Question: Information from the Form 990 for the

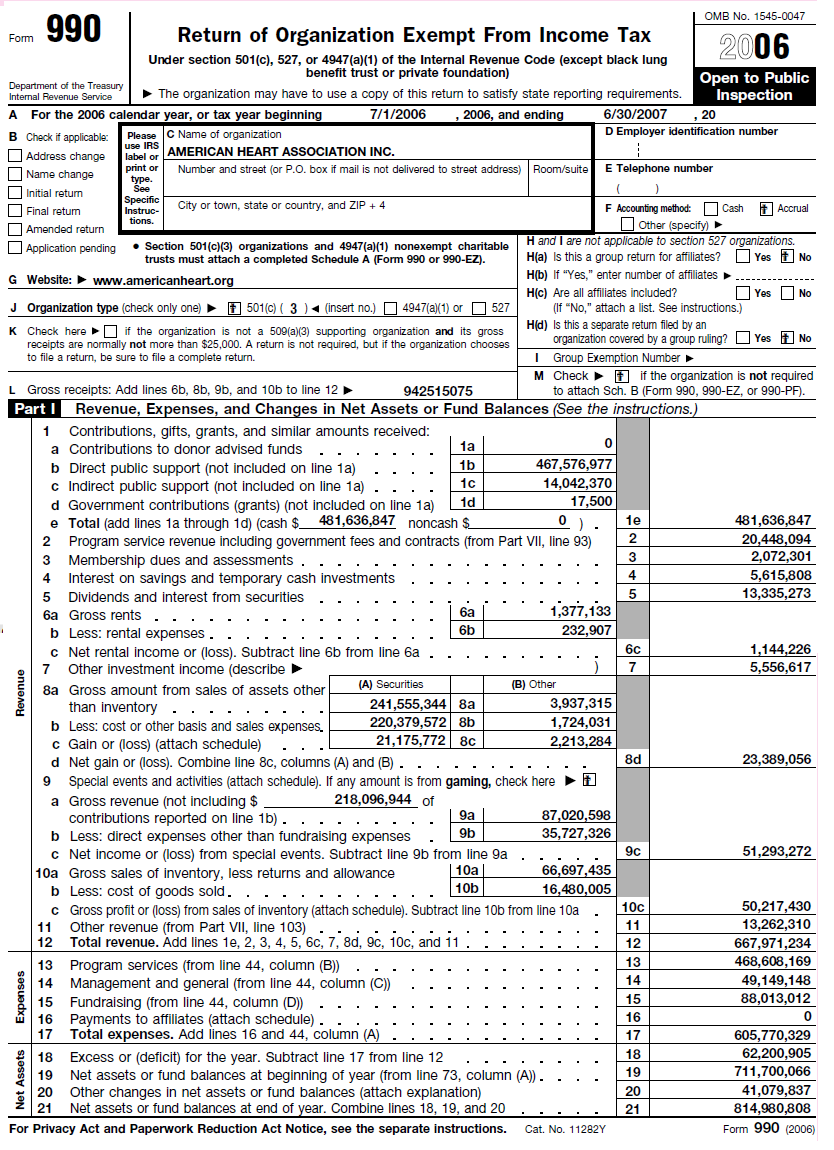

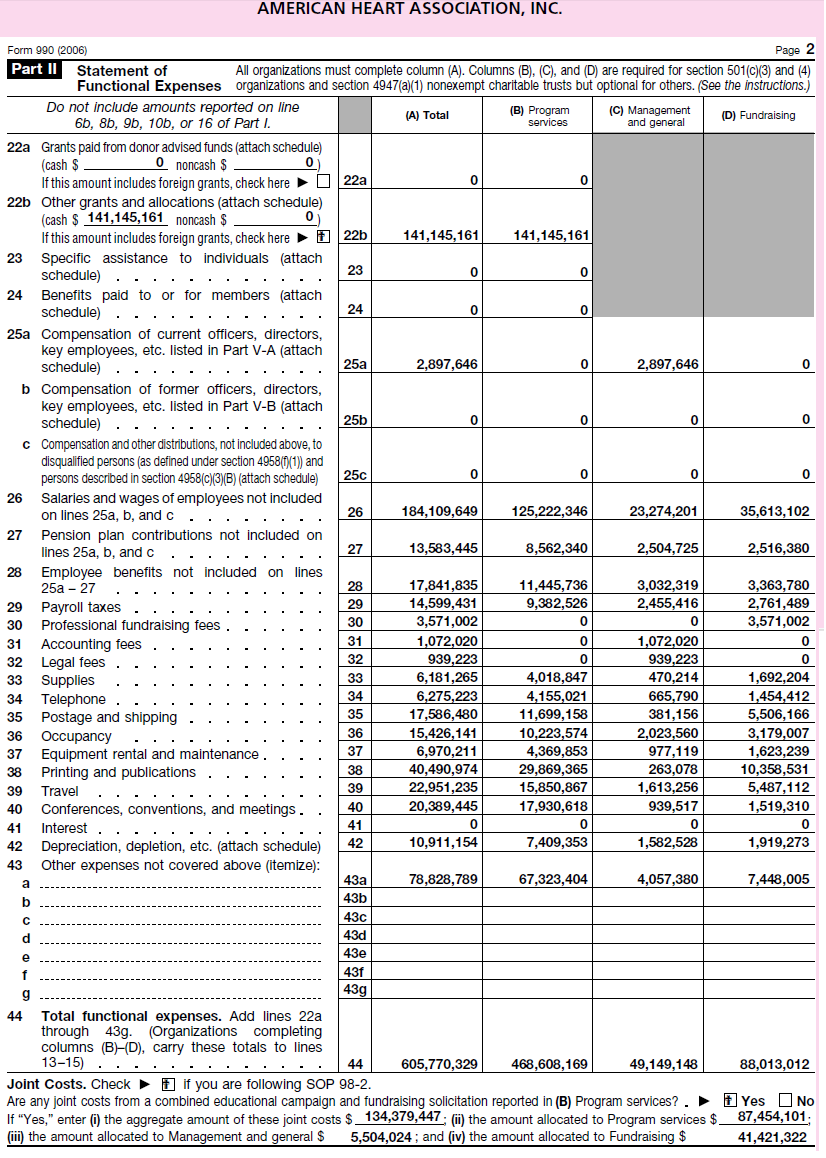

Information from the Form 990 for the American Heart Association for the fiscal year ending June 30, 2007, follows. The full text of the Form 990 is available at www.americanheart.org or www.guidestar.org.

Required

a. Compute the following performance measures using the Form 990 data presented in this exercise and comment on what information they convey to a potential donor without comparing them to prior years or other comparable agencies.

1. Current ratio—liquidity.

2. Revenues/expenses—going concern.

3. Program expenses/total expenses—program effectiveness.

4. Public support/fund-raising expenses—fund-raising efficiency.

5. Investment performance.

b. Obtain the audited annual financial statement for the American Heart Association for fiscal year 2007 from www.americanheart.org. Calculate the same ratios listed in requirement

a. Comment on any differences. (Note: Use the most recent year for which both audited financial statements and Form 990 are readily available.)

c. Discuss the advantages of analyzing financial performance using audited annual financial statement information versus IRS Form 990 information.

QUESTION CONTINUE TO NEXT PAGE

Transcribed Image Text:

OMB No. 1545-0047 990 Return of Organization Exempt From Income Tax 2006 Form Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation) Department of the Treasury Internal Revenue Service Open to Public Inspection > The organization may have to use a copy of this return to satisfy state reporting requirements. A For the 2006 calendar year, or tax year beginning 7/1/2006 , 2006, and ending 6/30/2007 , 20 D Employer identification number B Check if applicable: O Address change OName change Please C Name of organization use IRS Jabel or AMERICAN HEART ASSOCIATION INC. Number and street (or P.O. box if mail is not delivered to street address) Room/suite E Telephone number print or type. See O Initial return Specific Instruc- tions. City or town, state or country, and ZIP + 4 F Accounting method: O Other (specify) > H and I are not applicable to section 527 organizations. H(a) Is this a group return for affiliates? O Yes t No H(b) If "Yes," enter number of affiliates ..--.---------- O Final retum O Cash F Accrual O Amended return O Application pending • Section 501(c)(3) organizations and 4947(a)(1) nonexempt charitable trusts must attach a completed Schedule A (Form 990 or 990-EZ). G Website: www.americanheart.org H(c) Are all affiliates included? (If "No," attach a list. See instructions.) H(d) Is this a separate retum filed by an organization covered by a group ruling? I Group Exemption Number M Check F if the organization is not required O Yes O No J Organization type (check only one) > F 501(c) ( 3 )- (insert no.) O 4947(a)(1) or O 527 K Check here O if the organization is not a 509(a)(3) supporting organization and its gross receipts are normally not more than $25,000. A return is not required, but if the organization chooses to file a return, be sure to file a complete return. O Yes No L Gross receipts: Add lines 6b, 8b, 9b, and 10b to line 12 Part I Revenue, Expenses, and Changes in Net Assets or Fund Balances (See the instructions.) 942515075 to attach Sch. B (Form 990, 990-EZ, or 990-PF). Contributions, gifts, grants, and similar amounts received: a Contributions to donor advised funds b Direct public support (not included on line 1a) c Indirect public support (not included on line 1a) 1a a ... 1b 467,576,977 1c 14,042,370 1d 17,500 d Government contributions (grants) (not included on line 1a) e Total (add lines 1a through 1d) (cash $_ 481,636,847 noncash $ 481,636,847 20,448,094 2,072,301 1e ). Program service revenue including government fees and contracts (from Part VII, line 93) 2 Membership dues and assessments. 3 Interest on savings and temporary cash investments 4 5,615,808 5 Dividends and interest from securities 5 13,335,273 1,377,133 6a Gross rents... b Less: rental expenses. . c Net rental income or (loss). Subtract line 6b from line 6a . 7 Other investment income (describe 6a 6b 232,907 6c 1,144,226 7 5,556,617 (A) Securities (B) Other 8a Gross amount from sales of assets other than inventory .. b Less: cost or other basis and sales expenses. c Gain or (loss) (attach schedule) d Net gain or (loss). Combine line 8c, columns (A) and (B).. Special events and activities (attach schedule). If any amount is from gaming, check here > E 241,555,344 8a 220,379,572 8b 21,175,772 8c 3,937,315 1,724,031 2,213,284 8d 23,389,056 9 218,096,944 of a Gross revenue (not including $ contributions reported on line 1b). b Less: direct expenses other than fundraising expenses c Net income or (loss) from special events. Subtract line 9b from line 9a 87,020,598 35,727,326 9a 9b 9c 51,293,272 10a 66,697,435 16,480,005 10a Gross sales of inventory, less returns and allowance b Less: cost of goods sold.. c Gross profit or (loss) from sales of inventory (attach schedule). Subtract line 10b from line 10a 11 Other revenue (from Part VII, line 103) 10b 50,217,430 13,262,310 10c 11 12 Total revenue. Àdd lines 1e, 2, 3, 4, 5, 6c, 7, 8d, 9c, 10c, and 11 667,971,234 468,608,169 12 13 13 Program services (from line 44, column (B) 14 Management and general (from line 44, column (C)) 15 Fundraising (from line 44, column (D)) 16 Payments to affiliates (attach schedule) 17 Total expenses. Add lines 16 and 44, column (A). 14 49,149,148 15 88,013,012 16 17 605,770,329 62,200,905 711,700,066 18 Excess or (deficit) for the year. Subtract line 17 from line 12 18 19 19 Net assets or fund balances at beginning of year (from line 73, column (A)). 20 Other changes in net assets or fund balances (attach explanation) 21 Net assets or fund balances at end of year. Combine lines 18, 19, and 20 41,079,837 814,980,808 20 21 For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11282Y Form 990 (2006) D00000 enueney AMERICAN HEART ASSOCIATION, INC. Form 990 (2006) Page 2 Part II Statement of All organizations must complete column (A). Columns (B), (C), and (D) are required for section 501(c)(3) and (4) Functional Expenses organizations and section 4947(a)(1) nonexempt charitable trusts but optional for others. (See the instructions.) Do not include amounts reported on line (B) Program services (C) Management and general (A) Total (D) Fundraising 6b, 8b, 9b, 10b, or 16 of Part I. 22a Grants paid from donor advised funds (attach schedule) (cash $. If this amount includes foreign grants, check here O 22a O noncash $ 0) 22b Other grants and allocations (attach schedule) (cash $ 141,145,161 noncash $ If this amount includes foreign grants, check here E 22b 141,145,161 141,145,161 23 Specific assistance to individuals (attach schedule). . . 24 Benefits paid to or for members (attach schedule) 23 24 25a Compensation of current officers, directors, key employees, etc. listed in Part V-A (attach schedule) . . 25a 2,897,646 2,897,646 b Compensation of former officers, directors, key employees, etc. listed in Part V-B (attach schedule) .. c Compensation and other distributions, not included above, to disqualified persons (as defined under section 4958((1) and persons described in section 4958(c\/3/B) (attach schedule) 25b 25c 26 Salaries and wages of employees not included on lines 25a, b, and c . 26 184,109,649 125,222,346 23,274,201 35,613,102 27 Pension plan contributions not included on lines 25a, b, and c c. .. 27 13,583,445 8,562,340 2,504,725 2,516,380 28 Employee benefits not included on lines 25а - 27 17,841.835 14,599,431 28 11,445,736 3,032,319 3,363,780 29 9,382,526 2,455,416 2,761,489 29 Payroll taxes Professional fundraising fees Accounting fees 32 Legal fees 33 Supplies 34 Telephone 35 Postage and shipping 36 Occupancy Equipment rental and maintenance Printing and publications 30 30 3,571,002 3,571,002 31 1,072,020 939,223 6,181,265 1,072,020 939,223 31 32 33 4,018,847 470,214 1,692,204 34 6,275,223 4,155,021 665,790 1,454,412 17,586,480 15,426,141 6,970,211 40,490,974 11,699,158 10,223,574 4,369,853 29,869,365 35 381,156 5,506,166 2,023,560 977.119 36 3,179,007 1,623,239 37 37 263,078 1,613,256 38 38 10,358,531 39 Travel .. 39 22,951,235 15,850,867 5,487,112 40 Conferences, conventions, and meetings. 40 20,389,445 17,930,618 939,517 1,519,310 41 Interest 41 42 42 10,911,154 7,409,353 1,582,528 1,919,273 Depreciation, depletion, etc. (attach schedule) Other expenses not covered above (itemize): 43 a 43a 78,828,789 67,323,404 4,057,380 7,448,005 b 43b 43c d 43d 43e e f 43f g 43g 44 Total functional expenses. Add lines 22a through 43g. (Organizations completing columns (B)-(D), carry these totals to lines 13-15) . 44 605,770,329 468,608,169 49,149,148 88,013,012 Joint Costs. Check E if you are following SOP 98-2. Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services? . E Yes O No If "Yes," enter (i) the aggregate amount of these joint costs $_ 134,379,447; (ii) the amount allocated to Program services $ 87,454,101; (iii) the amount allocated to Management and general $ 5,504,024 ; and (iv) the amount allocated to Fundraising $ 41,421,322

> In order to expand its operations, Barton Corp. raised $5 million in a public offering of common stock, and also negotiated a $2 million loan from First National Bank. In connection with this financing, Barton engaged Hanover & Co., CPAs to audit Barton'

> The CPA firm of Bigelow, Barton, and Brown was expanding rapidly. Consequently, it hired several junior accountants, including a man named Small. The partners of the firm eventually became dissatisfied with Small's production and warned him they would be

> Lauren Yost & Co., a medium-sized CPA firm, was engaged to audit Stuart Supply Company. Several staff were involved in the audit, all of whom had attended the firm's in-house training program on effective auditing methods. Throughout the audit, Yost spen

> Following are 8 statements with missing terms involving auditor legal liability. 1. Under the Ultramares Doctrine, an auditor is generally not liability for _____ to third parties lacking _____. 2. The auditor will use a defense of _____ in a suit brough

> What are the major differences in the scope of the audit responsibilities for CPAs, GAO auditors, IRS agents, and internal auditors?

> The following questions deal with liability under the 1933 and 1934 securities acts. Choose the best response. a. Major, Major, & Sharpe, CPAs, are the auditors of MacLain Technologies. In connection with the public offering of $10 million of MacLain

> State several factors that have affected the incidence of lawsuits against CPAs in recent years.

> In what ways can the profession positively respond to and reduce liability in auditing?

> What potential sanctions does the SEC have against a CPA firm?

> Distinguish between the auditor's potential liability to the client, liability to third parties under common law, civil liability under the securities laws, and criminal liability. Describe one situation for each type of liability in which the auditor ca

> Contrast the auditor's liability under the Securities Act of 1933 with that under the Securities Exchange Act of 1934.

> Is the auditor's liability affected if the third party was unknown rather than known? Explain.

> Compare and contrast traditional auditors' legal responsibilities to clients and third-party users under common law. How has that law changed in recent years?

> Explain how an engagement letter might affect an auditor's liability to clients under common law.

> What is meant by contributory negligence? Under what conditions will this likely be a successful defense?

> What knowledge does the auditor need about the client's business in an audit of historical financial statements? Explain how this knowledge may be useful in performing other assurance or consulting services for the client.

> Individuals are licensed as CPAs by individual states. Information on the requirements for each state can be found on the National Association of State Boards of Accountancy (NASBA) web site (www.nasba.org). The Uniform CPA Examination is administered by

> Describe financial reporting of the consolidated activities of the U.S. government. Has the federal government received an unqualified audit opinion on its consolidated financial statements? If not, provide some reasons why it has not.

> “The FASAB sets standards for federal agencies that relate to external financial reporting, much like the GASB sets standards for state and local governments for external financial reporting.” Do you agree or disagree with this statement? Explain

> “Net position for a federal agency is similar to net assets of a state or local government.” Do you agree or disagree? Explain.

> Explain the differences among these accounts: (1) Estimated Revenues used by state and local governments, (2) Other Appropriations Realized used by federal agencies in their budgetary track, and (3) Fund Balance with Treasury used by federal agencies

> Discuss the conceptual framework of accounting for federal agencies and compare it to the conceptual framework established by the GASB for state and local governments.

> Describe the institutional process for establishing generally accepted accounting principles for the federal government.

> Identify the principals of the Joint Financial Management and Improvement Program (JFMIP) and identify in which branch of the federal government each operates. What role does each one play in the federal accounting standard setting process?

> Name the financial statements that should be prepared for each federal agency in conformity with OMB Circular A–136.

> Identify the budgetary accounts used in federal agency accounting and explain the sequential flow of budgetary authority through the accounts in your own words.

> The trial balance of the Federal Science Administration, as of August 31, 2011, follows: Required Prepare a statement of budgetary resources for the 11 months ended August 31, 2011, assuming that goods on order at the end of the prior year amounted to

> The Rural Assistance Agency operates three major programs as responsibility centers—the Food Bank, Housing Services, and Credit Counseling. Clients pay a fee for services on a sliding scale based on income. The following information is drawn from the acc

> Using the data from Problem 11–2, In Problem 11-2 Prepare the following: a. In general journal form, entries to close the budgetary accounts as needed and to close the operating statement proprietary accounts. b. In good form, a bal

> One amount is missing in the following trial balance of proprietary accounts, and another is missing from the trial balance of budgetary accounts of a certain agency of the federal government. This trial balance was prepared before budgetary accounts wer

> Choose the best answer. 1. Federal statutes assign responsibility for establishing and maintaining a sound financial structure for the federal government to which of the following: a. Comptroller General of the United States. b. Comptroller General, Secr

> The following excerpt is from the Inspector General’s transmittal letter to the Secretary of the Department of Transportation (DOT). U.S. Department of Transportation Office of the Secretary of Transportation Office of Inspector General Date: November 13

> Congress authorized the Flood Control Commission to start operations on October 1, 2011. Required a. Record the following transactions in general journal form as they should appear in the accounts of the Flood Control Commission. Record all expenses in

> A not-for-profit organization has hired you to conduct an audit. The audit has been requested by the organization’s board of directors. A mission of the organization is to provide for the education of children in the economically distre

> A city has approached you concerning the audit of its 2011 financial statements. State law requires the city to have an audit and submit the audited financial report to the state. New elections at the beginning of the fiscal year resulted in a change in

> Mountain Lake Mental Health Affiliates, a nongovernmental not-for-profit organization, has contacted Bill Wise, CPA, about conducting an annual audit for its first year of operations. The governing board wishes to obtain an audit of the financial stateme

> Your firm recently signed a letter of engagement to audit CitCo, the local city and county government. Over your morning cup of coffee, you open the local newspaper and read the following: Police are investigating how two computer servers belonging to Ci

> Explain the importance of diagnosis-related groups (DRGs) in the cost accounting systems of a health care provider.

> The city council members of Laurel City are considering establishing an audit committee as a subset of the council. Several members work for commercial businesses that have recently established such committees in response to the Sarbanes-Oxley Act of 200

> In this chapter, information was provided on the report of the National Single Audit Sampling project. The project was the outgrowth of concern over the quality of single audits. Based on the project’s results, it would appear that there is reason for co

> The City of Belleview receives pass-through funds from the state’s Department of Housing to assist in administering the federally funded Supportive Housing Program for the elderly. At the request of the state’s Department of Housing, the city has engaged

> A local exempt organization that trains at-risk youth for employment has an annual operating budget of $300,000, which includes revenue from operating a gift shop in a nearby hotel lobby. Gift shop sales result in a profit of $15,000. The organization ha

> The Silverton Symphony Orchestra Hall is a well-established not-for-profit organization exempt under IRC Sec. 501(c)(3) that owns a facility that is home to the local symphony orchestra. Its mission is to increase access to the arts for the community of

> EarthFriendly, Inc., an IRC Sec. 501(c)(3) organization, incurred lobbying expenses of $150,000 and exempt purpose expenditures of $1.2 million in carrying out its exempt mission. Required a. What are the tax consequences if the organization does not el

> The Kids Club of Clare County is a public charity under IRC Sec. 501(c)(3). It had total support last year of the following: Of the $350,000 received from contributors, $250,000 came from five contributors, each of whom gave more than $5,000; the other

> Choose the best answer. 1. State regulation of not-for-profit organizations derives from the state’s power to: a. Grant exemption from income taxes. b. Give legal life to a not-for-profit corporation. c. Grant exemption from sales taxes. d. Grant license

> Crossroads University is a tax-exempt, private university. An excerpt from Note 5 “Endowment Fund” of its 2007 audited financial statements is as follows: State law allows the board to appropriate investment income and as much of the net appreciation as

> What are assets limited as to use and how do they differ from restricted assets?

> For each of the following independent situations, determine whether the organization is at risk for receiving intermediate sanctions from the Internal Revenue Service for conferring excess economic benefits on disqualified persons. If so, indicate how th

> The following items are taken from the financial statements of the Kids Clubs of America for the years ending December 31, 2011, and 2010, with related notes. Required a. Explain what the term board-designated, unrestricted net assets means. What does

> The Atkins Museum recently hired a new controller. His experience with managerial accounting and strong communication skills were extremely attractive. The new controller sent each member of the Board of Trustees’ Finance Committee a se

> The balance sheet and statement of activities for the Central Area Disadvantaged Youth Center for fiscal year 2011, prepared by a volunteer accountant with business experience, are presented on the following page. Required a. Assume that you are the i

> Consider the following scenarios relating to activities that include a fund-raising appeal: 1. The Green Group’s mission is to protect the environment by increasing the portion of waste recycled by the public. The group conducts a door-to-door canvass of

> The Children’s Counseling Center was incorporated as a not-for-profit voluntary health and welfare organization 10 years ago. Its adjusted trial balance as of June 30, 2011, follows. 1. Salaries and fringe benefits were allocated to p

> Obtain the most recent audited annual financial report of the U.S. government. It is available from the Government Accountability Office (GAO). Required a. Did the U.S. Government have a surplus or deficit for this year? b. Was there an increase or decr

> How does support differ from revenues from exchange transactions? How do gains differ from revenues?

> Why is a statement of functional expenses considered an important financial statement for a voluntary health and welfare organization? How does a statement of functional expenses differ from the expense section of a statement of activities?

> What are the three categories into which NPOs must classify their net assets? Describe which net assets are included in each category. Would board-designated net assets be reported as temporarily restricted net assets? Explain your answer.

> Go to the Internet Web sites of five of the largest charitable organizations listed in Illustration 15–7 and search for financial information and performance measures they may disclose on their Web sites. Illustration 15-7 Required a

> What financial statements does FASB Statement No. 117 require NPOs to present? How do these financial statements compare to those typically prepared prior to SFAS 117?

> Which standards-setting bodies are assigned responsibility for establishing accounting and financial reporting standards for not-for-profit organizations? What issues remain unfinished on the FASB’s technical agenda for not-for-profit organizations (NPOs

> Explain how organizations in the not-for-profit sector differ from organizations in the public sector or for-profit business sector. Provide an example of an entity in each sector.

> How does a not-for-profit fund-raising foundation account for a gift intended for the benefit of a particular charity when the donor stipulates that the fundraising foundation may use its discretion to make the gift available to a different charity?

> What are special events? Give a few examples. Are special events conducted by the NPO reported differently on the statement of activities than special events conducted by an organization that is independent of the NPO?

> What criteria must be met before donated services can be recorded as contribution revenue and an expense? Give an example of a service that might qualify as a donated service for accounting purposes.

> Distinguish between program services expenses and supporting services expenses. Why is it important that NPOs report expenses for program services separately from those for supporting services?

> Discussion at a local meeting of government financial officers centered on using a balanced scorecard to present information to the public on the government’s Web site. Describe the components of a balanced scorecard and its advantages in communicating p

> What advantages does total quality management (TQM) offer a government? Is it fundamentally a budget approach?

> Identify some essential components of an annual budget process for a state or local government.

> As a certified public accountant, you have been asked by a group of local citizens to assist in establishing a not-for-profit organization for the purpose of raising funds to keep their neighborhood safe and clean. These people are concerned about the gr

> Describe the advantages of performance budgeting and program budgeting over incremental budgeting in a governmental entity.

> What is the difference between two types of line-item budgeting approaches—incremental budgeting and zero-based budgeting? Which of the two approaches is more widely used by governments?

> Explain how strategic planning, budgeting, and performance measurement can be integrated in a government and why this integration is desirable.

> “The sole objective of budgeting in a governmental entity is to demonstrate compliance with appropriation legislation.” Do you agree or disagree? Explain.

> The finance officer of a small city has heard that certain items of cost may be allowable under federal grants, even though they were not incurred specifically for the grant. To what source could the finance officer go to determine what costs are allowab

> Explain why conventional cost accounting systems have become less useful in both business and government settings. How does activity-based costing (ABC) reduce the problems created by conventional cost accounting systems?

> What are the three broad categories of service efforts and accomplishments (SEA) measures? Explain the GASB’s role in developing standards for SEA reporting.

> The City of Ankeny, Iowa, has produced a Service Efforts and Accomplishments report since 2003 in an attempt to answer the question, “Am I getting my money’s worth?” for its citizens. The city receive

> Eagleview City prepares a quarterly forecast of cash flows for its water service department. Data for the upcoming quarter (in alphabetical order) measured on the cash basis are presented below. The city maintains no more than the minimum cash balance

> The police chief of the Town of Meridian submitted the following budget request for the police department for the forthcoming budget year 2011–12. Upon questioning by the newly appointed town manager, a recent masters graduate with a

> The Little Feet Dance Association is a performing arts program in an urban area. It was established to increase appreciation for dance among youth and strengthen social bonds in the community. The association has been in existence for several years, and

> A portion of the General Fund operating budget for Southwest City’s Street Department follows here and on subsequent pages. Required After reading and evaluating the budget information for the Street Department of Southwest City, answe

> Choose the best answer. 1. An often used approach to budgeting that simply derives the New Year’s budget from the current year’s budget is called: a. Planning-programming-budgeting. b. Incremental budgeting. c. Zero-based budgeting. d. Performance budget

> On the basis of the following data, prepare a statement for the Town of Chippewa for the year ended June 30, 2011, showing the total cost of solid waste removal and the cost per ton of residential solid waste removed or cubic yard of commercial solid was

> The midsize City of Orangeville funds an animal control program intended to minimize the danger stray dogs pose to people and property. The program is under scrutiny because of current budgetary constraints and constituency pressure. An animal control wa

> The director of a not-for-profit organization was overheard saying that government auditing standards (GAGAS) were developed by the federal government to ensure that local governments were spending federal funds appropriately. Therefore, her organization

> What are the major types of auditor services described in the Government Accountability Office’s Government Auditing Standards (yellow book), and how do they differ?

> Define GAGAS, and describe how GAGAS differ from GAAS.

> A new board member for the Fire Protection District (a special purpose government) was reviewing the audit report for the district and noted that, although the district received an unqualified opinion, the audit report was longer than the one received by

> What is an opinion unit and of what significance is an opinion unit to the auditor?

> What are the three levels of audit to which a government or not-for-profit entity may be subject? Who is responsible for setting the standards or requirements for each of the three levels identified?

> The following is the pre-closing trial balance for Horton University as of June 30, 2011. Additional information related to net assets and the statement of cash flows is also provided. Additional information Net assets released from temporary restrict

> What are the benefits of having an audit committee?

> What is the National Single Audit Sampling Project and why is it important?

> Explain how federal award programs are selected for audit under the risk based approach.

> How is an OMB Circular A-133 audit related to a GAGAS audit? How is an OMB Circular A-133 audit different from a GAGAS audit?

> What is a revocable split-interest agreement and how is it recorded by a private college?

> What is an annuity agreement and how does it differ from a life income fund?

> Explain the conditions that must exist for a public or private college or university to avoid accounting recognition of the value of its collections of art, historical treasures, and similar assets.

> A private college has received a multi-year unconditional pledge from a major supporter. How will the college report the pledge in its financial statements?