Question: Kaj Rasmussen founded Scandi Home Furnishings as

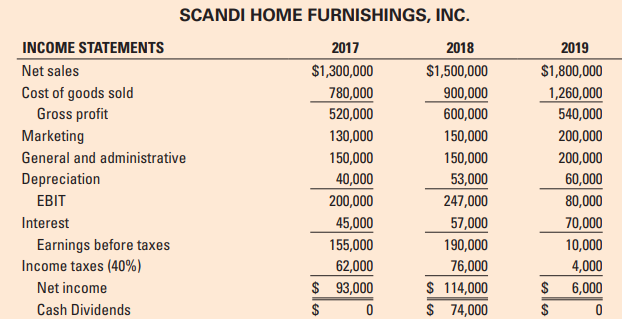

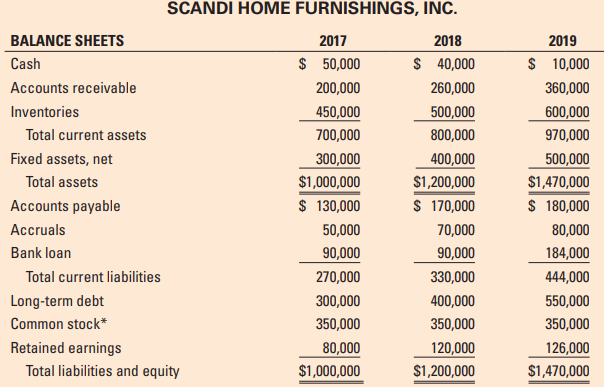

Kaj Rasmussen founded Scandi Home Furnishings as a corporation during mid-2016. Sales during the first full year (2017) of operation reached $1.3 million. Sales increased by 15 percent in 2018 and another 20 percent in 2019. However, after increasing in 2018 over 2017, profits fell sharply in 2019, causing Kaj to wonder what was happening to his “pride and joy†business venture. After all, Kaj worked as closely as possible to a 24/7 pace, beginning with the startup of Scandi and continuing through the first three full years of operation. Scandi Home Furnishings, located in eastern North Carolina, designs, manufactures, and sells Scandinavian designed furniture and accessories to home furnishings retailers.

The modern Scandinavian design has a streamlined and uncluttered look. While this furniture style is primarily associated with Denmark, both Norwegian and Swedish designers have contributed to the allure of Scandinavian home furnishings. Some say that the inspiration for the Scandinavian design can be traced to the elegant curves of art nouveau from which designers were able to produce aesthetically pleasing, structurally strong modern furniture.

Danish furnishings and the home furnishings produced by other Scandinavian countries—Sweden, Norway, and Finland—are made using wood (primarily oak, maple, and ash), aluminum, steel, and high-grade plastics. Kaj grew up in Copenhagen, Denmark, and received an undergraduate degree from a technical university in Sweden. As is typical in Europe, Kaj began his business career as an apprentice at a major home furnishings manufacturer in Copenhagen. After learning the trade, he quickly moved into a management position in the firm. However, after a few years, Kaj realized that what he really wanted to do was to start and operate his own Scandinavian home furnishings business. At the same time, after travelling throughout the world, he was sure that he wanted to be an entrepreneur in the United States. Kaj moved to the United States in early 2016. With $140,000 of his personal assets and $210,000 from venture investors, he began operations in mid-2016. Kaj, with a 40 percent ownership interest and industry-related management expertise, was allowed to operate the venture in a way that he thought was best for Scandi. Four years later, Kaj is sure he did the right thing. Following are the three years of income statements and balance sheets for Scandi Home Furnishings.

Kaj felt that he would need to continue to expand sales to maintain a competitive advantage. After first concentrating on selling Scandinavian home furnishings in the Northeast in 2017 and 2018, he decided to enter the West Coast market. An increase in expenses occurred associated with identifying, contacting, and selling to home furnishings retailers in California, Oregon, and Washington. Kaj Rasmussen hopes that you can help him better understand what has been happening to Scandi Home Furnishings from both operating and financial standpoints.

A. An analysis of the cash conversion cycle should also help Kaj understand what has been happening to the operations of Scandi. Prepare an analysis of the average conversion periods for the three components of the cash conversion cycle for 2017–2018 and 2018–2019. Explain what has happened in terms of each component of the cycle.

B. Kaj has been able to obtain some industry ratio data from the home furnishings industry trade association to which he belongs. The industry association collects proprietary financial information from members of the association, compiles averages to protect the proprietary nature of the information, and provides averages for use by individual trade association members. Over the 2017–2018 and 2018–2019 periods, the inventory-to-sale conversion period has averaged 200 days, while the sale-to-cash conversion period (days of sales outstanding) for the industry has averaged 60 days. How did Scandi’s operations compare with these industry averages in terms of these two components of the cash conversion cycle?

> On January 1, 20X1, Babson, Inc., leased two automobiles for executive use. The lease requires Babson to make five annual payments of $13,000, beginning January 1, 20X1. At the end of thelease term on December 31, 20X5, Babson guarantees that the residua

> Monk Company, a dealer in machinery and equipment, leased equipment with a 10-year life to Leland Inc. on July 1, 20X1. The fair value of the leased equipment at July 1, 20X1, is $1,849,591. The lease is appropriately accounted for as a sale by Monk and

> On January 1, 20X0, Roland Inc. issued $125 million of 8% bonds at par. The bonds pay interest semiannually on June 30 and December 31 of each year, and they mature in 15 years. OnDecember 31, 20X1 (before the interest payment is made), the bonds are tra

> First Solar, Inc., adopted the new revenue recognition standard, ASC Topic 606, in 2017. The following are condensed versions of First Solar’s balance sheet, income statement, and cash flow statement, as they were presented in the company’s 2017 annual r

> On January 1, 20X1, Brooks Energy issued $200 million of 15-year, floating-rate debentures atpar value. The debentures pay interest on June 30 and December 31 of each year. The floatinginterest rate is set equal to “LIBOR plus 6%” on January 1 of each ye

> Zero coupon bonds pay no interest—the only cash investors receive is the lump-sum principalpayment at maturity. On January 1, 20X1, The Ledge Inc. issued $250 million of zero couponbonds at a market yield rate of 12%. The bonds mature in 20 years. Requi

> Webb Company has outstanding a 7% annual, 10-year, $100,000 face value bond that it hadissued several years ago. It originally sold the bond to yield 6% annual interest. Webb uses theeffective interest rate method to amortize the bond premium. On June 30

> On February 1, 20X1, Davis Corporation issued 12%, $1,000,000 par, 10-year bonds for $1,117,000. Davis reacquired all of these bonds at 102% of par, plus accrued interest, on May 1, 20X3, and retired them. The unamortized bond premium on that date was $7

> On January 2, 20X1, West Company issued 9%, 10-year bonds in the amount of $500,000 thatmature on December 31, 20X9. The bonds were issued for $469,500 to yield 10%. Interest ispayable annually on December 31. West uses the effective interest method of a

> On January 1, 20X1, when the market interest rate was 14%, Luba Corporation issued 10-yearbonds in the face amount of $500,000 with interest at 12% payable semiannually. The bondsmature on December 31, 20X9. Required: Calculate the bond discount at issu

> By July 1, 20X2, the market yield on the Akers Company bonds described in E12-1 had risento 10%. Required: What was the bonds’ market price on July 1, 20X2?

> On January 1, 20X1, Tusk Company issued $300 million of bonds with a 6% coupon interestrate. The bonds mature in 10 years and pay interest annually on December 31 of each year. Themarket rate of interest on January 1, 20X1, for bonds of this risk class w

> On July 1, 20X1, Mirage Company issued $250 million of bonds with an 8% coupon interestrate. The bonds mature in 10 years and pay interest semiannually on June 30 and December 31of each year. The market rate of interest on July 1, 20X1, for bonds of this

> Akers Company sold bonds on July 1, 20X1, with a face value of $100,000. These bonds aredue in 10 years. The stated annual interest rate is 6% per year, payable semiannually on June 30and December 31. These bonds were sold to yield 8%. Required: How muc

> The following events and transactions related to David Company occurred after the balance sheet date of December 31, 20X1, and before the financial statements were issued in 20X2. None of the items is reflected in the financial statements as of December

> Raytheon Company’s 2018 Form 10-K states that sales to the U.S. government comprise 68% of its 2018 total net sales and sales to foreign governments through the U.S. government comprise 13% of its 2018 total net sales. Required: 1. Why does the SEC requ

> Describe the four successful rounds of venture financing (A through D) achieved by Spatial Technology in terms of sources and amounts. What additional financing sources have been used?

> Table 4 presents Eco-Products’ statement of cash flows for 2007. Was the firm building or burning cash in its operating activities? When also considering cash flows from investing activities, was Eco-Products in a net cash build or burn

> Discuss the competition faced by Spatial Technology in conjunction with 3D modeling technology in general and specifically with its ACIS product.

> Tables 2 and 3 present Eco-Products’ financial statement information for 2005, 2006, and 2007. Prepare a ratio analysis of the firm’s financial performance over the 2005–2007 period. Data from Table

> Describe Spatial Technology’s pricing and marketing strategy.

> What is the size of the domestic and global markets for food service disposable packaging? Who are the major competitors producing/selling environmentally friendly food service products? What intellectual property or competitive advantages does Eco Produ

> Describe the experience and expertise characteristics of the management team. Answer: The management team has a founder that is well known in the field with previous successful experience. The operations and financing members of the team have been sub

> Discuss Eco-Products’ revenue growth-based “business model” that evolved over the 2004 through early 2008 period in terms of (a) production versus distribution, (b) product line development, (c) branding, etc.

> What intellectual properly, if any, does Spatial Technology possess?

> Describe Eco-Products’ early history (1990–2003). Would you view the firm during that period as being a lifestyle business, an entrepreneurial venture, or something else? Why?

> From the Headlines—Sustainable Northwest: Describe Sustainable Northwest’s short-term inflows and outflows of cash. What would you expect to be the main ingredients of each part of the cash conversion cycle?

> Describe Spatial Technology’s business model in terms of revenues, profits, and cash flows.

> Francine Delgado has developed a business plan for producing and selling a new hair care product that emits nutrients to the scalp when used. The product residues have been judged to be environmentally safe. Following are her projected partial financial

> Refer to the information on the three ventures in Problem 2. A. If each venture had net sales of $10 million, calculate the dollar amount of net profit and total assets for Venture XX, Venture YY, and Venture ZZ. B. Which venture would have the largest d

> The Biometrix Corporation has been in operation for one full year (2019). Financial statements follow. Biometrix’s management is interested in determining the value of the venture as of the end of 2019. Sales are expected to grow at a 2

> The Minoso Corporation anticipates a 20 percent increase in sales for 2020, 2021, and 2022. Minoso is currently operating at full capacity and thus expects to increase its investment in both current and fixed assets in order to support the increase in fo

> Artero Corporation, discussed in Problems 7 and 12, is a retailer of toy products. This is a continuation of Problem 12. The firm’s management team recently extended the monthly sales forecasts through the last six months of 2021. Arter

> Artero Corporation, discussed in Problem 7, is a retailer of toy products. The firm’s management team recently extended the monthly sales forecasts that were prepared for the last three months of 2020 for an additional six months in 202

> Short-term financial planning for the PDC Company was described earlier in this chapter. Refer to the PDC Company’s projected monthly operating schedules in Table 6.2. PDC’s monthly sales for the remainder of 2020 are

> Several years ago, Dick and Barbara Harris were asked to attend an organizational meeting for a newly forming neighborhood babysitting cooperative. The idea was simple. Concerned and caring parents would join together in the cooperative and exchange baby

> Interact Systems, Inc., has developed software tools that help hotel chains solve application integration problems. Interact’s application integration server (AIS) provides a two-way interface between a central reservations system (CRS) and a property ma

> As your venture has moved from the development stage to the startup stage, a number of trade secrets have been developed along with an extensive client list. You are in the business of developing and installing computer networks for law firms. A. Your ma

> LearnRite.com offers e-commerce service for children’s edutainment products and services. The word edutainment is used to describe software that combines educational and entertainment components. Valuable product information and detaile

> Interact Systems, Inc., has developed software tools that help hotel chains solve application integration problems. Interact’s application integration server (AIS) provides a two-way interface between central reservations systems (CRS) and property manag

> Brian Motley founded MiniDiscs Corporation at the end of 2014 with a $1 million investment. After nearly one year of development, the venture produced an optical storage disk (about the size of a silver dollar) that could store more than 500 megabytes of

> Wok Yow Imports, Inc., is a rapidly growing, closely held corporation that imports and sells Asian style furniture and accessories at several retail outlets. The equity owners are considering selling the venture and want to estimate the enterprise or ent

> In 2019, Jennifer (Jen) Liu and Larry Mestas founded Jen and Larry’s Frozen Yogurt Company, which was based on the idea of applying the microbrew or microbatch strategy to the production and sale of frozen yogurt. Jen and Larry began producing small quan

> Interact Systems, Inc., has developed software tools that help hotel chains solve application integration problems. Interact’s application integration server (AIS) provides a two-way interface between central reservations systems (CRS) and property manag

> The SoftTec Products Company is a successful, small, rapidly growing, closely held corporation. The equity owners are considering selling the firm to an outside buyer and want to estimate the value of the firm. Following is last year’s

> The Pharma Biotech Corporation spent several years working on developing a DHA product that can be used to provide a fatty-acid supplement to a variety of food products. DHA stands for docosahexaenoic acid, an omega-3 fatty acid found naturally in cold-w

> The Alpha One Software Corporation was organized to develop software products that would provide Internet-based firms with information about their customers. As a result of initial success, the venture’s premier product allows firms wit

> The Castillo Products Company was started in 2017. The company manufactures components for personal digital assistant (PDA) products and for other handheld electronic products. A difficult operating year, 2018, was followed by a profitable 2019. The foun

> Compare and contrast (a) balance sheet insolvency and (b) cash flow insolvency.

> Kaj Rasmussen founded Scandi Home Furnishings as a corporation during mid-2016. Sales during the first full year (2017) of operation reached $1.3 million. Sales increased by 15 percent in 2018 and another 20 percent in 2019. However, after increasing in

> In 2019, Jennifer (Jen) Liu and Larry Mestas founded Jen and Larry’s Frozen Yogurt Company, which was based on the idea of applying the microbrew or microbatch strategy to the production and sale of frozen yogurt. (The reader may recall that we introduce

> Identify a successful entrepreneurial venture that has been in business at least three years. A. Use historical revenue information to examine how this particular venture moved through its life cycle stages. Determine the length of the development stage,

> The following ventures have supplied information on how they are being financed. Link the type and sources of financing to where each venture is likely to be in its life cycle. A. Voice River provides media-on-demand services via the Internet. Voice Rive

> The Salza Technology Corporation successfully increased its “top line” sales from $375,000 in 2018 to $450,000 in 2019. Net income also increased as did the venture’s total assets. You have been asked

> Rework Problem 4 based on the assumption that, because of an unexpected order, PDC’s sales are forecasted to be $160,000 for September 2020. Data from Problem 4: The PDC Company was described earlier in this chapter. Refer to the PDC C

> Rework Problem 3 based on the assumption that, because of an unexpected order, PDC’s sales are forecasted to be $160,000 for September 2020. Data from Problem 3: The PDC Company was described earlier in this chapter. Refer to the PDC C

> The PDC Company was described earlier in this chapter. Refer to the PDC Company’s projected monthly operating schedules in Table 6.2. PDC’s sales are projected to be $80,000 in September 2020. A. Prepare PDCâ

> The PDC Company was described earlier in this chapter. Refer to the PDC Company’s projected monthly operating schedules in Table 6.2. PDC’s sales are projected to be $80,000 in September 2020. A. Prepare PDCâ

> In the second year of operation, the Capital-Ideas Company forecasts revenues to grow to $5 million and expenses, before income tax, to be 70 percent of revenues. Rework Parts A, B, and C of Problem 5 to reflect this new level of revenues and expenses.

> Safety-First, Inc., makes portable ladders that can be used to exit second-floor levels of homes in the event of fire. Each ladder consists of fire-resistant rope and high-strength plastic steps. A lightweight fire-resistant cape with a smoke filter is i

> Make use of the financial statement data provided in Problem 8 for Safety-First, Inc. A. Calculate the operating profit margins and the NOPAT margins in 2018 and 2019 for Safety-First, Inc. What changes occurred? B. Calculate the operating return on asse

> Refer to the financial statement data provided below for Safety-First, Inc. A. Calculate the net profit margin, the sales-to-total-assets ratio, and the equity multiplier for both 2018 and 2019 using year-end (rather than average) balance sheet data. B.

> Use the financial statement data for Castillo Products presented in Problem 6. A. Calculate the net profit margin in 2018 and 2019 and the sales-to-total-assets ratio using year-end data for each of the two years. B. Use your calculations from Part A to

> The Castillo Products Company was started in 2017. The company manufactures components for personal digital assistant (PDA) products and for other hand-held electronic products. A difficult operating year, 2018, was followed by a profitable 2019. However

> Following are two years of income statements and balance sheets for the Munich Exports Corporation. A. Calculate the cash build, cash burn, and net cash burn or build for Munich Exports in 2019. B. Assume that 2020 will be a repeat of 2019. If your answe

> Use the financial statement data for the Bike-With-Us Corporation provided in Problem 3 to make the following calculations: A. Calculate the operating return on assets. B. Determine the effective interest rate paid on the long-term debt. C. Calculate the

> LeAnn Sands has reason to believe that 2020 will be a replication of 2019 (see Problem 8) except that cost of goods sold is expected to be 65 percent of the estimated $450,000 in revenues. Other income statement relationships are expected to remain the s

> LeAnn Sands wants to conduct revenue breakeven analyses of Salza Technology Corporation for 2019. Income statement information is shown in Problem 8. For 2019, the firm’s cost of goods sold is considered to be variable costs, and operating expenses are c

> Rework Problem 2 under the assumption that, in addition to your venture’s taxable income of $50,000, you expect to personally earn another $10,000 from a second job. Data from Problem 2: Assume your new venture, organized as a proprietorship, is in its

> In early 2013, Jennifer (Jen) Liu and Larry Mestas founded Jen and Larry’s Frozen Yogurt Company, which was based on the idea of applying the microbrew or micro batch strategy to the production and sale of frozen yogurt. They began producing small quanti

> The EnCal Corporation is a small, West Coast-based power company specializing in power generation methods that use clean-burning fuels and renewable natural resources. However, due to a complex and confusing power-pricing structure, EnCal is reeling from

> Following are the financial statements for the Chenhai Manufacturing Corporation for 2018 and 2019. The venture is in financial distress and hopes to turn around its financial performance in the near future. A. Calculate the sale-to-cash conversion perio

> New information for Gamma Systems Manufacturing Corporation has been brought to management’s attention. Use the financial statement information in Problem 5 and take into consideration that sales will grow at a 15 percent rate in 2020 and at a 10 percent

> Gamma Systems Manufacturing Corporation has reached its maturity stage, and its net sales are expected to grow at a 6 percent compound rate for the foreseeable future. Management believes that, as a mature venture, the appropriate equity discount rate fo

> Benito Gonzalez founded and grew the BioSystems Manufacturing Corporation over a several-year period. However, Benito has decided to harvest or exit BioSystems now at the end of 2019 with the intention of starting a new entrepreneurial venture. The Fuji

> Rework Problem 8 assuming that the earnings before interest and taxes are only $320,000 while capital expenditures (CAPEX) are $110,000. Assume the other information remains the same. Data from Problem 8: Find the enterprise valuation cash flow expected

> Show how your answers for Problem 3 would change if the new offering price was $0.80 for 1,500 shares. Assume other things remain the same. Data from Problem 3: Calculate the conversion price formula (CPF) and market price formula (MPF) prices for an of

> The Datametrix Corporation has been in operation for one full year (2019). Financial statements are shown below. Sales are expected to grow at a 30 percent annual rate for each of the next three years (2020, 2021, and 2022) before settling down to a long

> Why is the market value of currently issued debt subtracted from the enterprise value (in a debt-and-equity-only firm) to arrive at the value of equity? Why are future debt issues ignored in this subtraction?

> Suppose you are considering a venture conducting a current financing round involving an issue of 100,000 new shares at $3. The existing number of shares outstanding is 200,000. What are the related pre-money and post-money valuations?

> Jen and Larry’s frozen yogurt venture described in Problem 3 required some investment in bricks and mortar. Initial specialty equipment and the renovation of an old warehouse building in lower downtown, referred to as LoDo, cost $450,000 at the beginning

> Rework the two-stage example of Section 11.5 with first- and second-round required returns of 55 percent and 40 percent (instead of the original 50 percent and 25 percent). Interpret your results as they relate to the founders’ ownership and the feasibil

> Rework the two-stage example of Section 11.5 with 1,000,000 initial founders’ shares (instead of the original 2,000,000 shares). What changes? Data from Example 11.5: For most early-stage ventures, there are at least two strong motives for having an equ

> Return to the discussion of the FrothySlope venture at the beginning of the chapter. Formulate an answer for each of the five questions that are posed under the heading “What Is a Venture Worth?”

> Following are financial statements (historical and forecasted) for the Global Products Corporation. A. Assume that the cash account includes only required cash. Determine the dollar amount of equity valuation cash flow for 2020. B. Now assume that Global

> Ben Toucan, owner of The Aspen Restaurant, wants to determine the present value of his investment. The Aspen Restaurant is currently in the development stage but Toucan hopes to “begin” operations early next year. After-tax cash flows during the next fiv

> Following are two years of income statements and balance sheets for the Munich Exports Corporation. A. Munich has a target dividend payout of 40 percent of net income. Based on the 2019 financial statements relationships, estimate the sustainable sales g

> The Minoso Corporation anticipates a 20 percent increase in sales for 2020 over its 2019 level. Minoso is currently operating at full capacity and thus expects to increase its investment in both current and fixed assets in order to support the increase i

> Petal Providers Corporation, described, is interested in estimating its additional financing needed to support a rapid increase in sales next year. Last year, revenues were $1 million; net profit was $50,000; investment in assets was $750,000; payables a

> Two Rules (504 and 506) under Reg D relate to the (a) amount of offerings and (b) number of investors. Match Rules 504, 506, or “none” with each of the following: A. $5 million offering limit (in a twelve-month period) B. $1 million offering limit (in a

> Assume that BKAngel’s initial investments in the three ventures had been Venture 1 5 $500,000, Venture 2 5 $300,000, and Venture 3 5 $200,000, with each investment having achieved the same cash flows and ending values. A. Calculate the percentage rate of

> Refer to the Mini Case at the end of the chapter involving Jen and Larry’s Frozen Yogurt Company. A. Calculate the dollar amount of NOPAT if Jen and Larry’s venture achieves the forecasted $1.2 million in sales in 2020. What would NOPAT be as a percent o

> Refer to Problem 13 for Voice River, Inc. A. Estimate the WACC if the cost of common equity capital is 20 percent. B. Estimate the WACC if the cost of common equity capital is at the representative target rate of 25 percent for typical ventures in their

> Castillo Products Company, described below, improved its operations from a net loss in 2018 to a net profit in 2019. While the founders, Cindy and Rob Castillo, are happy about these developments, they are concerned about how long the firm took to comple

> Two years of financial statement data for the Munich Export Corporation are shown below. A. Calculate the inventory-to-sale, sale-to-cash, and purchase-to-payment conversion periods for Munich Exports for 2019. B. Calculate the length of Munich Exports&a

> Artero Corporation is a traditional toy products retailer that recently started an Internet-based subsidiary that sells toys online. A markup is added on goods the company purchases from manufacturers for resale. Swen Artero, the company president, is pr

> What is the purpose of the U.S. Bankruptcy Code? What are some of the characteristics of ventures that use instead of private liquidation?

> From the Headlines—Boom Supersonic: Comment on Boom Supersonic’s potential to eventual provide liquidity to its investors through an IPO or a sale. Which one seems more likely to you? Why?

> What is the enterprise (entity) method of valuation, and how does it differ from the other equity methods?

> From the Headlines—Excaliard: What ingredients would you need to conduct a VCSC valuation for Excaliard? Does your calculation suggest that a $15.5 million Series A round is reasonable?