Question: Kristin Helmud is the general manager of

Kristin Helmud is the general manager of Highland Inn, a local mid-priced hotel with 100 rooms. Her job objectives include providing resourceful and friendly service to the hotel’s guests, maintaining an 80% occupancy rate, improving the average rate received per room to $88 from the current $85, achieving a savings of 5% on all hotel costs, and reducing energy use by 10% by carefully managing the use of heating and air conditioning in unused rooms and by carefully managing the onsite laundry facility, among other means. The hotel’s owner, a partnership of seven people who own several hotels in the region, wants to structure Kristin’s future compensation to objectively reward her for achieving these goals. In the past, she has been paid an annual salary of $72,000 with no incentive pay. The incentive plan the partners developed has each of the goals weighted as follows:

If Kristin achieves all of these goals, the partners determined that her performance should merit a bonus of $30,000. The partners also agree that her salary will need to be reduced to $60,000 because of the addition of the bonus.

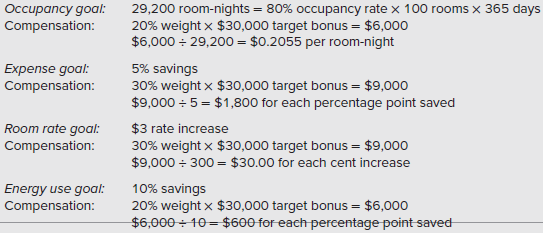

The goal measures used to compensate Kristin are as follows:

Kristin’s new compensation plan will thus pay her a $60,000 salary plus 20.55 cents per room-

Night sold plus $1,800 for each percentage point saved in the expense budget plus $30 for each cent increase in the average room rate plus $600 for each percentage point saved in energy use. The minimum potential compensation would be $60,000 and the maximum potential compensation for Kristin would be $60,000 + $30,000 = $90,000.

Required:

1. Based on this plan, compute Kristin’s total compensation if her performance results are:

a. 30,000 room-nights, 5% saved, $3.00 rate increase, and 8% reduction in energy use.

b. 25,000 room-nights, 3% saved, $1.15 rate increase, and 5% reduction in energy use.

c. 28,000 room-nights, 0% saved, $1.00 rate increase, and 2% reduction in energy use.

2. Comment on the expected effectiveness of this plan (including sustainability). In what way, if at all, would you change the compensation weights?

> Suppose you are the CEO of a large firm in a service business and you think that by acquiring a certain competing firm, you can generate growth and profits at a greater rate for the combined firm. You have asked some financial analysts to study the propo

> How would you explain the relationship between value-chain analysis and the use of the balanced scorecard for a firm that uses both? Use a hospital as an example.

> What industries do you think are most suited for value-chain analysis and why?

> Identify three or four well-known firms that succeed through cost leadership.

> Think of an example of a firm that succeeds on differentiation and give some examples of its strengths and weaknesses that would be included in a SWOT analysis.

> Think of an example of a firm that succeeds on cost leadership and give some examples of its strengths and weaknesses that would be included in a SWOT analysis.

> Explain the uses of value-chain analysis.

> Williams Auto has a machine that installs tires. The machine is now in need of repair. The machine originally cost $10,000 and the repair will cost $1,000, but the machine will then last two years. The labor cost of operating the machine is $0.50 per tir

> What is sustainability, and what does it mean for a business?

> Contrast using the balanced scorecard with using only financial measures of success.

> What is a balanced scorecard? What is its primary objective?

> Identify four or five potential critical success factors for an auto-repair shop.

> Identify four or five potential critical success factors for a large retail discount store that features a broad range of consumer merchandise.

> Identify four or five potential critical success factors for a small chain of retail jewelry stores.

> Identify four or five potential critical success factors for a large savings and loan institution.

> Identify and explain the two types of competitive strategy.

> Many would argue that the TV manufacturing business has become largely a commodity business, and competition is based on price, with many good brands offered at low prices at retailers such as Walmart. The manufacturers of TVs are said to have a barrier

> a. Consider a commodity business such as building materials, many types of food products, and many types of electronics products. A good example of a commodity is gasoline. Are these companies likely to compete on cost leadership or differentiation? Why?

> A company is formulating its marketing expense budget for the last quarter of the year. Sales in units for the third quarter amounted to 4,000; sales volume for the fourth quarter is expected to increase by 10 percent. Variable marketing expense per unit

> How many measures are usually on the balanced scorecard?

> What are some of the key issues to consider in effectively implementing a balanced scorecard?

> What is the difference between strategy and planning?

> Michael Porter argues a firm cannot be at the same time a cost leader and a differentiator. Do you think a firm could be a cost leader and then become a differentiator, or vice versa?

> Consider the three broad categories of firms: manufacturers, retailers, and service firms. Give an example of a cost leader and a differentiator in each of the three categories. Do there tend to be more cost leaders relative to differentiators in one or

> Take as an example the bank where you have your account(s) and state whether you think it is a cost leader or a differentiator and why.

> What is a commodity? Give some examples of what you consider to be commodities and explain whether you think the company making the commodity product or service is a cost leader or a differentiator and why.

> What would you consider to be the strategy of The Coca-Cola Company: cost leadership or differentiation? Why?

> In recent years, the drug VIOXX was removed from the market by the pharmaceutical giant Merck & Co. The drug was used to relieve arthritis pain and was especially beneficial for patients who needed a medication that was easy on the stomach. But research

> Do you think there is value to the firm and to its shareholders of a strong ethical climate in the firm? Why or why not? Do you think there is value to the firm and to its shareholders of a strong ethical climate in the firm? Why or why not?

> If the December 1 balance in the Direct Materials Inventory account was $37,000, the December 31 balance was $39,500, and $150,000 of direct materials were issued to production during December, what was the amount of direct materials purchased during the

> Identify what you think is a very successful firm and explain why. How did it become successful?

> Name the 13 contemporary management techniques and describe each briefly.

> Contrast past and present business environments with regard to the following aspects: basis of competition, manufacturing processes and manufacturing technology, required labor skills, emphasis on quality, number of products, number of markets, types of

> What are some factors in the contemporary business environment that are causing changes in business firms and other organizations? How are the changes affecting the way those firms and organizations use cost management information?

> The management accountant is a full business partner with management in which of the four stages of cost system development, and why?

> Award Plus Co. manufactures medals for winners of athletic events and other contests. Its manufacturing plant has the capacity to produce 10,000 medals each month; current monthly production is 7,500 medals. The company normally charges $225 per medal. V

> If Problem 10-58 (Budgeting and Sustainability) has not already been assigned, it can be assigned here. Note: For requirements 1 and 2, round answers to nearest whole number. For requirements 3a and 3b, round answer to 2 decimal places.

> Read the article by Joel Litman and Mark L. Frigo titled “When Strategy and Valuation Meet,” Strategic Finance, August 2004, pp. 31–39. The article provides a comprehensive discussion of how business strategy and business valuation are interrelated and p

> Refer to the information for Brooks Plumbing Products Inc. (BPP) in Problem 20-51. Required: (round all calculated answers to the nearest whole dollar) 1. What is the valuation of BPP (for 2022) using the market value method? 2. What is the valuation of

> Brooks Plumbing Products Inc. (BPP) manufactures plumbing fixtures and other home improvement products that are sold in Home Depot and Walmart as well as hardware stores. BPP has a solid reputation for providing value products, good quality, and a good p

> The George Company has a policy of maintaining an end-of-month cash balance of at least $30,000. In months where a shortfall is expected, the company can draw in $1,000 increments on a line of credit it has with a local bank, at an interest rate of 12 pe

> Refer to the information in Problem 20-49 for the Davidson Yachts Company. Required: 1. What is the valuation of Davidson Yachts Company using the book value of equity method? 2. What is the valuation of Davidson Yachts Company using the multiples-based

> Davidson Yachts is a small private company founded by two businesspeople who are friends and avid sailors. At present, they are interested in expanding the business and have asked you to review its financial statements. Davidson Yachts sells approximatel

> A study of the airline industry examined whether performance on a selected nonfinancial measure was a significant predictor of CEO compensation. A sample of 35 firms was taken, and regression was conducted to determine the potential relationship between

> Many people ask, “Are executives worth their very high pay?” As noted in the chapter, this is a difficult question to answer because the benefits an effective executive brings to the company are hard to measure. One th

> Universal Air Inc. supplies instrumentation components to airplane manufacturers. Although only a few competitors are in this market, the competition is fierce. Universal uses a traditional performance incentive plan to award middle-management bonuses o

> Digital Business Incorporated (DBI) is a worldwide manufacturing company that specializes in high technology products for the aerospace, automotive, and plastics industries. State-of-the-art technology and business innovation have been key to the firm’s

> McCoy Brands Inc. (MBI) is a retailer of consumer products. The company made two acquisitions in previous years to diversify its product lines. In 2020, MBI acquired a consumer electronics firm producing computers. MBI now (2022) has three divisions: Con

> A restaurant manager has the following goals: (1) serve 300 customers per day and (2) achieve an average price per customer of $6.88. The restaurant is open 365 days per year. The two goals are equally important. The manager’s salary is $68,000. The m

> DuMelon Publishing Inc. is a nationwide company headquartered in Boston, Massachusetts. The firm’s benefits are a significant element of employee compensation. All professional employees at DuMelon receive company-paid benefits, including medical insuran

> Royal Cigar Company is preparing a budget for cash collections. Its sales for November and December are estimated as $90,000 and $100,000, respectively. Past practice indicates that sales in any given month are collected as follows: month of sale, 75 per

> Brief Exercises 7-11 through 7-14 involve departmental cost allocation with two service departments and two production departments. Use the following information for these four exercises: What is the total cost in P1 and P2 after allocation using the d

> Kate’s Candy Co. makes chewy chocolate candies at a plant in Winston-Salem, North Carolina. Steve Bishop, the production manager at this facility, installed a packaging machine last year at a cost of $500,000. This machine is expected to last for 10 more

> As indicated in the chapter, determining the appropriate transfer price in a multinational setting is a very complex problem, with multiple strategic considerations. Consider as an example a U.S. company with a subsidiary in Italy and a subsidiary in Ire

> A subsidiary company located in country A purchases $100 worth of goods. It then repackages, exports, and sells those goods to the parent company, located in country B, for $200. The parent company sells the goods (to an external entity) for $300. Theref

> Zen Manufacturing, Inc., is a multinational firm with sales and manufacturing centers in 15 countries. One of its manufacturing divisions, in country X, sells a product to a retail division in country Y for $300,000 per unit. The division in country X ha

> Ajax Consolidated has several divisions; however, only two of its divisions transfer products to other divisions. The mining division refines toldine, which it transfers to the metals division, where toldine is processed into an alloy and is sold to cust

> Federated Manufacturing Inc. (FMI) produces electronic components in three divisions: industrial, commercial, and consumer products. The commercial products division annually purchases 10,000 units of part 23–6711, which the industrial

> Phoenix Inc., a cellular communication company, has multiple business units, organized as divisions. Each division’s management is compensated based on the division’s operating income. Division A currently purchases ce

> Mylar Corporation started as a single plant to produce its major components and then assembled its main product into electric motors. Mylar later expanded by developing outside markets for some components used in its motors. Eventually, the company reorg

> American Motors Inc. is divided, for performance evaluation purposes, into several divisions. The Automobile Division of American Motors purchases most of its transmission systems from another unit of the company. The Transmission Division’s incremental

> Increasing shareholder value is a key objective for many profit-seeking organizations. As indicated in the chapter, EVA® is meant to approximate economic income and, in this sense, can be viewed as a measure of shareholder value added by the firm during

> Campbell’s Wholesale Company is preparing monthly cash budgets for the fourth quarter of the year. Monthly sales revenue in this quarter is estimated as follows: October, $30,000; November, $24,000; and December, $20,000. All sales are made on open credi

> Refer to Problem 19-44 for reported financial statement data for Nimrod Inc. Required: 1. Using the financing approach, prepare an estimate of EVA® NOPAT (to the nearest whole dollar). In addition to the preceding data, you discovered the fol

> You are provided with the following financial statement information from Nimrod Inc. for its most recent fiscal year: The statement of income for the company for the year just ended is as follows: Assume a weighted-average cost of capital (WACC) of 1

> As referenced in the five-step process presented at the beginning of this chapter, one issue that confronts top management is selection of an appropriate time period for evaluating the financial performance of the company’s investment centers. This probl

> Blackwood Industries manufactures die machinery. To meet its expansion needs, it recently (2020) acquired one of its suppliers, Delta Steel. To maintain Delta’s separate identity, Blackwood reports Delta’s operations a

> Consolidated Industries is a diversified manufacturer with business units organized as divisions, including the Reigis Steel Division. Consolidated monitors its divisions on the basis of both unit contribution and return on investment (ROI), with investm

> One of the three underlying precepts of sustainability is economic performance (balanced with social and environmental performance). This question pertains to the application of ROI as part of a performance-management system related to corporate sustaina

> What is the return on investment (ROI) of corporate wellness programs? What are the nonfinancial returns on such investments? The following article addresses the concept of return on investment for the wellness of the organization’s workforce: Leonard L.

> The authors of an article published in Harvard Business Review (Laurie Bassei and Daniel McMurrer, “Maximizing Your Return on People,” Harvard Business Review (March 2007), p. 115-123) discuss how the concept of return on investment can be applied to the

> As indicated in the chapter, there are goal congruence problems associated with the use of return on investment (ROI) as an indicator of business unit financial performance. One such problem relates to the bias against accepting new investments because o

> Assume the purchase of new delivery trucks used in a product-delivery service. This equipment is needed to improve delivery service and respond to recent environmental goals embraced by the company. The cost of the new equipment is $1,200,000; the expect

> Easy Clean operates a chain of dry cleaners. It is experimenting with the use of a continuous improvement (i.e., kaizen) budget for operating expenses. Currently, a typical location has operating expenses of $10,000 per month. Plans are in place to achie

> Ready Products Inc. operates two divisions, each with its own manufacturing facility. The accounting system reports the following data for 2022: Ready estimates the useful life of each manufacturing facility to be 15 years. As of the end of 2022, the p

> Read the following article by Marc J. Epstein, Adriana Rejc Buhovac, and Kristi Yuthas: “Implementing Sustainability: The Role of Leadership and Organizational Culture,” Strategic Finance, April 2010, pp. 41–47. The article explains the use of management

> For each of the following cases, determine whether the business unit should be evaluated as a cost center or a profit center and explain why. If you choose cost center, then explain which type of cost center—the discretionary-cost center or the engineere

> Cardio World Inc. (CWI) is a sporting goods retailer that specializes in bicycles, running shoes, and related clothing. The firm has become successful by careful attention to trends in cycling, running, and changes in the technology and fashion of sport

> Levine Company is a manufacturer of very inexpensive cell phones and television sets. The company uses recycled parts and a highly structured manufacturing process to keep costs low so that it can sell at very low prices. The company uses lean accounting

> Braxton Hospital and Health Care Services (BHHS) in Braxton, Mississippi, is a part of the Pillford University Health System. BHHS is a 450-bed community teaching hospital with the following mission: “In six years, Braxton Hospital and Health Care Servic

> Suburban General Hospital owns and operates several community hospitals in North Carolina. One of its hospitals, Cordona Community Hospital, is a not-for-profit institution that has not met its financial targets in the past several years because of decre

> MetroBank is a fast-growing bank that serves the region around Jacksonville, Florida. The bank provides commercial and individual banking services, including investment and mortgage banking services. The firm’s strategy is to continue to grow by acquirin

> Hamilton-Jones, a large consulting firm in Los Angeles, has experienced rapid growth over the last 5 years. To better serve its clients and to better manage its practice, the firm decided 2 years ago to organize into five strategic business units, each o

> Pittsburgh-Walsh Company Inc. (PWC) manufactures lighting fixtures and electronic timing devices. The lighting fixtures division assembles units for the upscale and mid-range markets. The trend in recent years as the economy has been expanding is for sal

> Grey Manufacturing Company expects sales to total 13,000 units in the first quarter, 12,000 units in the second quarter, and 15,000 units in the third quarter of the current fiscal year. Company policy is to have on hand at the end of each quarter an amo

> RNB is a bank holding company for a statewide group of retail consumer-oriented banks. RNB was formed in the early 1960s by investors who believed in a high level of consumer services. The number of banks owned by the holding company expanded rapidly. Th

> Stratford Corporation is a diversified company whose products are marketed both domestically and internationally. Its major product lines are pharmaceutical products, sports equipment, and household appliances. At a recent meeting, Stratfordâ€

> Whitehouse Gardens Inc. is a chain of home supply and gardening product stores. Last year, Whitehouse adopted the balanced scorecard (BSC) for evaluation of store and store manager performance. The BSC has helped Whitehouse to identify the critical succe

> Fashionisto Inc. is an upscale clothing store in New York City and London. Each store has two main departments, Men’s Apparel and Women’s Apparel. Marie Phelps, Fashionisto’s CFO, wants to use strateg

> Kenneth Merchant and Tatiana Sandino summarize clearly some of the potential limitations of profit center evaluation in the article “Four Options for Measuring Value Creation,” Journal of Accountancy, August 2009, pp. 34–37 (available here: www.journalof

> This problem is an extension to the Bally Company COQ reporting example, reflected in Exhibit 17.10. At year 0, the management team for the company was presented with its first COQ report for the company. Top management was justifiably concerned both abo

> Assume that Allied Manufacturing Co. produces sheet metal, with a target thickness of 0.750 inch. Below are the observed thicknesses of output each day over the past 30 working days. Because the company has only recently begun operations and is eager to

> Drago Company produces a line of brass-based products, one of which is a flow control valve (for regulating the flow of water). The production of this valve requires the use of specialized equipment by highly trained employees. Recently, the company has

> Can lean principles be applied to so-called knowledge work? This issue is addressed in the following article: D. R. Staats and D. M. Upton, “Lean Knowledge Work,” Harvard Business Review, October 2011, pp. 101–110 (available at https://hbr.org/2011/10/le

> As indicated in the text, various tools from operations management and statistics are used to help support Six Sigma goals and process improvements in a lean environment. One such tool is a control chart—a key element used to assess statistical process c

> Ajax Manufacturing produces a single product, which takes 8.0 pounds of direct material per unit produced. The company’s policy is to maintain an end-of-quarter inventory of materials equal to 25 percent of the following quarter’s material requirements f

> Carrie Lee, the president of Lee Enterprises, was concerned about the results of her company’s new quality control efforts. “Maybe the emphasis we’ve placed on upgrading our quality control system wil

> Upon graduation, you and a friend established a computer-consultancy business. Your business has generally been successful, but you and your colleague wish to expand the business significantly over the next 3 years. You have always assumed that the servi

> Use the data in Problem 17-70 to respond to the requirements that follow. Required: 1. If you haven’t done so already (in conjunction with Problem 17-70), prepare in Excel a COQ report for 2022 and 2023. Show subtotals each year for ea

> Acme Materials Company manufactures and sells synthetic coatings that can withstand high temperatures. Its primary customers are aviation manufacturers and maintenance companies. The following table contains financial information pertaining to COQ in 202