Question: Jona Corporation has been using a voucher

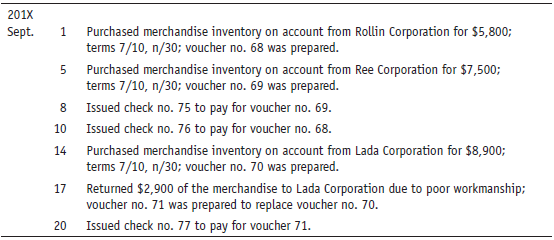

Jona Corporation has been using a voucher system for several years and records invoices at gross. Prepare entries in the voucher register and check register for the following transactions:

Transcribed Image Text:

201X Sept. Purchased merchandise inventory on account from Rollin Corporation for $5,800; terms 7/10, n/30; voucher no. 68 was prepared. 1 Purchased merchandise inventory on account from Ree Corporation for $7,500; terms 7/10, n/30; voucher no. 69 was prepared. Issued check no. 75 to pay for voucher no. 69. 10 Issued check no. 76 to pay for voucher no. 68. Purchased merchandise inventory on account from Lada Corporation for $8,900; terms 7/10, n/30; voucher no. 70 was prepared. 14 Returned $2,900 of the merchandise to Lada Corporation due to poor workmanship; voucher no. 71 was prepared to replace voucher no. 70. 17 20 Issued check no. 77 to pay for voucher 71.

> Why is a subsidiary ledger not needed for notes?

> Notes Receivable is a current liability on the balance sheet. Accept or reject. Why?

> What is the difference between finding a maturity date by (a) days or (b) months?

> Explain the parts of a promissory note.

> Spring Co. bought merchandise from All Co. with terms 2/10, n/30. Joanne Ring, the bookkeeper, forgot to pay the bill within the first 10 days. She went to Mel Ryan, the head accountant, who told her to backdate the check so that it looked like the bill

> How could Discount on Notes Payable be adjusted?

> How is the effective interest rate calculated?

> What is the normal balance of the Discount on Notes Payable account?

> F.O.B. destination means that title to the goods will switch to the buyer when goods are shipped. Do you agree or disagree? Why?

> When could interest be deducted in advance by a lender?

> List three reasons why a company may use Notes Payable instead of Accounts Payable and whether the company is the maker or payee.

> Why would a company age its Accounts Receivable?

> In which approach is the balance of the Allowance for Doubtful Accounts considered when the estimate of Bad Debts Expense is made? Please explain.

> The income statement approach used to estimate bad debts is based on Accounts Receivable on the balance sheet. Agree or disagree? Why?

> Recording Bad Debts Expense is a closing entry. True or false? Defend your position.

> Explain why the Allowance for Doubtful Accounts is a contra-asset account.

> Sean Nah, the bookkeeper for Revell Co., received a bank statement from Lone Bank. Sean noticed a $250 mistake made by the bank in the company’s favor. Sean called his supervisor, who said that as long as it benefits the company, he should not tell the b

> When an account receivable is written off, Bad Debts Expense must be debited. True or false? Please discuss.

> What is net realizable value?

> Explain the difference between F.O.B. shipping point and F.O.B. destination.

> What is the purpose of the Allowance for Doubtful Accounts?

> Pete Sazich, the accountant for Moore Company, feels that all bad debts will be eliminated if credit transactions are done by credit card. He also feels that the cost of the credit cards should be added to the price of the goods. Pete feels that in the f

> Explain the purpose of the Bad Debts Recovered account.

> What is the purpose of using a direct write-off method?

> The trial balance for Damon’s Repair Service appears in Figure 4.24. Figure 4.24: Adjustment Data to Update Trial Balance a. Insurance expired, $600. b. Repair supplies on hand, $2,400. c. Depreciation on repair equipment, $600. d. W

> Update the trial balance for Kent’s Moving Co. (Figure 4.23) for December 31, 201X. Figure 4.23: Adjustment Data to Update Trial Balance a. Insurance expired, $200. b. Moving supplies on hand, $1,100. c. Depreciation on moving truck,

> The following transactions occurred in June 201X for A. One’s Placement Agency: The chart of accounts for A. One Placement Agency is as follows: Your tasks are to do the following: a. Set up the ledger based on the chart of accounts

> On June 1, 201X, Brenda Rennicke opened Brenda’s Art Studio. The following transactions occurred in June: Your tasks are to do the following: a. Set up the ledger based on the following chart of accounts using four-column accounts. b.

> Jason Lang operates Jason’s Cleaning Service. As the bookkeeper, you have been requested to journalize the following transactions: The chart of accounts for Jason’s Cleaning Service is as follows: 201X Oct. 1 Pa

> The chart of accounts for Adler’s Delivery Service is as follows: Chart of Accounts Assets …………………………………….…..………………….………………………… Revenue Cash 111 ………………………………………………….………… Delivery Fees Earned 411 Accounts Receivable 112 …………………………………………………………… Expenses O

> From the trial balance of Girtie Lillis, Attorney-at-Law given in Figure 2.7 (40 min) on page 62, prepare (a) an income statement for the month of May, (b) a statement of owner’s equity for the month ended May 31, and (c) a balance shee

> Brett Pillows opened a consulting company, and the following transactions resulted: A. Brett invested $20,000 in the consulting agency. B. Bought office equipment on account, $8,000. C. Agency received cash for consulting work that it completed for a cl

> James Tanson, a retired army officer, opened Tanson’s Catering Service. As his accountant, analyze the transactions listed next and present them in proper form. a. The analysis of the transactions by using the expanded accounting equat

> Why doesn’t net realizable value change when an account is written off in the use of the Allowance account?

> Jody Williams, owner of Williams Home Decorating Service, has requested that you prepare from the following balances (a) an income statement for September 201X, (b) a statement of owner’s equity for September, and (c) a balance sheet as

> Journalize the following transactions: a. Sold merchandise on account to Troy Co., invoice no. 10, $50. b. Received check from Brown Co., $300, less 3% discount. c. Cash sales, $104. d. Issued credit memorandum no. 2 to Troy Co. for defective merchandis

> From the following T accounts of Bill’s Cleaning Service, (a) foot and determine ending balances, and (b) prepare a trial balance in proper form for December 201X. Cash 111 Accounts Payable 211 Cleaning Fees Earned 411 (A) 12,000 (

> Ben Shea is the accountant for Shea’s Internet Service. From the following information, his task is to construct a balance sheet as of June 30, 201X, in proper form. Could you help him? Building $ 55,000 Cash $38,000 Accounts Payab

> The following transactions occurred in the opening and operation of Brenden’s Delivery Service. A. Brenden Oulette opened the delivery service by investing $21,000 from his personal savings account. B. Purchased used delivery trucks on account, $6,000.

> From the trial balance in Figure 25.19 and the provided year-end information, prepare a worksheet for Stapel Corporation (assume no adjustments). Figure 25.19: Year-End Figures Raw materials inventory ……â&

> As the bookkeeper of Bishop Manufacturing, you are to record the following transactions in the general journal for the month of November: a. Raw materials of $78,000 were issued from the storeroom. b. Charged $62,000 of direct labor to production. c. Sup

> An analysis of the accounts of Billings Manufacturing reveals the following data for the month ended October 31, 201X: Costs Incurred: Raw materials purchased, $128,000; direct labor, $134,000; manufacturing overhead, $52,500. These specific overheads

> Glover Company has requested that you (1) assign indirect expenses to its jewelry and shoes departments as appropriate and (2) prepare an income statement for June 201X showing departmental contribution margins along with net income. Assume a 30% tax rat

> From the following partial data, prepare an income statement showing departmental income before tax along with net income for Phil’s Corporation for the year ended December 31, 201X. Net Sales, TVs …â€&br

> Explain the matching principle in relation to recording Bad Debts Expense.

> Given the following information about the clothing and hardware departments of Phillips Company, prepare a departmental expense allocation sheet showing expenses by department. Allocation Basis Rent and Insurance: …â€&brv

> From the following data, prepare in proper form an income statement showing departmental gross profit (assume a 28% tax rate) for Quick Stop for the year ended December 31, 201X. Cash ……………………………………………….………………………………….. $10,500 Accounts Receivable ………………

> From the following, construct a bank reconciliation for Capital Co. as of September 30, 201X. Checkbook balance ……………………..…………. $1,855.80 Bank statement balance ……………………………. 1975.40 Deposits in transit …………………….………….………. 271.20 Outstanding checks ………………

> The Simpson Company uses a voucher system and records invoices at gross. Record the following transactions in the voucher register and/or check register as appropriate: 201X Voucher no. 200 was prepared for the purchase of $3,900 worth of merchandis

> Sadie Corporation uses a voucher system and records invoices at gross. Record the following transactions in the voucher register and/or check register as appropriate: 201X July Purchased merchandise on account for $1,800 from Dana Company; terms 6/1

> From the information about Valdemar Corporation in Figures 22.10 and 22.11 (page 784), do the following: Figures 22.10: Figures 22.11: a. For each year calculate its current ratio and acid test ratio. b. For each year prepare the income statement in

> From the income statement (Figure 22.8) and balance sheet (Figure 22.9) of Aberson Company, compute the following for 2016: (a) current ratio, (b) acid test ratio, (c) accounts receivable turnover, (d) average collection period, (e) inventory turnover, (

> From the comparative income statement of Wood Company in Figure 22.7, do the following: Figure 22.7: a. Prepare a horizontal analysis with the amount of increase or decrease during 2016 along with the percent increase or decrease during 2015 (to the n

> From the comparative balance sheet of Lord Corporation in Figure 22.6: (a) prepare a horizontal analysis of each item for the amount of increase or decrease as well as the percent increase or decrease (to the nearest tenth of a percent); (b) vertically a

> What is the purpose of using reversing entries? Are they mandatory? When should they be used?

> From the financial statements and additional information provided in Problem 21A-1 for Dent Company, prepare a statement of cash flows using the direct method. Problem 21A-1: From the following income statement (Figure 21.12), balance sheet (Figure 21.

> From the following income statement (Figure 21.12), balance sheet (Figure 21.13), and additional data for Dent Company, prepare a statement of cash flows using the indirect method. Figure 21.12: Figure 21.13: Additional Data 1. All Plant and Equipme

> Maple Co. purchased merchandise costing $360,000. Calculate the cost of goods sold under the following situations: a. Beginning inventory $42,000 and no ending inventory b. Beginning inventory $49,000 and a $57,000 ending inventory c. No beginning inven

> Assuming a semiweekly depositor, from the following T accounts, record: (a) the July 3 payment for FICA (OASDI and Medicare) and federal income taxes, (b) the July 31 payment of SUTA tax, and (c) the July 31 deposit of any FUTA tax that may be required.

> If Joan’s Grocery Store downsized its operation during the second quarter of 201B and, as a result, paid only $6,119.83 in Form 941 taxes for the quarter that ended on June 30, 201B, should Joan’s Grocery Store make Form 941 tax deposits monthly or semiw

> Joan’s Grocery Store made the following Form 941 payroll tax deposits during the look-back period of July 1, 201A, through June 30, 201B: Quarter Ended …………………………. Amount Paid in 941 Taxes September 30, 201A …………………………………………. $15,784.01 December 31, 201

> Prepare a worksheet for Michaud Co. from the following information using Figure 11.10: Figure 11.10: a./b. Merchandise Inventory, ending c. Store Supplies on hand d. Depreciation on Store Equipment e. Accrued Salaries 13 3 4 MICHAUD CO. TRIAL BALA

> At the end of August 201X, the total amount of OASDI, $570, and Medicare, $230, was withheld as tax deductions from the employees of ABC, Inc. Federal income tax of $2,960 was also deducted from their paychecks. ABC is classified as a monthly depositor o

> Smith Computer Center had 360 pieces of merchandise inventory as of June 30, 201X.The inventory was purchased with prices as follows: Lot numbers represent oldest to newest. Assignment Using the FIFO, LIFO, and weighted-average methods, calculate the

> From the following accounts, journalize the closing entries (assume December 31). Mark Beckham, Capital 310 Gas Expense 510 70 140 Mark Beckham, Withdr. 312 Advertising Exp. 512 19 31 Income Summary 314 Dep. Exp., Taxi 516 57 Таxi Fees 410 1,200

> Temporary accounts could appear on a post-closing trial balance. Agree or disagree?

> Bates Co. had the following balances on December 31, 201X: The accountant for Bates has asked you to make an adjustment because $430 of janitorial services has just been performed for customers who had paid for 2 months. Construct a transaction analysi

> Based on the following payroll tax depositor classifications, determine the 941 tax deposit due date for each taxpayer: a. Monthly depositor, owing $1,850 tax for the third quarter. b. Monthly depositor, owing $4,100 tax for the month of May. c. Mon

> Taylor Company uses a special payroll account to pay employees. The gross amount of the payroll this week is $6,600; the net amount is $5,425. Journalize the transfer of funds to the payroll account and the distribution of paychecks to the employees.

> Prepare a worksheet for Mannon Co. from the following information using Figure 11.9: Figure 11.9: a./b. Merchandise Inventory, ending c. Store Supplies on hand d. Depreciation on Store Equipment e. Accrued Salaries 15 4 4 1 MANNON CO. TRIAL BALANC

> Oak Co. purchased merchandise costing $380,000. Calculate the cost of goods sold under the following situations: a. Beginning inventory $40,000 and no ending inventory b. Beginning inventory $54,000 and a $56,000 ending inventory c. No beginning invento

> Little Co. had the following balances on December 31, 201X: The accountant for Little has asked you to make an adjustment because $420 of janitorial services has just been performed for customers who had paid for 2 months. Construct a transaction analy

> Autumn Company has five salaried employees. Your task is to use the following information to prepare a payroll register to calculate net pay for each employee: Assume the following: 1. FICA OASDI is 6.2% on $117,000; FICA Medicare is 1.45% on all earni

> Go to the 2013 annual report for Kellogg’s Company at http://investor.kelloggs.com/ investor-relations/annual-reports and find the consolidated balance sheet. What is the cost of treasury stock for Kellogg’s in 2013 and 2012?

> Go to the 2013 annual report for Kellogg’s Company at http://investor.kelloggs .com/investor-relations/annual-reports and explain why Kellogg’s is not classified as a partnership.

> Go to the 2013 annual report for Kellogg’s Company at http://investor.kelloggs.com/ investor-relations/annual-reports and find out how inventories are valued. How much inventory did Kellogg’s have in 2013?

> Amy Jak is the National Sales Manager of Land.com. To get sales up to the projection for the old year, Amy asked the accountant to put the first 2 weeks’ sales in January back into December. Amy told the accountant that this secret would only be between

> Several banks have offered loans to Smith Computer Center for its expansion. However, Feldman wants to weigh each option to determine the best financial situation for the company. Currently, Smith Computer Center is trying to collect from its customers t

> Go to http://investor.kelloggs.com/investor-relations/annual-reports to access the Kellogg’s 2013 Annual Report. See Note 17 supplemental financial statement data and find the balance in Allowance for Doubtful Accounts for 2012 and 2013.

> Go to http://investor.kelloggs.com/investor-relations/annual-reports to access the Kellogg’s 2013 Annual Report and find the Consolidated Statement of Income. What is the cost of goods sold in 2013?

> Go to http://investor.kelloggs.com/investor-relations/annual-reports to access the Kellogg’s 2013 Annual Report and see how Kellogg’s records revenue. You will find this information in Note 1.

> Go to http://investor.kelloggs.com/investor-relations/annual-reports to access the Kellogg’s 2013 Annual Report. Go to Notes to Consolidated Financial Statements and find Note 8: Pension Benefits. How much did Kellogg’s spend to fund the 401(k) plans and

> Go to http://investor.kelloggs.com/investor-relations/annual-reports/ to access the Kellogg’s 2013 Annual Report and find out what the fiscal year is for Kellogg’s Company.

> When you look at the 2013 annual report for Kellogg’s Company at http://investor .kelloggs.com/investor-relations/annual-reports, do you think Kellogg’s uses a voucher system?

> Go to the 2013 annual report for Kellogg’s Company at http://investor.kelloggs.com/ investor-relations/annual-reports and find the Statement of Cash Flows for Kellogg’s. What is net cash provided by operations in 2013?

> Go to the annual 2013 report for Kellogg’s Company at http://investor.kelloggs .com/investor-relations/annual-reports under Financing Activities, Note 6. What is Kellogg’s scheduled repayment of long-term debt for principal in 2013 to 2017 (in millions)?

> Go to http://investor.kelloggs.com/investor-relations/annual-reports/ to access the Kellogg’s 2013 Annual Report, and look at how Kellogg’s depreciates its equipment. How is the equipment recorded?

> Why journalize adjusting entries after the formal reports in a manual system have been prepared?

> What is a contra-cost?

> Revenue is an asset. True or false? Please explain.

> Using the worksheet in Chapter 11 for Smith Computer Center, journalize and post the adjusting entries and prepare the financial statements.

> A balance sheet tells a company where it is going and how well it performs. True or false? Please explain.

> The total of the left-hand side of the accounting equation must equal the total of the right-hand side. True or false? Please explain.

> Define capital.

> List the three elements of the basic accounting equation.

> How has technology affected the role of the bookkeeper?

> How are businesses classified?

> Define, compare, and contrast sole proprietorships, partnerships, and corporations.

> What is the end product of the accounting process?

> What is an operating cycle?