Question: It is December 2020 and Wagner Inc.

It is December 2020 and Wagner Inc. recently hired a new accountant, Jodie Larson. Although Wagner is a private company, it follows IFRS. As part of her preparation of the 2020 financial statements for Wagner Inc., Jodie has proposed the following accounting changes.

1. At December 31, 2019, Wagner had a receivable of $250,000 from Michael Inc. on its statement of financial position that had been outstanding since mid-2018. In December 2020, Michael Inc. was declared bankrupt and no recovery is expected. Jodie proposes to write off the receivable in 2020 against retained earnings to correct a 2018 error.

2. Jodie proposes to change from double-declining-balance to straight-line depreciation for the company's manufacturing assets because of a change in the pattern in which the assets provide benefits to the company. If straight-line depreciation had been used for all prior periods, retained earnings would have been $380,800 higher at December 31, 2019. The change's effect just on 2020 income is a $48,800 reduction.

3. For equipment in the leasing division, Jodie proposes to adopt the sum-of-the-years'-digits depreciation method, which the company has never used before. Wagner began operating its leasing division in 2020. If straight-line depreciation were to be used, 2020 income would be $110,000 higher.

4. Wagner has decided to adopt the revaluation method for reporting and measuring its land, with this policy being effective from January 1, 2020. At December 31, 2019, the land's fair value was $900,000. The land's book value at December 31, 2019, was $750,000. (Hint: Refer to IAS 8 for the treatment of this specific change in policy.)

5. Wagner has investments that are recorded at fair value through other comprehensive income (FV-OCI). At December 31, 2019, an error was made in the calculation of the fair values of these investments. The amount of the error was an overstatement of the fair value by $200,000.

Wagner's income tax rate is 30%.

Instructions

a. For each of the changes described above, identify whether the situation is a change in policy, a change in estimate, or an error correction. Justify your answer.

b. For each of the changes described above, determine whether a restatement of the January 1, 2020 retained earnings is required. What is the amount of the adjustment, if any? Prepare the required journal entries to record any adjustments.

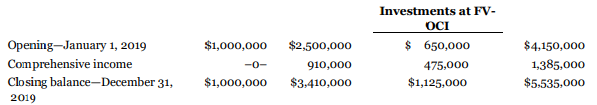

c. Prepare the contents of the statement of changes in equity for 2019 and 2020 following the format below. An excerpt from the statement of changes in equity for December 31, 2019, is provided below:

For 2020, net income is $1,350,000 and other comprehensive income is $150,000 (relating to the change in value of the FV-OCI Investment during 2020). There were no shares issued or repurchased during the year. There are no other changes to the equity accounts for 2020.

d. Identify what disclosures are required in the notes to the financial statements as a result of each of these changes.

Transcribed Image Text:

Share Retained Accumulated Other _Total Čapital Earnings Comprehensive Income Investments at FV- OCI Opening-January 1, 2019 $1,000,000 $2,500,000 $ 650,000 $4,150,000 Comprehensive income Closing balance-December 31, 1,385,000 $5.535,000 -0- 910,000 475,000 $1,000,000 $3.410,000 $1,125,000 2019

> At the end of 2019, Valerie Corporation reported a deferred tax liability of $41,000. At the end of 2020, the company had $241,000 of temporary differences related to property, plant, and equipment. Depreciation expense on this property, plant, and equip

> Adelphi Corp. in its first year of operations has the following differences between its carrying amounts and the tax bases of its assets and liabilities at the end of 2020. It is estimated that the warranty liability will be settled in 2021. The differe

> Rancour Ltd., which uses ASPE, recently expanded its operations into an adjoining municipality, and on March 30, 2020, it signed a 15-year lease with its Municipal Industrial Commission (MIC). The property has a total fair value of $450,000 on March 30,

> On September 15, 2020, Local Camping Limited, the lessee, entered into a 20-year lease with Sullivan Corp. to rent a parcel of land at a rate of $30,000 per year. Both Local and Sullivan use ASPE. The annual rental is due in advance each September 15, be

> Instructions Refer to the data and other information provided in E20.1, but now assume that Maleki’s fiscal year end is May 31. Prepare the journal entries on Maleki Corp.’s books to reflect the signing of the lease agreement and to record payments and

> Presented below are five independent situations. All the companies involved use ASPE, unless otherwise noted. 1. On December 31, 2020, Zarle Inc. sold equipment to Orfanakos Corp. and immediately leased it back for 10 years. The equipment’s selling pric

> On January 1, 2020, Hein Corporation sold equipment to Liquidity Finance Corp. for $720,000 and immediately leased the equipment back. Both Hein and Liquidity use ASPE. Other relevant information is as follows. 1. The equipment’s carrying value on Hein’

> The Bank of Montreal and Royal Bank of Canada financial statements for their years ended October 31, 2017, can be found on SEDAR (www.sedar.com). Instructions a. What is the average carrying amount of each company's common shares? Compare these values

> Wong Inc., the lessee entered into two leases on July 1, 2020 with Pomerleau Corp. Both companies are public corporations following IFRS. The leases are for a large auger and a jackhammer that will be used on a construction site, and both parties would p

> Zdon Inc. reports accounting income of $105,000 for 2020, its first year of operations. The following items cause taxable income to be different than income reported on the financial statements. 1. Capital cost allowance (on the tax return) is greater t

> Castle Leasing Corporation, which uses IFRS 16, signs a lease agreement on January 1, 2020, to lease electronic equipment to Wai Corporation, which also uses IFRS 16. The term of the non-cancellable lease is two years and payments are required at the end

> The following information concerns Saverio Corp.'s defined benefit pension plan. On January 1, 2020, the company amended its pension plan, which resulted in a reduction in prior service benefits for current employees. The present value of the reduced be

> On September 1, 2020, Wong Corporation, which uses ASPE, signed a five-year, non-cancellable lease for a piece of equipment. The terms of the lease called for Wong to make annual payments of $13,668 at the beginning of each lease year, starting September

> You are a senior auditor auditing the December 31, 2020 financial statements of Hoang Inc., a manufacturer of novelties and party favours and a user of ASPE. During your inspection of the company garage, you discovered that a 2019 Shirk automobile is par

> The following defined benefit pension data of Dahl Corp. apply to the year 2020 The company applies ASPE and has made an accounting policy choice to base its actuarial valuation of the DBO on the funding basis. Instructions a. Prepare a continuity sc

> Refer to the information in E19.7 about Berstler Limited's defined benefit pension plan. Instructions a. Prepare a 2020 pension work sheet with supplementary schedules of calculations. b. Prepare the journal entries at December 31, 2020, to record pe

> Berstler Limited sponsors a defined benefit pension plan, and follows ASPE. The corporation's actuary provides the following information about the plan (in thousands of dollars): Instructions a. Calculate the actual return on the plan assets in 2020.

> Qui Importers provides the following pension plan information: Instructions Calculate the actual return on the plan assets for 2020. Fair value of pension plan assets, January 1, 2020 Fair value of pension plan assets, December 31, 2020 $1,438,750

> Access the Bombardier Inc. financial statements for the year ended December 31, 2017, which can be found on SEDAR (www.sedar.com). Instructions a. The company had many different types of shares authorized, issued, and/or outstanding at the end of 2017

> Hang Technologies Inc. held a portfolio of shares and bonds that it accounted for using the fair value through other comprehensive income model at December 31, 2020. This was the first year that Hang had purchased investments. In part due to Hang's inexp

> Refer to the information for Rebek Corporation in E19.3. Instructions a. Prepare a pension work sheet: insert the January 1, 2020 balances and show the December 31, 2020 balances. b. Prepare all journal entries. c. What is the amount of the plan's s

> Rebek Corporation provides the following information about its defined benefit pension plan for the year 2020: Rebek follows IFRS. Instructions Prepare a continuity schedule for 2020 for the defined benefit obligation. a. Prepare a continuity schedu

> Yen Inc.'s only temporary difference at the beginning and end of 2020 is caused by a $4.8-million deferred gain for tax purposes on an instalment sale of a plant asset. The related receivable (only one half of which is classified as a current asset) is d

> Josit Ltd. initiated a one-person pension plan in January 2012 that promises the employee a pension on retirement according to the following formula: pension benefit = 2.5% of final salary per year of service after the plan initiation. The employee began

> On January 1, 2020, Roper Inc. agrees to buy 3 kg of gold at $40,000 per kilogram from Golden Corp on April 1, 2020, but does not intend to take delivery of the gold. On the day that the contract was entered into, the fair value of this forward contract

> Mila Enterprises Ltd. provides the following information about its defined benefit pension plan: Instructions a. Calculate the January 1, 2020 balances for the pension-related accounts if Mila follows IFRS. b. Prepare the required disclosures that wou

> The following is partial information related to Siri Ltd.'s non-pension, post-retirement health-care benefit plan at December 31, 2020: Instructions a. Prepare a schedule reconciling, to the extent possible, the plan surplus or deficit with the asset/li

> Opsco Corp. provides the following information about its post-retirement health-care benefit plan for the year 2020: Instructions a. Assuming Opsco follows IFRS, calculate the post-retirement benefit expense for 2020, and prepare all required journal e

> Rosek Inc. provides the following information related to its post-retirement health-care benefits for the year 2020: Rosek Inc. follows IFRS. Instructions a. Calculate the post-retirement benefit expense for 2020. b. Calculate the post-retirement be

> Access the annual financial statements of Empire Company Limited for its year ended May 6, 2017, at www.sedar.com or the company's website. Instructions Review Empire Company Limited's consolidated financial statements and provide answers to the follo

> MFI Holdings Inc. follows IFRS and applies the FV-OCI model with recycling and has adopted the option to show dividends received as operating activities. MFI's SFP contained the following comparative data at December 31: At December 31, 2020, the follow

> Neilson Corp. reported $245,000 of net income for 2020. In preparing the statement of cash flows, the accountant noted several items that might affect cash flows from operating activities. 1. During 2020, Neilson reported a sale of equipment for $7,000.

> Gao Limited, a publicly traded company, uses IFRS and had the following events and transactions occur in its fiscal year ended October 31, 2020. Although no dates are given, the events described are in chronological order. 1. Gao Limited repurchased com

> Ashley Limited, which follows IFRS, chooses to classify interest and dividends received as well as interest paid as operating activities and dividends paid as financing activities. Ashley had the following information available at the end of 2020: Not

> Comparative SFP accounts of Jensen Limited, which follows IFRS, appear below: Data from Jensen's 2020 income statement follow: Additional information: 1. Equipment that cost $10,000 and was 40% depreciated was sold in 2020. 2. Cash dividends were dec

> Laflamme Inc. follows IFRS and has adopted the policy of classifying interest paid as operating activities and dividends paid as financing activities. Comparative SFP accounts of Laflamme Inc., and its statement of income for the year ended December 31,

> The following is Mann Corp.'s comparative SFP at December 31, 2020 and 2019, with a column showing the increase (decrease) from 2019 to 2020: Additional information: 1. On December 31, 2019, Mann acquired 25% of Bligh Corp.'s common shares for $266,000

> Davis Inc. is a privately held company that uses ASPE. Davis had the following information available at March 31, 2020: Davis Inc.'s partial list of comparative account balances as at March 31, 2020 and 2019, is as follows: Additional information: 1.

> Sharma Corporation has decided that, in preparing its 2020 financial statements under IFRS, two changes should be made from the methods used in prior years: 1. Depreciation. Sharma has used the tax basis (CCA) method of calculating depreciation for fina

> On December 31, 2020, before the books were closed, management and the accountant at Flanagan Inc. made the following determinations about three depreciable assets. 1. Depreciable asset A (building) was purchased on January 2, 2017. It originally cost $

> Conduit Corporation has 45 current employees: 5 managers and 40 non-managers. The average wage paid is $250 per day for non-managers. The company has just finished negotiating a new employee contract with the non-managers that would see this increase by

> The founder, president, and major shareholder of Dewitt Corp. recently sold his controlling interest in the company to a national distributor in the same line of business. The change in ownership was effective June 30, 2020, halfway through Dewitt's curr

> You are the auditor of Maglite Services Inc., a privately owned full-service cleaning company following ASPE. It is undergoing its first audit for the period ended September 30, 2020. The bank has requested that Maglite have its statements audited this y

> As at December 31, 2020, Kendrick Corporation is having its financial statements audited for the first time ever. The auditor has found the following items that might have an effect on previous years. 1. Kendrick purchased equipment on January 2, 2017,

> Refer to the information in P20.3. Instructions a. Prepare the journal entries that Situ would make on January 1, 2020, and the adjusting journal entries at December 31, 2020, to record the annual interest income from the lease arrangement, assuming t

> Leader Enterprises Ltd. follows IFRS and has provided the following information: 1. In 2019, Leader was sued in a patent infringement suit, and in 2020, Leader lost the court case. Leader must now pay a competitor $50,000 to settle the suit. No previous

> You have just been hired as the new controller of SWT Services Inc., and on the top of the stack of papers on your new desk is a bundle of draft contracts with a note attached. The note says, “Please help me to understand which of these leases would be b

> On May 5, 2021, you were hired by Gavin Inc., a closely held company that follows ASPE, as a staff member of its newly created internal auditing department. While reviewing the company's records for 2019 and 2020, you discover that no adjustments have ye

> You have been assigned to examine the financial statements of Picard Corporation for the year ended December 31, 2020, as prepared following IFRS. Picard uses a periodic inventory system. You discover the following situations: 1. The physical inventory

> Both the management of Kimmel Instrument Corporation, a small company that follows IFRS, and its independent auditors recently concluded that the company's results of operations will be reliable and more relevant in future years if Kimmel changes its met

> Access the financial statements of Air Canada and WestJet Airlines Ltd. for their years ended December 31, 2017, through SEDAR (www.sedar.com) or the companies' websites. Review the financial statements, including the notes, and then answer the following

> Nadeau Company, a small company following ASPE, is adjusting and correcting its books at the end of 2020. In reviewing its records, it compiles the following information. 1. Nadeau has failed to accrue sales commissions payable at the end of each of the

> The following facts pertain to a non-cancellable lease agreement between Woodhouse Leasing Corporation and McKee Electronics Ltd., a lessee, for a computer system: The collectibility of the lease payments is reasonably predictable, and there are no impo

> Your employer, Wagner Inc., is a large Canadian public company that uses IFRS 16. You have collected the following information about a lease for a fleet of trucks used by Wagner to transport completed products to warehouses across the country. The trucks

> Ramey Corporation is a diversified public company with nationwide interests in commercial real estate development, banking, copper mining, and metal fabrication. The company has offices and operating locations in major cities throughout Canada. With corp

> Synergetics Inc. leased a new crane to Gumo Construction Inc. under a six-year, non-cancellable contract starting February 1, 2020. The lease terms require payments of $21,500 each February 1, starting February 1, 2020. Synergetics will pay insurance and

> LePage Manufacturing Ltd. agrees to lease equipment to Labonté Ltée. on July 15, 2020. LePage follows ASPE and Labonté is a public company following IFRS 16. The following information relates to the lease agreement. 1. The lease term is seven years, wit

> On January 1, 2020, Hunter Ltd. entered into an agreement to lease a truck from Situ Ltd. Both Hunter and Situ use IFRS 16. The details of the agreement are as follows: Additional information: 1. There are no abnormal risks associated with the collecti

> Lanier Dairy Ltd. leases its milk cooling equipment from Green Finance Corporation. Both companies use IFRS 16. The lease has the following terms. 1. The lease is dated May 30, 2020, with a lease term of eight years. It is non-cancellable and requires e

> Gaming Inc. issued a debenture bond to Karamoutz Bank to finance new technology it developed. The debenture was for $500,000, issued at face value, with a 10-year term and interest payable at 10%. Gaming Inc.'s new technology proved not to be technically

> Under the temporary difference approach, the tax rates used for deferred tax calculations are those enacted at the balance sheet date, and affect how the reversal will be treated for tax purposes. Instructions For each of the following situations, dis

> The consolidated financial statements of Deutsche Lufthansa AG for the year ended December 31, 2017, are available in the company's 2017 annual report on the www.lufthansagroup.com website. Instructions a. What is included in the current liabilities f

> Shikkiah Corp. (which is a private enterprise) tries to attract the most knowledgeable and creative employees it can find. To help accomplish this, the company offers a special group of technology employees the right to a fully paid sabbatical leave afte

> Dubois Steel Corporation, as lessee, signed a lease agreement for equipment for five years, beginning January 31, 2020. Annual rental payments of $41,000 are to be made at the beginning of each lease year (January 31). The insurance and repairs and maint

> Lee Industries Inc. and Lor Inc. enter into an agreement that requires Lor Inc. to build three dieselelectric engines to Lee’s specifications. Both Lee and Lor follow ASPE and have calendar year ends. Upon completion of the engines, Lee has agreed to lea

> At the end of the December 31, 2019 fiscal year, Yin Trucking Corporation, which follows IFRS 16, negotiated and closed a long-term lease contract for newly constructed truck terminals and freight storage facilities. The buildings were erected to the com

> Assume the same information as in P20.9. Instructions Answer the following questions, rounding all numbers to the nearest dollar. a. Assuming that Woodhouse Leasing Corporation’s accounting period ends on September 30, answer the fo

> Assume the same information as in P20.9. Instructions Follow the instructions assuming that McKee Electronics follows IFRS 16. From P20.9: The following facts pertain to a non-cancellable lease agreement between Woodhouse Leasing Corporation and McKe

> Interior Design Inc. (ID) is a privately owned business that provides interior decorating options for consumers. ID follows ASPE. The software that it purchased six years ago to present clients with designs that are unique to their offices is no longer s

> Dela Corporation initiated a defined benefit pension plan for its 50 employees on January 1, 2020. The insurance company that administers the pension plan provides the following information for the years 2020, 2021, and 2022: There were no balances as a

> Bouter Corporation Limited (BCL) began operations in 1996 and in 2006 adopted a defined benefit pension plan for its employees. By January 1, 2020, the defined benefit obligation was $510,000. On January 2, 2020, for the first time, BCL agreed to a new u

> Manon Corporation applies ASPE and sponsors a defined benefit pension plan. The following pension plan information is available for 2020 and 2021: The pension fund paid out benefits in each year. There were no actuarial gains or losses incurred on the D

> Access the financial statements for Loblaw Companies Limited for the year ended December 30, 2017 and Empire Company Limited for the year ended May 6, 2017, through SEDAR (www.sedar.com) and then answer the following questions. Instructions a. Calcula

> Brawn Corporation sponsors a defined benefit pension plan for its 100 employees. On January 1, 2020, the company's actuary provided the following information: The actuary calculated that the present value of future benefits earned for employee services

> You are the controller of a newly established technology firm that is offering a new pension plan to its employees. The plan was established on January 1, 2020, with an initial contribution by the employer equal to the actuarial estimate of the past serv

> The following information is available for HTM Corporation's defined benefit pension plan: On January 1, 2020, HTM Corp. amended its pension plan, resulting in past service costs with a present value of $78,000. Instructions a. Calculate the pension

> Eloisa Corporation applies IFRS. Information about Eloisa Corporation's income before income tax of $633,000 for its year ended December 31, 2020, includes the following: 1. CCA reported on the 2020 tax return exceeded depreciation reported on the incom

> Dungannon Enterprises Ltd. sells a specialty part that is used in widescreen televisions and provides the ultimate in screen clarity. To promote sales of its product, Dungannon launched a program with some of its smaller customers. In exchange for making

> The Hwang Candy Corporation (HCC) offers a mini piggy bank as a premium for every five chocolate bar wrappers that customers send in along with $2.00. The chocolate bars are sold by HCC to distributors for $0.30 each. Ignore any cost of goods sold. The p

> Renew Energy Ltd. (REL) manufactures and sells directly to customers a special long-lasting rechargeable battery for use in digital electronic equipment. Each battery sold comes with a guarantee that the company will replace free of charge any battery th

> Smythe Corporation sells televisions at an average price of $850 and they come with a standard one-year warranty. Ignore any cost of goods sold. Smythe also offers each customer a separate three-year extended warranty contract for $90 that requires the c

> Brooks Inc. sells portable computer equipment with a two-year warranty contract that requires the corporation to replace defective parts and provide the necessary repair labour. During 2020, the corporation sells for cash 400 computers at a unit price of

> Newfoundland University recently signed a contract with the bargaining unit that represents full-time professors. The contract agreement starts on April 1, 2019, the start of the university's fiscal year. The following excerpt outlines the portion of the

> Brookfield Asset Management Inc. Access the financial statements and accompanying notes of Brookfield Asset Management Inc. for the year ended December 31, 2017, through SEDAR (www.sedar.com) or on the company's website and then answer the following ques

> Access the annual report for Air Canada for its December 31, 2017 fiscal year end from SEDAR or the company's website (www.aircanada.com). Also, access the annual report for the year ended December 31, 2017, for British Airways plc from the company's par

> Describe risk in finance as up and down movement of return. Does this idea make sense in terms of the variance definition?

> What is the fundamental motivation behind portfolio theory? That is, what are people trying to achieve by investing in portfolios of stocks rather than in a few individual stocks or in debt? What observations prompted this view?

> How is the IPO price of a stock determined? Is that price likely to be the stock’s intrinsic value.

> Do stocks that don't pay dividends have value? Why?

> Discuss the accuracy of stock valuation, and compare it with that of bond valuation.

> Describe the approach to valuing a stock expected to grow at more than one rate in the future. Can there be more than two rates? What two things have to be true of the last rate?

> What is meant by normal growth? Contrast normal and super normal growth. How long can each last? Why?

> Why are growth rate models practical and convenient ways to look at stock valuation?

> Verbally rationalize the validity of a stock valuation model that doesn't contain a selling price as a source of cash flow to the investor. Give two independent arguments.

> Why did securities analysts issue biased reports in the 1990s? In what direction were the reports biased?

> How and why is the U.S. dollar unique among the world's currencies?

> Describe the primary conflict of interest that caused the public accounting industry to fail in its duty to protect the investing public’s interests in the 1990s.

> Describe the feature of financial reporting that made leasing popular before FASB 13.

> Is investing in options really investing or is it more like gambling?

> Options are more exciting than investing in the underlying stocks because they offer leverage. Explain this statement.