Question: Investigate what happens as the width of

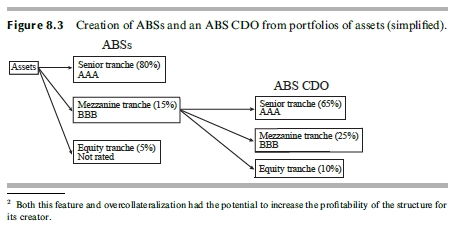

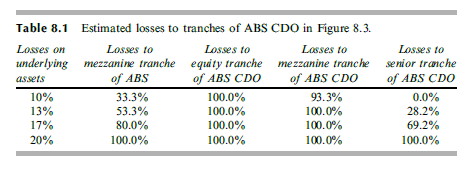

Investigate what happens as the width of the mezzanine tranche of the ABS in Figure 8.3 is decreased with the reduction of mezzanine tranche principal being divided equally between the equity and senior tranches. In particular, what is the effect on Table 8.1?

Transcribed Image Text:

Figure 8.3 Creation of ABSS and an ABS CDO from portfolios of assets (simplified). ABSS Assets Senior tranche (80%) AAA ABS CDO Mezzanine tranche (15%) BBB Senior tranche (65%) AAA Mezzanine tranche (25%) BBB Equity tranche (5%) Not rated Equity tranche (10%) Both this feature and overcollateralization had the potential to increase the profitability of the structure for its creator. Table 8.1 Estimated losses to tranches of ABS CDO in Figure 8.3. Losses on Losses to Losses to Losses to Losses to underlying mezzanine tranche equity tranche mezzanine tranche senior tranche of ABS CDO assets of ABS of ABS CDO of ABS CDO 10% 33.3% 100.0% 93.3% 0.0% 13% 100.0% 53.3% 80.0% 100.0% 28.2% 17% 100.0% 100.0% 69.2% 20% 100.0% 100.0% 100.0% 100.0%

> ‘‘The price of an at-the-money European futures call option always equals the price of a similar at-the-money European futures put option.’’ Explain why this statement is true.

> Consider a four-month futures put option with a strike price of 50 when the risk-free interest rate is 10% per annum. The current futures price is 47. What is a lower bound for the value of the futures option if it is (a) European and (b) American?

> Consider a two-month futures call option with a strike price of 40 when the risk-free interest rate is 10% per annum. The current futures price is 47. What is a lower bound for the value of the futures option if it is (a) European and (b) American?

> A foreign currency is currently worth $1.50. The domestic and foreign risk-free interest rates are 5% and 9%, respectively. Calculate a lower bound for the value of a six-month call option on the currency with a strike price of $1.40 if it is (a) Europea

> Calculate the value of an eight-month European put option on a currency with a strike price of 0.50. The current exchange rate is 0.52, the volatility of the exchange rate is 12%, the domestic risk-free interest rate is 4% per annum, and the foreign risk

> Calculate the value of a three-month at-the-money European call option on a stock index when the index is at 250, the risk-free interest rate is 10% per annum, the volatility of the index is 18% per annum, and the dividend yield on the index is 3% per an

> A currency is currently worth $0.80 and has a volatility of 12%. The domestic and foreign risk-free interest rates are 6% and 8%, respectively. Use a two-step binomial tree to value (a) a European four-month call option with a strike price of 0.79 and (b

> A fund manager has a portfolio worth $50 million with a beta of 0.87. The manager is concerned about the performance of the market over the next 2 months and plans to use 3-month futures contracts on a well-diversified index to hedge its risk. The curren

> A stock index is currently 300, the dividend yield on the index is 3% per annum, and the risk-free interest rate is 8% per annum. What is a lower bound for the price of a six month European call option on the index when the strike price is 290?

> ‘‘Once we know how to value options on a stock paying a dividend yield, we know how to value options on stock indices and currencies.’’ Explain this statement.

> Use the software DerivaGem to verify that Figures 11.1 and 11.2 are correct. Figure 11.1 option prices when So = 50, K = 50, r= 5%, a = 30%, and T = 1. Effect of changes in stock price, strike price, and expiration date on 4 Put option Call option pr

> A total return index tracks the return, including dividends, on a certain portfolio. Explain how you would value (a) forward contracts and (b) European options on the index.

> An index currently stands at 1,500. European call and put options with a strike price of 1,400 and time to maturity of six months have market prices of 154.00 and 34.25, respectively. The six-month risk-free rate is 5%. What is the implied dividend yield

> An index currently stands at 696 and has a volatility of 30% per annum. The risk-free rate of interest is 7% per annum and the index provides a dividend yield of 4% per annum. Calculate the value of a three-month European put with an exercise price of 70

> Consider a stock index currently standing at 250. The dividend yield on the index is 4% per annum, and the risk-free rate is 6% per annum. A three-month European call option on the index with a strike price of 245 is currently worth $10. What is the valu

> Explain why employee stock options on a non-dividend-paying stock are frequently exercised before the end of their lives, whereas an exchange-traded call option on such a stock is never exercised early.

> A company has granted 500,000 options to its executives. The stock price and strike price are both $40. The options last for 12 years and vest after 4 years. The company decides to value the options using an expected life of 5 years and a volatility of 3

> In a Dutch auction of 10,000 options, bids are as follows: A bids $30 for 3,000; B bids $33 for 2,500; C bids $29 for 5,000; D bids $40 for 1,000; E bids $22 for 8,000; and F bids $35 for 6,000. What is the result of the auction? Who buys how many at wha

> The one-year forward price of the Mexican peso is $0.0750 per MXN. The U.S. risk-free rate is 1.25% and the Mexican risk-free rate is 4.5%. The exchange rate volatility is 13%. What are the values of one-year European and American put options with a stri

> The notes accompanying a company’s financial statements say: ‘‘Our executive stock options last 10 years and vest after 4 years. We valued the options granted this year using the Black–Scholes–Merton model with an expected life of 5 years and a volatilit

> Using the notation in this chapter, prove that a 95% confidence interval for ST is between /

> A stock price is currently $40. Assume that the expected return from the stock is 15% and that its volatility is 25%. What is the probability distribution for the rate of return (with continuous compounding) earned over a 2-year period?

> Does a forward contract on a stock index have the same delta as the corresponding futures contract? Explain your answer.

> What difference does it make to your calculations in Problem 15.4 if a dividend of $1.50 is expected in 2 months?

> Calculate the price of a 3-month European put option on a non-dividend-paying stock with a strike price of $50 when the current stock price is $50, the risk-free interest rate is 10% per annum, and the volatility is 30% per annum.

> A company has an issue of executive stock options outstanding. Should dilution be taken into account when the options are valued? Explain your answer.

> The volatility of a stock price is 30% per annum. What is the standard deviation of the percentage price change in one trading day?

> Show that the Black–Scholes–Merton formulas for call and put options satisfy put–callparity.

> Consider an American call option on a stock. The stock price is $70, the time to maturity is 8 months, the risk-free rate of interest is 10% per annum, the exercise price is $65, and the volatility is 32%. A dividend of $1 is expected after 3 months and

> The DerivaGem Application Builder functions enable you to investigate how the prices of options calculated from a binomial tree converge to the correct value as the number of time steps increases. (See Figure 21.4 and Sample Application A in DerivaGem.)

> A stock price is currently $50. It is known that at the end of 6 months it will be either $45 or $55. The risk-free interest rate is 10% per annum with continuous compounding. What is the value of a 6-month European put option with a strike price of $50?

> Explain what a seven-year swap rate is.

> A bank finds that its assets are not matched with its liabilities. It is taking floating-rate deposits and making fixed-rate loans. How can swaps be used to offset the risk?

> Why is the expected loss to a bank from a default on a swap with a counterparty less than the expected loss from the default on a loan to the counterparty when the loan and swap have the same principal? Assume that there are no other derivatives transact

> It is May 5, 2017. The quoted price of a government bond with a 12% coupon that matures on July 27, 2034, is 110-17. What is the cash price?

> The price of a 90-day Treasury bill is quoted as 10.00. What continuously compounded return (on an actual/365 basis) does an investor earn on the Treasury bill for the 90-day period?

> It is January 30. You are managing a bond portfolio worth $6 million. The duration of the portfolio in 6 months will be 8.2 years. The September Treasury bond futures price is currently 108-15, and the cheapest-to-deliver bond will have a duration of 7.6

> The 350-day LIBOR rate is 3% with continuous compounding and the forward rate calculated from a Eurodollar futures contract that matures in 350 days is 3.2% with continuous compounding. Estimate the 440-day zero rate.

> What is the equation corresponding to equation (19.4) for (a) a portfolio of derivatives on a currency and (b) a portfolio of derivatives on a futures price?

> Suppose that a Eurodollar futures quote is 88 for a contract maturing in 60 days. What is the LIBOR forward rate for the 60- to 150-day period? Ignore the difference between futures and forwards for the purposes of this question.

> It is January 9, 2018. The price of a Treasury bond with a 6% coupon that matures on October 12, 2030, is quoted as 102-07. What is the cash price?

> How can the portfolio manager change the duration of the portfolio to 3.0 years in Problem 6.17? Data from 6.17: On August 1 a portfolio manager has a bond portfolio worth $10 million. The duration of the portfolio in October will be 7.1 years. The Dece

> On August 1, a portfolio manager has a bond portfolio worth $10 million. The duration of the portfolio in October will be 7.1 years. The December Treasury bond futures price is currently 91-12 and the cheapest-to-deliver bond will have a duration of 8.8

> Suppose that a bond portfolio with a duration of 12 years is hedged using a futures contract in which the underlying asset has a duration of 4 years. What is likely to be the impact on the hedge of the fact that the 12-year rate is less volatile than the

> Suppose that the Treasury bond futures price is 101-12. Which of the following four bonds is cheapest to deliver? Bond Price Conversion factor 1 125-05 1.2131 2 142-15 1.3792 3 115-31 1.1149 4 144-02 1.4026

> A U.S. Treasury bond pays a 7% coupon on January 7 and July 7. How much interest accrues per $100 of principal to the bondholder between July 7, 2017, and August 8, 2017? How would your answer be different if it were a corporate bond?

> What rate of interest with continuous compounding is equivalent to 8% per annum with monthly compounding?

> The term structure of interest rates is upward-sloping. Put the following in order of magnitude: (a) The 5-year zero rate (b) The yield on a 5-year coupon-bearing bond (c) The forward rate corresponding to the period between 4.75 and 5 years in the futur

> Assuming that risk-free zero rates are as in Problem 4.5, what is the value of an FRA where the holder will pay LIBOR and receive 4.5% (quarterly compounded) for a three month period starting in one year on a principal of $1,000,000? The forward LIBOR ra

> Suppose that risk-free zero interest rates with continuous compounding are as follows: Calculate forward interest rates for the second, third, fourth, fifth, and sixth quarters. Maturity (тоnhs) Rate (% per anmum) 3 3.0 3.2 9 3.4 12 3.5 15 3.6 18 3.7

> The 6-month and 1-year zero rates are both 5% per annum. For a bond that has a life of 18 months and pays a coupon of 4% per annum (with semiannual payments and one having just been made), the yield is 5.2% per annum. What is the bond’s price? What is th

> ‘‘An interest rate swap where 6-month LIBOR is exchanged for a fixed rate of 5% on a principal of $100 million for 5 years involves a known cash flow and a portfolio of nine FRAs.’’ Explain this statement.

> Explain how LIBOR is determined.

> Use the risk-free rates in Problem 4.14 to value an FRA where you will pay 5% (annually compounded) and receive LIBOR for the third year on $1 million. The forward LIBOR rate (annually compounded) for the third year is 5.5%. Risk-free rates in Problem 4.

> Suppose that risk-free zero interest rates with continuous compounding are as follows: Calculate forward interest rates for the second, third, fourth, and fifth years. Maturity (vears) Rate (% per annum) 1 2.0 2 3.0 3 3.7 4 4.2 5 4.5

> Suppose that 6-month, 12-month, 18-month, 24-month, and 30-month zero rates are, respectively, 4%, 4.2%, 4.4%, 4.6%, and 4.8% per annum, with continuous compounding. Estimate the cash price of a bond with a face value of 100 that will mature in 30 months

> A deposit account pays 4% per annum with continuous compounding, but interest is actually paid quarterly. How much interest will be paid each quarter on a $10,000 deposit?

> ‘‘Buying a put option on a stock when the stock is owned is a form of insurance.’’ Explain this statement.

> A bank quotes an interest rate of 7% per annum with quarterly compounding. What is the equivalent rate with (a) continuous compounding and (b) annual compounding?

> Prove the result in equation (11.7). (Hint: For the first part of the relationship, consider (a) a portfolio consisting of a European call plus an amount of cash equal to K, and (b) a portfolio consisting of an American put option plus one share.)

> Does a perfect hedge always succeed in locking in the current spot price of an asset for a future transaction? Explain your answer.

> In the corn futures contract traded on an exchange, the following delivery months are available: March, May, July, September, and December. Which of the available contracts should be used for hedging when the expiration of the hedge is in (a) June, (b) J

> The expected return on the S&P 500 is 12% and the risk-free rate is 5%. What is the expected return on an investment with a beta of (a) 0.2, (b) 0.5, and (c) 1.4?

> Suppose that, on October 24, 2018, a company sells one April 2019 live cattle futures contract. It closes out its position on January 21, 2019. The futures price (per pound) is 121.20 cents when it enters into the contract, 118.30 cents when it closes ou

> The standard deviation of monthly changes in the spot price of live cattle is (in cents per pound) 1.2. The standard deviation of monthly changes in the futures price of live cattle for the closest contract is 1.4. The correlation between the futures pri

> ‘‘Options and futures are zero-sum games.’’ What do you think is meant by this?

> The CME Group offers a futures contract on long-term Treasury bonds. Characterize the traders likely to use this contract.

> ‘‘When the futures price of an asset is less than the spot price, long hedges are likely to be particularly attractive.’’ Explain this statement.

> On July 1, an investor holds 50,000 shares of a certain stock. The market price is $30 per share. The investor is interested in hedging against movements in the market over the next month and decides to use an index futures contract. The index futures pr

> A company knows that it is due to receive a certain amount of a foreign currency in 4 months. What type of option contract is appropriate for hedging?

> An American put option on a non-dividend-paying stock has 4 months to maturity. The exercise price is $21, the stock price is $20, the risk-free rate of interest is 10% perannum, and the volatility is 30% per annum. Use the explicit version of the finite

> At the end of one day a clearing house member is long 100 contracts, and the settlement price is $50,000 per contract. The original margin is $2,000 per contract. On the following day the member becomes responsible for clearing an additional 20 long cont

> Explain what a stop–limit order to sell at 20.30 with a limit of 20.10 means.

> ‘‘If the minimum variance hedge ratio is calculated as 1.0, the hedge must be perfect.’’ Is this statement true? Explain your answer.

> Explain what is meant by basis risk when futures contracts are used for hedging.

> When first issued, a stock provides funds for a company. Is the same true of a stock option? Discuss.

> Explain why a short hedger’s position improves when the basis strengthens unexpectedly and worsens when the basis weakens unexpectedly.

> What are the most important aspects of the design of a new futures contract?

> The party with a short position in a futures contract sometimes has options as to the precise asset that will be delivered, where delivery will take place, when delivery will take place, and so on. Do these options increase or decrease the futures price?

> A company has a $20 million portfolio with a beta of 1.2. It would like to use futures contracts on a stock index to hedge its risk. The index futures price is currently standing at 1080, and each contract is for delivery of $250 times the index. What is

> Show by substituting for the various terms in equation (19.4) that the equation is true for: (a) A single European call option on a non-dividend-paying stock (b) A single European put option on a non-dividend-paying stock (c) Any portfolio of European pu

> Suppose that the standard deviation of quarterly changes in the prices of a commodity is $0.65, the standard deviation of quarterly changes in a futures price on the commodity is $0.81, and the coefficient of correlation between the two changes is 0.8. W

> An investor enters into a short forward contract to sell 100,000 British pounds for U.S. dollars at an exchange rate of 1.5000 USD per pound. How much does the investor gain or lose if the exchange rate at the end of the contract is (a) 1.4900 and (b) 1.

> Under what circumstances does a minimum variance hedge portfolio lead to no hedging at all?

> What is the difference between entering into a long forward contract when the forward price is $50 and taking a long position in a call option with a strike price of $50?

> What is the difference between a local and a futures commission merchant?

> Distinguish between the terms open interest and trading volume.

> Explain why the linear model can provide only approximate estimates of VaR for a portfolio containing options.

> Suppose that a company has a portfolio consisting of positions in stocks and bonds. Assume that there are no derivatives. Explain the assumptions underlying (a) the linear model and (b) the historical simulation model for calculating VaR.

> A financial institution owns a portfolio of options on the U.S. dollar–sterling exchange rate. The delta of the portfolio is 56.0. The current exchange rate is 1.5000. Derive an approximate linear relationship between the change in the portfolio value an

> Describe three ways of handling instruments that are dependent on interest rates when the model-building approach is used to calculate VaR. How would you handle these instruments when historical simulation is used to calculate VaR?

> Stock A, whose price is $30, has an expected return of 11% and a volatility of 25%. Stock B, whose price is $40, has an expected return of 15% and a volatility of 30%. The processes driving the returns are correlated with correlation parameter. In Excel,

> Use the spreadsheets on the author’s website to calculate the one-day 99% VaR and ES, employing the basic methodology in Section 22.2, if the four-index portfolio considered in Section 22.2 is equally divided between the four indices.

> Suppose that in Problem 22.12 the vega of the portfolio is 2 per 1% change in the annual volatility. Derive a model relating the change in the portfolio value in 1 day to delta, gamma, and vega. Explain without doing detailed calculations how you would u

> A bank has a portfolio of options on an asset. The delta of the options is –30 and the gamma is 5. Explain how these numbers can be interpreted. The asset price is 20 and its volatility is 1% per day. Adapt Sample Application E in the DerivaGem Applicati

> The text calculates a VaR estimate for the example in Table 22.9 assuming two factors. How does the estimate change if you assume (a) one factor and (b) three factors. Table 22.9 Change in portfolio value for a l-basis-point rate move (S milli ons).

> Some time ago a company entered into a forward contract to buy £1 million for $1.5 million. The contract now has 6 months to maturity. The daily volatility of a 6-month zero-coupon sterling bond (when its price is translated to dollars) is 0.06% and the

> Consider a position consisting of a $100,000 investment in asset A and a $100,000 investment in asset B. Assume that the daily volatilities of both assets are 1% and that the coefficient of correlation between their returns is 0.3. Estimate the 5-day 99%

> Explain why the Monte Carlo simulation approach cannot easily be used for American-style derivatives

> Use stratified sampling with 100 trials to improve the estimate of in Business Snapshot 21.1 and Table 21.1. Business Snapshot 21.1 Calculating Pi with Monte Carlo Simulation Suppose the sides of the square in Figure 21.13 are one unit in length. Im