Question: John Williams (birthdate August 2, 1976) is

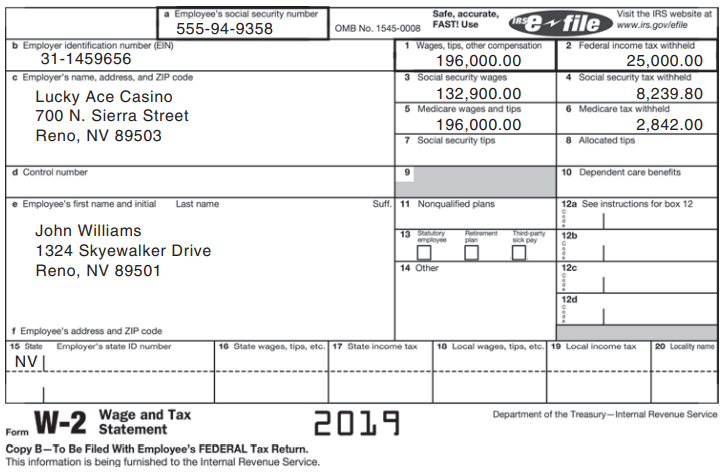

John Williams (birthdate August 2, 1976) is a single taxpayer. John’s earnings and withholdings as the manager of a local casino for 2019 are reported on his Form W-2:

John’s other income includes interest on a savings account at Nevada National Bank of $13,691. John pays his ex-wife, Sarah McLoughlin, $3,900 per month in accordance with their February 12, 2013 divorce decree. When their 12-year-old child (in the ex-wife’s custody) reaches the age of 18, the payments are reduced to $2,800 per month. His ex-wife’s Social Security number is 554-44-5555.

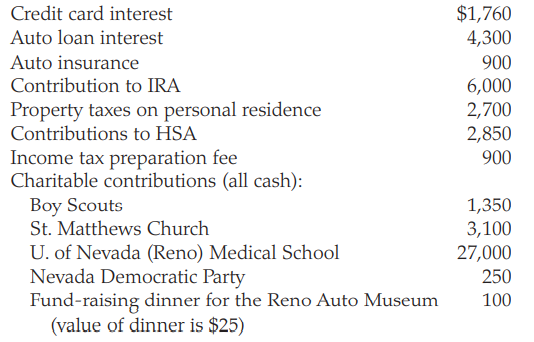

In 2019, John purchased a new car and so he kept track of his sales tax receipts during the year. His actual sales tax paid is $3,700, which exceeds the estimated amount per the IRS tables. John participates in a high-deductible health plan and is eligible to contribute to a health savings account. His HSA earned $75 in 2019. During the year, John paid the following amounts (all of which can be substantiated):

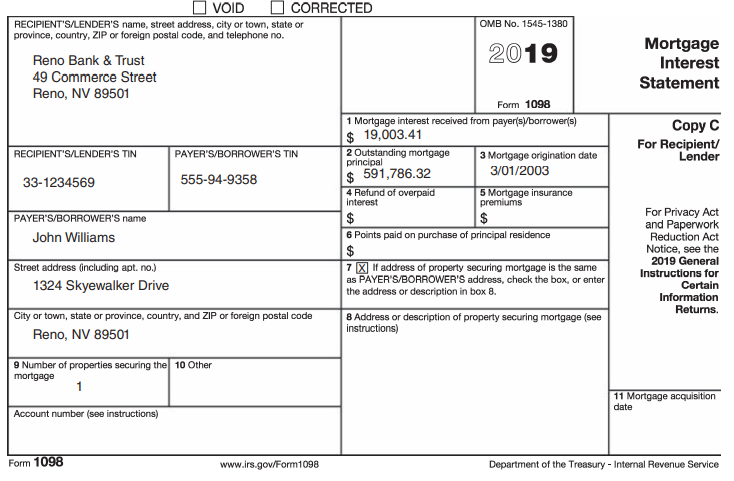

John also received the following Form 1098

Required: Complete John’s federal tax return for 2019. Use Form 1040, Schedule 1, Schedule A, Schedule B, and Form 8889 to complete this tax return. Make realistic assumptions about any missing data.

> Teresa is a civil engineer who uses her automobile for business. Teresa drove her automobile a total of 11,965 miles during 2019, of which 80 percent was business mileage. The actual cost of gasoline, oil, depreciation, repairs, and insurance for the yea

> Carey opens a law office in Chicago on January 1, 2019. On January 1, 2019, Carey purchases an annual subscription to a law journal for $170 and a 1-year legal reference service for $1,500. Carey also subscribes to Chicago Magazine for $54 so she can fin

> Go to the U.S. General Services Administration (GSA) website. For the month of September 30, 2019, what is the per diem rate for each of the following towns: a. Flagstaff, AZ b. Palm Springs, CA c. Denver, CO

> Scott Butterfield is self-employed as a CPA. He uses the cash method of accounting, and his Social Security number is 644-47-7833. His principal business code is 541211. Scott’s CPA practice is located at 678 Third Street, Riverside, CA

> 6. Which of the following items would be included in the gross income of the recipient? a. Insurance payments for medical care of a dependent child b. Insurance payments for loss of the taxpayer’s sight c. Season tickets worth $2,000 given to a son by hi

> 21. Shannon, a single taxpayer, has a long-term capital loss of $7,000 on the sale of bonds in 2019 and no other capital gains or losses. Her taxable income without this transaction is $47,000. What is her taxable income considering this capital loss? a.

> 11. Margaret and her sister support their mother and together provide 85 percent of their mother’s support. If Margaret provides 40 percent of her mother’s support: a. Her sister is the only one who can claim their mother as a dependent. b. Neither Marga

> 1. Which of the following recent tax changes is not scheduled to expire after 2025? a. Suspension of personal exemptions b. General lowering of individual tax rates c. Restrictions on the deduction of casualty and theft losses d. Reduction of corporate t

> 13. Kevin purchased a house 20 years ago for $100,000 and he has always lived in the house. Three years ago, Kevin married Karen, and she has lived in the house since their marriage. If they sell Kevin’s house in December 2019 for $425,000, what is their

> 3. Yasmeen purchases stock on January 30, 2018. If she wishes to achieve a long-term holding period, what is the first date that she can sell the stock as a long-term gain? a. January 20, 2019 b. January 31, 2019 c. February 1, 2019 d. July 31, 2018 e. J

> Ray and Maria Gomez have been married for 3 years. Ray is a propane salesman for Palm Oil Corporation and Maria works as a city clerk for the City of McAllen. Ray’s birthdate is February 21, 1991 and Maria’s is Decembe

> 17. Which of the following self-employed taxpayers are most likely permitted to deduct the cost of their uniform? a. A lawyer who wears a business suit b. A furnace repairman who must wear overalls while on the job c. A nurse who can wear casual clothe

> 7. Heather drives her minivan 953 miles for business purposes in 2019. She elects to use the standard mileage rate for her auto expense deduction. Her deduction will be a. $510 b. $515 c. $519 d. $553 e. $953 8. Which of the following taxpayers is entit

> 26. In 2019, Amy receives $8,000 (of which $3,000 is earnings) from a qualified tuition program. She does not use the funds to pay for tuition or other qualified higher education expenses. What amount is taxable to Amy? a. $0 b. $8,000 c. $3,000 d. $11,0

> 16. Harry’s wife Lila passes away in January of the current year. Fortunately, Lila had a $1 million life insurance policy. Harry elects to receive all $1 million in the current year and spends $200,000 of it on a luxury around-the-world trip with his ne

> 11. Which of the following does not result in a minimum $50 fine for an income tax preparer? a. Failure to provide a tax preparer identification number b. Cashing a refund check for a customer c. Failing to keep any record of the returns prepared d. Fail

> 2. The IRS does not have the authority to: a. Examine a taxpayer’s books and records b. Summon taxpayers to make them appear before the IRS c. Summon third parties for taxpayer records d. Place a lien on taxpayer property e. None of the above—the IRS has

> 11. Mansfield Incorporated, a calendar year corporation, is expecting to have a current year tax liability of $100,000. Which best describes the tax payments Mansfield should make to avoid penalty? a. Make payments at the end of June and December of $40,

> 1. Ironwood Corporation has ordinary taxable income of $65,000 in 2019, and a short-term capital loss of $15,000. What is the corporation’s tax liability for 2019? a. $7,500 b. $5,250 c. $10,500 d. $13,650 e. None of the above 2. Tayla Corporation gener

> 11. When calculating ordinary income, partnerships are not allowed which of the following deductions? a. Miscellaneous expenses b. Qualified business income deduction c. Depreciation d. Cost of goods sold e. Employee wages 12. Feela is a one-third pa

> 1. Which of the following may not be treated as a partnership for tax purposes? a. Arnold and Willis operate a restaurant. b. Thelma and Louise establish an LLP to operate an accounting practice. c. Lucy and Desi purchase real estate together as a busine

> Ken (birthdate July 1, 1988) and Amy (birthdate July 4, 1990) Booth have brought you the following information regarding their income, expenses, and withholding for the year. They are unsure which of these items must be used to calculate taxable income.

> 11. Ran’s wage income is $47,350 in 2019. The combined employer and employee FICA tax rates that apply to Ran’s wages are: a. 15.3% for Social Security and Medicare b. 6.2% for Social Security and Medicare c. 1.45% for Medicare d. 7.65 for Social Securit

> 2. Abbe, age 56, is married and has two dependent children, one age 14, and the other a 21-year-old full-time student. Abbe has one job, and her husband, age 58, is not employed. If she expects to earn wages of $50,000, file jointly, and take the standar

> 11. The amortization period for Section 197 intangibles is: a. 5 years b. 7 years c. 10 years d. 15 years e. 40 years 12. Which of the following intangibles is defined as a Section 197 intangible asset? a. An interest in land b. A partnership int

> 1. Alice purchases a rental house on August 22, 2019, for a cost of $174,000. Of this amount, $100,000 is considered to be allocable to the cost of the home, with the remaining $74,000 allocable to the cost of the land. What is Alice’s maximum depreciati

> 13. Joan, a single mother, has AGI of $61,500 in 2019. In September 2019, she pays $5,000 in qualified tuition for her dependent son who just started at Big University. What is Joan’s American Opportunity credit for 2019? a. $0 b. $1,250 c. $2,125 d. $

> 1. Russ and Linda are married and file a joint tax return claiming their three children, ages 4, 7, and 18, as dependents. Their adjusted gross income for 2019 is $415,300. What is Russ and Linda’s total child and other dependent credit for 2019? a. $500

> 13. For 2019, Roberta is a self-employed truck driver with earnings of $47,000 from her business. During the year, Roberta received $2,500 in interest income and dividends of $500. She also sold investment property and recognized a $1,500 gain. What is t

> 3. Which of the following entities is likely to have the greatest flexibility in choosing a year-end other than a calendar year-end? a. Sole proprietor b. General partnership c. Corporation d. S corporation 4. Which of the following is an acceptable met

> 31. Which of the following would typically be deductible as a casualty loss in 2019? a. Long-term damage to a home from termites b. An automobile accident during the daily commute c. A theft of a big screen television d. Dropping your smartphone in the p

> 21. In April 2019, Fred paid $60 of state income tax that was due when he filed his 2018 income tax return. During 2019, Fred’s employer withheld $1,500 of state income tax from his pay. In April 2020, Fred determined that his 2019 state tax liability wa

> Using the information from Problem 1A, assume Patty’s birthdate is May 18, 1952 and complete Form 1040-SR for Patty Banyan for the 2019 tax year. Data from Problem 1A: Patty Banyan is a single taxpayer (birthdate May 18, 1992) living a

> 11. What is the deadline for making a contribution to a traditional IRA or a Roth IRA for 2019? a. April 15, 2020 b. April 17, 2019 c. December 31, 2019 d. October 15, 2020 12. Which of the following statements with respect to a qualified retirement pl

> 1. Which of the following is a false statement about Health Savings Accounts (HSAs)? a. Taxpayers who contribute to an HSA must carry qualifying high-deductible health insurance. b. HSAs are available to any taxpayer using a health plan purchased throug

> 25. Jim has a net operating loss in 2019. If he does not make any special elections, what is the first year to which Jim carries the net operating loss? a. 2015 b. 2016 c. 2017 d. 2018 e. 2020 26. The qualified business income deduction is unavailable t

> Olive Corporation was formed and began operations on January 1, 2019. The corporation’s income statement for the year and the balance sheet at year-end are presented below. The corporation made estimated tax payments of $5,000 and the c

> Emily Jackson (Social Security number 765-12-4326) and James Stewart (Social Security number 466-74-9932) are partners in a partnership that owns and operates a barber shop. The partnership’s first year of operation is 2019. Emily and J

> Lisa Kohl (birthdate 02/14/1953) is an unmarried high school principal. Lisa received the following tax documents: During the year, Lisa paid the following amounts (all of which can be substantiated): Lisa’s sole stock transaction was r

> Trish Himple owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95-1234321 and her Social Security number is 123-45-6789. Trish keeps her books on an accrual basis.

> David and Darlene Jasper have one child, Sam, who is 6 years old (birthdate July 1, 2013). The Jaspers reside at 4639 Honeysuckle Lane, Los Angeles, CA 90248. David’s Social Security number is 577-11-3311, Darlene’s is

> Richard and Christine McCarthy have a 19-year-old son (born 10/2/2000; Social Security number 555-55-1212), Jack, who is a full-time student at the University of Key West. Years ago, the McCarthys shifted a significant amount of investments into Jack&aci

> Your supervisor has asked you to research the following situation concerning Owen and Lisa Cordoncillo. Owen and Lisa are brother and sister. In May 2019, Owen and Lisa exchange land they both held separately for investment. Lisa gives up a 2acre propert

> Your supervisor has asked you to research the following situation concerning Scott and Heather Moore. Scott and Heather are married and file a joint return. Scott works full-time as a wildlife biologist, and Heather is a full-time student enrolled at Onl

> Charlie’s Green Lawn Care is a cash basis taxpayer. Charlie Adame, the sole proprietor, is considering delaying some of his December 2019 customer billings for lawn care into the next year. In addition, he is thinking about paying some of the bills in la

> In 2019, Gale and Cathy Alexander hosted an exchange student, Axel Muller, for 9 months. Axel was part of International Student Exchange Programs (a qualified organization). Axel attended tenth grade at the local high school. Gale and Cathy did not claim

> While preparing Massie Miller’s 2019 Schedule A, you review the following list of possible charitable deductions provided by Massie: What would you say to Massie regarding her listed deductions? How much of the deduction is allowed for

> In 2019, Lou has a salary of $53,300 from her job. She also has interest income of $1,600 and dividend income of $400. Lou is single and has no dependents. During the year, Lou sold silver coins held as an investment for a $7,000 loss. Calculate the foll

> Leslie is a single taxpayer who is under age 65 and in good health. For 2019, she has a salary of $24,000 and itemized deductions of $1,000. Leslie allows her mother to live with her during the winter months (3–4 months per year), but her mother provides

> Patty Banyan is a single taxpayer (birthdate May 18, 1992) living at 543 Space Drive, Houston, TX 77099. Her Social Security number is 466-33-1234. For 2019, Patty has no dependents, and her W-2, from her job at a local restaurant where she parks cars, c

> 2. Jason and Mary are married taxpayers in 2019. They are both under age 65 and in good health. For 2019 they have a total of $41,000 in wages and $700 in interest income. Jason and Mary’s deductions for adjusted gross income amount to $5,000 and their i

> Indicate whether each of the items listed below would be included (I) in or excluded (E) from gross income for the 2019 tax year. a. Welfare payments b. Commissions c. Hobby income d. Scholarships for room and board e. $300 set of golf clubs, an em

> Linda and Richard are married and file a joint return for 2019. During the year, Linda, who works as an accountant for a national airline, used $2,100 worth of free passes for travel on the airline; Richard used the same amount. Linda and Richard also us

> Ellen is a single taxpayer. Ellen’s employer pays $150 per month ($1,800 this year) for her health insurance. During the year, Ellen had medical expenses of $3,500 and the insurance company paid $2,000 of the expenses. How much of the above amounts, if a

> Skyler is covered by his company’s health insurance plan. The health insurance costs his company $9,500 a year. During the year, Skyler is diagnosed with a serious illness and health insurance pays $100,000 for surgery and treatment. How much of the insu

> Kristen, a single taxpayer, receives two 2019 Forms W-2 from the two employers she worked for during the year. One Form W-2 lists her wages in Boxes 1, 3, and 5 as $18,700. Her other employer’s Form W-2 has $43,000 in Box 1 but only $46,500 in both Box 3

> Arlen is required by his 2019 divorce agreement to pay alimony of $2,000 a month and child support of $2,000 a month to his ex-wife Jane. What is the tax treatment of these two payments for Arlen? What is the tax treatment of these two payments for Jane?

> Answer the following questions: a. Under a 2017 divorce agreement, Joan is required to pay her ex-husband, Bill, $700 a month until their daughter is 18 years of age. At that time, the required payments are reduced to $450 per month. 1. How much of each

> During the 2019 tax year, Brian, a single taxpayer, received $7,400 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he received $30,000 in tax-exempt interest income and has

> Lydia, a married individual, was unemployed for a few months during 2019. During the year, she received $3,250 in unemployment compensation payments. How much of her unemployment compensation payments must be included in gross income?

> Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a stay-at-home parent and Walt is a high school teacher. Skylar’s Social Security number is 222-43-769

> In 2019, Van receives $20,000 (of which $4,000 is earnings) from a qualified tuition program. He uses the funds to pay for his college tuition and other qualified higher education expenses. How much of the $20,000 is taxable to Van?

> Jose paid the following amounts for his son to attend Big State University in 2019: How much of the above is a qualified higher education expense for purposes of his Qualified Tuition Program?

> As part of the property settlement related to their divorce, Cindy must give Allen the house that they have been living in, while she gets 100 percent of their savings accounts. The house was purchased for $90,000 20 years ago in Southern California and

> Go to the Turbo Tax Blog (http://blog.turbotax.intuit.com/) and search the blog for an article on the deduction of student loan interest. What is the maximum deduction that can be taken in a year?

> Go to the IRS website (www.irs.gov) and print out a copy of the most recent Schedule F of Form 1040.

> Go to the IRS website (www.irs.gov/newsroom) and note the name of the most recent news release.

> Greg died on July 1, 2019, and left Lea, his wife, a $45,000 life insurance policy which she elects to receive at $9,000 per year plus interest for 5 years. In the current year, Lea receives $9,500. How much should Lea include in her gross income?

> For each of the following independent cases, indicate the amount of gross income that must be included on the taxpayer’s 2019 income tax return. a. Malchia won a $4,000 humanitarian award. b. Rob won a new automobile (with a sticker price of $15,700 and

> In June of 2019, Kevin inherits stock worth $125,000. During the year, he collects $5,600 in dividends from the stock. How much of these amounts, if any, should Kevin include in his gross income for 2019? Why?

> What is the total dollar amount of personal and dependency exemptions which a married couple with two children (ages 11 and 14, both of which are qualified children) and $80,000 of adjusted gross income would deduct in 2019? What is the total child and o

> Abigail (Abby) Boxer is a single mother (birthdate April 28, 1981) working as a civilian accountant for the U.S. Army. Her Social Security number is 676-73-3311 and she lives at 3456 S Career Avenue, Sioux Falls, SD 57107. Helen, Abby’s

> In each of the following situations, determine whether the taxpayer(s) has/have a dependent and if so, the total amount of child tax credit and other dependent credit (assuming no limitations apply). a. Donna, a 20-year-old single taxpayer, supports her

> Sally and Charles Heck received the following Form 1099-DIV in 2019: The Hecks also received the following dividends and interest in 2019 (Forms 1099-DIV not shown): Assuming the Hecks file a joint tax return, complete Schedule B of Form 1040 for them fo

> Ellen’s tax client, Tom, is employed at a large company that offers health care flexible spending accounts to its employees. Tom must decide at the beginning of the year whether he wants to put as much as $2,700 of his salary into the health care flexibl

> How are qualified dividends taxed in 2019? Please give the rates of tax which apply to qualified dividends, and specify when each of these rates applies.

> Jessica and Carl were married on July 1, 2019. What are their options for filing status for their 2019 taxes?

> Melissa and Aaron are married taxpayers with taxable income of $105,000. a. When you calculate their tax liability, are you required to use the tax tables or the tax rate schedules, or does it matter? b. What is their 2019 tax liability?

> For each of the following cases, indicate the filing status for the taxpayer(s) for 2019 using the following legend: A – Single B – Married filing a joint return C – Married filing separate returns D – Head of household E - Qualifying widow(er) Case: a.

> Determine from the tax table in Appendix A the amount of the income tax for each of the following taxpayers for 2019:

> For each of the following situations (none of the taxpayers claim dependents), indicate whether the taxpayer(s) is (are) required to file a tax return for 2019. Explain your answer. a. Helen is a single taxpayer with interest income in 2019 of $8,750. b.

> Nicoula is a server at a La Jolla restaurant. Nicoula received $1,200 in unreported tips during 2019 and owes Social Security and Medicare taxes on these tips. Her total income for the year, including the tips, is $4,300. Is Nicoula required to file an i

> David Fleming is a single taxpayer living at 169 Trendie Street, Apartment 6B, La Jolla, CA 92037. His Social Security number is 865-68-9635 and his birthdate is September 18, 1974. David was employed as a delivery person for a local pizza restaurant. Da

> How much of each of the following is taxable? a. Cheline, an actress, received a $6,400 gift bag for attending the Academy Awards Ceremony during 2019. b. Jon received a gold watch worth $660 for 25 years of service to his accounting firm (not a qualifie

> Frank, age 35, and Joyce, age 34, are married and file a joint income tax return for 2019. Their salaries for the year total $84,800 and they have taxable interest income of $3,900. They have no deductions for adjusted gross income. Their itemized deduct

> Jim, age 50, and Martha, age 49, are married with three dependent children. They file a joint return for 2019. Their income from salaries totals $49,500, and they received $10,125 in taxable interest, $5,000 in royalties, and $3,000 in other ordinary inc

> Jonathan is a 35-year-old single taxpayer with adjusted gross income in 2019 of $46,300. He uses the standard deduction and has no dependents. a. Calculate Jonathan’s taxable income. Please show your work. b. When you calculate Jonathan’s tax liability a

> Alicia, age 27, is a single, full-time college student. She earns $13,200 from a part-time job and has taxable interest income of $1,450. Her itemized deductions are $845. Calculate Alicia’s taxable income for 2019. (Please note: Chapter 6 will cover the

> Ulysses and Penelope are married and file separate returns for 2019. Penelope itemizes her deductions on her return. Ulysses’ adjusted gross income was $17,400, his itemized deductions were $2,250. Neither have any dependents. Calculate Ulysses’ income t

> Diego, age 28, married Dolores, age 27, in 2019. Their salaries for the year amounted to $47,230 and they had interest income of $3,500. Diego and Dolores’ deductions for adjusted gross income amounted to $2,000, their itemized deductions were $16,000, a

> Indicate the date that the statute of limitations would run out on each of the following 2018 individual tax returns: a. A fraudulent tax return that was filed April 15, 2020 b. A tax return that was filed May 19, 2020 c. A tax return that was filed Febr

> In the 2019 tax year, Michelle paid the following amounts relating to her 2017 tax return: Which of the above items may be deducted on Michelle’s 2019 individual income tax return? Explain?

> Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. a.

> Warner and Augustine Robins, both 33 years old, have been married for 9 years and have no dependents. Warner is the president of Dragon Lady Corporation located in Macon. The Dragon Lady stock is owned 40 percent by Warner, 40 percent by Augustine, and 2

> For its current tax year, Ilex Corporation has ordinary income of $260,000, a short-term capital loss of $60,000, and a long-term capital gain of $20,000. Calculate Ilex Corporation’s tax liability for 2019.

> Ulmus Corporation is an engineering consulting firm and has $1,120,000 in taxable income for 2019. Calculate the corporation’s income tax liability for 2019.

> Go to the IRS website (www.irs.gov) and determine which IRS publication addresses the topic of corporate taxation. Print out the page with the Table of Contents of this IRS publication.

> Cypress Corporation, a calendar year end corporation, has an AMT credit carryforward from 2018 (the credit arose in 2017) in the amount of $43,000. In 2019, Cypress has $170,000 of taxable income. Assuming Cypress is not a personal service corporation, w

> Bill and Guilda each own 50 percent of the stock of Radiata Corporation, an S corporation. Guilda’s basis in her stock is $21,000. On May 26, 2019, Bill sells his stock, with a basis of $40,000, to Loraine for $50,000. For the 2019 tax year, Radiata Corp

> Cedar Corporation has an S corporation election in effect. During the 2019 calendar tax year, the corporation had ordinary taxable income of $200,000, and on January 15, 2019, the corporation paid dividends to shareholders in the amount of $120,000. How