Question: John Marshall is employed as a bank

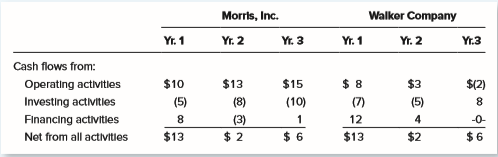

John Marshall is employed as a bank loan officer for First State Bank. He is comparing two companies that have applied for loans, and he wants your help in evaluating those companies. The two companies—Morris, Inc., and Walker Company—are approximately the same size and had approximately the same cash balance at the beginning of year 1. Because the total cash flows for the three-year period are virtually the same, John is inclined to evaluate the two companies as equal in terms of their desirability as loan candidates. Abbreviated information (in thousands of dollars) from Morris, Inc., and Walker Company is as follows.

Instructions:

a. Do you agree with John’s preliminary assessment that the two companies are approximately equal in terms of their strength as loan candidates? Why or why not?

b. What might account for the fact that Walker Company’s cash flow from financing activities is zero in year 3?

c. Generally, what would you advise John with regard to using statements of cash flows in evaluating loan candidates?

Transcribed Image Text:

Morrts, Inc. Walker Company Yr. 1 Yr. 2 Yr. 3 Yr. 1 Yr. 2 Yr.3 Cash flows from: Operating activitles $10 $13 $15 $ 8 $3 $(2) Investing activitles (5) (8) (10) (7) (5) 8 Financing activitles 8 (3) 1 12 4 -0- Net from all activitles $13 $ 2 $ 6 $13 $2 $ 6

> How artificial intelligence could be used to help with the evaluation of the estimate for the allowance for doubtful accounts? Could past allowances be tested for their predictive ability that might be able to help set allowances in the current period?

> Which distributions would you recommend be tested using Benford’s law? What would a Benford’s law evaluation of sales transaction amounts potentially show? What would a test of vendor numbers or employee numbers show? Anything different from a test of in

> In a certain company, one accountant records most of the adjusting journal entries at the end of the month. What type of analysis could be used to identify that this happens and the cumulative size of the transactions that the one accountant records? Is

> Auditors will frequently use the data reduction approach when considering potentially risky transactions. Provide an example of why focusing on a portion of the total number of transactions might be important for auditors to assess risk.

> Define Data Analytics and explain how a university might use its techniques to recruit and attract potential students.

> A number of business transactions carried out by Smalling Manufacturing Company are as follows. a. Borrowed money from a bank. b. Sold land for cash at a price equal to its cost. c. Paid a liability. d. Returned for credit some of the office equipmen

> Compute the missing amounts in the following table Assets Llabilities + Owners' Equity a. $635,000 $342,000 ? b. ? 562,500 $610,000 C. 307,500 ? 187,200

> Foster, Inc., purchased a truck by paying $5,000 and borrowing the remaining $30,000 required to complete the transaction. Briefly state how this transaction affects the company’s basic accounting equation.

> Walters Company purchased a piece of machinery on credit for $24,000. Briefly state the way this transaction affects the company’s basic accounting equation.

> Repeat Brief Exercise 2.8, except assume that rather than being a sole proprietorship or a partnership, Solway Company is organized as a corporation with capital stock of $48,000. How would the $60,000 of owners’ equity be presented in the company’s bala

> Solway Company is a sole proprietorship whose owner, Joe Solway, has an equity interest of $50,000. Had Solway been a partnership rather than a sole proprietorship, and the two equal partners were Joe and his brother Tom, how would the $50,000 owners’ eq

> Wilkes Company had the following transactions during the current year: Earned revenues of $100,000 and incurred expenses of $56,000, all in cash. Purchased a truck for $25,000. Sold land for $10,000. Borrowed $15,000 from a local bank. What was the total

> Wexler, Inc.’s income statement showed total expenses for the year to be $50,000. If the company’s revenues for the year were $135,000 and its year-end cash balance was $35,000, what was Wexler’s net income for the year?

> Wiley Company had total revenues of $360,000 for a recent month. During the month the company incurred operating expenses of $246,000 and purchased land for $66,000. Compute the amount of Wiley’s net income for the month.

> White Company’s assets total $780,000 and its owners’ equity consists of capital stock of $500,000 and retained earnings of $150,000. Does White Company have any outstanding liabilities and, if so, what is the total amount of its liabilities?

> Who are the sponsoring organizations of COSO, and what is COSO best known for doing?

> Bosh Company’s assets total $155,000 and its liabilities total $85,000. What is the amount of Bosh’s retained earnings if its capital stock amounts to $50,000?

> Spencer Software Company has assets of $1,020,000 and liabilities of $552,000. a. Prepare the owners’ equity section of the company’s balance sheet under each of the following independent assumptions: 1. The business is organized as a sole proprietorsh

> For each of the following categories, state concisely a transaction that will have the required effect on the elements of the accounting equation. a. Increase an asset and increase a liability. b. Decrease an asset and decrease a liability. c. Increas

> The following cases relate to the valuation of assets. Consider each case independently. a. World-Wide Travel Agency has office supplies costing $1,400 on hand at the balance sheet date. These supplies were purchased from a supplier that does not give

> The balance sheet items of Kiner Company as of December 31, current year, follow in random order. You are to prepare a balance sheet for the company, using a similar sequence for assets as illustrated in Exhibit 2–9. You must compute th

> The night manager of Willis Transportation Service, who had no accounting background, prepared the following balance sheet for the company at February 28, current year. The dollar amounts were taken directly from the company’s accountin

> Assets and liabilities are important elements of a company’s financial position. 1. Define assets. Give three examples of assets other than cash that might appear in the balance sheet of (1) American Airlines and (2) a professional sports team, such as

> The Walt Disney Company’s annual report for the year ended October 3, 2015, includes income statements for the years ending in 2013, 2014, and 2015. Net income for these three years is as follows (all in millions): $6,136 (2013), $7,501 (2014), and $8,38

> Locate the balance sheet, income statement, and statement of cash flows of Home Depot, Inc., in Appendix A of your text. Review those statements and then respond to the following for the year ended January 31, 2016 (fiscal year 2015). a. Did the company

> Prepare a two-column analysis that illustrates steps management might take to improve the appearance of its company’s financial statements. In the left column, briefly identify three steps that might be taken. In the right column, briefly describe for ea

> Shown in random order is a list of balance sheet items for Maple Valley Farms at September 30, current year. Instructions: a. Prepare a balance sheet by using these items and computing the amount for Retained Earnings. Use a sequence of assets similar

> On the basis of the information for Prestwick Company in Exercise 2.13, prepare a statement of cash flows in a form consistent with generally accepted accounting principles. You may assume all transactions were in cash and that the beginning cash balance

> An inexperienced accountant for Prestwick Company prepared the following income statement for the month of August, current year. Prepare a revised income statement in accordance with generally accepted accounting principles. PRESTWICK COMPANY AUGUS

> Jiminez, Inc., had the following transactions during the month of March, current year. Prepare an income statement based on this information, being careful to include only those items that should appear in that financial statement. 1. Cash received from

> During the month of October, current year, Weller Company had the following transactions. 1. Revenues of $14,400 were earned and received in cash. 2. Bank loans of $3,600 were paid off. 3. Equipment of $3,000 was purchased for cash. 4. Expenses of $9

> Professional judgment plays a major role in the practice of accounting. a. In general terms, explain why judgment enters into the accounting process. b. Identify at least three situations in which accountants must rely on their professional judgment, ra

> Explain whether each of the following balance sheet items increases, reduces, or has no direct effect on a company’s ability to pay its obligations as they come due. Explain your reasoning. a. Cash. b. Accounts Payable. c. Accounts Receivable. d. Capi

> Give an example of business transactions that would: a. Cause one asset to increase and another asset to decrease, with no effect on either liabilities or owners’ equity. b. Cause both total assets and liabilities to increase with no effect on owners’

> Can a business transaction cause one asset to increase without affecting any other asset, liability, or owners’ equity?

> Why is the going-concern assumption an important consideration in understanding financial statements?

> Why is the statement of financial position, or balance sheet, a logical place to begin a discussion of financial statements?

> The following list of balance sheet items are in random order for Alexander Farms, Inc., at September 30, current year. Instructions: a. Prepare a balance sheet by using these items and computing the amount for Retained Earnings. Use a sequence of a

> In general terms, what are revenues and expenses? How are they related in the determination of an enterprise’s net income or net loss?

> Why is a knowledge of accounting terms and concepts useful to persons other than professional accountants?

> What are the characteristics of a strong statement of cash flows?

> What is meant by the term adequate disclosure, and how do accountants fulfill this requirement in the preparation of financial statements?

> What is meant by the statement that the financial statements articulate?

> What are the three categories commonly found in a statement of cash flows, and what is included in each category?

> Moon Corporation and Star Corporation are in the same line of business and both were recently organized, so it may be assumed that the recorded costs for assets are close to current market values. The balance sheets for the two companies are as follows a

> This assignment introduces you to EDGAR, the Securities and Exchange Commission’s database of financial information about publicly owned companies. The SEC maintains EDGAR to increase the efficiency of financial reporting in the American economy and also

> The Public Company Accounting Oversight Board (PCAOB) is a direct outcome of the Sarbanes Oxley Act of 2002. This is considered one of the most significant pieces of legislation to have ever been enacted in terms of financial reporting in several decades

> You are employed by a business consulting firm as an information systems specialist. You have just begun an assignment with a startup company and are discussing with the owner her need for an accounting system. How would you respond to the following ques

> The date is November 18, current year. You are the chief executive officer of Omega Software— a publicly owned company that is currently in financial difficulty. Omega needs new large bank loans if it is to survive. You have been negotiating with several

> Ben Washington, sole owner of Washington Mattress Company, has an ownership interest in the company of $50,000 at January 1, current year. During that year, he invests an additional $20,000 in the company and the company reports a net income of $25,000.

> What is meant by generally accepted accounting principles, and how do these principles add to the integrity of financial accounting information?

> What is the role of the Public Company Accounting Oversight Board (PCAOB) in the audit of financial statements?

> What is meant by the professional designations CPA, CMA, and CIA, and how do these designations add to the integrity of accounting information

> Match the terms on the left with the descriptions on the right. Each description should be used only once. Torm Doscription Responsibilities a. A member in public practice should observe the Principles of The public the Code of Professional Conduct

> Match the terms on the left with the descriptions on the right. Each description should be used only once. Term Description Financlal accounting Management accounting Financial reporting c. The area of accounting that refers to providing Information

> Match the organizations on the left with the functions on the right. Each function should be used only once. Organization Function Institute of Internal Auditors a. The group that creates and promotes International Financial Reporting Standards (IFR

> List four external users of accounting information.

> Circus World is the name of a traveling circus. The ledger accounts of the business at June 30, current year are listed in alphabetical order. Instructions: a. Prepare a balance sheet by using these items and computing the amount of Cash at June 30, cu

> List three accounting-related skills that are useful to many people in their personal lives.

> Use the web to find the home page of the PCAOB. What are the four primary activities of the PCAOB?

> The FASB’s conceptual framework sets forth the Board’s views on which topics?

> What are the two primary organizations in the United States that are responsible for setting standards related to the preparation of accounting information?

> Match the terms on the left with the descriptions on the right. Each description should be used only once. Torm Description Control environment Risk assessment Control activities Information and a. Pollcles and procedures put in place by management

> A major focus of this course is the process of financial reporting. a. What is meant by the term financial reporting? b. What are the principal accounting reports involved in the financial reporting process? In general terms, what is the purpose of these

> Boeing Company is the largest manufacturer of commercial aircraft in the United States and is a major employer in Seattle, Washington. Explain why each of the following individuals or organizations would be interested in financial information about the c

> Identify several ways in which you currently use accounting information in your life as a student. Also identify several situations in which, while you are still a student, you might be required to supply financial information about yourself to others.

> Locate the Home Depot, Inc., 2015 financial statements in Appendix A of this text. Briefly peruse the financial statements and answer the following questions. a. Name the titles of each of Home Depot’s financial statements that provide specific informati

> Four accounting majors, Maria Acosta, Kenzo Nakao, Helen Martin, and Anthony Mandella, recently graduated from Central University and began professional accounting careers. Acosta entered public accounting, Nakao became a management accountant, Martin jo

> HERE COME THE CLOWNS! is the name of a traveling circus. The ledger accounts of the business at June 30, current year, are listed here in alphabetical order. Instructions: a. Prepare a balance sheet by using these items and computing the amount of Cas

> Ethical conduct and professional judgment each play important roles in the accounting process. a. In general terms, explain why it is important to society that people who prepare accounting information act in an ethical manner. b. Identify at least three

> The annual financial statements of all large, publicly owned corporations are audited. a. What is an audit of financial statements? b. Who performs audits? c. What is the purpose of an audit?

> Audits of financial statements are an important part of the accounting process to ensure integrity in financial reporting. a. What is the purpose of an audit? b. As an external user of accounting information, what meaning would you attach to an audit tha

> Describe which professional organization(s) would most likely be of greatest value to you if your position involved each of the following independent roles: a. Accounting educator. b. Management accountant. c. Certified public accountant.

> Internal accounting information is used primarily for internal decision making by an enterprise’s management. a. What are the three primary purposes of internal accounting information? b. Which of these is the most general and which is the most specific?

> The major focus of accounting information is to facilitate decision making. a. As an investor in a company, what would be your primary objective? b. As a manager of a company, what would be your primary objective? c. Is the same accounting information l

> You recently invested $18,000 of your savings in a security issued by a large company. The security agreement pays you 6 percent per year and has a maturity three years from the day you purchased it. What is the total cash flow you expect to receive from

> Describe the roles of the following organizations in establishing generally accepted accounting principles: a. FASB b. AICPA c. SEC From which of these organizations can you most easily obtain financial information about publicly owned companies?

> Generally accepted accounting principles play an important role in financial reporting. a. What is meant by the phrase generally accepted accounting principles? b. What are the major sources of these principles? c. Is there a single comprehensive list o

> When you invest your savings in a company, what is the difference between the return on your investment and the return of your investment?

> The Internet is a good place to get information that is useful to you in your study of accounting. For example, you can find information about accounting firms, standard setters, and regulators. Instructions: a. The largest U.S. accounting firms are ref

> Accounting is sometimes described as the language of business. What is meant by this description?

> What is the definition of internal control, and what are the five components of COSO’s internal control framework?

> Is internal accounting information primarily historical or future-oriented? How does that compare with financial accounting information?

> Is externally reported financial information always precise and accurate?

> What is the International Accounting Standards Board (IASB), and what are its objectives?

> What are the three primary financial statements with which we communicate financial accounting information?

> What is the Securities and Exchange Commission (SEC), and what is its role in external financial reporting?

> What is the Financial Accounting Standards Board (FASB), and what is its role in external financial reporting?

> Why was the Sarbanes-Oxley legislation passed in 2002, and what are its implications for the accounting profession?

> Star Scripts is a service-type enterprise in the entertainment field, and its manager, Joe Smartt, has only a limited knowledge of accounting. Joe prepared the following balance sheet, which although arranged satisfactorily, contains certain errors with

> The items making up the balance sheet of Maxx Trucking at December 31 are listed here in tabular form similar to the illustration of the accounting equation in Chapter 2 of the text During a short period after December 31, Maxx Trucking had the followi

> Big Screen Scripts is a service-type enterprise in the entertainment field, and its manager, William Pippin, has only a limited knowledge of accounting. Pippin prepared the following balance sheet, which, although arranged satisfactorily, contains certai

> Going from general to specific, what are the three primary objectives of financial reporting?

> Howard Jaffe is the founder and manager of Old Town Playhouse. The business wishes to obtain a bank loan to finance the production of its next play. As part of the loan application, Jaffe was asked to prepare a balance sheet for the business. He prepared

> Anita Spencer is the founder and manager of Spencer Playhouse. The business needs to obtain a bank loan to finance the production of its next play. As part of the loan application, Anita Spencer was asked to prepare a balance sheet for the business. She

> What is an audit, and how does it add to the integrity of accounting information?

> The balance sheet items of The Sweet Shop (arranged in alphabetical order) were as follows at the close of the business on September 30, current year. The transactions occurring during the first week of October were as follows. Oct. 3 Additional capit

> The balance sheet items of The Soda Shop (arranged in alphabetical order) were as follows at the close of business on September 30, 2015 The transactions occurring during the first week of October were as follows. Oct. 3 Additional capital stock was so

> List three professional certifications offered in accounting and the organizations that offer them.

> Assume you have recently completed your college degree with a major in accounting and have accepted a position on the accounting staff of a large corporation. Your supervisor suggests that in preparing for your first day on the job, you become familiar w