Question: Late in 2009, Canyon Power Company (CPC)

Late in 2009, Canyon Power Company (CPC) management was considering expansion of the company’s international business activities. CPC is an Arizona-based manufacturer of specialist electric motors for use in industrial equipment. All of the company’s sales were to other manufacturers in the industrial equipment industry. CPC’s worldwide market was supplied from subsidiaries in Germany, Mexico, and Malaysia as well as the United States. The company was particularly successful in Asia, mainly due to the high quality of its products, its technical expertise, excellent after-sale service, and of course the continued rapid economic growth in many Asian countries. This success led corporate management to consider seriously the feasibility of further expansion of its business in the Asian region.

The Malaysian subsidiary of CPC distributed and assembled electric motors. It also had limited manufacturing facilities so that it could undertake special adaptations required. With the maturing of the Asian market, particularly in the industrial sector, an expansion of capacity in that market was of strategic importance. The Malaysian subsidiary had been urging corporate management to expand its capacity since the beginning of 2009. However, an alternative scenario appeared more promising. The Indian economy, with its liberalized economic policies, was growing at annual rates much higher than those of many industrialized countries. Further, India had considerably lower labor costs and certain government incentives that were not available in Malaysia. Therefore, the company chose India for its Asian expansion project, and had a four-year investment project proposal prepared by the treasurer’s staff.

The proposal was to establish a wholly owned subsidiary in India producing electric motors for the Indian domestic market as well as for export to other Asian countries. The initial equity investment would be $1.5 million, equivalent to 67.5 million Indian rupees (Rs) at the exchange rate of Rs 45 to the U.S. dollar. (Assume that the Indian rupee is freely convertible, and there are no restrictions on transfers of foreign exchange out of India.) An additional Rs 27 million would be raised by borrowing from a commercial bank in India at an interest rate of 10Â percent per annum. The principal amount of the bank loan would be payable in full at the end of the fourth year. The combined capital would be sufficient to purchase plant of $1.8 million and would cover other initial expenditures, including working capital. The cost of installation would be $15,000, with another $5,000 for testing. No additional working capital would be required during the four-year period. The plant was expected to have a salvage value of Rs 10Â million at the end of four years. Straight-line depreciation would be applied to the original cost of the plant.

The firm’s overall marginal after-tax cost of capital was about 12 percent. However, because of the higher risks associated with an Indian venture, CPC decided that a 16 percent discount rate would be applied to the project. Present value factors at 16 percent are as follows:

Period………………………………………….Factor

1…………………………………………………………..0.862

2…………………………………………………………..0.743

3…………………………………………………………..0.641

4…………………………………………………………..0.552

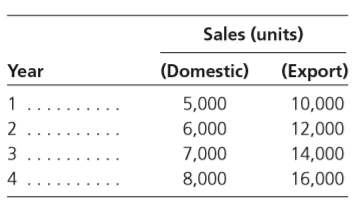

Sales forecasts are as follows:

The initial selling price of an electric motor was to be Rs 4,500 for Indian domestic sales and export sales in the Asian region, and the selling price in both cases was to increase at an annual rate of 10 percent. The exchange rate between the Indian rupee and the U.S. dollar was expected to vary as follows:…………..

January 1, Year 1…………………………………Rs 45 per U.S. dollar

December 31, Year 1…………………………….Rs 45 per U.S. dollar

December 31, Year 2…………………………….Rs 43 per U.S. dollar

December 31, Year 3…………………………….Rs 40 per U.S. dollar

December 31, Year 4……………………………..Rs 38 per U.S. dollar

Required:

Using the information provided, you are required to

1. Calculate net present value from both a project and a parent company perspective.

2. Recommend to CPC corporate management whether or not to accept the proposal.

Transcribed Image Text:

Sales (units) Year (Domestic) (Export) 1 5,000 10,000 2.. 6,000 12,000 3 ... 7,000 14,000 4. 8,000 16,000

> Why should MNCs be concerned about auditing issues?

> What are the problems caused by inflation in evaluating the performance of a foreign subsidiary?

> What issues are associated with the calculation of profit for a foreign subsidiary?

> Do you think it is important to separate the evaluation of the performance of a subsidiary from that of its manager? Why?

> What are the factors that influence the decision regarding the manner in which a particular subsidiary should be treated for purposes of performance evaluation (e.g., as a cost center or a profit center or an investment center)?

> Visit the Web site of Nokia Company (www.Nokia.com). Required: Comment on Nokia’s risk management activities as reported in the company’s 2009 annual report.

> What are the nonfinancial measures available to MNCs for evaluating foreign subsidiary performance?

> What differences can you identify between performance evaluation measures adopted by Japanese and U.S. MNCs?

> What are the main issues that need to be considered in designing and implementing a successful performance evaluation system for a foreign subsidiary?

> Explain the role of accounting in implementing multinational business strategy

> How do differences in cultural values across countries influence strategy implementation within an MNC?

> How does the organizational structure of an MNC influence its strategy implementation?

> Compare and contrast NPV and IRR as capital budgeting techniques.

> Explain the role of accounting in strategy formulation within an MNC.

> What are the external factors that influence strategy formulation within an MNC?

> What are the internal factors that influence strategy formulation within an MNC?

> Sedona Electronics of Arizona exports 25,000 Disc Drive Controllers (DDCs) per year to China under an agreement that covers the period 2009–2013. In China, the DDCs are sold for the RMB (Chinese currency) equivalent of $50 per unit. The total costs in th

> What are some of the problems of trying to regulate CSR practices through legislation?

> Identify five mechanisms for regulating CSR practices at the international level.

> Why is it necessary to regulate the CSR practices of firms?

> What are the implications of climate change for CSR?

> What motivates firms to engage in CSR practices?

> What is the conceptual basis for CSR?

> What are the theories often used to explain the CSR practices of firms?

> What is the Global Reporting Initiative?

> What is the Kyoto Protocol?

> What are the items often included in CSR reports?

> There is no clear definition of corporate social reporting (CSR). The European Commission defines CSR as “the responsibility of enterprises for their impacts on society.” In the United States, there is no governmental regulation regarding CSR. Companies

> What is corporate social reporting (CSR)?

> In what ways do company audit reports vary in different countries?

> What was the impact of the European Union’s Eighth Directive on the regulation of auditing in the United Kingdom?

> What is the PIOB? What is its role in audit regulation?

> On January 1, 2009, a U.S. firm made an investment in Germany that will generate $5 million annually in depreciation, converted at the current spot rate. Projected annual rates of inflation in Germany and in the United States are 5 percent and 2 percent,

> Refer to Exhibit 13.6. Required: Briefly explain the operating environment of a developing country of your choice using the framework that identifies the social, political, economic, and technological influences. Exhibit 13.6:

> A U.S. company is considering an investment project proposal to extend its operations in Germany. As part of the proposed project, the German operation is required to pay an annual royalty of €500,000 to the parent company. Required: Explain the cash fl

> The establishment of the Public Company Accounting Oversight Board (PCAOB) in 2002 was a major step toward strengthening the auditing function in the United States. Required: What can the PCAOB do to strengthen the auditing function in the United States

> This chapter refers to a unique ownership structure of many former state owned enterprises in China, which have been redefined to create new economic entities. Required: Describe the uniqueness of the ownership structure of the entities mentioned above,

> Some commentators argue that the two-tiered corporate structure, with a management board and a supervisory board, prevalent in many Continental European countries, is better suited for addressing corporate governance issues, including the issue of audito

> We’re in the business of satisfying thirst. We do it very well. We’re also thirsty ourselves. Thirsty for continued profitable growth. Every gain delivers more for our shareholders. We’re thirsty for

> Internationally, legislators and professional bodies have focused on corporate governance issues in making recommendations for restoring investor confidence, and auditing is an essential part of corporate governance. Required: Explain the link between a

> In June 2004, the IFAC Ethics Committee issued its “Revision to Paragraph 8.151 Code of Ethics for Professional Accountants.” Accordingly, for the audit of listed entities, a. The lead engagement partner should be rotated after a predefined period, norma

> In June 2003, IFAC issued an IAPS providing additional guidance for auditors internationally when they express an opinion on financial statements that are asserted by management to be prepared in either of the following ways: • Solely in accordance with

> ISA 700 describes three types of audit opinions that can be expressed by the auditor when an unqualified opinion is not appropriate: qualified, adverse, and disclaimer of opinion. Required: What are the circumstances under which each of the above three

> The responsibility for harmonizing auditing standards across countries rests with IFAC. Required: Comment on some of the problems faced by IFAC in achieving the above goal.

> In Anglo-Saxon countries, mechanisms are put in place to regulate auditors within the framework of professional self-regulation, whereas in many Continental European countries, quasi-governmental agencies play a major role in this area. Required: a. Bri

> The UK Corporate Governance Code takes the “comply or explain” approach. Required: a. Describe the main features of the comply or explain approach to corporate governance. b. Why do you think this approach seems to be popular internationally?

> Refer to the Report of Independent Auditors of Unilever N. V. and Unilever PLC, signed on 5 March 2013 (see the appendix to this chapter). Required: Identify the features in the above audit report that are unique to an MNC.

> Globalization has made cultural values irrelevant as a factor influencing multinational business and accounting. Required: State whether or not you agree with the preceding statement, and develop an argument to support the position you have taken.

> Developing a global business strategy for an MNC is a highly complex task. Required: Briefly discuss the complexities referred to in the preceding statement.

> Company R purchases a 25% interest in Company E on January 1, 2014, at its book value of $20,000. From 2014 through 2018, Company E earns a total of $200,000. From 2019 through 2023, it loses $300,000. In 2024, Company E reports net income of $30,000. Wh

> Company E reports net income of $100,000 for 2015. Assume the income is earned evenly throughout the year. Dividends of $10,000 are paid on December 31. What will Company R report as investment income under the following ownership situations, if: a. Comp

> Assume the same facts as for Question 1 above. The fair value of the investment in Company E is $220,000 on December 31, 2015. Answer the following questions assuming the investment is recorded using the fair value option: a. What is Company R’s investme

> Company P has internally generated net income of $250,000 (excludes share of subsidiary income). Company P has 100,000 shares of outstanding common stock. Subsidiary Company S has a net income of $60,000 and 40,000 shares of outstanding common stock. Wha

> On January 1, 2015, Company P sold a machine to its 70%-owned subsidiary, Company S, for $60,000. The book value of the machine was $50,000. The machine was depreciated using the straight-line method over five years. On December 31, 2017, Company S sold

> On January 1, 2016, Peanut Corporation acquires an 80% interest in Sunny Corporation. Information regarding the income and equity structure of the two companies as of the year ended December 31, 2018, is as follows: Additional information is as follo

> Company S is 80% owned by Company P. Near the end of 2015, Company S sold merchandise with a cost of $6,000 to Company P for $7,000. Company P sold the merchandise to a nonaffiliated firm in 2016 for $10,000. How much total profit should be recorded on t

> Par Company acquires 100% of the common stock of Sub Company for an agreedupon price of $900,000. The book value of the net assets is $700,000, which includes $50,000 of subsidiary cash equivalents. Existing fixed assets have fair values greater than the

> A primary beneficiary company has established control over a VIE by guaranteeing its long term debt and by establishing an income distribution contract. The balance sheet of the VIE on the acquisition date was as follows: The fair values of the land an

> Company P has internally generated net income of $200,000 (excludes share of subsidiary income). Company P has 100,000 shares of outstanding common stock. Subsidiary Company S has a net income of $60,000 and 40,000 shares of outstanding common stock. Com

> P Company acquires 80% of the common stock of S Company for an agreed-upon price of $640,000. The fair value of the NCI is $160,000. The book value of the net assets is $600,000, which includes $50,000 of subsidiary cash equivalents. Any excess is attrib

> What will be the effect of the above acquisition on cash flow statements prepared in periods after the year of the purchase?

> A parent company is a producer of production equipment, some of which is acquired and used by the parent’s subsidiary companies. The parent offers a discount to the subsidiaries but still earns a significant profit on the sales of equipment to a subsidia

> Your friend is a noncontrolling interest shareholder in a large company. He knows that the subsidiary company leases most of its assets from the parent company under operating leases. He further believes that the lease rates are in excess of market rates

> Company P purchased $100,000 of subsidiary Company S’s bonds for $96,000 on January 1, 2015, when the bonds had five years to maturity. The bonds had been issued at face value and pay interest at 8% annually. What will the impact of this transaction be o

> Subsidiary Company S has $1,000,000 of bonds outstanding at 8% annual interest. The bonds have 10 years to maturity. If the parent, Company P, is able to purchase the bonds at a price that reflects 6% annual interest, how will the noncontrolling interest

> Subsidiary Company S has $1,000,000 of bonds outstanding at 8% annual interest. The bonds have 10 years to maturity. If the parent, Company P, is able to purchase the bonds at a price that reflects 6% annual interest, what effect will the purchase have o

> Subsidiary Company S has $1,000,000 of bonds outstanding. The bonds have 10 years to maturity and pay interest at 8% annually. The parent has an average annual borrowing cost of 6% and wishes to reduce the interest cost of the consolidated company. What

> Company S is an 80%-owned subsidiary of Company P. Company S needed to borrow $500,000 on January 1, 2015. The best interest rate it could secure was 10% annual. Company P has a better credit rating and decided to borrow the funds needed from a bank at 8

> On January 1, 2015, Paro Company purchases 80% of the common stock of Solar Company for $320,000. Solar has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $100,000, and $150,000, respectively. Net income and divid

> Mast Corporation acquires a 75% interest in the common stock of Shaw Company on January 1, 2014, for $462,500 cash. Shaw has the following balance sheet on that date: Appraisals indicate that the book values for inventory, buildings and equipment, and

> P Company acquired the S Company for an agreed value of $900,000 and issues its common stock to make the deal. The fair value of the Company S net identifiable assets is $800,000. The issue costs of the stock used for payment is $50,000. If P Company was

> What are the accounting ramifications of each of the three following situations involving the payment of contingent consideration in an acquisition? a. P Company issues 100,000 shares of its $50 fair value ($1 par) common stock as payment to buy S Compan

> Harms acquires Blake on January 1, 2015, for $1,000,000. The amount of $800,000 is assigned to identifiable net assets. Goodwill is being impairment tested on December 31, 2019. There have not been any prior impairment adjustments. The following values a

> Pam Company acquires the net assets of Jam Company for an agreed-upon price of $900,000 on July 1, 2015. The value is tentatively assigned as follows: Current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> Panther Company is acquiring the net assets of Sharon Company. The book and fair values of Sharon’s accounts are as follows: What values will be assigned to current assets, land, building and equipment, thecustomer list, liabilities,

> Puncho Company is acquiring the net assets of Semos Company in exchange for commonstock valued at $900,000. The Semos identifiable net assets have book and fairvalues of $400,000 and $800,000, respectively. Compare accounting for the acquisition (includi

> Subsidiary Company S is 80% owned by Company P. Company S sold a machine with a book value of $100,000 to Company P for $150,000. The asset has a 5-year life and is depreciated under the straight-line method. The president of Company S thinks it has scor

> During 2015, Company P sold $50,000 of goods to subsidiary Company S at a profit of $12,000. One-fourth of the goods remain unsold at year-end. If no adjustments were made on the consolidated worksheet, what errors would there be on the consolidated inco

> Abrams Company is a sole proprietorship. The book value of its identifiable net assetsis $400,000, and the fair value of the same net assets is $600,000. It is agreed that thebusiness is worth $850,000. What advantage might there be for the seller if the

> Refer to the preceding information for Fast Cool’s acquisition of Fast Air’s common stock. Assume Fast Cool issues 35,000 shares of its $20 fair value common stock for 80% of Fast Air’s common stock.

> Identify each of the following business combinations as being vertical-backward, vertical-forward, horizontal, product extension, market extension, or conglomerate: a. An inboard marine engine manufacturer is acquired by an outboard engine manufacturer.

> Albers Company acquires an 80% interest in Barker Company on January 1, 2015, for $850,000. The following determination and distribution of excess schedule is prepared at the time of purchase: Albers uses the simple equity method for its investment in

> The audit of Barns Company and its subsidiaries for the year ended December 31, 2016, is completed. The working papers contain the following information: a. Barns Company acquires 4,000 shares of Webo Company common stock for $320,000 on January 1, 2015.

> On January 1, 2016, Mitta Corporation acquires a 60% interest (12,000 shares) in Train Company for $156,000. Train stockholders’ equity on the purchase date is as follows: Common stock ($5 par). . . . . . . . . . . . . . . . . . . . .

> On January 1, 2016, Palo Company acquires 80% of the outstanding common stock of Sheila Company for $700,000. On January 1, 2018, Sheila Company sells 25,000 shares of common stock to the public at $12 per share. Palo Company does not purchase any of the

> On January 1, 2015, Bear Corporation acquires a 60% interest in Kelly Company and an 80% interest in Samco Company. The purchase prices are $225,000 and $250,000, respectively. The excess of cost over book value for each investment is considered to be go

> On January 1, 2015, Wells Corporation acquires 8,000 shares of Towne Company stock and 18,000 shares of Sara Company stock for $176,000 and $240,000, respectively. Each investment is acquired at a price equal to the subsidiary’s book va

> On January 1, 2017, Black Jack Corporation purchases all of the preferred stock and 60% of the common stock of Zeppo Company for $56,000 and $111,000, respectively. Immediately prior to the purchases, Zeppo Company has the following stockholdersâ&#

> The following information pertains to Titan Corporation and its two subsidiaries, Boat Corporation and Engine Corporation: a. The three corporations are all in the same industry and their operations are homogeneous. Titan Corporation exercises control ov

> Marsha Corporation purchases an 80% interest in the common stock of Transam Corporation on December 31, 2013, for $720,000, when Transam has the following condensed balance sheet: On the December 31, 2013, purchase date, the dividends on the preferre

> Refer to the preceding information for Fast Cool’s acquisition of Fast Air’s common stock. Assume Fast Cool issues 35,000 shares of its $20 fair value common stock for 80% of Fast Air’s common stock.

> The information shown on page 425 is available regarding the investments of Billings Corporation in Channel Company for the years 2011–2015. The stockholders’ equity section of Channel Company’s b

> On January 1, 2013, Carlos Corporation purchases 90% (18,000 shares) of the outstanding common stock of Dower Company for $504,000. Just prior to Carlos Corporation’s purchase, Dower Company has the following stockholdersâ€&#

> Kraus Company has the following balance sheet on July 1, 2016: On July 1, 2016, Neiman Company purchases 80% of the outstanding common stock of Kraus Company for $310,000. Any excess of book value over cost is attributed to the equipment, which has an

> Smith Company is acquired by Roan Corporation on July 1, 2015. Roan exchanges 60,000 shares of its $1 par stock, with a fair value of $18 per share, for the net assets of Smith Company. Roan incurs the following costs as a result of this transaction: Ac

> During 2017, Away Company acquires a controlling interest in Stallward, Inc. Trial balances of the companies at December 31, 2017, are as follows: The following information is available regarding the transactions and accounts of the two companies: a.

> On January 1, 2015, James Company purchases 70% of the common stock of Craft Company for $245,000. On this date, Craft has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $100,000, and $150,000, respectively. On Ma

> The following determination and distribution of excess schedule is prepared on January 1, 2012, the date on which Palmer Company purchases a 60% interest in Sharon Company: On December 31, 2013, Palmer Company purchases an additional 20% interest in

> Refer to the preceding facts for Parson’s acquisition of Solar common stock. Parson uses the simple equity method to account for its investment in Solar. During 2017, Solar sells $40,000 worth of merchandise to Parson. As a result of th

> Refer to the preceding facts for Parson’s acquisition of Solar common stock. Parson uses the simple equity method to account for its investment in Solar. During 2016, Solar sells $30,000 worth of merchandise to Parson. As a result of th