Question: Kashi Sales, L.L.C., produces healthy,

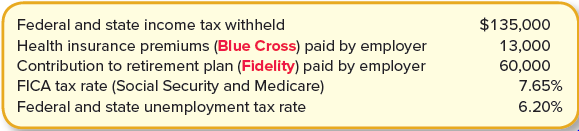

Kashi Sales, L.L.C., produces healthy, whole-grain foods such as breakfast cereals, frozen dinners, and granola bars. Assume payroll for the month of January was $500,000 and the following withholdings, fringe benefits, and payroll taxes apply:

Assume that Kashi has paid none of the withholdings or payroll taxes by the end of January (record them as payables), and no employee’s cumulative wages exceed the relevant wage bases.

Required:

1. Record the employee salary expense, withholdings, and salaries payable.

2. Record the employer-provided fringe benefits.

3. Record the employer payroll taxes.

> Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Calculate the following risk ratios for both companies for th

> Under what circumstances do we use the equity method to account for an investment in stock?

> When using the fair value method, we adjust the reported amount of the investment for changes in fair value after its acquisition. How is the change in fair value reflected in the balance sheet?

> When using the fair value method, we adjust the reported amount of the investment for changes in fair value after its acquisition. How is the change in fair value reflected in the income statement?

> Discuss the difference between an unrealized holding gain and a realized gain.

> Explain how we report dividends received from an investment under the fair value method.

> Tsunami Sushi purchases $130,000 of 5-year, 7% bonds from Deep Sea Explorers on January 1. Management intends to hold the debt securities to maturity. For bonds of similar risk and maturity, the market rate is 8%. Tsunami paid $124,728 for the bonds. It

> Star Studios is looking to purchase a new building for its upcoming film productions. The company finds a suitable location that has a list price of $1,600,000. The seller gives Star Studios the following purchase options: 1. Pay $1,600,000 immediately.

> Woody Lightyear is considering the purchase of a toy store from Andy Enterprises. Woody expects the store will generate net cash flows (cash inflows less cash outflows) of $60,000 per year for 20 years. At the end of the 20 years, he intends to sell the

> Mary Kate, Ashley, Dakota, and Elle each want to buy a new home. Each needs to save enough to make a 25% down payment. For example, to buy a $100,000 home, a person would need to save $25,000. At the end of each year for four years, the women make the fo

> Income statement and balance sheet data for The Athletic Attic are provided below. Required: 1. Calculate the following risk ratios for 2021 and 2022: a. Receivables turnover ratio. b. Inventory turnover ratio. c. Current ratio. d. Debt to equity ratio

> Financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Calculate the following risk ratios for the year ended February 3, 2018: a. Receivables turnover ratio. b. Average collection period. c. Inventory turnover r

> Data for The Athletic Attic are provided in P12–4B. Earnings per share for the year ended December 31, 2021, are $1.36. The closing stock price on December 31, 2021, is $22.42. Required: Calculate the following profitability ratios for 2021: 1. Gross pro

> The following income statement and balance sheets for The Athletic Attic are provided. Required: Assuming that all sales were on account, calculate the following risk ratios for 2021: 1. Receivables turnover ratio. 2. Average collection period. 3. Invent

> The balance sheets for Fantasy Football for 2021 and 2020 are provided below. Required: 1. Prepare a vertical analysis of Fantasy Football’s 2021 and 2020 balance sheets. Express each amount as a percentage of total assets for that year

> The income statements for Galaxy Tennis for the years ending December 31, 2021 and 2020, are provided below. Required: 1. Complete the “Amount” and “%” columns to be used in a horizo

> Game-On Sports operates in two distinct segments: athletic equipment and accessories. The income statement for each operating segment is presented below. Required: 1. Complete the “%” columns to be used in a vertical a

> Cash flows from operating activities for both the indirect and direct methods are presented for Electronic Transformations. Required: Complete the following income statement for Electronic Transformations. Assume all accounts payable are to suppliers. [H

> Data for Virtual Gaming Systems are provided in P11–4B. Required: Prepare the statement of cash flows for Virtual Gaming Systems using the direct method. Disclose any noncash transactions in an accompanying note.

> Refer to the information provided in P11–3B for Software Associates. Required: Prepare the operating activities section of the statement of cash flows for Software Associates using the direct method.

> International Genetic Technologies (InGen) and The Resources Development Association (RDA) are companies involved in cutting-edge genetics research. Selected financial data are provided below: Required: 1. Calculate the return on assets for both companie

> The income statement, balance sheets, and additional information for Virtual Gaming Systems are provided. Required: Prepare the statement of cash flows using the indirect method. Disclose any noncash transactions in an accompanying note.

> Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1.Calculate the following risk ratios for the year ended February 3, 2018: a. Receivables turnover ratio. b. Average collection period. c. Inventory tur

> Portions of the financial statements for Software Associates are provided below. Required: Prepare the operating activities section of the statement of cash flows for Software Associates using the indirect method.

> Natalie King has completed the basic format to be used in preparing the statement of cash flows (indirect method) for CPU Hardware Designers. All amounts are in thousands (000s). Below, in random order, are line items to be included in the statement of c

> Listed below are several transactions. For each transaction, indicate by letter whether the cash effect of each transaction is reported in a statement of cash flows as an operating (O), investing (I), financing (F), or noncash (NC) activity. Also, indica

> Selected financial data for DC Menswear is provided as follows: Required: 1. Calculate the return on equity for DC Menswear. How does it compare with the return on equity for Facebook and IBM reported in the chapter? 2. Calculate the dividend yield for D

> National League Gear has two classes of stock authorized: 4%, $20 par preferred, and $5 par value common. The following transactions affect stockholders’ equity during 2021, National League’s first year of operations: February 2 Issue 1.5 million shares

> Refer to the information provided in P10–2B. Required: Taking into consideration the beginning balances on January 1, 2021 and all the transactions during 2021, respond to the following for Nautical: 1. Prepare the stockholders’ equity section of the bal

> The stockholders’ equity section of The Seventies Shop is presented here. Required: Based on the stockholders’ equity section of The Seventies Shop, answer the following questions. Remember that all amounts are present

> The Athletic Village has done very well the past year, and its stock price is now trading at $102 per share. Management is considering either a 100% stock dividend or a 2-for-1 stock split. Required: Complete the following chart comparing the effects of

> Nautical has two classes of stock authorized: $10 par preferred, and $1 par value common. As of the beginning of 2021, 125 shares of preferred stock and 3,000 shares of common stock have been issued. The following transactions affect stockholdersâ&

> Match (by letter) the following terms with their definitions. Each letter is used only once. Definitions a. A debit balance in Retained Earnings. b. Priced high in relation to current earnings as investors expect future earnings to be higher. c. Effectiv

> Income statement and balance sheet data for Great Adventures, Inc., are provided below. As you can tell from the financial statements, 2022 was an especially busy year. Tony and Suzie were able to use the money received from borrowing and the issuance of

> Selected financial data for Surf City and Paradise Falls are as follows: Required: 1. Calculate the debt to equity ratio for Surf City and Paradise Falls for the most recent year. Which company has the higher ratio? 2. Calculate the return on assets for

> Christmas Anytime issues $850,000 of 6% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Required: Calculate the issue price of a bond and complete the first three rows of an amortization schedule when 1. T

> Super Splash issues $1,000,000, 7% bonds on January 1, 2021, that mature in 15 years. The market interest rate for bonds of similar risk and maturity is 6%, and the bonds issue for $1,098,002. Interest is paid semiannually on June 30 and December 31. Req

> Temptation Vacations issues $60 million in bonds on January 1, 2021, that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below: Required: 1. Were the bonds issued at face amount, a discount, or a p

> Viking Voyager specializes in the design and production of replica Viking boats. On January 1, 2021, the company issues $3,000,000 of 9% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Required: 1. If the

> Chunky Cheese Pizza has $61 million in bonds payable. The bond agreement states that the debt to equity ratio cannot exceed 3.25. Chunky’s total assets are $201 million, and its liabilities other than the bonds payable are $91 million. The company is con

> On January 1, 2021, Monster Corporation borrowed $9 million from a local bank to construct a new highway over the next four years. The loan will be paid back in four equal installments of $2,657,053 on December 31 of each year. The payments include inter

> On January 1, 2021, Stoops Entertainment purchases a building for $610,000, paying $110,000 down and borrowing the remaining $500,000, signing a 9%, 15-year mortgage. Installment payments of $5,071.33 are due at the end of each month, with the first paym

> Selected financial data regarding current assets and current liabilities for Ferris Air and Oceanic Airlines are provided as follows: Required: 1. Calculate the current ratio for Ferris Air and Oceanic Airlines. Which company has the better current ratio

> Authors Academic Press faces three potential contingency situations, described below. Authors’ fiscal year ends December 31, 2021. Required: Determine the appropriate means of reporting each situation for the year ended December 31, 2021, and record any

> Bryan Eubank began his accounting career as an auditor for a Big 4 CPA firm. He focused on clients in the high-technology sector, becoming an expert on topics such as inventory write-downs, stock options, and business acquisitions. Impressed with his tec

> Compact Electronics is a leading manufacturer of digital camera equipment. Assume the following transactions occur during the year ended December 31, 2021. Required: Record any amounts as a result of each of these contingencies. 1. Accounts receivable we

> Logan’s Roadhouse opened a new restaurant in November. During its first two months of operation, the restaurant sold gift cards in various amounts totaling $2,300. The cards are redeemable for meals within one year of the purchase date. Gift cards totali

> Named in honor of the late Dr. F. C. “Phog” Allen, the Kansas Jayhawks’ head coach for 39 years, Allen Fieldhouse is labeled by many as one of the best places in America to watch a college basketball game. Allen Fieldhouse has a seating capacity of 16,30

> Emily Turnbull, president of Aerobic Equipment Corporation, is concerned about her employees’ well-being. The company offers its employees free medical, dental, and life insurance coverage. It also matches employee contributions to a vo

> Eskimo Joe’s, designer of the world’s second best-selling T-shirt (just behind Hard Rock Cafe), borrows $21 million cash on November 1, 2021. Eskimo Joe’s signs a six-month, 7% promissory note to Stillwater National Bank under a prearranged short-term li

> Listed below are several terms and phrases associated with current liabilities. Pair each item from List A (by letter) with the item from List B that is most appropriately associated with it.

> Papa’s Pizza is the market leader and Pizza Prince is an up-and-coming player in the highly competitive delivery pizza business. The companies reported the following selected financial data ($ in thousands): Required: 1. Calculate the r

> New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $341,000. The ovens originally cost $455,000, had an estimated service life of 10 years, had an estimated residual value of $30,000, and were depre

> Togo’s Sandwich Shop had the following long-term asset balances as of January 1, 2021: Togo’s purchased all the assets at the beginning of 2019 (3 years ago). The building is depreciated over a 10-year service life usi

> “Why can’t we pay our shareholders a dividend?” shouts your new boss at Polar Opposites. “This income statement you prepared for me says we earned $5 million in our first year!â

> The following information relates to the intangible assets of Lettuce Express: a. On January 1, 2021, Lettuce Express completed the purchase of Farmers Produce, Inc., for $1,600,000 in cash. The fair value of the identifiable net assets of Farmers Produc

> Cheetah Copy purchased a new copy machine. The new machine cost $140,000 including installation. The company estimates the equipment will have a residual value of $35,000. Cheetah Copy also estimates it will use the machine for four years or about 8,000

> Stillwater Youth Programs (SYP) purchased a used school bus to transport children for its after-school program. SYP incurred the following expenses related to the bus for the current year: 1. Replaced a blown tire on the bus for $175. 2. Installed new se

> Northern Equipment Corporation purchased all the outstanding common stock of Pioneer Equipment Rental for $5,600,000 in cash. The book values and fair values of Pioneer’s assets and liabilities were. Required: 1. Calculate the amount No

> Sicily Pizza purchased baking ovens from New World Deli. New World Deli was closing its bakery business and sold its three-year-old ovens for $341,000. In addition to the purchase price, Sicily Pizza paid shipping costs of $16,000. Employees of Sicily Pi

> Barry Sanders, likely the best running back to ever play football, has opened a successful used-car dealership. He has noted a higher than normal percentage of sales for trucks and SUVs with hauling capacity at his dealership. He is also aware that sever

> The Italian Pizza Company purchased land as a factory site for $90,000. Prior to construction of the new building, the land had to be cleared of trees and brush. Construction costs incurred during the first year are listed below: Required: Determine the

> Refer to the transactions of Circuit Country in P6–3B. Required: 1. Assuming that Circuit Country uses a periodic inventory system, record the transactions. 2. Record the month-end adjustment to inventory, assuming that a final count reveals ending inven

> Payless ShoeSource and Dillard’s both offer men’s formal footwear. Payless offers lower- to middle-priced footwear, whereas Dillard’s offers more specialized, higher-end footwear. The average price fo

> Toys “R” Us sells a variety of children’s toys, games, books, and accessories. Assume that a local store has the following amounts for the month of March 2021. Required: 1. Prepare a multiple-step inc

> EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system, is a giant database of documents required to be submitted to the U.S. Securities and Exchange Commission (SEC). All publicly traded domestic companies use EDGAR to make the majority of

> At the beginning of November, Yoshi Inc.’s inventory consists of 60 units with a cost per unit of $94. The following transactions occur during the month of November. November 2 Purchase 90 units of inventory on account from Toad Inc. for $100 per unit,

> Trends by Tiffany sells high-end leather purses. The company has the following inventory transactions for the year. Required: 1. Using FIFO, calculate ending inventory and cost of goods sold. 2. Using LIFO, calculate ending inventory and cost of goods so

> A home improvement store, like Lowe’s, carries the following items: Required: 1. Compute the total cost of inventory. 2. Determine whether each inventory item would be reported at cost or net realizable value. Multiply the quantity of e

> At the beginning of June, Circuit Country has a balance in inventory of $3,000. The following transactions occur during the month of June. June 2 Purchase radios on account from Radio World for $2,700, terms 1/15, n/45. June 4 Pay cash for freight ch

> Pete’s Tennis Shop has the following transactions related to its top-selling Wilson tennis racket for the month of August: Required: 1. Calculate ending inventory and cost of goods sold at August 31, using the specific identification me

> Sylvester has a bird shop that sells canaries. Sylvester maintains accurate records on the number of birds purchased from its suppliers and the number sold to customers. The records show the following purchases and sales during 2021. Sylvester uses a per

> Jimmie’s Fishing Hole has the following transactions related to its top-selling Shimano fishing reel for the month of June: Required: 1. Calculate ending inventory and cost of goods sold at June 30, using the specific identification met

> Assume selected financial data for Sun Health Group and Select Medical Corporation, two companies in the health-care industry, are as follows: Required: 1. Calculate the receivables turnover ratio and average collection period for Sun Health and Select M

> On April 15, 2021, Sampson Consulting provides services to a customer for $110,000. To pay for the services, the customer signs a three-year, 12% note. The face amount is due at the end of the third year, while annual interest is due each April 15. (Hint

> By the end of its first year of operations, Previts Corporation has credit sales of $750,000 and accounts receivable of $350,000. Given it’s the first year of operations, Previts’ management is unsure how much allowance for uncollectible accounts it shou

> Aggressive Corporation approaches Matt Taylor, a loan officer for Oklahoma State Bank, seeking to increase the company’s borrowings with the bank from $100,000 to $200,000. Matt has an uneasy feeling as he examines the loan application

> Wanda B. Rich is the CEO of Outlet Flooring, a discount provider of carpet, tile, wood, and laminate flooring. At the end of the year, the company’s accountant provides Wanda with the following information, before any adjustment. Wanda

> Letni Corporation engages in the manufacture and sale of semiconductor chips for the computing and communications industries. During the past year, operating revenues remained relatively flat compared to the prior year but management notices a big increa

> Facial Cosmetics provides plastic surgery primarily to hide the appearance of unwanted scars and other blemishes. During 2021, the company provides services of $410,000 on account. Of this amount, $60,000 remains uncollected at the end of the year. An ag

> The following events occur for Morris Engineering during 2021 and 2022, its first two years of operations. February 2, 2021 Provide services to customers on account for $38,000. July 23, 2021 Receive $27,000 from customers on account. December 31, 2021 E

> Data Recovery Services (DRS) specializes in data recovery from crashed hard drives. The price charged varies based on the extent of damage and the amount of data being recovered. DRS offers a 10% discount to students and faculty at educational institutio

> Scenario 1: During 2021, The Hubbard Group provides services of $900,000 for repair of a state highway. The company receives an initial payment of $300,000 with the balance to be received the following year. Scenario 2: Rolling Stone magazine typically c

> Peter loves dogs and cats. For the past several years, he has owned and operated Homeward Bound, which temporarily houses pets while their owners go on vacation. For the month of June, the company has the following transactions: 1. June 2 Obtain cash by

> Below is a summary of all transactions of Dreamworks Bedding Supplies for the month of August 2021. Required: Prepare a statement of cash flows for the month of August, properly classifying each of the transactions into operating, investing, and financin

> The cash records and bank statement for the month of July for Glover Incorporated are shown below. Additional information: a. The difference in the beginning balances in the company’s records and the bank statement relates to check #53

> On October 31, 2021, the bank statement for the checking account of Blockwood Video shows a balance of $12,751, while the company’s records show a balance of $12,381. Information that might be useful in preparing a bank reconciliation is as follows: a. O

> Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Calculate American Eagle’s cash return on assets, cash flow t

> At the end of February, Howard Productions’ accounting records reveal a balance for cash equal to $19,225. However, the balance of cash in the bank at the end of February is only $735. Howard is concerned and asks the companyâ

> The general ledger of Jackrabbit Rentals at January 1, 2021, includes the following account balances: The following is a summary of the transactions for the year: 1. January 12 Provide services to customers on account, $62,400. 2. February 25 Provide se

> The general ledger of Pipers Plumbing at January 1, 2021, includes the following account balances: The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services for cash, $20,000, and on account, $65,000. 2. March 1

> Jaguar Auto Company provides general car maintenance to customers. The company’s fiscal year-end is December 31. The December 31, 2021, trial balance (before any adjusting entries) appears below. In addition, the company had the followi

> The year-end financial statements of Fighting Illini Financial Services are provided below. Required: 1. Record year-end closing entries. 2. Prepare a post-closing trial balance. (Hint: The balance of retained earnings will be the amount shown in the bal

> Orange Designs provides consulting services related to home decoration. Orange Designs provides customers with recommendations for a full range of home décor, including window treatments, carpet and wood flooring, paint colors, furniture, an

> Grasshopper Lawn Service provides general lawn maintenance to customers. The company’s fiscal year-end is December 31. Information necessary to prepare the year-end adjusting entries appears below. 1. On October 1, 2021, Grasshopper lent $60,000 to anoth

> The information necessary for preparing the 2021 year-end adjusting entries for Bearcat Personal Training Academy appears below. Bearcat’s fiscal year-end is December 31. 1. Depreciation on the equipment for the year is $7,000. 2. Salaries earned (but no

> Horned Frogs Fine Cooking maintains its books using cash-basis accounting. However, the company recently borrowed $50,000 from a local bank, and the bank requires the company to provide annual financial statements prepared using accrual-basis accounting

> Consider the following transactions. Required: For each transaction, determine the amount of revenue or expense, if any, that is recorded under accrual-basis accounting and under cash-basis accounting.

> Financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. What was the amount of increase or decrease in cash and cash equivalents for the most recent year? 2. What was net cash from operating activities for the mos

> Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1. For the most recent year, what amount does American Eagle report for current assets? What is the ratio of current assets to total assets? 2. For the