Question: Jimmy Olson died on June 15, 2015,

Jimmy Olson died on June 15, 2015, at the age of 75, after a brief illness. Jimmy is survived by his wife, Lois, and two adult sons, Clark and Kent. Jimmy left a valid will, requesting that Clark serve as executor of his estate. Jimmy’s widow will maintain the family residence, which was owned jointly.

Jimmy’s will provided the following specific devises:

2014 Corvette to his son, Clark............................................................................. $35,000

Summer cottage on Lake Michigan to his son Kent .............................................40,000

Stock investments to be shared equally between his two sons .........................400,000

Miscellaneous personal effects to his widow, Lois......................................................... —

Jimmy’s will also provided the following general devises of cash:

Clark—to cover executor’s services...................................................................... $5,000

Ms. Lana Lang, Jimmy’s personal trainer......................................................... 200,000

Jimmy’s church...................................................................................................... 50,000

The local symphony orchestra............................................................................... 50,000

Jimmy’s will further provides that Lois should receive any excess of income over expenses during the administration of his estate. All remaining assets are to be placed in a trust to support Lois for the remainder of her lifetime. Upon Lois’s death, the remainder of the estate is to be divided equally between Clark and Kent.

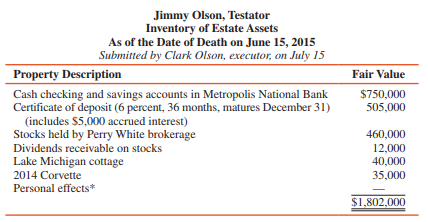

Clark filed notice of his appointment as executor on June 25 and placed the required notice to potential creditors in The Daily Planet, the local newspaper. Clark prepared and filed the following estate inventory with the probate court on July 15:

The following events occurred during June and July 2015:

June 22 Received a check in the amount of $15,000, representing interest on the certificates

of deposit, including the amount accrued at the date of death.

June 24 Received a dividend check in the amount of $12,000.

June 30 Paid $250 to repair a roof leak on the Lake Michigan cottage.

July 4 Paid $4,900 in funeral expenses for Jimmy.

July 12 Cashed out the certificate of deposit for $501,300. The additional $1,300

represented interest income from June 23 through July 12. The bank waived the fees

for early withdrawal because Jimmy had been a loyal, long-term customer.

July 15 Filed the estate inventory with the probate court.

July 20 Distributed the general property devises as provided in Jimmy’s will.

July 21 Distributed the general cash devises as provided in Jimmy’s will.

July 22 Closed the accounts, finalizing the estate administration, paid remaining estate

income to Lois, and transferred remaining estate assets to Lois Olson testamentary

income trust.

REQUIRED:

1. Prepare journal entries for the transactions related to the estate during 2015.

2. Prepare entries to terminate the estate and transfer remaining assets to the trust.

3. Prepare the final charge–discharge statement for the estate of Jimmy Olson for the period June 15, 2015 through July 22, 2015.

Transcribed Image Text:

Jimmy Olson, Testator Inventory of Estate Assets As of the Date of Death on June 15, 2015 Submitted by Clark Olson, executor, on July 15 Property Description Fair Value Cash checking and savings accounts in Metropolis National Bank Certificate of deposit (6 percent, 36 months, matures December 31) (includes $5,000 accrued interest) Stocks held by Perry White brokerage $750,000 505,000 460,000 Dividends receivable on stocks 12,000 40,000 Lake Michigan cottage 2014 Corvette 35,000 Personal effects* $1,802,000

> 1. The following revenues were among those reported by Arvida Township in 2016: Net rental revenue (after depreciation) from............................$40,000 a parking garage owned by Arvida Interest earned on investments held for.....................

> 1. Which of the following are eliminated from the financial statements under GASB 34? a General long-term debt account group b General fixed asset account group c Both a and b d None of the above 2. An expense would be reported in which of the following

> 1. Which of the following is not a governmental fund? a Special revenue fund b Debt service fund c Trust fund d General fund 2. Which of these funds generally follows the accrual basis of accounting? a General fund b Internal service fund c Debt service

> George Wilson dies on March 1, 2015, leaving a valid will. The will reads as follows: I leave my home, furnishings, remaining bank account balances and personal possessions to my wife Helen. I leave my automobile to my nephew, Dennis. I leave my stock in

> What is the distinction between equity insolvency and bankruptcy insolvency?

> A firm emerging from Chapter 11 bankruptcy that does not qualify for fresh-start reporting must still report the effect of the reorganization plan on its financial position and results of operations. How is debt forgiveness reported in the reorganized co

> Ram holds a $400,000 note receivable from Pat. It has been learned that Pat filed for Chapter 7 bankruptcy and that the expected recovery of nonsecured claims is 45¢ on the dollar. Inventory items with an estimated recoverable value of $80,000 secure Pat

> The Good Grubb Food for the Hungry Institute is a nongovernmental not-for-profit organization that provides free meals for the destitute in a large metropolitan area. Record the following transactions in the accounts of Good Grubb. 1. Cash gifts that wer

> Lop filed for relief under Chapter 11 of the bankruptcy act on January 2, 2016. A summary of Lop’s assets and equities on this date, and at June 30, 2016, follows. Estimated fair values of Lop’s assets at June 30 are a

> When can a creditors’ committee file a plan of reorganization under a Chapter 11 case?

> What is a debtor-in-possession reorganization case?

> Describe the duties of a trustee in a liquidation case under the BAPCPA 1978.

> Is a trustee appointed in Title 11 cases? Is a trustee appointed in all Chapter 7 cases? In all Chapter 11 cases? Discuss.

> What obligations does a debtor corporation have in a bankruptcy case?

> What classifications of fund balance are currently allowed and which ones are no longer allowed?

> What are the duties of the U.S. trustee under BAPCPA? Do U.S. trustees supervise the administration of all bankruptcy cases?

> You serve as the executor for the estate of Jeff Carpenter, who passed away on August 25, 2015, at the age of 102. Jeff’s estate consisted of two certificates of deposit totalling $800,000 and a $15,000 balance in his checking account. Total accrued inte

> Bankruptcy proceedings may be designated as voluntary or involuntary. Distinguish between the two types, including the requirements for filing of an involuntary petition.

> Describe prepetition liabilities subject to compromise on the balance sheet of a company operating under Chapter 11 of the bankruptcy act.

> 1. If numerous funds are maintained, which of the following transactions would typically not be reported in a municipality’s general fund? a The collection of property taxes b The purchase of office equipment c The receipt of grant funds for local youth

> FASB ASC 852 provides two conditions that must be met for an emerging firm to use fresh-start reporting. What are these two conditions?

> What is meant by a homestead, or family, allowance?

> Briefly summarize differences between principal and income transactions for estates and trusts. Why is the classification important in estate and trust accounting?

> Are estate income taxes the responsibility of the estate or its beneficiaries?

> Summarize reasons why it may be important to have a will.

> Briefly summarize how income earned on estate property should be treated by a beneficiary for purposes of filing a federal tax return. Where should the beneficiary look to provide this information?

> What is the meaning of a devise in estate accounting?

> Does accounting for a trust follow GAAP?

> You serve as the executor for the estate of Maribeth Rainy. The following transactions occur during July 2015: a The Rainy estate included a certificate of deposit in the amount of $600,000. On the date of death, there was $11,600 of accrued but unpaid i

> Ms. Jacki Jerome, a famous rock superstar, dies on November 28, 2015, and leaves her entire estate, with a fair value of $23,400,000 (after settling all estate expenses and liabilities) to her cousin Maggie. REQUIRED: Calculate the federal tax on Ms. Je

> 1. When equipment was purchased with general fund resources, which of the following accounts would have been increased in the general fund? a Due from general fixed assets account group b Expenditures c Appropriations d No entry should be made in the gen

> Distinguish between the various types of interfund activity.

> What is an appropriation? How can budgetary approval be arranged to give the legislative body maximum control over the budget? How can it be arranged to give the executive maximum flexibility?

> Are interfund transfers expenditures or expenses? Explain.

> How does the accounting treatment of a nine-month note payable differ from the accounting treatment of a five-year note payable within a governmental fund? Why?

> Use the information in P 23-3 to prepare a charge–discharge statement for the estate of George Wilson for the period March 1, 2015 through April 30, 2015. Information from P 23-3 George Wilson dies on March 1, 2015, leaving a valid will. The will reads

> What types of revenue do governments have? How do nonexchange transactions differ from exchange transactions?

> What does measurement focus mean? What two focuses are used in governmental accounting? Which fund types use each?

> What is the modified accrual basis of accounting? Which funds utilize the modified accrual basis of accounting?

> Why aren’t fixed assets recorded in the accounts of a general fund? Where are they recorded?

> What are the simplified and complete accounting equations for a proprietary fund?

> 1. Internal service funds are reported: a With governmental funds on the fund financial statements b With governmental activities on the government-wide statement of net position c With proprietary funds on the government-wide statement of net position d

> Three wealthy friends, Tom, Grant, and Karen, each decided to donate $5,000,000 to the not-for-profit organization of their choice. Each donation was made on May 21, 2016. Prepare the entries required for each of the recipient organizations under the fol

> 1. A nongovernmental VHWO receives $20,000 of unconditional promises to give with no donor-imposed restrictions. Of this amount, $14,000 is due during the current period and $6,000 is due in the next period. The organization estimates that 3 percent of t

> Comparative adjusted trial balances for the motor pool of Douwe County at June 30, 2016, and June 30, 2017, are as follows: REQUIRED: Prepare fund financial statements for the motor pool for the year ended June 30, 2017. (The statement of cash flows is

> The following transactions relate to the Fiedler County Utility Plant, a newly established municipal facility financed with debt secured solely by net revenue from fees and charges to external users. 1. The general fund made a $30,000,000 contribution to

> The City of Thomasville established an internal service fund to provide printing services to all city offices and departments. The following transactions related to the fund took place in 2016: 1. On January 15, the general fund transferred equipment wit

> What is the purpose of a capital projects fund? Are all general fixed assets of a governmental unit acquired through capital projects funds? Explain.

> What are the special requirements for the presentation of financial statements for a firm that is operating under Chapter 11 Bankruptcy protection?

> Caleb County had a beginning cash balance in its enterprise fund of $714,525. During the year, the following transactions affecting cash flows occurred: 1. Acquired equity investments totaling $165,000 for cash 2. Receipts from sales of goods or services

> The City of Meringen operates a central garage through an internal service fund to provide garage space and repairs for all city-owned and operated vehicles. The central garage fund was established by a contribution of $200,000 from the general fund, whe

> On July 1, 2016, Duchy County receives a $500,000 contribution from the local chapter of Homeless No More. A trust agreement specifying that the income from the contribution be distributed each May 15 to the downtown homeless shelter accompanies the cont

> On January 1, 2016, J. G. Monee created a student aid trust fund to which he donated a building with a fair value of $400,000 (his cost was $250,000), bonds having a market value of $500,000, and $100,000 cash. The trust agreement stipulated that princip

> The City of Laramee established a tax agency fund to collect property taxes for the City of Laramee, Bloomer County, and Bloomer School District. Total tax levies of the three governmental units were $200,000 for 2016, of which $60,000 was for the City o

> 1. Charges for services are a major source of revenue for: a A debt service fund b A trust fund c An enterprise fund d A capital projects fund 2. A city provides initial financing for its enterprise fund with the stipulation that the amount advanced be

> For an enterprise fund, note how each of the following transactions affects (a) net investment in capital assets (net of related debt), (b) restricted net position, and (c) unrestricted net position. (Record N/A if there is no effect on the net position

> What is the role of a subsidiary ledger in a governmental entity?

> Assume that supplies on hand at the beginning of the year amount to $60,000 and that supply purchases during the year are $400,000. Supplies on hand at year-end are $40,000, and the consumption basis of accounting for supplies is used. What adjusting ent

> For each of the following events or transactions, prepare the necessary journal entry or entries, and identify the fund or funds that will be affected. 1. A governmental unit collects fees totaling $4,500 at the municipal pool. The fees are charged to re

> You have been hired as trustee for the testamentary trust created by the will of Tom Josephson. The trust is created on June 30, 2015. (Use the information provided in P 23-6 and P 23-7.) The trust initially invests the proceeds from the estate in a chec

> How are capital leases recorded in governmental funds?

> Which funds may be used to account for the activities of a general governmental special assessment construction project with long-term financing? Explain.

> How do special assessment levies differ from general tax levies?

> The Town of Lilehammar has $3,000,000 of 6 percent bonds outstanding. Interest on the general obligation, general government indebtedness is payable semiannually each March 31 and September 30. December 31 is the fiscal year-end. Record the following tra

> The following information regarding the fiscal year ended December 31, 2016, was drawn from the accounts and records of the Volendam County general fund: Revenues and Other Asset Inflows Taxes.............................................................

> The following information was abstracted from the accounts of the general fund of the City of Lahti after the books had been closed for the fiscal year ended June 30, 2016: ADDITIONAL INFORMATION: The budget for the fiscal year ended June 30, 2016, pro

> The following summary of transactions was taken from the accounts of the Oslo School District general fund before the books had been closed for the fiscal year ended June 30, 2016: ADDITIONAL INFORMATION: 1. The estimated taxes receivable for the year

> The postclosing trial balance for the City of Fort Collins governmental funds at June 30, 2016, shows the following ledger account balances: ADDITIONAL INFORMATION: 1. During the year, Fort Collins purchased $9,000 in equipment, which was not depreciat

> The unsecured creditors of Dan filed a petition under Chapter 7 of the bankruptcy act on July 1, 2016, to force Dan into bankruptcy. The court order for relief was granted on July 10, at which time an interim trustee was appointed to supervise liquidatio

> The Town of Tyler approved the following general fund budget for the fiscal year July 1, 2016, to June 30, 2017: TOWN OF TYLER GENERAL FUND BUDGET SUMMARY FOR THE YEAR JULY 1, 2016 TO JUNE 30, 2017 Revenue Sources Taxes..................................

> Use the information in P 23-6 to prepare a charge–discharge statement for the estate of Tom Josephson for the period May 16, 2015 through June 30, 2015. Information from P 23-6 Tom Josephson dies on May 16, 2015, leaving a valid will. The will reads as

> Prepare journal entries to record the following grant-related transactions of an enterprise fund activity. Explain how these transactions should be reported in the enterprise fund’s financial statements, including the statement of cash flows. 1. Received

> List three items that might appear on the reconciliation between the governmental fund balance sheet and the government-wide statement of net position. List three items that might appear on the reconciliation between the governmental fund operating state

> The preclosing account balances of the general fund of the City of Batavia on June 30, 2017, were as follows: Debits Cash........................................................................................................ $80,000 Taxes receivable—de

> The unadjusted trial balance for the general fund of the City of Orchard Park at December 31, 2016, is as follows: Supplies on hand at December 31, 2016, are $3,000. The $50,000 encumbrance relates to equipment ordered November 28 for the Department of

> The City of Catalina authorized the construction of a new recreation center at a total cost of $1,000,000 on June 15, 2016. On the same date, the city approved a $1,000,000, 8 percent, 10-year general obligation serial bond issue to finance the project.

> In a special election held on May 1, 2016, the voters of the City of Cerone approved a $10,000,000 issue of 6 percent general obligation bonds maturing in 20 years. The proceeds of this sale will be used to help finance the construction of a new civic ce

> On June 15, 2016, Malmo City authorizes the issuance of $500,000 par of 6 percent serial bonds to be issued on July 1, 2016, and to mature in annual serials of $100,000 beginning on July 1, 2017. The proceeds of the bond issue are to be used to finance a

> The City of Stockholm authorized construction of a $600,000 addition to the municipal building in September 2016. The addition will be financed by $200,000 from the general fund and a $400,000 serial bond issue to be sold in April 2017. REQUIRED: Prepar

> 1. Howard City should use a capital projects fund to account for: a Proceeds of a capital grant to finance a new civic center that will not provide services primarily on a user-charge basis b Construction of sewer lines by the water and sewer utility to

> 1. The accounts “estimated revenues” and “appropriations” appear in the trial balance of the general fund. These accounts indicate: a The use of cash-basis accounting b The use of accrual-basis accounting c The formal use of budgetary accounts d The info

> Tom Josephson dies on May 16, 2015, leaving a valid will. The will reads as follows: I leave my automobile to my niece, Pat. I leave my stock investment accounts to my niece, Sue. I leave income on my estate to the local humane society. Estate expenses a

> You serve as the executor for the estate of Matthew Troy. Matthew’s will provides that all remaining assets other than specific items in the will pass to his longtime friend Melanie Matthews. The following transactions occur during October and November 2

> You serve as the executor for the estate of John Seagull. The following transactions occur during June 2015: a John’s estate included a municipal bond with a fair value of $1,000,000. On the date of death, there was $8,800 of accrued but unpaid interest.

> What are encumbrances, and how does encumbrance accounting help control expenditures?

> How is a conversion worksheet used? Why is it necessary?

> What is included on a budgetary comparison schedule? Is such a schedule required to be included in a CAFR?

> How can you determine whether or not a governmental fund should be considered major?

> How does a permanent fund differ from a special revenue fund? A private-purpose trust fund?

> The Village of Lester had appropriations of $250,000 for the current fiscal year. If $175,000 worth of items has been ordered but only $150,000 of the $175,000 has been received, what amount can city officials order prior to year-end? What happens if the

> The balance sheet of Sco appeared as follows on March 1, 2016, when an interim trustee was appointed by the U.S. trustee to assume control of Sco’s estate in a Chapter 7 case. ADDITIONAL INFORMATION: 1. Creditors failed to elect a tru

> 1. Bankruptcy Insolvency means: a Book value of assets is greater than liabilities b Fair value of assets is less than liabilities c Inability to meet financial obligations as they come due d Liabilities are greater than book value of assets 2. Aside fr

> What is the opportunity cost of having excessive amounts of liquid funds?

> Travis has invested $3,000 in a three month CD at 4%. How much will Travis have when the CD matures?

> Lisa is depositing $2,500 in a six month CD that pays 4.25% interest. How much interest will she accrue if she holds the CD until maturity?

> Teresa has just opened a NOW account that pays 3.5% interest. If she maintains a minimum balance of $500 for the next 12 months, how much interest will she earn?

> Recall that the Sampsons have resolved to save a total of $800 per month. Dave and Sharon notice that their local bank offers the certificates of deposit listed in the following table; they now need to determine which CDs will best suit their savings goa

> Recall that the Sampsons have resolved to save a total of $800 per month. Dave and Sharon notice that their local bank offers the certificates of deposit listed in the following table; they now need to determine which CDs will best suit their savings goa

> Mary’s last bank statement showed an ending balance of $168.51. This month, she deposited $600.00 in her account and withdrew a total of $239.00. Furthermore, Mary wrote a total of five checks, two of which have cleared. The two checks that have cleared

> Recall that the Sampsons have resolved to save a total of $800 per month. Dave and Sharon notice that their local bank offers the certificates of deposit listed in the following table; they now need to determine which CDs will best suit their savings goa