Question: Investors and lenders who read financial statements

Investors and lenders who read financial statements must determine the age, composition, and productivity of operating assets.

Refer to the financial information at the back of the book for Chipotle and Panera Bread.

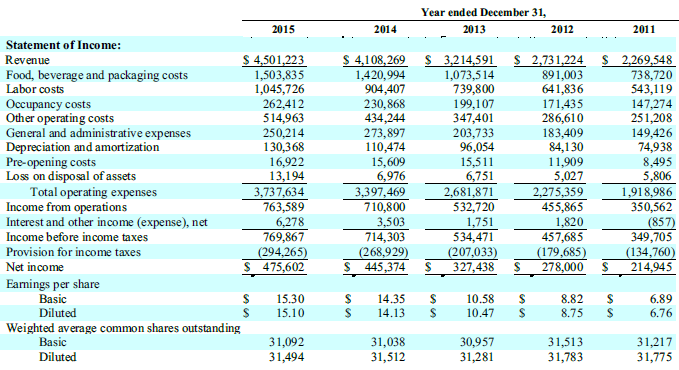

Financial information Chipotle:

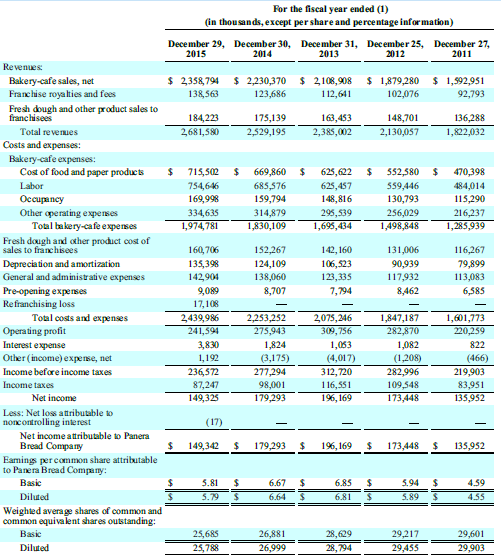

Financial information Panera Bread:

Required:

Part A. The Ratio Analysis Model

For each company, determine:

Replicate the five steps in the Ratio Analysis Model on page 378 to perform the analysis.

1. Formulate the Question

2. Gather the Information from the financial statements

3. Calculate the Ratio

4. Compare the Ratio with Other Ratios

5. Interpret the Ratios

Part B. The Business Decision Model

1. Formulate the Question

2. Gather Information from the financial statements and Other Sources

3. Analyze the Information Gathered

4. Make the Decision

5. Monitor Your Decision

Transcribed Image Text:

Year ended December 31, 2015 2014 2013 2012 2011 Statement of Income: $ 4,501,223 1,503,835 1,045,726 262,412 514,963 250,214 130,368 16,922 13,194 3,737,634 763,589 6,278 769,867 (294,265) $ 475,602 $ 3,214,591 $ 2,731,224 $ 2,269,548 1,073,514 739,800 199,107 347,401 203,733 96,054 15,511 6,751 2,681,871 532,720 1,751 534,471 (207,033) %24 $ 4,108,269 1,420,994 904,407 Revenue Food, beverage and packaging costs Labor costs Occupancy costs Other operating costs General and administrative expenses Depreciation and amortization Pre-opening costs Loss on disposal of assets Total operating expenses Income from operations Interest and other income (expense), net Income before income taxes 230,868 434,244 273,897 110,474 15,609 6,976 3,397,469 710,800 3,503 714,303 (268,929) $ 445,374 891,003 641,836 171,435 286,610 183,409 84,130 11,909 5,027 738,720 543,119 147,274 251,208 149,426 74,938 8,495 5,806 1,918,986 350,562 (857) 349,705 (134,760) %24 2,275,359 455,865 1,820 457,685 (179,685) %24 Provision for income taxes Net income 327,438 278,000 214,945 Eamings per share Basic 15.30 10.58 14.35 14.13 %24 8.82 8.75 6.89 6.76 Diluted 15.10 10.47 Weighted average common shares outstanding 31,513 31,783 31,217 31,775 Basic 31,092 31,494 31,038 31,512 30,957 31,281 Diluted For the fiscal year ended (1) (in thousands, except per share and percentage infor mation) December 29, December 30, Dece mber 31, December 25, December 27, 2013 2015 2014 2012 2011 Revenues: $ 2,358,794 $ 2,230,370 $ 2108,908 $ 1,879,280 $ 1,592,951 92,793 Bakery-cafe sales, net Franchise royalties and fees 138,563 123,686 112,641 102,076 Fresh dough and other product sales to franchisees 184,223 175,139 163,453 148,701 136,288 Total revenues 2,681,580 2,529,195 2,385,002 2,130,057 1,822,032 Costs and expenses: Bakery-cafe expenses: Cost of food and paper products 24 715,502 669,860 $ 625,622 552,580 2$ 470,398 Labor 754,646 685,576 625,457 559,446 484,014 Ocupancy 169,998 159,794 148,816 130,793 115,290 Other operating expenses Toal bakery-cafe experses 334,635 314,879 295,539 256,029 216,237 1,974,781 1,830,109 1,695,434 1,498,848 1,285,939 Fresh dough and other product cost of sales to franchisees 160, 706 152,267 142, 160 131,006 116,267 Deprecia tion and amortization General and administrative expenses 124,109 138,060 106, 523 123,335 135,398 90,939 79,899 142,904 117,932 113,083 Pre-opening experses Refranchising loss 9,089 8,707 7,794 8,462 6,585 17,108 Total costs and expenses 2439,986 2,253,252 2075,246 1,847,187 1,601,773 Operating profit 241,594 275,943 309, 756 282,870 220,259 1,053 (4,017) Interest expense 3,830 1,824 1,082 822 Other (income) experse, net 1,192 (3,175) (1,208) (466) Income before income taxes 236,572 277,294 312,720 282,996 219,903 Income taxes 87,247 98,001 116,551 109,548 83,951 Net income 149,325 179,293 196, 169 173,448 135,952 Less: Net loss attributable to noncontrolling interest (17) Net income attributable to Panera Bread Company 149,342 179,293 $ 196, 169 173,448 135,952 Eamings percommon share attributable to Panera Bread Company: Basic 2$ 3.81 6.67 6.85 2$ 3.94 4.39 Diluted 5.79 6.64 6.81 5.89 24 4.55 Weighted average shares of common and common equivalent shares outstanding: 28,629 28, 794 Basic 25,685 26,881 26,999 29,217 29,601 Diluted 25,788 29,455 29,903

> Refer to all of the facts in Problem 12-9. Problem 12-9: The balance sheet of Terrier Company at the end of 2016 is presented here, along with certain other information for 2017: December 31, 2016 Cash …………………………………………………………………………………… $ 140,000 Accoun

> The following balances are available for Chrisman Company: Bonds were retired during 2017 at face value, plant and equipment were acquired for cash, and common stock was issued for cash. Depreciation expense for the year was $35,000. Net income was rep

> Louise Abbott and Buddie Costello are partners in a comedy club business. The partnership agreement specifies the manner in which income of the business is to be distributed. Louise is to receive a salary of $20,000 for managing the club. Buddie is to re

> Refer to all of the facts in Problem 11-1. Problem 11-1: Peeler Company was incorporated as a new business on January 1, 2017. The corporate charter approved on that date authorized the issuance of 1,000 shares of $100 par, 7% cumulative, nonparticipat

> John Walton is an accountant for ABC Auto Dealers, a large auto dealership in a metropolitan area. ABC sells both new and used cars. New cars are sold with a five-year warranty, the cost of which is carried by the manufacturer. For several years, however

> Following is the consolidated statement of comprehensive income for Southwest Airlines for the year ended December 31, 2014: Required: 1. Which items were included in comprehensive income? If these items had been included on the income statement as par

> Refer to all of the facts in Problem 11-1. Problem 11-1: Peeler Company was incorporated as a new business on January 1, 2017. The corporate charter approved on that date authorized the issuance of 1,000 shares of $100 par, 7% cumulative, nonparticipat

> On January 1, 2017, Frederiksen Inc.’s Stockholders’ Equity category appeared as follows: Preferred stock, $80 par value, 7%, 3,000 shares issued and outstanding ……..…. $ 240,000 Common stock, $10 par value, 15,000 shares issued and outstanding …………..……

> Favre Company has a history of paying cash dividends on its common stock. However, the firm did not have a particularly profitable year in 2017. At the end of the year, Favre found itself without the necessary cash for a dividend and therefore declared a

> The Stockholders’ Equity category of Greenbaum Company’s balance sheet as of December 31, 2017, appeared as follows: Preferred stock, $100 par, 8%, 1,000 shares issued and outstanding $ 100,000 Common stock, $10 par, 20,000 shares issued and outstanding

> Ellen Hays received a windfall from one of her investments. She would like to invest $100,000 of the money in Linwood Inc., which is offering common stock, preferred stock, and bonds on the open market. The common stock has paid $8 per share in dividends

> Kirin Nerise and Milt O’Brien agreed to form a partnership to operate a sandwich shop. Kirin contributed $25,000 cash and will manage the store. Milt contributed computer equipment worth $8,000 and $92,000 cash. Milt will keep the financial records. Duri

> On May 1, Chong Yu deposited $120,000 of his own savings in a separate bank account to start a printing business. He purchased copy machines for $42,000. Expenses for the year, including depreciation on the copy machines, were $84,000. Sales for the year

> Peeler Company was incorporated as a new business on January 1, 2017. The corporate charter approved on that date authorized the issuance of 1,000 shares of $100 par, 7% cumulative, nonparticipating preferred stock and 10,000 shares of $5 par common stoc

> Wyhowski Inc. reported income from operations, before taxes, for 2015–2017 as follows: 2015 ………………………………………………………………………. $210,000 2016 ………………………………………………………………………. 240,000 2017 ………………………………………………………………………. 280,000 When calculating income, Wyhowski dedu

> Langsom’s Mfg. is planning for a new project. Usually, Langsom’s depreciates long-term equipment for ten years. The equipment for this project is specialized and will have no further use at the end of the project in three years. The manager of the projec

> Erinn Corporation has compiled its 2017 financial statements. Included in the Long-Term Liabilities category of the balance sheet are the following amounts: Included in the income statement are the following amounts related to income taxes: In the no

> On January 1, 2017, Muske Trucking Company leased a semitractor and trailer for five years. Annual payments of $28,300 are to be made every December 31 beginning December 31, 2017. Interest expense is based on a rate of 8%. The present value of the minim

> McGee Company issued $200,000 face value bonds at a premium of $4,500. The bonds contain a call provision of 101. McGee decides to redeem the bonds due to a significant decline in interest rates. On that date, McGee had amortized only $1,000 of the premi

> Assume the same set of facts for Stacy Company as in Problem 10-2 except that the market rate of interest of January 1, 2017, is 8% and the proceeds from the bond issuance equal $10,799. Required: 1. Prepare a five-year table (similar to Exhibit 10-5) t

> Stacy Company issued five-year, 10% bonds with a face value of $10,000 on January 1, 2017. Interest is paid annually on December 31. The market rate of interest on this date is 12%, and Stacy Company receives proceeds of $9,279 on the bond issuance. Req

> Becca Company is considering the issue of $100,000 face value, ten-year term bonds. The bonds will pay 6% interest each December 31. The current market rate is 6%; therefore, the bonds will be issued at face value. Required 1. For each of the following

> Bombeck Company sells a product for $1,500. When the customer buys it, Bombeck provides a one-year warranty. Bombeck sold 120 products during 2017. Based on analysis of past warranty records, Bombeck estimates that repairs will average 3% of total sales.

> Clearview Company manufactures and sells high-quality television sets. The most popular line sells for $1,000 each and is accompanied by a three-year warranty to repair, free of charge, any defective unit. Average costs to repair each defective unit will

> Brinker International operates Chili’s, Macaroni Grill, and other restaurant chains. The following items are classified as current liabilities on Brinker International’s balance sheets as of 2015 and 2014: Required:

> The following items are classified as current liabilities on Yum! Brands’ balance sheets as of December 27, 2014, and December 28, 2013: Required: 1. Yum! Brands uses the indirect method to prepare its statement of cash flows. Prepare

> Denver Company recently hired Terry Davis as an accountant. He was given responsibility for all accounting functions related to fixed asset accounting. Tammy Sharp, Terry’s boss, asked him to review all transactions involving the current year’s acquisiti

> On January 1, 2017, Chen Yu’s Office Supply Store plans to remodel the store and install new display cases. Chen has the following options of payment. Chen’s interest rate is 8%. a. Pay $180,000 on January 1, 2017. b. Pay $196,200 on January 1, 2018. c.

> Heartland Inc. is a medium-size company that has been in business for 20 years. The industry has become very competitive in the last few years, and Heartland has decided that it must grow if it is going to survive. It has approached the bank for a sizabl

> Tablon Inc. is a wholly owned subsidiary of Marbel Co. The philosophy of Marbel’s management is to allow the subsidiaries to operate as independent units. Corporate control is exercised through the establishment of minimum objectives fo

> Lang Company has not yet prepared a formal statement of cash flows for 2017. Following are comparative balance sheets as of December 31, 2017 and 2016, and a statement of income and retained earnings for the year ended December 31, 2017: Income taxes

> Refer to all of the facts in Problem 12-11. Problem 12-11: Glendive Corp. is in the process of preparing its statement of cash flows for the year ended June 30, 2017. An income statement for the year and comparative balance sheets are as follows: For

> Glendive Corp. is in the process of preparing its statement of cash flows for the year ended June 30, 2017. An income statement for the year and comparative balance sheets are as follows: For the Year Ended June 30, …â€&br

> The newly hired accountant at Ives Inc. prepared the following balance sheet: Assets Cash …………………………………………………………………………. $ 3,500 Accounts receivable ……………………………………………………… 5,000 Treasury stock ………………………………………………………….……… 500 Plant, property, and equipment

> The following transactions occurred at Horton Inc. during its first year of operation: a. Issued 100,000 shares of common stock at $5 each; 1,000,000 shares are authorized at $1 par value. b. Issued 10,000 shares of common stock for a building and land.

> The Stockholders’ Equity section of the December 31, 2017, balance sheet of Eldon Company appeared as follows: Preferred stock, $30 par value, 5,000 shares authorized,? shares issued …….. $120,000 Common stock,? par, 10,000 shares authorized, 7,000 shar

> The following items, listed alphabetically, appear on Walgreens Boots Alliance, Inc consolidated balance sheet at August 31, 2015 (in millions): Accrued expenses and other liabilities …………………………………………… $ 5,225 Deferred income taxes (long-term) ………………………

> Garden Fresh Inc. is a wholesaler of fresh fruits and vegetables. Each year, it submits a set of financial ratios to a trade association. Even though the association doesn’t publish the individual ratios for each company, the president

> Brand Company issued $1,000,000 face value, eight-year, 12% bonds on April 1, 2017, when the market rate of interest was 12%. Interest payments are due every October 1 and April 1. Brand uses a calendar year-end. Required: 1. Identify and analyze the ef

> On July 1, 2017, Leach Company needs exactly $103,200 in cash to pay an existing obligation. Leach has decided to borrow from State Bank, which charges 14% interest on loans. The loan will be due in one year. Leach is unsure, however, whether to ask the

> The following situations involve the application of the time value of money concept: 1. Janelle Carter deposited $9,750 in the bank on January 1, 2000, at an interest rate of 12% compounded annually. How much has accumulated in the account by January 1,

> Brian Imhoff’s grandparents want to give him some money when he graduates from high school. They have offered Brian three choices as follows: a. Receive $15,000 immediately. Assume that interest is compounded annually. b. Receive $2,250 at the end of eac

> Table leaf Inc. purchased a patent a number of years ago. The patent is being amortized on a straight-line basis over its estimated useful life. The company’s comparative balance sheets as of December 31, 2017 and 2016, included the fol

> On January 1, 2017, Castlewood Company purchased machinery for its production line for $104,000. Using an estimated useful life of eight years and a residual value of $8,000, the annual straight-line depreciation of the machinery was calculated to be $12

> During 2012, Reynosa Inc.’s research and development department developed a new manufacturing process. Research and development costs were $85,000. The process was patented on October 1, 2012. Legal costs to acquire the patent were $11,900. Reynosa decid

> Merton Company purchased a building on January 1, 2016, at a cost of $364,000. Merton estimated that its life would be 25 years and its residual value would be $14,000. On January 1, 2017, the company made several expenditures related to the building. Th

> Early in its first year of business, Toner Company, a fitness and training center, purchased new workout equipment. The acquisition included the following costs: Purchase price ……………………………………………………………….. $150,000 Tax …………………………………………………………………………………….. 1

> The following events took place at Pete’s Painting Company during 2017: a. On January 1, Pete bought a used truck for $14,000. He added a tool chest and side racks for ladders for $4,800. The truck is expected to last four years and then be sold for $800

> As assistant controller of Midwest Construction Company, you are reviewing with your boss, the controller, Dave Jackson, the financial statements for the year just ended. During the review, Jackson reminds you of an existing loan agreement with Southern

> The accounting staff of CCB Enterprises has completed the financial statements for the 2017 calendar year. The statement of income for the current year and the comparative statements of financial position for 2017 and 2016 follow. CCB Enterprises Statem

> McLaughlin Inc. operates with a June 30 year-end. During 2017, the following transactions occurred: a. January 1: Signed a one-year, 10% loan for $35,000. Interest and principal are to be paid at maturity. b. January 10: Signed a line of credit with Lit

> On June 30, 2017, Rolloff Inc. borrowed $25,000 from its bank, signing a 6% note. Principal and interest are due at the end of two years. Required: 1. Assuming that the note earns simple interest for the bank, calculate the amount of interest accrued on

> E-Gen Enterprises Inc. had property, plant, and equipment, net of accumulated depreciation, of $1,555,000 and intangible assets, net of accumulated amortization, of $34,000 at December 31, 2017. The company’s 2017 statement of cash flows, prepared using

> Book Company’s only asset as of January 1, 2017, was a copyright. During 2017, only the following three transactions occurred: Royalties earned from copyright use, $500,000 in cash Cash paid for advertising and salaries, $62,500 Amortization, $50,000 Re

> Payton Delivery Service purchased a delivery truck for $28,200. The truck will have a useful life of six years and zero salvage value. For the purposes of preparing financial statements, Payton is planning to use straight-line depreciation. For tax purpo

> The term tax shield refers to the amount of income tax saved by deducting depreciation for income tax purposes. Assume that Rummy Company is considering the purchase of an asset as of January 1, 2017. The cost of the asset with a five-year life and zero

> Dixon Manufacturing purchased, for cash, three large pieces of equipment. Based on recent sales of similar equipment, the fair market values are as follows: Required: 1. What value is assigned to each piece of equipment if the equipment was purchased f

> Sunset Corp. is a major regional retailer. The chief executive officer (CEO) is concerned with the slow growth both of sales and of net income and the subsequent effect on the trading price of the common stock. Selected financial data for the past three

> The president of Blue Moon Corp. and her department managers are reviewing the operating results of the year just completed. Sales increased by 12% from the previous year to $750,000. Average total assets for the year were $400,000. Net income, after add

> In December 2017, Rangers Inc. invested $100,000 of idle cash in U.S. Treasury notes. The notes mature on October 1, 2018, at which time Rangers expects to redeem them at face value of $100,000. The treasurer believes that the notes should be classified

> Consider completing this problem after Problem 13-1A to ensure that you obtain a clear understanding of the effect of various transactions on this measure of solvency. The following account balances are taken from the records of Degas Inc.: Current liab

> Consider completing Problem 13-2A after this problem to ensure that you obtain a clear understanding of the effect of various transactions on this measure of solvency. The following account balances are taken from the records of Monet’s

> The balance sheet of Poodle Company at the end of 2016 is presented here, along with certain other information for 2017: December 31, 2016 Cash …………………………………………………….…………………………………. $ 155,000 Accounts receivable ……………………………..………………………………….. 140,000 Total

> Refer to all of the facts in Problem 12-6A. Problem 12-6A: The income statement for Pluto Inc. for 2017 is as follows: For the Year Ended December 31, 2017 Sales revenue ………â€&brvb

> Refer to all of the facts in Problem 12-6A. Problem 12-6A: The income statement for Pluto Inc. for 2017 is as follows: For the Year Ended December 31, 2017 Sales revenue ………â€&brvb

> The income statement for Pluto Inc. for 2017 is as follows: For the Year Ended December 31, 2017 Sales revenue ………………â€&br

> Refer to all of the facts in Problem 12-3A. Problem 12-3A: Wabash Corp. just completed another successful year, as indicated by the following income statement: For the Year Ended December 31, 2017 Sales revenue …â€&brvba

> Refer to all of the facts in Problem 12-3A. Problem 12-3A: Wabash Corp. just completed another successful year, as indicated by the following income statement: For the Year Ended December 31, 2017 Sales revenue …â€&brvba

> Wabash Corp. just completed another successful year, as indicated by the following income statement: For the Year Ended December 31, 2017 Sales revenue …………â€&brv

> Refer to all of the facts in Problem 12-1A. Problem 12-1A: The following balances are available for Madison Company: Bonds were issued during 2017 at face value, and plant and equipment were acquired for cash. Depreciation expense for the year was $5

> Refer to the financial statement information of Panera Bread reprinted at the back of the book. Required: 1. Compute the following ratios and other amounts for each of the two years, ending December 30, 2015, and December 31, 2014. Because only two year

> Refer to all of the facts in Problem 12-9A. Problem 12-9A: The balance sheet of Poodle Company at the end of 2016 is presented here, along with certain other information for 2017: December 31, 2016 Cash ……………………………………………………………………………………. $ 155,000 Acco

> The following balances are available for Madison Company: Bonds were issued during 2017 at face value, and plant and equipment were acquired for cash. Depreciation expense for the year was $50,000. A net loss of $21,800 was reported. Required: 1. Prep

> Kay Katz and Doris Kan are partners in a dry-cleaning business. The partnership agreement specifies the manner in which income of the business is to be distributed. Kay is to receive a salary of $40,000 for managing the business. Doris is to receive inte

> Refer to all of the facts in Problem 11-1A. Problem 11-1A: Kebler Company was incorporated as a new business on January 1, 2017. The corporate charter approved on that date authorized the issuance of 2,000 shares of $100 par, 7% cumulative, nonparticip

> Following is the consolidated statement of stockholders’ equity of Costco Wholesale Corporation for the year ended August 30, 2015: Required: 1. Costco has an item in the statement of stockholders’ equity called Accu

> Refer to all of the facts in Problem 11-1A. Problem 11-1A: Kebler Company was incorporated as a new business on January 1, 2017. The corporate charter approved on that date authorized the issuance of 2,000 shares of $100 par, 7% cumulative, nonparticip

> On January 1, 2017, Svenberg Inc.’s Stockholders’ Equity category appeared as follows: Preferred stock, $80 par value, 8%, 1,000 shares issued and outstanding …… $ 80,000 Common stock, $10 par value, 10,000 shares issued and outstanding ………….. 100,000 A

> Travanti Company has a history of paying cash dividends on its common stock. Although the firm has been profitable this year, the board of directors is planning construction of a second manufacturing plant. To reduce the amount that they must borrow to f

> Rob Lowe would like to invest $100,000 in Franklin Inc., which is offering common stock, preferred stock, and bonds on the open market. The common stock has paid $1 per share in dividends for the past three years, and the company expects to be able to do

> Karen Locke and Gina Keyes agreed to form a partnership to operate a sandwich shop. Karen contributed $35,000 cash and will manage the store. Gina contributed computer equipment worth $11,200 and $128,800 cash. Gina will keep the financial records. Durin

> This case should be completed after responding to the requirements in Decision Case 13-2. Refer to the financial statement information of Chipotle and Panera Bread reprinted at the back of the book. Panera Bread’s financial statements:

> On May 1, Chen Chien Lao deposited $150,000 of her own savings in a separate bank account to start a printing business. She purchased copy machines for $52,500. Expenses for the year, including depreciation on the copy machines, were $105,000. Sales for

> Kebler Company was incorporated as a new business on January 1, 2017. The corporate charter approved on that date authorized the issuance of 2,000 shares of $100 par, 7% cumulative, nonparticipating preferred stock and 20,000 shares of $5 par common stoc

> Clemente Inc. has reported income for book purposes as follows for the past three years: Clemente has identified two items that are treated differently in the financial records and in the tax records. The first one is interest income on municipal bonds

> Thad Corporation has compiled its 2017 financial statements. Included in the Long-Term Liabilities category of the balance sheet are the following amounts: Included in the income statement are the following amounts related to income taxes: Required:

> On January 1, 2017, Kiger Manufacturing Company leased a factory machine for six years. Annual payments of $21,980 are to be made every December 31 beginning December 31, 2017. Interest expense is based on a rate of 9%. The present value of the minimum l

> Elliot Company issued $100,000 face value bonds at a premium of $5,500. The bonds contain a call provision of 101. Elliot decides to redeem the bonds due to a significant decline in interest rates. On that date, Elliot had amortized only $2,000 of the pr

> Assume the same set of facts for Ortega Company as in Problem 10-2A except that the market rate of interest of January 1, 2017, is 4% and the proceeds from the bond issuance equal $52,227. Required: 1. Prepare a five-year table (similar to Exhibit 10-5)

> Ortega Company issued five-year, 5% bonds with a face value of $50,000 on January 1, 2017. Interest is paid annually on December 31. The market rate of interest on this date is 8%, and Ortega Company receives proceeds of $44,011 on the bond issuance. Re

> Rivera Inc. is considering the issuance of $500,000 face value, ten-year term bonds. The bonds will pay 10% interest each December 31. The current market rate is 10%; therefore, the bonds will be issued at face value. Required: 1. For each of the follow

> Beck Company sells a product for $3,200. When the customer buys it, Beck provides a one-year warranty. Beck sold 120 products during 2017. Based on analysis of past warranty records, Beck estimates that repairs will average 4% of total sales. Required:

> Refer to the financial statement information of Chipotle reprinted at the back of the book. Financial statement of Chipotle: Required: 1. Using the format in Example 13-5, prepare common-size comparative income statements for 2015 and 2014. Round all

> The following items are included in the Current Liabilities category on the consolidated balance sheet of Darden Restaurants at May 31, 2015 and May 25, 2014: Required: 1. Darden Restaurants uses the indirect method to prepare its statement of cash flo

> The following items are classified as current liabilities on McDonald’s consolidated statements of financial condition (or balance sheet) at December 31 (in millions): Required: 1. McDonald’s uses the indirect method

> On January 1, 2017, Chen Yu’s Office Supply Store plans to remodel the store and install new display cases. Chen has the following options of payment. Chen’s interest rate is 8%. a. Pay $270,000 on January 1, 2017. b. Pay $294,300 on January 1, 2018. c.

> Early in its first year of business, Key Inc., a locksmith and security consultant, purchased new equipment. The acquisition included the following costs: Purchase price ……………………………………………………………………. $168,000 Tax …………………………………………………………………………………………. 16,500

> The following events took place at Tasty-Toppins Inc., a pizza shop that specializes in home delivery, during 2017: a. January 1, purchased a truck for $16,000 and added a cab and an oven at a cost of $10,900. The truck is expected to last five years and

> The accounting staff of SST Enterprises has completed the financial statements for the 2017 calendar year. The statement of income for the current year and the comparative statements of financial position for 2017 and 2016 follow. SST Enterprises Statem

> Midwest Inc. is a medium-size company that has been in business for 20 years. The industry has become very competitive in the last few years, and Midwest has decided that it must grow if it is going to survive. It has approached the bank for a sizable fi