Question: LeMond Incorporated, a Wisconsin corporation, runs

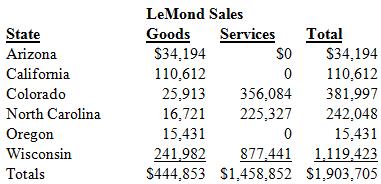

LeMond Incorporated, a Wisconsin corporation, runs bicycle tours in several states. LeMond also has a Wisconsin retail store and an Internet store that ships to out-of-state customers. The bicycle tours operate in Colorado, North Carolina, and Wisconsin where LeMond has employees and owns and uses tangible personal property. LeMond has real property only in Wisconsin and logs the following sales:

Assume the following tax rates: Arizona (5.6 percent), California (7.75 percent), Colorado (8 percent), North Carolina (6.75 percent), Oregon (8 percent), and Wisconsin (8.5 percent). How much sales and use tax must LeMond collect and remit?

Transcribed Image Text:

LeMond Sales State Goods $34,194 Services Total Arizona so $34,194 Califomia 110,612 110,612 Colorado 25,913 356,084 381,997 North Carolina 16,721 225,327 242,048 Oregon 15,431 15,431 Wisconsin 877,441 1,119,423 241,982 S444,853 $1,458,852 S1,903,705 Totals

> IBM incurs $250 million of research and experimental expenditures (R&E) in the United States. How does the “exclusive apportionment” of this deduction differ depending on the R&E apportionment method chosen in the computation of the foreign tax credit li

> Hank is a single individual who possesses a life insurance policy worth $300,000 that will pay his two children a total of $800,000 upon his death. This year Hank transferred the policy and all incidents of ownership to an irrevocable trust that pays inc

> Suppose Vince dies this year with a gross estate of $15 million and no adjusted prior gifts. Calculate the amount of estate tax due (if any) under the following alternative conditions. a. Vince leaves his entire estate to his spouse, Millie. b. Vince lea

> Winkin, Blinkin, and Nod are equal shareholders in SleepEZ, an S corporation. In the conditions listed below, how much income should each report from SleepEZ for 2016 under both the daily allocation and the specific identification allocation methods? Ref

> Montgomery has decided to engage in wealth planning and has listed the value of his assets below. The life insurance has a cash surrender value of $120,000 and the proceeds are payable to Montgomery’s estate. The trust is an irrevocable

> Jack is single and he made his first taxable gift of $1,000,000 in 2008. Jack made additional gifts in 2009, at which time he gave $1,750,000 to each of his three children and an additional $1,000,000 to State University (a charity). The annual exclusion

> What is the difference between a sales tax and a use tax?

> Carmen SanDiego, a U.S. citizen, is employed by General Motors Corporation, a U.S. corporation. On April 1, 2016, GM relocated Carmen to its Brazilian operations for the remainder of 2016. Carmen was paid a salary of $120,000 and was employed on a 5-day

> Owl Vision Corporation (OVC) is a North Carolina corporation engaged in the manufacture and sale of contact lens and other optical equipment. The company handles its export sales through sales branches in Belgium and Singapore. The average tax book value

> Waco Leather, Inc., a U.S. corporation, reported total taxable income of $5 million. Taxable income included 1.5 million of foreign source taxable income from the company’s branch operations in Mexico. All of the branch income is general category income.

> Mackinac Corporation, a U.S. corporation, reported total taxable income of $5 million. Taxable income included $1.5 million of foreign source taxable income from the company’s branch operations in Canada. All of the branch income is general category inco

> Distinguish between a definitely related deduction and a not definitely related deduction in the allocation and apportionment of deductions to foreign source taxable income.

> How does the U.S.-Belgium treaty define a permanent establishment for determining nexus? Look at Article 5 of the 2007 U.S.-Belgium income tax treaty, which you can find on the IRS Website, www.irs.gov.

> Falmouth Kettle Company, a U.S. corporation, sells its products in the United States and Europe. During the current year, selling, general, and administrative (SG&A) expenses included: Personnel department………………………………………………………………………………$

> Spartan Corporation, a U.S. company, manufactures green eye shades for sale in the United States and Europe. All manufacturing activities take place in Michigan. During the current year, Spartan sold 10,000 green eye shades to European customers at a pri

> Sam Smith is a citizen and bona fide resident of Great Britain (United Kingdom). During the current year, Sam received the following income: o Compensation of $30 million from performing concerts in the United States. o Cash dividends of $10,000 from a F

> Pavel, a citizen and resident of Russia, spent 100 days in the United States working for his employer, Yukos Oil, a Russian corporation. Under what conditions will Pavel be subject to U.S. tax on the portion of his compensation earned while working in th

> Carol receives $500 of dividend income from Microsoft, Inc., a U.S. company. True or False: Absent any treaty provisions, Carol will be subject to U.S. tax on the dividend regardless of whether she is a resident or nonresident. Explain.

> Compare and contrast general sales and use tax nexus and the new “Amazon” rule creating nexus in New York.

> Why are the income source rules important to a U.S. citizen or resident?

> Why does the United States allow U.S. taxpayers to claim a credit against their precredit U.S. tax for foreign income taxes paid?

> Use the facts in problem 41. If Guido meets the statutory requirements to be considered a resident of both the United States and Belgium, what criteria does the U.S.-Belgium treaty use to “break the tie” and determine Guido’s country of residence? Look a

> Distinguish between allocation and apportionment in sourcing deductions in computing the foreign tax credit limitation.

> Natasha is not a citizen of the United States, but she spends 200 days per year in the United States on business. She does not have a green card. True or False: Natasha will always be considered a resident of the United States for U.S. tax purposes becau

> Maria is not a citizen of the United States, but she spends 180 days per year in the United States on business-related activities. Under what conditions will Maria be considered a resident of the United States for U.S. tax purposes?

> What are the two categories of income that can be taxed by the United States when earned by a nonresident? How does the United States tax each category of income?

> Cathy, Heathcliff, and Isabelle are equal shareholders in Wuthering Heights (WH), an S corporation. Heathcliff has decided he would like to terminate the S election. In the following alternative scenarios, indicate whether the termination will occur and

> What are the major U.S. tax issues that apply to an outbound transaction?

> What are the major U.S. tax issues that apply to an inbound transaction?

> True or False: Subpart F income is always treated as a deemed dividend to the U.S. shareholders of a controlled foreign corporation. Explain.

> Discuss why restaurant meals, rental cars, and hotel receipts are often taxed at a higher-than-average sales tax rate.

> What is foreign base company sales income? Why does the United States include this income in its definition of subpart F income?

> True or False: A foreign corporation owned equally by 11 U.S. individuals can never be a controlled foreign corporation? Explain.

> True or False: A taxpayer will always prefer deducting an expense against U.S. source income and not foreign source income when filing a tax return in the United States. Explain.

> Why does the United States not allow deferral on all foreign source income earned by a controlled foreign corporation?

> Guido is a citizen and resident of Belgium. He has a full-time job in Belgium and has lived there with his family for the past 10 years. In 2014, Guido came to the United States for the first time. The sole purpose of his trip was business. He intended t

> What are the requirements for a foreign corporation to be a controlled foreign corporation for U.S. tax purposes?

> What is a “per se” entity under the check-the-box rules?

> What is a hybrid entity for U.S. tax purposes? Why is a hybrid entity a popular organizational form for a U.S. company expanding its international operations? What are the potential drawbacks to using a hybrid entity?

> What is a functional currency? What role does it play in the computation of an indirect credit for foreign tax credit purposes?

> Missy is one of 100 unrelated shareholders of Dalmatian, an S corporation. She is considering selling her shares. Under the following alternative scenarios, would the S election be terminated? Why or why not? a. Missy wants to sell half her shares to a f

> What is an indirect credit for foreign tax credit purposes? What is the tax policy reason for allowing such a credit?

> Describe how the failure to collect sales tax can result in a larger tax liability for a business than failing to pay income taxes.

> True or False: All dividend income received by a U.S. taxpayer is classified as passive category income for foreign tax credit limitation purposes. Explain.

> What are the potential U.S. tax benefits from engaging in a §863(b) sale?

> In what circumstances would a business be subject to income taxes in more than one state?

> Jane has been operating Mansfield Park as a C corporation and decides she would like to make an S election. What is the earliest the election will become effective under each of these alternative scenarios? a. Jane is on top of things and makes the elec

> Spartan Corporation manufactures quidgets at its plant in Sparta, Michigan. Spartan sells its quidgets to customers in the United States, Canada, England, and Australia. Spartan markets its products in Canada and England through branches in Toronto and

> Windmill Corporation manufactures products in its plants in Iowa, Canada, Ireland, and Australia. Windmill conducts its operations in Canada through a 50 percent owned joint venture, CanCo. CanCo is treated as a corporation for U.S. and Canadian tax purp

> Last year, Reggie, a Los Angeles, California resident, began selling autographed footballs through Trojan Victory (TV), Incorporated, a California corporation. TV has never collected sales tax. Last year TV had sales as follows: California ($100,000), Ar

> USCo manufactures and markets electrical components. USCo operates outside the United States through a number of CFCs, each of which is organized in a different country. These CFCs derived the following income for the current year. Determine the amount o

> Kai operates the Surf Shop in Laie, Hawaii, which designs, manufacturers, and customizes surf boards. Hawaii has a 4 percent excise tax technically paid by the seller. However, the state also allows "tax on tax" to be charged, which effectively means a c

> Melanie operates Mel’s Bakery in Foxboro, Massachusetts with retail stores in Connecticut, Maine, Massachusetts, New Hampshire, and Rhode Island. Mel’s also ships specialty breads nationwide upon request. Determine Mel’s sales tax collection responsibili

> Crazy Eddie Incorporated manufactures baseball caps and distributes them across the northeastern United States. The firm is incorporated and headquartered in New York and sells to customers in Connecticut, Delaware, Massachusetts, New Jersey, New York, O

> Ashton Corporation is headquartered in Pennsylvania and has a state income tax base there of $500,000. Of this amount, $50,000 was non-business income. Ashton’s Pennsylvania apportionment factor is 42.35 percent. The nonbusiness income allocated to Penns

> Mark is the sole shareholder of Tex Corporation. Mark first formed Tex as a C corporation. However, in an attempt to avoid having Tex’s income double taxed, Mark elected S corporation status for Tex several years ago. On December 31, 2016, Tex reports $5

> Brady Corporation is a Nebraska Corporation, but owns business and investment property in surrounding states as well. Determine the state where each item of income is allocated. a. $15,000 of dividend income. b. $10,000 of interest income. c. $15,000 of

> Susie’s Sweet Shop has the following sales, payroll and property factors: What are Susie’s Sweet Shop’s Iowa and Missouri apportionment factors under each of the following alternative scenarios? a. I

> Lucy and Ricky Ricardo live in Los Angeles, California. After they were married, they started a business named ILL Corporation (a C corporation). For state law purposes, the shares of stock in ILL Corp. are listed under Ricky’s name only. Ricky signed th

> Delicious Dave’s Maple Syrup, a Vermont Corporation, has property in the following states: What are the property apportionment factors for Maine, Massachusetts, New Hampshire, and Vermont in each of the following scenarios? a. Deliciou

> Nicole’s Salon, a Louisiana Corporation, operates beauty salons in Arkansas, Louisiana, and Tennessee. These salon’s payroll by state, are as follows: Nicole’s…………….…….....Salon State…………………..….. Payroll Arkansas…………………..…..$130,239 Louisiana…………………..…

> Bad Brad sells used semi-trucks and tractor trailers in the Texas panhandle. Bad Brad has sales as follows: Bad……………………………………………Brad State………………………………………….Sales Colorado………………………………$234,992 Oklahoma……………………………….402,450 New Mexico…………………………..675,204 Tex

> Hughie, Dewey, and Louie are equal shareholders in HDL, an S corporation. HDL’s S election terminates under each of the following alternative scenarios. When is the earliest it can again operate as an S corporation? a. The S election terminates on August

> Herger Corporation does business in California, Nevada, and Oregon and has nexus in these states as well. Herger’s California state tax base was $921,023 after making the required federal/state adjustments. Herger’s federal tax return contains the follow

> Bulldog Incorporated is a Georgia corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year: Use Georgia’s Corporate Income Tax Form 600 and Instructions to determine what

> Use California Publication 1061 (2013) to determine the various tests California uses to determine whether two or more entities are part of a unitary group.

> What types of property sales are subject to a sales tax and why might a state choose to exclude the sales of certain types of property?

> Peter Inc., a Kentucky corporation, owns 100 percent of Suvi Inc., a Mississippi corporation. Peter and Suvi file a consolidated federal tax return. Peter has income tax nexus in Kentucky and South Carolina. Suvi in Mississippi and South Carolina. Kentuc

> Software Incorporated is a sales and use tax software vendor that provides customers with a license to download and use its software on their machines. Software retains ownership of the software. It has customers in New Jersey and West Virginia. Does Sof

> Rockville Enterprises manufactures woodworking equipment and is incorporated and based in Evansville, Indiana. Its real property is all in Indiana. Rockville employs a large sales force that travels throughout the U.S. Determine whether each of the follo

> What is the difference, if any, between the state of a business’s commercial domicile and its state of incorporation?

> Describe briefly the nexus concept and explain its importance to state and local taxation.

> Compare and contrast the relative importance of judicial law to state and local and federal tax law.

> Compare and contrast federal/state tax differences and book/federal tax differences.

> Most states have increased the weight of the sales factor for the apportionment of business income. What are some possible reasons?

> Contrast the treatment of government sales and dock sales for the sales apportionment factor.

> Root Beer, Inc. (RBI) is incorporated and headquartered in Seattle, Washington. RBI runs an Internet business, makerootbeer.com, and sells bottling equipment and other supplies for making homemade root beer. It also has an Oregon warehouse from which it

> Compare and contrast the ways a multistate business divides business and non-business income among states.

> Compare and contrast the reasons why book/tax and federal/state adjustments are necessary for interest income.

> Explain the rationale for the factors (functional integration, centralization of management, and economies of scale) that determine whether two or more businesses form a unitary group under the Mobil decision.

> Calculate Anaheim Corporation’s excess net passive income tax in each of the following alternative scenarios. a. Passive investment income, $100,000; expenses associated with passive investment income, $40,000; gross receipts, $120,000; taxable income if

> Eagle Inc., a U.S. corporation intends to create a limitada in Brazil in 2016 to manufacture pitching machines. The company expects the operation to generate losses of US$2,500,000 during its first three years of operations. Eagle would like the losses t

> Explain the difference between separate-return states and unitary-return states.

> States are arguing for economic nexus; provide at least one reason for and one against the validity of economic nexus.

> Describe a situation in which it would be advantageous for a business to establish income tax nexus in a state.

> Climb Higher is a distributor of high-end climbing gear located in Paradise, Washington. Its sales personnel regularly perform the following activities in an effort to maximize sales: • Carry swag (free samples) for distribution to climbing shop employe

> Explain changes in the U.S. economy that have made Public Law 86-272 partially obsolete. Provide an example of a company that Public Law 86-272 works well for and one that it does not work well for.

> Julie wants to create an S corporation called J’s Dance Shoes (JDS). Describe how the items below affect her eligibility for an S election. a. Because Julie wants all her shareholders to have an equal say in the future of JDS, she gives them equal voting

> Do you know what Cloud computing is? Cloud computing is the use of hosted computer facilities through the Internet. Gmail, RIA Checkpoint, and even your iPhone are some applications of cloud computing. a. If HP provides a customized bundle of servers, s

> Happy Hippos (HH) is a manufacturer and retailer of New England crafts headquartered in Camden, Maine. HH provides services has sales, employees, property, and commercial domicile as follows: Happy Hippos sales of goods and services by state are as follo

> Sharon, Inc. is headquartered in State X and owns 100% of Carol, Josey, and Janice Corps, which form a single unitary group. Assume sales operations are within the solicitation bounds of Public Law 86-272. Each of the corporations has operations in the f

> Chandra was the sole shareholder of Pet Emporium that was originally formed as an S corporation. When Pet Emporium terminated its Selection on August 31, 2015, Chandra had a stock basis and an at-risk amount of zero. Chandra also had a suspended loss fro

> Timo is the sole owner of Jazz Inc., an S corporation. On October 31 2016, Timo executed an unsecured demand promissory note of $15,000, and he transferred the note to Jazz (Jazz could require Timo to pay it $15,000 on demand). When Timo transferred the

> Hannah Corporation, a U.S. corporation, owns 100 percent of the stock its two foreign corporations, Red S.A. and Cedar A.G. Red and Cedar derive all of their income from active foreign business operations. Red operates in a low- tax jurisdiction (20 perc

> Wood Corporation was a C corporation in 2015 but elected to be taxed as an S corporation in 2016. At the end of 2015, its earnings and profits were $15,500. The following table reports Wood’s (taxable) income for 2016 (its first year as

> Birch Corp., a calendar-year corporation, was formed three years ago by its sole shareholder, James, who has operated it as an S corporation since its inception. Last year, James made a direct loan to Birch Corp. in the amount of $5,000. Birch Corp. has

> Assume the same facts as in the previous problem, except that at the beginning of year 1 Jessica loaned Bikes-R-Us $3,000. In year 2, Bikes-R-Us reported ordinary income of $12,000. What amount is Jessica allowed to deduct in year 1? What are her stock a

> Jessica is a one-third owner in Bikes-R-Us, an S corporation that experienced a $45,000 loss this year (year 1). If her stock basis is $10,000 at the beginning of the year, how much of this loss clears the hurdle for deductibility (assume at-risk limitat

> Gary Holt LLP provides tax and legal services regarding tax-exempt bond issues of state and local jurisdictions. Gary typically provides the services from his New York offices. However, for large issuances Gary and his staff travel to the state to comple

> Virginia Corporation is a calendar year corporation. At the beginning of 2016, its election to be taxed as an S corporation became effective. Virginia Corp.’s balance sheet at the end of 2015 reflected the following assets (it did not h