Question: John Krog is president, chairman of the

John Krog is president, chairman of the board, production supervisor, and majority

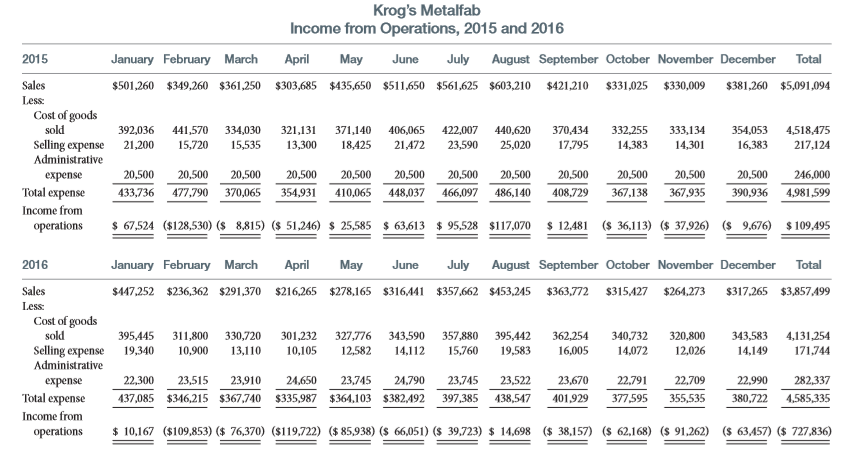

shareholder of Krog’s Metalfab, Inc. He formed the company in 1991 to manufacture custom-built aluminum storm windows for sale to contractors in the greater Chicago area. Since that time the company has experienced tremendous growth and currently operates two plants: one in Chicago, the main production facility, and a smaller plant in Moline, Illinois. The company now produces a wide variety of metal windows, framing materials, ladders, and other products related to the construction industry. Recently the company developed a new line of bronze-finished storm windows, and initial buyer reaction has been quite favorable. The company’s future seemed bright, but on January 3, 2016, a light fixture overheated causing a fire that virtually destroyed the entire Chicago plant. Three days later, Krog had moved 50 percent of his Chicago workforce to the Moline plant. Workers were housed in hotels, paid overtime wages, and provided with bus transportation home on weekends. Still, the company could not meet delivery schedules because of reduced operating capacity, and total business began to decline. At the end of 2016, Krog felt that the worst was over. A new plant had been leased in Chicago, and the company was almost back to normal. Finally, Krog could turn his attention to a matter of considerable importance: settlement with the insurance company. The company’s policy stipulated that the building and equipment loss be calculated at replacement cost. This settlement had been fairly straightforward, and the proceeds had aided the rapid rebuilding of the company. A valued feature of the insurance policy was “lost profit†coverage. This coverage was to “compensate the company for profits lost due to reduced operating capacity related to fire or flood damage.†The period of “lost profit†was limited to 12 months. Interpreting the exact nature of this coverage proved to be difficult. The insurance company agreed to reimburse Krog for the overtime premium, transportation, and housing costs related to operating out of the Moline plant. These expenses obviously minimized the damages related to the 12 months of lost or reduced profits. But was the company entitled to any additional compensation? Krog got out the latest edition of Construction Today. According to this respected trade journal, sales of products similar to products produced by Krog’s Metalfab had increased by 7 percent during 2016. Krog felt that were it not for the fire, his company could also have increased sales by this percentage. Income statement information is available for 2015 (the year prior to the fire) and 2016 (the year during which the company sustained “lost profitâ€). The expenses in 2016 include excess operating costs of $250,000. Krog has documentation supporting these items, which include overtime costs, hotel costs, meals, and such related to operating out of Moline. The insurance company is quite willing to pay for these costs since they reduced potential lost profit. The chief accountant at Krog, Peter Newell, has estimated lost profit to be only $34,184. Thus, he does not feel that it’s worthwhile spending a lot of company resources trying to collect more than the $250,000. Peter arrived at his calculation as follows:

Sales in 2015……………………………………………$5,091,094

Predicted sales in 2016, assuming

a 7% increase……………………………………………$5,447,471

Actual sales in 2016…………………………………….3,857,499

(A) Lost sales………………………………………………1,589,972

(B) Profit in 2015 as a percentage of 2015

sales ($109,495 ÷ 5,091,094)……………………………..0215

Lost profit (A × B)…………………………………….$ 34,184

Required:

a. Mr. Krog is not convinced by Peter’s analysis and has turned to you, an outside consultant, to provide a preliminary estimate of lost profit. Using the limited information contained in the financial statements for 2015 and 2016, estimate lost profits. (Hint: You can proceed as follows.)

Step 1: Determine the level of fixed and variable costs in 2015 as a function of sales. You can use account analysis, the high-low method, or regression if you are familiar with that technique. If you use account analysis, assume that cost of goods sold and selling expense are variable costs and administrative expense is a fixed cost.

Step 2: Predict what sales would have been in 2016 if there was no fire. Using this level of sales and the fixed and variable cost information from Step 1, estimate what profit would have been in 2016.

Step 3: The difference between actual profit in 2016 and the amount estimated in Step 2 is lost profit.

b. Based on your preliminary analysis, do you recommend that Mr. Krog aggressively pursue a substantial claim for lost profit?

c. What is the fundamental flaw in Peter Newell’s analysis?

Transcribed Image Text:

Krog's Metalfab Income from Operations, 2015 and 2016 2015 January February March Аpril May June July August September October November December Total Sales $501,260 $349,260 $361,250 $303,685 $435,650 $511,650 $561,625 $603,210 $421,210 $331,025 $330,009 $381,260 $5,091,094 Less: Cost of goods 422,007 23,590 sold 392,036 441,570 334,030 321,131 371,140 406,065 440,620 370,434 332,255 333,134 354,053 4,518,475 Selling expense Administrative 21,200 15,720 15,535 13,300 18,425 21,472 25,020 17,795 14,383 14,301 16,383 217,124 20,500 20,500 20,500 20,500 20,500 20,500 20,500 20,500 20,500 20,500 20,500 20,500 246,000 еxpense Total expense 433,736 477,790 370,065 354,931 410,065 448,037 466,097 486,140 408,729 367,138 367,935 390,936 4,981,599 Income from operations $ 67,524 ($128,530) ($ 8,815) ($ 51,246) $ 25,585 $ 63,613 $ 95,528 $117,070 $ 12,481 ($ 36,113) ($ 37,926) ($ 9,676) $ 109,495 2016 January February March Аpril May June July August September October November December Total Sales $447,252 $236,362 $291,370 $216,265 $278,165 $316,441 $357,662 $453,245 $363,772 $315,427 $264,273 $317,265 $3,857,499 Less: Cost of goods sold 327,776 343,590 14,112 357,880 362,254 16,005 320,800 343,583 14,149 4,131,254 171,744 395,445 311,800 330,720 301,232 395,442 340,732 Selling expense Administrative 19,340 10,900 13,110 10,105 12,582 15,760 19,583 14,072 12,026 expense 22,300 23,515 23,910 24,650 23,745 24,790 23,745 23,522 23,670 22,791 22,709 22,990 282,337 Total expense 437,085 $346,215 $367,740 $335,987 $364,103 $382,492 397,385 438,547 401,929 377,595 355,535 380,722 4,585,335 Income from operations $ 10,167 ($109,853) ($ 76,370) (s119,722) ($ 85,938) ($ 66,051) ($ 39,723) $ 14,698 ($ 38,157) ($ 62,168) ($ 91,262) ($ 63,457) ($ 727,836)

> RainRuler Stains produces a variety of exterior wood stains that have excellent coverage and longevity. In 2017, the company produced and sold 310,000 gallons of stain. There was no beginning inventory. Income for the year was as follows: In the past, t

> Provide two examples of costs that are likely to be variable costs.

> Distinguish between discretionary and committed fixed costs.

> Define the term mixed cost and provide an example of such a cost.

> In the past year, Williams Mold & Machine had sales of $7,000,000 and total production costs of $5,000,000. In the coming year, the company believes that sales and production can be increased by 25 percent, but this will require adding a second productio

> In a multiproduct setting, when would it not be appropriate to focus on a weighted average contribution margin per unit?

> What is the difference between the contribution margin and the contribution margin ratio?

> Explain the concept of a relevant range.

> Explain why total compensation paid to the sales force is likely to be a mixed cost.

> Provide two examples of costs that are likely to be fixed costs.

> Explain how to use account analysis to estimate fixed and variable costs.

> Which company would have higher operating leverage: a software company that makes large investments in research and development or a trucking company that relies on owner- operators (i.e. individuals who own and drive their own truck). Why?

> Michael Bordellet is the owner/pilot of Bordellet Air Service. The company flies a daily round trip from Seattle’s Lake Union to a resort in Canada. In 2016, the company reported an annual income before taxes of $120,403, although that

> Lancer Audio produces a high-end DVD player that sells for $1,300. Total operating expenses for the past 12 months are as follows: Required: a. Use regression analysis to estimate fixed and variable costs. Round to two decimal places. b. Compare your

> Lancer Audio produces a high-end DVD player that sells for $1,300. Total operating expenses for the past 12 months are as follows: Required: a. Use the high-low method to estimate fixed and variable costs. b. Based on these estimates, calculate the br

> Wilmington Chemicals produces a chemical, PX44, which is used to retard fading in exterior house paint. In the past year, the company produced 200,000 gallons at a total cost of $1,200,000 ($6 per gallon). The company is currently considering an order fo

> Lancer Audio produces a high-end DVD player that sells for $1,300. Total operating expenses for July were as follows: Units produced and sold………………150 Component costs………………..$ 71,000 Supplies…………………………………..2,500 Assembly labor………………………25,000 Rent……………………

> The Hotel Majestic is interested in estimating fixed and variable costs so that the company can make more accurate projections of costs and profit. The hotel is in a resort area that is particularly busy from November through February. In July and August

> Cindy Havana is a vice president of finance for Captain Wesley’s Restaurant, a chain of 12 restaurants on the East Coast, including five restaurants in Florida. The company is considering a plan whereby customers will be mailed coupons

> Fleet Valley Shoes produces two models: the Nx100 (a shoe aimed at competitive runners) and the Mx100 (a shoe aimed at fitness buffs). Sales and costs for the most recent year are indicated: Required: a. Suppose the company has 200,000 assembly hours a

> For the past 3 years, Rhetorix, Inc., has produced the model X100 stereo speaker. The model is in high demand, and the company can sell as many pairs as it can produce. The selling price per pair is $900. Variable costs of production are $300, and fixed

> Equillion, Inc., and Storis, Inc., are two companies in the pharmaceutical industry. Equillion has relatively high fixed costs related to research and development. Storis, however, does little research and development. Instead, the company pays for the r

> National Tennis Racquet Co. produces and sells three models: Required: (Round all percentages to two decimal places and monetary calculations to the nearest dollar.) a. What is the weighted average contribution margin per unit? b. Calculate the break-

> Fidelity Multimedia sells audio and video equipment and car stereo products. After performing a study of fixed and variable costs in the prior year, the company prepared a product-line profit statement as follows: Required: a. Calculate the contributio

> Edison Entrepreneur Services, Inc., is a legal services firm that files the paperwork to incorporate a business. Edison charges $1,200 for the incorporation application package and plans to file 1,600 applications next year. The company’s projected incom

> FirstTown Mortgage specializes in providing mortgage refinance loans. Each loan customer is charged a $500 loan processing fee by FirstTown when the loan is processed. FirstTown’s costs over the past year associated with processing the

> Zachary made plans to visit a friend in New York during the Memorial Day weekend. However, before the trip, his employer asked him if he would work overtime for 16 hours at $35 per hour during the weekend. What will be the opportunity cost if Zachary dec

> Gaming Solutions is a small company that assembles PCs to gamer customer specifications. The company buys all of its component parts from Northern Oregon Computer Warehouse. In the past year, the company had the following before-tax profit: The company,

> Last year, Emily Sanford had a booth at the three-day Indianapolis Craft Expo, where she sold a variety of silver jewelry handcrafted in India. Her before-tax profit was as follows: Sales………&ac

> Information for three costs incurred at Boole Manufacturing in the first quarter follows: Required: Plot each cost, making the vertical axis cost and the horizontal axis units produced. Classify each cost (depreciation, direct labor, and telecommunicat

> Rhetorix, Inc., produces stereo speakers. The selling price per pair of speakers is $1,000. The variable cost of production is $300 and the fixed cost per month is $49,000. Required: Calculate the expected profit for November, assuming that the company

> Campus Copy & Printing wants to predict copy machine repair expense at different levels of copying activity (number of copies made). The following data have been gathered: Required: Determine the fixed and variable components of repair expense usin

> Watson’s Fish Company buys whole salmon from various fishermen at $4 per pound and sells the fish to restaurants for $6 per pound. Its fixed costs are $20,000 per month. Required: How many pounds must be sold to break even, and how many pounds must be

> Consider two companies, Oakland Hill Golf Course and Brooks Men’s Clothing. Required: Which company is more likely to focus on the contribution margin per unit, and which is more likely to focus on the contribution margin ratio in cost-volume-profit an

> John Diaz is the president of Pacific Refrigeration. The company has 2,000 employees and manufactures and sells a variety of refrigeration units for commercial use. Recently, the company experienced large losses due to a downturn in the economy and a sub

> Dvorak Music produces two durable music stands: Stand A requires 2 labor hours and stand B requires 1 labor hour. The company has only 350 available labor hours per week. Further, the company can sell all it can produce of either product. Required: a.

> Refer to the data in Exercise 4-16. (Round all decimal answers to four places and all dollar answers to the nearest dollar.) Required: a. Calculate profit as a percent of sales in the prior year. b. Suppose sales in the current year increase by 15 per

> Parrish Plumbing provides plumbing services to residential customers from Monday through Friday. Ken Parrish, the owner, believes that it is important for his employees to have Saturday and Sunday off to spend with their families. However, he also recogn

> Wilde Home & Garden is organized into three departments. The following sales and cost data are available for the prior year: Required: a. What is the weighted average contribution margin ratio? b. What level of sales is needed to earn a profit of $

> Rhetorix, Inc. produces stereo speakers. The selling price per pair of speakers is $1,000. The variable cost of production is $300 and the fixed cost per month is $49,000. For November, the company expects to sell 125 pairs of speakers. Required: a. Ca

> Rhetorix, Inc., produces stereo speakers. The selling price per pair of speakers is $1,000. The variable cost of production is $300 and the fixed cost per month is $49,000. Required: a. Calculate the contribution margin associated with a pair of speake

> Gabby’s Wedding Cakes creates elaborate wedding cakes. Each cake sells for $600. The variable cost of making the cakes is $250, and the fixed cost per month is $8,750. Required: a. Calculate the break-even point for a month in units. b. How many cakes

> Lopez Mfg. is interested in estimating fixed and variable manufacturing costs using data from October. Based on judgment, the plant manager classified each manufacturing cost as fixed, variable, or part fixed and part variable: Required: a. Use account

> Madrigal Theater Company is interested in estimating fixed and variable costs. The following data are available for the month of December: Required: a. Use account analysis to estimate fixed cost per month and variable cost per tickets sold [i.e., esti

> Reef Office Supplies is interested in estimating the cost involved in hiring new employees. The following information is available regarding the costs of operating the Human Resource department at Reef Office Supplies in May, when there were 60 new hires

> Madrigal Theater Company is interested in estimating fixed and variable costs. The following data are available: Required: a. Use the high-low method to estimate fixed cost per month and variable costs per ticket sold [i.e., estimate a and b in the equ

> Marie Stefano is the group director of customer training for Mayfield Software. In this capacity, she runs a center in Kirkland, Washington, that provides training to employees of companies that use Mayfield’s inventory control, custome

> In 1928, Francis P. Rothmueller, a Northwest railroad magnate, established an endowment to fund the Rothmueller Museum in Minneapolis. The museum currently has a $30 million endowment, but it also has substantial operating costs and continues to add to i

> Peter Takesha, the manager of testing services at a medical diagnostics firm, purchased a new lab testing machine last year for $30,000. This year a new machine, which is faster and more reliable than Peter’s current model, is on the market. In deciding

> Why are units often in a different stage of completion with respect to raw materials and conversion costs?

> What is meant by the term transferred-in cost?

> What is meant by the term conversion costs?

> Explain the concept of an “equivalent unit,” including how it is calculated.

> Do transferred-in costs occur in all departments of a manufacturer using a process costing system? Explain.

> What is accomplished by preparing a reconciliation of the physical units as a part of the production cost report?

> What items of production cost make up the “costs to account for” in a production cost report?

> Explain the major differences between job-order and process costing systems.

> What are the four steps involved in the preparation of a production cost report?

> Explain how a cost can be controllable at one administrative level and noncontrollable at another administrative level.

> Identify three types of manufacturing companies for which process costing would be an appropriate product costing system. What characteristic(s) do the products of these companies have that would make process costing a good choice?

> The Wilmont Box Company produces a single box used by AirSpeed, an express shipping company. Wilmont uses a just-in-time system and has almost no inventories of material, work in process, or finished goods. Indeed, the balances are so small that the comp

> Lakeland Solvent produces a single product in two departments. The following costs relate to April: Required: Prepare journal entries to record: a. The issuance of direct material. b. The cost of direct labor (credit wages payable). c. The applicati

> Aussie Yarn is a U.S. producer of woolen yarn made from wool imported from Australia. Raw wool is processed, spun, and finished before being shipped out to knitting and weaving companies. Material is added in the beginning of processing, and conversion c

> Kao Tiles is a specialized producer of ceramic tiles. Its production process involves highly skilled workers and top-quality ceramic crafters. Work in Process is relatively large because each tile is in process for up to 3 weeks because of art, mold work

> Marquita Filters produces an air filter for use in jet aircraft. Parts are added at several points in the production process. In August, production began with 600 filters in Work in Process, 80 percent complete as to materials and 70 percent complete as

> The Plastic Glow Company makes glow sticks. It uses a process costing system and has had a just-in-time inventory policy. The plant has a capacity to produce 500,000,000 units a year but currently operates at 300,000,000 units per year. Direct material a

> Douglas Basket produces a specialty basket used by a gift basket company, Yours Truly Gifts. Douglas uses a just-in-time system and has very little inventories of material, work in process, or finished goods. Since the balances are so small, the company

> The Newberry Company accumulates costs for its product using a process costing system. Direct materials are added at the beginning of the production process, and conversion occurs evenly throughout the production process. Below is information related to

> Lindy Manufacturing uses a process costing system to track the production of the single product it makes in one department. At the start of November, there were 8,000 units in process that were 100 percent complete for direct material and 70 percent comp

> Indicate whether each of the following costs is most likely a fixed cost or a variable cost by writing “fixed” or “variable” in the space provided. a. Assembly labor. b. The cost of material used in production. c. Rent. d. Depreciation. e. Fuel cos

> Sassy Cotton produces fine cotton fabrics. The cotton is processed and finished before being shipped out to clothing companies. Material is added in the beginning of processing, and conversion costs are added evenly throughout processing. At the beginnin

> Hartwell Drug Company produces a supplement to improve bone density. Conversion costs are added evenly throughout the production process. The following information is available for March: Required: a. Compute the number of units completed in March. b.

> The Kioda Corporation assembles various components used in the electronics industry. The company’s major product, a computer chip, is the result of assembling three parts: X1, Y2, and Z3. The following information relates to production in January: • Beg

> Tropical Sun makes suntan lotion in two stages. The lotion is first blended in the Blending Department and then bottled and packed in the Bottling Department. The following information relates to the operations of the Blending Department for May. Requir

> The Carnival Caramel Company makes a high-quality caramel candy. The manufacturing process involves mixing ingredients (Mixing Department) and shaping the processed mixture into 1-pound balls (Shaping Department), which are sold to retail outlets. No add

> Simply Shine Shampoo is manufactured in two departments: Mixing and Packing. Once the shampoo mixture is completed in the Mixing Department, it is sent to Packaging, where a machine fills and seals individual bottles, which are then passed to a machine t

> Marion Chemicals produces a chemical used as a base in paints. In the manufacturing process, all materials are added at the start of the process, whereas labor and overhead are added evenly throughout production. Required: Fill in the missing informatio

> The balance in beginning Work in Process at Bing Rubber Company for direct labor was $140,000. During the month of March, an additional $800,000 of direct labor was incurred, and 35,000 pounds of rubber were produced. At the end of March, 10,000 pounds o

> During August, Wilson Lubricant completed 31,000 gallons of product. At the start of August there were 4,500 gallons in Work in Process, and at the end of August, there were 7,000 gallons in Work in Process. Required: How many gallons of product were s

> What are the four cost items that may enter a processing department?

> Identify each of the following statements with fixed costs or variable costs by writing “fixed” or “variable” in the space provided. a. A cost that varies in total with changes in the activity level. b. A cost that varies on a per-unit basis with chang

> Local 635 represents kitchen workers at hotels in several southern cities. Part of their labor agreement states that workers “shall receive one free meal per shift up to a cost of $12, with any cost over $12 being deducted from wages paid to said employe

> The IRS audited the tax returns of Darryl Strawberry, a former major league outfielder. It contended that, between 1986 and 1990, Strawberry earned $422,250 for autograph signings, appearances, and product endorsements, but he reported only $59,685 of in

> Your client, Hank Goedert, earned $100,000 of salary and received $40,000 of dividends in the current year. His itemized deductions total $37,000. In addition, Hank received $47,000 from a relative who was his former employer. You have researched whether

> You are preparing the tax return of Bold Corporation, which had sales of $60 million. Bold made a $1 million expenditure for which the appropriate tax treatment—deductible or capitalizable—is a gray area. Bold’s director of federal taxes and chief financ

> On his individual return, Al reports salary and exemptions for himself and seven dependents. His itemized deductions consist of mortgage interest, real estate taxes, and a large loss from breeding dogs. On his individual return, Ben reports self-employme

> Name some of the IRS administrative pronouncements.

> Describe how the IRS verifies tax returns at its service centers.

> According to Treasury Department Circular 230, what standard should a CPA meet to properly take a position on a tax return?

> Is the tax return preparer limited to the person who signs the return? Explain.

> Distinguish between the burdens of proof the government must meet to prove civil and criminal fraud.

> The IRS audited Tony’s return, and Tony agreed to pay additional taxes plus the negligence penalty. Is this penalty necessarily imposed on the total additional taxes that Tony owes? Explain.

> A trust owns an asset on which depreciation is claimed. The trust distributes all of its income to its sole income beneficiary. Whose taxable income is reduced by the depreciation?

> In April of the current year, Stan does not have sufficient assets to pay his tax liability for the previous year. However, he expects to pay the tax by August of the current year. He wonders if he should request an extension for filing his return instea

> Provide the following information relating to both individual and corporate taxpayers having a calendar year: a. Due date for an income tax return assuming the taxpayer requests no extension. b. Due date for the return assuming the taxpayer files an au

> The IRS notifies Tom that it will audit his current year return for an interest deduction. The IRS audited Tom’s return two years ago for a charitable contribution deduction. The IRS, however, did not assess a deficiency for the prior year return. Is any

> Your client wants to know whether she must file any documents for an automatic extension to file her tax return. What do you tell her?

> Tracy wants to take advantage of a “terrific business opportunity” by engaging in a transaction with Homer. Homer, domineering and impatient, wants Tracy to conclude the transaction within two weeks and under the terms proposed by Homer. Otherwise, Homer

> On which of the following issues will the IRS likely issue a private letter ruling and why? In your answer, assume that no other IRS pronouncement addresses the issue and that pertinent Treasury Regulations are not forthcoming. a. Whether the taxpayer c

> In what circumstances will the IRS rule on estate tax issues?