Question: LN Consulting is a calendar year, cash

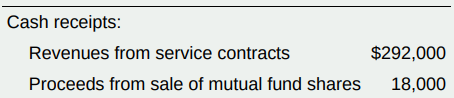

LN Consulting is a calendar year, cash basis unincorporated business. The business is not required to provide audited financial statements to any external user. LN’s accounting records show the following.

LN’s records reveal the following facts: In December, the bookkeeper prepaid $1,500 interest on a business debt. This interest is related to the next taxable year. LN disposed of two assets during the year. It exchanged computer equipment for office furniture. (These assets are not like-kind for federal tax purposes.) The original cost of the computer equipment was $13,000, and accumulated MACRS depreciation through date of exchange was $9,700. The office furniture has a $6,000 FMV. It sold 1,200 shares in a mutual fund for $18,000. LN purchased the shares as a short-term investment of excess working capital. The cost of the shares was $16,600. An electrical fire completely destroyed a company car. The adjusted basis of the car was $9,100, and LN’s property insurance company paid $7,000 in complete settlement of its damage claim. LN used the insurance money to pay various operating expenses. MACRS depreciation for assets placed in service in prior years (including the computer equipment and company car) is $4,600. The only asset acquired this year (in addition to the office furniture) was office equipment costing $8,300. The equipment was placed in service on August 19.

Based on these facts, compute the taxable income generated by LN Consulting’s activities, before any 20 percent deduction from AGI that might be available to LN’s owners.

Transcribed Image Text:

Cash receipts: Revenues from service contracts $292,000 Proceeds from sale of mutual fund shares 18,000 Insurance reimbursement for fire loss 7,000 Cash disbursements: Administrative salaries $ 32,000 Professional fees 800 Business meals 1,090 Business entertainment costs 2,000 State and local business taxes 5,000 Interest expense 7,600 Advertising 970 Office expense 1,200 Office rent 14,400 New office equipment 8,300

> On February 1, Mr. B purchased a business from Mr. and Mrs. S for a lump-sum price of $750,000. The business included the following balance sheet assets. Appraised FMV Accounts receivable $ …………………………….27,600 Inventory ……………………………………………….195,000 Offic

> Brillo Company uses the calendar year and the cash method of accounting. On December 29, 2018, Brillo made the following cash payments. To what extent can Brillo deduct the payment in 2018? a. $50,000 for a two-year office lease beginning on February 1,

> Discuss the strengths and weaknesses of the tax rule providing for 15-year amortization of the cost of business acquisition intangibles.

> Discuss the reasons why the Section 179 election is more valuable to small firms than to large firms.

> The manager of Firm Z, a new business that anticipates a steady growth in profits over the next decade, must decide between the cash method and the accrual method as the overall method for tax purposes. She understands that the difference between the two

> If a corporation purchases insurance on the life of its chief executive officer and the corporation is named the policy beneficiary, the premium payments are nondeductible. If the officer’s spouse and children are named as beneficiaries, the premium paym

> For many years, Mr. K, the president of KJ Inc., took the corporation’s most important clients golfing at The Links Golf Club several times a year. However, after the tax law was amended to disallow a deduction for business entertainment, Mr. K and his c

> Lester Inc. owns 55 percent of the outstanding stock of Marvin Corporation. The two corporations engage in numerous intercompany transactions that must be accounted for on both their financial statements and their tax returns. Discuss the circumstances i

> Discuss the choice of a taxable year for the following businesses: a. Retail plant and garden center. b. French bakery. c. Chimney cleaning business. d. Moving and transport business. e. Software consulting business.

> Describe the contrasting treatment of prepaid income under GAAP and under the tax law, and explain how each treatment reflects a different principle of conservatism.

> Firms generally prefer to engage in transactions that create assets instead of liabilities. However, firms prefer transactions generating deferred tax liabilities to transactions generating deferred tax assets. Can you explain this apparent contradiction

> Why do tax preferences often result in differences between book income and taxable income? Would a book/tax difference from a tax preference be a permanent difference or a temporary difference? Which type of difference is more valuable in NPV terms?

> Nello Company owed $23,400 overdue rent to its landlord, Bonview Inc. Because Nello is a desirable tenant, Bonview agreed to settle the overdue account for a $15,000 cash payment from Nello. Both Nello and Bonview are accrual basis taxpayers. a. What is

> Firm A expects to receive a $25,000 item of income in August and a second $25,000 item of income in December. The firm could delay the receipt of both items until January. As a result, it would defer the payment of tax on $50,000 income for one full year

> Why do income shifts and deduction shifts usually occur between taxpayers who are related parties?

> Compare the potential tax savings of an income shift from one entity to another if the entities are subject to: a. A progressive income tax system with rates from 5 percent to 19 percent. b. A progressive income tax system with rates from 10 percent to 5

> Assume that the U.S. Congress replaces the current individual and corporate income tax rate structures with a proportionate rate that applies to both types of taxpayers. Discuss the effect of this change in the federal law on tax strategies based on: a.

> Mr. T is considering a strategy to defer $10,000 income for five years with no significant opportunity cost. Discuss the strategic implications of the following independent assumptions: a. Mr. T is age 24. He graduated from law school last month and acce

> In June, Congress enacts legislation that increases income tax rates for all entities effective for the next calendar year. a. Why might such legislation result in an increase in federal tax revenues for this year? b. In what way would this legislation c

> Identify the reasons why managers should evaluate the flexibility of a tax planning strategy before implementing the strategy.

> For each of the following situations, discuss whether the individual is engaging in tax avoidance or tax evasion. a. Mr. L performed minor construction work for a number of people who paid him in cash. Because Mr. L knows that there is almost no chance t

> In the U.S. system of criminal justice, a person is innocent until proven guilty. Does this general rule apply to disputes between a taxpayer and the IRS?

> Which type of tax law provision should be more stable and less uncertain as to its future application: a provision relating to the proper measurement of taxable income or a provision designed to encourage individual taxpayers to engage in a certain econo

> Company K has a 30 percent marginal tax rate and uses a 7 percent discount rate to compute NPV. The company started a venture that will yield the following before-tax cash flows: year 0, $12,000; year 1, $21,000; year 2, $24,000; year 3, $17,600. a. If t

> Use a 5 percent discount rate to compute the NPV of each of the following series of cash receipts and payments: a. $6,200 received now (year 0), $1,890 paid in year 3, and $4,000 paid in year 5. b. $10,000 paid now (year 0), $12,690 paid in year 2, and $

> Explain the relationship between the degree of financial risk associated with future cash flows and the discount rate used to compute NPV.

> Corporation P owns 85 percent of the outstanding stock of Corporation R. This year, employees of Corporation R performed extensive management services for Corporation P. In return for the services, Corporation P paid a $250,000 fee to Corporation R, whic

> In each of the following cases, discuss how the taxpayers might respond to a tax rate increase in a manner consistent with the income effect. a. Mr. E earns $32,000 a year as an employee, and Mrs. E doesn’t work. b. Mr. F earns $22,000 a year as an emplo

> Corporation R and Corporation T conduct business in Jurisdiction Q. The corporations’ financial records for last year show the following: Jurisdiction Q decided to enact a tax on corporations conducting business within its jurisdictio

> Jurisdiction W has decided to enact a personal income tax on its residents. Policymakers are considering the following alternatives: a. No tax on income up to $35,000, and a 15 percent tax on all income in excess of $35,000. b. A 10 percent tax on all in

> The federal income tax is criticized as being both inequitable across individuals and overly complicated. Discuss why equity and simplicity can be considered conflicting tax policy goals.

> Jurisdiction E spends approximately $7 million each winter on snow removal. The jurisdiction is considering adding a new income tax provision that would allow people to deduct the cost of snow removal equipment purchased during the year. a. Does this pro

> Jurisdiction R and Jurisdiction S both impose a personal income tax on their residents. Under Jurisdiction R’s system, employers are required to withhold income tax from their employees’ paychecks and remit the tax to the government. Jurisdiction S’s sys

> The Internal Revenue Code and Treasury regulations are two major sources of federal tax law. Differentiate between the Code and the regulations in terms of their relative weight of authority.

> One way for the federal government to increase tax revenues would be to enact either a VAT or a national retail sales tax. The U.S. sales tax could be collected in the same manner and at the same time as state and local sales taxes. Which tax would be le

> Firm M and Firm N are related parties. For the past several years, Firm M’s marginal tax rate has been 30 percent, and Firm N’s marginal tax rate has been 21 percent. Firm M is evaluating a transaction that will generate $10,000 income in each of the nex

> Differentiate between a property tax and a transfer tax.

> Does the federal income tax or the federal payroll tax have the broader tax base?

> Both the federal government and many states impose so-called sin taxes: excise taxes levied on the retail sale of liquor and cigarettes. Discuss the reasons why sales of these particular items make a good tax base.

> Discuss the tax policy implications of the saying “an old tax is a good tax.”

> The federal government levies a gift tax on the value of property that people give away during their life and an estate tax on the value of property that people transfer at death. From the government’s perspective, which tax is more convenient?

> What evidence suggests that the federal tax system receives a low grade when evaluated on the standard of sufficiency?

> What nonmonetary incentives affect the amount of time and energy people devote to income-generating activities?

> Ms. V resides in a jurisdiction with a 35 percent income tax. Ms. V has $40,000 that she could invest in bonds paying 8 percent annual interest. She is also considering spending the $40,000 on a new luxury automobile. Ms. V is having a hard time deciding

> In each of the following cases, discuss how the taxpayers might respond to a tax rate increase in a manner consistent with the substitution effect. a. Mr. H earns $195,000 a year as a salaried employee, and Mrs. H doesn’t work. b. Mr. J earns $195,000 a

> Mr. and Mrs. K pay $18,000 annual tuition to a private school for their three children. They also pay $2,300 property tax on their personal residence to support the local public school system. Should Mr. and Mrs. K be exempt from this property tax?

> BPK Inc. and OPK Inc. are owned by the same family. BPK’s marginal tax rate is 21 percent, and OPK’s marginal tax rate is 32 percent. BPK is about to incur a $72,000 deductible expense that would benefit both corporations. OPK could obtain the same mutua

> Mr. P owns a residential apartment complex in a suburban area. This year, the local jurisdiction increased the property tax rate on the apartment complex. To offset this additional cost, Mr. P decreased the amount he usually spends on maintaining the ext

> Custer County is considering raising revenues by imposing a $25 fee on couples who obtain a marriage license within the county. Does this fee meet the definition of a transaction-based tax?

> Croyden is a calendar year, accrual basis corporation. Mr. and Mrs. Croyden (cash basis taxpayers) are the sole corporate shareholders. Mr. Croyden is president of the corporation, and Mrs. Croyden is vice president. Croyden’s financial

> Dollin Inc. is incorporated under Virginia law and has its corporate headquarters in Richmond. Dollin is a distributor; it purchases tangible goods from manufacturers and sells the goods to retailers. It has a branch office through which it sells goods i

> Univex is a calendar year, accrual basis retail business. Its financial statements provide the following information for the year. Univex’s records reveal the following facts: Bad debt expense equals the addition to an allowance for b

> Ms. BK is a self-employed architect who earns $300,000 annual taxable income. For the past several years, her tax rate on this income has been 35 percent. Because of recent tax law changes, Ms. BK’s tax rate for next year will decrease to 25 percent. a.

> Mrs. K, a single taxpayer, earns a $42,000 annual salary and pays 15 percent in state and federal income tax. If tax rates increase so that Mrs. K’s annual tax rate is 20 percent, how much additional income must she earn to maintain her after-tax disposa

> Jurisdiction Z levies an excise tax on retail purchases of jewelry and watches. The tax equals 3 percent of the first $1,000 of the purchase price plus 1 percent of the purchase price in excess of $1,000. a. Individual C purchases a watch for $500. Compu

> Refer to Country A’s rate structure described in the preceding problem. Ms. SP’s annual taxable income for years 1 through 5 is $150,000. Ms. OC’s taxable income for years 1 through 4 is $20,000. In year 5, Ms. OC wins a lottery, and her taxable income f

> Company G, which has a 30 percent marginal tax rate, owns a controlling interest in Company J, which has a 21 percent marginal tax rate. Both companies perform engineering services. Company G is negotiating a contract to provide services for a client. Up

> Country A levies an individual income tax with the following rate structure: Percentage Rate ……………………..……………………..Bracket 10% ………………………………………….Income from –0– to $20,000 15 ……………………………………….Income from $20,001 to $75,000 25 …………………………………….Income from $75,

> Government G levies an income tax with the following rate structure: Percentage Rate ……………………………………..…..Bracket 6% …………………………………………Income from –0– to $30,000 10 ……………………………………..Income from $30,001 to $70,000 20 ……………………………………Income from $70,001 to $200,

> Firm Q and Firm R conduct business in a foreign country that imposes a 3 percent VAT. Firm Q produces entertainment videos at a $6 material cost per unit and sells the videos to Firm R for $9 per unit. Firm R sells the videos at retail for $10 per unit.

> Mr. and Mrs. CS operate a hardware store in a jurisdiction that levies both a sales tax on retail sales of tangible personality and an annual personal property tax on business tangibles. The personal property tax is based on book value as of December 31.

> Firm L, which operates a mail-order clothing business, is located in State L. This year, the firm shipped $18 million of merchandise to customers in State R. State R imposes a 6 percent sales and use tax on the purchase and consumption of retail goods wi

> Refer to Government G’s rate structure described in the preceding problem. Taxpayer O earns $50,000 annually during years 1 through 10. Taxpayer P earns $20,000 annually during years 1 through 5 and $80,000 annually during years 6 through 10. a. How much

> Mrs. DK, a resident of Rhode Island, traveled to Delaware to purchase an oil painting from a local artist. The cost of the painting was $9,400. Rhode Island has a 7 percent sales and use tax, while Delaware has no sales and use tax. a. How much Rhode Isl

> TR Company conducts business exclusively in State V, which levies a 5 percent sales and use tax on goods purchased or consumed in state. This year, TR bought equipment in State B. The cost of the equipment was $90,000, and TR paid $5,400 sales tax to Sta

> Mr. E, a petroleum engineer, earns an $83,000 annual salary, while Mrs. E, a homemaker, has no earned income. Under current law, the couple pays 20 percent in state and federal income tax. Because of recent tax law changes, the couple’s future tax rate w

> This year, State A raised revenues by increasing its general sales tax rate from 5 percent to 6 percent. Because of the increase, the volume of taxable sales declined from $800 million to $710 million. In contrast, State Z raised revenues from its 5 perc

> Ms. JK recently made a gift to her 19-year-old daughter, Alison. Ms. JK’s marginal income tax rate is 37 percent, and Alison’s marginal income tax rate is 12 percent. In each of the following cases, compute the annual income tax savings resulting from th

> Ms. Pay, who has a 40.8 percent marginal tax rate on interest income (37 percent income tax + 3.8 percent Medicare contribution tax), owns HHL Inc. corporate bonds in her investment portfolio. She earned $74,800 interest this year on her HHL bonds. Compu

> Mrs. Yue, a resident of Virginia, paid $50,000 for a bond issued by Pennsylvania that paid $3,400 interest this year. Her marginal state income tax rate is 6 percent. Under Virginia law, interest on debt obligations issued by another state is taxable. Mr

> Mrs. Wolter, an unmarried individual, owns investment land with a $138,000 basis, a nine year holding period, and a $200,000 FMV. Compute the after-tax (income tax and Medicare contribution tax) sale proceeds in each of the following cases: a. She sells

> Mrs. Turner died this year at age 83. On the date of death, the FMV of Mrs. Turner’s property was $46.3 million, and she owed $2.491 million to various creditors. The executor of her estate paid $17,800 funeral expenses and $294,200 legal and accounting

> Mr. Jackson died on June 19 when the total FMV of his property was $23 million and his debts totaled $2.789 million. His executor paid $23,000 funeral expenses and $172,000 accounting and legal fees to settle the estate. Mr. Jackson bequeathed $500,000 t

> Mr. Ito, an unmarried individual, made a gift of real estate to his son. Compute the amount subject to federal gift tax in each of the following situations: a. The FMV of the real estate was $4.75 million, and the transfer was Mr. Ito’s first taxable gif

> Mr. Erwin’s marginal tax rate on ordinary income is 37 percent. His $958,000 AGI included a $24,900 net long-term capital gain and $37,600 business income from a passive activity. a. Compute Mr. Erwin’s income tax on the $62,500 investment income from th

> Boyd Salzer, an unmarried individual, has $212,950 AGI consisting of the following items. Salary …………………………………………………….$188,000 Interest income …………………………………………..2,900 Dividend income …………………………………………8,300 Rental income from real property ………………..13,750

> Mr. Garza earned an $85,000 salary and recognized a $12,000 loss on a security sale and a $14,000 gain on the sale of a limited partnership interest. His share of the partnership’s business income through date of sale was $2,100. (Both the gain and the b

> Ms. Adams owns an interest in ABCD Partnership, which is a passive activity. At the beginning of the year, she projects that her share of ABCD’s business loss will be $16,000 and that she will have the following additional items. Net profit from her con

> Refer to the facts in the preceding problem. At the beginning of the year, Mr. L could have invested his $50,000 in Business Z with an 8 percent annual return. However, this return would have been ordinary income rather than capital gain. a. Considering

> Ms. Turney owns a one-half interest in an apartment complex, which is her only passive activity. The complex operated at a $53,000 loss this year. In addition to her share of this loss, Ms. Turney had the following income items. Salary ………………………………………….

> Mr. Kelly owns stock in VP and in BL, both of which are S corporations. This year, he had the following income and loss items. Salary …………………………………………………$62,300 Business income from VP ………………………19,000 Business loss from BL …………………………(25,000) Compute Mr

> Mr. and Mrs. Morris own a grocery store as a sole proprietorship. Their net profit and other relevant items for the year are as follows. Grocery store net profit …………………………………………$44,000 Deduction for SE tax ………………………………………………(3,109) Dividends and intere

> Mr. and Mrs. Poe earned $115,900 compensation income and $963 interest this year and recognized a $600 short-term capital gain and a $7,200 long-term capital gain on the sale of securities. They incurred $4,400 investment interest expense and $25,500 oth

> Ms. Reid borrowed $50,000 from a broker to purchase Lero Inc. common stock. This year, she paid $3,900 interest on the debt. Compute her itemized deduction for this interest in each of the following cases: a. The Lero stock paid a $1,100 dividend this ye

> In 2005, Mr. Earl, a single taxpayer, contributed $45,000 in exchange for 500 shares of DB stock. In 2008, he paid $40,000 to another shareholder to purchase 1,000 more DB shares. All DB’s stock qualified as Section 1244 stock when it was issued. This ye

> In 2000, Ms. Ennis, a head of household, contributed $50,000 in exchange for 500 shares of Seta stock. Seta is a qualified small business. This year, Ms. Ennis sold all 500 shares for $117,400. Her only other investment income was an $8,600 long-term cap

> Mr. Dunn, who has a 32 percent marginal tax rate on ordinary income, recognized a $15,000 capital loss in 2018. Compute the tax savings from this loss assuming that: a. He also recognized an $18,000 short-term capital gain. b. He also recognized an $18,0

> Diane Stacy, who has a 32 percent marginal tax rate on ordinary income and a 3.8 percent Medicare contribution tax rate on investment income, owns 13,800 shares in Tobler Mutual Fund. This year, she received an $88,400 dividend from Tobler. Compute Diane

> Mr. Scott sold rental real estate that had a $186,200 adjusted basis ($200,000 million cost − $13,800 straight-line accumulated depreciation). The sales price was $210,000. This was his only property disposition for the year. Compute Mr. Scott’s income t

> Mr. G has $15,000 to invest. He is undecided about putting the money into tax-exempt municipal bonds paying 3.5 percent annual interest or corporate bonds paying 4.75 percent annual interest. The two investments have the same risk. a. Which investment sh

> Mr. and Mrs. Scoler sold commercial real estate for $685,000. Their adjusted basis at date of sale was $544,700 ($596,600 cost − $51,900 straight-line accumulated depreciation). Compute the Scolers’ income tax and Medicare contribution tax on their recog

> Mrs. Cox, a head of household, earned a $313,000 salary and recognized a $29,300 net long-term capital gain this year. Compute the income tax on the gain if: a. None of the gain is collectibles gain or un recaptured Section 1250 gain. b. $10,000 is colle

> Mr. Fox, a single taxpayer, recognized a $64,000 long-term capital gain, a $14,300 short-term capital gain, and a $12,900 long-term capital loss. Compute Mr. Fox’s income tax and Medicare contribution tax if his taxable income before consideration of his

> Refer to the preceding problem. Determine which of the four cases results in a capital loss carry forward for Mr. and Mrs. Revel. What is the amount and character of each carry forward? Data from Problem 24: Mr. and Mrs. Revel had $206,200 AGI before c

> Mr. and Mrs. Revel had $206,200 AGI before considering capital gains and losses. For each of the following cases, compute their AGI: a. On May 8, they recognized a $8,900 short-term capital gain. On June 25, they recognized a $15,000 long-term capital lo

> This year, Linda Moore earned a $112,000 salary and $2,200 interest income from a jumbo certificate of deposit. She recognized a $15,300 capital loss on the sale of undeveloped land. Compute Linda’s AGI and any capital loss carry forward into future year

> Mr. Alm earned a $61,850 salary and recognized a $5,600 capital loss on the sale of corporate stock this year. Compute Mr. Alm’s AGI and any capital loss carry forward into future years in each of the following cases: a. Mr. Alm had no other capital tran

> Refer to the preceding problem. For each case, determine CVF’s tax basis in the security received in the exchange. Data from Problem 19: CVF owned 2,000 shares of Jarvis nonvoting common stock with a $225,000 basis. In each of the following cases, dete

> Mr. Lay, who has a 37 percent marginal tax rate on ordinary income, earned a $22,030 dividend on his investment in Rexford Mutual Fund. Compute the income tax and the Medicare contribution tax on this dividend if his Form 1099 reported that: a. The entir

> CVF owned 2,000 shares of Jarvis nonvoting common stock with a $225,000 basis. In each of the following cases, determine CVF’s recognized gain or loss on the disposition of this stock: a. CVF exchanged it for 1,300 shares of Jarvis voting common stock wo