adjusting the field width so all fields fit on a page. Title and save

> For each buyer name, create a form (using the Forms Wizard) that contains the product name, quantity, and unit price of each product that the buyer is responsible for. Use the sub-form option with a datasheet layout. Save the form as Ch 12 Assignment 7 a

> Create a Financial Analysis for What SUP, Inc. as of December 31, 2020. You are to create What SUP’s financial analysis as of December 31, 2020, from the information found on file ch3-03.xls. This file contains three worksheets, which are labeled Income

> Modify the Products form (not the Ch 12 Assignment 5 form you just created) by changing the Category ID text box control to a special combo box control, listing the choices of Category-ID and Category-Name from the Category table. (Hint: Be sure to first

> Add a new field (Taxable) to the Product Table. Make the field a Yes/ No data type. Add this new field to the Products form (not the Ch 12 Assignment 4 form you just created) to the right of the Reorder Level control. Make Product ID 116 taxable. Save th

> Sales-people earn a 10 percent commission on the price of each sale. Create a new unbound calculated control to compute the possible commission on each product. Modify the Products form (not the Ch 12 Assignment 3 form you just created) by adding a calcu

> Modify the Product form (not the Ch 12 Assignment 2 form you just created) by changing the Category ID text box control to a combo box control that lists choices of A, B, C, D, E, or F. Save the form as Ch 12 Assignment 3. Print the newly created form fo