Question: Kingston Tires received the following invoice from

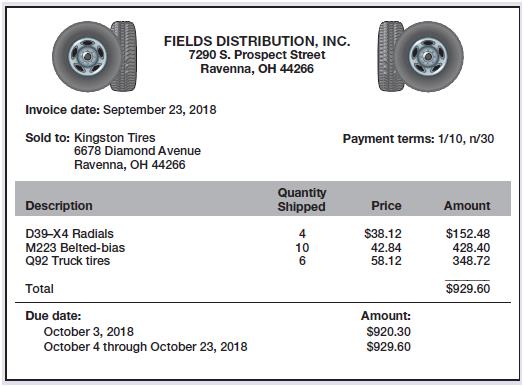

Kingston Tires received the following invoice from a supplier (Fields Distribution, Inc.):

Requirements:

1. Journalize the transaction required by Kingston Tires on September 23, 2018. Do not round numbers to the nearest whole dollar. Assume tires are purchased on account.

2. Journalize the return on Kingston’s books on September 28, 2018, of the D39–X4 Radials, which were ordered by mistake. Do not round numbers to the nearest whole dollar.

3. Journalize the payment on October 1, 2018, to Fields Distribution, Inc. Do not round numbers to the nearest whole dollar.

Transcribed Image Text:

FIELDS DISTRIBUTION, INC. 7290 S. Prospect Street Ravenna, OH 44266 Invoice date: September 23, 2018 Sold to: Kingston Tires Payment terms: 1/10, n/30 6678 Diamond Avenue Ravenna, OH 44266 Quantity Shipped Description Price Amount D39-X4 Radials 4 $38.12 $152.48 M223 Belted-bias 10 42.84 58.12 428.40 348.72 Q92 Truck tires Total $929.60 Due date: Amount: $920.30 October 3, 2018 October 4 through October 23, 2018 $929.60

> Under the new revenue recognition standard, what must companies do at the end of the period related to sales returns? Describe the journal entries that would be recorded.

> Under the new revenue recognition standard, how is the sale of inventory recorded?

> What are the two journal entries involved when recording the sale of inventory when using the perpetual inventory system?

> How is the net cost of inventory calculated?

> What is a purchase return? How does a purchase allowance differ from a purchase return?

> What would the credit terms of “2/10, n/EOM” mean?

> What account is debited when recording a purchase of inventory when using the perpetual inventory system?

> The account balances of Wilson Towing Service at June 30, 2018, follow: Requirements: 1. Prepare the balance sheet for Wilson Towing Service as of June 30, 2018. 2. What does the balance sheet report? Equipment $ 25,850 Service Revenue $ 15,000 Off

> What is an invoice?

> How is gross profit calculated, and what does it represent?

> What is Cost of Goods Sold (COGS), and where is it reported?

> Describe the operating cycle of a merchandiser.

> What are the two types of merchandisers? How do they differ?

> What is a merchandiser, and what is the name of the merchandise that it sells?

> Taylor Department Store uses a periodic inventory system. The adjusted trial balance of Taylor Department Store at December 31, 2018, follows: Requirements: 1. Prepare Taylor Department Store’s multi-step income statement for the year

> Journalize the following transactions that occurred in June 2018 for Daley Company. Assume Daley uses the periodic inventory system. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Dale

> The records of Grade A Beef Company list the following selected accounts for the quarter ended September 30, 2018: Requirements: 1. Prepare a single-step income statement. 2. Prepare a multi-step income statement. 3. J. Douglas, manager of the company,

> The unadjusted trial balance for Tuttle Electronics Company follows: Requirements: 1. Journalize the adjusting entries using the following data: a. Interest revenue accrued, $550. b. Salaries (Selling) accrued, $2,800. c. Depreciation Expenseâ

> The account balances of Wilson Towing Service at June 30, 2018, follow: Requirements: 1. Prepare the statement of retained earnings for Wilson Towing Service for the month ending June 30, 2018. 2. What does the statement of retained earnings report?

> The adjusted trial balance of Rockin Robbin Dance Company at April 30, 2018, follows: Requirements: 1. Prepare Rockin Robbin’s multi-step income statement for the year ended April 30, 2018. 2. Journalize Rockin Robbinâ€

> Journalize the following transactions that occurred in January 2018 for Sylvia’s Amusements. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Sylvia estimates sales ret

> Journalize the following transactions that occurred in February 2018 for Oceanic. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Oceanic estimates sales returns at the end of each mont

> Triton Department Store uses a periodic inventory system. The adjusted trial balance of Triton Department Store at December 31, 2018, follows: Requirements: 1. Prepare Triton Department Store’s multi-step income statement for the year

> Journalize the following transactions that occurred in March 2018 for Double Company. Assume Double uses the periodic inventory system. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. D

> The records of Farm Quality Steak Company list the following selected accounts for the quarter ended April 30, 2018: Requirements: 1. Prepare a single-step income statement. 2. Prepare a multi-step income statement. 3. M. Doherty, manager of the compan

> The unadjusted trial balance for Trudel Electronics Company at March 31, 2018, follows: Requirements: 1. Journalize the adjusting entries using the following data: a. Interest revenue accrued, $200. b. Salaries (Selling) accrued, $2,300. c. Depreciatio

> The adjusted trial balance of Rachael Rey Music Company at June 30, 2018, follows: Requirements: 1. Prepare Rachael Rey’s multi-step income statement for the year ended June 30, 2018. 2. Journalize Rachael Rey’s clos

> Journalize the following transactions that occurred in November 2018 for Julie’s Fun World. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Julie’s F

> Journalize the following transactions that occurred in September 2018 for Aquamarines. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Aquamarines estimates sales returns at the end of

> The account balances of Wilson Towing Service at June 30, 2018, follow: Requirements: 1. Prepare the income statement for Wilson Towing Service for the month ending June 30, 2018. 2. What does the income statement report? Equipment $ 25,850 Service

> This problem continues the Crystal Clear Cleaning practice set begun in Chapter 2 and continued through Chapters 3 and 4. Crystal Clear Cleaning has decided that, in addition to providing cleaning services, it will sell cleaning products. Crystal Clear u

> Rae Philippe was a warehouse manager for Atkins Oilfield Supply, a business that operated across eight Western states. She was an old pro and had known most of the other warehouse managers for many years. Around December each year, auditors would come to

> This case uses both the income statement (consolidated statements of operations) and the balance sheet (consolidated statements of financial position) of Target Corporation. Visit http://www.pearsonhighered.com/Horngren to view a link to the Target Corpo

> Ocean Life Boat Supply uses the periodic inventory method. The adjusted trial balance of Ocean Life Boat Supply at December 31, 2018, follows: Requirements: 1. Journalize the required closing entries at December 31, 2018. Assume ending Merchandise Inve

> Journalize the following transactions for Master Bicycles using the periodic inventory system. Explanations are not required. Nov. 2 Purchased $3,400 of merchandise inventory on account under terms 2/10, n/EOM and FOB shipping point. 6 Returned $800

> Journalize the following sales transactions for Straight Shot Archery using the periodic inventory system. Explanations are not required. The company estimates sales returns and allowances at the end of each month. Aug. 1 Sold $6,500 of equipment on

> Lawrence Appliances had the following purchase transactions. Journalize all necessary transactions using the periodic inventory system. Explanations are not required. Sep. 4 Purchased inventory of $6,900 on account from Max Appliance Wholesale, an a

> Journalize the following sales transactions for Morris Supply. Explanations are not required. Mar. 1 Morris Supply sold merchandise inventory for $3,000. The cost of the inventory was $1,800. The customer paid cash. Morris Supply was running a promo

> The adjusted trial balance of Quality Office Systems at March 31, 2018, follows: Requirements: 1. Journalize the required closing entries at March 31, 2018. 2. Set up T-accounts for Income Summary; Retained Earnings; and Dividends. Post the closing ent

> Estella Osage publishes an online travel magazine. In need of cash, the business applies for a loan with National Bank. The bank requires borrowers to submit financial statements. With little knowledge of accounting, Estella Osage, a stockholder, does no

> This and similar cases in later chapters focus on the financial statements of a real company—Target Corporation, a discount merchandiser that sells a wide assortment of general merchandise and food. Target sells both national and private and exclusive br

> Journalize the following transactions for Soul Art Gift Shop. Explanations are not required. Feb. 3 Purchased $3,300 of merchandise inventory on account under terms 3/10, n/EOM and FOB shipping point. 7 Returned $900 of defective merchandise purchas

> Journalize the following sales transactions for Antique Mall. Explanations are not required. The company estimates sales returns at the end of each month. Jan. 4 Sold $16,000 of antiques on account, credit terms are n/30. Cost of goods is $8,000. 8

> Howie Jewelers had the following purchase transactions. Journalize all necessary transactions. Explanations are not required. Jun. 20 Purchased inventory of $5,100 on account from Sanders Diamonds, a jewelry importer. Terms were 2/15, n/45, FOB ship

> Clink Electric uses the periodic inventory system. Clink reported the following selected amounts at May 31, 2018: Compute the following for Clink: a. Cost of goods sold. b. Gross profit. Merchandise Inventory, June 1, 2017 $ 16,000 Freight In $ 6,0

> Crazy Cookies earned net sales revenue of $66,000,000 in 2018. Cost of goods sold was $39,600,000, and net income reached $7,000,000, the company’s highest ever. Compute the company’s gross profit percentage for 2018.

> Emerson St. Book Shop’s unadjusted Merchandise Inventory at June 30, 2018 was $5,200. The cost associated with the physical count of inventory on hand on June 30, 2018, was $4,900. In addition, Emerson St. Book Shop estimated approximately $1,000

> Match the accounting terms with the corresponding definitions. 1. Credit Terms a. The cost of the merchandise inventory that the business has sold to customers. 2. FOB Destination b. An amount granted to the purchaser as an incentive to keep goods t

> Dobbs Wholesale Antiques makes all sales under terms of FOB shipping point. The company usually ships inventory to customers approximately one week after receiving the order. For orders received late in December, Kathy Dobbs, the owner, decides when to s

> Ashley Stamper opened a medical practice. During July, the first month of operation, the business, titled Ashley Stamper, MD, experienced the following events: Analyze the effects of these events on the accounting equation of the medical practiceof Ash

> Party-Time T-Shirts sells T-shirts for parties at the local college. The company completed the first year of operations, and the shareholders are generally pleased with operating results as shown by the following income statement: Bill Hildebrand, the

> This problem continues the Canyon Canoe Company situation and focuses on no merchandising transactions, adjusting and closing entries, and preparing financial statements. Canyon Canoe Company does not typically prepare adjusting and closing entries each

> This problem continues the Canyon Canoe Company situation from Chapter 4. At the beginning of the new year, Canyon Canoe Company decided to carry and sell T-shirts with its logo printed on them. Canyon Canoe Company uses the perpetual inventory system to

> Hyatt Hotels Corporation is headquartered in Chicago and is a leading global hospitality company. The company develops, owns, and operates hotels, resorts, and vacation ownership properties in 52 different countries. For the year ended December 31, 2015,

> Kathy Wintz formed a lawn service business as a summer job. To start the corporation on May 1, 2018, she deposited $1,000 in a new bank account in the name of the business. The $1,000 consisted of a $600 loan from Bank One to her company, Wintz Lawn Serv

> End of the Line Montana Refrigeration has these account balances at December 31, 2018: Requirements: 1. Calculate End of the Line Montana Refrigeration’s current ratio. 2. How much in current assets does End of the Line Montana Refrig

> Review the steps in the accounting cycle, and answer the following questions: 1. What is the first step? 2. Are any steps optional? 3. Which steps are completed throughout the period? 4. Which steps are completed only at the end of the period? 5. What i

> The following balances appear on the books of Sarah Simmons Enterprises: Retained Earnings, $29,600; Dividends, $10,500; Income Summary, $0; Service Revenue, $24,500; Salaries Expense, $6,200; Rent Expense, $3,500; and Advertising Expense, $2,000. All ac

> Brett Teddy Enterprises had the following accounts and normal balances listed on its December 31st adjusted trial balance: Service Revenue, $21,900; Salaries Expense, $6,000; Rent Expense, $4,400; Advertising Expense, $3,100; and Dividends, $6,900. Journ

> Refer to the data in Short Exercise S4-1. Prepare Dalton’s classified balance sheet at December 31, 2018. Assume the Notes Payable is due on December 1, 2025. Use the report form. Short Exercise 4-1: Dalton Hair Stylistsâ€&#

> The analysis of the first eight transactions of Advanced Accounting Service follows. Describe each transaction. ASSETS LIABILITIES ++ EQUITY Contributed Capital Retained Earnings Cash + Accounts +Equipment Accounts + Common Dividends + Service - Sal

> Ocean Breeze Associates accrued $8,500 of Service Revenue at December 31. Ocean Breeze Associates received $14,500 on January 15, including the accrued revenue recorded on December 31. Requirements: 1. Record the adjusting entry to accrue Service Revenu

> For each account listed, identify whether the account would be included on a post- closing trial balance. Signify either Yes (Y) or No (N). a. Office Supplies b. Interest Expense c. Retained Earnings d. Dividends e. Service Revenue f. Accumulated Deprec

> For each account listed, identify whether the account is a temporary account (T) or a permanent account (P). a. Rent Expense b. Prepaid Rent c. Equipment d. Common Stock e. Salaries Payable f. Dividends g. Service Revenue h. Supplies Expense i. Office S

> A partial worksheet for Aaron Adjusters is presented below. Solve for the missing information. A L M Income Statement Balance Sheet 5 Debit Credit Debit Credit 32 Total 33 Net (c) $ 22,400 (a) (b) $ 61,400 5,300 (d) 34 Total (e) (f) (g) $ 61,400 35

> A partial worksheet for Ramey Law Firm is presented below. Solve for the missing information. A м Income Statement Balance Sheet 6 Debit Credit Debit Credit 32 Total 33 Net (b) (a) $ 24,850 $ 211,325 $ 202,950 8,375 (c) 34 Total (d) $ 24,850 (e) (f)

> Answer the following questions: Requirements: 1. What type of normal balance does the Retained Earnings account have—debit or credit? 2. Which type of income statement account has the same type of balance as the Retained Earnings account? 3. Which type

> For each account listed, identify the category in which it would appear on a classified balance sheet. a. Office Supplies b. Interest Payable c. Retained Earnings d. Copyrights e. Land f. Accumulated Depreciation—Furniture g. Land (held for long-term in

> Refer to the data in Short Exercise S4-1. Prepare Dalton’s statement of retained earnings for the year ended December 31, 2018. Short Exercise 4-1: Dalton Hair Stylists’s adjusted trial balance follows. Prepare Dalton’s income sta

> Dalton Hair Stylists’s adjusted trial balance follows. Prepare Dalton’s income statement for the year ended December 31, 2018.

> Indicate the effects of the following business transactions on the accounting equation for Sam’s Snack Foods, a supplier of snack foods. Transaction (a) is answered as a guide. a. Sam’s Snack Foods received cash from issuance of common stock to stockhold

> List the steps of the accounting cycle.

> What are the steps in the closing process?

> How is the Income Summary account used? Is it a temporary or permanent account?

> What is the closing process?

> Why are financial statements prepared in a specific order? What is that order?

> What are reversing entries? Are they required by GAAP?

> What is the current ratio, and how is it calculated?

> What types of accounts are listed on the post-closing trial balance?

> If a business had a net loss for the year, what would be the closing entry to close Income Summary and transfer the net loss to the Retained Earnings account?

> What are permanent accounts? Are permanent accounts closed in the closing process?

> Indicate the effects of the following business transactions on the accounting equation of Vivian’s Online Video store. Transaction (a) is answered as a guide. a. Received cash of $10,000 from issuance of common stock. b. Earned video rental revenue on ac

> What are temporary accounts? Are temporary accounts closed in the closing process?

> If a business had a net loss for the year, where would the net loss be reported on the worksheet?

> How could a worksheet help in preparing financial statements?

> What does liquidity mean?

> Identify two liability categories on the classified balance sheet, and give examples of each category.

> Identify two asset categories on the classified balance sheet, and give examples of each category.

> What is a classified balance sheet?

> What does the balance sheet report?

> What does the statement of retained earnings show?

> What does the income statement report?

> As the manager of a Papa Sean’s restaurant, you must deal with a variety of business transactions. Give an example of a transaction that has each of the following effects on the accounting equation: a. Increase one asset and decrease another asset. b. De

> What document are financial statements prepared from?

> The unadjusted trial balance and adjustment data of Myla’s Motors at December 31, 2018, follow: Adjustment data at December 31, 2018: a. Depreciation on equipment, $1,700. b. Accrued Wages Expense, $1,300. c. Office Supplies on hand,

> On December 1, Curt Wilson began an auto repair shop, Wilson’s Quality Automotive. The following transactions occurred during December: The business uses the following accounts: Cash; Accounts Receivable; Office Supplies; Prepaid Insu

> The unadjusted trial balance of Watson Anvils at December 31, 2018, and the data for the adjustments follow: Adjustment data: a. Unearned Revenue still unearned at December 31, $3,600. b. Prepaid Rent still in force at December 31, $2,000. c. Office Su

> The unadjusted trial balance of Fleming Investment Advisers at December 31, 2018, follows: Adjustment data at December 31, 2018: a. Unearned Revenue earned during the year, $700. b. Office Supplies on hand, $3,000. c. Depreciation for the year, $3,000.

> The adjusted trial balance of Bradley Irrigation System at December 31, 2018, follows: Requirements: 1. Prepare the company’s income statement for the year ended December 31, 2018. 2. Prepare the company’s statement

> Adjusted trial balance of Rocket Real Estate Appraisal at June 30, 2018, follows: Requirements: 1. Prepare the company’s income statement for the year ended June 30, 2018. 2. Prepare the company’s statement of retain