Question: Kelly Klothing Designs started the current year

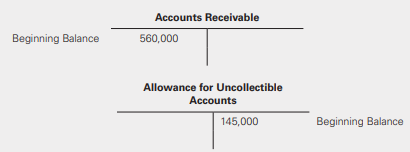

Kelly Klothing Designs started the current year with the following account balances related to its customer accounts:

Kelly reported credit sales of $1,211,800 for the current year. The company collected $56,000 on account and determined that a $35,000 account due from Cruze Company was uncollectible.

Required:

Prepare the journal entries required for each of the following events:

a. Credit sales for the current year. Ignore the effects on cost of goods sold and inventory.

b. Cash collections for the year.

c. The write-off of the Cruze Company account.

d. The current year’s provision for bad debts assuming that Kelly estimates bad debts at 15% of ending accounts receivable.

> Discuss whether the following scenarios would preclude a contract from a customer under the revenue recognition standard. a. Tarik Company is not certain that it can recognize revenue of sales made to a customer because it has no formal written agreement

> IFRS. Use the information in E11-14, part (a) to prepare the required footnote disclosure under IFRS for Kurtis Koal Company, Inc.’s property, plant, and equipment for Years 1 and 2, including a statement of its accounting policy and a table with account

> Use the information in E11-13, part (a) to prepare the required footnote disclosure for Kurtis Koal Company, Inc.’s property, plant, and equipment for Years 1 and 2, including a statement of its accounting policy and a table with accou

> The Aries Group sold one of its plant assets on April 1 of the current year for $250,000. The asset had an original cost of $500,000 and an estimated residual value of $80,000. Aries used the straight-line method of depreciation assuming an estimated use

> The Gemini Group sold one of its plant assets on August 1 of the current year for $200,000. The asset had an original cost of $500,000 and an estimated residual value of $80,000. The firm used the straight-line method of depreciation assuming an estimate

> IFRS. Repeat the requirements in E11-18 assuming that Ace acquired the asset on July 14 of the current year. Use partial-year depreciation assuming that the manufacturing equipment was acquired at the beginning of the month to simplify the computation.

> On January 2 of the current year, Vaughn, Inc. acquired land for $2,000,000 to be used to construct a new service and repair center. The closing costs amounted to $110,000, and Vaughn paid $20,000 for the current period’s property taxes. There was an exi

> Repeat the requirements in E11-17 assuming that Ace acquired the asset on July 14 of the current year. Use partial-year depreciation assuming that the manufacturing equipment was acquired at the beginning of the month to simplify the computation.

> Repeat the requirements in E11-17 assuming that Ace is an IFRS reporter and the manufacturing equipment has two components: computer controls and engine. The amount allocated to the computer controls is $500,000. The computer controls have a 5-year usefu

> Ace Manufacturing, Inc. purchased a new piece of manufacturing equipment at a total acquisition cost of $3,000,000 on January 4 of the current year. The firm estimates that the equipment has a useful life of 10 years or 13,250,000 units of output and a r

> Repeat the requirements in E11-14 assuming that Kurtis Koal Company, Inc. acquired the asset on August 1 of the current year. Use partial-year depreciation without adopting any of the acceptable conventions that simplify the computation Data from E11-14

> Prepare all journal entries necessary to reflect the use of the percentage-of-completion method in 2018 for CCC in BE8-18. Data From BE8-18:

> Repeat the requirements in E11-13 assuming that Kurtis Koal Company, Inc. acquired the asset on August 1 of the current year. Data from E11-13: Prepare the depreciation schedules for the machine assuming that Kurtis Koal used the following methods (each

> IFRS. Repeat the requirements in E11-13 assuming that Kurtis Koal Company, Inc. is an IFRS reporter and the mining machine has two components: casing and engine. The amount allocated to the engine is $800,000. The engine has a 6-year useful life and $60,

> Kurtis Koal Company, Inc. purchased a new mining machine at a total cost of $900,000 on the first day of its fiscal year. The firm estimates that the machine has a useful life of 6Â years or 6,000,000 tons of coal and a residual value of $60,0

> IFRS. Avery Air, Plc, a UK company, conducts regularly scheduled maintenance and improvement of its fleet of airplanes. During the year, it replaced engines at a cost of £2,900,000, upgraded airplane interiors at a cost of £610,000, and spent £1,300,000

> Clave Building Products, Inc. conducts regularly scheduled maintenance of its machinery and equipment every Friday afternoon. The cost of maintenance for the current year amounted to $345,000. The regular maintenance revealed the need to conduct a major

> IFRS. Assume that the Yawyag Corporation in E11-8 is an IFRS reporter and complete the following: Required: a. Compute the weighted-average accumulated expenditures for the current year. b. Compute the amount of interest related to the construction p

> St. Charles Flooring Company recently purchased a new tile-cutting machine with an invoice price of $215,500. The cost of delivery was $2,000, and installation amounted to $3,550. To test the machine, St. Charles cut 100 tiles that cost $4.50 each. The t

> Joe the Grocer Markets, Inc. (JTGM) adopted the dollar-value LIFO inventory method using 2018 as the base year. JTGM uses FIFO for its internal books. Information related to its inventory is presented in the following table: Required: a. Compute JTGM&ac

> CWB Teleconcepts, Inc. manufactures and distributes three models of handheld devices: the Flame, the Globe, and the HD3. CWB uses the dollar-value LIFO method. Information for 2018, 2019, and 2020 is presented in the following table. The cumulative pric

> Total Color, Inc. manufactures and distributes house paints. Total Color uses the dollar-value LIFO method. Information for 2018, 2019, and 2020 is presented in the following table. Year Inventory – FIFO 2018 – Base year $356,000 2019 $379,700 2

> Cosmo Computer Consultants (CCC) signed a contract in 2018 to develop a computer network system for Platinum Entertainment. Cosmo uses the percentage-of completion method and determines its measure of progress using the cost-to-cost approach. The firm pr

> Burke Company uses the LIFO perpetual method for financial reporting and tax purposes. A summary of Burke’s inventory for the current year follows. Required: a. Compute the ending inventory and cost of goods sold for the current year.

> Inventory transactions for Jack Franklin Stores are summarized in the following table. The company uses the LIFO perpetual method for both financial and tax reporting The inventory footnote from Jack Franklin Stores’ annual report ind

> Answer the following questions using the information provided in E10-3 Required: a. Prepare a partial income statement and balance sheet for Zoola, Inc. under each of the inventory valuation methods. b. Assume that the company reported current assets

> Zoola, Inc. provided the following information regarding its inventory for the current year, its second year of operations. Compute Zoola’s ending inventory and cost of goods sold under each of the following cost-flow methods assuming

> Zorinak, Inc. uses the dollar-value LIFO retail inventory method for costing inventory. It has beginning inventory costing $154,000 at a cost-to-retail ratio of 72%. During the year, Zorinak purchased goods with a cost basis of $770,000 and a retail valu

> Kiresh, Inc. uses the LIFO retail inventory method for costing inventory. It has beginning inventory at a cost of $57,000 and retail value of $95,000. During the year, Kiresh purchased goods with a cost basis of $136,700 and a retail value of $220,484. I

> Answer the following questions using the information provided in E10-1: Required: a. Prepare a partial income statement and balance sheet for Arthur Lloyd under each of the inventory valuation methods. b. Assume that the company reported current asse

> Zimma, Inc. uses the LIFO retail inventory method for costing inventory. It has beginning inventory at a cost of $23,000 and at a cost-to-retail ratio of 58%. During the year, Zimma purchased goods with a cost basis of $78,400 and a retail value of $132,

> A flood destroyed Addio Company’s warehouse and all of its inventory. Addio will use the gross profit method to determine its inventory in the warehouse at the time. Addio’s management believes that the average of the last two years’ gross profit percent

> A tsunami destroyed Kyoto Company’s warehouse and all of its inventory. Kyoto’s prior-year balance sheet reported ending inventory totaling $5,097. Kyoto’s management believes that last year’s gross profit percentage is a good estimate of the gross profi

> Vermont Cabin Construction Company uses the percentage-of-completion method on a three-year project with the cost-to-cost method of measuring progress. Compute the percent completed and the amount of revenue and gross profit to be recognized for each yea

> Melvin Corporation uses the conventional retail method for financial reporting. The company’s inventory records are summarized as follows. Estimate Melvin’s ending inventory using the conventional retail method. (Roun

> Use the same information in E10-13 but now assume that Printmaster Distributors Company is an IFRS reporter. Required: a. Conduct a lower-of-cost-or-market test for Printmaster assuming that it uses the individual-item approach for LCM computations. b.

> Use the information in E10-13 but now assume that Printmaster Distributors Company measures inventory cost using the LIFO method. Required: a. Conduct a lower-of-cost-or-market test for Printmaster assuming that it uses the total inventory approach for

> Printmaster Distributors Company sells laser printers and replacement toner cartridges. Printmaster uses FIFO for inventory costing. It sells two models—black and color laser printers. The black printers and black toner cartridges are i

> Use the same information in E10-11 now assuming that All-Kinds-ofCases Company is an IFRS reporter. Assume the company uses FIFO. Required: a. Conduct a lower-of-cost-or-market test for All-Kinds-of-Cases assuming that it uses the individual-item approa

> All-Kinds-of-Cases Company sells cases for smart phones and notepad computers. The company uses the LIFO method for costing inventory. All-Kinds-of-Cases groups inventory by the device manufacturer for which the case is made in its LCM computations. All-

> Nicky Bisco Products adopted the dollar-value LIFO method using 2018 as the base year for financial reporting purposes. It uses FIFO for its internal books. Information related to Bisco’s inventory follows: Required: a. Compute Bisco&a

> Moving Average, FIFO, LIFO. Arthur Lloyd Associates provided the following information regarding its inventory for the current year, its second year of operations. Required: Compute Arthur Lloyd’s ending inventory and cost of goods sol

> Michael’s Bucket Company borrowed $350,000 from J.R. Malone Capital by issuing a 4-year (48-month), 7% note payable. Interest is due and payable at the beginning of each month based on the outstanding balance at the beginning of the prior month. Michael’

> Using the information provided in E9-7, prepare the journal entries required to record the provision for bad debts for the current year assuming the following. Required: Klug estimates its bad debt expense as 4% of ending accounts receivable. For purpo

> For each scenario, determine when to recognize revenue. a. Top Notch Processing, Inc. enters into a contract to provide monthly accounting services to a customer for one year. b. A customer purchased a motorcycle from Bright Star Cycles for $16,000. The

> The Klug Group provided the following analysis of its aged schedule of accounts receivable: The allowance for uncollectible accounts had a credit balance of $260,400 at the beginning of the year. During the year, the company wrote off bad debts of $10,6

> Sammy’s Downtown Properties developed an aged schedule of accounts receivable at the end of each year. The company estimated an allowance for uncollectible accounts based on the following estimates: Sammy’s reported

> Answer the following questions using the information provided in E9-4. Required: Prepare the journal entries required to record each of the following events. a. Giaraldi’s credit management decided to write off all accounts that were

> Giaraldi Garden Products, Inc. developed an aged schedule of accounts receivable at the end of each year. The company estimated an allowance for uncollectible accounts based on the following estimates: Giaraldi reported net credit sales of $18,500,000

> Sodesta Company offers volume discounts to its customers. Customers buying more than $100,000 in products receive a 1% discount. Customers buying more than $200,000 in products receive a 3% discount. Sodesta also offers sales discounts with payment terms

> The following information is from the books of Towl Ball Company for the month of April. C The balance in Towl Ball’s cash account on April 30 is $16,232. Towl Ball received the following bank statement from Independence Day Bank for t

> The following information is from the books of Sun Bright Solar Company for the month of March. The balance in SunBright Solar’s cash account on March 31 is $313,850. SunBright Solar received the following bank statement from Jefferson

> On May 1, 2018, Lubin’s Heavy Equipment sold a piece of equipment to Perry Products, Inc., at a selling price of $4,850,000. Lubin’s agreed to accept a 10-month, 8% note with interest due on its maturity date, March 1, 2019. Lubin’s year-end is December

> DRB, Inc. enters into an arrangement with Genius Enterprises by which Genius will purchase $100,000 of DRB’s receivables and charge a 6% fee. As part of the agreement, Genius will hold back $9,000 as additional security. DRB sold the receivable with reco

> Using the information in BE8-13, indicate how Sycamore should allocate the transaction price to the three products using the residual approach. Data From BE8-13:

> On May 1, Onyx, Inc. factored $600,000 of accounts receivable with Cookie Finance without recourse. Cookie Finance assessed a finance charge of 6% of the total accounts receivable factored and retained an amount equal to 2% (i.e., there is a 2% holdback)

> Mac Antiques, Inc. sold $15,780,000 of its accounts receivable to Maximum Cash Capital (MCC). MCC charges a fee equal to 5% of the receivables factored and holds back an additional 2% as security. MCC will return the hold back to Mac when the receivables

> Krouse Incorporated sold $1,000,000 of its accounts receivable to Fusilli Factors. Fusilli charges a fee equal to 8% of the receivables factored and holds back an additional 4% as security. Fusilli will return the hold back to Krouse when the receivables

> IFRS. Use the same information in E9-10 and now assume that Sawyer’s Fence Company reports under IFRS. Required: a. Determine whether Sawyer’s borrowing from Hannibal would be treated as a borrowing or sale under IFRS. Prepare any journal entries neede

> Sawyer’s Fence Company borrowed $240,000 from Hannibal Capital by issuing a 3-year (36-month), 6% note payable. Sawyer’s uses $270,000 of its accounts receivable as collateral for the lending arrangement, transferring the right to the receivable payments

> Eaves Elevators Incorporated provided the following information regarding restrictions placed on its use of cash: In addition to these balances, Eaves had $595,825 of unrestricted cash at the end of the year. Prepare the relevant asset sections to be re

> ATickets.com sells discount airline tickets online. The company orders the tickets after a customer makes a purchase request. Atickets.com earns a flat fee of 25% of the total ticket price. The company sold $1,000,000 in airline tickets during the curren

> Ray’s Sporting Goods, Inc. shipped aluminum baseball bats on consignment to Martin Stores on April 6, 2019. The total cost of the bats is $31,000 with a retail value of $50,000. Martin agrees to accept the consigned merchandise and is eligible to receive

> Historically, about 8% of all the merchandise Asiago, Inc. sells is returned. On January 4, Asiago sold merchandise costing $40,000 to a customer for $62,000 on account. On January 17, Asiago refunded $3,200 for the return of some of the merchandise. On

> Webster Hall, Inc. is a major publisher of college textbooks. Webster Hall allows college bookstores to return all purchases within two months of delivery. The company shipped $700,000 in textbooks in December 2019 based on orders for the spring 2020 sem

> Using the information in BE8-13, indicate how Sycamore should allocate the transaction price to the three products using the expected-cost-plus-a-margin approach. Data From BE8-13:

> Using the information provided in E8-15, assume that Bailey uses the completed-contract method. Prepare the journal entries required in each year to record the contract (show all supporting computations). Data from E8-15:

> Bailey Builders Corporation accepted a three-year, $1,000,000 fixed fee contract to renovate a parking deck. Bailey uses the percentage-of-completion method and the cost-to-cost method of measuring progress. Information related to the construction contra

> Using the information provided in E8-13, prepare the journal entries for each year to record the contract, assuming that Gary uses the completed-contract method (show all supporting computations). Data from E8-13:

> Gary Construction Associates accepted a contract to build an office building on January 2, 2018. The company will complete the contract within two years. Gary provided the following information related to the revenue, estimated costs, progress billings,

> Shemsoft Software Technicians recently accepted a contract to develop an inventory management system for Chez and Company. Shemsoft is required to complete the installation of the new inventory management system in two years. Shemsoft provided the follow

> Far Horizons, Inc. sells mobile phones, wireless plans, and service plan packages. Far Horizons packages the following items for sale. Far Horizons has determined that each item is a separate performance obligation. A customer purchases a new phone pack

> Gundy Communications Systems signed a contract to develop and install an integrated network for Dwight Auto Dealerships, Inc. in five phases. Each phase is considered a performance obligation. The transaction price, including installation, is $2,600,000.

> Perfect Party Company contracts with a customer to provide its birthday party package including a cake, balloons, and musical entertainment. It regularly sells the following products separately at the following standalone selling prices. Perfect Party a

> Green-Up Inc. contracts with a building manager to provide goods and services to enhance the energy efficiency. It offers consulting services, including recommending ways to increase energy efficiency and monitor performance. It also provides items such

> Green-Up Inc. contracts with a building manager to provide goods and services to enhance energy efficiency. It offers consulting services, including recommending ways to increase energy efficiency and monitor performance. It also provides items such as t

> Sycamore enters into a contract with a customer to sell three products for a total transaction price of $15,000. Each product is appropriately classified as a separate performance obligation. Sycamore only sells products A and B on an individual basis, s

> Smart Cookie Learning Centers enters into a contract to customize and sell its LaLa tutoring software to the Westbro United School District. The contract price is $6,000,000 and must be paid to Smart Cookie immediately. Under the terms of the contract, S

> Tarheel Farm, Inc. (TFI) is a North Carolina corporation involved in agricultural production and has an October 31 fiscal year-end. It is not publicly traded, but it is required to prepare annual financial statements complying with U.S. GAAP for its bank

> More Toys, Inc., a toy retailer that has a calendar year-end and prepares interim financial statements quarterly. As of March 31, 20X4, More Toys has 10,000 Gabriella dolls in stock. The Gabriella dolls are from a recent movie that was showing in the the

> Companies sometimes use accounts receivable as collateral in a secured borrowing or sell them to a factor. The accounting method for these types of transactions is governed by ASC 860—Transfers and Servicing. Review all of ASC 860-10 to answer the follow

> ABC Lending signed a loan agreement with AMRO, Inc. on January 2, 2017. AMRO is borrowing $500,000 for 10 years with a stated interest rate of 7%. AMRO will make a payment of $71,188.75 at the end of each year. AMRO paid $10,000 in points to ABC Lending

> On January 2, 2018, JCR Jets, a calendar-year company, accepts a contract with a major airline to build four jets. JCR accepts a fixed fee of $300 million and must complete the project within three years. JCR Jets uses the percentage-of-completion method

> Assume the same information for Case 4. IFRS does not provide specific rules for software; the accounting for software development costs falls under the general guidance for intangible assets. Does IFRS require that software development costs be expensed

> Companies sometimes develop software for either external use (for example, to sell to customers) or for internal use. Should a company expense or capitalize software for internal use? U.S. GAAP provides specific guidance regarding software and, furthermo

> Ed’s Market Company (EMC) grows and sells fresh fruits and vegetables. EMC is an IFRS reporter. EMC experienced three different unfortunate events in the current year. 1. In February, the government acquired 20 acres from EMC in an eminent domain case.

> Ed’s Market Company (EMC) grows and sells fresh fruits and vegetables. EMC experienced three different unfortunate events in the current year. 1. In February, the government acquired 20 acres from EMC in an eminent domain case. EMC was carrying the land

> Sycamore Sidewalk Company enters into a contract with a customer to sell three products for a total transaction price of $15,000. Information related to these three products is provided in the following table. How should Sycamore Sidewalk Company alloc

> On rare occasions, a company will acquire property, plant, or equipment in a nonmonetary exchange in which two entities exchange one nonmonetary asset for another nonmonetary asset. Read sections 5, 20, and 30 of ASC 845-10. Describe the accounting treat

> Treasure Island Corporation (TIC) sells time shares in luxury oceanfront cottages. During the year ended December 31, 2017, TIC completed a project consisting of 100 cottages in a particularly scenic portion of Hawaii. The project cost TIC $110.24 millio

> Tarheel Farm, Inc. (TFI) is a North Carolina corporation involved in agricultural production and has an October 31 fiscal year-end. It is not publicly traded, but it is required to prepare annual IFRS-complying financial statements for its bank. TFI typi

> The Kroger Co. reported cash income taxes paid of $557 million for the year ended January 28, 2017 (fiscal year 2016). In addition, it reported the following: a. What is the LIFO reserve for Kroger as of January 28, 2017? January 30, 2016? b. What is th

> KR Automotives is a calendar-year car dealer that sells cars made by Hoyta. KR uses LIFO and calculates the lower of cost or market using an individual-item basis. The CFO of KR believes that KR will need to write-down its inventory of one particular car

> Wildcat Sporting Goods (WSG) sells athletic shoes and trendy sports apparel to a variety of sporting goods stores in the Northeast and, in 2011, WSG also began direct Internet sales to consumers. WSG’s common shares are publicly traded

> Absco, Inc. is a calendar-year-end clothing manufacturer that sells exclusively to retailers. It engages in a large number of contracts with its customers. Following are some specific contract issues that have arisen this year. 1. Absco signed a contrac

> Tolls R Us is a company whose primary business activity is operating toll roads. Tolls R Us receives licenses from the government to operate the toll roads that are typically expensed for a specified period of time. The company routinely projects the ant

> Bookstores International, a bookstore chain, has been quite successful over the past few decades and is now in expansion mode. It typically approaches opening a new bookstore by first determining the general geographic location for a new store and then i

> BBS is a calendar-year corporation that manufactures baseballs. BBS produced 9.5 million baseballs in 20x7 and incurred fixed production overhead costs of $2 million. In the past 5 years, it has produced the following number of baseballs: The decline i

> TGW Construction Company enters into a contract to build an office building and detached parking garage for $24 million. TGW determines that the building and parking garage represent separate performance obligations. The standalone price of similar struc

> The following information is from the 2016 financial statements of Revlon, the beauty products company. Required: Use Revlon’s financial information to answer the following questions: a. What is Revlon’s operating cyc