Question: Kali Corp. established a petty cash fund

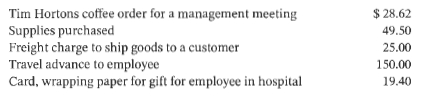

Kali Corp. established a petty cash fund early in 2020 to increase the efficiency of accounting for small cash transactions and to improve control over many of the small expenditures it makes. The company decided to set up the imprest fund at $500 and a cheque was issued for this amount and given to the petty cash custodian. During January, the petty cash custodian made the following disbursements and placed a receipt for each in the cash box provided.

The petty cash was replenished on January 22 when the amount of cash in the fund was $225.15. In June, after six months' experience with the fund , management decided to increase the imprest fund nto $700.

Instructions

a. Prepare the journal entries to establish the petty cash fund, to reimburse it on January 22, and to increase the fund in June.

b. Describe where the petty cash will be reported on Kali Corp.'s financial statements.

c. Explain briefly why many companies have a policy of reimbursing the petty cash fund on each balance sheet date.

> Your client, Danyleyko Leasing Company, is preparing a contract to lease a machine to Souvenirs Corporation for a period of 25 years. Danyleyko has an investment cost of $365,755 in the machine, which has a useful life of 25 years and no salvage value at

> Viavelo Inc. manufactures cycling equipment. Recently, the company's vice-president of operations has requested construction of a new plant to meet the increasing demand for the company's bikes. After a careful evaluation of the request, the board of dir

> LEW Company purchased a machine at a price of $100,000 by signing a note payable, which requires a single payment of $123,210 in two years. a. Assuming annual compounding of interest, what rate of interest is being paid on the loan? Use either a financia

> HQ Ltd. purchased a used truck from Trans Auto Sales Inc. HQ paid a $4,000 down payment and signed a note that calls for 36 payments of $1,033.34 at the end of each month. The stated rate of interest in the note is 4%. As an incentive for entering into t

> Nevine Corporation owns and manages a small 10-store shopping centre, which it classifies as an investment property. Nevine has a May 31 year end and initially recognized the property at its acquisition cost of $10.8 million on June 2, 2019. The acquisit

> Plaza Holdings Inc., a publicly listed company in Canada, ventured into construction of a mega shopping mall in Edmonton, which is rated as the largest shopping mall in North America. The company's board of directors, after much market research, decided

> On March 1 2020, Russell Winery Ltd. purchased a five-hectare commercial vineyard for $1,050,000. The total purchase price was based on appraised market values of the building, grapevines, and equipment ($580,000, $260,000, and $210,000, respectively). R

> Light stone Equipment Ltd. wanted to expand into New Brunswick and was impressed by the provincial government's grant program for new industry. Once it was sure that it would qualify for the grant program, it purchased property in downtown Saint John on

> Jamil Jonas is an accountant in public practice as a sole proprietor. Not long ago, Jamil struck a deal with his neighbor Ralph to prepare Ralph's business income tax and GST returns for 2020 in exchange for Ralph's services as a landscaper. Ralph provid

> Delray Inc. follows IFRS and has the following amounts for the year ended December 31, 2020: gain on disposal of FV-NI investments (before tax), $15,000; loss from operation of discontinued division (net of tax), $42,000; income from operations (before t

> Cannon Ltd. purchased an electric wax melter on April 30, 2020, by trading in its old gas model and paying the balance in cash. The following data relate to the purchase: Instructions Assuming that Cannon's fiscal year ends on December 31 and depreciat

> On September 1, 2020, Rupert Ltd. Purchased equipment for $30,000 by signing a two-year note payable with a face value of $30,000 due on September 1, 2022. The going rate of interest for this level of risk was 8%. The company has a December 31 year end.

> Native Inc. decided to purchase equipment from Central Ontario Industries on January 2, 2020, to expand its production capacity to meet customers' demand for its product. Native issued a $900,000, five-year, non-interest bearing note to Central Ontario f

> In early February 2020, Huey Corp. began construction of an addition to its head office building that is expected to take 18 months to complete. The following 2020 expenditures relate to the addition: On February 1, Huey issued a $100,000, three-year not

> The following three situations involve the capitalization of borrowing costs for public companies following IFRS. Situation 1 On January 1, 2020, Oksana Inc. signed a fixed-price contract to have Builder Associates construct a major head office facility

> On December 31, 2020, Omega Inc., a public company, borrowed $3 million at 12% payable annually to finance the construction of a new building. In 2021, the company made the following expenditures related to this building structure (unless otherwise noted

> The following transactions occurred during 2020. Assume that depreciation of 10% per year is charged on all machinery and 5% per year on buildings, on a straight-line basis, with no estimated residual value. Assume also that depreciation is charged for a

> On January 1, 2020, the accounting records of Sasseville Ltee included a debit balance of $15 million in the building account and of $12 million in the related accumulated depreciation account. The building was purchased in January 1980 for $15 million,

> On January l, 2020, Algo Ltd. acquires a building at a cost of $230,000. The building is expected to have a 20-year life and no residual value. The asset is accounted for under the revaluation model, using the asset adjustment method. Revaluations are ca

> A partial statement of financial position of Blue water Ltd. on December 31, 2019, showed the following property, plant, and equipment assets accounted for under the cost model (accumulated depreciation includes depreciation for 2019): Blue water uses

> On January l , 2020, Twist Corp. had cash and common shares of $60,000. At that date, the company had no other asset, liability, or shareholders' equity balances. On January 2, 2020, Twist paid $40,000 cash for equity securities that it designated as fai

> Wen Corp., a public company located in Manitoba, both purchases and constructs various pieces of machinery and equipment that it uses in its operations. The following items are for machinery that was purchased and a piece of equipment that was constructe

> In fiscal 2020, Ivanjoh Realty Corporation purchased unimproved land for $55,000. The land was improved and subdivided into building Jots at an additional cost of $34,460. These building lots were all the same size but, because of differences in location

> Iqbal Corporation uses the lower of FIFO cost and net realizable value method on an individual item basis, applying the direct method. The inventory at December 31, 2019, included product AG. Relevant per-unit data for product AG follow: There were 1,0

> The net income per books of Russell Industries Limited was determined without any knowledge of the following errors. The 2015 year was Russell's first year in business. No dividends have been declared or paid. Instructions a. Prepare a work sheet to sh

> Eureka Limited has a calendar-year accounting period. The following errors were discovered in 2020. 1. The December 31, 2018 merchandise inventory had been understated by $51,000. 2. Merchandise purchased on account in 2019 was recorded on the books for

> At December 31, 2020, Igor Ltd. has outstanding non cancellable purchase commitments for 32,500 liters of raw material at $2.00 per liter. The material will be used in Igor's manufacturing process, and the company prices its raw materials inventory at co

> During 2020, Buildit Furniture Limited purchased a railway carload of wicker chairs. The manufacturer of the chairs sold them to Buildit for a lump sum of $59,850, because it was discontinuing manufacturing operations and wanted to dispose of its entire

> In an annual audit of Solaro Company Limited, you find that a physical inventory count on December 31, 2020, showed merchandise of $441,000. You also discover that the following items were excluded from the $441,000: 1. Merchandise of $61,000 is held by

> Jaeco Corporation asks you to review its December 31, 2020 inventory values and prepare the adjustments that are needed to the books. The following information is given to you: 1. Jaeco uses the periodic method of recording inventory. A physical count re

> The financial statements of Trifolium Corporation for fiscal 2018 to fiscal 2020 are as follows (in thousands): Instructions a. Calculate Trifolium's (1) inventory turnover and (2) average days to sell inventory for each of the two years ended in 2020

> Cyan Corporation is a manufacturer of paints and specialty coatings. In March 2020, Beck Inc. filed a lawsuit against Cyan Corporation for alleged patent infringement, claiming $1.1 million in damages. Cyan's lawyer disputed the claim, but in December 20

> Nicholas's Christmas Tree Farm Ltd. grows pine, fir, and spruce trees. The farm cuts and sells trees during the Christmas season and exports most of the trees to the United States. The remaining trees are sold to local tree-lot operators. It normally tak

> The inventory of 3T Company on December 31, 2020, consists of the following items. Instructions a. Determine the inventory as at December 31, 2020, by the lower of cost and net realizable value method, applying this method directly to each item. b. Det

> As a result of its annual inventory count, Tarweed Corp. determined its ending inventory at cost and at lower of cost and net realizable value at December 31, 2019, and December 31, 2020. December 31, 2019, was Tarweed's first year end. This information

> Information is presented in E8.l 7 on the inventory of mini-kettles at Funnell Company Limited for the month of May. Instructions a. Assuming that the perpetual inventory method is used, calculate the inventory cost at May 31 under each of the following

> Schonfeld Corporation began operations on December 1, 2019. The only inventory transaction in 2019 was the purchase of inventory on December 10, 2019, at a cost of $20 per unit. None of this inventory was sold in 2019. Relevant information for fiscal 202

> Two or more items are omitted in each of the following tabulations of income statement data for a business following ASPE. Instructions Fill in the amounts that are missing.

> The Ogale Equipment Corporation maintains a general ledger account for each class of inventory, debiting the individual accounts for increases during the period and crediting them for decreases. The transactions that follow are for the Raw Materials inve

> On April 1, 2020, Ibrahim Corporation assigns $400,000 of its accounts receivable to First National Bank as collateral for a $200,000 loan that is due mJuly 1, 2020. The assignment agreement calls for Ibrahim to continue to collect the receivables. First

> By December 31, 2020, Clearing Corp. had performed a significant amount of environmental consulting services for Rank Ltd. Rank was short of cash, and Clearing agreed to accept a $200,000, non-interest-bearing note due December 31, 2022, as payment in fu

> On July 1, 2020, Agincourt Inc. made two sales: 1. It sold excess land in exchange for a four-yea r, non-interest-bearing promissory note in the face amount of $1,101,460. The land's carrying value is $590,000. 2. It rendered services in exchange for an

> Environmental Corporation specializes in the production and sale of eco friendly packaging. In 2020, Environmental reported net income (earnings) in excess of analyst expectations. This included a significant gain on disposal of investments in the year a

> On September 1, 2020, Myo Inc. sold goods to Khin Corporation, a new customer. Before shipping the goods, Myo's credit and collections department conducted a procedural credit check and determined that Khin is a high credit-risk customer. As a result, My

> Little Corp. was experiencing cash flow problems and was unable to pay its $105,000 account payable to Big Corp. when it fell due on September 30, 2020. Big agreed to substitute a one-year note for the open account. The following two options were present

> At January 1, 2020, the credit balance of Andy Corp.'s Allowance for Doubtful Accounts was $400,000. During 2020, the bad debt expense entry was based on a percentage of net credit sales. Net sales for 2020 were $80 million, of which 90% were on account.

> At the end of 2020, Perez Corporation has accounts receivable of $2.5 million and an allowance for doubtful accounts of $120,000. On January 16, 2021, Perez determined that its $20,000 receivable from Morganfield Ltd. will not be collected, and managemen

> LeB!anc Inc. shows a balance of $519,289 in the Accounts Receivable account on December 31, 2020. The balance consists of the following: Instructions Show how the information above should be presented on the SFP of LeBlanc Inc. at December 31,2020.

> Eli Corp. has just received its August 31, 2020 bank statement, which is summarized as follows: The general ledger Cash account contained the following entries for the month of August: Deposits in transit at August 31 are $3,800, and cheques outstand

> The Becker Milk Company Limited, a real estate and investment management company, reports the following information in its financial statements for the years ended April 30, 2017, 2016, and 2015: Instructions a. Calculate the accounts receivable turnov

> Lute Retail Ltd. Follows ASPE. It transfers $355,000 of its accounts receivable to an independent trust in a securitization transaction on July 11, 2020, receiving 96% of the receivables balance as proceeds. Lute will continue to manage the customer acco

> Chessman Corporation factors $600,000 of accounts receivable with Liquidity Financing, Inc. on a with recourse basis. Liquidity Financing will collect the receivables. The receivable records are transferred to Liquidity Financing on August 15, 2020. Liqu

> Several of Kimper Corporation's major customers experienced cash flow problems in 2020, mainly due to their increasing labour and production costs in 2019 and 2020. As a result, Kimper's accounts receivable turnover ratio (net sales revenue/average trade

> The controller for Fashion Co. is trying to determine the amount of cash to report on the December 31, 2020 statement of financial position. The following information is provided: 1. A commercial savings account with $600,000 and a commercial chequing ac

> Uddin Publishing Co. publishes college textbooks that are sold to bookstores on the following terms. Each title has a fixed wholesale price, terms f.o.b. shipping point, and payment is due 60 days after shipment. The retailer may return a maximum of 30%

> Organic Growth Company is testing a number of new agricultural seeds that it has recently harvested. To stimulate interest, it has decided to grant five of its largest customers the unconditional right to return these products if not fully satisfied. The

> Aaron's Agency sells an insurance policy offered by Capital Insurance Company for a commission of $100. In addition, Aaron will receive a further commission of $10 each year for as long as the policyholder does not cancel the policy. After selling the po

> Blair Biotech enters into a licensing agreement with Pang Pharmaceutical for a drug under development. Blair will receive a payment of $10,000 if the drug receives regulatory approval. Based on prior experience with the drug-approval process, Blair deter

> Presented below are four revenue recognition situations. I. Grupo sells goods to MTN for $1 million, payment due at delivery. 2. Grupo sells goods on account to Grifols for $800,000, payment due in 30 days. The terms are f.o.b. destination. 3. Grupo sell

> Celie Inc. manufactures and sells computers that include an assurance type warranty for 90 days. Celie offers an optional extended coverage plan under which it will repair or replace any defective part for three years from the expiration of the assurance

> On December 31, 2020, Grando Company sells production equipment to Fargo Inc. for $50,000. Grando includes a one-year assurance warranty service with the sale of all its equipment. The customer receives and pays for the equipment on December 31, 2020. Gr

> Zagat Inc. enters into an agreement on March 1, 2020, to sell aluminum ingots for $200,000 cash to Werner Metal Company. As part of this agreement, Zagat also agrees to repurchase from Werner the ingots in 60 days at the original sales price of $200,000

> Cramer Corp. sells idle machinery to Enyart Company on July 1, 2020, for $40,000. Cramer agrees to repurchase this equipment from Enyart on June 30, 2021, for a price of $42,400 (an imputed interest rate of 6%). Instructions a. Prepare the journal entry

> In 2020, Renato Corp. had cash receipts from customers of $152,000 and cash payments for operating expenses of $97,000. At January 1, 2020, accounts receivable were $13,000 and total prepaid expenses were $17,500. At December 31, 2020, accounts receivabl

> To increase sales, Letourneau Inc., a public company following IFRS, implemented a customer loyalty program that rewards a customer with one loyalty point for every $30 of merchandise purchased. Each point is redeemable for a $2.50 discount on any purcha

> Revenue Recognition under Earnings Approach-Various Consumer Industries Instructions a. Explain the principles and criteria for revenue recognition under the earnings approach. b. For each scenario noted in E6.l, discuss when revenue should be recognized

> Omega Pharmaceuticals Inc. licenses its patent rights for North America to an approved drug compound for five years to Crane Distributing Ltd. Omega determines that the patented drug formula has significant stand-alone value. Under the terms of the licen

> On May 1, 2020, Richardson Inc. entered into a contract to deliver one of its specialty mowers to Kickapoo Landscaping Co. The contract requires Kickapoo to pay the contract price of $900 in advance on May 15, 2020. Kickapoo pays Richardson on May 15, 20

> On January 1, 2020, Gordon Co. enters into a contract to sell a customer a wiring base and a shelving unit that sits on the base in exchange for $3,000. The contract requires delivery of the base first but states that payment for the base will not be mad

> Refer to the revenue arrangement in E6.16. Data of E6.16: Instructions Repeat requirements (a) and (b), assuming Crankshaft does not have market data with which to determine the stand-alone selling price of the installation services. As a result, an e

> Crankshaft Company manufactures equipment. Crankshaft's products range from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $200,000 to $1.5 million, and are quoted inclusive of installation. T

> Shaw Company sells goods that cost $300,000 to Ricard Company for $400,000 on January 2, 2020. The sales price includes an installation fee, which is valued at $40,000. The fair value of the goods is $370,000. The goods were delivered on March 1, 2020.ln

> Sanchez Co. enters into a contract to sell Product A and Product Bon January 2, 2020, for an upfront cash payment of $150,000. Product A will be delivered in two years (January 2, 2022) and Product B will be delivered in five years (January 2, 2025). San

> During December 2020, Soft Skin Ltd. sells $20,000 of gift cards to customers. From reliable past experience, management estimates that 8% of the gift cards sold will not be redeemed by customers. In January 2021, $2,000 of these cards is redeemed for me

> In 2020, I & T Corporation reported net income of $8.6 million, and declared and paid preferred share dividends of $3.2 million. During 2020, I & Thad a weighted average of 900,000 common shares outstanding. Calculate I & T's 2020 earnings per share.

> Taylor Marina has 300 available slips that rent for $800 per season. Payments must be made in full by the start of the boating season, April 1, 2021. The boating season ends October 31, and the marina has a December 31 year end. Slips for future seasons

> Best Lawn Care Inc. (BLC) offers its customers two lawn maintenance services. One service is for a one-year maintenance plan at a cost of $200. Customers can earn a 5% discount from this price if they pay before BLC's calendar fiscal year for maintenance

> Assume the facts given in E6.37 except that Vaughn's non-cancellable fixed price contract with Atlantis is for $9.5 million. Billings and collections are lower in 2022 by $500,000 each. Instructions a. Using the percentage-of-completion method, calcul

> Assume the facts given in E6.37 except now assume that the construction industry has experienced significant expansion, making construction materials and labor more costly than originally estimated. Vaughn finds it extremely difficult to estimate the cos

> Vaughn Enterprises Ltd. has entered into a contract beginning in February 2020 to build two warehouses for Atlantis Structures Ltd. The contract is a non-cancellable fixed price contract for $10 million. The following data pertain to the construction per

> Shanahan Construction Company has entered into a non-cancellable contract beginning January 1, 2020, to build a parking complex. It has been estimated that the complex will cost $600,000 and will take three years to construct. The complex will be billed

> Yanmei Construction Company began operations on January 1, 2020. During the year, Yanmei entered into a non-cancellable contract with Lundquist Corp. to construct a manufacturing facility. At that time, Yanmei estimated that it would take five years to c

> Hamilton Construction Company uses the percentage-of-completion method of accounting. In 2020, Hamilton began work under non-cancellable contract #E2-D2, which provided for a contract price of $2.2 million. Other details follow: Instructions a. How muc

> On April 1, 2020, Dougherty Inc. entered into a cost plus fixed fee non-cancellable contract to construct an electric generator for Altom Corporation. At the contract date, Dougherty estimated that it would take two years to complete the project at a cos

> During 2020, Nilsen Company started a construction job with a contract price of $1.6 million. The job was completed in 2022. The following information is avai lable. The contract is non-cancellable. Instructions a. Calculate the amount of gross profit

> Neon Limited had 40,000 common shares on January 1, 2020. On April 1, 8,000 shares were repurchased. On August 31, 12,000 shares were issued. Calculate the number of shares outstanding at December 31, 2020, and the weighted average number of shares for 2

> Refer to the information in E6.30. Information of E6.30: Rex's Reclaimers entered into a contract with Dan's Demolition to manage the processing of recycled materials on Dan's various demolition projects. Services for the three-year contract include col

> The following are transactions between Wang Corp., the consignor, and Ren Stores Ltd., the consignee, for the month of June 2020. Wang uses a perpetual inventory system and has a separate perpetual record for inventory sent out on consignment. At the end

> On May 31, 2020, Eisler Company consigned 80 freezers, costing $500 each, to Remmers Company. The cost of shipping the freezers amounted to $740 and was paid by Eisler Company. On December 30, 2020, a report was received from the consignee, indicating th

> Sider Inc., a registered broker, enters into a finder's fee agreement with HOM Homes Ltd. on June 15, 2020. Sider will find leads in the form of buyers potentially interested in purchasing HO M's real estate holdings. Along with finding potential buyers,

> On October 5, 2020, Diamond in the Rough Recruiting Group Inc.'s board of directors decided to dispose of the Blue Division. A formal plan was approved. Diamond derives approximately 75% of its income from its human resources management practice. The Blu

> Assume that Elrond Inc. decided to sell DemandTV Ltd., a subsidiary, on September 30, 2020. There is a formal plan to dispose of the business component, and the sale qualifies for discontinued operations treatment. Pertinent data on the operations of the

> Pike Corporation, a clothing retailer, had income from operations (before tax) of $375,000, and recorded the following before-tax gains/(losses) for the year ended December 31, 2020: As at January 1, 2020, Pike had one piece of land that had an original

> Canviar Corp. maintains its financial records using the cash basis of accounting. Because it would like to secure a long-term loan from its bank, the company asks you, as an independent CPA, to convert its cash basis income statement information to the a

> In its first year of operations, 2020, Strats Corp. invoiced $172,000 in service revenue. Of that amount, $18,000 was still owing from customers at the end of year. In 2020, Strats incurred various operating expenses totalling $81,000, of which $77,500 w

> At December 31, 2020, Tres Hombres Corporation had the following shares outstanding: 10% cumulative preferred shares, 107,500 shares outstanding…………………..$10,750,000 Common shares, 4,000,000 shares outstanding……………………………………….20,000,000 During 2020, the c

> Use the information in BE4.l 7 to prepare a statement of retained earnings for Global Corporation, assuming that in 2020, Global discovered that it had overstated 2017 depreciation by $40,000 (net of tax of $17,000).

> The shareholders' equity section of Cadmium Corporation as at December 31, 2020, follows: Net income of $24 million for 2020 reflects a total effective tax rate of 25%. Included in the net income figure is a loss of $15 million (before tax) relating to t

> Rainy Day Umbrella Corporation had the following balances at December 31, 2019 (all amounts in thousands): preferred shares, $3,375; common shares, $8,903; contributed surplus, $3,744; retained earnings, $23,040; and accumulated other comprehensive incom

> Eddie Zambrano Corporation, a private company, began operations on January 1, 2017. During its first three years of operations, Zambrano reported net income and declared dividends as follows: Instructions Prepare a 2020 statement of retained earnings fo