Question: It had been a quiet Monday morning

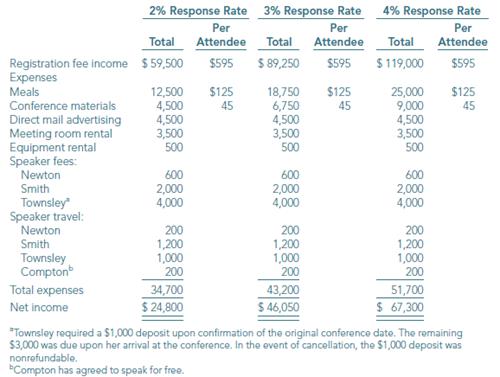

It had been a quiet Monday morning for Anna Hogue, senior project manager at Flagstone Consulting. Everything seemed to be falling into place for the company’s first conference, “Healthcare Management in the New Millenium,†scheduled for October 11 and 12 in Boston. Then Ethan Tang, the staff consultant in charge of registration, stuck his head in the door. “Anna,†said Ethan, “I think we may have a problem with the conference. Only 15 people have registered. Our marketing consultants told us to expect at least a 3% registration rate from our direct mail campaign. Based on the 5,000 conference fliers we mailed, do you think another 135 people will register in the next three weeks?†Anna and Ethan had worked together to develop a budget for the conference, as follows. They had budgeted for registration response rates of 2%, 3%, and 4%, but a response rate of 0.3% was far outside their expectations.

Anna thought for a second, and then replied, “Ethan, based on what the marketing fi rm told us, at least 75% of all registrations are received a month before the conference. This response has me a bit worried. If we need to cancel the conference, we must do it before Thursday. Otherwise, it will be too late.†Anna and Ethan called a couple of contacts at other organizations, who related similar experiences with low preconference registration. They indicated that medical professionals often wait until the last minute to register and that in some instances, conferences had been rescheduled and re-advertised to increase registration.

Anna and Ethan decided they needed more information before they could make a final decision on the fate of the conference. Rescheduling it would require them to confirm the new dates with the speakers. Conference facilities would also need to be secured for the new dates. Fortunately, the conference materials had not been sent to the printer yet, so the printed materials would not become obsolete. Anna and Ethan decided that if the conference were rescheduled, Flagstone would offer a reduced registration fee of $525 to companies that sent more than one person.

Anna called some of the Boston-area professionals who had expressed interest in the conference but had not registered yet. Some of them indicated that they had never received the registration mailing. After contacting the marketing fi rm about the matter, Anna learned that there had indeed been problems with the mailing. The marketing fi rm had subcontracted the mailing to a second fi rm, which could not verify that all the materials had been mailed. Anna wondered how many other prospects had not received the mailing.

Next, Anna arranged a conference call with all the speakers, to explain what was going on. They agreed that the mailing problem could have contributed to the low registration. All the speakers were available on December 8 and 9, and were willing to change their schedules to accommodate Flagstone if the fi rm chose to reschedule the conference. Steve Smith indicated that he had already purchased a nonrefundable airline ticket for $800. If the conference were rescheduled, he would incur an additional $100 charge to change the flight. William Townsley indicated that he was already scheduled to be in Boston on December 7, so Flagstone would not have to cover his travel expenses if the conference were rescheduled.

Ethan called the University Parks Inn to discuss the facilities contract. Although Flagstone had made no payments to the hotel yet, the special events coordinator reminded Ethan of two points in the contract:

1. A cancellation fee of $10,000 would need to be paid if the conference were canceled at this late date. However, the inn would agree to waive the cancellation fee if the conference were rescheduled within four months of the original date.

2. Flagstone had guaranteed a minimum of 40 guest rooms. If conference attendees booked fewer rooms, Flagstone would have to pay an additional $5,000 for the meeting room rental. Ethan also contacted the marketing firm about doing additional mailings. In light of the problems with the earlier mailing, the marketing firm offered to do two additional mailings for a total of $1,500. They also agreed to expand the mailing list to include several other professional organizations, as well as students at medical and nursing schools in the area. The firm estimated the new mailings would reach 6,500 people and should result in a 2% registration rate. Of that 2%, 10% were expected to qualify for the reduced registration fee.

Required:

a. What alternatives are available to Anna and Ethan with regard to holding the conference?

b. Prepare pro-forma income statements for each of the alternatives you identified in question (a). c. Adjust the statements in part (b) by eliminating the unavoidable costs from the calculation to show only the relevant income/loss from each option.

d. What are the pros and cons of holding the conference as scheduled?

e. What are the pros and cons of canceling the conference?

f. What are the pros and cons of rescheduling the conference?

g. How should Flagstone view this conference—in the short term or in the long term?

Transcribed Image Text:

2% Response Rate 3% Response Rate 4% Response Rate Per Per Per Total Attendee Total Attendee Total Attendee $ 119,000 Registration fee income $59,500 Expenses $595 $89,250 $595 $595 Meals 12,500 4,500 4,500 3,500 500 $125 45 18,750 6,750 4,500 3,500 500 $125 45 25,000 9,000 4,500 3,500 500 $125 Conference materials 45 Direct mail advertising Meeting room rental Equipment rental Speaker fees: Newton Smith Townsley Speaker travel: Newton Smith 600 600 600 2,000 4,000 2,000 4,000 2,000 4,000 Townsley Compton 200 1,200 1,000 200 200 1,200 1,000 200 200 1,200 1,000 200 51,700 $ 67,300 Total expenses 34,700 $ 24,800 43,200 S 46,050 Net income *Townsloy required a $1,000 deposit upon confirmation of the original conference date. The romaining $3,000 was due upon her arrival at the conference. In the event of cancellation, the $1,000 deposit was nonrefundable. Compton has agreed to speak for free.

> Martha Gentry won an $18 million lottery and elected to receive her winnings in 30 equal annual installments. After receiving the first 10 installments, Martha and her husband divorced, and the remaining 20 payments became part of the property settlement

> To calculate the unit cost of the video games that he sells at his mall kiosk, Joel Lawson added up all his costs and divided by the number of units he sold during the year. He then used this unit cost to estimate total costs for the coming year. Requir

> Farrior Fashions needs to replace a beltloop attacher that currently costs the company $40,000 in annual cash operating costs. This machine is of no use to another company, but it could be sold as scrap for $2,160. Managers have identified a potential re

> Margaret wants to buy a car when she graduates from Central University four years from now. She believes that she will need $30,000 to buy the car. Required: a. Calculate how much money Margaret must put into her savings account today to have $30,000 in

> The Seago Company is planning to purchase $500,000 of equipment with an estimated seven-year life and no estimated salvage value. The company has projected the following annual cash flows for the investment. Year……………….Projected Cash Flows 1………………………………

> Tom Falkland is considering refinancing his home mortgage to reduce his house payment by $125 per month. Closing costs associated with the refinancing will total $5,000. Tom will finish medical school in four years, at which time he will sell the house a

> Boyer Cosmetics is planning to expand its product line to include stage makeup. The expansion will require the company to purchase special mixing equipment at a cost of $125,532. The equipment will have a useful life of 16 years. Required: a. If Boyer u

> Garrett Boone, Farish Enterprises’ vice president of operations, needs to replace an automatic lathe on the production line. The model he is considering has a sales price of $285,000 and will last for 9 years. It will have no salvage value at the end of

> Harrison Hammocks is considering the purchase of a new weaving machine to prepare fabric for its hammocks. The machine under consideration costs $88,235 and will save the company $14,000 in direct labor costs. It is expected to last 14 years. Required:

> Larry’s Lawn Service needs to purchase a new lawnmower costing $7,756 to replace an old lawnmower that cannot be repaired. The new lawnmower is expected to have a useful life of four years, with no salvage value at the end of that period. Required: a. I

> Review the data provided in Exercise 9-2. Reference from Exercise 9-2: Mighty Vita produces a wide range of herbal supplements sold nationwide through independent distributors. In response to an increasing demand for its products, the company is consi

> Review the data provided in Exercise 9-1. Reference from Exercise 9-1: Metro Industries is considering the purchase of new equipment costing $1,200,000 to replace existing equipment that will be sold for $180,000. The new equipment is expected to have a

> Marla Mason owns and operates a home health care agency. She reported the following cost information for the first four months in 2017. Identify each of the following costs as fixed, variable, or mixed and calculate the missing values. Home Visit Hou

> Chuck has just won the Flyball Lottery. He has two options for receiving his prize. The first option is to accept a $200,000 cash payment today. The second option is to receive $20,000 at the end of each of the next 19 years and a $50,000 lump sum paymen

> Review the data provided in Exercise 9-1. Reference Data Exercise 9-1: Metro Industries is considering the purchase of new equipment costing $1,200,000 to replace existing equipment that will be sold for $180,000. The new equipment is expected to have a

> “Maybe I should have stuck with teaching high school art. No matter what I try, I can’t seem to turn that Roanoke plant around.” That’s how the meeting between Warren Wingo, CEO of clothing manufacturer Wingo Designs, and Angie Tillery, vice president of

> Preston Plastics is about to wrap up its capital budgeting cycle, and department managers across the company have submitted 500 capital project requests for consideration in the next round of funding. Preston’s CFO, Dan LaMontagne, is trying to decide wh

> Capital Toys’ management is considering eliminating product A, which has been showing a loss for several years. The company’s annual income statement, in $000s, is as follows: Required: a. Restate the income statemen

> PlayTime, Inc., is a leading manufacturer of sporting equipment. The company is in the process of evaluating the best use of its Plastics Division, which is currently manufacturing molded fishing tackle boxes. The company manufactures and sells 8,000 tac

> Betsy Willis owns Test Tutor, an educational tutoring center in Baytown, Florida. The center offers private tutoring in math, writing, and science. Information about the tutoring sessions is as follows: Since the company opened fi ve years ago, demand h

> Marwick Innovations, Inc. produces exercise and fitness gear. Two of its newer products require a finishing process that can only be completed on machines that were recently purchased for this purpose. The machines have a maximum capacity of 6,000 machin

> Elizabeth Lee is a top seller on eBay®. In fact, her business has grown so large that she can no longer manage her items on eBay’s website and ship her products to the auction winners in a timely manner. When she first started, she had to ship only a few

> Wright Water Co. is a leading producer of greenhouse irrigation systems. Currently, the company manufactures the timer unit used in each of its systems. Based on an annual production of 50,000 timers, the company has calculated the following unit costs.

> Identify each of the following costs, incurred monthly by Furman Flower Cart, as fixed, variable, or mixed. Explain your reasoning. Bouquets Sold 5,000 3,000 7,000 $ 9,000 $ 7,500 $ 5,300 $11,000 $ 2,000 Balloons (10 per bouquet) $15,000 $ 7,500 $ 8,

> Managerial accounting information is not just for accountants. All areas within an organization can use the information to support decision making. Choose a position in an organization that is appealing to you and identify several decisions that you migh

> Klump Trekkers, Inc., manufactures engines that are used in recreational equipment, such as motorcycles and personal watercraft. The company currently assembles the camshafts for these motors in its assembly department, which employs 40 skilled technicia

> Wilson Vistas is a leading producer of vinyl replacement windows. The company’s growth strategy focuses on developing domestic markets in large metropolitan areas. The company operates a single manufacturing plant in Kansas City with an annual capacity o

> Guilford Packaging Company is a leading manufacturer of cardboard boxes and other product packaging solutions. One of the company’s major product lines is custom-printed cake boxes that are sold to some of the country’s best known bakeries at a price of

> Ridley and Scott Mercantile operates two stores, one on Maple Avenue and the other on Fenner Road. Results for the month of May, which is representative of all months, are as follows: The following information pertains to Ridley and Scottâ€&

> Luis Herrera, an up-and-coming fashion designer, created a new line of men’s fashion socks in response to the growing number of celebrities who are expressing their individuality by replacing traditional navy and black socks with brighter colors and bold

> Physical Phitness, Inc. operates three divisions, Weak, Average, and Strong. As it turns out, the Weak division has the lowest operating income, and the president wants to close it. “Survival of the fittest, I say!” wa

> Twinkie Trivia Co. manufactures and sells two trivia products, the Square Trivia Game and the Round Trivia Game. Last quarter’s operating profits, by product, and for the company as a whole, were as follows: Forty percent of the Round

> In 2015, Yum! Brands, Inc., the world’s largest quick-service restaurant company (Pizza Hut, Kentucky Fried Chicken, and Taco Bell), opened 577 new Pizza Hut restaurants and closed 456 others. Required: If you were in charge of these decisions, what inf

> In response to a growing awareness of gluten allergies, Outland Bakery tried using gluten-free fl our in its three most popular cookies. After several attempts and a lot of inedible cookies, the company perfected new recipes that yield delicious gluten-f

> Wendy’s Wind Toys manufactures decorative kites, banners, and windsocks. During the month of January, Wendy received orders for 3,000 Valentine’s Day banners and 1,200 Easter kites. Because several sewing machines are in the shop for repairs, Wendy’s has

> Will Jones, LLP is a small CPA firm that focuses primarily on preparing tax returns for small businesses. The company pays a $500 annual fee plus $10 per tax return for a license to use Mega Tax software. Required: a. What is the company’s total annual

> Umbrella Co. is considering the introduction of three new products. Per unit sales and cost information are as follows: The company has only 1,800 direct labor hours available to commit to production of any new products. Required: How many of each pro

> Balloon, Inc. produces three types of balloons—small, medium, and large—with the following characteristics: The company has only 2,000 machine hours available each month. Required: How many units of each type of bal

> Merit Bay Communications operates a customer call center that handles billing inquiries for several large insurance firms. Since the center is located on the outskirts of town, where there are no restaurants within a 20-minute drive, the company has alwa

> Every year Underwood Industries manufactures 15,000 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials…………………….…………..$ 6 Direct labor…………………………………………12 Variable manufacturing overhead….……..

> Steeple Rides makes bicycles. It has always purchased its bicycle tires from the Balyo Tires at $15 each but is currently considering making the tires in its own factory. The estimated costs per unit of making the tires are as follows: Direct materials…

> The Outland Company manufactures 1,000 units of a part that could be purchased from an outside supplier for $12 each. Outland’s costs to manufacture each part are as follows: Direct materials……………………………..…$ 2 Direct labor………………………………………….3 Variable manu

> The following operating information reports the results of Chappell Company’s production and sale of 12,500 air-conditioned motorcycle helmets last year. Based on early market forecasts, Chappell expects the same results this year. Sales…….…………………………………

> Marston Manufacturing has an annual capacity of 85,000 units per year. Currently, the company is making and selling 78,000 units a year. The normal sales price is $120 per unit, variable costs are $90 per unit, and total fixed expenses are $2,000,000. An

> Jason McGregor manages an IT department for a large corporation. Kelly Preston, vice president for marketing, has asked him to help her evaluate two statistical packages for monitoring customer purchases. Stat- Max costs $912,000, requires 2 gigabytes of

> Madison Ironworks made 500 defective units last month. Fortunately, the units were identified as defective before they were sold to customers. They are currently included in Madison’s ending inventory balance at $200 each. At the end of the quarter, the

> Erin Brushwood sells gourmet chocolate chip cookies. The results of her last month of operations are as follows: Required: a. Prepare a contribution format income statement for Erin. b. If Erin sells her cookies for $2 each, how many cookies did she sell

> Can produce 50,000 units per year. Three years ago the company borrowed $200,000 to purchase the machine; it still owes $125,000 of that amount. Cherry could sell the machine for $70,000 and purchase a new, more efficient machine at a cost of $220,000. T

> Whirlwind Industries is a multiproduct company with several manufacturing plants. The Brownwood Plant manufactures and distributes two carpet cleaning products, Household and Commercial, under the Karpet Kleen label. The forecasted operating results for

> Several years ago, Roberson Robotics outsourced component BF-365, a key component of many of its products. At the time, CFO Sam Summers concluded that outsourcing was the correct decision, but she decided to revisit that decision after overhearing some c

> Highland Manufacturing produces two products in its Saratoga plant, balzene and galvene. Since it opened its doors in 1965, Highland has been using a single manufacturing overhead pool to accumulate overhead costs. Overhead has been allocated to products

> Elliot-Jones manufactures two large-screen television models. The 65-inch fl at-panel LED model has been in production since 2012 and sells for $900. The company introduced a 55-inch 4K ultra HD in 2016; it sells for $1,140. The company’

> Santamaria Skiffs manufactures three models of speedboats—Superior, Deluxe, and Ultra—which are sold through marine retail stores. Budgeted information for the coming year is as follows. Currently, the company allocat

> Best Test Laboratories was founded 25 years ago to evaluate the reaction of materials to extreme increases in temperature. Much of the company’s early growth was attributable to government contracts to test the suitability of weapons, t

> Nancy’s Nut House is a processor and distributor of a variety of different nuts. The company buys nuts from around the world and roasts, seasons, and packages them for resale. Nancy’s Nut House currently offers 15 diff

> Lancaster Orthopedics specializes in hip, knee, and shoulder replacement surgery. In addition to the actual surgery, the company provides its patients with preoperative and postoperative inpatient care in a fully equipped hospital. Lancaster pays its sur

> Anthony Herrera recently fulfilled his long-time dream of opening a gym that offers spinning exercise classes for $5 per person. To differentiate his gym and better serve his clients, Anthony provides a towel, a bottle of water, and an after-work out pro

> Chevis Consulting provides weekly payroll processing for a number of small businesses. Gia Chevis, the company’s owner, has been using an activity-based costing system for several years. She used the following information in preparing t

> Refer to the information about Voss Visuals in Problem 7-20. Voss’s managers have gathered the following information about selling and administrative costs. Reference from Problem 7-20: Required: a. Using the information given here

> Ellis Perry is an electronics components manufacturer. Information about the company’s two products follows: The company incurs $899,000 in overhead per year and has traditionally applied overhead on the basis of direct labor hours. R

> Voss Visuals produces tablets and books. Total overhead costs traditionally have been allocated on the basis of direct labor hours. After implementing activity-based costing, managers determined the following cost pools and cost drivers. They also decide

> The Trust Department of First National Bank offers two types of service, Basic and Premier. Trust customers with basic service do not grant trust officers any discretion in managing their accounts. The trust officers or their assistants merely execute th

> In the Reality Check on page 370, you read that the U.S. Postal Service altered its pricing strategy based on the results of an activity-based costing analysis. Specifically, the new rates were designed to encourage customers to use computer-readable mai

> Clive Franks was reviewing the product costs for his line of artist’s oil paints. The current production schedule calls for the paints to be produced in batches of 1,000 tubes. Between each batch, the mixing and packaging lines must be completely cleaned

> Jay Krue makes two products, Simple and Complex. As their names suggest, Simple is the more basic product, and Complex comes with all the bells and whistles. The company has always allocated overhead costs to products based on machine hours. Last year, t

> You’re killing me!” exclaimed Myles Werntz, product manager for Premium products. “All along I’ve been told that the Premium line costs the company $125; we charge $225 and make a $100 profi t. Now you’re saying that costs have increased to $200. That’s

> Harrison-Brown is a book publisher that reissues old titles. The company offers these books with either a standard machine-glued hard cover or a deluxe, hand-embossed, hand-stitched, leather cover. Harrison-Brown currently allocates overhead to the books

> The Carpenter Company sells sports decals that can be personalized with a player’s name, team name, and jersey number for $10 each. Carpenter buys the decals from a supplier for $3 each and spends an additional $0.50 in variable operating costs per decal

> Clifton Informatics provides data processing services to small businesses in the Northeast. For years, the company has allocated the cost of the data storage department using the number of tape mounts (how many times a data tape is loaded onto the comput

> Refer to the data in exercise 7-7. Reference of Exercise 7-7: Eric Parker has been studying his department’s profitability reports for the past six months. He has just completed a managerial accounting course and is beginning to quest

> Wieters Industries manufactures several products including a basic case for a popular smart phone. The company is considering adopting an activity-based costing approach for setting its budget. The company’s production activities, budge

> Pletzke Company manufactures dental instruments. The company’s product line includes products as simple as dental picks and products as complex as panoramic x-ray machines. Carol Lindquist, a senior product manager responsible for imple

> Brett Graham has been working on Hiltech’s activity based cost implementation team. One of his assignments is to study the information services department. One activity cost pool in the department is providing support for computer users by providing a he

> Grimes Grocery operates a chain of convenience stores in the Northwest. As a result of a recent consultant’s visit, the company is in the beginning stages of implementing an activity-based costing system. The following activity cost pools have been ident

> Using the table below, place an X in the column that corresponds to the type of activity level referred to in each scenario. UNIT BATCH PRODUCT CUSTOMER ORGANIZATIONAL Setting up a machine for a production run of 500 units a. b. Conducting a seminar

> Mitchell Manufacturing’s single finished goods warehouse is located across the street from its manufacturing facility. A recent study of product sales showed that most product lines are sold primarily in a single geographical region. For instance, the Wi

> Plyler Plastics Company produces a variety of custom plastics products for a worldwide clientele. The company’s cost accounting manager, Martha Johns, is beginning to implement an activity-based costing system and has gathered data on the quality inspect

> Barnes Entertainment Corporation prepared a master budget for the month of November that was based on sales of 150,000 board games. The budgeted income statement for the period is as follows. During November, Barnes produced and sold 180,000 board game

> After graduating from dental school two years ago, Dr. Lauren Farish purchased the dental practice of a long-time dentist who was retiring. In January of this year she had to replace the outdated autoclave equipment she inherited from the previous dentis

> Stratton, Ltd. manufactures shirts, which it sells to customers for embroidering with various slogans and emblems. The standard cost card for the shirts is as follows. Sandy Robison, operations manager, was reviewing the results for November when he be

> Pressure Reducers, Inc. produces and sells lumbar support cushions for office chairs using a special foam that molds to a person’s back. Since all products are made to order, the only inventory the company maintains is raw materials. Th

> Lexi Belcher picked up the monthly report that Irvin Santamaria left on her desk. She smiled as her eyes went straight to the bottom line of the report and saw the favorable variance for operating income, confirming her decision to push the workers to ge

> Attacus Company manufactures deep-sea fishing rods, which it distributes internationally through a chain of wholesalers. The following data are taken from the budget prepared at the beginning of the year by Attacus’s controller. The com

> Russell Marks shook his head in disbelief as he and operations manager Tom Hanover reviewed the month’s flexible budget performance report. “How did you manage to make such a poor showing last month?” he asked Hanover. “You didn’t meet your production sc

> Sommers Irrigation, Inc. is known throughout the world for its H2O-X high-capacity water pump, used in irrigation systems. The pump’s standard cost is as follows. The company’s predetermined fixed overhead rate is base

> Carson Construction Consultants performs cement core tests in its Greenville laboratory. The following standard costs for the tests have been developed by the company’s controller, Landon Carson, based on performing 2,100 core tests per month. / At th

> Hunter Family Instruments makes cellos. During the past year, the company made 6,400 cellos even though the budget planned for only 5,600. The company paid its workers an average of $15 per hour, which was $1 higher than the standard labor rate. The prod

> POD Incasements manufactures protective cases for MP3 players. During November, the company’s workers clocked 800 more direct labor hours than the flexible budget amount of 25,000 hours to complete 100,000 cases for the Christmas season. All workers were

> The following information is available for Coady’s Chocolates: Required: a. Calculate the direct materials price and quantity variances. b. What might have caused the variances you calculated? Actual production Budgeted production

> The Boeing Company produces commercial aircraft. The following passage is taken from Management’s Discussion and Analysis, included in Boeing’s 2005 Annual Report. Commercial aircraft production costs include a significant amount of infrastructure costs,

> The sole supplier of Montrose, Inc.’s critical direct material declared bankruptcy last year. As a result, Montrose had to quickly find alternative sources for the material. Since no one supplier had enough material to meet the company’s needs, Montrose

> Levine Labs used 50,000 ounces of specimen adhesive during the year. The direct materials standard allows 1.5 ounces of adhesive at a price of $0.40 per ounce for each pathology test. The direct materials quantity variance was $880 F. Required: How many

> Refer to the information about Adarmes Adventures given in Exercise 6-4. Information from Exercise 6-4: Adarmes Adventures manufactures aluminum canoes. In planning for the coming year, CFO Alexis King is considering three different sales targets: 2,500

> Adarmes Adventures manufactures aluminum canoes. In planning for the coming year, CFO Alexis King is considering three different sales targets: 2,500 canoes, 3,000 canoes, and 3,500 canoes. Canoes sell for $800 each. The standard variable cost informatio

> Rogers Sports sells volleyball kits that it purchases from a sports equipment distributor. The following static budget based on sales of 2,000 kits was prepared for the year. Fixed operating expenses account for 80% of total operating expenses at this le

> At the monthly management meeting, Leslie Smith, president of Mama Fran’s Fantastic Foods, was reviewing the April budget report with some satisfaction. “Our actual results are never exactly what we budget, but I guess

> Spitzer Specialty Furniture manufactures furniture for specialty shops throughout the Southwest. With annual sales of $12 million, the company has four major product lines—bookcases, magazine racks, end tables, and bar stoolsâ

> Conradt Connectivity Company manufactures various electrical connectors. The company’s sales budget for the first six months of the coming year is as follows. All sales are made on credit. Conradt is planning to change its credit poli

> R. Wilson Ascots, a retailer of collegiate neckwear, has completed the sales forecast for the coming year. R. Wilson Ascots maintains an ending inventory level of 60% of the following month’s cost of goods sold. The companyâ€

> Identify each of the following costs in terms of its cost behavior—variable, fixed, mixed, or step. a. The cost of coffee beans at a Starbucks shop b. Depreciation of airplanes at Southwest Airlines c. Nurses’ wages at M. D. Anderson Cancer Center, assum