Question: Last Chance Mine (LC) purchased a coal

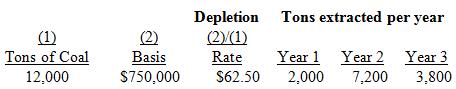

Last Chance Mine (LC) purchased a coal deposit for $750,000. It estimated it would extract 12,000 tons of coal from the deposit. LC mined the coal and sold it, reporting gross receipts of $1 million, $3 million, and $2 million for years 1 through 3, respectively. During years 1 – 3, LC reported net income (loss) from the coal deposit activity in the amount of ($20,000), $500,000, and $450,000, respectively. In years 1 – 3, LC actually extracted 13,000 tons of coal as follows:

a. What is Last Chance’s cost depletion for years 1, 2, and 3?

b. What is Last Chance’s percentage depletion for each year (the applicable percentage for coal is 10 percent)?

c. Using the cost and percentage depletion computations from the previous parts, what is Last Chance’s actual depletion expense for each year?

Transcribed Image Text:

Depletion Tons extracted per year (2)(1) Rate (1) (2) Year 1 Year 2 Year 3 7,200 Tons of Coal Basis 12,000 S750,000 S62.50 2,000 3,800

> What are tax reasons why a corporation may choose to cap its executives’ salaries at $1 million?

> What are nontax reasons why a corporation may choose to cap its executives’ salaries at $1 million?

> Holding all else equal, does an employer with a higher marginal tax rate or lower marginal tax rate have a lower after-tax cost of paying a particular employee’s salary? Explain.

> Seiko’s current salary is $85,000, and she fancies European sports cars. She purchases a new auto each year. Seiko is currently a manager for an office equipment company. Her friend, knowing of her interest in sports cars, tells her about a manager posit

> Nicole and Braxton are each 50 percent shareholders of NB Corporation. Nicole is also an employee of the corporation. NB is a calendar-year taxpayer and uses the accrual method of accounting. The corporation pays its employees monthly on the first day of

> Describe the circumstances in which an employee may not value a nontaxable fringe benefit.

> Explain the policy reason for including the value of country club memberships provided to an executive as a taxable fringe benefit.

> Explain why Congress allows employees to receive certain fringe benefits tax-free but others are taxable?

> Describe a cafeteria plan and discuss why an employer would provide a cafeteria plan for its employees.

> Explain why an employee might accept a lower salary to receive a nontaxable fringe benefit. Why might an employee not accept a lower salary to receive a nontaxable fringe benefit?

> Assume that a friend has accepted a position working as an accountant for a large automaker. As a signing bonus, the employer provides the traditional cash incentive but also provides the employee with a vehicle not to exceed a retail price of $25,000. E

> Mike is working his way through college and trying to make ends meet. Tara, a friend, is graduating soon and tells Mike about a really great job opportunity. She is the onsite manager for an apartment complex catering to students. The job entails working

> Compare and contrast the employer’s tax consequences of providing taxable and nontaxable fringe benefits.

> When an employer provides group-term life to an employee, what are the tax consequences to the employee? What are the tax consequences for the employer?

> Lars Osberg, a single taxpayer with a 35 percent marginal tax rate, desires health insurance. The health insurance would cost Lars $8,500 to purchase if he pays for it himself (Lars’s AGI is too high to receive any tax deduction for the insurance as a me

> Explain the differences and similarities between a fringe benefit as a form of compensation and salary.

> What risks do employees making an §83(b) election on a restricted stock grant assume?

> Matt just started work with Boom Zoom, Inc., a manufacturer of credit card size devices for storing and playing back music. Due to the popularity of their devices, analysts expect Boom Zoom’s stock price to increase dramatically. In addition to his salar

> How is the tax treatment of restricted stock different from that of nonqualified options? How is it similar?

> In 2016, Jill, age 35, received a job offer with two alternative compensation packages to choose from. The first package offers her $90,000 annual salary with no qualified fringe benefits, requires her to pay $3,500 a year for parking, and pay her life i

> Sylvana is given a job offer with two alternative compensation packages to choose from. The first package offers her $250,000 annual salary with no qualified fringe benefits. The second package offers $235,000 annual salary plus health and life insurance

> Santini’s new contract for 2016 indicates the following compensation and benefits: Santini is 54 years old at the end of 2016. He is single and has no dependents. Assume that the employer matches $1 for $1 for the first $6,000 that the

> Fizbo Corporation is in the business of breeding and racing horses. Fizbo has taxable income of $5,000,000 other than from these transactions. It has nonrecaptured §1231 losses of $10,000 from 2012 and $13,000 from 2010. Consider the following transacti

> WAR (We Are Rich) has been in business since 1983. WAR is an accrual method sole proprietorship that deals in the manufacturing and wholesaling of various types of golf equipment. Hack & Hack CPAs have filed accurate tax returns for WARâ€&

> Vertovec Inc., a large local consulting firm in Utah, hired several new consultants from out of state last year to help service their expanding list of clients. To aide in relocating the consultants, Vertovec Inc. purchased the consultants’ homes in thei

> Bills Corporation runs a defense contracting business that requires security clearance. To prevent unauthorized access to its materials, Bills requires its security personnel to be on duty except for a 15-minute break every two hours. Since the nearest r

> Mark received 10 ISOs at the time he started working for Hendricks Corporation five years ago when Hendricks’s price was $5 per share (each option gives him the right to purchase 10 shares of Hendricks Corporation stock for $5 per share). Now that Hendri

> Suppose that David adopted the last-in first-out (LIFO) inventory-flow method for his business inventory of widgets (purchase prices below). In late December, David sold widget #2 and next year David expects to purchase three more widgets at the followi

> This year Amber opened a factory to process and package landscape mulch. At the end of the year, Amber’s accountant prepared the following schedule for allocating manufacturing costs to the mulch inventory, but her accountant is unsure

> Nicole’s business uses the accrual method of accounting and accounts for inventory with specific identification. In year 0, Nicole received a $4,500 payment with an order for inventory to be delivered to the client early next year. Nicole has the invento

> In October of year 0, Janine received a $6,000 payment from a client for 25 months of security services she will provide starting on November 1 of year 0. This amounts to $240 per month. a. When must Janine recognize the income from the $6,000 advance p

> On April 1 of year 0 Stephanie received a $9,000 payment for full payment on a three-year service contract (under the contract Stephanie is obligated to provide advisory services for the next three years). a. What amount of income should Stephanie recog

> Ben teaches golf lessons at a country club under a business called Ben’s Pure Swings (BPS). He operates this business as a sole proprietorship on the accrual basis of accounting. Ben’s trusty accountant, Brian, has produced the following accounting infor

> Way Corporation disposed of the following tangible personal property assets in the current year. Assume that the delivery truck is not a luxury auto. Calculate Way Corporation’s 2016 depreciation expense (ignore §179 expense and bonus depreciation for th

> Parley needs a new truck to help him expand Parley’s Plumbing Palace. Business has been booming and Parley would like to accelerate his tax deductions as much as possible (ignore §179 expense and bonus depreciation for this problem). On April 1, Parley p

> Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, $300 per night for three night’s lodging, $200 for

> Harris Corp. is a technology start-up and is in its second year of operations. The company didn’t purchase any assets this year but purchased the following assets in the prior year: Harris did not know depreciation was tax deductible un

> Convers Corporation (June 30 year-end) acquired the following assets during the current tax year (ignore §179 expense and bonus depreciation for this problem): What is the allowable MACRS depreciation on Convers’ property i

> Evergreen Corporation (calendar year end) acquired the following assets during the current year (ignore §179 expense and bonus depreciation for this problem): a. What is the allowable MACRS depreciation on Evergreen’s prope

> At the beginning of the year, Dee began a calendar-year business and placed in service the following assets during the year: Assuming Dee does not elect §179 expensing or bonus depreciation, answer the following questions: a. What is Dee&acir

> DLW Corporation acquired and placed in service the following assets during the year: Assuming DLW does not elect §179 expensing or bonus depreciation, answer the following questions: a. What is DLW’s year 1 cost recovery fo

> At the beginning of the year, Pop lock began a calendar-year dog boarding business called Griff’s Palace. Pop lock bought and placed in service the following assets during the year: Assuming Poplock does not elect §179 expen

> Wanting to finalize a sale before year-end, on December 29, WR Outfitters sold to Bob a warehouse and the land for $125,000. The appraised fair market value of the warehouse was $75,000, and the appraised value of the land was $100,000. a. What is Bob’

> Brittany started a law practice as a sole proprietor. She owned a computer, printer, desk, and file cabinet she purchased during law school (several years ago) that she is planning to use in her business. What is the depreciable basis that Brittany shoul

> Dennis contributed business assets to a new business in exchange for stock in the company. The exchange did not qualify as a nontaxable exchange. The fair market value of these assets was $287,000 on the contribution date. Dennis’s original basis in the

> In January, Prahbu purchases a new machine for use in an existing production line of his manufacturing business for $90,000. Assume that the machine is a unit of property and is not a material or supply. Prahbu pays $2,500 to install the machine, and aft

> Ralph invited a potential client to dinner and the theatre. Ralph paid $250 for the dinner and $220 for the theatre tickets in advance. They first went to dinner and then they went to the theatre. a. What amount can Ralph deduct if, prior to the dinner,

> Emily purchased a building to store inventory for her business. The purchase price was $760,000. Beyond this, Emily incurred the following necessary expenses to get the building ready for use: $2,000 to repair minor leaks in the roof, $5,000 to make the

> Jose purchased a delivery van for his business through an online auction. His winning bid for the van was $24,500. In addition, Jose incurred the following expenses before using the van: shipping costs of $650; paint to match the other fleet vehicles at

> Bethany incurred $20,000 in research and experimental costs for developing a specialized product during July of year 1. Bethany went through a lot of trouble and spent $10,000 in legal fees to receive a patent for the product in August of year 3. Bethany

> Nicole organized a new corporation. The corporation began business on April 1 of year 1. She made the following expenditures associated with getting the corporation started: a. What is the total amount of the start-up costs and organizational expenditure

> Juliette formed a new business to sell sporting goods this year. The business opened its doors to customers on June 1. Determine the amount of start-up costs Juliette can immediately expense (not including the portion of the expenditures that are amortiz

> After several profitable years running her business, Ingrid decided to acquire the assets of a small competing business. On May 1 of year 1, Ingrid acquired the competing business for $300,000. Ingrid allocated $50,000 of the purchase price to goodwill.

> Paul Vote purchased the following assets this year (ignore §179 expensing and bonus depreciation when answering the questions below): a. What is Paul’s allowable MACRS depreciation expense for the property? b. What is Paul&a

> Burbank Corporation (calendar-year end) acquired the following property this year: a. Assuming no bonus or §179 expense, what is Burbank’s maximum cost recovery for this year? b. Assuming Burbank would like to maximize its c

> Lina purchased a new car for use in her business during 2016. The auto was the only business asset she purchased during the year and her business was extremely profitable. Calculate her maximum depreciation deductions (including §179 expense unless state

> Indicate the amount (if any) that Josh can deduct as ordinary and necessary business deductions in each of the following expenditures and explain your solution. a. Josh borrowed $50,000 from the First State Bank using his business assets as collateral.

> Assume that Ernesto purchased a laptop computer on July 10 of year 1 for $3,000. In year 1, 80 percent of his computer usage was for his business and 20 percent was for computer gaming with his friends. This was the only asset he placed in service during

> Phil owns a ranch business and uses 4-wheelers to do much of his work. Occasionally, though, he and his boys will go for a ride together as a family activity. During year 1, Phil put 765 miles on the 4-Wheeler that he bought on January 15 for $6,500. Of

> Acorn Construction (calendar-year end C-corporation) has had rapid expansion during the last half of the current year due to the housing market’s recovery. The company has record income and would like to maximize their cost recovery, as

> Assume that Sivart Corporation has 2016 taxable income of $750,000 before the §179 expense and acquired the following assets during 2016: a. What is the maximum amount of §179 expense Sivart may deduct for 2016? b. What is the max

> Woo lard Inc. has taxable income in 2016 of $150,000 before any depreciation deductions (§179, bonus, or MACRS) and acquired the following assets during the year: a. If Woo lard elects $50,000 of §179, what is Woo lardâ€

> Chaz Corporation has taxable income in 2016 of $312,000 before the §179 expense and acquired the following assets during the year: What is the maximum total depreciation expense that Chaz may deduct in 2016? Placed in Asset Service Basis

> Assume that ACW Corporation has 2016 taxable income of $1,000,000 before the §179 expenses, acquired the following assets during 2016 (assume no bonus depreciation): a. What is the maximum amount of §179 expense ACW may deduct for

> Dain’s Diamond Bit Drilling purchased the following assets this year. Assume its taxable income for the year was $53,000 before deducting any §179 expense (assume no bonus depreciation). a. What is the maximum amount of &Ac

> Assume that Timberline Corporation has 2016 taxable income of $240,000 before the §179 expense. a. What is the maximum amount of §179 expense Timberline may deduct for 2016? What is Timberline’s §179

> Assume that TDW Corporation (calendar year end) has 2016 taxable income of $650,000 before the §179 expenses, acquired the following assets during 2016: a. What is the maximum amount of §179 expense TDW may deduct for 2016? b. Wha

> Erin is considering switching her business from the cash method to the accrual method at the beginning of next year (year 1). Determine the amount and timing of her §481 adjustment assuming the IRS grants Erin’s request in the following alternative scena

> AMP Corporation (calendar year end) has 2016 taxable income of $900,000 before the §179 expense. During 2016, AMP acquired the following assets: a. What is the maximum amount of §179 expense AMP may deduct for 2016? b. What is the

> Carl purchased an apartment complex for $1.1 million on March 17 of year 1. $300,000 of the purchase price was attributable to the land the complex sits on. He also installed new furniture into half of the units at a cost of $60,000. a. What is Carl’s a

> On November 10 of year 1 Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,200,000; $300,000 was allocated to the basis of the land and the remaining $900,000 was allocated to

> If a business places several different assets in service during the year, must it use the same depreciation method for all assets? If not, what restrictions apply to the business’s choices of depreciation methods?

> What depreciation methods are available for tangible personal property? Explain the characteristics of a business likely to adopt each method.

> Can a taxpayer with very little current year income choose to not claim any depreciation expense for the current year and thus save depreciation deductions for the future when the taxpayer expects to be more profitable?

> MACRS depreciation requires the use of a recovery period, method, and convention to depreciate tangible personal property assets. Briefly explain why each is important to the calculation.

> Graber Corporation runs a long-haul trucking business. Graber incurs the following expenses: replacement tires, oil changes, and a transmission overhaul. Which of these expenditures may be deducted currently and which must be capitalized? Explain.

> Explain why the expenses incurred to get an asset in place and operable should be included in the asset’s basis.

> Compare and contrast the basis of property acquired via purchase, conversion from personal use to business or rental use, a nontaxable exchange, gift, and inheritance.

> Nancy operates a business that uses the accrual method of accounting. In December, Nancy asked her brother, Hank, to provide her business with consulting advice. Hank billed Nancy for $5,000 of consulting services in year 0 (a reasonable amount), but Nan

> Is an asset’s initial or cost basis simply its purchase price? Explain.

> Explain the similarities and dissimilarities between depreciation, amortization, and depletion. Describe the cost recovery method used for each of the four asset types (personal property, real property, intangible property, and natural resources).

> Explain the differences and similarities between personal property, real property, intangible property, and natural resources. Also, provide an example of each type of asset.

> Explain the reasoning why the tax laws require the cost of certain assets to be capitalized and recovered over time rather than immediately expensed.

> Explain why percentage depletion has been referred to as a government subsidy.

> Compare and contrast the cost and percentage depletion methods for recovering the costs of natural resources. What are the similarities and differences between the two methods?

> Compare and contrast the recovery periods of §197 intangibles, organizational expenditures, start-up costs, and research and experimentation expenses.

> Explain the amortization convention applicable to intangible assets.

> Discuss the method used to determine the amount of organizational expenditures or start-up costs that may be immediately expensed in the year a taxpayer begins business.

> Compare and contrast the similarities and differences between organizational expenditures and start-up costs for tax purposes.

> Dustin has a contract to provide services to Dado Enterprises. In November of year 0, Dustin billed Dado $10,000 for the services he rendered during the year. Dado is an accrual-method proprietorship that is owned and operated by Dustin’s father. a. Wha

> Compare and contrast the tax and financial accounting treatment of goodwill. Are taxpayers allowed to deduct amounts associated with self-created goodwill?

> What is a §197 intangible? How do taxpayers recover the costs of these intangibles? How do taxpayers recover the cost of a §197 intangible that expires (such as a covenant not to compete)?

> Compare and contrast how a Land Rover SUV and a Mercedes Benz sedan are treated under the luxury auto rules. Also include a discussion of the similarities and differences in available §179 expense.

> Discuss why Congress limits the amount of depreciation expense businesses may claim on certain automobiles.

> Are taxpayers allowed to claim depreciation expense on assets they use for both business and personal purposes? What are the tax consequences if the business use drops from above 50 percent in one year to below 50 percent in the next?

> Describe assets that are considered to be listed property. Why do you think the Internal Revenue Service requires them to be “listed”?

> Why might a business elect only the §179 expense it can deduct in the current year rather than claiming the full amount available?

> What strategies will help a business maximize its current depreciation deductions (including §179)? Why might a taxpayer choose not to maximize its current depreciation deductions?

> Compare and contrast the types of businesses that would benefit from and those that would not benefit from the §179 expense.

> Explain the two limitations placed on the §179 deduction. How are they similar? How are they different?