Question: Jamie Peters invested $100,000 to set

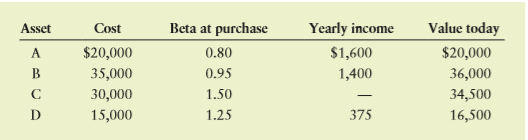

Jamie Peters invested $100,000 to set up the following portfolio 1 year ago.

a. Calculate the portfolio beta on the basis of the original cost figures.

b. Calculate the percentage return of each asset in the portfolio for the year.

c. Calculate the percentage return of the portfolio on the basis of original cost, using income and gains during the year.

d. At the time Jamie made his investments, investors were estimating that the market return for the coming year would be 10%. The estimate of the risk-free rate of return averaged 4% for the coming year. Calculate an expected rate of return for each stock on the basis of its beta and the expectations of market and risk free returns.

e. On the basis of the actual results, explain how each stock in the portfolio performed relative to those CAPM-generated expectations of performance. What factors could explain these differences?

Transcribed Image Text:

Asset Cost Beta at purchase Yearly income Value today A $20,000 0.80 $1,600 $20,000 B. 35,000 0.95 1,400 36,000 30,000 1.50 34,500 D 15,000 1.25 375 16,500

> Edwards Manufacturing Company (EMC) is considering replacing one machine with another. The old machine was purchased 3 years ago for an installed cost of $10,000. The firm is depreciating the machine under MACRS, using a 5-year recovery period. The new m

> Cushing Corporation is considering the purchase of a new grading machine to replace the existing one. The existing machine was purchased 3 years ago at an installed cost of $20,000; it was being depreciated under MACRS, using a 5-year recovery period. Th

> Vastine Medical Inc. is considering replacing its existing computer system, which was purchased 2 years ago at a cost of $325,000. The system can be sold today for $200,000. It is being depreciated using MACRS and a 5-year recovery period. A new computer

> Samuels Manufacturing is considering the purchase of a new machine to replace one it believes is obsolete. The firm has total current assets of $920,000 and total current liabilities of $640,000. As a result of the proposed replacement, the following cha

> Given the following list of outlays, indicate whether each is normally considered a capital expenditure or an operating expenditure. Explain your answers. a. An outlay of $27,600 for a marketing research report b. A $275 outlay for an office machine c. A

> A firm can purchase new equipment for a $150,000 initial investment. The equipment generates an annual after-tax cash inflow of $44,400 for 4 years. a. Determine the net present value (NPV) of the equipment, assuming the firm has a 10% cost of capital. I

> Simes Innovations Inc. is negotiating to purchase exclusive rights to manufacture and market a solar-powered toy car. The car’s inventor has offered Simes the choice of either a one-time payment of $1,500,000 today or a series of five year-end payments o

> Using a 10% cost of capital, calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. Cash flows (CF,) in thousands Year B D E -$2.50 --$375 -$550 -$750 -$1,150 1 50

> You wish to evaluate a project requiring an initial investment of $59,500 and having a useful life of 7 years. What minimum amount of annual cash inflow do you need if your firm has an 8.7% cost of capital? If the project is forecast to earn $11,400 per

> Le Pew Cosmetics is evaluating a new fragrance mixing machine. The machine requires an initial investment of $360,000 and will generate after-tax cash inflows of $62,650 per year for 8 years. For each of the costs of capital listed, (1) calculate the ne

> Calculate the net present value (NPV) for the following 15-year projects. Comment on the acceptability of each. Assume that the firm has a cost of capital of 9%. a. Initial investment is $1,000,000; cash inflows are $150,000 per year. b. Initial investme

> Bill Williams has the opportunity to invest in project A, which costs $9,000 today and promises to pay $2,200, $2,500, $2,500, $2,000, and $1,800 over the next 5 years. Or Bill can invest $9,000 in project B, which promises to pay $1,500, $1,500, $1,500,

> Risk is a major concern of almost all investors. When shareholders invest their money in a firm, they expect managers to take risks with those funds. What ethical limits should managers observe when taking risks with other people’s money?

> Wolff Enterprises must consider several investment projects, A through E, using the capital asset pricing model (CAPM) and its graphical representation, the security market line (SML). Relevant information is presented in the following table. a. Calcul

> Shell Camping Gear Inc. is considering two mutually exclusive projects. Each requires an initial investment (CF0) of $100,000. John Shell, president of the company, has set a maximum payback period of 4 years. The after-tax cash inflows associated with e

> Diane Dennison is a financial analyst working for a large chain of discount retail stores. Her company is looking at the possibility of replacing the existing fluorescent lights in all of its stores with LED lights. The main advantage of making this swit

> White Rock Services Inc. has an opportunity to make an investment with the following projected cash flows. a. Calculate the NPV at the following discount rates and plot an NPV profile for this investment: 0%, 5%, 7.5%, 10%, 15%, 20%, 22.5%, 25%, 30%. b

> The High-Flying Growth Company (HFGC) has been expanding very rapidly in recent years, making its shareholders rich in the process. The average annual rate of return on the stock in the past few years has been 20%, and HFGC managers believe that 20% is a

> Froogle Enterprises is evaluating an unusual investment project. What makes the project unusual is the stream of cash inflows and outflows shown in the following table. a. Why is it difficult to calculate the payback period for this project? b. Calcula

> Birkenstock is considering an investment in a nylon-knitting machine. The machine requires an initial investment of $27,000, has a 5-year life, and has no residual value at the end of the 5 years. The company’s cost of capital is 10.87%

> Projects A and B, of equal risk, are alternatives for expanding Rosa Company’s capacity. The firm’s cost of capital is 13%. The cash flows for each project are shown in the following table. a. Calculate each project&ac

> Pound Industries is attempting to select the best of three mutually exclusive projects. The initial investment and after-tax cash inflows associated with these projects are shown in the following table. a. Calculate the payback period for each project.

> Thomas Company is considering two mutually exclusive projects. The firm, which has a 12% cost of capital, has estimated its cash flows as shown in the following table. a. Calculate the NPV of each project, and assess its acceptability. b. Calculate the

> Rieger International is evaluating the feasibility of investing $95,000 in a piece of equipment that has a 5-year life. The firm has estimated the cash inflows associated with the proposal, as shown in the following table. The firm has a 12% cost of capi

> Nicholson Roofing Materials Inc. is considering two mutually exclusive projects, each with an initial investment of $150,000. The company’s board of directors has set a maximum 4-year payback requirement and has set its cost of capital

> Botany Bay Inc., a maker of casual clothing, is considering four projects. Because of past financial difficulties, the company has a high cost of capital at 15%. a. Calculate the NPV of each project, using a cost of capital of 15%. b. Rank acceptable p

> Nova Products has a 5-year maximum acceptable payback period. The firm is considering the purchase of a new machine and must choose between two alternative ones. The first machine requires an initial investment of $14,000 and generates annual after-tax c

> Benson Designs has prepared the following estimates for a long-term project it is considering. The initial investment is $18,250, and the project is expected to yield after-tax cash inflows of $4,000 per year for 7 years. The firm has a 10% cost of capit

> Oak Enterprises accepts projects earning more than the firm’s 15% cost of capital. Oak is currently considering a 10-year project that provides annual cash inflows of $10,000 and requires an initial investment of $61,450. (Note: All amounts are after tax

> Acme Oscillators is considering an investment project that has the following rather unusual cash flow pattern. a. Calculate the project’s NPV at each of the following discount rates: 0%, 5%, 10%, 20%, 30%, 40%, 50%. b. What do the cal

> Bryson Sciences is planning to purchase a high-powered microscopy machine for $385,000 and incur an additional $31,300 in installation expenses. It is replacing older microscopy equipment that can be sold for $116,500, resulting in taxes from a gain on t

> Bell Manufacturing is attempting to choose the better of two mutually exclusive projects for expanding the firm’s warehouse capacity. The relevant cash flows for the projects are shown in the following table. The firm’

> Peace of Mind Inc. (PMI) sells extended warranties for durable consumer goods such as washing machines and refrigerators. When PMI sells an extended warranty, it receives cash up front from the customer, but later PMI must cover any repair costs that ari

> For each of the projects shown in the following table, calculate the internal rate of return (IRR). Then indicate, for each project, the maximum cost of capital that the firm could have and still find the IRR acceptable. Project A Project B Project

> A project costs $2,500,000 up front and will generate cash flows in perpetuity of $240,000. The firm’s cost of capital is 9%. a. Calculate the project’s NPV. b. Calculate the annual EVA in a typical year. c. Calculate the overall project EVA and compare

> Neil Corporation has three projects under consideration. The cash flows for each project are shown in the following table. The firm has a 16% cost of capital. a. Calculate each project’s payback period. Which project is preferred acco

> Jenny Jenks has researched the financial pros and cons of entering into a 1-year MBA program at her state university. The tuition and books for the master’s program will have an up-front cost of $50,000. If she enrolls in an MBA program, Jenny will quit

> Hook Industries is considering the replacement of one of its old metal stamping machines. Three alternative replacement machines are under consideration. The relevant cash flows associated with each are shown in the following table. The firmâ€

> The Ball Shoe Company is considering an investment project that requires an initial investment of $542,000 and returns after-tax cash inflows of $75,000 per year for 10 years. The firm has a maximum acceptable payback period of 8 years. a. Determine the

> Netflix common stock has a beta, b, of 0.8. The risk-free rate is 3%, and the market return is 10%. a. Determine the risk premium on Netflix common stock. b. Determine the required return that Netflix common stock should provide. c. Determine Netflix’s c

> Determine the cost for each of the following preferred stocks. Preferred stock Par value Sale price Flotation cost Annual dividend A $100 $101 $9.00 11% B 40 38 $3.50 8% C 35 37 $4.00 $5.00 D 30 26 5% of par $3.00 E. 20 20 $2.50 9%

> A few years ago, Largo Industries implemented an inventory auditing system at an installed cost of $175,000. Since then, it has taken depreciation deductions totaling $124,250. What is the system’s current book value? If Largo sold the system for $110,00

> Taylor Systems has just issued preferred stock. The stock has an 8% annual dividend and a $100 par value and was sold at $99.50 per share. In addition, flotation costs of $1.50 per share must be paid. a. Calculate the cost of the preferred stock. b. If t

> Wans is interested in buying a new motorcycle. She has decided to borrow money to pay the $25,000 purchase price of the bike. She is in the 25% federal income tax bracket. She can either borrow the money at an interest rate of 5% from the motorcycle deal

> Gronseth Drywall Systems Inc. is in discussions with its investment bankers regarding the issuance of new bonds. The investment banker has informed the firm that different maturities will carry different coupon rates and sell at different prices. The fir

> For each of the following $1,000-parvalue bonds, assuming annual interest payment and a 40% tax rate, calculate the after-tax cost to maturity, using the approximation formula. Life (years) Discount (-) or premium (+) Coupon interest rate Bond Under

> David Abbot is buying a new house, and he is taking out a 30-year mortgage. David will borrow $200,000 from a bank, and to repay the loan he will make 360 monthly payments (principal and interest) of $1,199.10 per month over the next 30 years. David can

> Assume that the risk-free rate, RF, is currently 8%; the market return, rm, is 12%; and asset A has a beta, bA, of 1.10. a. Draw the security market line (SML) on a set of “non-diversifiable risk (x-axis)– required return (y-axis)” axes. b. Use the CAPM

> Assume that the risk-free rate, RF, is currently 9% and that the market return, rm, is currently 13%. a. Draw the security market line (SML) on a set of “non diversifiable risk (x-axis)– required return (y-axis)” axes. b. Calculate and label the market r

> Use the basic equation for the capital asset pricing model (CAPM) to work each of the following problems. a. Find the required return for an asset with a beta of 0.90 when the risk-free rate and market return are 8% and 12%, respectively. b. Find the ris

> Katherine Wilson is wondering how much risk she must undertake to generate an acceptable return on her portfolio. The risk-free return currently is 5%. The return on the overall stock market is 16%. Use the CAPM to calculate how high the beta coefficient

> Landscapes Unlimited has spent $2,200 evaluating a new service area for expanding its business territory. The expansion will require the purchase of a new truck for $35,000, and fitting the truck with a flatbed that will cost $6,500 to install. The compa

> For each case in the following table, use the capital asset pricing model to find the required return. Risk-free rate, Rp Market Case return, rm Beta, ß A 1% 8% 1.30 B 2 6 0.90 C 5 13 -0.20 D 12 1.00 E 10 0.60 64

> Rose Berry is attempting to evaluate two possible portfolios, which consist of the same five assets held in different proportions. She is particularly interested in using beta to compare the risks of the portfolios, so she has gathered the data shown in

> You are considering three stocks—A, B, and C—for possible inclusion in your investment portfolio. Stock A has a beta of 0.80, stock B has a beta of 1.40, and stock C has a beta of -0.30. a. Rank these stocks from the most risky to the least risky. b. If

> During the 1990s, General Electric put together a long string of consecutive quarters in which the firm managed to meet or beat the earnings forecasts of Wall Street stock analysts. Some skeptics wondered if GE “managed” earnings to meet Wall Street’s ex

> American Exploration Inc., a natural gas producer, is trying to decide whether to revise its target capital structure. Currently, it targets a 50-50 mix of debt and equity, but it is considering a target capital structure with 70% debt. American Explorat

> Currently, Warren Industries can sell 15-year, $1,000-par-value bonds paying annual interest at a 7% coupon rate. Because current market rates for similar bonds are just under 7%, Warren can sell its bonds for $1,010 each; Warren will incur flotation cos

> Lang Enterprises is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm is in the 40% tax bracket. Debt The firm can raise debt by selling $1,000-par-value, 8% coupon interest rate, 20-year

> John Dough has just been awarded his degree in business. He has three education loans outstanding. They all mature in 5 years, and he can repay them without penalty any time before maturity. The amounts owed on each loan and the annual interest rate asso

> Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital (WACC). The WACC is to be measured by using the following weights: 40% long-term debt, 10% preferred stock,

> Edna Recording Studios Inc. reported earnings available to common stock of $4,200,000 last year. From those earnings, the company paid a dividend of $1.26 on each of its 1,000,000 common shares outstanding. The capital structure of the company includes 4

> Iridium Corp. has spent $3.5 billion over the past decade developing a satellitebased telecommunication system. It is currently trying to decide whether to spend an additional $350 million on the project. The firm expects that this outlay will finish the

> After careful analysis, Dexter Brothers has determined that its optimal capital structure is composed of the sources and target market value weights shown in the following table. The cost of debt is 4.2%, the cost of preferred stock is 9.5%, the cost o

> Webster Company has compiled the information shown in the following table. a. Calculate the WACC using book value weights. b. Calculate the WACC using market value weights. c. Compare the answers obtained in parts a and b. Explain the differences.

> The market values and after-tax costs of various sources of capital used by Ridge Tool are shown in the following table. a. Calculate the firm’s WACC. b. Explain how the firm can use this cost in the investment decision-making process

> Bell Jewelers wishes to explore the effect on its cost of capital of the rate at which the company pays taxes. The firm wishes to maintain a capital structure of 40% debt, 10% preferred stock, and 50% common stock. The cost of financing with retained ear

> Using the data for each firm shown in the following table, calculate the cost of retained earnings and the cost of new common stock using the constant-growth valuation model. Projected dividend per growth rate share next year Current market Dividend

> Ross Textiles wishes to measure its cost of common stock equity. The firm’s stock is currently selling for $70.67. The firm just recently paid a dividend of $4. The firm has been increasing dividends regularly. Five years ago, the dividend was just $2.99

> Mace Manufacturing is in the process of analyzing its investment decision-making procedures. Two projects evaluated by the firm recently involved building new facilities in different regions, North and South. The basic variables surrounding each project

> Mike is searching for a stock to include in his current stock portfolio. He is interested in Hi-Tech Inc.; he has been impressed with the company’s computer products and believes that Hi-Tech is an innovative market player. However, Mi

> Greengage Inc., a successful nursery, is considering several expansion projects. All the alternatives promise to produce an acceptable return. Data on four possible projects follow. a. Which project is least risky, judging on the basis of range? b. Whi

> Metal Manufacturing has isolated four alternatives for meeting its need for increased production capacity. The following table summarizes data gathered relative to each alternative. a. Calculate the coefficient of variation for each alternative. b. If

> If Halley Industries reimburses employees who earn master’s degrees and who agree to remain with the firm for an additional 3 years, should the expense of the tuition reimbursement be categorized as a capital expenditure or an operating expenditure?

> Swan’s Sportswear is thinking about bringing out a line of designer jeans. Currently, it is negotiating with two well-known designers. Because of the highly competitive nature of the industry, the two lines of jeans have been given code

> Micro-Pub Inc. is considering the purchase of one of two microfilm cameras, R and S. Both should provide benefits over a 10-year period, and each requires an initial investment of $4,000. Management has constructed the accompanying table showing estimate

> Solar Designs is considering an investment in an expanded product line. Two possible types of expansion are under review. After investigating the possible outcomes, the company made the estimates shown in the following table. The pessimistic and optimist

> Sharon Smith, the financial manager for Barnett Corporation, wishes to select one of three prospective investments: X, Y, and Z. Assume that the measure of risk Sharon cares about is an asset’s standard deviation. The expected returns a

> Answer the questions below for assets A to D shown in the table. a. What impact would a 10% increase in the market return be expected to have on each asset’s return? b. What impact would a 10% decrease in the market return be expected to have on each ass

> A firm wishes to assess the impact of changes in the market return on an asset that has a beta of 1.20. a. If the market return increased by 15%, what impact would this change be expected to have on the asset’s return? b. If the market

> For each of the investments shown in the following table, calculate the rate of return earned over the period. Cash flow during period -$ 800 Beginning-of- period value $ 1,100 120,000 End-of- Investment period value A $ $ 100 B 15,000 118,000 C 7,0

> You are analyzing the performance of two stocks. The first, shown in Panel A, is Cyclical Industries Incorporated. Cyclical Industries makes machine tools and other heavy equipment, the demand for which rises and falls closely with the overall state of t

> A firm wishes to estimate graphically the betas for two assets, A and B. It has gathered the return data shown in the following table for the market portfolio and for both assets over the past 10 years, 2009–2018. a. On a set of &acir

> David Talbot randomly selected securities from all those listed on the New York Stock Exchange for his portfolio. He began with a single security and added securities one by one until a total of 20 securities were held in the portfolio. After each securi

> Cooper Electronics uses NPV profiles to visually evaluate competing projects. Key data for the two projects under consideration are given in the following table. Using these data, graph, on the same set of axes, the NPV profiles for each project, using d

> Joe Martinez, a U.S. citizen living in Brownsville, Texas, invested in the common stock of Telmex, a Mexican corporation. He purchased 1,000 shares at 20.50 pesos per share. Twelve months later, he sold them at 24.75 pesos per share. He received no divid

> Matt Peters wishes to evaluate the risk and return behaviors associated with various combinations of assets V and W under three assumed degrees of correlation: perfectly positive, uncorrelated, and perfectly negative. The expected returns and standard de

> You have been given the historical return data shown in the first table on three assets—F, G, and H—over the period 2016–2019. Using these assets, you have isolated the three investment alternatives

> Jamie Wong is thinking of building an investment portfolio containing two stocks, L and M. Stock L will represent 40% of the dollar value of the portfolio, and stock M will account for the other 60%. The historical returns over the last 6 years, 2013&aci

> Answer the following questions, assuming that the rates of return associated with a given asset investment are normally distributed; that the expected return, r, is 18.9%; and that the coefficient of variation, CV, is 0.75. a. Find the standard deviation

> Three assets—F, G, and H—are currently under consideration by Perth Industries. The probability distributions of expected returns for these assets are shown in the following table. a. Calculate the average return, r,

> Swift Manufacturing must choose between two asset purchases. The annual rate of return and the related probabilities given in the following table summarize the firm’s analysis to this point. a. For each project, compute: (1) The range

> Douglas Keel, a financial analyst for Orange Industries, wishes to estimate the rate of return for two similar-risk investments, X and Y. Douglas’s research indicates that the immediate past returns will serve as reasonable estimates of future returns. A

> McCracken Roofing Inc. common stock paid a dividend of $1.20 per share last year. The company expects earnings and dividends to grow at a rate of 5% per year for the foreseeable future. a. What required rate of return for this stock would result in a pri

> Use the constant-growth dividend model (Gordon growth model) to find the value of each firm shown in the following table. Firm Dividend expected next year Dividend growth rate Required return A. $1.20 8% 13% 4.00 5 15 C 0.65 10 14 D 6.00 8. 9. E 2.2

> Billabong Tech uses the internal rate of return (IRR) to select projects. Calculate the IRR for each of the following projects and recommend the best project based on this measure. Project T-Shirt requires an initial investment of $15,000 and generates c

> Jones Design wishes to estimate the value of its outstanding preferred stock. The preferred issue has an $80 par value and pays an annual dividend of $6.40 per share. Similar-risk preferred stocks are currently earning a 9.3% annual rate of return. a. Wh

> Kelsey Drums Inc. is a well-established sup- plier of fine percussion instruments to orchestras all over the United States. The company’s class A common stock has paid a dividend of $2.80 per share per year for the last 12 years. Management expects to co

> TXS Manufacturing has an outstanding preferred stock issue with a par value of $65 per share. The preferred shares pay dividends annually at a rate of 10%. a. What is the annual dividend on TXS preferred stock? b. If investors require a return of 8% on

> Valerian Corp. convertible preferred stock has a fixed conversion ratio of five common shares per one share of preferred stock. The preferred stock pays a dividend of $10.00 per share per year. The common stock currently sells for $20.00 per share and pa