Question: Inverness Steel Corporation is a producer of

Inverness Steel Corporation is a producer of flat-rolled carbon, stainless and electrical steels, and tubular products. The company’s income statement for the 2018 fiscal year reported the following information ($ in millions):

Sales ………………………………….. $6,255

Cost of goods sold …………………. 5,190

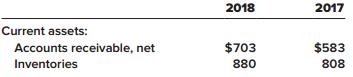

The company’s balance sheets for 2018 and 2017 included the following information ($ in millions):

The statement of cash flows reported bad debt expense for 2018 of $8 million. The summary of significant accounting policies included the following notes ($ in millions):

Accounts Receivable (in part)

The allowance for uncollectible accounts was $10 and $7 at December 31, 2018 and 2017, respectively. All sales are on credit.

Inventories

Inventories are valued at the lower of cost or market. The cost of the majority of inventories is measured using the last in, first out (LIFO) method. Other inventories are measured principally at average cost and consist mostly of foreign inventories and certain raw materials. If the entire inventory had been valued on an average cost basis, inventory would have been higher by $480 and $350 at the end of 2018 and 2017, respectively.

During 2018, 2017, and 2016, liquidation of LIFO layers generated income of $6, $7, and $25, respectively.

Required:

Using the information provided:

1. Determine the amount of accounts receivable Inverness wrote off during 2018.

2. Calculate the amount of cash collected from customers during 2018.

3. Calculate what cost of goods sold would have been for 2018 if the company had used average cost to value its entire inventory.

4. Calculate the following ratios for 2018:

a. Receivables turnover ratio

b. Inventory turnover ratio

c. Gross profit ratio

5. Explain briefly what caused the income generated by the liquidation of LIFO layers. Assuming an income tax rate of 35%, what was the effect of the liquidation of LIFO layers on cost of goods sold in 2018?

Transcribed Image Text:

2018 2017 Current assets: Accounts receivable, net $703 $583 Inventories 880 808

> Jackson County Senior Services is a nonprofit organization devoted to providing essential servicesto seniors who live in their own homes within the Jackson County area. Three services areprovided for seniors—home nursing, meals on wheel

> Birch Company normally produces and sells 30,000 units of RG-6 each month. RG-6 is a small electrical relay used as a component part in the automotive industry. The selling price is $22 per unit, variable costs are $14 per unit, fixed manufacturing overh

> Han Products manufactures 30,000 units of part S-6 each year for use on its production line. At this level of activity, the cost per unit for part S-6 is as follows: Direct materials . . . . . . . . . . . . . . . . . . . . $ 3.60 Direct labor. . . . . .

> Hollings Company sells and delivers office furniture in the Rocky Mountain area. The costs associated with the acquisition and annual operation of a delivery truck are given below: Insurance . . . . . . . . . . . . . . . . . . . . . . . . . $1,600 Licen

> QualSupport Corporation manufactures seats for automobiles, vans, trucks, and various recreational vehicles. The company has a number of plants around the world, including the DenverCover Plant, which makes seat covers. Ted Vosilo is the plant manager of

> Wesco Incorporated’s only product is a combination fertilizer/weedkiller called GrowNWeed. GrowNWeed is sold nationwide to retail nurseries and garden stores. Zwinger Nursery plans to sell a similar fertilizer/weedkiller compound throug

> Haley Romeros had just been appointed vice president of the Rocky Mountain Region of the Bank Services Corporation (BSC). The company provides check processing services for small banks. The banks send checks presented for deposit or payment to BSC, whic

> The Scottie Sweater Company produces sweaters under the “Scottie” label. The company buys raw wool and processes it into wool yarn from which the sweaters are woven. One spindle of wool yarn is required to produce one

> Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand, and it is trying to decide whether to sell the T-bone steaks as they are initially cut or to process them further into fi

> Chilczuk, S.A., of Gdansk, Poland, is a major producer of classic Polish sausage. The company uses a standard cost system to help control costs. Manufacturing overhead is applied to production on the basis of standard direct labor-hours. According to the

> TufStuff, Inc., sells a wide range of drums, bins, boxes, and other containers that are used in thechemical industry. One of the company’s products is a heavy-duty corrosion-resistant metal drum,called the WVD drum, used to store toxic

> The questions in this exercise are based on the Nordstrom, Inc., 2004 annual report at http:// phx.corporate-ir.net/phoenix.zhtml?c=93295&p=irol-reportsAnnual. You do not need to print theannual report in order to answer the questions. Required: 1. What

> The questions in this exercise are based on FedEx Corporation. To answer the questions youwill need to download FedEx’s Form 10-K for the fiscal year ended May 31, 2005 at www.sec.gov/edgar/searchedgar/companysearch.html. Once at this website, input CIK

> Distinguish between a traceable cost and a common cost. Give several examples ofeach.

> Barlow Company manufactures three products: A, B, and C. The selling price, variable costs, andcontribution margin for one unit of each product follow: The same raw material is used in all three products. Barlow Company has only 5,000 poundsof raw mater

> What benefits result from decentralization?

> Why does the balanced scorecard include financial performance measures as well as measuresof how well internal business processes are doing?

> In what way can the use of ROI as a performance measure for investment centers lead tobad decisions? How does the residual income approach overcome this problem?

> How is it possible for a cost that is traceable to a segment to become a common cost if thesegment is divided into further segments?

> Kristen Lu purchased a used automobile for $8,000 at the beginning of last year and incurred the following operating costs: Depreciation ($8,000 ÷ 5 years) . . . . . . . . . $1,600 Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,200 G

> Dorsey Company manufactures three products from a common input in a joint processing operation.Joint processing costs up to the split-off point total $350,000 per quarter. The company allocatesthese costs to the joint products on the basis of their relat

> Morton Company’s variable manufacturing overhead should be $4.50 per standard direct laborhour and fixed manufacturing should be $270,000 per year. The company manufactures a single product that requires two direct labor-hours to comple

> Privack Corporation has a standard cost system in which it applies overhead to products based on the standard direct labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Required: 1. Compute the pre

> A fellow accountant has solicited your opinion regarding the classification of short-term obligations repaid prior to being replaced by a long-term security. Cheshire Foods, Inc., issued $5,000,000 of short-term commercial paper during 2017 to finance co

> The following events are indicated in note 15 of J. Crew’s 10-K annual report for the fiscal year ended January 29, 2011, and its 10-K was filed on March 21, 2011. Acquisition On November 23, 2010, the Company entered into an Agreement and Plan of Merger

> Reporting requirements for contingent liabilities under IFRS differ somewhat from those under U.S. GAAP. Required: For each of the following, access the online version of the indicated financial report and answer the question. Also compare reporting und

> You have been hired as the new controller for the Ralston Company. Shortly after joining the company in 2018, you discover the following errors related to the 2016 and 2017 financial statements: a. Inventory at December 31, 2016, was understated by $6,00

> Refer to the situation described in BE 9–15. What steps would be taken to report the error in the 2018 financial statements? In BE 9–15 In 2018, Winslow International, Inc.’s controller discovered that ending inventories for 2016 and 2017 were overstate

> The following is an excerpt from USAToday.com: Microsoft (MSFT) on Thursday extended the warranty on its Xbox 360 video game console and said it will take a charge of more than $1 billion to pay for “anticipated costs.” Under the new warranty, Microsoft

> IGF Foods Company is a large, primarily domestic, consumer foods company involved in the manufacture, distribution and sale of a variety of food products. Industry averages are derived from Troy’s The Almanac of Business and Industrial

> On January 1, 2018, the Taylor Company adopted the dollar-value LIFO method. The inventory value for its one inventory pool on this date was $400,000. Inventory data for 2018 through 2020 are as follows: Required: Calculate Taylor’s e

> In 2018, Wade Window and Glass changed its inventory method from FIFO to LIFO. Inventory at the end of 2017 is $150,000. Describe the steps Wade Window and Glass should take to report this change.

> Right Medical introduced a new implant that carries a five-year warranty against manufacturer’s defects. Based on industry experience with similar product introductions, warranty costs are expected to approximate 1% of sales. Sales were $15 million and a

> For the Coca-Cola bonds described in BE 12-2, prepare journal entries to record (a) Any unrealized gains or losses occurring in 2018 and (b) The sale of the bonds in 2019. In BE 12-2 S&L Financial buys and sells securities expecting to earn profits on s

> As a second-year financial analyst for A.J. Straub Investments, you are performing an initial analysis on Fizer Pharmaceuticals. A difficulty you’ve encountered in making comparisons with its chief rival is that Fizer uses U.S. GAAP and the competing com

> Morgan Stanley is a leading investment bank founded in 1935. The company’s fiscal year ends December 31, 2013, and it filed its financial statements with the SEC on February 25, 2014. On February 5, 2014, Bloomberg reported that Morgan Stanley would make

> The Cloud Company employs a perpetual inventory system and the McKenzie Corporation uses a periodic system. Describe the differences between the two systems in accounting for the following events: (1) Purchase of merchandise, (2) Sale of merchandise, (3)

> Kevin Brantly is a new hire in the controller’s office of Fleming Home Products. Two events occurred in late 2018 that the company had not previously encountered. The events appear to affect two of the company’s liabil

> Late in 2018, you and two other officers of Curbo Fabrications Corporation just returned from a meeting with officials of the City of Jackson. The meeting was unexpectedly favorable even though it culminated in a settlement with city authorities that req

> In the March 2019 meeting of Valleck Corporation’s board of directors, a question arose as to the way a possible obligation should be disclosed in the forthcoming financial statements for the year ended December 31. A veteran board member brought to the

> Cates Computing Systems develops and markets commercial software for personal computers and workstations. Three situations involving compensation for possible future absences of Cates’s employees are described below. a. Cates compensates employees at the

> The balance sheet at December 31, 2018, for Nevada Harvester Corporation includes the liabilities listed below: a. 11% bonds with a face amount of $40 million were issued for $40 million on October 31, 2009. The bonds mature on October 31, 2029. Bondhold

> Rockwell Corporation uses a periodic inventory system and has used the FIFO cost method since inception of the company in 1979. In 2018, the company decided to switch to the average cost method. Data for 2018 are as follows: Additional Information: a.

> Camden Biotechnology began operations in September 2018. The following selected transactions relate to liabilities of the company for September 2018 through March 2019. Camden’s fiscal year ends on December 31. Its financial statements are issued in Apri

> Carswell Electronics adopted the dollar-value LIFO method on January 1, 2018, when the inventory value of its one inventory pool was $720,000. The company decided to use an external index, the Consumer Price Index (CPI), to adjust for changes in the cost

> Consider the following liabilities of Future Brands, Inc., at December 31, 2018, the company’s fiscal year-end. Should they be reported as current liabilities or long-term liabilities? 1. $77 million of 8% notes are due on May 31, 2022. The notes are cal

> What is the effect of a company electing the fair value option with respect to a held-to-maturity investment or an available-for-sale investment?

> Blanton Plastics, a household plastic product manufacturer, borrowed $14 million cash on October 1, 2018, to provide working capital for year-end production. Blanton issued a four-month, 12% promissory note to L&T Bank under a prearranged short-term line

> Alamar Petroleum Company offers its employees the option of contributing retirement funds up to 5% of their wages or salaries, with the contribution being matched by Alamar. The company also pays 80% of medical and life insurance premiums. Deductions rel

> Lawler Clothing sold manufacturing equipment for $16,000. Lawler originally purchased the equipment for $80,000, and depreciation through the date of sale totaled $71,000. What was the gain or loss on the sale of the equipment?

> Transit Airlines provides regional jet service in the Mid-South. The following is information on liabilities of Transit at December 31, 2018. Transit’s fiscal year ends on December 31. Its annual financial statements are issued in April. 1. Transit has o

> Listed below are several terms and phrases associated with current liabilities. Pair each item from List A (by letter) with the item from List B that is most appropriately associated with it. List A List B a. Informal agreement b. Secured loan 1. Fa

> Van Rushing Hunting Goods’ fiscal year ends on December 31. At the end of the 2018 fiscal year, the company had notes payable of $12 million due on February 8, 2019. Rushing sold 2 million shares of its $0.25 par, common stock on February 3, 2019, for $9

> Lincoln Chemicals became involved in investigations by the U.S. Environmental Protection Agency in regard to damages connected to waste disposal sites. Below are four possibilities regarding the timing of (A) the alleged damage caused by Lincoln, (B) an

> The Cummings Company charged various expenditures made during 2018 to an account called repairs and maintenance expense. You have been asked by your supervisor in the company’s internal audit department to review the expenditures to determine if they wer

> The Heinrich Tire Company recalled a tire in its subcompact line in December 2018. Costs associated with the recall were originally thought to approximate $50 million. Now, though, while management feels it is probable the company will incur substantial

> During December, Rainey Equipment made a $600,000 credit sale. The state sales tax rate is 6% and the local sales tax rate is 1.5%. Prepare the appropriate journal entry.

> HolmesWatson (HW) is considering what the effect would be of reporting its liabilities under IFRS rather than U.S. GAAP. The following facts apply: a. HW is defending against a lawsuit and believes it is virtually certain to lose in court. If it loses th

> Under IFRS No. 9, which reporting categories are used to account for equity investments when the investor lacks the ability to significantly influence the operations of the investee?

> On January 1, 2018, Pet Friendly Stores adopted the retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2018 and 2019 are as follows: Required: 1. Estimate the 2018 and 2019 ending inventory and cost of goods s

> Sometimes compensation packages include bonuses designed to provide performance incentives to employees. The difficulty a bonus can cause accountants is not an accounting problem, but a math problem. The complication is that the bonus formula sometimes s

> The unadjusted trial balance of the Manufacturing Equitable at December 31, 2018, the end of its fiscal year, included the following account balances. Manufacturing’s 2018 financial statements were issued on April 1, 2019. Accounts receivable ……………………………

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Required: Determine the specific citation for accounting for each of the following items: 1. If it is only reasonably possible that a contingent loss will occur, the c

> Refer to the situation described in BE 11–2. Assume the machine was purchased on March 31, 2018, instead of January 1. Calculate depreciation expense for 2018 and 2019 using each of the following depreciation methods: (a) straight line, (b) sum-of-the-ye

> CircuitTown commenced a gift card program in January 2018 and sold $10,000 of gift cards in January, $15,000 in February, and $16,000 in March 2018 before discontinuing further gift card sales. During 2018, gift card redemptions were $6,000 for the Janua

> S&L Financial buys and sells securities expecting to earn profits on short-term differences in price. On December 27, 2018, S&L purchased Coca-Cola bonds at par for $875,000 and sold the bonds on January 3, 2019, for $880,000. At December 31, the bonds h

> Cast Iron Grills, Inc., manufactures premium gas barbecue grills. The company uses a periodic inventory system and the LIFO cost method for its grill inventory. Cast Iron’s December 31, 2018, fiscal year-end inventory consisted of the following (listed i

> The following selected transactions relate to liabilities of Interstate Farm Implements for December 2018. Interstate’s fiscal year ends on December 31. Required: Prepare the appropriate journal entries for these transactions. 1. On December 15, receive

> In Lizzie Shoes’ experience, gift cards that have not been redeemed within 12 months are not likely to be redeemed. Lizzie Shoes sold gift cards for $18,000 during August 2018. $4,000 of cards were redeemed in September 2018, $3,000 in October, $2,500 in

> Diversified Semiconductors sells perishable electronic components. Some must be shipped and stored in reusable protective containers. Customers pay a deposit for each container received. The deposit is equal to the container’s cost. They receive a refund

> Bavarian Bar and Grill opened for business in November 2018. During its first two months of operation, the restaurant sold gift certificates in various amounts totaling $5,200, mostly as Christmas presents. They are redeemable for meals within two years

> The FASB Accounting Standards Codification represents the single source of authoritative U.S. generally accepted accounting principles. Required: 1. What is the specific citation that describes the disclosure requirements that must be made by publicly t

> On January 1, 2018, Poplar Fabricators Corporation agreed to grant its employees two weeks of vacation each year, with the stipulation that vacations earned each year can be taken the following year. For the year ended December 31, 2018, Poplar Fabricato

> JWS Transport Company’s employees earn vacation time at the rate of 1 hour per 40-hour work period. The vacation pay vests immediately (that is, an employee is entitled to the pay even if employment terminates). During 2018, total wages paid to employees

> Raleigh Department Store uses the conventional retail method for the year ended December 31, 2016. Available information follows: a. The inventory at January 1, 2016, had a retail value of $45,000 and a cost of $27,500 based on the conventional retail me

> The following selected transactions relate to liabilities of United Insulation Corporation. United’s fiscal year ends on December 31. Required: Prepare the appropriate journal entries through the maturity of each liability. 2018 Jan. 13 Negotiated a rev

> Mondale Winery depreciates its equipment using the group method. The cost of equipment purchased in 2018 totaled $425,000. The estimated residual value of the equipment was $40,000 and the group depreciation rate was determined to be 18%. What is the ann

> On July 1, 2018, Ross-Livermore Industries issued nine-month notes in the amount of $400 million. Interest is payable at maturity. Required: Determine the amount of interest expense that should be recorded in a year-end adjusting entry under each of the

> On January 1, 2018, Canseco Plumbing Fixtures purchased equipment for $30,000. Residual value at the end of an estimated four-year service life is expected to be $2,000. The company expects the machine to operate for 10,000 hours. Calculate depreciation

> On November 1, 2018, Quantum Technology, a geothermal energy supplier, borrowed $16 million cash to fund a geological survey. The loan was made by Nevada BancCorp under a noncommitted short-term line of credit arrangement. Quantum issued a nine-month, 12

> On December 12, 2018, Pace Electronics received $24,000 from a customer toward a cash sale of $240,000 of diodes to be completed on January 16, 2019. What journal entries should Pace record on December 12 and January 16?

> Lee Financial Services pays employees monthly. Payroll information is listed below for January 2018, the first month of Lee’s fiscal year. Assume that none of the employees exceeded any relevant wage base. Salaries …………………………………………….…………….………………………… $500

> The Dow Chemical Company provides chemical, plastic, and agricultural products and services to various consumer markets. The following excerpt is taken from the disclosure notes of Dow’s 2015 annual report: In total, the Company’s accrued liability for p

> On July 15, 2018, the Nixon Car Company purchased 1,000 tires from the Harwell Company for $50 each. The terms of the sale were 2/10, n/30. Nixon uses a periodic inventory system and the net method of accounting for purchase discounts. Required: 1. Prep

> In 2018, Hopyard Lumber changed its inventory method from LIFO to FIFO. Inventory at the end of 2017 of $127,000 would have been $145,000 if FIFO had been used. Inventory at the end of 2018 is $162,000 using the new FIFO method but would have been $151,0

> The Commonwealth of Virginia filed suit in October 2016 against Northern Timber Corporation, seeking civil penalties and injunctive relief for violations of environmental laws regulating forest conservation. When the 2017 financial statements were issued

> Woodmier Lawn Products introduced a new line of commercial sprinklers in 2017 that carry a one-year warranty against manufacturer’s defects. Because this was the first product for which the company offered a warranty, trade publications

> Sound Audio manufactures and sells audio equipment for automobiles. Engineers notified management in December 2018 of a circuit flaw in an amplifier that poses a potential fire hazard. An intense investigation indicated that a product recall is virtually

> Indicate (by letter) the way each of the items listed below should be reported in a balance sheet at December 31, 2018. Item Reporting Method 1. Commercial paper N. Not reported C. Current liability L. Long-term liability D. Disclosure note only 2.

> Refer to the circumstances listed in E 13–21, but assume that Erismus prepares its financial statements according to International Financial Reporting Standards. In E 13–21 The following selected circumstances relate to pending lawsuits for Erismus, Inc

> On January 1, 2018, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2018 and 2019 are as follows: Required: Estimate the 2018 and 2019 ending inventory and cos

> The following selected circumstances relate to pending lawsuits for Erismus, Inc. Erismus’s fiscal year ends on December 31. Financial statements are issued in March 2019. Erismus prepares its financial statements according to U.S. GAAP. Required: Indic

> Life.com issued $10 million of commercial paper on April 1 on a nine-month note. Interest was discounted at issuance at a 6% discount rate. What is the effective interest rate on the commercial paper?

> At the beginning of its fiscal year, Koeplin Corporation purchased a machine for $50,000. At the end of the year, the machine had a fair value of $32,000. Koeplin’s controller recorded depreciation of $18,000 for the year, the decline in the machine’s va

> Explain the accounting treatment and disclosures required when a change is made in depreciation method.

> The following selected transactions relate to contingencies of Classical Tool Makers, Inc., which began operations in July 2018. Classical’s fiscal year ends on December 31. Financial statements are issued in April 2019. Required: Prepare the year-end e

> At April 1, 2019, the Food and Drug Administration is in the process of investigating allegations of false marketing claims by Hulkly Muscle Supplements. The FDA has not yet proposed a penalty assessment. Hulkly’s fiscal year ends on December 31, 2018. T

> Tanner-UNF Corporation acquired as a long-term investment $240 million of 6% bonds, dated July 1, on July 1, 2018. Company management has the positive intent and ability to hold the bonds until maturity, but when the bonds were acquired Tanner-UNF decide

> Lance Brothers Enterprises acquired $720,000 of 3% bonds, dated July 1, on July 1, 2018, as a long-term investment. Management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 4% for bonds of simi

> On July 1, 2018, Gupta Corporation bought 25% of the outstanding common stock of VB Company for $100 million cash. At the date of acquisition of the stock, VB’s net assets had a total fair value of $350 million and a book value of $220 million. Of the $1