Question: Key comparative figures for Apple, Google, and

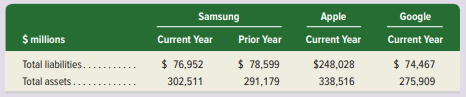

Key comparative figures for Apple, Google, and Samsung follow.

Required

1. Compute Samsung’s debt ratio for the current year and prior year.

2. Did Samsung’s financial leverage increase or decrease in the current year?

3. Looking at the current year debt ratio, is Samsung a more risky or less risky investment than (a) Apple and (b) Google?

> Salsa Company is considering an investment in technology to improve its operations. The investment costs $250,000 and will yield the following net cash flows. Management requires a 10% return on investments. Required 1. Determine the payback period for t

> Rowan Co. is considering two alternative investment projects. Each requires a $250,000 initial investment. Project A is expected to generate net cash flows of $60,000 per year over the next six years. Project B is expected to generate net cash flows of $

> Garcìa Co. can invest in one of two alternative projects. Project Y requires a $360,000 initial investment for new machinery with a four-year life and no salvage value. Project Z requires a $360,000 initial investment for new machinery with a

> Project Y requires a $350,000 investment for new machinery with a four-year life and no salvage value. The project yields the following annual results. Cash flows occur evenly within each year. Required 1. Compute Project Y’s annual net

> Factor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $480,000 cost with an expected four-year life and a $20,000 salvage value. Additional annual information for this new pr

> Refer to Apple’s financial statements in Appendix A to answer the following. 1. For the fiscal year ended September 28, 2019, what amount is credited to Income Summary to summarize its revenues earned? Hint: make sure to consider any “Other income” repor

> Sager Company builds custom retaining walls for large commercial customers. On May 1, the company had no inventories of work in process or finished goods but held the following raw materials. On May 4, the company began work on Job 102 for Woos Company a

> At the beginning of the year, Learner Company’s manager estimated total direct labor cost to be $2,500,000. The manager also estimated the following overhead costs for the year. For the year, the company incurred $1,520,000 of actual ov

> Marco Company shows the following costs for three jobs worked on in April. Additional Information a. Raw Materials Inventory has a March 31 balance of $80,000. b. Raw materials purchases in April are $500,000, and total factory payroll cost in April is

> At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. Additional information a. Job 5 was started in May, and the following costs were assigned to it in May: direct materials, $6,000; direct labor, $1

> A manufacturing company reports the following information. Required 1. Compute raw materials inventory turnover for the most recent two years. 2. Is the current year change in raw materials inventory turnover ratio favorable or unfavorable? 3. Compute d

> The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone Company. Required Identify each cost as either a product cost or a period cost. If a product cost, classify it as direct materials, direct

> Plum Corporation began the month of May with $700,000 of current assets, a current ratio of 2.50:1, and an acid-test ratio of 1.10:1. During the month, it completed the following transactions. The company uses a perpetual inventory system. May 2 Purchase

> Selected comparative financial statements of Korbin Company follow. Required 1. Compute each year’s current ratio. Round ratios to one decimal. 2. Express the income statement data in common-size percent’s. Round perc

> Selected comparative financial statements of Heroin Company follow. Required 1. Compute trend percent’s for all components of both statements using 2015 as the base year. Round percent’s to one decimal. Analysis Comp

> Refer to Golden Corporation’s financial statements and related information in Problem 16-6A. Required Prepare a complete statement of cash flows using the direct method for the current year.

> This Comprehensive Problem requires account balances from the April month-end, which are available in Connect or in the Working Papers. Assume it is Monday, May 1, the first business day of the month, and you have just been hired as the accountant for Co

> Refer to For ten Company’s financial statements and related information in Problem 16-3A. Required Prepare a complete statement of cash flows using the direct method. Disclose any noncash investing and financing activities in a note.

> Refer to the information in Problem 16-1A. Required Prepare the operating activities section of the statement of cash flows using the direct method for the current year.

> Lansing Company’s current-year income statement and selected balance sheet data at December 31 of the current and prior years follow. Required Prepare the operating activities section of the statement of cash flows using the indirect m

> Stoll Co.’s long-term available-for-sale portfolio at the start of this year consists of the following. Stoll enters into the following transactions involving its available-for-sale debt securities this year. Jan. 29 sold one-half of th

> Ike issues $180,000 of 11%, three-year bonds dated January 1, 2021, that pay interest semiannually on June 30 and December 31. They are issued at $184,566 when the market rate is 10%. Required 1. Prepare the January 1 journal entry to record the bonds’

> Refer to the bond details in Problem 14-3A. Required 1. Compute the total bond interest expense over the bonds’ life. 2. Prepare an effective interest amortization table like the one in Exhibit 14B.2 for the bonds’ life. 3. Prepare the journal entries t

> Refer to the bond details in Problem 14-4A. Required 1. Prepare the January 1 journal entry to record the bonds’ issuance. 2. Determine the total bond interest expense to be recognized over the bonds’ life. 3. Prepare an effective interest amortization

> The following information is available for both Pulaski Company and Scott Company at the current year-end. Required 1. Compute the debt-to-equity ratio for both companies. 2. Which company has the riskier financing structure?

> On January 1, McNeil Company borrows $100,000 cash by signing a four-year, 9% installment note. The note requires four equal payments consisting of accrued interest and principal on December 31 for each of the next four years. Required 1. Compute the am

> On January 1, 2021, Norwood borrows $200,000 cash from a bank by signing a five-year installment note bearing 8% interest. The note requires equal payments of $50,091 each year on December 31. Required 1. Complete an amortization table for this installm

> Bug-Off Exterminators provides pest control services and sells extermination products manufactured by other companies. The following six-column table contains the company’s unadjusted trial balance as of December 31, 2021. The following

> Legacy issues $325,000 of 5%, four-year bonds dated January 1, 2021, that pay interest semiannually on June 30 and December 31. They are issued at $292,181 when the market rate is 8%. Required 1. Prepare the January 1 journal entry to record the bonds’

> Ellis Company issues 6.5%, five-year bonds dated January 1, 2021, with a $250,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $255,333. The annual market rate is 6% on the issue date. Required 1. Calculate t

> Raphael Corporation’s balance sheet shows the following stockholders’ equity section. Required 1. Determine the par values of the corporation’s preferred stock and its common stock. 2. If two years&ac

> Required Prepare journal entries for (a) the sale of inventory, (b) the allocation of its gain or loss, (c) the payment of liabilities at book value, and (d) the distribution of cash in each of the following separate cases: Inventory is sold for (1) $600

> Meir, Benson, and Lau are partners and share income and loss in a 3:2:5 ratio (in percent’s: Meir, 30%; Benson, 20%; and Lau, 50%). The partnership’s capital balances are as follows: Meir, $168,000; Benson, $138,000; and Lau, $294,000. Benson decides t

> Mo, Lu, and Barb formed the MLB Partnership by making investments of $67,500, $262,500, and $420,000, respectively. They predict annual partnership net income of $450,000 and are considering the following alternative plans of sharing income and loss: (a)

> Ries, Bax, and Thomas invested $80,000, $112,000, and $128,000, respectively, in a partnership. During its first calendar year, the firm earned $249,000. Required Prepare the entry to close the firm’s Income Summary account as of its December 31 year-en

> Watts and Lyon are forming a partnership. Watts invests $42,000 and Lyon invests $63,000. The partners agree that Watts will work one-third of the total time devoted to the partnership and Lyon will work two thirds. They have discussed the following alte

> Mike Derr and Mark Finger form a partnership. Derr contributes the following items (at market value). Prepare the partnership’s journal entry to record Derr’s investment.

> On January 1, Matzo Co. pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $644,000, with a useful life of 20 ye

> Key comparative figures for Apple and Google follow 1. What is the debt ratio for Apple in the current year and for the prior year? 2. What is the debt ratio for Google in the current year and for the prior year? 3. Which of the two companies has the hig

> Both Apple and Google sell electronic devices, and each of these companies has a different product mix. Assume the following data are available for both companies. Required 1. Compute income for each company. 2. Compute the degree of operating leverage

> At December 31, Hawke Company reports the following results for its calendar year. In addition, its unadjusted trial balance includes the following items. Required 1. Prepare the adjusting entry to record bad debts under each separate assumption. a.&aci

> Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, No. 5888 for $1,028 and No. 5893 for $494. Check No. 5893 was still outstanding as of September 30. The following in

> The April transactions of Wised Company are described in Problem 7-2A. Required 1. Prepare a general journal, purchases journal, and cash payments journal. Number all journal pages as page 3. Enter the transactions of Wised Company that should be journa

> Wised Company completes these transactions during April of the current year (the terms of all its credit sales are 2/10, n/30). Apr. 2 purchased $14,300 of merchandise on credit from North Company, terms 2/10, n/60. 3 Sold merchandise on credit to Page A

> Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10, n/30). Mar. 1 purchased $43,600 of merchandise from Van Industries, terms 2/15, n/30. 2 Sold merchandise on credit to Min Ch

> AA 26-3 Samsung invested $21,766 in the current year to expand its manufacturing capacity. Assume that these assets have an 8-year life and generate net cash flows of $4,000 per year, and that Samsung requires a 7% return on its investments. (Samsung $s

> Key comparative figures for Samsung, Apple, and Google follow. Required 1. Compute the gross margin ratio for each of the three companies. 2. Is Samsung’s gross margin ratio better or worse than that for (a) Apple? (b) Google? 3. Is the

>  The following selected information is available from Samsung’s financial statements. Required 1. Compute Samsung’s current ratio for both the current year and the prior year. 2. In the current year,

> Key comparative figures for Samsung, Apple, and Google follow. Required 1. Compute profit margin for Samsung, Apple, and Google. 2. Which company is least successful on the basis of profit margin?

> Key comparative figures for both Apple and Google follow. Required 1. What is the total amount of assets invested for the current year in (a) Apple and (b) Google? 2. What is the current year return on assets for (a) Apple and (b) Google? 3. How much ar

> Samsung is a leading global manufacturer that competes with Apple and Google. Key financial figures for Samsung follow Required 1. What is the return on assets for Samsung in the (a) current year and (b) prior year? 2. Does Samsung’s r

> Assume Samsung and Apple are bidding on a large device support service job for a U.S.-based business. Samsung estimates direct labor for this service job to include 800 phone support hours and 1,200 technical specialist hours. Samsung pays phone support

> For the current annual reports of Samsung and Apple, assume they report the following. Required 1. Compute the recent two years’ days’ sales in raw materials inventory for (a) Samsung and (b) Apple. 2. Is the current

> Key figures for Samsung follow (in $ millions). Required 1. Compute common-size percent’s for Samsung using the data given. Round percent’s to one decimal. 2. What is Samsung’s gross margin ratio on

> Key comparative information for Samsung, Apple, and Google follows. Required 1. Compute the recent two years’ cash flow on total assets ratio for Samsung. 2. Is the change in Samsung’s cash flow on total assets ratio

> Following are selected data from Samsung, Apple, and Google. Required 1. Compute Samsung’s return on total assets for the two most recent years. 2. for the current year, is Samsung’s return on total assets better or wo

> Selected results from Samsung, Apple, and Google follow Required 1. Compute Samsung’s debt-to-equity ratio for the current year and the prior year. 2. Is Samsung’s financing structure more risky or less risky in the cu

> Use the following financial information for Samsung. Required 1. Compute earnings per share (EPS) for Samsung. 2. If Samsung buys back outstanding shares from investors, would we expect EPS to increase or decrease from the buyback?

> Review Samsung’s 1938 to 1970 history at en.wikipedia.org/wiki/Samsung. 1. Byung-Chull Lee, the founder, organized/started the company in what year? What was the original name? 2. What was the original company’s operating focus? 3. Samsung lists its busi

> Comparative figures for Samsung, Apple, and Google follow. Required 1. Compute the times interest earned ratio for the most recent two years for Samsung using the data shown. 2. Is the change in Samsung’s time’s intere

> Information on assumed capital investments in the current year for Google and Apple follow. Required 1. Compute break-even time for both companies. 2. Based on break-even time, which company can expect its investment to more quickly yield positive net ca

> Comparative figures for Samsung, Apple, and Google follow. Required 1. Compute total asset turnover for the most recent two years for Samsung using the data shown. 2. Is the change in Samsung’s asset turnover favorable or unfavorable? 3

>  Key figures for Samsung follow. 1. Compute Samsung’s accounts receivable turnover for the current year. 2. In the current year, does Samsung’s accounts receivable turnover underperform or outperform

> Key figures for Samsung follow. Required 1. Compute cash and cash equivalents as a percent (rounded to one decimal) of total current assets, total assets, total current liabilities, and total shareholders’ equity for both years. 2. Comp

> Key figures for Samsung and Google follow. Required 1. Compute Samsung’s days’ payable outstanding for the most recent two years. 2. Assuming Samsung is not at risk of damaging its relationships with suppliers, does it

> Key figures for Samsung follow. Required 1. For the most recent two years, compute Samsung’s (a) inventory turnover and (b) days’ sales in inventory. 2. Is the change in Samsung’s inventory turnover f

> The production department described in Exercise 20-8 reports the cost information below. a. Compute cost per equivalent unit for both direct materials and conversion. b. Using the weighted average method, assign April’s costs to the dep

> The first production department of Stone Inc. reports the following for April. Compute the number of equivalent units of production for both direct materials and conversion for April using the weighted average method.

> Refer to the information in Exercise 20-6. Assume that Fields uses the FIFO method of process costing. a. Calculate the number of units started and completed this period for the Forming department. b. Calculate the equivalent units of production for both

> Fields Company has two manufacturing departments, Forming and Painting. The company uses the weighted average method and it reports the following unit data for the Forming department. Units completed in the Forming department are transferred to the Paint

> Refer to the information in Exercise 20-4 and compute the department’s equivalent units of production for direct materials for each of the three separate assumptions a, b, and c using the FIFO method.

> Apple and Google report the following income statement data (some are assumed). Use the companies’ service revenue and cost data to answer the requirements. Required 1. Compute the gross profit ratio for each of the two years shown for

> The first production department in a process manufacturing system reports the following unit data. Compute this production department’s equivalent units of production for direct materials under each of the following three separate assum

> Identify each of the following production features as applying more to job order operations, to process operations, or to both job order and process operations.

> For each of the following products and services, indicate whether it is more likely produced in a process operation or in a job order operation.

> A manufacturer reports the following for two of its divisions for a recent month. For each division, compute (1) return on investment, (2) profit margin, and (3) investment turnover.

> A growing chain is trying to decide which store location to open. The first location (A) requires a $1,000,000 investment in average assets and is expected to yield annual income of $160,000. The second location (B) requires a $600,000 investment in aver

> The Ski department reports sales of $605,000 and cost of goods sold of $425,000. Its expenses follow. For the Ski department only, prepare a (1) departmental income statement and (2) departmental contribution to overhead report. (3) Based on these two

> Gomez Company has two service departments (Personnel and Office) and two operating departments (Shoes and Clothing). Following are the direct expenses and square feet occupied by the four departments, and the total sales for the two operating departments

> Renata Co. has four departments: Materials, Personnel, Manufacturing, and Packaging. Information follows. The four departments share the following indirect expenses for supervision, utilities, and insurance. Allocate each of the three indirect expenses t

> Mia works in both the Jewelry department and the Cosmetics department of a retail store. She assists customers in both departments and organizes merchandise in both departments. The store allocates her wages between the two departments based on the time

> Lucia Company has two service departments: Office and Purchasing .Total expenses for the Office is $24,000 and for Purchasing is $34,000. Expenses for the Office are allocated to operating departments based on sales. Expenses for Purchasing are allocated

> For the current annual reports of Apple and Google, assume they report the following. Required 1. Compute the recent two years’ raw materials inventory turnover ratio for (a) Apple and (b) Google. 2. Is the current year change in Apple

> Refer to the information in Exercise 24-1 and prepare a responsibility accounting performance report for the ATV department.

> A dairy company processed raw milk for $60,000. This raw milk can be converted into the following types of milk with listed sales values. Use the value basis to (1) allocate the total cost of the raw milk to each type of milk and (2) determine the gross

> A manufacturer reports the data below. (1) Compute the number of days in the cash conversion cycle. (2) Is the company more efficient at managing cash than its competitor who has a cash conversion cycle of 14 days?

> A manufacturer reports the data below. (1) Compute the number of days in the cash conversion cycle for each year. (2) Did the company manage cash more effectively in the current year?

> Midwest Mfg. uses a balanced scorecard as part of its performance evaluation. The company wants to include information on its sustainability efforts in its balanced scorecard. For each performance measure below, indicate the most likely balanced scorecar

> The Food division of Garcia Company reports the following for the current year. Garcia wants to achieve at least a 10% profit margin next year. Two alternative strategies are proposed. Strategy 1: Increase advertising expenses by $225,000. The company ex

> A retailer reports the following for its geographic divisions for the year. Americas Europe China 1. Compute profit margin for each division. 2. Based on profit margin, which division performed best?

> A company reports the following for the past year. The company’s CFO believes that income for next year will be $1,200,000. Average assets will be the same as the past year. 1. Compute return on investment for the past year. 2. If the C

> Refer to the information in Exercise 24-12. Assume that each of the company’s divisions has a target income at 7% of average assets. Compute residual income for each division.

> Arctica manufactures snowmobiles and ATVs. These products are made in different departments, and each department has its own manager. Each responsibility performance report includes only those costs that the department manager can control: direct materia

> Key figures for Apple and Google follow. Required 1. Compute common-size percent’s for each company using the data given. Round percent’s to one decimal. 2. If Google paid a dividend, would retained earnings as a perc

> Refer to Exercise 23-13. Hart Company uses a standard costing system. Prepare the journal entry to charge direct materials costs to Work in Process Inventory and record the direct materials variances.

> Hart Company made 3,000 shelves using 22,000 pounds of wood costing $266,200. The company’s direct materials standards for one shelf are 8 pounds of wood at $12 per pound. 1. Compute the direct materials price and quantity variances along with the total

> Camila Company has set the following standard cost per unit for direct materials and direct labor. During June the company incurred the following actual costs to produce 9,000 units. Compute the (1) direct materials price and quantity variances and (2) d

> Lucia Company has set the following standard cost per unit for direct materials and direct labor. During May the company incurred the following actual costs to produce 9,000 units. Compute the (1) direct materials price and quantity variances and (2) dir

> A manufactured product has the following information for August. (1) Prepare the standard cost card showing standard cost per unit. (2) Compute total budgeted cost for production in August. (3) Compute total cost variance for August, and indicate whether

> Lewis Co. reports the following fixed budget and actual results for May. Prepare a flexible budget performance report showing variances between budgeted and actual results, and indicate whether each variance is favorable or unfavorable.