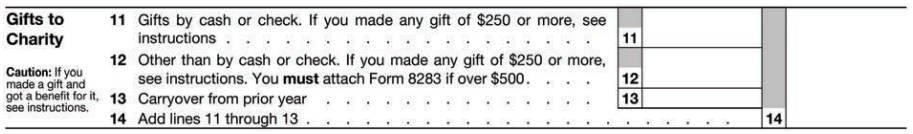

Question: Jerry made the following contributions during

Jerry made the following contributions during 2019:

His synagogue (by check) = $1,100

The Republican Party (by check) = 180

The American Red Cross (by check) = 200

His fraternal organization for tickets to a holiday party = 100

In addition, Jerry donated used furniture to the Salvation Army that he purchased years ago for $400 with a fair market value of $200. Assuming Jerry has adjusted gross income of $45,000, has the necessary written acknowledgments, and itemizes deductions, complete the Gifts to Charity section of Schedule A below to show Jerry’s deduction for 2019.

> Before agreeing to the purchase of a large order of solvent, a company wants to see conclusive evidence that the mean value of a particular impurity is less than 1.0 ppb. What hypotheses should be tested? What are the type I and type II errors in this si

> A 50.00-mL aliquot of 0.1000 M NaOH is titrated with 0.1000 M HCl. Calculate the pH of the solution after the addition of 0.00, 10.00, 25.00, 40.00, 45.00, 49.00, 50.00, 51.00, 55.00, and 60.00 mL of acid, and prepare a titration curve from the data.

> A 5.500-g sample of a pesticide was decomposed with metallic sodium in alcohol, and the liberated chloride ion was precipitated as AgCl. Express the results of this analysis in terms of percent DDT 1C14H9Cl52 based on the recovery of 0.1873 g of AgCl.

> Calculate the change in pH to three decimal places that occurs when 0.50 mmol of a strong acid is added to 100 mL of a. 0.0100 M lactic acid 1 0.0800 M sodium lactate. b. 0.0800 M lactic acid 1 0.0200 M sodium lactate. c. 0.0500 M lactic acid 1 0.0500

> Calculate the change in pH that occurs when 1.50 mmol of a strong base is added to 100 mL of the solutions listed in Problem 12-34. Calculate values to three decimal places.

> Calculate the change in pH that occurs when 1.00 mmol of a strong acid is added to 100 mL of the solutions listed in Problem 12-3

> Calculate the change in pH that occurs in each of the following solutions as a result of a tenfold dilution with water. Round calculated values for pH to three figures to the right of the decimal point. a. H2O b. 0.0500 M HCl c. 0.0500 M NaOH d. 0.

> What is the pH of a solution that is a. Prepared by dissolving 3.30 g of 1NH422SO4 in water, adding 125.0 ml of 0.1011 M naoh, and diluting to 500.0 ml? b. 0.120 M in piperidine and 0.010 M in its chloride salt? c. 0.050 M in ethylamine and 0.167 M in it

> What is the pH of a solution that is a. Prepared by dissolving 6.75 g of lactic acid (90.08 g/mol) and 5.19 g of sodium lactate (112.06 g/mol) in water and diluting to 1.00 L? b. 0.0430 M in acetic acid and 0.0175 M in sodium acetate? c. Prepared by diss

> A solution is 0.0500 M in NH4Cl and 0.0300 M in NH3. Calculate its OH-concentration and its pH a.Neglecting activities. b.Taking activities into account.

> The solubility-product constant for Ce(IO3)3 is 3.2 × 10-10. What is the Ce3+ concentration in a solution prepared by mixing 50.00 mL of 0.0500 M Ce3+with 50.00 mL of a. Water? b. 0.0500 M IO3-? c. 0.250 M IO3-? d. 0.0450 M IO3-?

> Calculate the pH of the solution that results when 20.0 mL of 0.2500 M NH3 is a.Mixed with 20.0 ml of distilled water. b.Mixed with 20.0 ml of 0.250 M hcl solution. c.Mixed with 20.0 ml of 0.300 M hcl solution. d.Mixed with 20.0 ml of 0.200 M NH4Cl solut

> Describe in your own words why the confidence interval for the mean of five measurements is smaller than that for a single result.

> A 0.2121-g sample of an organic compound was burned in a stream of oxygen, and the CO2 produced was collected in a solution of barium hydroxide. Calculate the percentage of carbon in the sample if 0.6006 g of BaCO3 was formed.

> The ascorbic acid concentration in mmol/L of five different brands of orange juice was measured. Six replicate samples of each brand were analyzed. The following partial ANOVA table was obtained. a. Fill in the missing entries in the table. b. State the

> Sewage and industrial pollutants dumped into a body of water can reduce the dissolved oxygen concentration and adversely affect aquatic species. In one study, weekly readings are taken from the same location in a river over a two-month period. Some scien

> A prosecuting attorney in a criminal case presented as principal evidence small fragments of glass found embedded in the coat of the accused. The attorney claimed that the fragments were identical in composition to a rare Belgian stained glass window bro

> To test the quality of the work of a commercial laboratory, duplicate analyses of a purified benzoic acid (68.8% C, 4.953% H) sample were requested. It is assumed that the relative standard /reported results are 68.5% C and 4.882% H. At the 95% confidenc

> A standard method for the determination of glucose in serum is reported to have a standard deviation of 0.36 mg/dL. If s = 0.36 is a good estimate of σ, how many replicate determinations should be made in order for the mean for the analysis of a sample t

> A chemist obtained the following data for percent lindane in the triplicate analysis of an insecticide preparation: 7.23, 6.95, and 7.53. Calculate the 90% confidence interval for the mean of the three data, assuming that a. The only information about th

> A volumetric calcium analysis on triplicate samples of the blood serum of a patient believed to be suffering from a hyperparathyroid condition produced the following data: mmol Ca/L = 3.15, 3.25, 3.26. What is the 95% confidence interval for the mean of

> How many replicate measurements are necessary to decrease the 95% and 99% confidence limits for the analysis described in Problem 5-8 to ± 0.15 μg Cu/mL?

> How many replicate measurements are needed to decrease the 95% and 99% confidence limits for the analysis described in Problem 5-7 to ± 1.9 μg Fe/mL?

> Write expressions for the autoprotolysis of a. H2O. b. HCOOH. c. CH3NH2. d. NH3.

> An atomic absorption method for determination of copper in fuel samples yielded a pooled /reciprocating aircraft engine showed a copper content of 6.87 μg Cu/mL. Calculate the 95% and 99% confidence intervals for the result if it was based on a. A singl

> An atomic absorption method for the determination of the amount of iron present in used jet engine oil was found from pooling 30 triplicate analyses to have a standard deviation s = 2.9 µg Fe/mL. If s is a good estimate of σ, calculate the 95% and 99% co

> The last result in each set of data in Problem 5-4 may be an outlier. Apply the Q test (95% confidence level) to determine whether or not there is a statistical basis to reject the result.

> Calculate the 95% confidence interval for each set of data in Problem 5-4 if s is a good estimate of σ and has a value of set A, 0.015; set B, 0.30; set C, 0.070; set D, 0.20; set E, 0.0090; and set F, 0.15.

> Consider the following sets of replicate measurements: Calculate the mean and the standard deviation for each of these six data sets. Calculate the 95% confidence interval for each set of data. What does this interval mean?

> Discuss how the size of the confidence interval for the mean is influenced by the following (all the other factors are constant): a. The standard deviation σ. b. The sample size N. c. The confidence level.

> The accepted values for the sets of data in Problem 4-7 are set A, 9.0; set B, 55.33; set C, 0.630; set D, 5.4; set E, 20.58; and set F, 0.965. For the mean of each set, calculate a. The absolute error. b. The relative error in parts per thousand.

> Consider the following sets of replicate measurements For each set, calculate the (a) mean, (b) median, (c) spread or range, (d) standard deviation, and (e) coefficient of variation.

> From the normal curve of error, find the probability that a result is outside the limits of ±2σ from the mean. What is the probability that a result has a more negative deviation from the mean than -2σ?

> From the Gaussian (normal) error curve, what is the probability that a result from a population lies between 0 and +1σ of the mean? What is the probability of a result occurring that is between +1σ and +2σ of the mean?

> Why is 1g no longer exactly 1 mole of unified atomic mass units?

> Briefly describe or define and give an example of a. A strong electrolyte. b. A Brønsted-Lowry base. c. The conjugate acid of a Brønsted-Lowry base. d. Neutralization, in terms of the Brønsted-Lowry concept. e. An amphiprotic solute. f. A zwitterion

> Sally hires a maid to work in her home for $280 per month. The maid is 25 years old and not related to Sally. During 2019, the maid worked 9 months for Sally. a. What is the amount of Social Security tax Sally must pay as the maid’s employer? b. What is

> Stewart Beauf is a self-employed surfboard maker in 2019. His Schedule C net income is $126,503 for the year. He also has a part-time job and earns $16,100 in wages subject to FICA taxes. Calculate Stewart’s self-employment tax for 2019 using Schedule SE

> Dori is 58 years old and retired in 2019. She receives a pension of $25,000 a year and no other income. She wishes to put the maximum allowed into an IRA. How much can she contribute to her IRA?

> Bob is a single, 40-year-old doctor earning $190,000 a year and is not covered by a pension plan at work. What is the maximum deductible contribution into a Traditional IRA in 2019?

> Barry is a single, 40-year-old software engineer earning $190,000 a year and is not covered by a pension plan at work. How much can he put into a Roth IRA in 2019?

> What is the maximum amount a 55-year-old taxpayer and 52-year-old spouse can put into a Traditional or Roth IRA for 2019, assuming they earn $70,000 in total and are not participants in pension plans?

> What is the maximum amount a 45-year-old taxpayer and 45-year-old spouse can put into a Traditional or Roth IRA for 2019 (assuming they have sufficient earned income, but do not have an income limitation and are not covered by another pension plan)?

> Phil and Linda are 25-year-old newlyweds and file a joint tax return. Linda is covered by a retirement plan at work, but Phil is not. a. Assuming Phil’s wages were $27,000 and Linda’s wages were $18,500 for 2019 and they had no other income, what is the

> During the 2019 tax year, Irma incurred the following expenses Union dues = $244 Tax return preparation fee = 150 Brokerage fees for the purchase of stocks = 35 Uniform expenses not reimbursed by her employer = 315 If Irma’s adjusted gross income is $23,

> On January 3, 2019, Carey discovers his diamond bracelet has been stolen. The bracelet had a fair market value and adjusted basis of $7,500. Assuming Carey had no insurance coverage on the bracelet and his adjusted gross income for 2019 is $45,000, calcu

> Richard McCarthy (born 2/14/1965; Social Security number 100-10-9090) and Christine McCarthy (born 6/1/1967; Social Security number 101-21-3434) have a 19-year-old son (born 10/2/2000 Social Security number 555-55-1212), Jack who is a full-time student a

> In June of 2019, Maureen’s house is vandalized during a long-term power failure after a hurricane hit the city. The president of the United States declares Maureen’s city a disaster area as a result of the wide-scale vandalism. In which tax year may Maur

> Karen, 28 years old and a single taxpayer, has a salary of $33,000 and rental income of $33,000 for the 2019 calendar tax year. Karen is covered by a pension through her employer. a. What is the maximum amount that Karen may deduct for contributions to

> At the end of 2019, Mark owes $250,000 on the mortgage related to the 2016 purchase of his residence. When his daughter went to college in the fall of 2019, he borrowed $20,000 through a home equity loan on his house to help pay for her education. The in

> Helen paid the following amounts of interest during the 2019 tax year: Mortgage interest on Dallas residence (loan balance $50,000) = $1,600 Automobile loan interest (personal use only) = 440 Mortgage interest on Vail residence (loan balance $50,000) = 3

> Ken paid the following amounts for interest during 2019: Qualified interest on home mortgage = $5,322 Auto loan interest = 850 “Points” on the mortgage for acquisition of his personal residence = 400 Service charges o

> Mary paid $2,000 of state income taxes in 2019. She paid $1,500 of state sales tax on the purchase of goods and she also purchased a car in 2019 and paid sales tax of $3,000. How should Mary treat the taxes paid on her 2019 tax return?

> Serena is a 38-year-old single taxpayer. She operates a small business on the side as a sole proprietorship. Her 2019 Schedule C reports net profits of $15,624. Her employer does not offer health insurance. Serena pays health insurance premiums of $7,545

> Laura is a single taxpayer living in New Jersey with adjusted gross income for the 2019 tax year of $35,550. Laura’s employer withheld $3,410 in state income tax from her salary. In April of 2019, she pays $550 in additional state taxe

> Mike sells his home to Jane on April 2, 2019. Jane pays the property taxes covering the full calendar year in October, which amount to $2,500. How much may Mike and Jane each deduct for property taxes in 2019? Mike’s deduction? Jane’s deduction?

> Bea Jones (birthdate March 27, 1984) moved from Texas to Florida in December 2018. She lives at 654 Ocean Way, Gulfport, FL 33707. Bea’s Social Security number is 466-78-7359 and she is single. Her earnings and income tax withholding fo

> Lyndon’s employer withheld $10,100 in state income taxes from Lyndon’s wages in 2019. Lyndon obtained a refund of $1,700 this year for overpayment of state income taxes for 2018. State income taxes were an itemized deduction on his 2018 return. His 2019

> In 2019, Margaret and John Murphy (both over age 65) are married taxpayers who file a joint tax return with AGI of $26,100. During the year they incurred the following expenses: In addition, they drove 80 miles for medical transportation, and their insur

> During 2019, Jill, age 39, participated in a Section 401(k) plan which provides for maximum employee contributions of 12 percent. Jill’s salary was $80,000 for the year. Jill elects to make the maximum contribution. What is Jill’s maximum tax-deferred co

> Anthony, a self-employed plumber, makes a maximum contribution to a SEP for his employee, Debra. Debra’s compensation is $50,000 for the year. How much is he allowed to contribute to the plan for Debra?

> Tony is a 45-year-old psychiatrist who has net earned income of $300,000 in 2019. What is the maximum amount he can contribute to his SEP for the year?

> During 2019, Jerry is a self-employed therapist, and his net earned income is $160,000 from his practice. Jerry’s SEP Plan, a defined contribution plan, states that he will contribute the maximum amount allowable. Calculate Jerry’s contribution.

> Evan participates in an HSA carrying family coverage for himself, his spouse, and two children. In 2019, Evan has $100 per month deducted from his paycheck and contributed to the HSA. In addition, Evan makes a one-time contribution of $2,000 on April 15,

> Dick owns a house that he rents to college students. Dick receives $800 per month rent and incurs the following expenses during the year: Dick purchased the house in 1979 for $48,000. The house is fully depreciated. Calculate Dick’s net

> On July 1, 2019, Ted, age 73 and single, sells his personal residence of the last 30 years for $368,000. Ted’s basis in his residence is $48,776. The expenses associated with the sale of his home total $22,080. On December 15, 2019, Ted purchases and occ

> Larry Gaines, a single taxpayer, age 42, sells his personal residence on November 12, 2019, for $151,200. He lived in the house for 7 years. The expenses of the sale are $9,072, and he has made capital improvements of $10,150. Larry’s cost basis in his r

> Dr. George E. Beeper is a single taxpayer born on September 22, 1971. He lives at 45 Mountain View Dr., Apt. 321, Spokane, WA 99210. Dr. Beeper’s Social Security number is 775-88-9531. Dr. Beeper works for the Pine Medical Group, and hi

> In 2019, Michael has net short-term capital losses of $1,500, a net long-term capital loss of $27,000, and other ordinary taxable income of $45,000. a. Calculate the amount of Michael’s deduction for capital losses for 2019. b. Calculate the amount and

> Jocasta owns an apartment complex that she purchased 6 years ago for $750,000. Jocasta has made $50,000 of capital improvements on the complex, and her depreciation claimed on the building to date is $128,700. Calculate Jocasta’s adjusted basis in the bu

> Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2019: None of the stock is qualified small business stock. The stock basis was reported to the IRS. Calculate Charu’s net capital gain or loss

> During 2019, Tom sold Sears stock for $10,000. The stock was purchased 4 years ago for $13,000. Tom also sold Ford Motor Company bonds for $35,000. The bonds were purchased 2 months ago for $30,000. Home Depot stock, purchased 2 years ago for $1,000, was

> Rob Wriggle operates a small plumbing supplies business as a sole proprietor. In 2019, the plumbing business has gross business income of $421,000 and business expenses of $267,000, including wages paid of $58,000. The business sold some land that had be

> Julie, a single taxpayer, has completed her 2019 Schedule C and her net loss is $40,000. Her only other income is wages of $30,000. Julie takes the standard deduction of $12,200 in 2019. a. Calculate Julie’s taxable income or loss. b. Calculate the busin

> Clifford Johnson has a limited partnership investment and a rental condominium. Clifford actively manages the rental condominium. During 2019, his share of the loss from the limited partnership was $11,000, and his loss from the rental condo was $17,000.

> Walter, a single taxpayer, purchased a limited partnership interest in a tax shelter in 1993. He also acquired a rental house in 2019, which he actively manages. During 2019, Walter’s share of the partnership’s losses was $30,000, and his rental house ge

> Martin sells a stock investment for $26,000 on August 2, 2019. Martin’s adjusted basis in the stock is $15,000. a. If Martin acquired the stock on November 15, 2018, calculate the amount and the nature of the gain or loss. b. If Martin had acquired the

> Joan is a self-employed attorney in New York City. Joan took a trip to San Diego, CA, primarily for business, to consult with a client and take a short vacation. On the trip, Joan incurred the following expenses: Calculate Joan’s travel

> Russell (birthdate February 2, 1968) and Linda (birthdate August 30, 1973) Long have brought you the following information regarding their income and expenses for the current year. Russell owns and operates a landscaping business called Lawns and Landsca

> Teresa is a civil engineer who uses her automobile for business. Teresa drove her automobile a total of 11,965 miles during 2019, of which 80 percent was business mileage. The actual cost of gasoline, oil, depreciation, repairs, and insurance for the yea

> Carey opens a law office in Chicago on January 1, 2019. On January 1, 2019, Carey purchases an annual subscription to a law journal for $170 and a 1-year legal reference service for $1,500. Carey also subscribes to Chicago Magazine for $54 so she can fin

> Go to the U.S. General Services Administration (GSA) website. For the month of September 30, 2019, what is the per diem rate for each of the following towns: a. Flagstaff, AZ b. Palm Springs, CA c. Denver, CO

> Scott Butterfield is self-employed as a CPA. He uses the cash method of accounting, and his Social Security number is 644-47-7833. His principal business code is 541211. Scott’s CPA practice is located at 678 Third Street, Riverside, CA

> 6. Which of the following items would be included in the gross income of the recipient? a. Insurance payments for medical care of a dependent child b. Insurance payments for loss of the taxpayer’s sight c. Season tickets worth $2,000 given to a son by hi

> 21. Shannon, a single taxpayer, has a long-term capital loss of $7,000 on the sale of bonds in 2019 and no other capital gains or losses. Her taxable income without this transaction is $47,000. What is her taxable income considering this capital loss? a.

> 11. Margaret and her sister support their mother and together provide 85 percent of their mother’s support. If Margaret provides 40 percent of her mother’s support: a. Her sister is the only one who can claim their mother as a dependent. b. Neither Marga

> 1. Which of the following recent tax changes is not scheduled to expire after 2025? a. Suspension of personal exemptions b. General lowering of individual tax rates c. Restrictions on the deduction of casualty and theft losses d. Reduction of corporate t

> 13. Kevin purchased a house 20 years ago for $100,000 and he has always lived in the house. Three years ago, Kevin married Karen, and she has lived in the house since their marriage. If they sell Kevin’s house in December 2019 for $425,000, what is their

> 3. Yasmeen purchases stock on January 30, 2018. If she wishes to achieve a long-term holding period, what is the first date that she can sell the stock as a long-term gain? a. January 20, 2019 b. January 31, 2019 c. February 1, 2019 d. July 31, 2018 e. J

> Ray and Maria Gomez have been married for 3 years. Ray is a propane salesman for Palm Oil Corporation and Maria works as a city clerk for the City of McAllen. Ray’s birthdate is February 21, 1991 and Maria’s is Decembe

> 17. Which of the following self-employed taxpayers are most likely permitted to deduct the cost of their uniform? a. A lawyer who wears a business suit b. A furnace repairman who must wear overalls while on the job c. A nurse who can wear casual clothe

> 7. Heather drives her minivan 953 miles for business purposes in 2019. She elects to use the standard mileage rate for her auto expense deduction. Her deduction will be a. $510 b. $515 c. $519 d. $553 e. $953 8. Which of the following taxpayers is entit

> 26. In 2019, Amy receives $8,000 (of which $3,000 is earnings) from a qualified tuition program. She does not use the funds to pay for tuition or other qualified higher education expenses. What amount is taxable to Amy? a. $0 b. $8,000 c. $3,000 d. $11,0

> 16. Harry’s wife Lila passes away in January of the current year. Fortunately, Lila had a $1 million life insurance policy. Harry elects to receive all $1 million in the current year and spends $200,000 of it on a luxury around-the-world trip with his ne

> 11. Which of the following does not result in a minimum $50 fine for an income tax preparer? a. Failure to provide a tax preparer identification number b. Cashing a refund check for a customer c. Failing to keep any record of the returns prepared d. Fail

> 2. The IRS does not have the authority to: a. Examine a taxpayer’s books and records b. Summon taxpayers to make them appear before the IRS c. Summon third parties for taxpayer records d. Place a lien on taxpayer property e. None of the above—the IRS has

> 11. Mansfield Incorporated, a calendar year corporation, is expecting to have a current year tax liability of $100,000. Which best describes the tax payments Mansfield should make to avoid penalty? a. Make payments at the end of June and December of $40,

> 1. Ironwood Corporation has ordinary taxable income of $65,000 in 2019, and a short-term capital loss of $15,000. What is the corporation’s tax liability for 2019? a. $7,500 b. $5,250 c. $10,500 d. $13,650 e. None of the above 2. Tayla Corporation gener

> 11. When calculating ordinary income, partnerships are not allowed which of the following deductions? a. Miscellaneous expenses b. Qualified business income deduction c. Depreciation d. Cost of goods sold e. Employee wages 12. Feela is a one-third pa

> 1. Which of the following may not be treated as a partnership for tax purposes? a. Arnold and Willis operate a restaurant. b. Thelma and Louise establish an LLP to operate an accounting practice. c. Lucy and Desi purchase real estate together as a busine