Question: Jersey Computer Company has estimated the costs

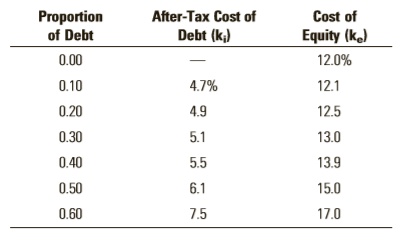

Jersey Computer Company has estimated the costs of debt and equity capital (with bankruptcy and agency costs) for various proportions of debt in its capital structure:

a. Determine the firm’s optimal capital structure, assuming a marginal income tax rate (T) of 40 percent.

b. Suppose that the firm’s current capital structure consists of 30 percent debt and 70 percent equity. How much higher is its weighted cost of capital than at the optimal capital structure?

Transcribed Image Text:

Proportion After-Tax Cost of Cost of of Debt Debt (k;) Equity (ke) 0.00 12.0% 0.10 4.7% 12.1 0.20 4.9 12.5 0.30 5.1 13.0 0.40 5.5 13.9 0.50 6.1 15.0 0.60 7.5 17.0

> Commercial Hydronics is considering replacing one of its larger control devices. A new unit sells for $29,000 (delivered). An additional $3,000 will be needed to install the device. The new device has an estimated 20-year service life. The estimated salv

> Show that the internal rate of return of the following investment is 0, 100, and 200 percent: Net investment $ -1,000 Year 0 Net cash flows +6,000 Year 1 -11,000 Year 2 +6,000 Year 3

> Two mutually exclusive investment projects have the following forecasted cash flows: a. Compute the internal rate of return for each project. b. Compute the net present value for each project if the firm has a 10 percent cost of capital. c. Which pro

> A company is planning to invest $100,000 (before tax) in a personnel training program. The $100,000 outlay will be charged off as an expense by the firm this year (year 0). The returns from the program in the form of greater productivity and a reduction

> An acre planted with walnut trees is estimated to be worth $12,000 in 25 years. If you want to realize a 15 percent rate of return on your investment, how much can you afford to invest per acre? (Ignore all taxes and assume that annual cash outlays to ma

> Jefferson Products Inc. is considering purchasing a new automatic press brake, which costs $300,000 including installation and shipping. The machine is expected to generate net cash inflows of $80,000 per year for 10 years. At the end of 10 years, the bo

> Suppose the British short-term interest rate is 13 percent and the corresponding U.S. rate is 8 percent. Suppose at the same time that the discount on forward pounds is 3 percent per year. Do these conditions present an opportunity for covered interest a

> A machine that costs $8,000 is expected to operate for 10 years. The estimated salvage value at the end of 10 years is $0. The machine is expected to save the company $1,554 per year before taxes and depreciation. The company depreciates its assets on a

> A firm wishes to bid on a contract that is expected to yield the following after-tax net cash flows at the end of each year: Year Net………………………Cash Flow 1……………………………………$5,000 2……………….…………………….8,000 3……………….…………………….9,000 4…………….……………………….8,000 5………….………

> Calculate the net present value and profitability index of a project with a net investment of $20,000 and expected net cash inflows of $3,000 a year for 10 years if the project’s required return is 12 percent. Is the project acceptable?

> What are the primary types of real options in capital budgeting? Give examples of each type.

> What effect would you expect the use of MACRS depreciation rules to have on the acceptability of a project having a 10-year economic life but a 7-year MACRS classification?

> What major problems can you foresee in applying capital budgeting techniques to investments made by public sector and not-for-profit enterprises or organizations?

> What are the primary objectives of the investment project post-audit review?

> What are the primary strengths and weaknesses of the payback approach in capital budgeting?

> Describe how the profitability index approach may be used by a firm faced with a capital rationing investment funds constraint.

> When are multiple rates of return likely to occur in an internal rate of return computation? What should be done when a multiple rate of return problem arises?

> If the 1-year U.S. Treasury bill rate is 7.0 percent, the spot rate between U.S. dollars and British pounds is £1 = $1.69, and the 90-day forward rate is £1 = $1.68, what rate of interest is expected on British Treasury bills, assuming that interest rate

> When is it possible for the net present value and the internal rate of return approaches to give conflicting rankings of mutually exclusive investment projects?

> How does the net present value model complement the objective of maximizing shareholder wealth?

> Will all individuals apply the same certainty equivalent estimates to the cash flows from a project? Why or why not?

> Describe how certainty equivalent cash flow estimates can be derived for individual project cash flows.

> On average, the expected value of returns from each $1 of premiums paid on an insurance policy is less than $1; this is due to the insurance company’s administrative costs and profits. In spite of this fact, why do so many individuals and organizations p

> Computer simulation is used to generate a large number of possible outcomes for an investment project. Most firms invest in a particular project only once, however. How can a computer simulation model be helpful to the typical decision maker who is makin

> What are the primary advantages and disadvantages of applying simulation to capital budgeting risk analysis?

> When should a firm consider the portfolio effects of a new project?

> How does the basic net present value capital budgeting model deal with the phenomenon of increasing risk of project cash flows over time?

> Recalling the discussion in Chapter 8, when is the standard deviation of a project’s cash flows an appropriate measure of project risk? When is the coefficient of variation an appropriate measure?

> Describe how the concepts of relative purchasing power parity, interest rate parity, and the international Fisher effect are related.

> How would you define risk as it is used in a capital budgeting analysis context?

> How does the basic net present value model of capital budgeting deal with the problem of project risk? What are the shortcomings of this approach?

> Why is the marginal cost of capital the relevant concept for evaluating investment projects, rather than a firm’s actual, historic cost of capital?

> What are the similarities and differences in preferred stock and debt as sources of financing for a firm?

> What factors determine the required rate of return for any security?

> What market risk premium should be used when applying the CAPM to compute the cost of equity capital for a firm if: a. The risk-free rate is the 90-day Treasury bill rate? b. The risk-free rate is the 20-year government bond rate?

> Discuss the pros and cons of various sources of estimates of future earnings and dividend growth rates for a company.

> Describe how to derive the break points in the marginal cost of capital schedule.

> Evaluate the statement “Depreciation-generated funds have no explicit cost and therefore should be assigned a zero cost in computing a firm’s cost of capital.”

> Discuss the meaning of an optimal capital budget.

> What are the advantages to a U.S. firm of financing its foreign investments with funds raised abroad?

> Should a firm pay cash dividends in a year in which it raises external common equity?

> Why do investors generally consider common stock to be riskier than preferred stock?

> Why is corporate long-term debt riskier than government long-term debt?

> Does the retained earnings figure shown on a firm’s balance sheet necessarily have any relationship to the amount of retained earnings the firm can generate in the coming year? Explain.

> Washington Paper Company has estimated the costs of debt and equity capital (with bankruptcy and agency costs) for various proportions of debt in its capital structure as follows: The firm’s marginal (and average) income tax rate is 4

> Ohio Quarry Inc. has $12 million in assets. Its expected operating income (EBIT) is $2 million and its income tax rate is 40 percent. If Ohio Quarry finances 20 percent of its total assets with debt capital, the pretax cost of funds is 10 percent. If the

> Colorado Coal Company has estimated the costs of debt and equity capital (with bankruptcy and agency costs) for various proportions of debt in its capital structure. The company’s income tax rate is 40 percent. a. Fill in the missing

> Arrow Technology, Inc. (ATI) has total assets of $10 million and expected operating income (EBIT) of $2.5 million. If ATI uses debt in its capital structure, the cost of this debt will be 12 percent per annum. a. Complete the following table: b. Det

> Piedmont Instruments Corporation has estimated the following costs of debt and equity capital for various fractions of debt in its capital structure. a. Based on these data, determine the company’s optimal capital structure (i) with

> Describe the factors that cause exchange rates to change over time.

> Two firms, No Leverage Inc. and High Leverage Inc., have equal levels of operating risk and differ only in their capital structure. No Leverage is unlevered and High Leverage has $500,000 of perpetual debt in its capital structure. Assume that the perpet

> a. Referring to Table 13.3, calculate the market value of firm L (with a corporate income tax) if the equity amount in its capital structure decreases to $3,000 and the debt amount increases to $3,000. b. For firm L (with equity ¼ $3,000 a

> Referring to Table 13.2, calculate the market value of firm L (without a corporate income tax) if the equity amount in its capital structure decreases to $5,000 and the debt amount increases to $5,000. At this capital structure, the cost of equity is 15

> What other factors besides operating leverage can affect a firm’s business risk?

> Explain the difference between business risk and financial risk.

> What is arbitrage? How is it used in deriving the proposition that the value of a firm is independent of its capital structure?

> What role does signaling play in the establishment of a firm’s capital structure?

> What assumptions are required in deriving the proposition that a firm’s cost of capital is independent of its capital structure?

> Explain why, according to the pecking order theory, firms prefer internal financing to external financing.

> According to the pecking order theory, if additional external financing is required, which type of securities should a firm issue first? Last?

> Describe two techniques that a company can use to hedge against transaction exchange risk.

> What is the asymmetric information concept? What role does this concept play in a company’s decision to change its financial structure or issue new securities?

> What is the relationship between the value of a firm and its capital structure, given the existence of a corporate income tax, bankruptcy costs, and agency costs?

> What is the relationship between the value of a firm and its capital structure without a corporate income tax? With a corporate income tax?

> Explain the research results of Modigliani and Miller in the area of capital structure.

> National Value Foods Company (NVFC) is considering opening a new wholly owned subsidiary in Booneville. To finance this investment, NVFC is considering two financing plans: (1) sell 600,000 shares of common stock at $20 each; or (2) sell 200,000 shares

> Rauchous Resources has traditionally been financed in a most conservative way. The CEO and founder, Rebecca, just does not believe in debt. However, after hearing a consultant discuss the concept of an optimal capital structure, she began to consider new

> Ellington’s Cabaret is planning a major expansion that will require $95 million of new financing. Ellington’s currently has a capital structure consisting of $400 million of common equity (with a cost of 14 percent and 4 million shares outstanding), $50

> EBITDA Inc. a subsidiary of Robinson Enterprises, is considering the purchase of a fleet of new BMWs for the CEO and other senior managers. Currently the firm has a capital structure that consists of 60 percent debt, 30 percent common equity, and 10 perc

> University Technologies, Inc. (UTI) has a current capital structure consisting of 10 million shares of common stock, $200 million of first-mortgage bonds with a coupon interest rate of 13 percent, and $40 million of preferred stock paying a 5 percent div

> Waco Manufacturing Company has a cash (and marketable securities) balance of $150 million. Free cash flows during a projected one-year recession are expected to be $200 million with a standard deviation of $200 million. (Assume that free cash flows are a

> What is covered interest arbitrage?

> Next year’s EBIT for the Latrobe Company is approximately normally distributed with an expected value of $8 million and a standard deviation of $5 million. The firm’s marginal tax rate is 40 percent. Fixed financial charges (interest payments) next year

> Bowaite’s Manufacturing has a current cash and marketable securities balance of $50 million. The company’s economist is forecasting a two-year recession. Free cash flows during the recession, which are normally distributed, are expected to total $70 mill

> Lassiter Bakery currently has 3 million shares of common stock outstanding that sell at a price of $25 per share. Lassiter also has $10 million of bank debt outstanding at a pretax interest rate of 12 percent and a private placement of $20 million in bon

> The Oakland Shirt Company has computed its indifference level of EBIT to be $500,000 between an equity financing option and a debt financing option. Interest expense under the debt option is $200,000 and $100,000 under the equity option. The EBIT for the

> Jenkins Products has a current capital structure that consists of $50 million in longterm debt at an interest rate of 10 percent and $40 million in common equity (10 million shares). The firm is considering an expansion program that will cost $10 million

> The Bullock Cafeteria Corporation has computed the indifference point between debt and common equity financing options to be $4 million of EBIT. EBIT is approximately normally distributed with an expected value of $4.5 million and a standard deviation of

> The Anaya Corporation is a leader in artificial intelligence research. Anaya’s present capital structure consists of common stock (30 million shares) and debt ($250 million with an interest rate of 15%). The company is planning an expansion and wishes to

> High Sky Inc., a hot-air balloon manufacturing firm, currently has the following simplified balance sheet: The company is planning an expansion that is expected to cost $600,000. The expansion can be financed with new equity (sold to net the company $4

> Morton Industries is considering opening a new subsidiary in Boston, to be operated as a separate company. The company’s financial analysts expect the new facility’s average EBIT level to be $6 million per year. At this time, the company is considering t

> Two capital goods manufacturing companies, Rock Island and Davenport, are virtually identical in all aspects of their operations—product lines, amount of sales, total size, and so on. The two companies differ only in their capital struc

> What is the theory of interest rate parity?

> Emco Products has a present capital structure consisting only of common stock (10 million shares). The company is planning a major expansion. At this time, the company is undecided between the following two financing plans (assume a 40 percent marginal t

> Kaufman Industries expects next year’s operating income (EBIT) to equal $4 million, with a standard deviation of $2 million. The coefficient of variation of operating income is equal to 0.50. Interest expenses will be $1 million, and preferred dividends

> Scherr Corporation’s current EPS is $5.00 at a sales level of $10 million. At this sales level, EBIT is $2 million. Scherr’s DCL has been estimated to be 2.0 at the current level of sales. Sales are forecast to have an expected value of $11 million next

> Walker’s Gunnery, a small arms manufacturer, has current sales of $10 million and operating income (EBIT) of $450,000. The degree of operating leverage for Walker is 2.5. Next year’s sales are expected to increase by 5 percent. Walker has found that, ove

> Earnings per share (EPS) for Valcor Inc. are $3 at a sales level of $2 million. If Valcor’s degree of operating leverage is 2.0 and its degree of combined leverage is 8.0, what will happen to EPS if operating income increases by 3 percent?

> McGonnigal Inc. has expected sales of $40 million. Fixed operating costs are $5 million, and the variable cost ratio is 65 percent. McGonnigal has outstanding a $10 million, 10 percent bank loan and $3 million in 12 percent coupon-rate bonds. McGonnigal

> Connely Inc. expects sales of silicon chips to be $30 million this year. Because this is a very capital-intensive business, fixed operating costs are $10 million. The variable cost ratio is 40 percent. The firm’s debt obligations consist of a $2 million,

> Cohen’s Bowling Emporium has a degree of financial leverage of 2.0 and a degree of combined leverage of 6.0. The breakeven sales level for Cohen’s has been estimated to be $500,000. Fixed costs total $250,000. What effect will a 15 percent increase in sa

> A firm has sales of $10 million, variable costs of $5 million, EBIT of $2 million, and a degree of combined leverage of 3.0. a. If the firm has no preferred stock, what are its annual interest charges? b. If the firm wishes to reduce its degree of comb

> Blums Inc. expects its operating income over the coming year to equal $1.5 million, with a standard deviation of $300,000. Its coefficient of variation is equal to 0.20. Blums must pay interest charges of $700,000 next year and preferred stock dividends

> Rank in order of priority (highest to lowest) the following claims on the proceeds from the liquidation of a bankrupt firm: • Taxes owed to federal, state, and local governments • Preferred stockholders • Common stockholders • Expenses of administeri

> A firm has earnings per share of $2.60 at a sales level of $5 million. If the firm has a degree of operating leverage of 3.0 and a degree of financial leverage of 5.5 (both at a sales level of $5 million), forecast earnings per share for a 2 percent sale

> McGee Corporation has fixed operating costs of $10 million and a variable cost ratio of 0.65. The firm has a $20 million, 10 percent bank loan and a $6 million, 12 percent bond issue outstanding. The firm has 1 million shares of $5 (dividend) preferred s

> Given the following information for Computech, compute the firm’s degree of combined leverage (dollars are in thousands except EPS): 2015 2016 Sales $ 500,000 $ 570,000 Fixed costs 120,000 120,000 Variable costs 300,000 342,000 Ear

> Albatross Airlines’ fixed operating costs are $5.8 million, and its variable cost ratio is 0.20. The firm has $2 million in bonds outstanding with a coupon interest rate of 8 percent. Albatross has 30,000 shares of preferred stock outstanding, which pays

> Show algebraically that Equation 14.2: is equivalent to Equation 14.1: Sales - Variable costs DOL at X = EBIT ДЕВІТ EBIT ASales DOL at X = Sales

> Gibson Company sales for the year 2016 were $3 million. The firm’s variable operating cost ratio was 0.50, and fixed costs (that is, overhead and depreciation) were $900,000. Its average (and marginal) income tax rate is 40 percent. Currently, the firm h